Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

td140502 2

Caricato da

Joyce SampoernaTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

td140502 2

Caricato da

Joyce SampoernaCopyright:

Formati disponibili

PT Trimegah Securities Tbk - www.trimegah.

com

1 DAILY

TRIM Daily

Today macro numbers and results likely to drive the market. Macro: we expect

positive results with March trade surplus of USD770mn versus consensus of

USD520mn (USD785mn in Feb) and expect April in!ation of 7.20% YoY versus

consensus 7.25% (7.32% in March). We have done recap of results (please see

page 2). We expect GGRM, TCID to continue rising on strong 1Q result. Of 70

companies that we have input into our 1Q result database, there is a balance

between above (17 companies), in-line (14 companies) and below (19 companies).

Of the 70 companies, 1Q YoY growth is 13%, in-line with our expectation for

FY2014.

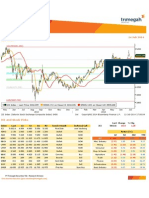

Jakarta Composite Index (JCI) was up by 20.5 points or 0.42% to 4,840.1 yesterday.

Index movers were mostly driven by Mining (+1.11%), Consumer Goods (+0.89%),

and Infrastructure (+0.87%). Total transaction value was Rp7.0tr with regular

market transaction Rp5.7tr. IDX recorded Rp169bn net sell by foreign investors.

Today, JCI is expected to continue its strengthening. Technically, we expect JCI to

move in the range of 4788-4871. However, JCI closed a gap up yesterday and JCI

may face further short-term correction.

JCI 4,840.1

BBCA 11000 Buy

We expect BBCA to trade up today in the range of

10550-11250

BBNI 4815 Buy

With stochastic indicator to form a golden cross, we

expect a upware movement for BBNI today in the range

of 4780-4850

BBRI 9900 Buy

We expect BBRI to further strengthen, with todays

trading range of 9675-10300

PTBA 9875 Buy

PTBA remains strong with potential upside in the range

of 9675-10200 for today.

HRUM 2360 Buy

HRUM is expected to continue its strengthening within

the support and resistance levels of 2300-2415

ITMG 25475 Buy

ITMG forme a long white candle and increasing

volumes, yesterday. ITMG have a potential upside with

trading range for today at level 25275-25900

AALI 29400 Buy

AALI a potential upside today with trading range 29150-

30100

ADHI 2265 Sell

ADHI today is expected to continue its weakening trend

and trade in 2860-3045 range

WIKA 2985 Sell

Despite the recent open black candle formation,

stochastic oscillator will form a dead cross, in our view.

Thus, WIKAs trading range today is around 2200-2310

TRIM Highlights

Market View

Traders Pick

REKSA DANA TRIMEGAH

ASSET MANAGEMENT

NAB Chg %

Trim Kapital 8,261.8 34.4 0.42

Trim Kapital + 3,075.4 10.3 0.34

Trim Syariah SHM 1,526.6 2.9 0.19

Tram Consumption + 1,342.8 4.8 0.36

Trim Komb 2 1,830.6 5.7 0.31

Trim Syariah B 2,171.7 6.2 0.28

Trim Dana Stabil 2,096.3 -0.3 -0.01

Trim Dana Tetap 2 1,665.0 -0.5 -0.03

Tram PDPT USD 1.1 0.0 0.06

Tram Reguler INC 994.7 0.0 0.00

Tram Strategic Fund 1,066.8 -2.1 -0.20

Trim Kas 2 1,074.8 0.1 0.01

MAY 02, 2014

Change : 0.42%

Transaction Volume (m) : 4,366.8

Transaction Value (Rpbn) : 7,016.9

Mkt Cap (Rptr) : 4,798.6

Market P/E (x) : 15.1

Market Div. Yield (%) : 2.0

Price Chg %

Dow Jones 16,558.9 -21.9 -0.1

Nasdaq 4,127.5 12.9 0.3

Nikkei 14,485.1 181.0 1.3

ST Times 3,264.7 0.0 0.0

FTSE 6,808.9 28.9 0.4

Hang Seng 22,134.0 -0.0 -0.0

GLOBAL INDICES

(USD) (Rp) Chg %

TLKM 40.1 11,588.0 0.39 1.0

DUAL LISTING (NYSE )

Chg %

USD IDR 11,562 13.0 0.1

10 yr Indo Govr bond (%) 8.00 -0.0 -0.1

10 yr US govt bond (%) 2.6 -0.03 -1.1

Spread (%) 5.38 0.02 1.0

EIDO 27.8 0.1 0.4

Foreign YtD (USDmn) 2,894 -14.7 -0.5

OTHERS

Global Wrap

In U.S., the Fed maintained the fed funds target rate at a range of zero to 0.25%

and reduced monthly bond purchases in May to USD45bn from USD55bn. The U.S.

GDP up 0.1% QoQ annualized in 1Q14 (vs consensus: 1.1%) from 2.6% gain in

prior quarter. The U.S. initial jobless claims jumped to 344,000 in the April 26 week

(vs consensus: 320,000), following an upwardly revised 330,000 in prior week.

PT Trimegah Securities Tbk - www.trimegah.com

2 DAILY

RESULT 1Q14

Date Ticker Sector

Net pro!t

(Rpbn)

YoY

Trimegah

est (Rpbn)

Con-

sensus

(Rpbn)

% of Tri-

megah

% of

Consen-

sus

Comment

4/29/2014 SMCB Cement 324 76% NA 1,155 NA 28% Above

4/28/2014 PTPP Construction 61 44% 468 493 13% 12% Above

4/30/2014 TCID Consumer 63 62% NA 180 NA 35% Above

4/29/2014 INDF Consumer 1,373 90% NA 4,142 NA 33% Above

4/30/2014 GGRM Consumer 1,417 35% NA 4,925 NA 29% Above

4/28/2014 ROTI Consumer 61 9% NA 218 NA 28% Above

4/24/2014 BBRI FIG 5,938 17% 24,068 23,515 25% 25% Above

4/29/2014 BBNI FIG 2,393 16% 9,642.2 9,559 25% 25% Above

4/28/2014 BMRI FIG 4,925 14% 20,212 19,974 24% 25% Above

4/28/2014 BBCA FIG 3,665 27% 15,869 16,035 23% 23% Above

4/29/2014 ADRO* Mining 128 348% 291 218 44% 59% Above

4/29/2014 TOBA Mining 8 141% NA 25 NA 31% Above

4/29/2014 UNTR Mining 1,576 40% 5,681 5,250 28% 30% Above

4/28/2014 PTBA Mining 536 9% 1,245 1,846 43% 29% Above

4/29/2014 HRUM* Mining 11 55% 56 42 19% 26% Above

4/29/2014 AALI Plantation 785 120% NA 2,680 NA 29% Above

4/30/2014 BSDE Property 708 -46% NA 2,030 NA 35% Above

4/30/2014 SMGR Cement 1,303 5% 5,715 5,869 23% 22% In-line

4/24/2014 SMBR Cement 76 59% 375 399 20% 19% In-line

4/30/2014 WTON Construction 80 8% NA 307 NA 26% In-line

4/30/2014 WIKA Construction 168 7% NA 707 NA 24% In-line

4/29/2014 WSKT Construction 7 24% 373 409 2% 2% In-line

4/29/2014 ASII Consumer 4,727 -4% 22,307 20,943 21% 23% In-line

4/29/2014 LEAD* Oil and gas service 6 62% NA 23 NA 24% In-line

4/29/2014 LSIP Plantation 224 123% NA 995 NA 22% In-line

4/30/2014 CTRS Property 138 32% NA 523 NA 26% In-line

4/30/2014 ACES Retail 135 50% NA 530 NA 26% In-line

4/30/2014 ERAA Retail 80 7% NA 388 NA 21% In-line

4/30/2014 TLKM Telco 3,649 5% NA 15,320 NA 24% In-line

4/30/2014 JSMR Transportation 376 13% NA 1,663 NA 23% In-line

4/29/2014 TAXI Transportation 29 23% 179 160 16% 18% In-line

4/28/2014 WINS* Oil and gas service 8 30% NA 32 NA 24% In-line.

4/29/2014 TOTL Construction 38 -21% NA 227 NA 17% Below

4/29/2014 UNVR Consumer 1,361 -5% NA 5,945 NA 23% Below

4/30/2014 RMBA Consumer (452) NM NA 335 NA -135% Below

4/17/2014 BDMN FIG 875 -13% 4,212 4,152 21% 21% Below

4/29/2014 BBTN FIG 341 2% 1,665 1,754 20% 19% Below

4/30/2014 KLBF Health 476 6% NA 2,308 NA 21% Below

4/30/2014 AKRA Logistics 180 13% NA 868 NA 21% Below

4/30/2014 INCO* Mining 18 -43% NA 104 NA 17% Below

4/30/2014 SUGI* Oil and gas upstream 16 41% NA 425 NA 4% Below

4/29/2014 SIMP Plantation 192 92% NA 969 NA 20% Below

4/30/2014 SGRO Plantation 55 141% NA 320 NA 17% Below

PT Trimegah Securities Tbk - www.trimegah.com

3 DAILY

RESULT 1Q14 CONTINUE

Date Ticker Sector

Net pro!t

(Rpbn)

YoY

Trimegah

est (Rpbn)

Con-

sensus

(Rpbn)

% of Tri-

megah

% of

Consen-

sus

Comment

4/30/2014 CPIN Poultry 661 -8% NA 3,331 NA 20% Below

4/30/2014 CTRA Property 228 5% NA 1,209 NA 19% Below

4/30/2014 ECII Retail 26 -14% NA 345 NA 8% Below

4/30/2014 MPPA Retail 51 81% NA 433.32 NA 12% Below

4/30/2014 MAPI Retail 46 -34% NA 444 NA 10% Below

4/30/2014 RALS Retail 41 -3% NA 457 NA 9% Below

4/30/2014 ISAT Telco (3) -100% NA 502 NA -1% Below

4/30/2014 GIAA* Transportation (164) NM NA 53 NA -311% Below

4/30/2014 MICE Consumer 10 -4% NA NA NA NA Stock is

4/30/2014 SQBB Health 50 29% NA NA NA NA Stock is

4/30/2014 BYAN* Mining (0.512) -439% NA NA NA NA Stock is

4/30/2014 OKAS* Miscellaneous (0.153) -147% NA NA NA NA Stock is

4/30/2014 KONI Miscellaneous 5 621% NA NA NA NA Stock is

4/30/2014 TKIM* Paper 0.010 -34% NA NA NA NA Stock is

4/30/2014 CANI Shipping (117) NM NA NA NA NA Stock is

4/28/2014 TURI Consumer 78 -22% NA NA NA NA

4/29/2014 MBTO Consumer 2 -65% NA NA NA NA

4/29/2014 PANS FIG 136 21% NA NA NA NA

4/28/2014 PNBN FIG 675 12% NA NA NA NA

4/30/2014 KREN FIG 40 2% NA NA NA NA

4/28/2014 JPRS Manufacturing 5 0% NA NA NA NA

4/28/2014 CTBN* Manufacturing 8 -16% NA NA NA NA

4/30/2014 LION Manufacturing 9 -36% NA NA NA NA

4/30/2014 GAMA Property 9 60% NA NA NA NA

4/28/2014 HERO Retail 55 0% NA NA NA NA

4/30/2014 CSAP Retail 19 69% NA NA NA NA

4/30/2014 PBRX* Textile 8 744% NA NA NA NA

PT Trimegah Securities Tbk - www.trimegah.com

4 DAILY

News of the Day

GIAA: Voluntary prepayment of USD376mn

GIAA has performed voluntary prepayment to Citi Club

Deal in the amount of USD166mn and Rp427bn. The loan

was received on 7 November 2012 and Citibank NA acted as

coordinating bank. In 1Q14 GIAA booked operating income of

USD807mn, similar to PY while its passangers rose 16% YoY

to 6.4mn from 5.6mn. Source: Investor Daily

ICON: Focuses in property

The villa rental business has been sluggish lately thus PT

Island Indonesia Tbk (ICON) is !nally ready to change the

original villa concept and focus instead on the town house

concept through its subsidiary PT Patra Supplies Services. PT

Patra Supplies will develop the Condotel Springhill townhouse

concept in Jimbaran, Bali as the property sector in Bali is

currently booming. The company will buy 75% stake in PT

Bhumi Lestari, worth Rp60bn. Both companies will build 113

villas and 121 condominiums. The entire project covers 5.5

hectors of land, and 70% out of the 121 units sold at Rp1.5bn

have already been ordered. The project is estimated to obtain

Rp522bn in revenues. Source: Kontan

TICKER

dividend

(Rp/shares)

Price

(25-apr-14)

Rating

Target

price

Dividend

yield

EX Date TYPE Pay Date

MPPA 186 2,770 Buy 3,000 6.7% 6-May-14 Regular + Special Cash 19-May-14

MLPL 21 640 NA NA 3.3% 5/19/2014 Regular Cash 6/5/2014

BDMN 127 4,090 Hold 4,250 3.1% 5/30/2014 BDVD Forecast -

INDF 165 7,050 NA 7,781 2.3% 7/17/2014 BDVD Forecast -

INTP 470 21,950 Buy 27,400 2.1% 6/20/2014 BDVD Forecast -

GGRM 900 56,500 Hold 56,321 1.6% 7/31/2014 BDVD Forecast -

UNTR 350 21,700 Buy 24,000 1.6% 5/17/2014 BDVD Forecast -

KLBF 20 1,545 Hold 1,535 1.3% 6/13/2014 BDVD Forecast -

ADRO 11 1,185 Buy 1,300 1.0% 5/29/2014 BDVD Forecast -

UNVR 320 29,250 Hold 28,654 1.1% 6/30/2014 BDVD Forecast -

AALI 290 29,400 Sell 26,208 1.0% 5/8/2014 BDVD Forecast -

Dividend Table

PT Trimegah Securities Tbk - www.trimegah.com

5 DAILY

Result 1Q14

(USDmn) 1Q13 4Q13 1Q14

QoQ

chg

(%)

YoY chg

(%)

1Q14

YoY chg

(%)

1Q14/

1Q14E

(%)

1Q14/

2014E

(%)

1Q14/

cons

(%)

Revenue 224 170 128 (24.8) (42.7) 128 (42.7) 64.0 13.4 16.3

Gross pro!t 39 35 29 (18.8) (26.9) 29 (26.9) 63.4 13.3 18.5

Operating pro!t 13 9 11 21.8 (14.3) 11 (14.3) 55.3 11.6 15.0

Net pro!t 7 6 11 94.5 54.8 11 54.8 91.7 19.3 25.5

Gross margin (%) 17.4 20.6 22.3 1.6 4.8 22.3 4.8

Operating margin (%) 5.8 5.3 8.6 3.3 2.9 8.6 2.9

Net margin (%) 3.1 3.3 8.4 5.2 5.3 8.4 5.3

HRUM: ABOVE CONSENSUS BUT BELOW OUR ESTIMATE

HRUM posted 1Q14 net pro!t of USD10.8mn (+95%

QoQ and 55% YoY), came slightly above the consensus

but below our estimate as 1Q14 top line formed only

13% of our full-year projection.

Coal sales volumes dropped 30% YoY to 1.9mn

tons (MSJ only) while ASP decreasing by 7% YoY to

USD64.6/ton.

1Q14 gross, operating and net margins improved

by 4.8%, 2.9% and 5.3% YoY, respectively, mostly

supported by 18.8% lower cash cost of USD41.2/ton

(Rpbn) 1Q13 4Q13 1Q14

QoQ

chg

(%)

YoY chg

(%)

1Q14

YoY chg

(%)

1Q14/

1Q14E

(%)

1Q14/

2014E

(%)

1Q14/

cons

(%)

Revenue 208 226 236 4.4 13.6 236 13.6 82.0 19.7 19.7

Gross pro!t 33 48 38 (20.9) 14.6 38 14.6 77.5 18.6 18.6

Operating pro!t 19 14 22 58.6 20.5 22 20.5 79.2 19.0 19.0

Net pro!t 9 3 14 434.8 51.7 14 51.7 100.5 24.1 24.1

Gross margin (%) 16.1 21.4 16.2 (5.2) 0.1 16.2 0.1

Operating margin (%) 9.0 6.3 9.5 3.2 0.5 9.5 0.5

Net margin (%) 4.5 1.2 6.0 4.8 1.5 6.0 1.5

NIPS

Net pro!t increased by 51% YoY to Rp14.1bn, while

core net pro!t jumping 130% YoY to Rp19.6bn.

1Q14 bottom line reached 24% of our FY14 projection

(inline), while core net pro!t reached 35% of our full-

year expectation (above).

Top-line increased by 4.4% QoQ and 13.6% YoY to

reach Rp236bn (18% below our projection), formed

by Rp127.9bn (-5.4% YoY) car battery sales, Rp49bn

(+25% YoY) motorcycle battery sales and Rp49.2bn

(+46% YoY) industrial battery sales.

We reiterate our BUY call on the counter with DCF

based (WACC: 12.1%, TG: 5%) target price of Rp470/

sh (65% upside).

PT Trimegah Securities Tbk - www.trimegah.com

6 DAILY

Result 1Q14

SMGR booked 1Q14 net pro!t up 5.4% YoY to Rp1.3tr,

formed 22.2% and 22.8% of consensus FY estimates

and ours; in-line.

Revenues stood at Rp6.2tr (+11.4% YoY); representing

22.8% and 22.5% of consensus and our FY targets; in-

line.

Margins are stagnant compared to previous quarter

and year.

We have a Hold recommendation on SMGR with TP of

Rp17,000/sh. Currently, SMGR is traded at Rp14,850/

sh equivalent to 15.4x of 14PE.

(Rpbn) 1Q13 4Q13 1Q14

QoQ

chg

(%)

YoY chg

(%)

1Q14

YoY chg

(%)

1Q14/

1Q14E

(%)

1Q14/

FY14E

(%)

1Q14/

cons

(%)

Revenue 5,544 7,110 6,178 (13.1) 11.4 6,178 11.4 99.6 22.5 22.8

Gross pro!t 2,485 3,104 2,675 (13.8) 7.7 2,675 7.7 97.4 22.1 21.7

Operating pro!t 1,599 1,927 1,639 (14.9) 2.5 1,639 2.5 89.5 20.5 21.2

Net pro!t 1,236 1,464 1,303 (11.0) 5.4 1,303 5.4 98.9 22.8 22.2

Gross margin (%) 44.8 43.7 43.3 (1.5) (1.5) 43.3 (1.5)

Operating margin (%) 28.8 27.1 26.5 (2.3) (2.3) 26.5 (2.3)

Net margin (%) 22.3 20.6 21.1 (1.2) (1.2) 21.1 (1.2)

SMGR

(Rpbn) 1Q13 4Q13 1Q14

QoQ

chg

(%)

YoY chg

(%)

1Q14

YoY chg

(%)

1Q14/

1Q14E

(%)

1Q14/

2014E

(%)

1Q14/

cons

(%)

Revenue 773 na 814 na 5.3 814 5.3 102.9 25.7 23.4

Gross pro!t 106 na 128 na 21.3 128 21.3 110.1 27.5 25.2

Operating pro!t 98 na 114 na 16.8 114 16.8 110.4 27.6 25.9

Net pro!t 74 na 80 na 8.7 80 8.7 106.9 26.7 26.2

Gross margin (%) 13.7 na 15.7 na 2.1 15.7 2.1

Operating margin (%) 12.6 na 14.0 na 1.4 14.0 1.4

Net margin (%) 9.6 na 9.9 na 0.3 9.9 0.3

WTON

WTON booked 1Q14 net income grew by 8.7% YoY to

Rp80bn. The results is representing 26.2% and 26.7%

of FY14 consensus estimates and ours; in-line.

Revenues up 5.3% YoY to Rp814bn, formed 23.4% of

FY consensus estimates and 25.7% of ours.

Gross margins expanded to 15.7% from 13.7% in

1Q13, resulting higher operating margin at 14.0%

(1Q13: 12.6%). However, WTON booked higher

interest expense of Rp7.8bn (vs. Rp1.6bn interest

income in 1Q13), resulting net margin stood at 9.9%

(1Q13: 9.6%).

We have a Buy recommendation on WTON with TP of

Rp880/sh; at current price of Rp735 WTON are traded

at 21.3x of 14PE.

PT Trimegah Securities Tbk - www.trimegah.com

7 DAILY

WIKA 1Q14 net pro!t up 6.8% YoY to Rp168bn. The

results is representing 23.7% of consensus and our

FY estimates; in-line. Average for the past 2 years 1Q

results formed 23.7% of FY !gures.

Revenues up 6.2% YoY to Rp2.8tr; translating to

19.9% of consensus FY estimates and 19.2% of ours;

in-line.

WIKAs subsidiary, WTON, booked 1Q14 revenues of

Rp814bn (+5.3% YoY) and net income of Rp80bn

(+8.7% YoY). WTONs revenues contributed around

29% of WIKAs while the bottom line accounted for

48% of WIKAs.

Margins are stagnant compared to previous quarter

and year.

We have a Buy recommendation on WIKA with TP of

Rp2850/sh. WIKA is traded at 14PE of 19.7x.

(Rpbn) 1Q13 4Q13 1Q14

QoQ

chg

(%)

YoY chg

(%)

1Q14

YoY chg

(%)

1Q14/

1Q14E

(%)

1Q14/

FY14E

(%)

1Q14/

cons

(%)

Revenue 2,628 3,972 2,792 (29.7) 6.2 2,792 6.2 96.5 19.2 19.9

Gross pro!t 291 478 316 (34.0) 8.5 316 8.5 90.2 17.7 20.0

Operating pro!t 274 439 279 (36.3) 2.0 279 2.0 101.1 20.1 19.2

Net pro!t 157 180 168 (6.9) 6.8 168 6.8 99.9 23.7 23.7

Gross margin (%) 11.1 12.0 11.3 (0.7) 0.2 11.3 0.2

Operating margin (%) 10.4 11.0 10.0 (1.0) (0.4) 10.0 (0.4)

Net margin (%) 6.0 4.5 6.0 1.5 0.0 6.0 0.0

WIKA

Result 1Q14

(Rpbn) 1Q13 4Q13 1Q14

QoQ

chg

(%)

YoY chg

(%)

1Q14

YoY chg

(%)

1Q14/

1Q14E

(%)

1Q14/

2014E

(%)

1Q14/

cons

(%)

Revenue 1,360 4,144 1,440 (65.3) 5.8 1,440 5.8 84.2 11.7 12.1

Gross pro!t 108 649 131 (79.7) 21.8 131 21.8 97.9 8.8 9.0

Operating pro!t 84 505 70 (86.2) (16.9) 70 (16.9) 63.8 5.8 6.3

Net pro!t 12 226 16 (92.8) 40.8 16 40.8 112.9 3.2 3.8

Gross margin (%) 7.9 15.7 9.1 (6.5) 1.2 9.1 1.2

Operating margin (%) 6.2 12.2 4.8 (7.4) (1.3) 4.8 (1.3)

Net margin (%) 0.8 5.5 1.1 (4.3) 0.3 1.1 0.3

ADHI

ADHI booked 1Q14 earnings up 40.8% YoY to Rp16bn,

formed 3.8% and 3.2% of consensus FY estimates and

ours; in-line. Historically, 1Q !gures represented only

2.8% of FY results.

Revenues up 5.8% YoY to Rp1.4tr, translating to 12.1%

and 11.7% of consensus FY target and ours; in-line.

Average for the past 2 years 1Q results formed 10.8%

of FY !gures.

Compared to same period previous year, gross margin

improved to 9.1% from 7.9% in 1Q13. However, ADHI

booked !nance cost of Rp24.3bn vs. Rp13.8bn in 1Q13

(+75.8% YoY).

ADHIs management is targeting 2014 revenues growth

of 50% YoY to Rp14.7tr and earnings growth of 40%

YoY to Rp571bn. The target supported by high order

book, which is expected to reach Rp28.6tr (+33.7%

YoY).

Currently, we have a Buy recommendation on ADHI, is

traded at 14 PE of 10.6x. Our TP is Rp2,550/sh, we are

reviewing our recommendation on ADHI.

PT Trimegah Securities Tbk - www.trimegah.com

8 DAILY

(Rpbn) 1Q13 4Q13 1Q14

QoQ

chg

(%)

YoY chg

(%)

1Q14

YoY chg

(%)

1Q14/

1Q14E

(%)

1Q14/

2014E

(%)

1Q14/

cons

(%)

Sales 2,640 3,203 3,126 -2.4 18.4 3,126 18.4 93.6 20.7 21.1

Gross Pro!t 419 524 530 1.2 26.4 530 26.4 99.9 22.2 22.3

Operating Pro!t 75 165 68 -58.7 -8.6 68 -8.6 92.1 11.7 11.6

Net Pro!t 63 124 51 -58.9 -19.4 51 -19.4 87.5 12.4 11.8

Gross Margins (%) 15.9 16.3 16.9 16.9

Opr Margins (%) 2.8 5.2 2.2 2.2

Net Margins (%) 2.4 3.9 1.6 1.6

MPPA: SLIGHTLY BELOW OUR AND CONSENSUS EXPECTATION

MPPA posted 1Q14 net pro!t of Rp51bn (-19.4%YoY)

which formed 11.8% and 12.4% of consensus and our

FY estimates; slightly below.

Core pro!t is Rp60bn (+64.2%YoY) which accounted

for 14.9% of our FY14 estimate.

Revenues reached Rp3.1tr (+18.4%YoY), forming

21.1% and 20.7% of consensus and our full-year

targets.

Currently, MPPA is traded at Rp2,770/sh equivalent to

39.4x of14PE. We have a Hold recommendation with

TP of Rp3,000/sh.

Result 1Q14

PT Trimegah Securities Tbk - www.trimegah.com

9 DAILY

Indices Region +/- (%) YTD (%)

2.69 0.16 1.76

1.91

-21.93 -0.13 -0.11

-1.18

0.60 0.18 3.12

28.87 0.43 0.89

19.11 0.20 0.53

4.46

42.00 0.50 3.34

0.23

-13.13

6.04

Market Div. Yield (%)

0.9

1.3

1.3

1.3

2.0

2.0

3.2

3.6

5.3

7.1

UNVR

BBRI

KLBF

GGRM

TOWR

LPPF

TBIG

PNBN

ADRO

EXCL

JCI

6.04

6.26

-4.24

-2.85

-11.09

-9.22

-0.03 -0.00 -5.03

-2.98 -0.15 -2.46

2.09

0.01 0.00 3.07

2.61 0.18 8.95

71.46 1.08 13.89

12.18 0.66 0.24

0.00 0.00 14.54

Market Div. Yield (%)

-0.2

-0.4

-0.7

-0.8

-0.9

-1.4

-1.4

-1.7

-2.9

-4.9

TLKM

BBNI

ASII

SMGR

UNTR

SCMA

CPIN

INCO

TINS

BDMN

1,018,014

376,521

290,610

231,644

228,720

202,629

200,261

195,563

175,494

172,800

ASII

BBRI

TLKM

TRAM

BMRI

SILO

BBCA

SMGR

GGRM

ADRO

JCI ####

293,168

267,057

254,235

252,807

242,601

185,965

181,227

180,256

175,458

171,882

165,362

ADRO

ENRG

TLKM

TRAM

TMPI

DOID

NIRO

LCGP

MTFN

BUMI

BBTN

Market Div. Yield (%)

8,041

4,883

4,546

4,485

4,343

4,258

4,153

3,710

3,626

3,263

LMPI

BBRI

SRIL

ASII

ADRO

BMRI

TLKM

SSMS

LSIP

PWON

YTD (Rp) 13.24% 4,366.8 MXWO MSCI Word 1,690.4 2.69 0.16 1.76

YTD (USD) 21.13% 7,016.9 SPX S&P 500 1,883.7 -0.32 -0.02 1.91

Moving Avg 20day 4,868.7 4,798.6 US

Moving Avg 50day 4,753.6 15.1 16,558.9 -21.93 -0.13 -0.11

Moving Avg 200day 4,490.6 2.0 Nasdaq US 4,127.5 12.85 0.31 -1.18

Europe

Indonesia & Sectors +/- (%) YTD (%) EURO 50 Europe 338.5 0.60 0.18 3.12

MSCI Indonesia 5,651.4 15.7 0.28 15.14 FTSE London 6,808.9 28.87 0.43 0.89

JII 647.7 2.4 0.38 10.69 DAX Jerman 9,603.2 19.11 0.20 0.53

LQ45 815.0 2.9 0.35 14.60 CAC France 4,487.4 -10.29 -0.23 4.46

JAKFIN Index 644.5 1.5 0.24 19.27 SMI Swiss 8,476.7 42.00 0.50 3.34

JAKINFR Index 1,025.6 8.8 0.87 10.23 BRIC

JAKMINE Index 1,475.5 16.2 1.11 3.23 BOVESPA Brazil 51,626.7 -211.9 -0.41 0.23

JAKCONS Index 2,013.9 17.7 0.89 13.01 MICEX Russia 1,306.0 1.23 0.09 -13.13

JAKTRAD Index 872.7 4.1 0.47 12.35 SENSEX India 22,417.8 -48.39 -0.22 6.04

7.57 NIFTY India 6,696.4 -18.85 -0.28 6.26

7.40 SHCOMP China 2,026.4 6.02 0.30 -4.24

JAKPROP Index 426.2 0.5 0.12 26.46 SZCOMP China 1,027.6 7.74 0.76 -2.85

JAKAGRI Index 2,422.8 16.1 0.67 13.22

Nikkei Japan 14,485.1 181.0 1.27 -11.09

Commodities +/- (%) YTD (%) TPX Japan 1,182.2 19.80 1.70 -9.22

Hong kong 22,134.0 -0.03 -0.00 -5.03

9.57 KOSPI S.Korea 1,961.8 -2.98 -0.15 -2.46

TAIEX Taiwan 8,791.4 -80.67 -0.91 2.09

1.02 FSSTI Singapore 3,264.7 0.01 0.00 3.07

11.56 ASEAN

-15.42 SET Thailand 1,414.9 2.61 0.18 8.95

-13.72 PCOMP Philipines 6,707.9 71.46 1.08 13.89

KLCI Malaysia 1,871.5 12.18 0.66 0.24

0.17 VNINDEX Vietnam 578.0 0.00 0.00 14.54

31.55

Market Div. Yield (%)

Dow Jones Industrial

Developed ASIA

JCI

HSI

Indices

YTD (Rp) 13.24% 4,366.8 MXWO MSCI Word 1,690.4

YTD (USD) 21.13% 7,016.9 SPX S&P 500 1,883.7

Moving Avg 20day 4,868.7 4,798.6

Moving Avg 50day 4,753.6 15.1

Moving Avg 200day 4,490.6 2.0

Nilai (Rpbn)

Mkt Cap (Rptr)

4,840.15 20.47 0.42%

Market P/E (x)

Volume (m)

Dow Jones Industrial

JCI

Market Div. Yield (%)

Indonesia & Sectors +/- (%) YTD (%)

MSCI Indonesia 5,651.4 15.7 0.28 15.14 FTSE London 6,808.9

JII 647.7 2.4 0.38 10.69 DAX Jerman 9,603.2

LQ45 815.0 2.9 0.35 14.60 CAC France 4,487.4

JAKFIN Index 644.5 1.5 0.24 19.27 SMI Swiss 8,476.7

JAKINFR Index 1,025.6 8.8 0.87 10.23

JAKMINE Index 1,475.5 16.2 1.11 3.23 BOVESPA Brazil 51,626.7

JAKCONS Index 2,013.9 17.7 0.89 13.01 MICEX Russia 1,306.0

JAKTRAD Index 872.7 4.1 0.47 12.35 SENSEX India 22,417.8

JAKMIND Index 1,296.3 -3.5 -0.27 7.57 NIFTY India 6,696.4

JAKBIND Index 516.3 -1.7 -0.33 7.40 SHCOMP China 2,026.4

JAKPROP Index 426.2 0.5 0.12 26.46 SZCOMP China 1,027.6

JAKAGRI Index 2,422.8 16.1 0.67 13.22

Commodities +/- (%) YTD (%)

Developed ASIA

CRB Index 307.0 -2.5 -0.81 9.57 KOSPI S.Korea 1,961.8

Oil & Gas

Crude Oil (USD/bbl) 99.4 -0.3 -0.28 1.02 FSSTI Singapore 3,264.7

Natural Gas 4.7 -0.1 -1.69 11.56

COAL (AUS Daily) 73.8 0.8 1.10 -15.42

COAL (Australia,wk) 73.0 0.0 0.00 -13.72

Industrial Metals

Alumunium (USD/tonne) 1,764.8 -2.0 -0.12 0.17 VNINDEX Vietnam 578.0

Nickel (USD/tonne) 18,285 -40.0 -0.22 31.55

Tin (USD/tonne) 22,855 -95 -0.41 2.26

Precious Metal Kurs Region +/- (%) YTD (%)

Gold (USD/t oz.) 1,283.4 -12.5 -0.96 6.75 USDEUR Euro 0.721

Silver (USD/t oz.) 19.0 -0.1 -0.30 -1.53 USDGBP 0.592

Soft Commodities USDCHF Switzerland 0.879

CPO (Malaysia - Rm/tonne) 2,691.0 1.0 0.04 2.40 USDCAD Canada 1.096

Rubber (JPY/kg) 2,020.9 26.9 1.35 -23.98 USDAUD Australia 1.078

Corn (USD/bu.) 507.0 -7.0 -1.36 20.14 USDNZD New Zealand 1.158

Wheat (USD/bu.) 707.3 -5.8 -0.81 16.85 USDJPY Japan 102.33

Soybeans (USD/bu.) 1,461.0 -70.0 -4.57 11.31 USDCNY China 6.26

Rice (Indonesia) (Rp/kg) 8,600.0 0.0 0.00 0.00 USDHKD Hongkong 7.753

USDSGD Singapore 1.253

Kurs Region +/- (%) YTD (%)

6.75 USDEUR Euro 0.721 0.000 0.00 -0.80

-0.1 -0.30 -1.53 USDGBP 0.592 -0.001 -0.17 -1.92

USDCHF Switzerland 0.879 -0.001 -0.08 -1.38

CPO (Malaysia - Rm/tonne) 2,691.0 1.0 0.04 2.40 USDCAD Canada 1.096 -0.000 -0.04 2.93

-23.98 USDAUD Australia 1.078 0.001 0.12 -4.19

20.14 USDNZD New Zealand 1.158 -0.003 -0.22 -5.05

16.85 USDJPY Japan 102.33 0.130 0.13 -2.77

11.31 USDCNY China 6.26 (0.00) (0.00) 3.38

Rice (Indonesia) (Rp/kg) 8,600.0 0.0 0.00 0.00 USDHKD Hongkong 7.753 -0.000 -0.00 -0.02

USDSGD Singapore 1.253 -0.001 -0.10 -0.81

Rupiah Indonesia 11,562 0.00 0.00 -5.00

Market Div. Yield (%)

United Kingdom

Statistics

INDONESIA & SECTORS +/- (%) YTD(%)

COMMODITIES +/- (%) YTD(%)

INDICES REGION +/- (%) YTD(%)

KURS REGION +/- (%) YTD(%)

JCI WINNERS (%) JCI LOSERS (%) JCI VOLUME (Lot) JCI FREQ (X) JCI VALUE (Rpmn)

PT Trimegah Securities Tbk - www.trimegah.com

10 DAILY

World Economic Calendar

Date Time Country Event Period Survey Actual Prior

24-Apr-14 US Initial Jobless Claims (000's) 19-Apr 315 329 305

US Durable Goods Orders (%) Mar 2.0 2.6 2.1

GE IFO Business Climate Apr 110.4 111.2 110.7

GE IFO Expectations Apr 105.8 107.3 106.4

25-Apr-14 US Univ. of Michigan Con!dence Apr F 83.0 84.1 82.6

US Markit US Services PMI Apr P 55.5 54.2 55.3

JN Natl CPI YoY (%) Mar 1.6 1.6 1.5

28-Apr-14 US Pending Home Sales MoM (%) Mar 1.0 3.4 -0.5

US Pending Home Sales YoY (%) Mar -10.3 -7.4 -10.0

US Dallas Fed Manf. Activity Apr 6.0 11.7 4.9

29-Apr-14 US Consumer Con!dence Index Apr 83.3 82.3 83.9

GE CPI MoM (%) Apr P -0.10 -0.20 0.30

GE CPI YoY (%) Apr P 1.4 1.3 1.0

30-Apr-14 US Fed QE3 Pace (USD bn) Apr 45 45 55

US Fed Pace of Treasury Purchases (USD bn) Apr 25 25 30

US Fed Pace of MBS Purchases (USD bn) Apr 20 20 25

US FOMC Rate Decision (%) 30-Apr 0.25 0.25 0.25

US ADP Employment Change (000's) Apr 210 220 209

US GDP Annualized QoQ (%) 1Q A 1.1 0.1 2.6

US Chicago Purchasing Manager Apr 56.5 63.0 55.9

JN Industrial Production MoM (%) Mar P 0.5 0.3 -2.3

1-May-14 US Initial Jobless Claims (000's) 26-Apr 320 344 330

US Personal Income Mar 0.4 0.5 0.4

US Personal Spending Mar 0.6 0.9 0.5

US PCE Core YoY Mar 1.2 1.2 1.1

CH Manufacturing PMI Apr 50.5 50.4 50.3

2-May-14 ID Trade Balance (USD mn) Mar 500 -- 785

ID Exports YoY Mar -1.30 -- -2.96

ID Imports YoY (%) Mar -4.20 -- -9.98

ID CPI YoY (%) Apr 7.25 -- 7.32

ID CPI NSA MoM (%) Apr 0.01 -- 0.08

ID Consumer Con!dence Index Apr -- -- 118.2

ID HSBC Indonesia Manufacturing PMI Apr -- -- 50.1

US Change in Nonfarm Payrolls (000's) Apr 210 -- 192

US Unemployment Rate (%) Apr 6.6 -- 6.7

US Labor Force Participation Rate (%) Apr -- -- 63.2

US ISM New York Apr -- -- 52

US Factory Orders (%) Mar 1.3 -- 1.6

EC Markit EU Manufacturing PMI Apr -- -- 53.4

EC Unemployment Rate (%) Mar -- -- 11.9

5-May-14 ID GDP YoY (%) 1Q 5.65 -- 5.72

ID GDP QoQ (%) 1Q 1.32 -- -1.42

US ISM Non-Manf. Composite Apr -- -- 53.1

CH HSBC China Manufacturing PMI Apr F 48.4 -- 48.3

6-May-14 US Trade Balance (USD bn) Mar -- -- -43.2

US IBD/TIPP Economic Optimism May -- -- 48

EC Retail Sales MoM (%) Mar -- -- 0.4

GE Markit/BME Germany Composite PMI Apr F -- -- 56.3

GE Markit Germany Services PMI Apr F -- -- 55

7-May-14 CH HSBC China Services PMI Apr -- -- 51.9

CH HSBC China Composite PMI Apr -- -- 49.3

GE Factory Orders MoM (%) Mar -- -- 0.6

CH HSBC China Composite PMI Apr -- -- 49.3

GE Factory Orders MoM (%) Mar -- -- 0.6

PT Trimegah Securities Tbk - www.trimegah.com

11 DAILY 11

RESEARCH TEAM

Sebastian Tobing, CFA

Head of Research & Institutional Sales

(sebastian.tobing@trimegah.com)

Frederick Daniel Tanggela

Equity Analyst

(frederick.daniel@trimegah.com)

Robby Ha!l

Equity Analyst

(robby.ha!l@trimegah.com)

Melvina Wildasari

Equity Analyst

(melvina.wildasari@trimegah.com)

EQUITY CAPITAL MARKET TEAM

JAKARTA

Nathanael Benny Prasetyo

Head of Retail ECM

(benny.prasetyo@trimegah.com)

Ariawan Anwar

Artha Graha, Jakarta

(ariawan.anwar@trimegah.com)

Windra Djulnaily

Pluit, Jakarta

(windra.djulnaily@trimegah.com)

Musji Hartono

Mangga Dua, Jakarta

(musji.hartono@trimegah.com)

Ferry Zabur

Kelapa Gading, Jakarta

(ferry.zabur@trimegah.com)

Very Wijaya

BSD, Jakarta

(very.wijaya@trimegah.com)

SUMATRA

Juliana Effendy

Medan, Sumatera Utara

(juliana.effendi@trimegah.com)

Tantie Rivi Watie

Pekanbaru, Riau

(tantierw@trimegah.com)

Hari Mulyono Soewandi

Palembang, Sumatra Selatan

(hari.mulyono@trimegah.com)

Maria Renata

Equity Analyst

(maria.renata@trimegah.com)

Gina Novrina Nasution, CSA

Equity Analyst

(gina.nasution@trimegah.com)

Hapiz Sakti Azi

Research Associate

(hapiz.azi@trimegah.com)

Paula Ruth

Research Associate

(paula@trimegah.com)

EAST INDONESIA

Wiranto Sunyoto

Branch Area Manager

(wiranto.sunyoto@trimegah.com)

Sonny Muljadi

Surabaya, Jawa Timur

(sonny.muljadi@trimegah.com

Ni Made Dwi Hapsari Wijayanti

Denpasar, Bali

(dwihapsari.wijayanti@trimegah.com)

Ivan Jaka Perdana

Malang, Jawa Timur

(ivan.perdana@trimegah.com)

Agus Jatmiko

Balikpapan, Kalimantan Timur

(agus.jatmiko@trimegah.com)

Ari!n Pribadi

Ujung Pandang, Sulawesi Selatan

(ari!n.pribadi@trimegah.com)

CENTRAL JAVA

Agus Bambang Suseno

Solo, Jawa Tengah

(agus.suseno@trimegah.com)

Andrew Jatmiko

Yogyakarta, Jawa Tengah

(andrew.jatmiko@trimegah.com)

Muhammad Ishaq

Semarang, Jawa Tengah

muhammad.ishaq@trimegah.com)

Joshua N.C. Tjeuw

Research Associate

(joshua.tjeuw@trimegah.com)

Rovandi

Research Associate

(rovandi@trimegah.com)

WEST JAVA

Asep Saepudin

Bandung, Jawa Barat

(asep.saepudin@trimegah.com)

Arif!anto

Cirebon, Jawa Barat

(arif!anto@trimegah.com)

INSTITUTIONAL SALES

Daniel Dwi Seputro

Head of Institutional Equity Sales

daniel.dwi@trimegah.com

Dewi Yusnita

Equity Institutional Sales

dewi.yusnita@trimegah.com

Meitawati

Equity Institutional Sales

meitawati.edianingsih@trimegah.com

Fachruly Fiater

Equity Institutional Sales

fachruly.!ater@trimegah.com

Henry Sidarta

Equity Institutional Sales

henry.sidarta@trimegah.com

Raditya Andyono

Equity Institutional Sales

raditya.andyono@trimegah.com

Nancy Pardede

Equity Institutional Sales

nancy.pardede@trimegah.com

DISCLAIMER:

This report has been prepared by PT Trimegah Securities Tbk on behalf of itself and its afliated companies

and is provided for information purposes only. Under no circumstances is it to be used or considered as

an offer to sell, or a solicitation of any offer to buy. This report has been produced independently and the

forecasts, opinions and expectations contained herein are entirely those of Trimegah Securities. While all

reasonable care has been taken to ensure that information contained herein is not untrue or misleading at

the time of publication, Trimegah Securities makes no representation as to its accuracy or completeness and

it should not be relied upon as such. This report is provided solely for the information of clients of Trimegah

Securities who are expected to make their own investment decisions without reliance on this report. Neither

Trimegah Securities nor any ofcer or employee of Trimegah Securities accept any liability whatsoever for

any direct or consequential loss arising from any use of this report or its contents. Trimegah Securities and/or

persons connected with it may have acted upon or used the information herein contained, or the research or

analysis on which it is based, before publication. Trimegah Securities may in future participate in an offering

of the companys equity securities.

PT Trimegah Securities Tbk

Gedung Artha Graha 18

th

Floor

Jl. Jend. Sudirman Kav. 52-53

Jakarta 12190, Indonesia

t. +62-21 2924 9088

f. +62-21 2924 9150

www.trimegah.com

Potrebbero piacerti anche

- Learn About The United States: Quick Civics Lessons For The Naturalization TestDocumento33 pagineLearn About The United States: Quick Civics Lessons For The Naturalization TestLuiz FirminoNessuna valutazione finora

- America The Story of Us Episode 4 Division WorksheetDocumento1 paginaAmerica The Story of Us Episode 4 Division WorksheetHugh Fox III100% (1)

- ALLATSON - Ilan Stavans's Latino USA - A Cartoon HistoryDocumento22 pagineALLATSON - Ilan Stavans's Latino USA - A Cartoon HistoryNerakNessuna valutazione finora

- BNP Daily 20140806Documento28 pagineBNP Daily 20140806waewrichNessuna valutazione finora

- Plessy v. Ferguson 1896Documento2 paginePlessy v. Ferguson 1896Stephanie Dyson100% (1)

- V-Guard Industries: CMP: INR523 TP: INR650 BuyDocumento10 pagineV-Guard Industries: CMP: INR523 TP: INR650 BuySmriti SrivastavaNessuna valutazione finora

- NMDC LTD: Metals & Mining Sector Outlook - PositiveDocumento5 pagineNMDC LTD: Metals & Mining Sector Outlook - Positivemtnit07Nessuna valutazione finora

- td140219 2Documento7 paginetd140219 2Joyce SampoernaNessuna valutazione finora

- td140218 2Documento6 paginetd140218 2Joyce SampoernaNessuna valutazione finora

- NTPC, 1Q Fy 2014Documento11 pagineNTPC, 1Q Fy 2014Angel BrokingNessuna valutazione finora

- Market Daily: Company UpdateDocumento15 pagineMarket Daily: Company UpdatebodaiNessuna valutazione finora

- 5 March 2015Documento1 pagina5 March 2015Ady HasbullahNessuna valutazione finora

- Q4 FY16 Industry Update & Key Performance Highlights (Company Update)Documento62 pagineQ4 FY16 Industry Update & Key Performance Highlights (Company Update)Shyam SunderNessuna valutazione finora

- Sun TV, 1Q Fy 2014Documento11 pagineSun TV, 1Q Fy 2014Angel BrokingNessuna valutazione finora

- Madras Cements 4Q FY 2013Documento10 pagineMadras Cements 4Q FY 2013Angel BrokingNessuna valutazione finora

- Bharti Airtel: Performance HighlightsDocumento13 pagineBharti Airtel: Performance HighlightsAngel BrokingNessuna valutazione finora

- 24 March 2015Documento1 pagina24 March 2015Ady HasbullahNessuna valutazione finora

- Auto & Ancillary Banking and Financial Services Consumer and RelatedDocumento1 paginaAuto & Ancillary Banking and Financial Services Consumer and RelatedArunddhuti RayNessuna valutazione finora

- TCS, 1Q Fy 2014Documento14 pagineTCS, 1Q Fy 2014Angel BrokingNessuna valutazione finora

- Designed For Infrastructure - 2015 Market StrategyDocumento30 pagineDesigned For Infrastructure - 2015 Market StrategyAbdul AzizNessuna valutazione finora

- Ultratech: Performance HighlightsDocumento10 pagineUltratech: Performance HighlightsAngel BrokingNessuna valutazione finora

- Tata Power: CMP: Inr87 TP: INR77 (-11%)Documento8 pagineTata Power: CMP: Inr87 TP: INR77 (-11%)Rahul SainiNessuna valutazione finora

- Misc (Hold, Eps ) : HLIB ResearchDocumento3 pagineMisc (Hold, Eps ) : HLIB ResearchJames WarrenNessuna valutazione finora

- KSL - Ushdev International Limited (IC) - 25 Jan 2013Documento12 pagineKSL - Ushdev International Limited (IC) - 25 Jan 2013Rajesh KatareNessuna valutazione finora

- CIMB Analysis of DaibochiDocumento7 pagineCIMB Analysis of DaibochiJames WarrenNessuna valutazione finora

- Shree Cement: CMP: INR9,253 TP: INR9,778 BuyDocumento8 pagineShree Cement: CMP: INR9,253 TP: INR9,778 BuyAshish NaikNessuna valutazione finora

- SharpDocumento6 pagineSharppathanfor786Nessuna valutazione finora

- Gail LTD: Better Than Expected, AccumulateDocumento5 pagineGail LTD: Better Than Expected, AccumulateAn PNessuna valutazione finora

- Bharat Petroleum Corporation Limited - Oil & Gas: CMP-'728.1 "Hold" TP-'794.0Documento4 pagineBharat Petroleum Corporation Limited - Oil & Gas: CMP-'728.1 "Hold" TP-'794.0sakiv1Nessuna valutazione finora

- 4 May Opening BellDocumento8 pagine4 May Opening BelldineshganNessuna valutazione finora

- GAIL 2QF12 Result ReviewDocumento6 pagineGAIL 2QF12 Result ReviewdikshitmittalNessuna valutazione finora

- Etrading - Daily Research 03-Jul-2013Documento6 pagineEtrading - Daily Research 03-Jul-2013Coba ImageNessuna valutazione finora

- Market Outlook Market Outlook: Dealer's DiaryDocumento9 pagineMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNessuna valutazione finora

- Development Bank of Mongolia: General UpdateDocumento22 pagineDevelopment Bank of Mongolia: General Updatesodbayarg100% (1)

- Daily Report 20141023Documento3 pagineDaily Report 20141023Joseph DavidsonNessuna valutazione finora

- Infotech 4Q FY 2013Documento13 pagineInfotech 4Q FY 2013Angel BrokingNessuna valutazione finora

- Ideas Troika - 15 May 2014Documento21 pagineIdeas Troika - 15 May 2014bodaiNessuna valutazione finora

- Tata Consultancy Services Result UpdatedDocumento14 pagineTata Consultancy Services Result UpdatedAngel BrokingNessuna valutazione finora

- Bharti Airtel, 1Q FY 2014Documento14 pagineBharti Airtel, 1Q FY 2014Angel BrokingNessuna valutazione finora

- Solar Q1FY12 Result Update 2-8-2011Documento6 pagineSolar Q1FY12 Result Update 2-8-2011equityanalystinvestorNessuna valutazione finora

- 3 March 2015Documento1 pagina3 March 2015Ady HasbullahNessuna valutazione finora

- Ultratech 4Q FY 2013Documento10 pagineUltratech 4Q FY 2013Angel BrokingNessuna valutazione finora

- Group Assignment 01: Accounting For Managers PBA4807Documento15 pagineGroup Assignment 01: Accounting For Managers PBA4807dkNessuna valutazione finora

- O&G Services - Jason Saw DMG PartnersDocumento18 pagineO&G Services - Jason Saw DMG Partnerscybermen35Nessuna valutazione finora

- Nestle IndiaDocumento38 pagineNestle Indiarranjan27Nessuna valutazione finora

- IRB Infra, 1Q FY 14Documento14 pagineIRB Infra, 1Q FY 14Angel BrokingNessuna valutazione finora

- Tata Consultancy Services Result UpdatedDocumento15 pagineTata Consultancy Services Result UpdatedAngel BrokingNessuna valutazione finora

- 13 May 2015Documento1 pagina13 May 2015Ady HasbullahNessuna valutazione finora

- Bumi Armada 4QFY11 20120228Documento3 pagineBumi Armada 4QFY11 20120228Bimb SecNessuna valutazione finora

- Supreme Industries: Near-Term Lower Margins With Inventory Loss Upgrade To BuyDocumento6 pagineSupreme Industries: Near-Term Lower Margins With Inventory Loss Upgrade To BuygirishrajsNessuna valutazione finora

- UOB Kayhian Hartalega 1Q2014Documento4 pagineUOB Kayhian Hartalega 1Q2014Piyu MahatmaNessuna valutazione finora

- Hartalega Holdings (HART MK) : Malaysia DailyDocumento4 pagineHartalega Holdings (HART MK) : Malaysia DailyPiyu MahatmaNessuna valutazione finora

- MRF 1Q Fy2013Documento12 pagineMRF 1Q Fy2013Angel BrokingNessuna valutazione finora

- Morning Call Morning Call: Markets End Lower Infy ZoomsDocumento4 pagineMorning Call Morning Call: Markets End Lower Infy ZoomsrcpgeneralNessuna valutazione finora

- Popular IndicatorsDocumento11 paginePopular IndicatorsMazlan NorinahNessuna valutazione finora

- Finolex Industries Limited: Q2FY14 ResultsDocumento17 pagineFinolex Industries Limited: Q2FY14 ResultsSwamiNessuna valutazione finora

- 23 12 11 Yanzhou Coal NomuraDocumento14 pagine23 12 11 Yanzhou Coal NomuraMichael BauermNessuna valutazione finora

- PTT 2010 AnalystMeetingDocumento43 paginePTT 2010 AnalystMeetingspmzNessuna valutazione finora

- Aditya Birla Nuvo: Consolidating Growth BusinessesDocumento6 pagineAditya Birla Nuvo: Consolidating Growth BusinessesSouravMalikNessuna valutazione finora

- Malaysia Stock News 20-02Documento6 pagineMalaysia Stock News 20-02Chia CyNessuna valutazione finora

- 20 April 2015Documento1 pagina20 April 2015Ady HasbullahNessuna valutazione finora

- India Equity Analytics-Persistent System: Focusing On The Increase IP-led RevenuesDocumento20 pagineIndia Equity Analytics-Persistent System: Focusing On The Increase IP-led RevenuesNarnolia Securities LimitedNessuna valutazione finora

- Balrampur Chini (BALCHI) : Higher Sugar Realisation Drives EarningsDocumento6 pagineBalrampur Chini (BALCHI) : Higher Sugar Realisation Drives Earningsdrsivaprasad7Nessuna valutazione finora

- Audit Forensik Sesi 01 Dosen LainDocumento29 pagineAudit Forensik Sesi 01 Dosen LainJoyce SampoernaNessuna valutazione finora

- Trimegah CF 20151117 Silo Reduces Estimates Maintain Buy 2Documento6 pagineTrimegah CF 20151117 Silo Reduces Estimates Maintain Buy 2Joyce SampoernaNessuna valutazione finora

- 2Documento15 pagine2Joyce SampoernaNessuna valutazione finora

- TRIM DailyDocumento14 pagineTRIM DailyJoyce SampoernaNessuna valutazione finora

- 2Documento15 pagine2Joyce SampoernaNessuna valutazione finora

- 2Documento15 pagine2Joyce SampoernaNessuna valutazione finora

- TRIM DailyDocumento14 pagineTRIM DailyJoyce SampoernaNessuna valutazione finora

- TRIM Technical Call: JCI ChartDocumento5 pagineTRIM Technical Call: JCI ChartJoyce SampoernaNessuna valutazione finora

- TRIM DailyDocumento16 pagineTRIM DailyJoyce SampoernaNessuna valutazione finora

- Trimegah Economy 20151120 Economy Outlook 2016 2Documento20 pagineTrimegah Economy 20151120 Economy Outlook 2016 2Joyce SampoernaNessuna valutazione finora

- TRIM DailyDocumento9 pagineTRIM DailyJoyce SampoernaNessuna valutazione finora

- TRIM DailyDocumento15 pagineTRIM DailyJoyce SampoernaNessuna valutazione finora

- Trimegah CF 20151117 Silo Reduces Estimates Maintain Buy 2Documento6 pagineTrimegah CF 20151117 Silo Reduces Estimates Maintain Buy 2Joyce SampoernaNessuna valutazione finora

- TRIM DailyDocumento17 pagineTRIM DailyJoyce SampoernaNessuna valutazione finora

- Press Release Agen Penjual Ori012 2015 Eng Final 17sep15 Website 1Documento2 paginePress Release Agen Penjual Ori012 2015 Eng Final 17sep15 Website 1Joyce SampoernaNessuna valutazione finora

- TRIM DailyDocumento15 pagineTRIM DailyJoyce SampoernaNessuna valutazione finora

- TRIM Technical Call: JCI ChartDocumento5 pagineTRIM Technical Call: JCI ChartJoyce SampoernaNessuna valutazione finora

- TRIM DailyDocumento9 pagineTRIM DailyJoyce SampoernaNessuna valutazione finora

- Created by Trial Version: Market ShareDocumento1 paginaCreated by Trial Version: Market ShareJoyce SampoernaNessuna valutazione finora

- Trimegah CF 20151117 Silo Reduces Estimates Maintain Buy 2Documento6 pagineTrimegah CF 20151117 Silo Reduces Estimates Maintain Buy 2Joyce SampoernaNessuna valutazione finora

- BT 28 MeiDocumento4 pagineBT 28 MeiJoyce SampoernaNessuna valutazione finora

- 2Documento8 pagine2Joyce SampoernaNessuna valutazione finora

- TRIM DailyDocumento7 pagineTRIM DailyJoyce SampoernaNessuna valutazione finora

- td140417 2Documento8 paginetd140417 2Joyce SampoernaNessuna valutazione finora

- td140414 2Documento6 paginetd140414 2Joyce SampoernaNessuna valutazione finora

- Global Green DictatorshipDocumento32 pagineGlobal Green DictatorshipRaymond YoungNessuna valutazione finora

- Ch22 Revised Apr 14 08Documento116 pagineCh22 Revised Apr 14 08Daddha ShreetiNessuna valutazione finora

- Constitution Study of Federalism in India, USA, CanadaDocumento36 pagineConstitution Study of Federalism in India, USA, Canadapradeep yadavNessuna valutazione finora

- Topic Research Paper - Ethan AllenDocumento6 pagineTopic Research Paper - Ethan Allenapi-330958116Nessuna valutazione finora

- A "Short" Story of The Great DepressionDocumento3 pagineA "Short" Story of The Great DepressionCarolina Elizondo100% (1)

- Delissa Japan Case Study by ASBDocumento16 pagineDelissa Japan Case Study by ASBBurhan LongNessuna valutazione finora

- Chapter: 1 Location Planning and Analysis: Need For Location Decisions Nature of Location DecisionsDocumento52 pagineChapter: 1 Location Planning and Analysis: Need For Location Decisions Nature of Location DecisionsHammad AshrafNessuna valutazione finora

- DH 1224Documento10 pagineDH 1224The Delphos HeraldNessuna valutazione finora

- DLGA FDA Letter - April 9, 2020Documento3 pagineDLGA FDA Letter - April 9, 2020New Mexico Political ReportNessuna valutazione finora

- Current Issues in The International Relations - 4th Week Analysis - Süha Mete KalenderDocumento2 pagineCurrent Issues in The International Relations - 4th Week Analysis - Süha Mete KalenderSüha Mete KalenderNessuna valutazione finora

- Peace by Peaceful MeansDocumento3 paginePeace by Peaceful MeansisuryaningtyasNessuna valutazione finora

- Arcor GroupDocumento3 pagineArcor GroupSonu Avinash Singh0% (1)

- Mineral Commodity Summaries 2013 by USGSDocumento201 pagineMineral Commodity Summaries 2013 by USGSnationalminingNessuna valutazione finora

- Organized Resistance and Black Educators Quest For School EqalityDocumento35 pagineOrganized Resistance and Black Educators Quest For School EqalityChris StewartNessuna valutazione finora

- Sub-Delegation: Administrative Law LLM I SemesterDocumento4 pagineSub-Delegation: Administrative Law LLM I SemesterShashikantSauravBarnwalNessuna valutazione finora

- From Paper To Platform: Transforming The B2B Publishing Business ModelDocumento56 pagineFrom Paper To Platform: Transforming The B2B Publishing Business ModelMariaNessuna valutazione finora

- Mexican Migration To The United States of AmericaDocumento19 pagineMexican Migration To The United States of AmericaAngeloCicchettiNessuna valutazione finora

- Trilateral Commission Membership 2007Documento17 pagineTrilateral Commission Membership 2007JBSfanNessuna valutazione finora

- How To Write An Essay On Social IssuesDocumento6 pagineHow To Write An Essay On Social Issuesparajms8778Nessuna valutazione finora

- Print-And-Take PDF of Houston Chronicle Editorial Board Primary Runoff EndorsementsDocumento1 paginaPrint-And-Take PDF of Houston Chronicle Editorial Board Primary Runoff EndorsementsHouston Chronicle0% (1)

- Moving West - Opportunity or OppressionDocumento2 pagineMoving West - Opportunity or OppressionToni Joof Student - GreenHopeHSNessuna valutazione finora

- Native AmericanDocumento2 pagineNative AmericanHibinoNessuna valutazione finora

- IB Geography HL ExtensionDocumento15 pagineIB Geography HL ExtensionZlata VotčenikovaNessuna valutazione finora

- Health Coverage: City Responds To Lawsuit On Election ShiftDocumento32 pagineHealth Coverage: City Responds To Lawsuit On Election ShiftSan Mateo Daily JournalNessuna valutazione finora

- Ush Cw-Marshall Plan and Nato LessonDocumento4 pagineUsh Cw-Marshall Plan and Nato Lessonapi-279879955Nessuna valutazione finora

- Reading Questions - Chapter 27 ApushDocumento4 pagineReading Questions - Chapter 27 ApushLaurel HouleNessuna valutazione finora