Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Bank Reconciliation Statements

Caricato da

Senelwa Anaya0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

270 visualizzazioni3 pagineA bank reconciliation statement explains the difference between the balance at the bank as per the cashbook and balance as per the bank statement. Errors made in the cashbook include: payments over / understated deposits and payments misposted and Uncredited deposits / cheques. Errors in the bank statement include: Overstating / understating and dishonoured cheques and overdrawals.

Descrizione originale:

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoA bank reconciliation statement explains the difference between the balance at the bank as per the cashbook and balance as per the bank statement. Errors made in the cashbook include: payments over / understated deposits and payments misposted and Uncredited deposits / cheques. Errors in the bank statement include: Overstating / understating and dishonoured cheques and overdrawals.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

270 visualizzazioni3 pagineBank Reconciliation Statements

Caricato da

Senelwa AnayaA bank reconciliation statement explains the difference between the balance at the bank as per the cashbook and balance as per the bank statement. Errors made in the cashbook include: payments over / understated deposits and payments misposted and Uncredited deposits / cheques. Errors in the bank statement include: Overstating / understating and dishonoured cheques and overdrawals.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 3

1

BANK RECONCILIATION STATEMENTS

The cashbook for cash at bank records all the transactions taking place at the bank i.e. the movements of the

account held with the bank. The bank will send information relating to this account using a bank statement

for the firm to compare.

Ideally, the records as per the bank and the cashbook should be the same and therefore the balance carried

down in the cashbook should be the same as the balance carried down by the bank in the bank statement.

In practice however, this is not the case and the two (balance as per the bank and firm) are different. A bank

reconciliation statement explains the difference between the balance at the bank as per the cashbook and

balance at bank as per the bank statement.

Causes of the differences:

Items Appearing In The Cashbook And Not Reflected In The Bank Statement.

Unpresented Cheques: Cheques issued by the firm for payment to the creditors or to other supplies but

have not been presented to the firms bank for payment.

Uncredited deposits/ cheques: These are cheques received from customers and other sources for which

the firm has banked but the bank has not yet availed the funds by crediting the firms account.

Errors made in the cashbook

These include:

Payments over/ understated

Deposits over/ understated

Deposits and payments misposted

Overcastting and undercasting the Bal c/ d in the cashbook.

ii) Items appearing in the bank statement and not reflected in the cashbook:

Bank charges: These charges include service, commission or cheques.

Interest charges on overdrafts.

Direct Debits (standing orders) e.g. to pay Alico insurance.

Dishonored cheques

A cheque would be dishonored because:

Stale cheques

Post dated cheques

Insufficient funds

Differences in amounts in words and figures.

Direct credits

Interest Income/ Dividend incomes

Errors of The Bank Statement (Made By The Bank).

Such errors include:

Overstating/ understating.

Deposits

Withdrawals

The Purposes of a bank reconciliation statement.

1. To update the cashbook with some of the items appearing in the bank statement e.g. bank charges,

interest charges and dishonoured cheques and make adjustments for any errors reflected in the

cashbook.

2. To detect and prevent errors or frauds relating to the cashbook.

2

3. To detect and prevent errors or frauds relating to the bank.

Steps in preparing a bank reconciliation statement.

1. To update the cashbook with the items appearing in the bank statement and not appearing in the

cashbook except for errors in the bank statement. Adjustments should also be made for errors in the

cashbook.

2. Compare the debit side of the cashbook with the credit side of the bank statement to determine the

uncredited deposits by the bank.

3. Compare the credit side of the cashbook with the debit side of the bank statement to determine the

unpresented cheques.

4. Prepare the bank reconciliation statement which will show:

a) Unpresented cheques

b) Uncredited deposits

c) Errors on the bank statement

d) The updated cashbook balance.

The format is as follows:

(Format 1)

Name:

Bank Reconciliation Statement as at 31/ 12

shs shs

Balance at bank as per cashbook (updated) x

Add: Un presented cheques x

Errors on Bank Statement (see note 1) x x

x

Less: Uncredited deposits x

Errors on Bank Statement (see note 2) x (x)

Balance at bank as per Balance Sheet x

Note 1: These types of errors will have an effect of increasing the balance at bank e.g. an overstated deposit

or an understated payment by the bank.

Note 2: These types of errors will have an effect of decreasing the balance at bank e.g. an understated deposit

or an overstated payment by the bank, or making an unknown payment.

Format 2

Name:

Bank Reconciliation Statement as at 31/ 12

shs shs

Balance at bank as per bank statement x

Add: Uncredited deposits x

Add errors on bank statement (note 2) x x

x

Less: Unpresented cheques x

Errors on bank statement (note 1) x (x)

Balance at bank as per cashbook (updated) x

===

3

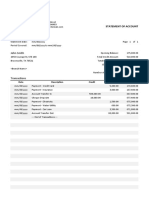

Illustration

Draw up a bank reconciliation statement, after writing the cashbook up to date, ascertaining the balance on

the bank statement, from the following as on 31 March 2003:

shs

Cash at bank as per bank column of the cashbook (Dr) 38,960

Bankings made but not yet entered on bank statement 6,060

Bank charges on bank statement but not yet in cashbook 280

Un presented cheques C Clarke 1170 Standing

order to ABC Ltd entered on bank statement, but not in cash book 550

Credit transfer from A Wood entered on bank statement, but not yet in cashbook 1,890

Solution

Cashbook Bank

2003 shs 2003 shs

31/ 3 Bal b/ d 38960 Bank charges 280

ABC (standing order) 550

A Wood (credit transfer) 1890 31/ 3 Bal C/ D 40,020

40,850 40,850

Bank Reconciliation as at 31/ 03/ 2003

shs shs

Balance at bank as per cashbook 40,020

Add: Unpresented cheques 1,170

41,190

Less: Uncredited deposits (6,060)

Balance at bank as per Balance Sheet 35,130

=====

Potrebbero piacerti anche

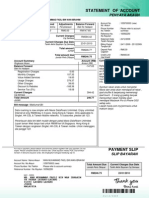

- International Graduate Financial StatementDocumento1 paginaInternational Graduate Financial Statementmasoudgh2005Nessuna valutazione finora

- Understanding Bank of America Interest Checking: An Overview of Key Policies and FeesDocumento2 pagineUnderstanding Bank of America Interest Checking: An Overview of Key Policies and FeesGheorghiu GheorgheNessuna valutazione finora

- Bank Reconciliation StatementDocumento3 pagineBank Reconciliation StatementTalha MahmoodNessuna valutazione finora

- BankStatement PDFDocumento1 paginaBankStatement PDFsantiago ospinaNessuna valutazione finora

- My Statements ControlDocumento6 pagineMy Statements ControlDaniel KentNessuna valutazione finora

- Income StatementDocumento3 pagineIncome StatementTahira HassenNessuna valutazione finora

- Mobile Services: Tax InvoiceDocumento4 pagineMobile Services: Tax InvoiceAnonymous zwCV8ZNessuna valutazione finora

- Stephanie December 2018 EStatementDocumento2 pagineStephanie December 2018 EStatementSteve Allison100% (1)

- Frequently Asked Questions On Electronic Clearing ServiceDocumento7 pagineFrequently Asked Questions On Electronic Clearing Serviceravi150888Nessuna valutazione finora

- Authority LetterDocumento2 pagineAuthority LetterIrfanMajeedShahJillaniNessuna valutazione finora

- Victor M Orozco 8860 SW 123 CT APT K310 Miami FL 33186Documento4 pagineVictor M Orozco 8860 SW 123 CT APT K310 Miami FL 33186Wa Riz LaiNessuna valutazione finora

- CurrentBillDownload 1 PDFDocumento1 paginaCurrentBillDownload 1 PDFАлександр ТимофеевNessuna valutazione finora

- Robinhood: Account Summary Portfolio AllocationDocumento3 pagineRobinhood: Account Summary Portfolio Allocationkrushnavadan5666Nessuna valutazione finora

- Chase Bank Financial StatementDocumento3 pagineChase Bank Financial StatementGo DumpNessuna valutazione finora

- Bank Reconciliation Statement 0007Documento16 pagineBank Reconciliation Statement 0007Hussein Abdou HassanNessuna valutazione finora

- Template Bank Statement: The Bank's Name and LogoDocumento1 paginaTemplate Bank Statement: The Bank's Name and LogoThuta KhaingNessuna valutazione finora

- Bill PageDocumento2 pagineBill PageadsfasdfkjNessuna valutazione finora

- Statement of AccountDocumento18 pagineStatement of AccountKalsom MahatNessuna valutazione finora

- Spending Account StatementDocumento2 pagineSpending Account StatementTaylor LynnNessuna valutazione finora

- FIN.2.2.1 - Bank Transactions: General Ledger - Journals - General JournalDocumento3 pagineFIN.2.2.1 - Bank Transactions: General Ledger - Journals - General JournalIslam SultanNessuna valutazione finora

- Account Statement - Apr 30, 2021Documento6 pagineAccount Statement - Apr 30, 2021Clifton WilsonNessuna valutazione finora

- Bank Reconciliation StatementDocumento22 pagineBank Reconciliation StatementasimaNessuna valutazione finora

- Amex EstatementDocumento2 pagineAmex Estatementjohn vikNessuna valutazione finora

- Bank Reconciliation StatementDocumento13 pagineBank Reconciliation StatementAli Hassan100% (1)

- Retail XXX6651 Statement 10 - 19 - 2015Documento2 pagineRetail XXX6651 Statement 10 - 19 - 2015alfonso loboNessuna valutazione finora

- Christopher Collins March Bank StatementDocumento2 pagineChristopher Collins March Bank StatementJim BoazNessuna valutazione finora

- Lalakay Elementary School: Statement of AccountDocumento4 pagineLalakay Elementary School: Statement of AccountReyes C. ErvinNessuna valutazione finora

- ACCT1501 Perdisco Bank StatementDocumento1 paginaACCT1501 Perdisco Bank StatementLauren De Zilva50% (2)

- Bank Statement Template 1 - TemplateLabDocumento3 pagineBank Statement Template 1 - TemplateLabMakel AlqadaffiNessuna valutazione finora

- Earnings Statement: Non NegotiableDocumento3 pagineEarnings Statement: Non NegotiableKang KimNessuna valutazione finora

- Amex StatementDocumento4 pagineAmex Statementthe kingfishNessuna valutazione finora

- BillingStatement - LOLITA P. AREVALO - 2Documento2 pagineBillingStatement - LOLITA P. AREVALO - 2Franco Evale YumulNessuna valutazione finora

- 2017-10-18 Settlement Agreement - ARCH Resorts LLC V City of McKinney V Collin County - 17-8776Documento83 pagine2017-10-18 Settlement Agreement - ARCH Resorts LLC V City of McKinney V Collin County - 17-8776BridgetteNessuna valutazione finora

- Bank Statement Template 1Documento3 pagineBank Statement Template 1Frank GallagherNessuna valutazione finora

- Take Charge Understanding Your Electricty BillDocumento2 pagineTake Charge Understanding Your Electricty Billneww33Nessuna valutazione finora

- Checking Summary: Jpmorgan Chase Bank N.A. Ohio/West Virginia Markets P O Box 2618 0 Baton Rouge, La 70826-0 180Documento1 paginaChecking Summary: Jpmorgan Chase Bank N.A. Ohio/West Virginia Markets P O Box 2618 0 Baton Rouge, La 70826-0 180Abhishek VNessuna valutazione finora

- Bank Statement Template DownloadDocumento2 pagineBank Statement Template DownloadRudy AlconcherNessuna valutazione finora

- Business Accounts Papers 2003 OnwardsDocumento329 pagineBusiness Accounts Papers 2003 OnwardsAbdul WahidNessuna valutazione finora

- Bank Account Statement Zion T&E (V1.1draft)Documento6 pagineBank Account Statement Zion T&E (V1.1draft)Usama AhmadNessuna valutazione finora

- BillSTMT 4588260000514267Documento3 pagineBillSTMT 4588260000514267Fahad AhmedNessuna valutazione finora

- StatementDocumento2 pagineStatementKaitlin CromNessuna valutazione finora

- Service Address: Page 1 of 2Documento2 pagineService Address: Page 1 of 2Anonymous p73NEZGNessuna valutazione finora

- Bank Financial Statements: Format of Bank Balance SheetDocumento10 pagineBank Financial Statements: Format of Bank Balance SheetMannavan ThiruNessuna valutazione finora

- Account History-TD Canada Trust-Savving2122Documento2 pagineAccount History-TD Canada Trust-Savving2122AhsanNessuna valutazione finora

- IMM5444EDocumento5 pagineIMM5444Enskiba1Nessuna valutazione finora

- Bank StatementsDocumento14 pagineBank StatementsDanielle Ann OreaNessuna valutazione finora

- USA Citibank BankDocumento6 pagineUSA Citibank BankPolo OaracilNessuna valutazione finora

- Paystub 2019 05 31 PDFDocumento1 paginaPaystub 2019 05 31 PDFAnonymous wkIlICXmQfNessuna valutazione finora

- Multiple Bank Account Registration FormDocumento2 pagineMultiple Bank Account Registration FormprasadkarkareNessuna valutazione finora

- HDFC Bank Credit CardDocumento1 paginaHDFC Bank Credit CardArihant JainNessuna valutazione finora

- Coop Bank Kenya Tariff-GuideDocumento1 paginaCoop Bank Kenya Tariff-GuideSamuel Kamau100% (1)

- Statement Jazzy1 EstatementDocumento2 pagineStatement Jazzy1 EstatementJoshua HansonNessuna valutazione finora

- James Honeyman Danielle R Honeyman 25409 Via Pacifica Valencia Ca 91355-2616Documento6 pagineJames Honeyman Danielle R Honeyman 25409 Via Pacifica Valencia Ca 91355-2616Dani HoneymanNessuna valutazione finora

- Simply Jordan TD Bank Statement Andrew Apr 2021Documento2 pagineSimply Jordan TD Bank Statement Andrew Apr 2021MD MasumNessuna valutazione finora

- Thank You For Your Payment!: Return To Home PrintDocumento1 paginaThank You For Your Payment!: Return To Home PrintAce MereriaNessuna valutazione finora

- Flerzi Ernani Zitella 10130 Doral BLVD Doral FL 33178-2921Documento4 pagineFlerzi Ernani Zitella 10130 Doral BLVD Doral FL 33178-2921Joachim NosikNessuna valutazione finora

- Dave Banking Account StatementDocumento2 pagineDave Banking Account Statementdaniel floydNessuna valutazione finora

- Christopher Collins Feburary Bank StatementDocumento2 pagineChristopher Collins Feburary Bank StatementJim BoazNessuna valutazione finora

- Telecommunications Regulation Handbook: InterconnectionDocumento62 pagineTelecommunications Regulation Handbook: InterconnectionParam StudyNessuna valutazione finora

- Telecommunications Regulation HandbookDocumento48 pagineTelecommunications Regulation Handbookzempoak 05Nessuna valutazione finora

- Approaches To Regulation of The ICT Sector - 9Documento82 pagineApproaches To Regulation of The ICT Sector - 9Senelwa AnayaNessuna valutazione finora

- Approaches To Regulation of The ICT Sector - 10Documento74 pagineApproaches To Regulation of The ICT Sector - 10Senelwa AnayaNessuna valutazione finora

- Approaches To Regulation of The ICT Sector - 10Documento74 pagineApproaches To Regulation of The ICT Sector - 10Senelwa AnayaNessuna valutazione finora

- Approaches To Regulation of The ICT Sector - 12Documento38 pagineApproaches To Regulation of The ICT Sector - 12Senelwa AnayaNessuna valutazione finora

- Telecom Mod1 PDFDocumento34 pagineTelecom Mod1 PDFShahzebKhurshidNessuna valutazione finora

- Ict Regulation Toolkit: Providing Practical Advice and Concrete Best Practice Guidelines To Enable Access To Icts For AllDocumento8 pagineIct Regulation Toolkit: Providing Practical Advice and Concrete Best Practice Guidelines To Enable Access To Icts For AllAndrew KatemiNessuna valutazione finora

- Approaches To Regulation of The ICT Sector - 4Documento224 pagineApproaches To Regulation of The ICT Sector - 4Senelwa AnayaNessuna valutazione finora

- Approaches To Regulation of The ICT Sector - 2Documento22 pagineApproaches To Regulation of The ICT Sector - 2Senelwa AnayaNessuna valutazione finora

- Approaches To Regulation of The ICT Sector - 8Documento5 pagineApproaches To Regulation of The ICT Sector - 8Senelwa AnayaNessuna valutazione finora

- Approaches To Regulation of The ICT Sector - 3Documento15 pagineApproaches To Regulation of The ICT Sector - 3Senelwa AnayaNessuna valutazione finora

- Approaches To Regulation of The ICT Sector - 6Documento56 pagineApproaches To Regulation of The ICT Sector - 6Senelwa AnayaNessuna valutazione finora

- Co-Op 3 PDFDocumento14 pagineCo-Op 3 PDFSenelwa AnayaNessuna valutazione finora

- Co-Op 7 PDFDocumento3 pagineCo-Op 7 PDFSenelwa AnayaNessuna valutazione finora

- Co-Op 0-10 PDFDocumento187 pagineCo-Op 0-10 PDFSenelwa AnayaNessuna valutazione finora

- The Co-Operative Societies Act (Amended), 2004Documento46 pagineThe Co-Operative Societies Act (Amended), 2004Shaji Mullookkaaran100% (1)

- Co-Op 10 PDFDocumento10 pagineCo-Op 10 PDFSenelwa AnayaNessuna valutazione finora

- Co-Op 0-6 PDFDocumento88 pagineCo-Op 0-6 PDFSenelwa AnayaNessuna valutazione finora

- Co-Op 8 PDFDocumento40 pagineCo-Op 8 PDFSenelwa AnayaNessuna valutazione finora

- Cir 1 Sec 8Documento38 pagineCir 1 Sec 8anand_dec84Nessuna valutazione finora

- Co-Op 0-8 PDFDocumento50 pagineCo-Op 0-8 PDFSenelwa AnayaNessuna valutazione finora

- Co-Op 5 PDFDocumento7 pagineCo-Op 5 PDFSenelwa AnayaNessuna valutazione finora

- Co-Op 6 PDFDocumento6 pagineCo-Op 6 PDFSenelwa AnayaNessuna valutazione finora

- Cooperatives Full NotesDocumento96 pagineCooperatives Full Noteswelcome2jungle100% (8)

- CHAPTER 8 Practice of Management in CooperativesDocumento10 pagineCHAPTER 8 Practice of Management in Cooperativesalex266100% (4)

- Co-Operative Movement in IndiaDocumento20 pagineCo-Operative Movement in IndiaAbhijeet KulshreshthaNessuna valutazione finora

- Co-Op 2Documento14 pagineCo-Op 2Senelwa AnayaNessuna valutazione finora

- Co-Op 1 PDFDocumento27 pagineCo-Op 1 PDFSenelwa AnayaNessuna valutazione finora

- How To Organize A CooperativeDocumento12 pagineHow To Organize A CooperativeKAKKAMPI100% (35)

- Islamic StudyDocumento80 pagineIslamic StudyWasim khan100% (1)

- Sayyid Mumtaz Ali and 'Huquq Un-Niswan': An Advocate of Women's Rights in Islam in The Late Nineteenth CenturyDocumento27 pagineSayyid Mumtaz Ali and 'Huquq Un-Niswan': An Advocate of Women's Rights in Islam in The Late Nineteenth CenturyMuhammad Naeem VirkNessuna valutazione finora

- ISA UPANISHAD, Translated With Notes by Swami LokeswaranandaDocumento24 pagineISA UPANISHAD, Translated With Notes by Swami LokeswaranandaEstudante da Vedanta100% (4)

- TriboSys 3203 3204Documento1 paginaTriboSys 3203 3204Hayden LeeNessuna valutazione finora

- Payslip Oct-2022 NareshDocumento3 paginePayslip Oct-2022 NareshDharshan Raj0% (1)

- Strategic Management AnswerDocumento7 pagineStrategic Management AnswerJuna Majistad CrismundoNessuna valutazione finora

- Foundation of Education Catholic Counter Reformation Kerth M. GalagpatDocumento12 pagineFoundation of Education Catholic Counter Reformation Kerth M. GalagpatKerth GalagpatNessuna valutazione finora

- 1.1.1partnership FormationDocumento12 pagine1.1.1partnership FormationCundangan, Denzel Erick S.100% (3)

- Kalmar Care For Material Handling, EN PDFDocumento9 pagineKalmar Care For Material Handling, EN PDFAki MattilaNessuna valutazione finora

- Great Mysteries of Übel StaalDocumento72 pagineGreat Mysteries of Übel StaalJosé Thomaz Nonô BisnetoNessuna valutazione finora

- ĐỀ SỐ 6 - KEYDocumento6 pagineĐỀ SỐ 6 - KEYAnh MaiNessuna valutazione finora

- Elizabeth Stevens ResumeDocumento3 pagineElizabeth Stevens Resumeapi-296217953Nessuna valutazione finora

- Obaid Saeedi Oman Technology TransfeDocumento9 pagineObaid Saeedi Oman Technology TransfeYahya RowniNessuna valutazione finora

- "Ako Ang Daigdig" by Alejandro Abadilla: An AnalysisDocumento3 pagine"Ako Ang Daigdig" by Alejandro Abadilla: An AnalysisJog YapNessuna valutazione finora

- Internship ReportDocumento44 pagineInternship ReportRAihan AhmedNessuna valutazione finora

- C.V ZeeshanDocumento1 paginaC.V ZeeshanZeeshan ArshadNessuna valutazione finora

- Gacal v. PALDocumento2 pagineGacal v. PALLynne SanchezNessuna valutazione finora

- Finals Week 12 Joint Arrangements - ACTG341 Advanced Financial Accounting and Reporting 1Documento6 pagineFinals Week 12 Joint Arrangements - ACTG341 Advanced Financial Accounting and Reporting 1Marilou Arcillas PanisalesNessuna valutazione finora

- Greece and Britain Since 1945Documento1 paginaGreece and Britain Since 1945Νότης ΤουφεξήςNessuna valutazione finora

- Checklist ISO 22000Documento30 pagineChecklist ISO 22000Abdelhamid SadNessuna valutazione finora

- First Aid Is The Provision of Initial Care For An Illness or InjuryDocumento2 pagineFirst Aid Is The Provision of Initial Care For An Illness or InjuryBasaroden Dumarpa Ambor100% (2)

- Professionals and Practitioners in Counselling: 1. Roles, Functions, and Competencies of CounselorsDocumento70 pagineProfessionals and Practitioners in Counselling: 1. Roles, Functions, and Competencies of CounselorsShyra PapaNessuna valutazione finora

- Cost of Preferred Stock and Common StockDocumento20 pagineCost of Preferred Stock and Common StockPrincess Marie BaldoNessuna valutazione finora

- Salesforce - Service Cloud Consultant.v2021!11!08.q122Documento35 pagineSalesforce - Service Cloud Consultant.v2021!11!08.q122Parveen KaurNessuna valutazione finora

- Earning and Stock Split - Asquith Et Al 1989Documento18 pagineEarning and Stock Split - Asquith Et Al 1989Fransiskus ShaulimNessuna valutazione finora

- HSE RMO and Deliverables - Asset Life Cycle - Rev0Documento4 pagineHSE RMO and Deliverables - Asset Life Cycle - Rev0Medical Service MPINessuna valutazione finora

- Definition of ConsiderationDocumento3 pagineDefinition of ConsiderationZain IrshadNessuna valutazione finora

- Network DDoS Incident Response Cheat SheetDocumento1 paginaNetwork DDoS Incident Response Cheat SheetDizzyDudeNessuna valutazione finora

- State of Cyber-Security in IndonesiaDocumento32 pagineState of Cyber-Security in IndonesiaharisNessuna valutazione finora

- P 141Documento1 paginaP 141Ma RlNessuna valutazione finora