Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Republic V Del Monte

Caricato da

Lea Angelica Rioflorido0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

11 visualizzazioni5 paginecase digest

Titolo originale

Republic v Del Monte

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentocase digest

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

11 visualizzazioni5 pagineRepublic V Del Monte

Caricato da

Lea Angelica Riofloridocase digest

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 5

Republic v Del Monte G.R. No.

156956 October 9, 2006

C.J. Panganiban

Facts:

Vilfran Liner lost in a case against Del Monte Motors. They were made to pay 11

million pesos forservice contracts with Del Monte, and such was sourced from the

counterbond posted by Vilfran. CISCO issued the counterbond. CISCO opposed

but was rebuffed. The RTC released a motion for execution commanding the

sheriff to levy the amount on the property of CISCO. To completely satisfy the

amount, the Insurance Commissioner was also commanded to withdraw

the security deposit filed by CISCO with the Commission according to Sec 203

of the Insurance Code.

Insurance Commissioner Malinis was ordered by the RTC to withdraw the security

bond of CISCO for the payment of the insurance indemnity won by Del

Monte Motor against Vilfran Liner, the insured.

Malinis didnt obey the order, so the respondent moved to cite him in contempt of

Court. The RTC ruled against Malinis because he didnt have legal basis.

Issues:

1. Whether or not the security deposit held by the Insurance Commissioner

pursuant to Section 203 of the Insurance Code may be levied or garnished in favor

of only one insured.

2. Whether or not the Insurance Commissioner has power to withhold the release

of the security deposit.

Held: No. Yes. Petition granted.

Ratio:

1. Sec 203- No judgment creditor or other claimant shall have the right to levy upon

any of the securities of the insurer held on deposit pursuant to the requirement of

the Commissioner.

The court also claimed that the security deposit shall be (1) answerable for all the

obligations of the depositing insurer under its insurance contracts; (2) at all times

free from any liens or encumbrance; and (3) exempt from levy by any claimant.

To allow the garnishment of that deposit would impair the fund by decreasing it to

less than the percentage of paid-up capital that the law requires to be maintained.

Further, this move would create, in favor of respondent, a preference of credit over

the other policy holders and beneficiaries.

Also, the securities are held as a contingency fund to answer for the claims

against the insurancecompany by all its policy holders and their beneficiaries. This

step is taken in the event that the company becomes insolvent or otherwise unable

to satisfy the claims against it. Thus, a single claimant may not lay stake on the

securities to the exclusion of all others. The other parties may have their own

claims against the insurance company under other insurance contracts it has

entered into.

2. The Insurance Code has vested the Office of the Insurance Commission with

both regulatory and adjudicatory authority over insurance matters.

Under Sec 414 of the Insurance Code, "The Commissioner may issue such

rulings, instructions, circulars, orders and decisions as he may deem necessary to

secure the enforcement of the provisions of this Code.

The commissioner is authorized to (1) issue (or to refuse to issue) certificates of

authority to persons or entities desiring to engage in insurance business in the

Philippines;16 (2) revoke or suspend these certificates of authority upon finding

grounds for the revocation or suspension; (3) impose upon insurance companies,

their directors and/or officers and/or agents appropriate penalties --

fines, suspension or removal from office -- for failing to comply with the Code or

with any of the commissioner's orders, instructions, regulations or rulings, or for

otherwise conducting business in an unsafe or unsound manner.

Included here is the duty to hold security deposits under Secs 191 and 202 of the

Code for the benefit of policy holders. Sec 192, on the other hand, states:

the securities deposited as aforesaid shall be returned upon the company's

making application therefor and proving to the satisfaction of the Commissioner

that it has no further liability under any of its policies in the Philippines.

He has been given great discretion to regulate the business to protect the public.

Also An implied trust is created by the law for the benefit of all claimants under

subsisting insurance contracts issued by the insurance company. He believed that

the security deposit was exempt from execution to protect the policy holders.

PHILAMLIFE V. ANSALDO - JURISDICTION OF THE INSURANCE

COMMISSIONER

234 SCRA 509

Facts:

> Ramon M. Paterno sent a letter-complaint to the Insurance Commissioner

alleging certain problems encountered by agents, supervisors, managers and

public consumers of the Philamlife as a result of certain practices by said

company.

> Commissioner requested petitioner Rodrigo de los Reyes, in his capacity as

Philamlife's president, to comment on respondent Paterno's letter.

> The complaint prays that provisions on charges and fees stated in the Contract

of Agency executed between Philamlife and its agents, as well as the

implementing provisions as published in the agents' handbook, agency bulletins

and circulars, be declared as null and void. He also asked that the amounts of

such charges and fees already deducted and collected by Philamlife in connection

therewith be reimbursed to the agents, with interest at the prevailing rate reckoned

from the date when they were deducted

> Manuel Ortega, Philamlife's Senior Assistant Vice-President and Executive

Assistant to the President, asked that the Commissioner first rule on the questions

of the jurisdiction of the Insurance Commissioner over the subject matter of the

letters-complaint and the legal standing of Paterno.

> Insurance Commissioner set the case for hearing and sent subpoena to the

officers of Philamlife. Ortega filed a motion to quash the subpoena alleging that

the Insurance company has no jurisdiction over the subject matter of the case and

that there is no complaint sufficient in form and contents has been filed.

> The motion to quash was denied.

Issue:

Whether or not the insurance commissioner had jurisdiction over the legality of the

Contract of Agency between Philamlife and its agents.

Held:

No, it does not have jurisdiction.

The general regulatory authority of the Insurance Commissioner is described in

Section 414 of the Insurance Code, to wit:

"The Insurance Commissioner shall have the duty to see that all laws relating to

insurance, insurance companies and other insurance matters, mutual benefit

associations and trusts for charitable uses are faithfully executed and to perform

the duties imposed upon him by this Code, . . . ."

On the other hand, Section 415 provides:

"In addition to the administrative sanctions provided elsewhere in this Code, the

Insurance Commissioner is hereby authorized, at his discretion, to impose upon

insurance companies, their directors and/or officers and/or agents, for any willful

failure or refusal to comply with, or violation of any provision of this Code, or any

order, instruction, regulation or ruling of the Insurance Commissioner, or any

commission of irregularities, and/or conducting business in an unsafe or unsound

manner as may be determined by the Insurance Commissioner, the following:

a) fines not in excess of five hundred pesos a day; and

b) suspension, or after due hearing, removal of directors and/or officers and/or

agents."

A plain reading of the above-quoted provisions show that the Insurance

Commissioner has the authority to regulate the business of insurance, which is

defined as follows:

"(2) The term 'doing an insurance business' or 'transacting an insurance

business,' within the meaning of this Code, shall include (a) making or proposing to

make, as insurer, any insurance contract; (b) making, or proposing to make, as

surety, any contract of suretyship as a vocation and not as merely incidental of the

surety; (c) doing any kind of business, including a reinsurance business,

specifically recognized as constituting the doing of an insurance business within

the meaning of this Code; (d) doing or proposing to do any business in substance

equivalent to any of the foregoing in a manner designed to evade the provisions of

this Code. (Insurance Code, Sec. 2 [2])

Since the contract of agency entered into between Philamlife and its agents is not

included within the meaning of an insurance business, Section 2 of the Insurance

Code cannot be invoked to give jurisdiction over the same to the Insurance

Commissioner. Expressio unius est exclusio alterius.

White Gold Marine Service Inc. vs. Pioneer Insurance and Surety Co.

Post under case digests, Commercial Law at Tuesday, February 21, 2012 Posted

by Schizophrenic Mind

Facts: Petitioner White Gold bought a protection and indemnity coverage for its

ships from Steamship Mutual through Respondent Pioneer. Certificates and

receipts thus were given. However, Petitioner failed to fulfill its payments thus

Steamship refused to renew its coverage. Steamship then filed for collection

against Petitioner for recovery of unpaid balance. Thereafter, Petitioner also filed

a complaint against Steamship and Respondent before theInsurance

Commission for violations (186,187 for Steamship and 299,300,301 in relation to

302 and 303 for Respondent) of the Insurance Code-license requirements as an

Insurance company for the former and as insurance agent for the latter. Said

commission dismissed the complaint which decision was affirmed by the CA.

Issue: Whether or not Steamship Mutual is a Protection and Indemnity Club

engaged in the insurance business in the Philippines

Held: Steamship Mutual as a P & I Club is a mutual insurance company engaged

in the marine insurance business.

An insurance contract is a contract of indemnity. This means that one party

undertakes for a consideration to indemnify another party against loss, damage, or

liability arising from an unknown or contingent event. While to determine if a

contract is an insurance contract we can look at the nature of the promise, the act

to be performed, exact nature of the agreement in view of the entire occurrence,

contingency or circumstance where the performance is mandated. The label is not

controlling. While under Section 2(2) ofthe Insurance Code the phrase doing

an insurance business constitutes the following: 1) making or proposing to make,

as insurer, any insurance contract; 2) making or proposing to make, as surety, any

contract of suretyship as a vocation and not as merely incidental to any other

legitimate business or activity of the surety; 3) doing any kind of business,

including a reinsurance business, specifically recognized as constituting the doing

of an insurance business within the meaning of this code; 4) doing or proposing to

do any business in substance to any of the foregoing in a manner designed to

evade the provision of this code.

Taking all of these in to consideration, Steamship Mutual engaged inmarine

insurance business undertook to indemnify Petitioner White Gold against marine

losses as enumerated under sec. 99 of the Insurance Code. It is immaterial

whether profit is derived from making insurance contract and that no separate or

direct consideration is received since these does not preclude the existence of

aninsurance business.

NOTES:

*Mutual Insurance company- cooperative enterprise where the members are both

the insurer and insured.

*Protection and Indemnity Club- a form of insurance against third party liability

where the third party is anyone other than the P & I Club and its members

UCPB v Masagana G.R. No. 137172. April 4, 2001

C.J. Davide

Facts:

In our decision of 15 June 1999 in this case, we reversed and set aside the

assailed decision[1] of the Court of Appeals, which affirmed with modification

the judgment of the trial court (a) allowing Respondent to consign the sum of

P225,753.95 as full payment of the premiums for the renewalof the five insurance

policies on Respondents properties; (b) declaring the replacement-renewalpolicies

effective and binding from 22 May 1992 until 22 May 1993; and (c) ordering

Petitioner to pay Respondent P18,645,000.00 as indemnity for the burned

properties covered by the renewal-replacement policies. The modification

consisted in the (1) deletion of the trial courts declaration that three of the policies

were in force from August 1991 to August 1992; and (2) reduction of the award of

the attorneys fees from 25% to 10% of the total amount due the Respondent.

Masagana obtained from UCPB five (5) insurance policies on its Manila properties.

The policies were effective from May 22, 1991 to May 22, 1992. On June 13, 1992,

Masaganas properties were razed by fire. On July 13, 1992, plaintiff tendered five

checks for P225,753.45 asrenewal premium payments. A receipt was issued. On

July 14, 1992, Masagana made its formal demand for indemnification for the

burned insured properties. UCPB then rejected Masaganas claims under the

argument that the fire took place before the tender of payment.

Hence Masagana filed this case.

The Court of Appeals disagreed with UCPBs argument that Masaganas tender

of payment of the premiums on 13 July 1992 did not result in the renewal of the

policies, having been made beyond the effective date of renewal as provided under

Policy Condition No. 26, which states:

26. Renewal Clause. -- Unless the company at least forty five days in advance of

the end of the policy period mails or delivers to the assured at the address shown

in the policy notice of its intention not to renew the policy or to condition

its renewal upon reduction of limits or elimination of coverages, the assured shall

be entitled to renew the policy upon payment of the premium due on the effective

date of renewal.

Both the Court of Appeals and the trial court found that sufficient proof exists that

Masagana, which had procured insurance coverage from UCPB for a number of

years, had been granted a 60 to 90-day credit term for the renewal of the policies.

Such a practice had existed up to the time the claims were filed. Most of the

premiums have been paid for more than 60 days after the issuance. Also, no timely

notice of non-renewal was made by UCPB.

The Supreme Court ruled against UCPB in the first case on the issue of whether

the fire insurance policies issued by petitioner to the respondent covering the

period from May 22, 1991 to May 22, 1992 had been extended or renewed by an

implied credit arrangement though actualpayment of premium was tendered on a

later date and after the occurrence of the risk insured against.

UCPB filed a motion for reconsideration.

The Supreme Court, upon observing the facts, affirmed that there was no valid

notice of non-renewal of the policies in question, as there is no proof at all that the

notice sent by ordinary mail was received by Masagana. Also, the premiums were

paid within the grace period.

Issue: Whether Section 77 of the Insurance Code of 1978 must be strictly applied

to Petitioners advantage despite its practice of granting a 60- to 90-day credit term

for the payment of premiums.

Held: No. Petition denied.

Ratio:

Section 77 of the Insurance Code provides: No policy or contract of insurance

issued by an insurance company is valid and binding unless and until the premium

thereof has been paid

An exception to this section is Section 78 which provides: Any acknowledgment in

a policy or contract of insurance of the receipt of premium is conclusive evidence

of its payment, so far as to make the policy binding, notwithstanding any stipulation

therein that it shall not be binding until premium is actually paid.

Makati Tuscany v Court of Appeals- Section 77 may not apply if the parties have

agreed to thepayment in installments of the premium and partial payment has been

made at the time of loss.

Section 78 allows waiver by the insurer of the condition of prepayment and makes

the policy binding despite the fact that premium is actually unpaid. Section 77

does not expressly prohibit an agreement granting credit extension. At the very

least, both parties should be deemed in estoppel to question the arrangement they

have voluntarily accepted.

The Tuscany case has provided another exception to Section 77 that the insurer

may grant creditextension for the payment of the premium. If the insurer has

granted the insured a credit term for the payment of the premium and loss occurs

before the expiration of the term, recovery on the policy should be allowed even

though the premium is paid after the loss but within the credit term.

Moreover, there is nothing in Section 77 which prohibits the parties in an insurance

contract to provide a credit term within which to pay the premiums. That

agreement is not against the law,morals, good customs, public order or public

policy. The agreement binds the parties.

It would be unjust if recovery on the policy would not be permitted against

Petitioner, which had consistently granted a 60- to 90-day credit term for

the payment of premiums. Estoppel bars it from taking refuge since Masagana

relied in good faith on such practice. Estoppel then is the fifth exception.

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Ra 8042 vs. 10022Documento26 pagineRa 8042 vs. 10022Lea Angelica RiofloridoNessuna valutazione finora

- LetterDocumento1 paginaLetterLea Angelica RiofloridoNessuna valutazione finora

- Certification of 3-Year Employment as Marketing OfficerDocumento1 paginaCertification of 3-Year Employment as Marketing OfficerLea Angelica RiofloridoNessuna valutazione finora

- Labor Relations: Self-Organization Representation Collective Bargaining ULP and StrikeDocumento180 pagineLabor Relations: Self-Organization Representation Collective Bargaining ULP and StrikeLea Angelica RiofloridoNessuna valutazione finora

- Criminal Law - Justice Velasco's CasesDocumento117 pagineCriminal Law - Justice Velasco's CasesNikki MendozaNessuna valutazione finora

- Succession Case DigestDocumento13 pagineSuccession Case DigestLea Angelica Rioflorido100% (1)

- (100 Manuel Labor NotesDocumento10 pagine(100 Manuel Labor NotesLea Angelica RiofloridoNessuna valutazione finora

- Combined Materials Criminal Law 2016Documento37 pagineCombined Materials Criminal Law 2016Lea Angelica RiofloridoNessuna valutazione finora

- Petition For ReviewDocumento9 paginePetition For ReviewLea Angelica Rioflorido100% (1)

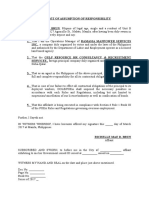

- Affidavit of Assumption of ResponsibilityDocumento1 paginaAffidavit of Assumption of ResponsibilityLea Angelica Rioflorido50% (4)

- 2f Property Case DigestsDocumento142 pagine2f Property Case DigestsJenny Ong Ang63% (8)

- Now Acknowledged The View FF and That StatesDocumento43 pagineNow Acknowledged The View FF and That StatesLea Angelica RiofloridoNessuna valutazione finora

- G.R. No. 154342. July 14, 2004Documento215 pagineG.R. No. 154342. July 14, 2004Lea Angelica RiofloridoNessuna valutazione finora

- Labor StandardsDocumento194 pagineLabor StandardsLea Angelica RiofloridoNessuna valutazione finora

- Aquino vs. PeopleDocumento3 pagineAquino vs. PeopleLea Angelica RiofloridoNessuna valutazione finora

- Provident Tree Farms vs. BatarioDocumento2 pagineProvident Tree Farms vs. BatarioLea Angelica Rioflorido100% (1)

- People V. Bravo: The Decomposin G Body of Nine Year Old Girl Juani A An Olin !len"len# $as Found in A An Lo "" Na&ed' Shir Less andDocumento24 paginePeople V. Bravo: The Decomposin G Body of Nine Year Old Girl Juani A An Olin !len"len# $as Found in A An Lo "" Na&ed' Shir Less andLea Angelica RiofloridoNessuna valutazione finora

- Envi FinalDocumento68 pagineEnvi FinalLea Angelica RiofloridoNessuna valutazione finora

- Republic of The Philippines Municipal Trial Court Branch 10, Metro ManilaDocumento7 pagineRepublic of The Philippines Municipal Trial Court Branch 10, Metro ManilaLea Angelica RiofloridoNessuna valutazione finora

- Rioflorido, Lea Angelica RDocumento4 pagineRioflorido, Lea Angelica RLea Angelica RiofloridoNessuna valutazione finora

- Case DigestDocumento22 pagineCase DigestLea Angelica RiofloridoNessuna valutazione finora

- Corpo 21-30Documento22 pagineCorpo 21-30Lea Angelica RiofloridoNessuna valutazione finora

- 2f Property Case DigestsDocumento142 pagine2f Property Case DigestsJenny Ong Ang63% (8)

- Case DigestDocumento22 pagineCase DigestLea Angelica RiofloridoNessuna valutazione finora

- Credit 3Documento13 pagineCredit 3Lea Angelica RiofloridoNessuna valutazione finora

- Pol - Rev. 1Documento12 paginePol - Rev. 1Lea Angelica RiofloridoNessuna valutazione finora

- Case DigestDocumento29 pagineCase DigestLea Angelica RiofloridoNessuna valutazione finora

- Case Digest On Election LawDocumento40 pagineCase Digest On Election Lawmarezaambat77% (13)

- Comm2 InsuranceDocumento169 pagineComm2 InsuranceLea Angelica RiofloridoNessuna valutazione finora

- Pol Rev. Case DigestsDocumento47 paginePol Rev. Case DigestsLea Angelica RiofloridoNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Joseph Wolf TranscriptDocumento2 pagineJoseph Wolf TranscriptJoseph WolfNessuna valutazione finora

- United States Court of Appeals, Third CircuitDocumento5 pagineUnited States Court of Appeals, Third CircuitScribd Government DocsNessuna valutazione finora

- Hermes v. Thursday Friday DocketDocumento4 pagineHermes v. Thursday Friday DocketCharles E. ColmanNessuna valutazione finora

- Law On SalesDocumento26 pagineLaw On SalesAnonymous wDganZNessuna valutazione finora

- UGRD-ETHNS6102 Euthenics 2 Prelims ExamDocumento10 pagineUGRD-ETHNS6102 Euthenics 2 Prelims ExamLight YagamiNessuna valutazione finora

- Manila Times Guilty of Libel in Policarpio CaseDocumento2 pagineManila Times Guilty of Libel in Policarpio CaseRostum Agapito100% (1)

- Corporate Veil ExplainedDocumento9 pagineCorporate Veil ExplainedRaman SrivastavaNessuna valutazione finora

- CA Reverses RTC, Dismisses Complaint for Recovery of PropertyDocumento316 pagineCA Reverses RTC, Dismisses Complaint for Recovery of PropertyMa Gloria Trinidad ArafolNessuna valutazione finora

- United States Court of Appeals, Tenth CircuitDocumento3 pagineUnited States Court of Appeals, Tenth CircuitScribd Government DocsNessuna valutazione finora

- Regulating Act of 1773Documento4 pagineRegulating Act of 1773BhoomiNessuna valutazione finora

- Loan Agreement: Transaction Details ScheduleDocumento13 pagineLoan Agreement: Transaction Details ScheduleNaren Singh TanwarNessuna valutazione finora

- Naval v. CA, GR 167412, Feb. 2, 2006, 483 SCRA 102Documento1 paginaNaval v. CA, GR 167412, Feb. 2, 2006, 483 SCRA 102Gia DimayugaNessuna valutazione finora

- Contract To SellDocumento2 pagineContract To SellArden Kim83% (12)

- Soga Presentation Group 4Documento11 pagineSoga Presentation Group 4vivek1119Nessuna valutazione finora

- Cape Law Unit 1 Exam QuestionsDocumento10 pagineCape Law Unit 1 Exam QuestionsBrett SmithNessuna valutazione finora

- 48 FilipinasTextile Mills v. CA (2003)Documento3 pagine48 FilipinasTextile Mills v. CA (2003)Ronald SarcaogaNessuna valutazione finora

- Apparel Quality Management: Assignment - 2Documento7 pagineApparel Quality Management: Assignment - 2Debdeep GhoshNessuna valutazione finora

- Analyzing the Challenger Space Shuttle Accident Using Ethical TheoriesDocumento8 pagineAnalyzing the Challenger Space Shuttle Accident Using Ethical TheoriesAhmad KhaledNessuna valutazione finora

- Diagnostic Examination in Criminal JusrisprudenceDocumento12 pagineDiagnostic Examination in Criminal JusrisprudenceLab LeeNessuna valutazione finora

- 11.3. Valdes v. RTCDocumento9 pagine11.3. Valdes v. RTCJenNessuna valutazione finora

- Motion to Reconsider RulingDocumento5 pagineMotion to Reconsider RulingEnan Inton100% (1)

- GSIS Vs The City Treasurer of Manila DigestDocumento3 pagineGSIS Vs The City Treasurer of Manila Digestsharmine_ruizNessuna valutazione finora

- Week 3 - Ethics.Documento4 pagineWeek 3 - Ethics.Mac Kevin MandapNessuna valutazione finora

- Peter Cammarano ELEC ComplaintDocumento61 paginePeter Cammarano ELEC ComplaintMile Square ViewNessuna valutazione finora

- RTC Branch 5 Dismisses Estafa Case Due to Prosecution's Failure to ProsecuteDocumento14 pagineRTC Branch 5 Dismisses Estafa Case Due to Prosecution's Failure to ProsecuteMp CasNessuna valutazione finora

- Chapter 2Documento20 pagineChapter 2Erin LoydNessuna valutazione finora

- Judge Bias AllegationsDocumento5 pagineJudge Bias Allegationsdnel13Nessuna valutazione finora

- TAXATION CASE DIGESTS ON 2016 PHILIPPINE TAXATION COURSE OUTLINEDocumento19 pagineTAXATION CASE DIGESTS ON 2016 PHILIPPINE TAXATION COURSE OUTLINEMarkonitchee Semper Fidelis100% (1)

- The Subject of Sovereignty - Law, Politics and Moral Reasoning in Hugo GrotiusDocumento27 pagineThe Subject of Sovereignty - Law, Politics and Moral Reasoning in Hugo GrotiusΓιώργος ΑντωνίουNessuna valutazione finora

- People vs. Gozo Digest (Auto-Limitation)Documento1 paginaPeople vs. Gozo Digest (Auto-Limitation)elleNessuna valutazione finora