Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Index - M3

Caricato da

Lan DoanDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

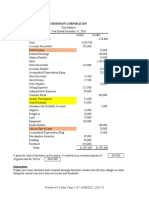

Index - M3

Caricato da

Lan DoanCopyright:

Formati disponibili

GOVERNANCE CONCEPTS

Authors

OECD (1999)

Stewardship theory

Donaldson & Davis (1991)

Pastoriza and Arino (2008)

Agency theory

Jensen & Meckling (1976)

Lord Cadbury (CFACG 1992)

Milton Friedman

Anglo-American law

ASX Principles

Professional Accountants in Business Committee (PAIB) of IFAC

US Sarbanes - Oxley Act 2002

US Sarbanes - Oxley Act 2002

Percy (1995)

Bosch (1995)

Australian Shareholders' Association (ASA)

Institutional shareholders

California Public Employees' Retirement System (CalPERS)

Milton Friedman

Milton Friedman

Edward Freeman (1984)

Cadbury report - Financial Aspects of CG

Ramsay (2001)

OECD Principles

OECD

Listing Rules

Sarbanes-Oxley

Nestor & Thompson (2000)

La Porta, Lopez-de-Silanes & Schleifer (1999)

Nestor & Thompson (2000)

Weil, Gotshal & Manges (2002)

Yasui (1999)

Pande & Kaushik (2011)

Harris (1997)

Uhrig (2003)

Monks & Minow (2008)

Kirkpatrick (2009)

IFAC PAIB (IFAC 2004)

Anglo-American law

Key words

The CG strcuture specifies the distribution..monitoring performance

Good CG aims to ensure that organizations run in the best interests of their stakeholders

naturally act favourably on behalf of the owners

the agent may not naturally act for thes best interest of the principal

the agent will not always act in the best interest of the principal

series of checks and balances

primary responsibility of a corporation is to maximise the wealth of its shareholders

duty of board is firstly to shareholdersfrom duty of directrors to act in good faith in best interest of Coy

Remuneration committee's structure

companies should establish a strategy committee

Nomination committee indentifies and selects ppl who will replace staff when they leave

Audit committee is in many ways the most important in relation to the conformance aspects of CG

must have an audit committee

provide audit committee has the responsibility to 'hire and fire' auditors

audit committee's review should place particular focus on changes in accounting policies..

audit committee might merely impose an additional layer of bureaucracy

powers of shareholders

active in striving for improvements in CG of Australian companies

possess great power to control corporations through voting power they exercise in respect of these shares

California Public Employees' Retirement System (CalPERS)

to use its resources and engage in activities designed to increase profit..without deception and fraud

important of stakeholders

gave recommendations to companies. The concept of 'comply and explain'

did not recommend a ban on the provision of non-audit services to audit clients

principles-based - framework for individual nations (6 core principles)

duties to stakeholders as an important and integral part of CG

top 300 companies must not only have audit committee but also must meet recommendation 4.2

require that all members of audit committee must be independent at all times

most European countries, ownership and control are held cohesive group of insiders

in the west, the board members are outsiders representing the shareholders. In Japan, insiders leading management

there has been significant abuse, not just by director but by all..

identified risk as being important for both performance and conformance aspects of governance

the remuneration of boards and senior management also remains a highly controversial issue in many OECD

countries

directors must act in the best interests of the corpoation as a whole. But, if director belives that acting to this

approach will lead to long-term success --> mistaken

maximise shareholder wealth 'within the rules'. 'Rules' include expectations about proper treatment of all

stakeholders

European emphasise 'cooperative relationship and consensus' , whereases Anglo-Saxon emphasise ' competition

and market processes'

the agency of problem of the market-based system is much less of a problem in the relationship-based system

Page

4

5

6

7

7

8

12

16

19

28

28

28

29

29

29

30

31

32

32

33

35

36

36

41

43

45

48

56

56

62

63

63

63

67

71

74

74

75

76

78

36

Ethics and Corporate Governance

Module 1: Accounting and Society

Part A: Interaction with Society /Accounting in Society

Recruiting the Best (Add value, Lifelong and Professiona capabilities)

Depiction of Accounting (Stereotype of Accounting Dimik&Felton)

Coate: +Prudence (Social skills), - Colourful Accountant(Downside of Service ideal)

Moral Agency (Ethical Approaches to achieve outcomes)

Technical Functions and Social Impact

1.- Understanding Accounting (Social practice: Professional capabilities + Service ideal)TSKE/SSKE

2.- Social Impact: Less Prescriptive more judgments) Lonegan: GFC

3.- Theoretycal Analysis of Social Impact

Body of Knowledge: Parkers & Millers

Macro Level ( Business & goverments - Power and control)

Micro Level (Manager & Employee - Motivation and Behaviour)

Capabilities Considerations (Sufficient capabilities=complex&difficult professional Judgements)

TSKE: General Accounting Activities

SSKE: Social Skills & Capabilities well developed

Both vital : Lifelong learning for both activities.

Accounting roles, Activities & Relationship

PAIB : Professional Accounting in Business

IFAC-PAIB, value adding, Value creation,.

Contemporary role/Main activities of a Professional Accountant.

1. Accountants employed in Large Business (Strategy development & implementation)

2. Public Practice: Accounting Firm Environment-Big 4, Large 7 second tier firms)

3. SME's ( very small SME's relying in SMP's practice. Large firms :few or one Accountant)

IFAC: SME'S focus on compliance, not being much value in performance(profitability)

PAIB: Accountans reponsible to generate value for the success of company.

Ethics ( Moral, Ethics, Business Ethics, Professional Ethics; APES 110, Guidelines &rules)

Accounting and Effective Governance

Accounting: OECD 2004, Social practice.

Corporate Governance: IFAC-Performance + Conformance

Part B: Accountants as a member of a profession.

Trust and Profession: Integrity, Autonomy, Professional Judgement

Atributte of a Profession: Autonomy and Service Ideal

A systematic Body of Theory and Knowledge

An Extensive Education Process

An Ideal Service to the Community

A High degree of Autonomy and Independence (Objectivity and integrity)

A code of Ethics for members (APES 110, AASB, AUASB, Corporate Law)

A Distintictive ethos or culture ( CPA)

Application of Professional Judgement (Schon 1988)

The Existence of Governing Body (CPA membership)

Professions: The 'market control' view (Monopolistic Power, Self Regulation (West 2003)

Evolution of the profession

Professionalisation: Larson - Power creation

Power and Exclusion: (Ethics Vs Profit - Gold Collarism, Kelley 1985)

Ideals of Accounting: E's Education, Ethics, expertise and Entrepreneuship

Accoutnting Under Challenge

Credibility of the profession: Ethics & Failure: GFC failure-Manage Risk & underdtanding Accounting valuation

Greater Regulation: AASB, Asic, FRC reporting, and Corporation

Restoring Credibility to accounting: IFAC 2009 Recomendations, Sarbanes Oxly 2002, Coso 2004, CLERP 9, CPA,)

Reading 1.1: How softskills can boost your career

Reading 1.2: The strategic accountant

Reading 1.3: Public practice: firm of the future

Reading 1.4: Profile: Roel Van Vegel -The sweet sounds of success

Questions: 1.1 Recall Lonergan' GFC failured, Was that slow reaction the only cause of GFC?

Questions: 1.2 Outline 4 possibles accountig-related roles with an SME and for each role indentify the task to be undertaken?

Questions: 1.3 Reading 1.4. Is that busienss ME or an SME? How did the PAIB add value to Andrew Rueu's business?

Questions: 1.4 Why have SME's not relied in the past on theirexternal accoutnants for business asvisory?

Questions: 1.5 Discuss 4 situations where accountants may aplly professional judgements in their course of work?

Module 2: Ethics

Part A: Professional ethics

Apply the concepts of service ideal

The well-being of society

The pursuit of excellence ( Professional Behaviour)

Community service (Relationship of trust)

A code of ethics for professional accountants

The conceptual framework (principles-based) approach (APESB : blended code of Principles and rules)

Threats

Examples of threats

Safeguards (Institutionals & In the work Environement)

The public interest - an introduction to the code (Accountat primary loyalty is with the public - not client/employer)

Fundamental principles of professional conduct

Integrity(Straigforward, honest - Financial information)

Objectivity (Impartial, honest, free from conflict of interest)

Professional independence to the provision (Independence=Objectivity + Integrity)

Independance of mind (reality ) and appereance(more desvastating, Lack of indepen)

of assurance service

Common threats to independence (Examples)

Professional independence in practice (s290-291)

Provision of non-audit service to an audit client (S290) - Additonal value for an Audit Client)

Professional competence and due care

Confidentiality

Professional behaviour

Code of ethics for members in public practice

Professional appointment (acceptance should no be granted automately - Solicitation)

Referrals (special assigment)

Conflicts of interest

Incompatible activities (self interest threat)

Conflicts between two or more clients (members must not provide services unless consent to do it is received)

Second opinions (seek permission from clients)

Fees and other types of remuneration

Professional fees (billing arrangements)

Contingent and referral fees (Actions of transactions/Result of services)

Commissions and soft-dollar benefits

(Inconsitent with CPA - Professionalims, Fees for commissions: Self interest threat to objectivity)

Marketing professional services (Consistency with Professional Behaviour)

Code of ethics for members in business

Potential conflicts (Undertake task inconsistent with professional duties)

Preparation and reporting of information and earnings management (Revenue Recognition, Greed)

Reporting with integrity (Public Interest - trust)

Professional And ethical failures by menbers/public practice - Sonya Denisse & Trevor Neil)

Financial interests (Threats and Safeguards)

Gifts, hospitality and inducements

Self-regulation and professional discipline

The profession's self-regulatory process

Accounting professional and ethical standards board (APESB) (high level of Professional Practice)

Roles of APESB

The quality assurance process (Components: Standard setting, Conformity withstadards, preactice review, Firm regulations)

APES 320 Quality control for firms

Policies and procedures for address each element

Professional discipline (To achieve credibility & confidence of the general Public / Sources of complaint, CPA)

Procedures

Penalties and appeals

Part B: A conceptual framework for ethical behaviour

Theoretical approach to ethics

A concept map

Normative theory - 2 key functions:

(Framework for judging moral righteness and framework decision making to resolve Ethical problems)

Teleological theories (consequential)

Ethical egoism

Differences between psychological egoism, ethical egoism (table 2.5)

and utilitarianism

Utilitarianism

Five basic steps

Limitation of consequential and utilitarian analysis

Dentological theories (Duties)

Rights theory

Justice theory (Aristoteles)

A philisophical model of ethical decision-making (Mathison 1988)

Aplication of multiples theories to unethical dilemma

Virtue ethics

An introduction to professional and ethical judgment

Kohlberg's theory of cognitive moral reasoning and development

Six stages of cognitive moral development

Level 1: Pre-conventional

Level 2: Conventional

Level 3: Post-conventional

Levels of moral reasoning in accounting

Factors influencing decision-making

Individual (Cognitive development) - Kholbers theory

Organisational ( organisational culture, Code of ethics, Others significants)

Schein's six primary mechanisms(Leader rely on this, can achieve cultural success, cultural failure, cultural change)

Stress in the workplace

Professional (APESB)

Societal

Law and regulation

Culture (Confucionism: Japan, China), Relativism

Ethical decision-making models (Influences on an Individual Decision) - HEURISTIC

American Accounting Association Model (AAA) - Lagender & Rockness

Seven steps model

AICPA Decision Tree

Reading 2.1 Accountants, Ethical issues and the Corporate Governance text?

Reading 2.2 Six cures forcurrent Ethical Breakdowns

Reading 2.3 Ethics Decision tree fro CPAs in business and industry

Questions: 2.1 Consider Implications of an accountant with isufficient time to perform duties? What should you do?

Questions: 2.2 Your firm executes investment transactions for a client. You are now asked to audit this client, I s there a threat to yur independence?

Questions: 2.3 A new qualified CPA is asked to perform an audit to small company, The accountant has not experience in that field, What should you do?

Questions: 2.4 You have been asked to audti 1/2 year finanical statement, (second opninion?

Questions: 2.5 You mamage fundraisng company, Soft dollar benefits?

Questions: 2.6 New assurance Services without previuos experience, Does this complain with the Code of Ethics?

Questions: 2.7 Explain why integrity is an essential attributer of the profession

Questions: 2.8 Quality assurance and ethical issues arising from?

Questions: 2.9 Utiliarims definitions, problems and difffences?

Questions: 2.10 Does you employee have a right to enquiie into activitiess of your personal life? In realtion of rights theory?

Questions: 2.11 Which Stage of Kholbert theory of CMD best describe the decision making behaviour of Accountants

Module 3: Governance

Part A: Overview of Corporate Governance ( Information and Comunication)

Goverance(CG = Performance + conformance)

Accountants and Effective Governance

Importance of CG

The Need of CG

Stewardship Theory

Agency Theory (Jensesn and Meckling - 1976 : 2 Key assumptions, Barriers to Goal Congruence)

Agency Issues and Costs

Monitoring costs : Cost associated by principals in order to know & control agency matters)

Bonding costs : reducing residual & monitoring cost for a greater remuneration - borne by agent)

Residual costs: (Loss & Cost under performance : An agency cost borne by principals)

Excessive non-financial benefits: Over-consumption of perks (lack og goal congruence: reduce both profitability and Cash flow)

Empire building: Financial rewards: Power and influence increase: purcharse subsidiare)

Risk avoidance: (Risky investment avoidance because of fixed salary package)

Differing time horizons : Perpetual cash flows, interest in the firm for the duration of their employment)

Components of Corporate Governance

Corporations

Directors and Boards

Board of Directors (Bosh Report in Australia, Rogers CJ ( AWA Ltd)

Alternative board structures and relationships (2 tier board structures: top tier - supervisory and second tier - management

Board Chair - Independence( OECD: chair not mention should be Indep.. / UK CGC should be indep..)

Role of CEO - Agent of the Board ( Board member and CEO/ Agency relationship arise)

Independence of directors

Duties and Responsibilities of Directors

Conflict of interest (Independence od Ppereance and Independence of mind help to assess conflicts of interest)

Act in the corporation's best interest ( good faith, Honestly and without fraud or collusion)

Exercise powers for proper purpose: ( do not abuse their power - Example Advance Bank)

Nominee directors ( use power for proper Purposes when nominate & appoint directors))

Duty to retain discretion ( do not delegate to theird discretion to act as a director)

Duty of care, skill and diligence (Centro case)

Duty to avoid insolvent trading: (UK / US flexible system, Australia: stricter *Shut down the organisation)

Committees of the Board

Risk management committee

Nomination committee

Remuneration committee

Audit committee ( AASB: Objectives ans Resposabilitites, Benefists and limitations)

Shareholders ( Bosch -1995) rights and Obligations

Individual Shareholders ( ASA , Media an Internet)

Institutionals Shareholders (Insurance companies/ funds ) (Hampel Report, now reflected in UK CGC)

Internal and External Auditors

Regulators : Essential to ensure that companies can compete against each other in a fair an reasonable manner)

Regulations versus De Regulations (Free market (self interest- Miltond Friedman)

Principle based ( OCED, ASX CGC and UK FRC) versus rules -based regulations ( US Sarbanes - Oxley Act)

Stakeholders

Stakeholder concept

Stakeholder map

Employees

Suppliers and lenders

Consumers (customers)

Part B: International Perspective on Corporate Goveranance

Global Push for Improved Governance

Key Factors driving the need for better Corporate Governance

Thirty years of Corporate Goverance

International Development Timetables

United Kingdom

Cadbury report (1992) ( Concept of Comply or Explan / If not, Why not reporting)

Financial aspects of corporate governance (1992)

Principal recommendations of the board

Non-executive vs independence directors

Strategic role of the board

Greenbury Committee

Enhanced transparency on directors' remunerations

Hampel committee

Importance of corporate governance

The combined code and the turnbull guidance

Combined code of 18 principles and 48 code provisions

Number of non-executive directors

Higgs review and smith report

Composition of the board and sub-committee

UK combined code on corporate governance (FRC 2008)

United States

Committee of sponsoring organisations of threadway commission (COSO)

(Report realted to Internal control and Enterprise risk management)

Internal control - integrated framework

Fradulent financial reporting

Enterprise risk management

Sarbanes-Oxley act ( Strenghtened Audit requirements, increase financial disclosures, Internal controls)

Audit reform

Corporate accountability

Financial disclosures,loans and code of ethics

Criminal fraud and whistleblowing

Other International Approaches

International Corporate Goverance Network

OECD Principles of Corporate Goverance

APEC

Australia

Ramsay report (2001)

Key recommendations on independence of auditors

ASX corporate governance principles and recommendations (2007)

Eight Principles and recommendations

Corporate Law Economic Reform (CLERP) 9 Act (2004)

Audit reform

Financial reporting

Other (Whistleblowing, shareholder participation)

Part C: Codes and Guidance

OECD Principles of Corporate Governance

Six principles of corporate governance

Basis for effective corporate governance framework

Rights of shareholders and key ownership functions

Equitable treatment of shareholders

Role of stakeholders in corporate governance

Disclosure and transparency

Responsibilities of the board

UK Finanancial Reporting Council Corporate Governance Code (Apendix 3.1) last part of material Module 3

Main Principle: Comply or explain

Section A: Leadership (Roles of Board, Divison of Resposabilitites, chairman)

Section D: Remuneration (Components of remuneration, Procedures)

Section E: Realtion with Shareholders( Dialogue, Constructive use AGM)

ASX CGC Recommendations (if not why not reporting requirement): 8 principles

Lay solid foundations for management and oversight

Structure the board to add value

Promote ethical and responsible decision making (code ofconduct)

Safeguard integrity in financial reporting (Audit committee)

Make timely and balanced disclosure

Respect the rights of shareholders

Recognise and manage risk

Remunerate fairly and responsibly - Remuneration Committee

Alternative International Approaches to Governance

Market Based System (Outsider system, Shareholder systems or Anglo Saxon System)

Corporate Goverance of US and UK (Shareholders primary focus)

CEO/Chair same - Principal agent realtionship

Focus in Funds and Insurance company, less in banks ( Disclosures based)

Realtionship Based System - European approaches

Stakeholders Active recognized

Banks play an active role, long term large shareholders protect to threat of takeovers.

Insiders groups monitor management, Reduce of Agency problems

Different polititcal, legal and regulatory Structures (European contries)

Germany and France

Relationship Based System - Asian Aproaches

Differing Corporate Governance models ( Concentration of Ownership of companies)

China: Governement - controlled organisation, 6 maint types of Enterprises.

India

Japan(Outsider boards representing SHs or board member are insiders leading managemet)

Family Controlled companies and Business Networks - East Asian

Governance in Other Sectors

Not-for-profit organizations

Small and medium enterprises

Public sector

Part D: Governance Failures and Improvements

Common Failure Factors

Remuneration: 2 main issues

Wilful blindness

Complex financial instruments

Improving Corporate Governance

Section B: Effectiveness ( Board: Composition, Appointment, Commitment, Development, Information, Supprot, Evaluation,

Reelection)

Section C: Accountability(Risk management and Internal control, Audit Committee and Auditors,)

Company Law, Employee representation, Stakeholders issues, Shs rights and participation mechanics, Board

Structure, roles and responsibilities, Supervisory body independence and leadership, Disclousre

Sarbanes-Oxley regulations aims to prevent this type of approachby requiring CEO and CFO sign off on financial accountsand certify the

appropriateness of internal controls

Risk Management

Internal control and risk management: ISA 215-Ifac2009, Sarbanex Oxley Act US 2002)

Internal Control and Risk systems - Including accounting , Risk Control and internal audit

Independence of the Chair

Continued evolution of CG

Part : Case Studies of Governance Failure

Example 3.3 Centro case

Example 3.5 The Enron audit committee

Question 3.1: What is major issue that arise form an agency relationship, where powers of control are delegated. (Conflict of intererst)

Question 3.2: Describe key aspects of the principal and agent problems that exist within corporations and that can result in loss of value for the shareholders.

Question 3.3: Classify each of the items above as having either a performance focus or a conformance focus

Question 3.4: Describe the role of the CEO, and give example of the types of activities the CEO and the board should perform

Reflective question: Do you agree with idea that different directos within same organization may be held to have a different standard of care based on their qualifications?

Question 3.5:

Question 3.6: Discuss whether there is potential for conflict between Core principle 2, Item A4 and Core principle 3, Item A2.

Question 3.7: Evaluate the following case study using OECD principles

Question 3.8: a. Who is responsible for reviewing a company 's internal controls?

b. How often should a board undertake a formal evaluation of its own performance?

c. Outline whether a chief executive may also be the chair. Suggest reasons why the FRC Code has taken this view.

Question 3.9: Review the following case scenario

Question 3.10:

Question 3.11:

Question 3.12: Identify strengths and weaknesses of the market-based system of CG as practised in countries such as US, UK and Aus.

Question 3.13: Identify advantages and dis of European relationship-based insider system of CG.

Question 3.14: Outline the benefits and costs of the family-based insider system of CG practised in Asia.

Question 3.15: What are the key issues of governance affecting not-for-profit organizations?

Question 3.16: What do you consider to be the main CG issues affecting small biz?

Module 4: Corporations and their stakeholders CORPORATIONS AND OTHER ENTITIES

Corporation Governance Success Factors

Board Appointment and Cessation

Appointment

At least 18 yrs old

Disqualified from managing a corporation cannot be appointed a director, also a senior executive

De-staggering (max 10yrs for independece director

Departures (Bosch 1995)

Disqualification ( automatic, disqualified 5 years)

Automatic disqualifications (criminal Offences)

Disqualifications on applications (5 to 20 years - civil penalties)

Examine Enron audit committee actions in light of the earlier discussion on the benefits and limitations of audit committee. Evaluate effectiveness of

the committee and what steps you would recommend to improve the Enron audit committee in this situation.

Why is disclosure important for the integrity of equity markets? In your answer, you should address what occurs when information is monopolised by

priviledge groups

Is interest in CG regulation and legislation inevitably associated with recession, market failure and corporate collapse, or is it possible to maintain

attention on improving standards of CG at times of market expansion and biz growth?

Removal: (in Aus, 5% of issued captial or at least 100 small sh/h --> call extraordinary meeting to revmove individual directors by 50% votes

cast

Two-strikes rule - Sh/h spill the whole board (provide for two-strikes and re-election of all board members, provide better information to sh/h)

Ethics of disqualification (directors make poor performance or poor judgement)

Diversity - Fairness and Performance

Board diversity (individual's race, gender, ethnicity, age, etc.)

Discrimination in employment is key area in diversity

Adopting diversity (necessary to create an environment where diversity becomes part of culture of CG, NAB is an example)

Key points of NAB's diversity by AICD

Remuneration and Performance

Board and executives took higher risks when their remuneration based on financial performance --> personal gain

Understanding the debate

Having a say on pay' in Aus, UK and US

International Debates about Remuneration Levels and Fairness

Remuneration of Executive & non executives director - UK FRC CGC 2010

Disclosure and transparency and remuneration: no Individual should set their own remuneration levels.

Remuneration Disclosure - International Approaches : France, UK, USA

Tightening rules regarding remuneration - Australian illustrations (true nature of current, past and future remuneration to executives)

Remuneration, risk and the GFC (remuneration based on profit -->take higher risk)

Employees (vital and internal Stakeholders - OECD Guidelines)

Australian Consumer Law (unfair practices, penalties and compensation)

Occupational health and safety

Fair pay and working conditions

Family and Holiday Entitlements: Al, Paternity & maternity Leave, others type of entitlements)

Ethical obligations - Employee Goverance (Code of conduct - Satysfying the objectives of the OECD principles

Case examples of Failure : Nike, James Hardie

Whistleblowers

Australian Corporation Act Whistleblower Protection ( Example: Sherron Watkins - ENRON)

Trade and labour unions (Collectives Bargaining)

External Stakeholders ( Considered outsiders in term of Governance)

Global Society and Environment (corporations to asssume ethicals leadership)

The Economic and Legal System

The legal System as a Stakeholder (Good laws to achieve good outcomes and should do so reliably and acces to court)

Competition and Protecting Markets for Goods and Services ( monitor by ACCC)

Competition Policy ( Competitve markets to avoid Monopolist Corporation) - Policy Objectives

Competition and Stakeholders (Maintain competition btw technologies in the bradbank sector, internet providers)

Ethical obligations (Collusion btw competitor very bad) - Tab 4.2 International Competition legislation and Regualtions

Regulations on anti-competitive behavious (Detailed rules to regulate:

Abuse of market power ( Predatory Markets - ACCC: Penalties against Cabagge and Intel)

Mergers and acquisition (reduce # of competitors - prohibited or limited)

Agreement between competitors - Cartel Conduct

Workable Competititon ( requirements of workable or effective compettion) (judgements based in Balance of Probabilitites)

Non executives Directors: not performance based incentives, Based only reasonable retur for time dedicated to

corporation's businesses

Executives Directors : Remuneration committee: remunerated for their perfomance/achieving of goal congruence

Performance-based remuneration (Fixed:individual/corporation performace and At Risk portion: Reaching certain goals and

performance beanchmarking)

Compettitors Collusion -Cartel Behaviour

Output Restrictions ( Agreemts wil lcause Shortage in markets - price raises.

Allocating Customers Suppliers or territories ( Creating Artificial Monopolies)

Bid Rigging (Work collude - Competitve Tenders Inflate price to win a bid)

Price Fixing (Parallel Conduct) - Examples

Unilateral restrictions on Supply (exclusivng dealing) - Third line forcing: Ilegal, anticompetitive and lessen competition)

Resale Price Maintenance (Ilegal practice: sells products above a stated price)

Approvals Procedures (Franchises: formal mechanisms to authorise third line forcing - ACCC)

Proof, penalties and redress - Criminal and Civil

Laws Leading to Criminal Penalties (proof beyond reasonable doubt - Punishment: fines/Jail)

Laws with Civil Outcomes and Civil Penalties (Balance of probabilities - Fines: penalties payables to the state)

Redress and Penalties for anticompetitve breaches (Redress or remedies, Damages or compensation, Penalties,others)

Legal Compliances and Governance (Other real costs)

Compliance Programs : Competition Law, Consumer Law, corporate law and others) ) Main benefits)

Avoiding Harm ((posible benefits for Compliance programs, Benefits for all major stakeholders)

Consumers and Customers

Ethical obligations (Long term sustainable realtionshipconsumers (customers)and final product users)

Regulation and consumer protection( Table 4.3 Consumer protection Legislation)

Guarantees and warranties

Misleading Conduct a representation

Truth versus truthful impression in advertising (Examples :Joan Sutherland and Nudie Foods)

Puffery versus deception (Extreme exageration: Puffery is aceptable) (Deceitfull communication)

Unconscionable conduct ( sufficiently unfair as to be considered as Unconscienable)

Examples of transactions : Amadio Case - Consumer Law)

Tests for unconscionable conduct

Suppliers and lenders

Considering Suppliers and Lenders as a Stakeholders ( table 4.4)

Expanding Ethics (Minimum Ethical Standards should be displayed by supliers / HSBC Supplier code of Conduct)

Financial Markets as a Stakeholders (2 governing Theories:Efficency of Markets and Investor Confidence)

Roles of Markets ( ROI)

Roles of the Media

Role of Other Intermediaries ( Investments banks, Consultants and Auditors)

Protecting the Financial Markets (Directord / Officers breaking the law)

Insider Traiding rules (Key Test in determaining Insider trading, Examples of Insider Trading, Case: PAroo)

Owners ( UK FRC CGC (FRC 2010a: Succes of Companies and Informed Shareholders)

Shareholders group and descriptions (Table 4.5)

Rights, remedies and responsibilities (Table 4.6 OECD 2004: Shareholders rights)

Redress or remedy ( Shs unhappy, Unfairly treated: Example - Minority Shs)

Representation (OECD, UK FRC, ASC CGC : Guanrantee rights)

Shareholders representation ( Table 4.7), Example of iNstitutional Shs)

The corporation

Distinct features

Types of corporations (Table 4.8, Level of Companies: Figure 4.2)

Board of Directors / Board Structure

Directors should be formally appointed, Types of Behaviour:De facto,Shadow director, type of Agents)

Duties and responsibilities of directors - Key Duties:

Conflict of interest (Independence od Ppereance and Independence of mind help to assess conflicts of interest)

Act in the corporation's best interest ( good faith, Honestly and without fraud or collusion)

Nominee directors ( use power for proper Purposes when nominate & appoint directors))

Act for proper purpose ( do not abuse their power - Example Advance Bank)

Duty to retain discretion ( do not delegate to theird discretion to act as a director)

Duty of care, skill and dilligence (IN australia : SAFE HARBOUR RULE)

Insolvent trading (UK / US flexible system, Australia: stricter *Shut down the organisation)

Takeovers

Legal and ethical considerations (Conflict interest, Lack of Disclosure, Anti Trust andMOnopolies issues)

Remedies and Enforcement

Types of Remedies

If directors refuse to act - Statutory derivative action

Account for Profits

Compensation and damages

Rescission and restitution(restoration of property)

Injuction

Appointment and Cessation

Appointment (UH FRC 2010: directors of top 350: Every year to be subject to shs vote every year as a Director)

Resignation

Removal

Disqualification ( automatic, disqualified 5 years)

Automatic disqualifications (criminal Offences)

Disqualifications on applications (5 to 20 years - civil penalties)

Ethics of disqualification

Question 4.1 Anglo American legal system : Commom Law and Cvil law system proved protection to Stakeholders interest?

Question 4.2 Diffrences between Company and corporation?

Question 4.3 Dexribe Key aspects of the pricncipal and agents problems thatexist within Corporations and result of loss of value for stakeholders

queation 4.5 Withleblowing and why has become an inportant component of good corporate governance

Module 5: Corporate social responsibiliy

Definition and Overview

The evolution of CSR - A brief hstory

Definition (Commmision of European Communitites, CPA - CSR reporting, Australian CSR reporting practices)

The concept of accountability (Linkage between accounting and accountability, Responsabilitties)

Gray, Owen and Maunders (1987)

Role of Corporate report (and corporate reporting)

Social reporting (Components of CSR reporting)

GRI guidelines on Social performance indicators

The aspects that social reporting encompasses

Environment reporting (Component of CSR reporting)

GRI guidelines on Environmantal performance indicators

Sustainability reporting

Definition of Sustainability Reporting - GRI 2007 guidelines

GRI performance indicators - (Economic, social and Enviromental performance categories)

The externalities created by business organisations (Definition, Positive (benefits) or Negative (cost), qualitatives terms)

Gray and Bebbington (1992) on sustainable cost / Calculations

The importance of climate change and its relevance to CSR reporting (Carbon tax scheme)

Alternative perceptions about the responsibilities of organisations ( Organisations responsabilities/Accountabilities)

Milton Friedman on the role of business (shs focus - not strong advocate for Social and envirponemental reporting))

Alternative view - Mathews 1993 ( Community Expectations))

Who are the stakeholders of an organisation?

Definition (Freeman 1984) of stakeholders, BHP, Toyota and Amcor focus on Accountability)

The shareholder primary perspective

Shareholder primary Vs social contract perspective

Motivations for embracing CSR reporting (Accountability to Stakeholders or economic focused to protect Shs value)

Elightened self-interest

Good faith requirements

Drivers towards better CSR (BCA) "(Doing right thing" BCA is based in Managerial Reasosining rather than ethical)

Motivations for disclosing social and environment information in CSR (Deegan 2009)

Stakeholder management

Stakeholder theory - The Managerial branch

Gray, Owen and Maunders (1987) - (Powerful & Influence Stakeholders in order to get support and Approval)

Stakeholder theory - The ethical branch

(Managers have a fiduciary duty to all stakeholdersrather than just Shs)

Organisational legitimacy (highly motivation for corporations to provide CSR information)

Legitimacy theory ( Community perceptions - disclousres in order to survive - non to demostrate Accountability)

The social contract (Organisations to meet requirements of both legitmacy and relevance-Schocker&Setti)

Methods to legitimise its activities (Dowling & Pfeffer 1975)

Course of actions to repair legitimacy (Lindblom 1994)

Empirical evidence consistent with legitimacy theory

Other incentives tied to maximising the value of the organisation (WBC - Environmental issues ans Financial positions)

Preferential capital flow (Investments portfolis - VicSuper Sustainability report)

Brand and reputation (Social and Environmental performance - remedial actions to rebuild lost legitimacy (Islam &Deegan)

Risk management incentives(Direct&Indirect Costs, Reducing risk - climate change for transparent reporting)

Limitations of traditional financial reporting

Accounting framework focus in Shareholders primacy perspective.

Cannot answer questions related to SocIAL AND Enviromental Performance)

Definitions of Elements of Financial reporting

Enviromental Resources (Externalities(Benefits/Cost) not controlled by Entity - not considered Assets of the Entity)

The practice of discounting future cash flows

The Stern review on the Economics of climate changes (Value of the cost of climate change overstimated)

Issues of 'reliable measurement' and 'probability' (JI and Deegan - Laibilites & Provsions realted to Externalitites difficult to measure)

Yankelovich - Measurement issue - assessment - wrong practice)

The entity assumption (Externalitites to be ignored)

Current regulations for CSR reporting

Requirements embodied within the Corporations Act and accounting standards

Corporation Act :Directors to Provide financial details of Environmtnal performance)

Corporations act section 299 (1)(f) on environmental performance / Asic require entities to disclose financial/non financial)

Corporations act section 299 A on Directors' report

AASB 137 Provisions, contigent liabilities and contigent assets -Uncertain(Entities no quantify externaliites, non measureable/reliable)

AASB 116 Property, plant and equipment

National Greenhouse and Energy Reporting Act 2007 - Objectives

NGER Act: Reporting thresholds

National Pollutant Inventory (NPI) - Howes 2001 - NPI compel's business to release information

Energy Efficiency Opportunities Act 2005 - required to undertake detailed energy assessment to identify oportunitites)

Other legislations aimed at motivating improvements in Social and Environmental performance)

Australia: Independent pricing and regualtion tribunal, NSW ENErgy Saving Scheme, Commonwealth Renewablwe Energy target Scheme)

European Union Emmisions Trading Scheme (Creation of Emmisions allowances)

Voluntary frameworks for CSR reporting

The global reporting initiative (GRI) - G3 Guidelines, Sectors Suplements, Protocols, National Annexures)

Practical applications and testo to help to apply this principle:

External factors in defining material topics

Internal factors in defining material topics

The Guidelines then recommended content

International guidance in CSR-related performance and reporting

Carbon disclosure project (Carbon emission and climate change represent significant business risk - Investment decision)

Accountability AA1000 series & principles

Equator Principles (determine, assess ans manage Social and Environmental risk in project financing)

The Greenhouse gas protocol GHC Kyoto Protocol - 2 Standards / objectives

Trucost (Help to identify high -risk sectors for investments / cash flows - meet environemntal reporting requirments)

Social audits and their relationship to CSR reporting (Elkington -Definintion: Assess performance in realtion to Society requirements and expectations)

The Body shop

Nike

Social Accountability International (SAI) - Social Accounting Standards SA2008)

Examples of best practice and innovative reporting

CSR The zone of acceptability (Identify leading edge / Reporting Sophisitcation)

ACCA sustainability reporting awards judging criteria (VicSuper, Fuji xerox, CPA Sustainability report - Positive attributes and recommendations)

Integrated Reporting: IIRC missions and objectives for an integrated reporting framework, roles of IIRC

International initiatives on climate change - Institutional Framework to reduce emmision(mitigation) and adapting toclimatechange(Adaption). - Kyoto Protocolo

The Copenhagen accord (interim measure to address various aspects of climate change)

Climate change accounting techniques (Cap-and trade method for carbon emmision - designed as a market based aproach)

Financial accounting treatment for Cap and Trade scheme (Fixed price and Floating-price)

Accounting for the levels of actual emissions (3 Categories), NCOS -set up by Australian Governement; Genuine csrbon offset)

Greenhouse gas emissions ( yarra Valley Water Sustainability report

Environmental management accounting

IFAC to define EMA, IN realtion to waste - Glad Stated, Deegan: prescrition in relation to creating more refine accounts of waste)

Deegan - EMA Benefits

Corporate governance mechanisms aimed at improving social & environmental perf

Accountable and Transparent, Stakeholders engagement to fulfill thwir environmental and Social responsabilities

ISO 14001 Environemntal Management System and ISO 26000 Guidance on Social responsibility

Sustainability performance and remuneration - Amcor Sustainability Report: core values/Performance indicators

Question 1 : Linkage between Accountability and Corporatereporting

Question 2 Nature of Externality, (positive and negative externality

Question 6 Explain how any assessment undertaken by management can affect the audience of the reports

Question 7 Limitations of financial reporting practices realted to climatechange

Question 8 Enlightened self interest against Sustainbale development as a guiding principle

Question 18 Identify 5 corporate governance policies thatcould act to enhance an organisation's social and environmental performance.

Eco-balance (mass balance:Inflows-production process/outflows -finished products, organisattion to formulate measure to reduce

enviromental impact(recycled, waste products, waste and emissions)

Page #

Recruiting the Best (Add value, Lifelong and Professiona capabilities) 1

1

Coate: +Prudence (Social skills), - Colourful Accountant(Downside of Service ideal) 1

1

1

1.- Understanding Accounting (Social practice: Professional capabilities + Service ideal)TSKE/SSKE 1

1

1

1

1

1

Capabilities Considerations (Sufficient capabilities=complex&difficult professional Judgements) 1

1

1

1

1

1

Contemporary role/Main activities of a Professional Accountant. 1

1. Accountants employed in Large Business (Strategy development & implementation) 1

2. Public Practice: Accounting Firm Environment-Big 4, Large 7 second tier firms) 1

3. SME's ( very small SME's relying in SMP's practice. Large firms :few or one Accountant) 1

IFAC: SME'S focus on compliance, not being much value in performance(profitability) 1

PAIB: Accountans reponsible to generate value for the success of company. 1

Ethics ( Moral, Ethics, Business Ethics, Professional Ethics; APES 110, Guidelines &rules) 1

1

1

1

1

1

1

1

1

A High degree of Autonomy and Independence (Objectivity and integrity) 1

1

1

1

1

Professions: The 'market control' view (Monopolistic Power, Self Regulation (West 2003) 1

Power and Exclusion: (Ethics Vs Profit - Gold Collarism, Kelley 1985)

Ideals of Accounting: E's Education, Ethics, expertise and Entrepreneuship

Credibility of the profession: Ethics & Failure: GFC failure-Manage Risk & underdtanding Accounting valuation

Restoring Credibility to accounting: IFAC 2009 Recomendations, Sarbanes Oxly 2002, Coso 2004, CLERP 9, CPA,)

Questions: 1.1 Recall Lonergan' GFC failured, Was that slow reaction the only cause of GFC?

Questions: 1.2 Outline 4 possibles accountig-related roles with an SME and for each role indentify the task to be undertaken?

Questions: 1.3 Reading 1.4. Is that busienss ME or an SME? How did the PAIB add value to Andrew Rueu's business?

Questions: 1.4 Why have SME's not relied in the past on theirexternal accoutnants for business asvisory?

Questions: 1.5 Discuss 4 situations where accountants may aplly professional judgements in their course of work?

Page #

2

2

2

2

2

2

The conceptual framework (principles-based) approach (APESB : blended code of Principles and rules) 2

2

2

2

The public interest - an introduction to the code (Accountat primary loyalty is with the public - not client/employer) 2

2

2

Objectivity (Impartial, honest, free from conflict of interest) 2

Professional independence to the provision (Independence=Objectivity + Integrity)

Independance of mind (reality ) and appereance(more desvastating, Lack of indepen)

2

2

Professional independence in practice (s290-291) 2

Provision of non-audit service to an audit client (S290) - Additonal value for an Audit Client) 2

2

2

2

2

Professional appointment (acceptance should no be granted automately - Solicitation) 2

2

2

2

Conflicts between two or more clients (members must not provide services unless consent to do it is received) 2

2

2

2

Contingent and referral fees (Actions of transactions/Result of services) 2

2

(Inconsitent with CPA - Professionalims, Fees for commissions: Self interest threat to objectivity)

Marketing professional services (Consistency with Professional Behaviour) 2

2

2

Preparation and reporting of information and earnings management (Revenue Recognition, Greed) 2

2

Professional And ethical failures by menbers/public practice - Sonya Denisse & Trevor Neil) 2

2

2

2

2

Accounting professional and ethical standards board (APESB) (high level of Professional Practice) 2

2

The quality assurance process (Components: Standard setting, Conformity withstadards, preactice review, Firm regulations) 2

2

2

Professional discipline (To achieve credibility & confidence of the general Public / Sources of complaint, CPA) 2

2

2

2

2

2

(Framework for judging moral righteness and framework decision making to resolve Ethical problems)

2

2

Differences between psychological egoism, ethical egoism (table 2.5) 2

2

2

2

2

2

2

2

A philisophical model of ethical decision-making (Mathison 1988) 2

2

2

2

2

2

2

2

2

2

2

Organisational ( organisational culture, Code of ethics, Others significants) 2

Schein's six primary mechanisms(Leader rely on this, can achieve cultural success, cultural failure, cultural change) 2

2

2

2

2

2

Ethical decision-making models (Influences on an Individual Decision) - HEURISTIC 2

2

2

2

Questions: 2.1 Consider Implications of an accountant with isufficient time to perform duties? What should you do?

Questions: 2.2 Your firm executes investment transactions for a client. You are now asked to audit this client, I s there a threat to yur independence?

Questions: 2.3 A new qualified CPA is asked to perform an audit to small company, The accountant has not experience in that field, What should you do?

Questions: 2.4 You have been asked to audti 1/2 year finanical statement, (second opninion?

Questions: 2.6 New assurance Services without previuos experience, Does this complain with the Code of Ethics?

Questions: 2.10 Does you employee have a right to enquiie into activitiess of your personal life? In realtion of rights theory?

Questions: 2.11 Which Stage of Kholbert theory of CMD best describe the decision making behaviour of Accountants

Page #

Overview of Corporate Governance ( Information and Comunication) 3 4

3 4

3 5

3 5

3 6

3 6

Agency Theory (Jensesn and Meckling - 1976 : 2 Key assumptions, Barriers to Goal Congruence) 3 7

3 8

Monitoring costs : Cost associated by principals in order to know & control agency matters) 3 8

Bonding costs : reducing residual & monitoring cost for a greater remuneration - borne by agent) 3 9

Residual costs: (Loss & Cost under performance : An agency cost borne by principals) 3 9

Excessive non-financial benefits: Over-consumption of perks (lack og goal congruence: reduce both profitability and Cash flow) 3 9

Empire building: Financial rewards: Power and influence increase: purcharse subsidiare) 3 9

Risk avoidance: (Risky investment avoidance because of fixed salary package) 3 9

Differing time horizons : Perpetual cash flows, interest in the firm for the duration of their employment) 3 10

3 11

11

13

Board of Directors (Bosh Report in Australia, Rogers CJ ( AWA Ltd) 14

Alternative board structures and relationships (2 tier board structures: top tier - supervisory and second tier - management 16

Board Chair - Independence( OECD: chair not mention should be Indep.. / UK CGC should be indep..) 16

Role of CEO - Agent of the Board ( Board member and CEO/ Agency relationship arise) 16

17

19

Conflict of interest (Independence od Ppereance and Independence of mind help to assess conflicts of interest) 19

Act in the corporation's best interest ( good faith, Honestly and without fraud or collusion) 20

Exercise powers for proper purpose: ( do not abuse their power - Example Advance Bank) 21

Nominee directors ( use power for proper Purposes when nominate & appoint directors)) 21

Duty to retain discretion ( do not delegate to theird discretion to act as a director) 21

22

Duty to avoid insolvent trading: (UK / US flexible system, Australia: stricter *Shut down the organisation) 26

27

27

28

28

Audit committee ( AASB: Objectives ans Resposabilitites, Benefists and limitations) 28

3 31

3 32

Institutionals Shareholders (Insurance companies/ funds ) (Hampel Report, now reflected in UK CGC) 3 32

34

Regulators : Essential to ensure that companies can compete against each other in a fair an reasonable manner) 34

Regulations versus De Regulations (Free market (self interest- Miltond Friedman)

Principle based ( OCED, ASX CGC and UK FRC) versus rules -based regulations ( US Sarbanes - Oxley Act) 35

3 36

36

37

38

39

39

3 40

40

40

3 41

3 41

41

Cadbury report (1992) ( Concept of Comply or Explan / If not, Why not reporting) 3 41

3

3

3

3

3 42

3

3

3

3

3

3

3

3

3

3 42

Committee of sponsoring organisations of threadway commission (COSO) 3 42

(Report realted to Internal control and Enterprise risk management) 3

3

3

3

Sarbanes-Oxley act ( Strenghtened Audit requirements, increase financial disclosures, Internal controls) 3 42

3

3

3

3

3 42

3

3

43

3 43

3

ASX corporate governance principles and recommendations (2007) 3 43

3

3 43

3

3

3

45

45

3 45

Basis for effective corporate governance framework 3 45

Rights of shareholders and key ownership functions 3 46

3 47

3 48

3 49

3 49

UK Finanancial Reporting Council Corporate Governance Code (Apendix 3.1) last part of material Module 3 3 51

Section A: Leadership (Roles of Board, Divison of Resposabilitites, chairman)

Section D: Remuneration (Components of remuneration, Procedures)

Section E: Realtion with Shareholders( Dialogue, Constructive use AGM)

ASX CGC Recommendations (if not why not reporting requirement): 8 principles 53

54

54

Promote ethical and responsible decision making (code ofconduct) 55

Safeguard integrity in financial reporting (Audit committee) 56

56

57

57

Remunerate fairly and responsibly - Remuneration Committee 58

3 59

Market Based System (Outsider system, Shareholder systems or Anglo Saxon System) 3 60

Corporate Goverance of US and UK (Shareholders primary focus) 3

Focus in Funds and Insurance company, less in banks ( Disclosures based)

3 62

3

Banks play an active role, long term large shareholders protect to threat of takeovers. 3

Insiders groups monitor management, Reduce of Agency problems 3

Different polititcal, legal and regulatory Structures (European contries) 3 63

3

3 64

3 65

Differing Corporate Governance models ( Concentration of Ownership of companies) 3 65

China: Governement - controlled organisation, 6 maint types of Enterprises. 3 67

3 70

Japan(Outsider boards representing SHs or board member are insiders leading managemet) 3 67

Family Controlled companies and Business Networks - East Asian 70

71

71

72

73

75

75

76

76

77

77

Section B: Effectiveness ( Board: Composition, Appointment, Commitment, Development, Information, Supprot, Evaluation,

Reelection)

Section C: Accountability(Risk management and Internal control, Audit Committee and Auditors,)

Company Law, Employee representation, Stakeholders issues, Shs rights and participation mechanics, Board

Structure, roles and responsibilities, Supervisory body independence and leadership, Disclousre

Sarbanes-Oxley regulations aims to prevent this type of approachby requiring CEO and CFO sign off on financial accountsand certify the

appropriateness of internal controls

77

Internal control and risk management: ISA 215-Ifac2009, Sarbanex Oxley Act US 2002) 77

Internal Control and Risk systems - Including accounting , Risk Control and internal audit 78

79

79

What is major issue that arise form an agency relationship, where powers of control are delegated. (Conflict of intererst) 8

Describe key aspects of the principal and agent problems that exist within corporations and that can result in loss of value for the shareholders. 11

Classify each of the items above as having either a performance focus or a conformance focus 15

Describe the role of the CEO, and give example of the types of activities the CEO and the board should perform 17

Reflective question: Do you agree with idea that different directos within same organization may be held to have a different standard of care based on their qualifications?

31

Discuss whether there is potential for conflict between Core principle 2, Item A4 and Core principle 3, Item A2. 51

51

51

b. How often should a board undertake a formal evaluation of its own performance?

c. Outline whether a chief executive may also be the chair. Suggest reasons why the FRC Code has taken this view.

52

61

62

Identify strengths and weaknesses of the market-based system of CG as practised in countries such as US, UK and Aus. 62

Identify advantages and dis of European relationship-based insider system of CG. 65

Outline the benefits and costs of the family-based insider system of CG practised in Asia. 70

What are the key issues of governance affecting not-for-profit organizations? 72

73

Page #

4 4

4 5

4 5

Disqualified from managing a corporation cannot be appointed a director, also a senior executive 4

5

4 6

4 6

4

4 6

4

4 8

4

Disqualifications on applications (5 to 20 years - civil penalties) 4

Examine Enron audit committee actions in light of the earlier discussion on the benefits and limitations of audit committee. Evaluate effectiveness of

the committee and what steps you would recommend to improve the Enron audit committee in this situation.

Why is disclosure important for the integrity of equity markets? In your answer, you should address what occurs when information is monopolised by

priviledge groups

Is interest in CG regulation and legislation inevitably associated with recession, market failure and corporate collapse, or is it possible to maintain

attention on improving standards of CG at times of market expansion and biz growth?

Removal: (in Aus, 5% of issued captial or at least 100 small sh/h --> call extraordinary meeting to revmove individual directors by 50% votes

cast

Two-strikes rule - Sh/h spill the whole board (provide for two-strikes and re-election of all board members, provide better information to sh/h)

Ethics of disqualification (directors make poor performance or poor judgement) 4 9

4

4 10

4

Adopting diversity (necessary to create an environment where diversity becomes part of culture of CG, NAB is an example) 11

12

12

Board and executives took higher risks when their remuneration based on financial performance --> personal gain

12

4 14

Remuneration of Executive & non executives director - UK FRC CGC 2010 4

4 15

4 15

4 15

Disclosure and transparency and remuneration: no Individual should set their own remuneration levels. 4 16

Remuneration Disclosure - International Approaches : France, UK, USA 4

Tightening rules regarding remuneration - Australian illustrations (true nature of current, past and future remuneration to executives) 17

Remuneration, risk and the GFC (remuneration based on profit -->take higher risk) 18

4

4

4

4

Family and Holiday Entitlements: Al, Paternity & maternity Leave, others type of entitlements) 4

Ethical obligations - Employee Goverance (Code of conduct - Satysfying the objectives of the OECD principles 4

4

4

Australian Corporation Act Whistleblower Protection ( Example: Sherron Watkins - ENRON) 4

4

4

Global Society and Environment (corporations to asssume ethicals leadership) 4

4

The legal System as a Stakeholder (Good laws to achieve good outcomes and should do so reliably and acces to court) 4

Competition and Protecting Markets for Goods and Services ( monitor by ACCC) 4

Competition Policy ( Competitve markets to avoid Monopolist Corporation) - Policy Objectives 4

4

Competition and Stakeholders (Maintain competition btw technologies in the bradbank sector, internet providers) 4

Ethical obligations (Collusion btw competitor very bad) - Tab 4.2 International Competition legislation and Regualtions 4

Regulations on anti-competitive behavious (Detailed rules to regulate: 4

Abuse of market power ( Predatory Markets - ACCC: Penalties against Cabagge and Intel) 4

Mergers and acquisition (reduce # of competitors - prohibited or limited) 4

4

Workable Competititon ( requirements of workable or effective compettion) (judgements based in Balance of Probabilitites)

Non executives Directors: not performance based incentives, Based only reasonable retur for time dedicated to

corporation's businesses

Executives Directors : Remuneration committee: remunerated for their perfomance/achieving of goal congruence

Performance-based remuneration (Fixed:individual/corporation performace and At Risk portion: Reaching certain goals and

performance beanchmarking)

4

Output Restrictions ( Agreemts wil lcause Shortage in markets - price raises. 4

Allocating Customers Suppliers or territories ( Creating Artificial Monopolies) 4

Bid Rigging (Work collude - Competitve Tenders Inflate price to win a bid) 4

4

Unilateral restrictions on Supply (exclusivng dealing) - Third line forcing: Ilegal, anticompetitive and lessen competition) 4

Resale Price Maintenance (Ilegal practice: sells products above a stated price) 4

Approvals Procedures (Franchises: formal mechanisms to authorise third line forcing - ACCC) 4

4

Laws Leading to Criminal Penalties (proof beyond reasonable doubt - Punishment: fines/Jail) 4

Laws with Civil Outcomes and Civil Penalties (Balance of probabilities - Fines: penalties payables to the state) 4

Redress and Penalties for anticompetitve breaches (Redress or remedies, Damages or compensation, Penalties,others) 4

4

Compliance Programs : Competition Law, Consumer Law, corporate law and others) ) Main benefits) 4

Avoiding Harm ((posible benefits for Compliance programs, Benefits for all major stakeholders) 4

4

Ethical obligations (Long term sustainable realtionshipconsumers (customers)and final product users) 4

Regulation and consumer protection( Table 4.3 Consumer protection Legislation) 4

4

Truth versus truthful impression in advertising (Examples :Joan Sutherland and Nudie Foods) 4

Puffery versus deception (Extreme exageration: Puffery is aceptable) (Deceitfull communication) 4

Unconscionable conduct ( sufficiently unfair as to be considered as Unconscienable) 4

4

4

4

Expanding Ethics (Minimum Ethical Standards should be displayed by supliers / HSBC Supplier code of Conduct)

Financial Markets as a Stakeholders (2 governing Theories:Efficency of Markets and Investor Confidence)

Role of Other Intermediaries ( Investments banks, Consultants and Auditors)

Insider Traiding rules (Key Test in determaining Insider trading, Examples of Insider Trading, Case: PAroo) 4

Owners ( UK FRC CGC (FRC 2010a: Succes of Companies and Informed Shareholders)

4

Rights, remedies and responsibilities (Table 4.6 OECD 2004: Shareholders rights) 4

Redress or remedy ( Shs unhappy, Unfairly treated: Example - Minority Shs)

4

Shareholders representation ( Table 4.7), Example of iNstitutional Shs)

4

4

4

Directors should be formally appointed, Types of Behaviour:De facto,Shadow director, type of Agents)

4

Conflict of interest (Independence od Ppereance and Independence of mind help to assess conflicts of interest) 4

Act in the corporation's best interest ( good faith, Honestly and without fraud or collusion) 4

Nominee directors ( use power for proper Purposes when nominate & appoint directors)) 4

Act for proper purpose ( do not abuse their power - Example Advance Bank) 4

Duty to retain discretion ( do not delegate to theird discretion to act as a director) 4

Duty of care, skill and dilligence (IN australia : SAFE HARBOUR RULE) 4

Insolvent trading (UK / US flexible system, Australia: stricter *Shut down the organisation) 4

4

Legal and ethical considerations (Conflict interest, Lack of Disclosure, Anti Trust andMOnopolies issues) 4

Appointment (UH FRC 2010: directors of top 350: Every year to be subject to shs vote every year as a Director) 4

4

4

4

4

Disqualifications on applications (5 to 20 years - civil penalties) 4

4

Question 4.1 Anglo American legal system : Commom Law and Cvil law system proved protection to Stakeholders interest?

Question 4.3 Dexribe Key aspects of the pricncipal and agents problems thatexist within Corporations and result of loss of value for stakeholders

queation 4.5 Withleblowing and why has become an inportant component of good corporate governance

Page #

5

5

Definition (Commmision of European Communitites, CPA - CSR reporting, Australian CSR reporting practices) 5

The concept of accountability (Linkage between accounting and accountability, Responsabilitties) 5

5

5

5

5

5

5

5

5

5

GRI performance indicators - (Economic, social and Enviromental performance categories) 5

The externalities created by business organisations (Definition, Positive (benefits) or Negative (cost), qualitatives terms) 5

5

The importance of climate change and its relevance to CSR reporting (Carbon tax scheme) 5

Alternative perceptions about the responsibilities of organisations ( Organisations responsabilities/Accountabilities) 5

Milton Friedman on the role of business (shs focus - not strong advocate for Social and envirponemental reporting)) 5

5

5

Definition (Freeman 1984) of stakeholders, BHP, Toyota and Amcor focus on Accountability) 5

5

5

Motivations for embracing CSR reporting (Accountability to Stakeholders or economic focused to protect Shs value) 5

5

5

Drivers towards better CSR (BCA) "(Doing right thing" BCA is based in Managerial Reasosining rather than ethical) 5

Motivations for disclosing social and environment information in CSR (Deegan 2009) 5

5

5

Gray, Owen and Maunders (1987) - (Powerful & Influence Stakeholders in order to get support and Approval) 5

5

5

Organisational legitimacy (highly motivation for corporations to provide CSR information) 5

Legitimacy theory ( Community perceptions - disclousres in order to survive - non to demostrate Accountability) 5

The social contract (Organisations to meet requirements of both legitmacy and relevance-Schocker&Setti) 5

Methods to legitimise its activities (Dowling & Pfeffer 1975) 5

5

5

Other incentives tied to maximising the value of the organisation (WBC - Environmental issues ans Financial positions) 5

Preferential capital flow (Investments portfolis - VicSuper Sustainability report) 5

Brand and reputation (Social and Environmental performance - remedial actions to rebuild lost legitimacy (Islam &Deegan) 5

Risk management incentives(Direct&Indirect Costs, Reducing risk - climate change for transparent reporting) 5

5

5

Cannot answer questions related to SocIAL AND Enviromental Performance) 5

5

Enviromental Resources (Externalities(Benefits/Cost) not controlled by Entity - not considered Assets of the Entity) 5

5

The Stern review on the Economics of climate changes (Value of the cost of climate change overstimated) 5

Issues of 'reliable measurement' and 'probability' (JI and Deegan - Laibilites & Provsions realted to Externalitites difficult to measure) 5

5

5

5

Corporation Act :Directors to Provide financial details of Environmtnal performance) 5

Corporations act section 299 (1)(f) on environmental performance / Asic require entities to disclose financial/non financial) 5

5

AASB 137 Provisions, contigent liabilities and contigent assets -Uncertain(Entities no quantify externaliites, non measureable/reliable) 5

5

5

5

National Pollutant Inventory (NPI) - Howes 2001 - NPI compel's business to release information 5

Energy Efficiency Opportunities Act 2005 - required to undertake detailed energy assessment to identify oportunitites) 5

Other legislations aimed at motivating improvements in Social and Environmental performance) 5

Australia: Independent pricing and regualtion tribunal, NSW ENErgy Saving Scheme, Commonwealth Renewablwe Energy target Scheme) 5

5

5

The global reporting initiative (GRI) - G3 Guidelines, Sectors Suplements, Protocols, National Annexures) 5

5

5

5

5

Carbon disclosure project (Carbon emission and climate change represent significant business risk - Investment decision) 5

5

Equator Principles (determine, assess ans manage Social and Environmental risk in project financing) 5

5

Trucost (Help to identify high -risk sectors for investments / cash flows - meet environemntal reporting requirments) 5

5

Social audits and their relationship to CSR reporting (Elkington -Definintion: Assess performance in realtion to Society requirements and expectations) 5

5

5

5

5

5

ACCA sustainability reporting awards judging criteria (VicSuper, Fuji xerox, CPA Sustainability report - Positive attributes and recommendations) 5

Integrated Reporting: IIRC missions and objectives for an integrated reporting framework, roles of IIRC

International initiatives on climate change - Institutional Framework to reduce emmision(mitigation) and adapting toclimatechange(Adaption). - Kyoto Protocolo 5

The Copenhagen accord (interim measure to address various aspects of climate change) 5

Climate change accounting techniques (Cap-and trade method for carbon emmision - designed as a market based aproach) 5

Financial accounting treatment for Cap and Trade scheme (Fixed price and Floating-price) 5

Accounting for the levels of actual emissions (3 Categories), NCOS -set up by Australian Governement; Genuine csrbon offset) 5

5

5

IFAC to define EMA, IN realtion to waste - Glad Stated, Deegan: prescrition in relation to creating more refine accounts of waste) 5

5

Accountable and Transparent, Stakeholders engagement to fulfill thwir environmental and Social responsabilities

ISO 14001 Environemntal Management System and ISO 26000 Guidance on Social responsibility 5

Sustainability performance and remuneration - Amcor Sustainability Report: core values/Performance indicators

Question 6 Explain how any assessment undertaken by management can affect the audience of the reports

Question 8 Enlightened self interest against Sustainbale development as a guiding principle

Question 18 Identify 5 corporate governance policies thatcould act to enhance an organisation's social and environmental performance.

Eco-balance (mass balance:Inflows-production process/outflows -finished products, organisattion to formulate measure to reduce

enviromental impact(recycled, waste products, waste and emissions)

Workshop

2

2

2

3

3

3

3

3

4

4

4

4

4

4

4

4

5

5

5

5

5

5

5

5

5

5

5

5

6

6

6

6

6

6

6

6

7

7

7

8

8

8

8

8

8

8

8

Workshop

9

9

9

9

9

10

10

10

10

11

11

12

12

12

12

12

13

13

13

13

13

13

14

14

14

14

14

14

14

14

14

14

14

14

14

14

18

19

19

19

19

19

19

19

19

19

19

19

19

19

20

20

20

20

20

20

20

20

20

20

20

20

20

20

20

20

20

20

20

21

21

21

21

Workshop

2

2

3

3

3

4

2

5

5

5

5

5

5

5

5

5

5

5

5

5

5

5

5

5

5

5

5

5

5

5

5

5

5

5

5

5

5

5

5

5

6

6

6

6

6

6

6

6

6

6

7

7

7

7

7

7

7

7

7

7

7

7

7

7

7

7

7

7

7

7

7

7

7

8

8

8

8

8

8

8

8

8

8

8

8

8

8

8

8

8

25

Workshop

9

9

9

9

10

10

10

10

10

10

10

10

10

10

10

10

10

12

12

12

12

12

12

12

12

12

12

12

12

12

12

12

12

12

13

13

13

13

13

13

13

13

14

14

14

14

14

14

14

14

14

14

14

14

14

15

15

15

15

15

15

15

15

15

16

16

16

16

16

16

16

16

16

16

17

17

17

17

17

17

17

17

17

17

17

17

17

18

18

18

18

19

19

19

19

19

19

19

19

19

19

19

19

19

19

19

19

19

19

19

19

19

19

19

19

19

Workshop

Potrebbero piacerti anche

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- VAL02 Activity6Documento4 pagineVAL02 Activity6lui navidadNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Periodic Operational PlanDocumento4 paginePeriodic Operational Planali abdel hadiNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- Bonus 1 - Case Study #2Documento1 paginaBonus 1 - Case Study #2Mamatha SinghNessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Re ModelDocumento1 paginaRe ModelMani KandanNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Emergence of Discount Broker in India "Zerodha": Sumit VermaDocumento16 pagineEmergence of Discount Broker in India "Zerodha": Sumit VermasumitNessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)