Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Idea in

Caricato da

sunilTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Idea in

Caricato da

sunilCopyright:

Formati disponibili

1

( )

..

3 ,

21, , - 110125

PUNJAB & SIND BANK

(A Govt. of India Undertaking)

HO Foreign Exchange

Department

3rd Floor, Bank House

21, Rajendra Place, N Delhi-

110125

: 011- 25728460, 25728462 Fax: 011-25747782 ; E-mail:ho.fex@psb.org.in

Circular No . :

1684/13/12

Date

18/04/2012

Code No. of the Department

H 9007

Number of pages of Circular

12

Running circular No of the Bank

181/ 2012

TO ALL BRANCHES/CONTROLLING OFFICES

REG : MASTER CIRCULAR on FCNR Deposits

GUIDELINES FOR BRANCHES IN CONSONANCE WITH RBIS GUIDELINES ON

FCNR ARE AS UNDER:

2

PREFACE

S.NO. CONTENTS PAGE NO.

1. Opening of FCNR (B) Account 3

2. Definition of the term Deposit 3

3. Features of FCNR (B) Scheme 3

4. Manner of payment of Interest 4

5. Premature withdrawal of deposits 4

6. Payment of interest on overdue FCNR (B) Deposits 5

7. Restrictions on advances against FCNR (B) Deposits 5-6

8. Interest payable on the deposit of a deceased depositor 6-7

9. Addition or deletion of name/s of joint account holders 7

10. Payment of interest on FCNR (B) deposits of NRIs on return to India 7-8

11. Conversion of FCNR (B) Accounts of Returning Indians into RFC

Account - Waiver of Penalty

8

12. Conversion of FCNR (B) Accounts of Returning Indians into RFC

Accounts/Resident Rupee Accounts- Payment of interest

8

13. Payment of interest on term deposit maturing on Saturday/Sunday/

holiday/non-business working day

8

14 Annexure-I Definition of Relatives 9

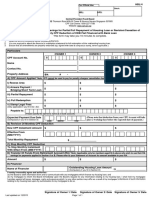

15 Account Opening Form & Declaration 10-12

3

The Foreign Currency (Non Resident) Accounts (Banks) Scheme (FCNR B) was

introduced with the effect from May 1993 to replace the then prevailing FCNR (A),

where the foreign exchange risk was borne by RBI and subsequently by the Govt. of

India.

Presently bank is offering FCNR (B) deposit scheme in five currencies i.e. for US

Dollar, Pound Sterling, EURO, Canadian Dollar and Australian Dollar.

Opening of FCNR (B) Account

1) . FCNR (B) accounts can be opened by following persons:

a) Non-resident individuals of Indian nationality or origin (NRIs).

b) Jointly by two or more Non Resident Individuals on either or Survivor basis.

c) Jointly by Non Resident Individuals with resident close relative (relatives as

defined in Section 6 of the Companies Act, 1956 Annexure I) on a Former

or Survivor basis.

2) KYC/AML etc guidelines issued by bank from time to time to be complied with

3) Nomination facility available.

Definition of the term Deposit

The deposits under the Scheme mean term deposits received by the branch for a

fixed period and withdrawable only after the expiry of the said fixed period and

includes Reinvestment Deposits.

Features of FCNR (B) Scheme

1. Repatriation of funds in foreign currencies is permitted.

2. The deposits can be accepted under the Scheme for the following maturity

periods:

(a) One year and above but less than two years

(b) Two years and above but less than three years

4

(c) Three years and above but less than four years

(d) Four years and above but less than five years

(e) Five years only

Note: Recurring Deposits are not permitted under FCNR (B) Scheme.

3. Transfer of funds from existing NRE accounts to FCNR (B) accounts and vice

versa, of the same account holder, is permissible without the prior approval of

Reserve Bank of India.

Manner of payment of Interest

1. The interest on FCNR (B) deposits should be calculated and paid at intervals of

180 days each and thereafter for the remaining actual number of days. However,

the depositor has the option to receive the interest on maturity with

compounding effect.

2. The rate fixed by the bank for deposits of staff members, existing or retired,

should not exceed the ceiling rate prescribed by RBI. However, presently our

bank is offering interest rate to all clients up to maximum ceiling permitted by

RBI, as such, no additional interest is to be paid to staff.

Premature withdrawal of deposits

1. Branch on request from the depositor may permit premature withdrawal of

deposits under the FCNR (B) Scheme. Branches are advised to charge interest as

under in case of premature withdrawal of FCNR (B) Deposit:

Withdrawal before one year- no interest is payable.

When withdrawal is on / after completion of one year 1% penalty to be

charged on applicable interest rate prevailing on the date of placement of the

deposit for the completed period.

2. Conversion of FCNR (B) deposits into NRE deposits is also subject to the penal

provision relating to premature withdrawal.

5

Payment of interest on overdue FCNR (B) Deposits

Branches may renew an overdue deposit or a portion thereof provided the overdue

period from the date of maturity till the date of renewal (both days inclusive) does not

exceed 14 days. The rate of interest payable on the amount of the deposit so renewed

should be the appropriate rate of interest for the period of renewal as prevailing on the

date of maturity or on the date when the depositor seeks renewal, whichever is lower.

In the case of overdue deposits where the overdue period exceeds 14 days and if the

depositor places the entire amount of overdue deposit or a portion thereof as a fresh

FCNR (B) deposit, branches are advised as under to pay overdue interest on the

amount so placed as fresh FCNR deposit as under:

In absence of any instructions for automatic renewal already given by party, overdue

interest to be paid as per following rates for the intervening period at the time of

renewal.

GBP 0.50%

EURO 0.75%

USD 0.50%

CAD 0.50%

AUD 1.50%

Note: In case the depositor has given mandate / instructions for automatic renewal

of FCNR, issue of payment of overdue interest does not arise.

Furthermore, Branches will recover the interest so paid for the overdue period if the

deposit is withdrawn before completion of the minimum stipulated period under the

scheme, after renewal.

Restrictions on advances against FCNR (B) Deposits -

As per RBI guidelines in force as on date, Banks are prohibited from granting fresh

loans or renewing existing loans in excess of Rupees 100 lacs against FCNR (B)

6

deposits either to the depositors or third parties. Branch should not undertake artificial

slicing of the loan amount to circumvent the ceiling.

(Branches to refer to HO Advances Circulars issued from time to time in respect

of interest, margin & quantum of loan against FCNR)

Interest payable on the deposit of a deceased depositor

In the case of a term deposit standing in the name/s of -

1. A deceased individual depositor, or

2. Two or more joint depositors, where one of the depositors has died, interest

should be paid in the manner indicated below:

i. At the contracted rate on the maturity of the deposit;

ii. In the event of the payment of the deposit being claimed before the maturity

date, the branch should pay interest at an applicable rate prevailing on the

date of placement of the deposit, without charging penalty;

iii. In the event of death of the depositor before the date of maturity of the

deposit and the amount of the deposit being claimed after the date of

maturity, the branch should pay interest at the contracted rate till the date of

maturity. From the date of maturity to the date of payment, the branch

should pay simple interest at the applicable rate operative on the date of

maturity, for the period for which the deposit remained with the branch

beyond the date of maturity. However, in the case of death of the depositor

after the date of maturity of the deposit, the branch should pay interest at a

rate operative on the date of maturity in respect of savings deposits held

under RFC Account Scheme, from the date of maturity till the date of

payment;

iv. If, on request from the claimant/s, the branch agrees to split the amount of

term deposit and issues two or more receipts individually in the name/s of

the claimant/s, it should not be construed as premature withdrawal of the

7

term deposit for the purpose of levy of penalty provided the period and

aggregate amount of the deposit do not undergo any change.

Note: In the case of claimant/s being residents, the maturity proceeds may be

converted into Indian rupees on the date of maturity and interest be paid for the

subsequent period at the rate applicable to a deposit of similar maturity under the

domestic deposit scheme.

Addition or deletion of name/s of joint account holders

A branch may, at the request of all the joint holders, allow the addition or deletion of

name/s of joint account holder/s if the circumstances so warrant or allow an

individual depositor to add the name of another person as a joint holder. However, in

no case should the amount or duration of the original deposit undergo a change

in any manner whatsoever, and all the joint account holders should be non-

residents of Indian nationality or origin. The branch should ascertain the reasons

from the applicants for doing so and also satisfy them about the bona fide nature of

the request. Further, opening of accounts in the names of Pakistani/Bangladeshi

nationals, though of Indian origin, will require approval of the Reserve Bank from

the exchange control angle.

Note: As per AP (Dir Series) Circular No 13 dt 15.09.2011, now Non Resident

Individuals NRI in India are permitted to open NRE/FCNR (B) account with their

resident close relative (relatives as defined in Section 6 of the Companies Act, 1956 -

given in annexure-I) on a Former or Survivor basis. The resident close relative

shall be eligible to operate the Account as Power of Attorney holder in accordance

with the extant instructions during the life of NRI/PIO account holder.

Payment of interest on FCNR (B) deposits of NRIs on return to India

Branch may allow FCNR (B) deposits of persons of Indian nationality/origin who

return to India for permanent settlement to continue till maturity at the contracted rate

of interest, if desired. Such deposits should be treated as resident deposits from the

date of return of the account holder to India. Premature withdrawal of such FCNR (B)

deposits should be subject to penal provisions of the Scheme. Branch should convert

the FCNR (B) deposits on maturity into Resident Rupee Deposit Account or RFC

8

Account (if eligible) at the option of the account holder. The rate of interest on the

new deposit (Rupee account or RFC Account) should be the relevant rate applicable

for such deposit account.

Conversion of FCNR (B) Accounts of Returning Indians into RFC Account

a) Waiver of Penalty in case of deposit having run for minimum period of deposit:

The penal provisions would not be applicable in the case of premature conversion of

balances held in FCNR (B) deposits into Resident Foreign Currency Accounts by

Non-Resident Indians on their return to India.

b) If deposit has not run for minimum period of deposit

If the deposit has not run for a minimum maturity period (I year at present)

branches should pay interest as applicable on saving bank on RFC accounts

prevailing at the time of conversion of FCNR(B) Account into RFC / Resident

Rupee Account .

Payment of interest on term deposit maturing on Saturday/Sunday/ holiday/non-

business working day

In case of reinvestment deposits, branch should pay interest for the intervening

Saturday/Sunday/holiday/non-business working day on the maturity value. However,

in the case of ordinary term deposits, the interest for the intervening

Saturday/Sunday/holiday/non-business working day should be paid on the original

principal amount.

Branches are advised to strictly follow the above guidelines in letter and spirit..

Asstt General Manager

9

Anneure-I

Extracts from the Companies Act, 1956

Section 2 (41) relative means, with reference to any person, any one who is related to

such person in any of the ways specified in section 6, and no others:

Section 6. Meaning of relative:

A person shall be deemed to be a relative of another, if, and only if, -

(a) The are members of a Hindu undivided family; or

(b) They are husband and wife or

(c) The one is related to the other in the manner indicated in Schedule IA.]

[ Schedule IA) [See section 6 (c)]

List of Relatives

1. Father.

2. Mother (including step-mother)

3. Son (including step-son).

4. Sons wife.

5. Daughter (including step-daughter).

6. Fathers father.

7. Fathers mother

8. Mothers mother.

9. Mothers father.

10. Sons son.

11. Sons Sons wife.

12. Sons daughter.

13. Sons daughters husband.

14. Daughters husband.

15. Daughters son.

16. Daughters sons wife.

17. Daughters daughter.

18. Daughters daughters husband.

19. Brother (including step-brother).

20. Brothers wife.

21. Sister (including step-sister)

22. Sisters husband.

10

11

12

Potrebbero piacerti anche

- BNK 632: International Finance &bankingDocumento31 pagineBNK 632: International Finance &bankingShubham SrivastavaNessuna valutazione finora

- Opening of AccountsDocumento6 pagineOpening of AccountswubeNessuna valutazione finora

- Auto FD DeclarationDocumento2 pagineAuto FD DeclarationsumitNessuna valutazione finora

- Master Circular On Interest Rates On FCNR (B) Deposits PurposeDocumento11 pagineMaster Circular On Interest Rates On FCNR (B) Deposits PurposePradeep MehtaNessuna valutazione finora

- 14 - 10 - 23 Afternoon Test 1 Without AnswerDocumento8 pagine14 - 10 - 23 Afternoon Test 1 Without Answerkkprabhu1122Nessuna valutazione finora

- Banking Principle,,,Ch - 2Documento11 pagineBanking Principle,,,Ch - 2Mubarik AhmedinNessuna valutazione finora

- Opening of Term DepositDocumento8 pagineOpening of Term DepositDeepak RoyNessuna valutazione finora

- Enash 24 FormDocumento2 pagineEnash 24 FormmukeshNessuna valutazione finora

- Terms Conditions-Term Deposits RevisedDocumento2 pagineTerms Conditions-Term Deposits RevisedSunny KumarNessuna valutazione finora

- All About Interest Rates in IndiaDocumento27 pagineAll About Interest Rates in IndiaNitinAggarwalNessuna valutazione finora

- FCNR Ac by Pranab NamchoomDocumento18 pagineFCNR Ac by Pranab NamchoomPranab NamchoomNessuna valutazione finora

- PL Agreement Version June23Documento5 paginePL Agreement Version June23mk2475576Nessuna valutazione finora

- Knowledge Bank - Advances Against DepositsDocumento4 pagineKnowledge Bank - Advances Against DepositsKajeev KumarNessuna valutazione finora

- NHPC Application Form DetailsTNC PDFDocumento47 pagineNHPC Application Form DetailsTNC PDFHariprasad ManchiNessuna valutazione finora

- 'The Deposit Insurance and Credit Guarantee Corporation' (DICGC-India)Documento5 pagine'The Deposit Insurance and Credit Guarantee Corporation' (DICGC-India)Veeraswamy AmaraNessuna valutazione finora

- Various Investment Avenues in IndiaDocumento74 pagineVarious Investment Avenues in IndiaRakeshNessuna valutazione finora

- Bangladesh Bank: Department of Offsight SupervisionDocumento6 pagineBangladesh Bank: Department of Offsight SupervisionArabi HossainNessuna valutazione finora

- OTS FORMULA Agri Loans Upto 25 Lacs Cir 481 2023 Mobile VersionDocumento7 pagineOTS FORMULA Agri Loans Upto 25 Lacs Cir 481 2023 Mobile VersionDigbalaya SamantarayNessuna valutazione finora

- CRR & SLRDocumento19 pagineCRR & SLRBalpreet KaurNessuna valutazione finora

- Govt SchemesDocumento49 pagineGovt SchemesArul pratheebNessuna valutazione finora

- To Be Stamped As An AgreementDocumento9 pagineTo Be Stamped As An AgreementManikumarNessuna valutazione finora

- Bob Auto Renewal Sanction Letter 1167708Documento6 pagineBob Auto Renewal Sanction Letter 1167708Navin DongreNessuna valutazione finora

- Customers' Deposit Accounts: Unit IVDocumento26 pagineCustomers' Deposit Accounts: Unit IVShaifaliChauhanNessuna valutazione finora

- Customer AccountsDocumento32 pagineCustomer AccountsJitendra VirahyasNessuna valutazione finora

- Bank Financial ManagementDocumento4 pagineBank Financial ManagementSelvaraj VillyNessuna valutazione finora

- Terms Deposit Rules Terms & ConditionDocumento2 pagineTerms Deposit Rules Terms & ConditionKrrish LaraieNessuna valutazione finora

- 92MRCD010710 F3Documento27 pagine92MRCD010710 F3Neelam PatilNessuna valutazione finora

- Encash 24 FormDocumento1 paginaEncash 24 Formvipin jainNessuna valutazione finora

- Risalah Ansuran Bulanan Rumah Ogos 2012 EngDocumento4 pagineRisalah Ansuran Bulanan Rumah Ogos 2012 EngcheqmateNessuna valutazione finora

- PNB Doctor - S DelightDocumento18 paginePNB Doctor - S DelightNishesh KumarNessuna valutazione finora

- It Can Be Identified 4 Basic Scenarios When Rescheduling A LoanDocumento4 pagineIt Can Be Identified 4 Basic Scenarios When Rescheduling A LoanMd Salah UddinNessuna valutazione finora

- Account Number Deposit Amount Interest Rate (%P.A.) Start Date Maturity Date Maturity AmountDocumento2 pagineAccount Number Deposit Amount Interest Rate (%P.A.) Start Date Maturity Date Maturity AmountKhushbu NanavatiNessuna valutazione finora

- Public Provident Fund Scheme (PPF) Bod - 25112021Documento5 paginePublic Provident Fund Scheme (PPF) Bod - 25112021Priya KalraNessuna valutazione finora

- Sbi Personal Finance MitcDocumento2 pagineSbi Personal Finance MitcHumaid ShaikhNessuna valutazione finora

- SyllabusDocumento24 pagineSyllabusRipon DebNessuna valutazione finora

- Provisional Tax Saving Fixed Deposit Confirmation AdviceDocumento3 pagineProvisional Tax Saving Fixed Deposit Confirmation AdviceKunda MalleshNessuna valutazione finora

- Overdraft Against Property Loan AgreementDocumento56 pagineOverdraft Against Property Loan Agreementkirubaharan2022Nessuna valutazione finora

- SIB's Policy On Bank Deposits: PreambleDocumento8 pagineSIB's Policy On Bank Deposits: PreamblenithiananthiNessuna valutazione finora

- RLLR - PGB - 1115 - Term Loan Agreement (Personal Loan)Documento8 pagineRLLR - PGB - 1115 - Term Loan Agreement (Personal Loan)kanwariqbalsinghNessuna valutazione finora

- Josbin SebastianDocumento11 pagineJosbin SebastianJosbin sebastianNessuna valutazione finora

- Cir 56-I - Implementing Guidelines of The Pag-IBIG MPL Program For Non-IISP BranchesDocumento7 pagineCir 56-I - Implementing Guidelines of The Pag-IBIG MPL Program For Non-IISP Branchesmaxx villaNessuna valutazione finora

- Fixed Deposit Schemes: Scheme (A) - Non Cumulative Scheme (B) - CumulativeDocumento4 pagineFixed Deposit Schemes: Scheme (A) - Non Cumulative Scheme (B) - CumulativeoooohlalaNessuna valutazione finora

- Policy On Bank DepositsDocumento6 paginePolicy On Bank DepositsprojectbmsNessuna valutazione finora

- Punjab National BankDocumento28 paginePunjab National Bankgauravdhawan1991Nessuna valutazione finora

- Salient Features of Policy For Engagement of Recovery AgenciesDocumento17 pagineSalient Features of Policy For Engagement of Recovery Agenciesashaorissa1997Nessuna valutazione finora

- Guidelines For Compromise Settlement of Dues of Banks and Financial Institutions Through Lok AdalatsDocumento3 pagineGuidelines For Compromise Settlement of Dues of Banks and Financial Institutions Through Lok AdalatsMahesh Prasad PandeyNessuna valutazione finora

- 28 March 2024 - DEA Fund Scheme - Finance 360Documento17 pagine28 March 2024 - DEA Fund Scheme - Finance 360Aniket RathoreNessuna valutazione finora

- CRR & SLRDocumento3 pagineCRR & SLRSwathy SidharthanNessuna valutazione finora

- Fixed DepositDocumento37 pagineFixed DepositMinal DalviNessuna valutazione finora

- Form HBL4Documento3 pagineForm HBL4klerinetNessuna valutazione finora

- Fair Practices Code: ObjectiveDocumento16 pagineFair Practices Code: ObjectiveBADRI VENKATESHNessuna valutazione finora

- Handbook On Govt Business Products 20210818174621Documento9 pagineHandbook On Govt Business Products 20210818174621omvir singhNessuna valutazione finora

- Loan PolicyDocumento5 pagineLoan PolicySoumya BanerjeeNessuna valutazione finora

- Agreement Personal LoanDocumento8 pagineAgreement Personal LoanAnkush KotakNessuna valutazione finora

- AGREEMDocumento4 pagineAGREEMshree.shree10010Nessuna valutazione finora

- Business and Industrial Law.Documento8 pagineBusiness and Industrial Law.ZubyrKhanNessuna valutazione finora

- RD - Terms and ConditionsDocumento9 pagineRD - Terms and ConditionsDhiraj NemadeNessuna valutazione finora

- BP Unit 4Documento7 pagineBP Unit 4Nandhini VirgoNessuna valutazione finora

- Circular No. 300 - Guidelines Implementing The Pag-IBIG Fund Housing Loan Restructuring and Penalty Condonation ProgramDocumento10 pagineCircular No. 300 - Guidelines Implementing The Pag-IBIG Fund Housing Loan Restructuring and Penalty Condonation ProgramRogerMacadangdangGeonzonNessuna valutazione finora

- Thrift Savings Plan Investor's Handbook for Federal EmployeesDa EverandThrift Savings Plan Investor's Handbook for Federal EmployeesNessuna valutazione finora

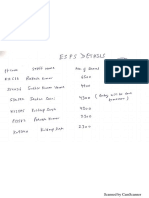

- Ps Ram SirDocumento2 paginePs Ram SirsunilNessuna valutazione finora

- Esps ApplicationDocumento2 pagineEsps ApplicationsunilNessuna valutazione finora

- Bo RudrapryagDocumento4 pagineBo RudrapryagsunilNessuna valutazione finora

- Esps DetailsDocumento1 paginaEsps DetailssunilNessuna valutazione finora

- Target of NULMDocumento5 pagineTarget of NULMsunilNessuna valutazione finora

- 398 Small DairyDocumento4 pagine398 Small DairysunilNessuna valutazione finora

- LC 255Documento1 paginaLC 255sunilNessuna valutazione finora

- PM Meets Jaitley After He Opts Out of Cabinet: Indigooptsfor Pratt&Whitney Rival, DealsoonDocumento11 paginePM Meets Jaitley After He Opts Out of Cabinet: Indigooptsfor Pratt&Whitney Rival, DealsoonsunilNessuna valutazione finora

- Gursewak Singh So Mohinder SinghDocumento4 pagineGursewak Singh So Mohinder SinghsunilNessuna valutazione finora

- Gurjant SinghDocumento3 pagineGurjant SinghsunilNessuna valutazione finora

- Baljinder SinghDocumento4 pagineBaljinder SinghsunilNessuna valutazione finora

- Angrej Singh So Gurbaksh SinghDocumento4 pagineAngrej Singh So Gurbaksh SinghsunilNessuna valutazione finora

- Balveer Singh PDFDocumento2 pagineBalveer Singh PDFsunilNessuna valutazione finora

- Angrej Singh PDFDocumento4 pagineAngrej Singh PDFsunilNessuna valutazione finora