Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Preferred Stock and Corp. Debt

Caricato da

Janine Alyssa AsuncionCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Preferred Stock and Corp. Debt

Caricato da

Janine Alyssa AsuncionCopyright:

Formati disponibili

PREFERRED STOCK

An equity security with properties of both an equity and a debt instrument, and is generally

considered a hybrid instrument. Preferreds are senior (i.e. higher ranking) to common stock, but

subordinate to bonds in terms of claim (or rights to their share of the assets of the company)

Features of Preferred Stock

Preference in dividends

Preference in assets, in the event of liquidation

Convertibility to common stock.

Callability, at the option of the corporation

Nonvoting

Preferred stock may be cumulative or noncumulative

Preferred stock may or may not have a fixed liquidation value (or par value) associated with

it. This represents the amount of capital which was contributed to the corporation when the

shares were first issued.

Preferred stock has a claim on liquidation proceeds of a stock corporation equal to its par

(or liquidation) value, unless otherwise negotiated. This claim is senior to that of common

stock, which has only a residual claim.

Some preferred shares have special voting rights to approve extraordinary events (such as

the issuance of new shares or approval of the acquisition of a company) or to elect directors,

but most preferred shares have no voting rights associated with them; some preferred

shares gain voting rights when the preferred dividends are in arrears for a substantial time.

Types

Prior preferred stockMany companies have different issues of preferred stock outstanding at

one time; one issue is usually designated highest-priority. If the company has only enough

money to meet the dividend schedule on one of the preferred issues, it makes the payments on

the prior preferred. Therefore, prior preferreds have less credit risk than other preferred

stocks (but usually offers a lower yield).

Preference preferred stockRanked behind a company's prior preferred stock (on a seniority

basis) are its preference preferred issues. These issues receive preference over all other classes

of the company's preferred (except for prior preferred). If the company issues more than one

issue of preference preferred, the issues are ranked by seniority. One issue is designated first

preference, the next-senior issue is the second and so on.

Convertible preferred stockThese are preferred issues which holders can exchange for a

predetermined number of the company's common-stock shares. This exchange may occur at

any time the investor chooses, regardless of the market price of the common stock. It is a one-

way deal; one cannot convert the common stock back to preferred stock.

Cumulative preferred stockIf the dividend is not paid, it will accumulate for future payment.

Exchangeable preferred stockThis type of preferred stock carries an embedded option to be

exchanged for some other security.

Participating preferred stockThese preferred issues offer holders the opportunity to receive

extra dividends if the company achieves predetermined financial goals. Investors who

purchased these stocks receive their regular dividend regardless of company performance

(assuming the company does well enough to make its annual dividend payments). If the

company achieves predetermined sales, earnings or profitability goals, the investors receive an

additional dividend.

Perpetual preferred stockThis type of preferred stock has no fixed date on which invested

capital will be returned to the shareholder (although there are redemption privileges held by

the corporation); most preferred stock is issued without a redemption date.

Putable preferred stockThese issues have a "put" privilege, whereby the holder may (under

certain conditions) force the issuer to redeem shares.

Monthly income preferred stockA combination of preferred stock and subordinated debt

Non-cumulative preferred stockDividends for this type of preferred stock will not accumulate

if they are unpaid

CORPORATE DEBT (bond)

A corporate bond is a bond issue by a corporation. It is a bond that a corporation issues to raise

money effectively in order to expand its business. The term is usually applied to longer-term debt

instruments, generally with a maturity date falling at least a year after their issue date.

The term "corporate bonds" is used to include all bonds except those issued

by governments in their own currencies.

Corporate bonds are often listed on major exchanges (bonds there are called "listed" bonds)

and the coupon (i.e. interest payment) is usually taxable. Sometimes this coupon can be zero

with a high redemption value.

Some corporate bonds have an embedded call option that allows the issuer to redeem the

debt before its maturity date. Other bonds, known as convertible bonds, allow investors to

convert the bond into equity.

Types of Corporate Bonds

Corporate bonds can be issued as secured, unsecured, senior or subordinated. Secured corporate

bonds indicate that the bond is backed by collateral of some kind, while unsecured bonds are

backed by little but faith. Bonds for senior debt are also commonly secured by some sort of

collateral and are almost always repaid before any bonds for subordinated debt. In addition, some

corporate bonds may offer a call option, which would allow the corporation who issued it to

essentially redeem their debt prior to the maturity date of the bond.

Risks of Corporate Bonds

Corporate bonds are widely considered to possess a much higher default risk, though this depends

on the corporation, market conditions, company rating and the governments that the issuer of the

bonds is compared to. Here is a brief list of other risks to consider before investing in corporate

bonds:

Interest Rate Yields can change, bringing a change in the value of bonds.

Supply Price depression can occur if similar, but new bonds are issued heavily.

Credit Spread If the credit spread becomes insufficient to compensate for the default, the value

obviously deteriorates.

Liquidity Bonds can be difficult to sell at a price that is anywhere comparable to what was

originally paid for them if there is no interest in the secondary market.

Tax Change Any taxation changes have the potential to negatively impact a corporate bonds

value, as well as its value on the market.

Inflation As always, fixed funds are reduced in real value by inflation. If inflation is at all

anticipated, prices may be drop almost immediately.

Potrebbero piacerti anche

- 40 Credit Repair SecretsDocumento8 pagine40 Credit Repair Secretswlingle11753% (19)

- Dividend Investing for Beginners & DummiesDa EverandDividend Investing for Beginners & DummiesValutazione: 5 su 5 stelle5/5 (1)

- Deed of TrustDocumento8 pagineDeed of TrustKay67% (3)

- Evaluation Chapter 11 LBO M&ADocumento32 pagineEvaluation Chapter 11 LBO M&AShan KumarNessuna valutazione finora

- Fixed Income Securities - Understanding Bonds & Their TypesDocumento24 pagineFixed Income Securities - Understanding Bonds & Their TypesSHRIRAJ LIGADENessuna valutazione finora

- Bond InvestmentDocumento8 pagineBond InvestmentMingmiin TeohNessuna valutazione finora

- Types of SharesDocumento4 pagineTypes of SharesMARNessuna valutazione finora

- Convertible Preferred StockDocumento3 pagineConvertible Preferred StockManojit Ghatak100% (1)

- Succession (MY REVIEWER)Documento14 pagineSuccession (MY REVIEWER)Devilleres Eliza DenNessuna valutazione finora

- FINA 3780 Chapter 5Documento42 pagineFINA 3780 Chapter 5roBinNessuna valutazione finora

- Business Entities Fall 2010Documento75 pagineBusiness Entities Fall 2010David Yergee100% (1)

- Samsung Financial Performance PresentationDocumento28 pagineSamsung Financial Performance PresentationMazed100% (1)

- Ccabeg Case Studies Accountants Public PracticeDocumento20 pagineCcabeg Case Studies Accountants Public PracticeAj de CastroNessuna valutazione finora

- CHAPTER 8 Stocks and Their ValuationDocumento39 pagineCHAPTER 8 Stocks and Their ValuationAhsan100% (1)

- Annuity Lecture - Engineering EconomyDocumento13 pagineAnnuity Lecture - Engineering Economyjohnhenryyambao0% (1)

- FM Textbook Solutions Chapter 1 Second EditionDocumento6 pagineFM Textbook Solutions Chapter 1 Second EditionlibredescargaNessuna valutazione finora

- Financial Planning and Control Word Document andDocumento12 pagineFinancial Planning and Control Word Document andketanagarwal143Nessuna valutazione finora

- Understanding Preferred SharesDocumento10 pagineUnderstanding Preferred SharesNeo KinNessuna valutazione finora

- Preferred StockDocumento8 paginePreferred Stockhasan jamiNessuna valutazione finora

- BondsDocumento7 pagineBonds2024921917Nessuna valutazione finora

- Hybrid Securities ExplainedDocumento2 pagineHybrid Securities ExplainedbugsbugsNessuna valutazione finora

- Financial Management of Preference Shares and DebenturesDocumento25 pagineFinancial Management of Preference Shares and DebenturesAbhinita PoojaryNessuna valutazione finora

- Hybrid Financing: Preference Shares and Convertibles: D The Annual Dividend, I The Interest Rate in Decimal FormDocumento5 pagineHybrid Financing: Preference Shares and Convertibles: D The Annual Dividend, I The Interest Rate in Decimal FormJericho_Jauod_9677Nessuna valutazione finora

- CZ Patel College Submits Report on Equity Shares, Debentures & Preference SharesDocumento18 pagineCZ Patel College Submits Report on Equity Shares, Debentures & Preference Sharesrishi raj modiNessuna valutazione finora

- IM Module 3Documento7 pagineIM Module 3Ravikumar KanniNessuna valutazione finora

- Capital Markets: Presented by AbhishekDocumento22 pagineCapital Markets: Presented by AbhishekBeerappa RamakrishnaNessuna valutazione finora

- Long-Term Funds Sourcing: Equity Financing: Mary Chienny Anne HocosolDocumento19 pagineLong-Term Funds Sourcing: Equity Financing: Mary Chienny Anne HocosolChienny HocosolNessuna valutazione finora

- Preferred Shares FeaturesDocumento13 paginePreferred Shares FeaturesyamaleihsNessuna valutazione finora

- Assignment, StockDocumento5 pagineAssignment, StockNawshad HasanNessuna valutazione finora

- Preferred Stock FeaturesDocumento2 paginePreferred Stock FeaturesLJBernardoNessuna valutazione finora

- Chapter 4 LopezDocumento4 pagineChapter 4 LopezMarivic VNessuna valutazione finora

- Sabbir Hossain 111 161 350Documento37 pagineSabbir Hossain 111 161 350Sabbir HossainNessuna valutazione finora

- What are Preferred Shares and How Do They Differ from Common StockDocumento9 pagineWhat are Preferred Shares and How Do They Differ from Common StockMariam LatifNessuna valutazione finora

- Chapter 4 Corporate StockDocumento5 pagineChapter 4 Corporate StockJhanice MartinezNessuna valutazione finora

- Legal Aspect of Business AssignmentDocumento25 pagineLegal Aspect of Business AssignmentUBSHimanshu KumarNessuna valutazione finora

- Group Work ResearchDocumento16 pagineGroup Work ResearchMaryam YusufNessuna valutazione finora

- What is Equity ShareDocumento4 pagineWhat is Equity ShareDea khushi SharmaNessuna valutazione finora

- Meaning: Asset Company Call Shares Money Creditor Interest Ordinary Shares Means Share Profits ReturnsDocumento10 pagineMeaning: Asset Company Call Shares Money Creditor Interest Ordinary Shares Means Share Profits ReturnskhuushbuNessuna valutazione finora

- FM ReviewerDocumento20 pagineFM ReviewerBSA - Cabangon, MerraquelNessuna valutazione finora

- Capital MarketDocumento30 pagineCapital MarketBhavesh RathiNessuna valutazione finora

- Advantages and Disadvantages of Preferred StockDocumento5 pagineAdvantages and Disadvantages of Preferred StockVaibhav Rolihan100% (2)

- FIN242: Preferred Stock Investment GuideDocumento10 pagineFIN242: Preferred Stock Investment GuideMūhãmmâd Åïmãñ Bïn ÂbddūllähNessuna valutazione finora

- Common Stock and Preffered Stock1Documento5 pagineCommon Stock and Preffered Stock1mengistuNessuna valutazione finora

- Understanding Fixed-Income SecuritiesDocumento4 pagineUnderstanding Fixed-Income SecuritiesJennyveive RiveraNessuna valutazione finora

- Corporate Securities: Ma. Pamela Z. Sepulveda Bsa 4 Financial Management 102 AUGUST 23, 2018Documento51 pagineCorporate Securities: Ma. Pamela Z. Sepulveda Bsa 4 Financial Management 102 AUGUST 23, 2018anon_855990044Nessuna valutazione finora

- Reasons for Listing in IPODocumento6 pagineReasons for Listing in IPOkdoshi23Nessuna valutazione finora

- StocksDocumento9 pagineStocksHassan Tahir SialNessuna valutazione finora

- Report on Key Features, Benefits and Drawbacks of Preference Share CapitalDocumento6 pagineReport on Key Features, Benefits and Drawbacks of Preference Share CapitalChirag GoyalNessuna valutazione finora

- Introduction To Company AccountingDocumento19 pagineIntroduction To Company AccountingIsra GhousNessuna valutazione finora

- 2 Types of SecuritiesDocumento2 pagine2 Types of SecuritiesMark MatyasNessuna valutazione finora

- Unit 2 FMDocumento53 pagineUnit 2 FMdhall.tushar2004Nessuna valutazione finora

- Managerial Finance chp7Documento11 pagineManagerial Finance chp7Linda Mohammad FarajNessuna valutazione finora

- Why Invest in Preferred Shares?: TH THDocumento6 pagineWhy Invest in Preferred Shares?: TH THSiti Shakiroh Ahmad TajudinNessuna valutazione finora

- Types of SharesDocumento10 pagineTypes of Sharesinsomniac_satanNessuna valutazione finora

- Legal Sources of Corporate FundingDocumento24 pagineLegal Sources of Corporate Fundingmr singhNessuna valutazione finora

- Unit 1.17 - Capital Market InstrumentsDocumento30 pagineUnit 1.17 - Capital Market InstrumentsBhuviNessuna valutazione finora

- 2 Stock and BondDocumento18 pagine2 Stock and BondHarris NarbarteNessuna valutazione finora

- Equity Financing: Sresth Verma Bba 6A 05290201718Documento12 pagineEquity Financing: Sresth Verma Bba 6A 05290201718Sresth VermaNessuna valutazione finora

- Chapter 10b Long Term Finance - EquityDocumento27 pagineChapter 10b Long Term Finance - EquityIvy CheekNessuna valutazione finora

- Chapter 6Documento20 pagineChapter 6Alliyah KayeNessuna valutazione finora

- Chapter 3Documento19 pagineChapter 3Tofik SalmanNessuna valutazione finora

- Sources of Finance and Capitalization TheoriesDocumento11 pagineSources of Finance and Capitalization Theoriespurvang selaniNessuna valutazione finora

- Understanding Types of Debt, Risk and ReturnDocumento33 pagineUnderstanding Types of Debt, Risk and ReturnSabbir HossainNessuna valutazione finora

- Secondary MarketDocumento2 pagineSecondary MarketRigved DarekarNessuna valutazione finora

- Chapter 4 FIDocumento7 pagineChapter 4 FISeid KassawNessuna valutazione finora

- Lecture 12Documento30 pagineLecture 12cikbidNessuna valutazione finora

- STLT Finance 3 - Equity MarketsDocumento10 pagineSTLT Finance 3 - Equity MarketsHanae ElNessuna valutazione finora

- Investment Alternatives of Capital MarketDocumento4 pagineInvestment Alternatives of Capital MarketMuhammad RizwanNessuna valutazione finora

- Unit 2Documento11 pagineUnit 2POORNA GOYANKA 2123268Nessuna valutazione finora

- Week 1 & 2Documento8 pagineWeek 1 & 2SHAHZAD ALI DARYABNessuna valutazione finora

- Letter To The Thesis AdviserDocumento2 pagineLetter To The Thesis AdviserJanine Alyssa AsuncionNessuna valutazione finora

- CH 23 SMDocumento35 pagineCH 23 SMNafisah Mambuay100% (1)

- CH 13 SMDocumento31 pagineCH 13 SMNafisah MambuayNessuna valutazione finora

- Management of People Relationships.Documento18 pagineManagement of People Relationships.Janine Alyssa AsuncionNessuna valutazione finora

- Review of Related LiteratureDocumento4 pagineReview of Related LiteratureJanine Alyssa AsuncionNessuna valutazione finora

- Property Law Final ProjecttDocumento14 pagineProperty Law Final ProjecttMd Aatif IqbalNessuna valutazione finora

- 1 Which of The Following Statements Is Incorrect A AnDocumento2 pagine1 Which of The Following Statements Is Incorrect A AnAmit PandeyNessuna valutazione finora

- Pledge Case DigestDocumento8 paginePledge Case DigestAlarm GuardiansNessuna valutazione finora

- Compounding InterestismDocumento23 pagineCompounding InterestismJhay Mike BatunaNessuna valutazione finora

- The Cost of CollegeDocumento12 pagineThe Cost of Collegeapi-284073874Nessuna valutazione finora

- Sdlkfjasd LFKDocumento66 pagineSdlkfjasd LFKTerryLasutNessuna valutazione finora

- Computation Sheet: ST ND RD TH TH TH TH TH THDocumento1 paginaComputation Sheet: ST ND RD TH TH TH TH TH THJohn DavidNessuna valutazione finora

- 0integrated Accounting: Financial Accounting & Reporting (P1)Documento32 pagine0integrated Accounting: Financial Accounting & Reporting (P1)Jochelle Anne PaetNessuna valutazione finora

- Annual Report 2021 EDLDocumento92 pagineAnnual Report 2021 EDLSabaiphone SouvanlasyNessuna valutazione finora

- Analysis of Financial Performance HealthDocumento6 pagineAnalysis of Financial Performance Healthningrum suryadinataNessuna valutazione finora

- Chapter - AnanthiDocumento81 pagineChapter - AnanthiRiya SadasivamNessuna valutazione finora

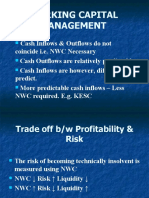

- Working Capital Management: Cash Inflows & Outflows Do NotDocumento30 pagineWorking Capital Management: Cash Inflows & Outflows Do NotTabish BhatNessuna valutazione finora

- Tax 2 Module1 Estate TaxationDocumento28 pagineTax 2 Module1 Estate TaxationXyza JabiliNessuna valutazione finora

- Divya Final FinalDocumento54 pagineDivya Final FinalujwaljaiswalNessuna valutazione finora

- Lobrigas Unit4 Topic2 AssessmentDocumento7 pagineLobrigas Unit4 Topic2 AssessmentClaudine LobrigasNessuna valutazione finora

- A Study On Working Capital Management With Reference To The India Cements LTDDocumento4 pagineA Study On Working Capital Management With Reference To The India Cements LTDEditor IJTSRDNessuna valutazione finora

- Mjs and Associates V Chase 12312010 Client Lance CassinoDocumento8 pagineMjs and Associates V Chase 12312010 Client Lance Cassinoapi-293779854Nessuna valutazione finora

- Chapter 7 Bonds PayableDocumento9 pagineChapter 7 Bonds PayableCarlos arnaldo lavadoNessuna valutazione finora

- North South University: Lecturer Department of Finance & Accounting School of Business & Economics (SBE)Documento28 pagineNorth South University: Lecturer Department of Finance & Accounting School of Business & Economics (SBE)Imrul Farhan Pritom 1620326630Nessuna valutazione finora

- Apollo Credit Market Outlook Jul23Documento157 pagineApollo Credit Market Outlook Jul23supNessuna valutazione finora