Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

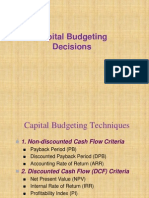

Capital Budgeting Techniques

Caricato da

Anonymous rWn3ZVARLgCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Capital Budgeting Techniques

Caricato da

Anonymous rWn3ZVARLgCopyright:

Formati disponibili

The Basics of Capital Budgeting

I. Project Classifications

A. Replacement projects = expenditures to replace worn-out or damaged euipment

reuired in the production of profita!le products

B. Replacement" cost reduction = expenditures to replace ser#icea!le !ut o!solete

euipment and lower costs

C. $xpansion of existing products or mar%ets = expenditures to increase output of

existing products or to expand retail outlets or distri!ution facilities in mar%ets now

!eing ser#ed

&. $xpansion of new products or mar%ets = expenditures to produce new products or

to expand into new mar%ets

$. 'afet( and)or en#ironmental products = expenditures necessar( to compl( with

go#ernment orders* la!or agreements* or insurance polic( terms

+. ,ther = expenditures on office !uildings* par%ing lots* and executi#e aircraft

II. Capital Budgeting Techniues

A. Three wa(s to determine appropriate project* !e it either an expansion or

replacement project* independent projects or mutuall( exclusi#e projects

-. Pa(!ac% period

.. /et present #alue 0/P12

3. Internal rate of return 0IRR2

4. 5odified internal rate of return 05IRR2

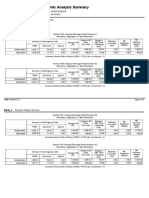

B. $xample" After-tax* incremental cash flows of two projects

6ear Project A Project B

7 -84.*777 -849*777

- -4*777 .:*777

. -4*777 -.*777

3 -4*777 -7*777

4 -4*777 -7*777

9 -4*777 -7*777

C. Pa(!ac% period

-. &ef;n" amount of time reuired for a firm to reco#er its initial in#estment in

a project* as calculated from cash flows

Pa(!ac% period = num!er of (ears prior to full reco#er( < 0unreco#ered cost

at start of last (ear2)0cash flow during full reco#er( (ear2

.. 1iewed as unsophisticated capital !udgeting techniue

. Page -

3. &ecision rule" =et /> (ears = firm;s maximum accepta!le pa(!ac% period

a. Independent projects" Accept all projects whose pa(!ac% periods ?

/>

!. 5utuall( exclusi#e projects" Among those projects whose pa(!ac%

periods are ? />* choose the project with the shortest pa(!ac% period

4. The example"

a. Project A" The cash inflow of e#er( (ear = 8-4*777.

84.*777)-4*777= 3 = =@ Project A;s pa(!ac% period is 3 (ears

6ear 7 - . 3 4 9

Cash flow -84.*777 8-4*777 8-4*777 8-4*77

7

8-4*77

7

8-4*777

Cumulati#e cash flow -84.*777 -8.:*777 -8-4*777 87 8-4*77

7

8.:*777

Pa(!ac% period = 3 (ears

!. Project B" To get 849*777 = =@ /eed all the 8.:*777 of the -

st

(ear

08-A*777 left to go2* need all the 8-.*777 of the second (ear 089*777 left

to go2* need onl( 89*777 of the 8-7*777 earned during third (ear. To

prorate the time need after the second (ear " 89*777)8-7*777 = .9 (ear

= =@ Project B;s pa(!ac% period = ..9 (ears

6ear 7 - . 3 4 9

Cash flow -849*777 8.:*777 8-.*77

7

8-7*77

7

8-7*77

7

8-7*777

Cumulati#e cash flow -849*777 -8-A*777 -89*777 89*777 8-4*77

7

8.:*777

Pa(!ac% period = . (ears < 89*777)8-7*777 (ears = ..9 (ears

c. =et /> = 3.9 (ears

d. If independent projects" accept !oth projects !ecause 3 ? 3.9 and ..9 ?

3.9

e. If projects mutuall( exclusi#e" pic% project B as ..9 ? 3 ? 3.9

9. Pros and cons of the pa(!ac% method

a. The pros"

i. Bidel( used

ii. Computationall( simple

iii. Intuiti#e appeal

i#. 'ince it measures how uic% firm reco#ers initial in#estment*

gi#es implicit consideration to time #alue of mone(

#. B( pic%ing projects with pa(!ac% ? /> = =@ approach is ma(

reduce ris% and pa(!ac% period has some relation to ris%

exposure

!. The con"

a. /> a su!jecti#e predetermined measure

!. Pa(!ac% period not lin%ed to goal of shareholder wealth

maximiCation

. Page .

c. Approach doesn;t full( ta%e the time #alue of mone( into

account 0cash flows aren;t discounted to present #alue2

d. Pa(!ac% period approach ignores cash flows recei#ed after the

pa(!ac% period.

. Page 3

D. ,ne possi!le modification" &iscounted pa(!ac% at -7E cost of capital

a. =ength of time reuired for in#estment;s cash flows* discounted at the

cost of capital to co#er its cost

!. Project A"

6ear 7 - . 3 4 9

Cash flow -849*777 8-4*777 8-4*777 8-4*777 8-4*77

7

8-4*777

&iscounted cash flow -849*777 8-.*A.A 8--*9A7 8-7*9-: 8F*9D. 8:*DF3

Cumulati#e discounted cash flow -849*777 -83.*.A3 -8.7*A7. -8-7*-:4 -8D.. 8:*7A-

Pa(!ac% period = 4 < D..):DF3 = 4 < .7A = 4.7A

c. Project B

6ear 7 - . 3 4 9

Cash flow -849*777 8.:*777 8-.*77

7

8-7*77

7

8-7*77

7

8-7*777

&iscounted cash flow -849*777 8.9*499 8F*F-A 8A*9-3 8D*:37 8D*.7F

Cumulati#e discounted cash flow -849*777 -8-F*949 -8F*D.: -8.*--9 84*A-9 8-7*F.4

Pa(!ac% period = 3 < .--9)D:37 = 3 < 7.3- = 3.73-

d. If /> = 4"

i. If projects are independent" Accept Project B and reject

project A. 3.73- ? 4 ? 4.7A

ii. If projects are mutuall( exclusi#e" Accept Project B and reject

project A. 3.73- ? 4 ? 4.7A

&. /et present #alue 0/P12

-. &ef;n" sophisticated capital !udgeting techniue found !( su!tracting

project;s initial in#estment from present #alue of future cash flows 0which

where discounted at rate eual to firm;s cost of capital2

.. =et C+

t

!e the firm;s cash flow in (ear t. =et % !e the firm;s cost of capital.

/

t /-- / - .

7 7 t - . /-- /

t=-

C+ C+ C+ C+ C+

/P1 = - C+ = < < < < - C+

0- < r2 0-<r2 0-<r2 0-<r2 0-<r2

L

3. r = discount rate = reuired return = cost of capital = opportunit( cost =

minimum return that must !e earned on project to lea#e firm;s mar%et #alue

unchanged

4. &ecision rule"

a. Independent projects" Accept all projects with /P1 @ 7

!. 5utuall( exclusi#e projects" choose project with largest positi#e /P1

9. The example" =et r = -7E

a. $xcel formula" /P10discount rate* C+

-

* . . . * C+

/

2 G C+

7

!. Project A"

A - . 3 4 9

8-4*777 8-4*777 8-4*777 8-4*777 8-4*777

/P1 =-84.*777< < < < < =8--*7A-

0-.-72 0-.-72 0-.-72 0-.-72 0-.-72

c. Project B

. Page 4

B - . 3 4 9

8.:*777 8-.*777 8-7*777 8-7*777 8-7*777

/P1 =-849*777< < < < < =8-7*F.4

0-.-72 0-.-72 0-.-72 0-.-72 0-.-72

d. &ecision rule"

i. If A and B are independent projects" pic% !oth projects.

8--*7F- @ 7 and 8-7*7.4 @ 7

ii. If Projects A and B are mutuall( exclusi#e" Pic% project A

!ecause 8--*7F- @ 8-7*F.4 @ 7

$. Internal Rate of Return 0IRR2

-. &ef;n" 'ophisticated capital !udgeting techniue. It is that discount rate

where the net present #alue of the project is eual to Cero. It is the discount

rate that euates the present #alue of the future cash flows with the initial

in#estment.

.. =et IRR = the internal rate of return. IRR is the discount rate that sol#es the

following euation"

/

t /-- / - .

7 7 t - . /-- /

t=-

C+ C+ C+ C+ C+

- C+ = < < < < - C+ = 87

0- < IRR2 0- < IRR2 0- < IRR2 0- < IRR2 0- < IRR2

L

3. &ecision rule" let r = the firm;s cost of capital

a. Independent projects" Accept an( project whose IRR @ r.

!. 5utuall( exclusi#e projects" Among those projects with an IRR @ r*

choose the project with the largest IRR.

4. $xcel formula" IRR0!eginning cell"last cell* guess2

$nter (earl( cash flows in order from initial in#estment to terminal cash

flow. The !eginning cell of the arra( contains the initial in#estment* while

the last cell contains cash flows of the last (ear of the project. Huess is a

fraction to initiate the con#ergence to the solution.

9. $xample"

a. Project A - - IRR = -F.:DE

. 3 4 9

8-4*777 8-4*777 8-4*777 8-4*777 8-4*777

-84.*777 < < < < < =87

0-.-F:D2 0-.-F:D2 0-.-F:D2 0-.-F:D2 0-.-F:D2

!. Project B - - IRR = .-.D9E

. 3 4 9

8.:*777 8-.*777 8-7*777 8-7*777 8-7*777

-849*777 < < < < < =87

0-..-D92 0-..-D92 0-..-D92 0-..-D92 0-..-D92

c. &ecision rules" =et r = -7E

i. Independent projects" 'ince IRR

A

= -F.:DE @ -7.77E and

IRR

B

= .-.D9E @ -7.77E accept !oth projects A and B

ii. 5utuall( exclusi#e projects" Pic% project B !ecause IRR

B

@

IRR

A

@ r or .-.D9E @ -F.:DE @ -7.77E. In this case* there is

a conflict in the choices recommended !( /P1 and IRR.

According to /P1* project A should !e accepted* while

according to IRR* project B is preferred.

III. The possi!ilities of conflicting ran%ings using /P1 and IRR

A. $xamine the net present #alue profiles

-. /et present #alue profile = graph depicting project;s /P1 for #arious

discount rates

. Page 9

.. +igure - is the /P1 profiles for the example

. Page D

+igure -

NPV Pro f iles

-10.0

-5.0

0.0

5.0

10.0

15.0

20.0

0.00% 5.00% 10.00% 15.00% 20.00% 25.00% 30.00%

Di sc ount Ra t e ( %)

Project A

Project B

3. Conflicting decisions" Independent #s mutuall( exclusi#e projects

a. Refer to figure " IRR

A

= %

4

* IRR

B

= %

D

Cross o#er rate where /P1

A

= /P1

B

= %

.

!. Refer to +igure . on next page. Assume projects A and B are

independent.

Cost of Capital /P1 Approach IRR Approach /P1 and IRR AgreeI

%

-

Accept AJ Accept B Accept AJ Accept B 6es

%

.

Accept AJ Accept B Accept AJ Accept B 6es

%

3

Accept AJ Accept B Accept AJ Accept B 6es

%

4

Reject AJ Accept B Reject AJ Accept B 6es

%

9

Reject AJ Accept B Reject AJ Accept B 6es

%

D

Reject AJ Reject B Reject AJ Reject B 6es

%

A

Reject AJ Reject B Reject AJ Reject B 6es

Conclude" Bhen projects are independent* /P1 and IRR approach

alwa(s agree.

c. Refer to +igure . on next page. /ow assume projects A and B are

mutuall( exclusi#e.

Cost of Capital /P1 Approach IRR Approach /P1 and IRR AgreeI

%

-

Accept AJ Reject B Reject AJ Accept B /o

%

.

Accept either A or B Reject AJ Accept B /o

%

3

Reject AJ Accept B Reject AJ Accept B 6es

%

4

Reject AJ Accept B Reject AJ Accept B 6es

%

9

Reject AJ Accept B Reject AJ Accept B 6es

%

D

Reject AJ Reject B Reject AJ Reject B 6es

%

A

Reject AJ Reject B Reject AJ Reject B 6es

Conclude" +or mutuall( exclusi#e projects* if % ? the crosso#er rate*

then the recommendations of the /P1 and IRR approaches will

disagree. If % @ the crosso#er rate then the recommendations of the

two approaches agree.

. Page A

+igure .

d. Bhich approach is !etterI

i. /P1 approach is theoreticall( correct. The /P1 approach

assumes cash flows are rein#ested at the firm;s cost of capital.

Kowe#er* the IRR assumes the firm;s cash flows are

rein#ested at the IRR which is greater than the firm;s cost of

capital. Because the cost of capital is a more realistic estimate

of the rate at which the firm could rein#est intermediate cash

flows* use of the /P1 is theoreticall( prefera!le with its more

conser#ati#e and realistic rein#estment rate of the cost of

capital.

ii. 'ur#e(s show financial managers prefer IRR. 5anagers tend

to tal% more a!out rates of return than actual dollar returns.

5anagers comforta!le with return data* the( express interest

rates and profita!ilit( in percentage rates. /P1 seems less

intuiti#e as it doesn;t measure !enefits relati#e to amount

in#ested.

. Page :

B. 5ultiple IRR

-. /ormal cash flows

a. A project has normal cash flows if it has one or more outflows 0costs2

followed !( a series of cash inflows

!. $xamples"

i. - < < < < <

ii. - - - < < < < <

.. /onnormal cash flows

a. A project has nonnormal cash flows if a cash outflow occurs

sometime after the inflows ha#e commenced.

!. $xamples"

i. - < < < < -

ii. - < < < - < < <

3. Le( result" If a project has nonnormal cash flows* it can ha#e multiple IRRs.

a. A project has nonnormal cash flows if a cash outflow occurs

sometime after the inflows ha#e commenced.

!. $xample" Assume r = -.E

6ear 7 - .

Cash flow -8477*777 8FD7*77

7

-89A.*777

&iscounted cash flow 0r=-.E2 -8477*777 8:9A*-4

3

-8499*FF9

Cumulati#e discounted cash flow -8477*777 849A*-4

3

8-*-4:

i. P1 = 8-*-4: M Accept project

ii. +ind IRR. 'ol#e following euation

- .

8FD7*777 -89A.*777

-8477*777 < < =7

0- < IRR2 0- < IRR2

4770-<IRR2

.

-FD70-<IRR2<9A.=7

477NIRR

.

< .0IRR2 < -O -FD70- < IRR2 < 9A. = 7

4770IRR

.

2--D70IRR2<-. =7

-770IRR

.

2-47IRR<3 = 7 M

.

-0-472 P 0-472 - 40-772032

IRR =

.0-772

+ind two IRR" -7E and 37E

iii. 'ee Ta!le - and +igure 3 on next page

. Page F

Multiple IRR

-$20,000.00

-$15,000.00

-$10,000.00

-$5,000.00

$0.00

0 0.1 0.2 0.3 0.4 0.5 0.6

r

P

V

PV

Table 1

r PV

0.00-$12,000.00

0.02 -$8,612.07

0.04 -$5,769.23

0.06 -$3,417.59

0.08 -$1,508.92

0.10 $0.00

0.12 $1,147.96

0.14 $1,969.84

0.16 $2,497.03

0.18 $2,757.83

0.20 $2,777.78

0.22 $2,579.95

0.24 $2,185.22

0.26 $1,612.50

0.28 $878.91

0.30 $0.00

0.32 -$1,010.10

0.34 -$2,138.56

0.36 -$3,373.70

0.38 -$4,704.89

0.40 -$6,122.45

0.42 -$7,617.54

0.44 -$9,182.10

0.46-$10,808.78

0.48-$12,490.87

0.50-$14,222.22

0.52-$15,997.23

0.54-$17,810.76

0.56-$19,658.12

+igure -

. Page -7

C. 5odified internal rate of return = 5IRR

-. 5IRR = discount rate at which the present #alue of a project;s cost is eual

to the present of its terminal #alue* where the terminal #alue is found as the

sum of the future #alues of the cash inflows* compounded at the firm;s cost of

capital

.. /otation

a. C,+

t

= cash outflow in (ear t

!. CI+

t

= cash inflow in (ear t

c. 5IRR = modified internal rate of return

d. 5IRR euates present #alue of terminal #alue to present #alue of costs

terminal #alue = T1 =

/

/-t

t

t=7

CI+ 0-<r2

P1 cost =

/

t

t

t=7

C,+

0-<r2

5IRR is that interest rate that sol#es the following euation"

/

/-t

t /

t t=7

t /

t=7

CI+ 0- < r2

C,+

=

0- < r2 0- < 5IRR2

e. &ecision rule" Accept project if 5IRR @ cost of capital = r

f. $xample" Return to pre#ious example of Projects A and B

6ear Project A Project B

7 -84.*777 -849*777

- -4*777 .:*777

. -4*777 -.*777

3 -4*777 -7*777

4 -4*777 -7*777

9 -4*777 -7*777

i. Project A

4 3 .

T1=8-4*7770-.-72 <8-4*7770-.-72 <8-4*7770-.-72 <8-4*7770-.-72<8-4*777=8:9*4A-.47

P1 of costs = 84.*777

9

8:9*4A-.47

84.*777 =

0- < 5IRR2

M -9..AE

ii. Project B

4 3 .

T1=8.:*7770-.-72 <8-.*7770-.-72 <8-7*7770-.-72 <8-7*7770-.-72 <8-7*777=8F7*7DD.:7

P1 of costs = 849*777

. Page --

9

8F7*7DD.:7

849*777 =

0- < 5IRR2

M -4.:FE

iii. &ecision" If projects are independent M Accept !oth since

5IRR @ r

4. /ote

a. 5IRR sol#es multiple IRR pro!lem* can ne#er !e more than one

5IRR. Compare it to cost of capital.

!. Is 5IRR good for choosing !etween mutuall( exclusi#e projectsI

i. In general* no.

ii. Conflicts ma( occur if projects differ in length M In this case

use /P1

. Page -.

Potrebbero piacerti anche

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- American Marketing AssociationDocumento9 pagineAmerican Marketing AssociationAnonymous rWn3ZVARLg100% (1)

- International Business: by Charles W.L. HillDocumento34 pagineInternational Business: by Charles W.L. HillAnonymous rWn3ZVARLgNessuna valutazione finora

- Assignment No.1: Directorate of Distance Learning Education G.C University, FaisalabadDocumento2 pagineAssignment No.1: Directorate of Distance Learning Education G.C University, FaisalabadAnonymous rWn3ZVARLgNessuna valutazione finora

- Technology ManagementDocumento4 pagineTechnology ManagementAnonymous rWn3ZVARLg0% (1)

- Technologymanagement 130107233508 Phpapp01Documento25 pagineTechnologymanagement 130107233508 Phpapp01Anonymous rWn3ZVARLgNessuna valutazione finora

- Chapter 11Documento20 pagineChapter 11Pradeep DevNessuna valutazione finora

- Technology ManagementDocumento4 pagineTechnology ManagementAnonymous rWn3ZVARLg0% (1)

- 2015 CSC Scholarship Application GuideDocumento4 pagine2015 CSC Scholarship Application GuideAnonymous rWn3ZVARLgNessuna valutazione finora

- Gcuf-Business Incubation Center: We Are Providing Wings To FlyDocumento1 paginaGcuf-Business Incubation Center: We Are Providing Wings To FlyAnonymous rWn3ZVARLgNessuna valutazione finora

- V V, V V, V V, V, V E) E Density W W V V Entropy (A, VDocumento1 paginaV V, V V, V V, V, V E) E Density W W V V Entropy (A, VAnonymous rWn3ZVARLgNessuna valutazione finora

- CSC Filled Application FormDocumento3 pagineCSC Filled Application FormAnonymous rWn3ZVARLgNessuna valutazione finora

- Business Case Study of Contract LawDocumento6 pagineBusiness Case Study of Contract LawAnonymous rWn3ZVARLgNessuna valutazione finora

- Return To WorkDocumento3 pagineReturn To WorkAnonymous rWn3ZVARLgNessuna valutazione finora

- Rout StressMedicine96Documento12 pagineRout StressMedicine96Anonymous rWn3ZVARLgNessuna valutazione finora

- MA EnglishDocumento8 pagineMA EnglishAnonymous rWn3ZVARLg50% (2)

- BASIC WORDS of Chines LanguageDocumento5 pagineBASIC WORDS of Chines LanguageAnonymous rWn3ZVARLgNessuna valutazione finora

- Test Information: S# Test Name Sample Type PerformedDocumento11 pagineTest Information: S# Test Name Sample Type PerformedAnonymous rWn3ZVARLgNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Basics of Capital Budgeting: Should We Build This Plant?Documento41 pagineThe Basics of Capital Budgeting: Should We Build This Plant?MoheuddinMayrajNessuna valutazione finora

- Chapter 9 AssignmentDocumento4 pagineChapter 9 AssignmentabraamNessuna valutazione finora

- Capital Budgeting DecisionsDocumento44 pagineCapital Budgeting Decisionsarunadhana2004Nessuna valutazione finora

- Summary of Capital Budgeting Techniques GitmanDocumento12 pagineSummary of Capital Budgeting Techniques GitmanHarold Dela FuenteNessuna valutazione finora

- LEMBAR JAWABAN CH.10 (Capital Budgeting Techniques)Documento4 pagineLEMBAR JAWABAN CH.10 (Capital Budgeting Techniques)Cindy PNessuna valutazione finora

- NPV Other Investment CriteriaDocumento2 pagineNPV Other Investment CriteriaЕлена АтоянNessuna valutazione finora

- PBL Session 2 SAMPLEG1Documento1 paginaPBL Session 2 SAMPLEG1Chriz Anjelo ToledoNessuna valutazione finora

- 3Documento4 pagine3Deysy ReyesNessuna valutazione finora

- Evapro (Kriteria Investasi) FinalDocumento23 pagineEvapro (Kriteria Investasi) FinalNanda YudhaNessuna valutazione finora

- Capital BudgetingDocumento12 pagineCapital Budgetingola nasserNessuna valutazione finora

- US Military Budget Through The YearsDocumento1 paginaUS Military Budget Through The YearsMatthew HanzelNessuna valutazione finora

- Financial Management:: Investment Decision CriteriaDocumento96 pagineFinancial Management:: Investment Decision CriteriaBen OusoNessuna valutazione finora

- Chapter 10 - Capital Budgeting TechniquesDocumento20 pagineChapter 10 - Capital Budgeting TechniquesManar AmrNessuna valutazione finora

- Econo - Anjaniya Ramnagar RoadDocumento3 pagineEcono - Anjaniya Ramnagar Roaddharmendra kumarNessuna valutazione finora

- Chapter 10 SolutionsDocumento21 pagineChapter 10 SolutionsFranco Ambunan Regino75% (8)

- Case StudyDocumento16 pagineCase StudyRocket SinghNessuna valutazione finora

- Ec 1745 Fall 2008 Problem Set 1Documento2 pagineEc 1745 Fall 2008 Problem Set 1tarun singhNessuna valutazione finora

- ID Analisis Kebijakan Investasi Alat RadiolDocumento12 pagineID Analisis Kebijakan Investasi Alat RadiolKhoirotul HisanNessuna valutazione finora

- Assignment 5 - Investment CriteriaDocumento3 pagineAssignment 5 - Investment Criteriarubabshahid2002Nessuna valutazione finora

- Michele Cagan, The Everything Accounting Book: Balance Your Budget, Manage Your Cash Flow, and Keep Your Books in The Black"Documento1 paginaMichele Cagan, The Everything Accounting Book: Balance Your Budget, Manage Your Cash Flow, and Keep Your Books in The Black"Sasi MurugesanNessuna valutazione finora

- Financial Management Lesson 6Documento4 pagineFinancial Management Lesson 6ThraiaFiore MercadejasNessuna valutazione finora

- Project Appraisal - Capital Budgeting MethodsDocumento55 pagineProject Appraisal - Capital Budgeting Methodsmanju09535Nessuna valutazione finora

- Solutions To Capital Budgeting Problems Capital Budgeting Handout 3 Expansion Problems Ellis Construction Company T 0 Initial InvestmentDocumento9 pagineSolutions To Capital Budgeting Problems Capital Budgeting Handout 3 Expansion Problems Ellis Construction Company T 0 Initial InvestmentAnand SridharanNessuna valutazione finora

- Example Prob, NPV, IRR&PIDocumento10 pagineExample Prob, NPV, IRR&PITin Bernadette DominicoNessuna valutazione finora

- Financial Management Theory and Practice 14Th Edition Brigham Solutions Manual Full Chapter PDFDocumento36 pagineFinancial Management Theory and Practice 14Th Edition Brigham Solutions Manual Full Chapter PDFchristopher.ridgeway589100% (10)

- Chapter 12 - NewDocumento16 pagineChapter 12 - Newshadow033333Nessuna valutazione finora

- P10-10 & P10-21 Managerial FinanceDocumento5 pagineP10-10 & P10-21 Managerial Financevincent alvinNessuna valutazione finora

- MAhmed 2355 13293 1/assignment Capital BudgetingDocumento2 pagineMAhmed 2355 13293 1/assignment Capital BudgetingAli KhanNessuna valutazione finora

- The Basics of Capital Budgeting: Evaluating Cash Flows: Solutions To End-Of-Chapter ProblemsDocumento5 pagineThe Basics of Capital Budgeting: Evaluating Cash Flows: Solutions To End-Of-Chapter ProblemsRichi MatheuNessuna valutazione finora

- Analisis Kelayakan Usaha Ternak Kelinci Dan Nilai Tambah Olahan Daging Kelinci Pada Koperasi Peternak Kelinci BogorDocumento18 pagineAnalisis Kelayakan Usaha Ternak Kelinci Dan Nilai Tambah Olahan Daging Kelinci Pada Koperasi Peternak Kelinci BogorGumilar AchmadNessuna valutazione finora