Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Banking Activities

Caricato da

adnan04Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Banking Activities

Caricato da

adnan04Copyright:

Formati disponibili

What is Bank Deposits? Money placed into a banking institution for safekeeping.

Bank deposits are made to deposit accounts at a banking institution, such as savings accounts, checking accounts and money market accounts. The account holder has the right to withdraw any deposited funds, as set forth in the terms and conditions of the account. The "deposit" itself is a liability owed by the bank to the depositor (the person or entity that made the deposit), and refers to this liability rather than to the actual funds that are deposited. Customer Acceptance Policy: B policy for acceptance of customers takes into consideration all factors related to the customer, his activity, his related accounts, and any other relevant indicators. The policy includes ade!uate description of customers in accordance to their associated risk. Due Diligence requirements "#$eneral %ules "&" b does not open accounts or deal with customers of un#known identity or have fictitious or unreal names. "&' (taff should identify and verify the customer)s and actual beneficiary)s identity whether the customer is a natural or *uridical person. "&+ (taff should apply due diligence procedures for customers and actual beneficiaries in the following cases, a# -stablishing continuous business relationship with new customers. b# Making a casual transactions (or several transactions that seem to be related) for an amount e.ceeding (/% 01,222) or its e!uivalent in foreign currencies. c# 3n case the Bank has any suspicion in respect of accuracy or ade!uacy of the information obtained in relation to the customer)s identity. "&4 The Bank should not enter into a business relationship or e.ecute any transactions before applying due diligence procedures stipulated in these instructions. "&1 The Bank may postpone the verification of the customer)s identity until after the establishment of the business relationship provided that the verification should happen as soon as possible and that this postponement is necessary for the business re!uirement, and provided there is control on the risk of Money 5aundering and Terrorism 6inancing.

"&7 3n case the Bank enters in a business relationship with the customer and could not complete the verification procedures, it should terminate this relationship and consider notifying the 6inancial 3nformation 8nit immediately as stipulated in the item ((eventh). "&0 The Bank should update the customer)s identification information periodically and every 1 years at the ma.imum, taking into consideration the customer)s risk level, and in the event of any doubt about the identity information or about the customer himself. The Bank should obtain a declaration from the customer determining the actual beneficiary and informing the Bank of any change in his personal data, and an undertaking that he shall provide the Bank with the relevant supporting documents. "&9. The Bank shall not enter into any correspondent banking relationship with any shell bank. 3n addition, the Bank should not enter into a correspondent banking relationship or e.ecute any transactions before applying due diligence procedures stipulated in the :M5 manual.. Know Your Customer: Know Your Customer (kyc Policies an! Proce!ures" The principal source of reputational risk to the bank is an inadvertent association with the customers involved in criminal activity. 5aundering of money derived from criminal activity is an area of particular concern to the bank. A soun! KYC program is one o# the $est tools to !etect suspicious acti%ity The ob*ective of the ;< policy is to enable the bank to form a reasonable belief that it knows the true identity of each customer, while implementing a risk based approach for clients to deter = detect attempts to use B as a platform to place, layer or integrate proceeds of criminal activities through any of its products = services. &eneral KYC policy 'equirements >erify customer identification evidence confirming the identity of and obtaining sufficient information about customers in order to be able to conclude that they are reputable and involved in legitimate business activities and they are also not ?listed@ in sanction and warning lists relevant to /atar. -stablish the reason for the relationship, a clear understanding of the purpose of the account and the nature of the customer business or employment including the position held. Aetermine that the sources of wealth&funds are derived from legitimate sources. Aetermine the anticipated volume = level of activity to be conducted across the account

Maintain the necessary information and documents to satisfy regulatory and best practice re!uirements. Bo account to be opened or transaction processed until the personal or commercial valid identity of their individual or legal entity opening the account has been established and verified ;< should be conducted for all beneficial owners of any account, Cower of :ttorney Dolders, or trustees :ccounts should be reported to :M5 = 6T 8nit if any outstanding identity verifications cannot be resolved ( individual = commercial) :ccounts should be reviewed = reported if it is suspected that the account is funded or the account holders are involved in any illegitimate income&activity. Bo account should be opened for any non face to face customers. :ll accounts should be sub*ect to interview and identity verification . Bo account should be opened or retained if there is any evidence of the account being used for any type of ?:lternative %emittances,@ e., ?Dawala@

&arnishee (r!er

$arnishee order is court order instructing a bank that funds held on behalf of a debtor should not be released until directed by the court. The order may also instruct the bank to pay a given sum to the *udgment creditor from these funds.

What is Push Marketing? Cush marketing brings content to the user. :lso known as ?traditional marketing,@ push is the grandmother of modern marketing. Airect mail marketing, such as catalogs and brochures, are prime e.amples of push marketing.

What is Pull Marketing? <es, you guessed it, pull marketing is the opposite of push marketing. This type of marketing ?pulls@ a consumer into the business. Meaning, the customer seeks out your company. TodayEs consumer is an avid researcher. De or she reads reviews, conducts keyword searches and asks 6acebook friends for suggestions. Cull marketing gives you an opportunity to attract the customers who want answers you already provide. Fhen you see a social media offer for a product you love, this is pull marketing at work. Cush marketing and pull marketing differ in concept and application. 5etEs e.plore the five main differences between push and pull. )" *erminology Push +arketing, This is also known as outbound marketing, since it pushes marketing out to customers. Pull +arketing, This is also known as inbound marketing. The term ?inbound@ means that your marketing efforts generate a response, interest, in!uiries, transactions, etc. That is, customers come to you for answers. ," -trategy Push +arketing, Cush strategy is about devising ways to place products before prospects. This usually involves some form of paid advertising, T> ads, radio spots, billboards and flyers. Pull +arketing, Cull makes it easy for customers to find you. The focus is on creating awareness and increasing brand visibility, particularly on the web. Cull marketing strategies include eBooks, white papers, blogs and social media marketing. ." Channels Push +arketing, This type of marketing typically starts offline, with a few e.ceptions. : direct mail postcard is an e.ample of offline marketing. :n email offer is a perfect e.ample of how push marketing can translate to the web. <ou can also combine both. 6or e.ample, send a postcard that includes a 8%5 to an irresistible online offer. Pull +arketing, Cull is usually a web#based method. Blog posts, eBooks and other online#content machines are forms of pull marketing that live on the web. /" Application Cush and pull also differ in application. 5etEs consider a few specific e.amples.

-.ample ", Chone Push,<ou pick up the phone and cold call a list of prospects Pull,They call you and place an order, having found your number on your site -.ample ', Airect Mail Push, <ou mail out a holiday coupon Pull, : customer emails you to in!uire about your services 0" 1ngagement Push +arketing, 3f done incorrectly, push marketing can be disruptive. :s a result, push customers tend to be less engaged. This happens when marketers send a ?Dail Mary@ to a large swath of customers hoping for a lucky touchdown. Pull +arketing, Marketing is easy when customers come to you. Cull marketing generally en*oys a higher level of engagement because the customers seek out the companies. Cull marketing can also fail if you target the wrong audience, or betray a customerEs trust.

Pro!uct 2i#e Cycle -tages

:s consumers, we buy millions of products every year. :nd *ust like us, these products have a life cycle. Glder, long# established products eventually become less popular, while in contrast, the demand for new, more modern goods usually increases !uite rapidly after they are launched. Because most companies understand the different product life cycle stages, and that the products they sell all have a limited lifespan, the ma*ority of them will invest heavily

in new product development in order to make sure that their businesses continue to grow. Product Life Cycle Stages Explained The product life cycle has 4 very clearly defined stages, each with its own characteristics that mean different things for business that are trying to manage the life cycle of their particular products. 3ntro!uction -tage H This stage of the cycle could be the most e.pensive for a company launching a new product. The siIe of the market for the product is small, which means sales are low, although they will be increasing. Gn the other hand, the cost of things like research and development, consumer testing, and the marketing needed to launch the product can be very high, especially if itEs a competitive sector. &rowth -tage H The growth stage is typically characteriIed by a strong growth in sales and profits, and because the company can start to benefit from economies of scale in production, the profit margins, as well as the overall amount of profit, will increase. This makes it possible for businesses to invest more money in the promotional activity to ma.imiIe the potential of this growth stage. +aturity -tage H Auring the maturity stage, the product is established and the aim for the manufacturer is now to maintain the market share they have built up. This is probably the most competitive time for most products and businesses need to invest wisely in any marketing they undertake. They also need to consider any product modifications or improvements to the production process which might give them a competitive advantage. Decline -tage H -ventually, the market for a product will start to shrink, and this is whatEs known as the decline stage. This shrinkage could be due to the market becoming saturated (i.e. all the customers who will buy the product have already purchased it), or because the consumers are switching to a different type of product. Fhile this decline may be inevitable, it may still be possible for companies to make some profit by switching to less#e.pensive production methods and cheaper markets. Product Life Cycle Examples 3tEs possible to provide e.amples of various products to illustrate the different stages of the product life cycle more clearly. Dere is the e.ample of watching recorded television and the various stages of each method, ". 3ntroduction # +A T>s '. $rowth # Blueray discs&A>% +. Maturity # A>A 4. Aecline # >ideo cassette

The idea of the product life cycle has been around for some time, and it is an important principle manufacturers need to understand in order to make a profit and stay in business. Dowever, the key to successful manufacturing is not *ust understanding this life cycle, but also proactively managing products throughout their lifetime, applying the appropriate resources and sales and marketing strategies, depending on what stage products are at in the cycle.

-trategy: -.isting product # -.isting Market -.isting product # Bew Market Bew product # -.isting Market Bew product # Bew Market De#ine 'elationship +anagement : strategy employed by an organiIation in which a continuous level of engagement is maintained between the organiIation and its audience. %elationship management can be between a business and its customers (customer relationship management) and between a business and other businesses (business relationship management). %elationship management is a focus of the financial and investing industries as a way to identify potential cross#sales of products and services.

), 4un!amentals o# Customer -er%ice. The list is short and to the point H no need to elaborate on simple steps that should be the norm for all teams interacting with your customer. )" :nswer your phone. 3t is a pleasant surprise when real people answer phones and are ready to serve. ," %espond to emails and social media contacts fast. -ngage and acknowledge. ." Ao what you say you are going to do. This strategy solves most problems and creates satisfied customers. /" $et it right the first time. 6irst time resolution is e.pected.

0" 6i. problems fast. :pologiIe sincerely and follow up. 5" (top blaming. ustomers donEt care about your internal issues. 6" 5isten the first time. 5et the customer know you heard them to keep them from repeating. 7" 8se the customerEs name. This easy step can make a big difference when done with respect. 8" Make eye contact. Fhen face#to#face, look at the customer and not *ust acknowledge from a distance. )9" Be sincere and real. ustomers are tired of the practiced phrases. onnect and engage. ))"Thank the customer. 5eave the customer with a positive impression. )," Dave fun. ustomers want to do business with likeable, happy people.

-B2 'egular Deposit Programme ( -'DP

J 3f any monthly installment remains unpaid for 1 (five) consecutive months, the account will be closed automatically and the account will be settled as detailed below,# 'elationship: *enure Applie! 3nterest 5ess than "(one) year Bo interest More than " year but (avings %ate less + years More than + years but Matured value of + years and rest as per less 1 years prevailing interest rate on savings rate More than 1 years but Matured value of 1 years and rest as per less "2 years prevailing interest rate on savings rate. 3f failure to pay monthly installment on due dates he&she will pay penalty of Tk. '2&# (Twenty) ne.t subse!uent installment.

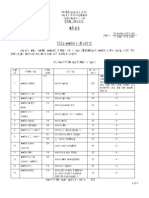

+onthly 3nstallment; *enure an! +aturity <alue will $e as per #ollowing -che!ule:= 3nstallment : Years .99 099 )999 ,999 ,099 0999 )9999

+ <ears 1 <ears 0 <ears "2 <ears

"+,222 '",022 4+,422 97,922 ",29,722 ',"0,'22 4,+4,422 '4,022 4",422 9',922",71,722 ',20,222 4,"4,222 9,'9,222 "+,"',22 +K,K22 71,722 ",+",'22',7',422 +,'9,222 7,17,222 2 "",1",22 '+,2',22 7K,"22","1,"22 ',+2,'224,72,422 1,01,122 2 2

-B2 'egular 3ncome Programme ( -'3P

". (B5 %egular 3ncome Crogram is an income program, which helps you to earn a monthly fi.ed amount on your deposits at (B5 for period of " year. '. Aeposit of Tk. 12,222&# (6ifty Thousand) and multiples thereof but ma.imum limit of Tk. '1,22,222&# (Taka Twenty 6ive 5ac) and Tk. 12,22,222&# (Taka 6ifty 5ac) at a time for the individual customer and the company respectively. Aepositor will earn "' e!ual monthly profit. Depositor can earn money !ue !ate as per #ollowing sche!ule:= Deposit Amount Monthly 3nterest Cayable 09;999 122 );99;99 ,;99;99 .;99;99 /;99;999 > 9 9 9 a$o%e ",222 ',222 +,2224,222 = :bove

B. C , This schedule changeable.

-B2 Dou$le 3ncome Plus ( D3? Programme

". Aeposit of Tk. "2,222&# (Ten Thousand) and multiples thereof will be acceptable under this program. '. : specially designed receipt shall be issued for the deposit under this program.

+. The instrument shall be issued for 7 years. 4. :t maturity after 7 years the depositor will be get double plus (A3L). 1. 3f any depositor intends to withdraw his deposit before maturity, the following rules will apply ,#

Bo benefit including interest&profit shall be allowed for pre#mature encashment within " (one) year. 3f the accounts&deposits are closed&en#cashed after " (one) year of its opening interest shall be allowed on the deposit at prevailing 6A% 3nterest %ate.

7. The instrument will be acceptable as collateral security against any investment sub*ect to registering lien with the issuing Branch. 0. 3n case of instrument get lost, the procedure for the issuance of a duplicate receipt will be the same as applicable in case of loss of 6A%.

-B2 0 ( 4i%e 2acs -a%ings -cheme

". :ny body can open this scheme by Aeposited Tk.1,222&#(five thousand) only per Month. '. The tenure of the scheme is 7 (si.) years. +. :fter (i. <ears Aepositor will get Tk. 1,'2,222&#. 4. 3f failure to pay monthly installment on due dates he&she will pay penalty of Tk. '2&# (twenty) on ne.t subse!uent installment. 1. 3n case of premature close of the account the account holder will get savings rate interest but not interest less than 7 (si.) months. 7. 3f 4 (four) consecutive monthly installment unpaid the account will be closed automatically.

-B2 )9 ( *en 2acs -a%ings -cheme

". :ny body can open this scheme by deposited Tk. 4,122&# (four thousand five hundred) only per month. '. This scheme tenure "2 (Ten) years. +. :fter "2 (Ten) years depositor will get Tk. "2,22,222&. 4. 3f failure to pay monthly installment on due dates he&she will pay penalty of Tk. '2&# (twenty) ne.t subse!uent installment. 1. 3n case of premature close of the account the account holder will get saving rate interest but not interest less than 7 (si.) months. 7. 3f 4 (four) consecutive monthly installment unpaid the account will be closed automatically.

-B2 2akhapoti Plus ( -2P? Programme

". The depositor will have the option to choose any installment siIe at the time of opening of the account and will not be allowed change the siIe of installment afterwards. '. 3n case of premature closing of the account minimum after " (one) year completion, the account holder will get (aving %ate of 3nterest only. But no interest will be paid before " (one) year completion of continued payment.

+. 3n case of premature close of the account the account holder will get savings rate interest but not interest less than 7 (si.) months. 4. 3f any client fails to pay monthly installment on due dates in ma.imum 4 (four) months he&she will pay penalty of Tk. '2&# (Twenty) per month to the ne.t subse!uent installment. 1. 3f any client fails to pay 4 (four) consecutive monthly installments the account will be closed automatically.

+onthly 3nstallment; *enure an! +aturity <alue will $e as per #ollowing -che!ule : +onthly 3nstallment +,922 ',722 ",422 922 722 *enure ' <ears + <ears 1 <ears 0 <ears "2 <ears Amount to $e pai! a#ter +aturity ",2+,472 ","',K12 ","1,2K2 ",++,922 ",+9,'"2

-B2 +illionaire Plus ( -+P? Program

". The depositor will have the option to choose any installment siIe at the time of opening of the account and will not be allowed change the siIe of installment afterwards. '. 3n case of premature closing of the account minimum after " (one) year completion, the account holder will get (aving %ate of 3nterest only. But no interest will be paid before " (one) year completion of continued payment. +. 3n case of premature close of the account the account holder will get savings rate interest but not interest less than 7 (si.) months.

4. 3f any client fails to pay monthly installment on due dates in ma.imum 4 (four) months he&she will pay penalty of Tk. '2&# (Twenty) per month to the ne.t subse!uent installment. 1. 3f any client fails to pay 4 (four) consecutive monthly installments the account will be closed automatically.

+onthly 3nstallment; *enure an! +aturity <alue will $e as per #ollowing -che!ule : +onthly 3nstallment '4,222 "+,122 K,222 1,122 +,922 *enure + <ears 1 <ears 0 <ears "2 <ears "+ <ears Amount to $e pai! a#ter +aturity "2,+2,222 "2,70,222 "2,K2,222 "2,01,222 "2,00,222

De#inition o# @ Partnership@; @partner@; #irm@ an! @#irm name@= "Cartnership" is the relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all. Cersons who have entered into partnership with one another are called individually " partners" and collectively " a firm" , and the name under which their business is carried on is called the " firm name" *ypes o# partnership #irm TYPES ! P"#T$E#S%&P !&#M )" &eneral or Anlimite! Partnership : partnership in which the liability of all the partners is unlimited is known as unlimited partnership. :ll the partners can take part in the working of the business. 3n 3ndia, only this kind of partnership e.ists. $eneral partnership can be classified into three types such as partnership#at#will, particular partnership and *oint venture. They are discussed below. a" PartnershipBatBwill Cartnership#at#will is a partnership which is formed to carry on business without specifying any period of time. The life of such a partnership continues as long as the partners are willing to continue it as such. The partnership can be terminated, if any partner notifies his desire to !uit.

$" Particular Partnership 3t is a partnership established for a stipulated period of time or for the completion of a specified venture. 3t automatically comes to an end with the e.piry of the stipulated period or on the completion of the specified venture, as the case may be. 6or e.ample, a partnership may be created for one year only. Fhen thetime lapses, the partnership comes to an end. c" Coint <enture : *oint venture is a temporary partnership which is formed to complete a specific venture or *ob during a specified period of time. -very partner does not have the right of implied agency. Bo partner can withdraw his interest in the firm before the completion of the venture. 6or e.ample, a partnership is formed for the construction of a building. The partnership comes to an end if the construction is over. ," 2imite! Partnership : partnership in which the liability of the partner is limited is called limited partnership. The 5aw does not permit the formation of a limited partnership in 3ndia. But in -urope and 8.(.:. limited partnership is allowed. : limited partnership firm must have at least one partner whose liability is unlimited. The liability of remaining partners is limited. Thus limited partnership consists of two types of partners, general partner and limited partner.

*ypes o# Partners: The kinds of partners are as follows, "cti'e partner The partner takes active part in the affairs of the firm and en*oys full voice in its management. Sleeping or (ormant partner The partner voluntarily surrenders the right to take part in the affairs of the firm and has no voice in its management. to the outsiders the partner is not known but the liability is unlimited. $ominal partner The partner only lends his&her name and credit to the firm. on the strength of the reputation and goodwill of nominal partner, the firm may attract additional business and capital. the partner may or may not be given share in the profit but he never takes any

active part in the management of the business however such partner is known to the outsiders as the partner of the firm and therefor he is held liable to the third parties. Minor partner :ccording to section +2 indian partnership act "K+' a partner below "9 years of age can enter into partner ship but the liability is limited by his share in the partner ship capital within si. months from attaining the age of ma*ority such partner has to give public notice to the desire to continue in the partner ship firm. if he wants to continue after attaining ma*ority such partner will be regarded as the full fledged partner with unlimited liability. %olding out partner : person may represent himself or may knowingly permit him to be represented as a partner of firm. such as person directly or indirectly holding him as a partner shall be liable as a partner for the obligation created on the misrepresentation. he will, ofcourse, not be entitled for any rights of the partner ship. Partner )y estoppel 3f a person by oral or written or with an activity if he creates a belief to the outsiders that he is a partner in a certain firms and with that belief outsiders give loan to that firm or sell goods on credit, in such case, he cannot say that he is a partner. such a partner is called as a partner by estoppel. this type of partner doesn)t pay capital and interfere in the affairs of the firm. Secret partner The partner doesn)t disclose his name as a partner in a certain firm before public. he keeps his name as a secret. such a partner is called secret partner. though his name was secret he cannot escape from the debts of the firm. Partner in profits The partner enters in to the partnership firm with the understanding that he will be shared only in profits but also in losses. such a partner is called partner in profits. but such partner is fully responsible for the firm debts. ut going partner The partner will go out voluntarily with out dissolution of the firm. such a partner is called outgoings partner. such a partner is responsible for firm debts during his tenure as a partner. on the date of his outgoing if such a partner gives public notice by stating that

he going out from the partner ship from there after he will not be responsible for any debts of the firm. &ncoming partner Fith the consent of other partners if a new partner *oins in the running partner ship firm such a partner is called incoming partner. he will not be responsible for the debts of the firm prior to his *oins period. in general, incoming partner pays amount to the e.isting partners in the form of good will as per the partnership agreement.

(ection+K A3((G58T3GB G6 : 63%M. The dissolution of a partnership between all the partners of a firm is called the "dissolution of the firm". (ection42 A3((G58T3GB B< :$%--M-BT. : firm may be dissolved with the consent of all the partners or in accordance with a contract between the partners. (ection4" GMC85(G%< A3((G58T3GB. : firm is dissolved (a) by the ad*udication of all the partners or of all the partners but one as insolvent, or (b) by the happening of any event which makes it unlawful for the business of the firm to be carried on or for the partners to carry it on in partnership , Crovided that, where more than one separate adventure or undertaking is carried on by the firm, the illegality of one or more shall not of itself cause the dissolution of the firm in respect of its lawful adventures and undertakings (ection4' A3((G58T3GB GB TD- D:CC-B3B$ G6 -%T:3B GBT3B$-B 3-(.

(ub*ect to contract between the partners a firm is dissolved (a) if constituted for a fi.ed term, by the e.piry of that termM (b) if constituted to carry out one or more adventures or undertakings, by the completion thereofM (c) by the death of a partnerM and

(d) by the ad*udication of a partner as an insolvent. (ection4+ A3((G58T3GB B< BGT3 - G6 C:%TB-%(D3C :T F355. (") Fhere the partnership is at will, the firm may be dissolved by any partner giving notice in writing to all the other partners of his intention to dissolve the firm. (') The firm is dissolved as from the date mentioned in the notice as the date of dissolution or, if no date is so mentioned, as from the date of the communication of the notice. (ection44 A3((G58T3GB B< TD- G8%T. :t the suit of a partner, the ourt may dissolve a firm on any of the following grounds, namely ,# (a) that a partner has become of unsound mind, in which case the suit may be brought as well by the ne.t friend of the partner who has become of unsound mind as by any other partnerM (b) that a partner, other than the partner suing, has become in any way permanently incapable of performing his duties as partnerM (c) that a partner, other than the partner suing, is guilty of conduct which is likely to affect pre*udicially the carrying on of the business regard being had to the nature of the businessM (d) that a partner, other than the partner suing, will#ully or persistently commits breach of agreements relating to the management of the affairs of the firm of the conduct of its businessM or otherwise so conducts himself in matters relating to the business that it is not reasonably practicable for the other partners to carry on the business in partnership with himM (e) that a partner, other than the partner suing, has in any way transferred the whole of his interest in the firm to a third party, or has allowed his share to be charged under the provisions of rule 4K of Grder NN3 of the 6irst (chedule to the ode of ivil Crocedure, "K29, or has allowed it to be sold in the recovery of arrears of land revenue or of any dues recoverable as arrears of land revenue due by the partnerM (f) that the business of the firm cannot be carried on save at a lossM or (g) on any other ground which renders it *ust and e!uitable that the firm should be dissolved.

D1&(*3AB21 3D-*'A+1D*"

(a) -.cept as provided in subsections (c) and (d), "negotiable instrument" means an unconditional promise or order to pay a fi.ed amount of money, with or without interest or other charges described in the promise or order, if it, (") is payable to bearer or to order at the time it is issued or first comes into possession of a holderM (') is payable on demand or at a definite timeM and (+) does not state any other undertaking or instruction by the person promising or ordering payment to do any act in addition to the payment of money, but the promise or order may contain (i) an undertaking or power to give, maintain, or protect collateral to secure payment, (ii) an authoriIation or power to the holder to confess *udgment or realiIe on or dispose of collateral, or (iii) a waiver of the benefit of any law intended for the advantage or protection of an obligor.

1ssential 4eatures o# Degotia$le 3nstruments are gi%en $elow: )" Writing an! -ignature: Begotiable 3nstruments must be written and signed by the parties according to the rules relating to Cromissory Botes, Bills of -.change and he!ues. Aemand Arafts are also construel as Begotiable 3nstruments in the limiting case as they have the same property as B.3. 3nstrumes. ," +oney: Begotiable instruments are payable by legal tender money of 3ndia. The liabilities of the parties of Begotiable 3nstruments are fi.ed and determined in terms of legal tender money. ." Degotia$ility: Begotiable 3nstruments can be transferred from one person to another by a simple process. 3n the case of bearer instruments, delivery to the transferee is sufficient. 3n the case of order instruments two things are re!uired for a valid transfer, endorsement (i.e., signature of the holder) and delivery. :ny instrument may be made non#transferable by using suitable words, e.g., ?pay to N only.@

/" *itle: The transferee of a negotiable instrument, when he fulfils certain conditions, is called the holder in due course. The holder in due course gets a good title to the instrument even in cases where the title of the transferrer is defective. 0" Dotice: 3t is not necessary to give notice of transfer of a negotiable instrument to the party liable to pay. The transferee can sue in his own name. 5" Presumptions: ertain presumptions apply to all negotiable instruments. -.ample, 3t is presumed that there is consideration. 3t is not necessary to write in a promissory note the words ?for value received@ or similar e.pressions because the payment of consideration is presumed. The words are usually included to create additional evidence of consideration. 6" -pecial Proce!ure: : special procedure is provided for suits on promissory notes and bills of e.change (The procedure is prescribed in the ivil Crocedure ode). : decree can be obtained much more !uickly than it can be in ordinary suits. 7" Popularity: Begotiable instruments are popular in commercial transactions because of their easy negotiability and !uick remedies. 8" 1%i!ence: : document which fails to !ualify as a negotiable instrument may nevertheless be used as evidence of the fact of indebtedness. Who can $e pai! money o# a cheque? Cayee Bearer -ndorse

Potrebbero piacerti anche

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- E Vswks Cöwewa I BXWZ Wefvm Evsjv 'K E VSK Cöavb KVH©VJQ XVKVDocumento1 paginaE Vswks Cöwewa I BXWZ Wefvm Evsjv 'K E VSK Cöavb KVH©VJQ XVKVadnan04Nessuna valutazione finora

- Bangladesh Bank Head Office Dhaka: Foreign Exchange Policy DepartmentDocumento1 paginaBangladesh Bank Head Office Dhaka: Foreign Exchange Policy DepartmentamirentezamNessuna valutazione finora

- Mar 022020 BRPDL 05Documento1 paginaMar 022020 BRPDL 05Tim McCartyNessuna valutazione finora

- Mar 222020 BRPD 05Documento3 pagineMar 222020 BRPD 05Tim McCartyNessuna valutazione finora

- Foreign Exchange Policy Department: Enhancement of Loan Limit From Export Development FundDocumento1 paginaForeign Exchange Policy Department: Enhancement of Loan Limit From Export Development Fundadnan04Nessuna valutazione finora

- (A) There Is Bonafide Business Relationship Between The Remitter(s) and The Supplier(s)Documento1 pagina(A) There Is Bonafide Business Relationship Between The Remitter(s) and The Supplier(s)adnan04Nessuna valutazione finora

- Evsjv 'K E VSK: Cöavb KVH©VJQDocumento1 paginaEvsjv 'K E VSK: Cöavb KVH©VJQadnan04Nessuna valutazione finora

- Foreign Exchange Policy Department: Bangladesh BankDocumento1 paginaForeign Exchange Policy Department: Bangladesh Bankadnan04Nessuna valutazione finora

- Sports Bar Business PlanDocumento13 pagineSports Bar Business Planadnan04Nessuna valutazione finora

- Best Computer Mcqs Over 1000 by MD Khalil Uddin.Documento63 pagineBest Computer Mcqs Over 1000 by MD Khalil Uddin.subashnayak999Nessuna valutazione finora

- 41th BCS Advertisement - Final (Website) PDFDocumento18 pagine41th BCS Advertisement - Final (Website) PDFsopnil aliNessuna valutazione finora

- Demutualization Act 2013Documento16 pagineDemutualization Act 2013adnan04Nessuna valutazione finora

- Table of ContentDocumento2 pagineTable of Contentadnan04Nessuna valutazione finora

- Ptak Prize - 70 - Scholarship Winners ListDocumento5 paginePtak Prize - 70 - Scholarship Winners Listadnan04Nessuna valutazione finora

- Role of Treasury FunctionDocumento4 pagineRole of Treasury Functionadnan040% (1)

- Presentation CanadaDocumento15 paginePresentation Canadaadnan04Nessuna valutazione finora

- Basel 3Documento18 pagineBasel 3adnan04Nessuna valutazione finora

- Test 10Documento3 pagineTest 10adnan04Nessuna valutazione finora

- Department of Financial Institutions of BBDocumento1 paginaDepartment of Financial Institutions of BBadnan04Nessuna valutazione finora

- Housing Market in CanadaDocumento7 pagineHousing Market in Canadaadnan04Nessuna valutazione finora

- Weávcb: 33Zg Wewmgm Cix V-2012Documento13 pagineWeávcb: 33Zg Wewmgm Cix V-2012kimbhutkimakarymailNessuna valutazione finora

- Role of Treasury FunctionDocumento4 pagineRole of Treasury Functionadnan040% (1)

- Literature ReviewDocumento2 pagineLiterature Reviewadnan04Nessuna valutazione finora

- Guidelines To Write An Internship ReportDocumento2 pagineGuidelines To Write An Internship Reportadnan04Nessuna valutazione finora

- What Does DuPont Analysis MeanDocumento1 paginaWhat Does DuPont Analysis Meanadnan04Nessuna valutazione finora

- Performance AppraisalDocumento34 paginePerformance AppraisalbunkusaikiaNessuna valutazione finora

- PHONE EtiquetteDocumento14 paginePHONE Etiquetteroziahzailan100% (1)

- Chapter 11Documento6 pagineChapter 11adnan04Nessuna valutazione finora

- Mr. Pervez Said. Handbook of Islamic Banking Products & Services.Documento138 pagineMr. Pervez Said. Handbook of Islamic Banking Products & Services.akram_tkdNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Heirs of Marcelina Arzadon Crisologo vs. Rañon PDFDocumento21 pagineHeirs of Marcelina Arzadon Crisologo vs. Rañon PDFral cbNessuna valutazione finora

- PAL vs. Heald Lumber Co.Documento2 paginePAL vs. Heald Lumber Co.Anonymous 8liWSgmINessuna valutazione finora

- Ross Rica Sales Center, Inc. v. Spouses Ong DigestDocumento4 pagineRoss Rica Sales Center, Inc. v. Spouses Ong DigestRobyn Bangsil100% (2)

- Critical Legal ThinkingDocumento5 pagineCritical Legal ThinkingFrancisco Javier Fontán MármolNessuna valutazione finora

- Legprof FINAL EXAM Digests - 1Documento14 pagineLegprof FINAL EXAM Digests - 1Viktor MoralesNessuna valutazione finora

- In Re: Yuri Plyam and Natalia Plyam, 9th Cir. BAP (2015)Documento32 pagineIn Re: Yuri Plyam and Natalia Plyam, 9th Cir. BAP (2015)Scribd Government DocsNessuna valutazione finora

- 2005-2006 Red Onion State PrisonReports of Physical AbuseDocumento9 pagine2005-2006 Red Onion State PrisonReports of Physical AbuseHRCFedUpNessuna valutazione finora

- Entry - ZPS America V Hammond EnterprisesDocumento11 pagineEntry - ZPS America V Hammond EnterprisespauloverhauserNessuna valutazione finora

- Auction in Malinta, Inc. vs. Warren Embes Luyaben: G.R. No. 173979, February 12, 2007 Ponente: Ynares-Santiago, JDocumento2 pagineAuction in Malinta, Inc. vs. Warren Embes Luyaben: G.R. No. 173979, February 12, 2007 Ponente: Ynares-Santiago, JEap BustilloNessuna valutazione finora

- Paje V Casino DigestDocumento3 paginePaje V Casino Digestnicole hinanay100% (4)

- Case Digests (Fourth Set) Civil Review I S.Y. 2019 - 2020Documento11 pagineCase Digests (Fourth Set) Civil Review I S.Y. 2019 - 2020Ariana Cristelle PagdangananNessuna valutazione finora

- GR 114742Documento6 pagineGR 114742Rache BaodNessuna valutazione finora

- NOCOM V CAMERINO Summary JudgementsDocumento2 pagineNOCOM V CAMERINO Summary JudgementsAnonymous 0h8tl2iJNessuna valutazione finora

- Jacinto Vs KaparazDocumento1 paginaJacinto Vs KaparazMikey GoNessuna valutazione finora

- SyllabusDocumento5 pagineSyllabusJenny LianNessuna valutazione finora

- Lozano Vs Nograles Case DigestDocumento2 pagineLozano Vs Nograles Case DigestJohnReyVillalon100% (4)

- Abagatnan Vs Clarito, G.R. No. 211966, August 7, 2017Documento2 pagineAbagatnan Vs Clarito, G.R. No. 211966, August 7, 2017apremsNessuna valutazione finora

- Mindanao Bus Co. v. City Assessor and Treasurer 1962Documento6 pagineMindanao Bus Co. v. City Assessor and Treasurer 1962Maricel Caranto FriasNessuna valutazione finora

- 7107 Islands Publishing-StatconDocumento4 pagine7107 Islands Publishing-StatconFritz Frances DanielleNessuna valutazione finora

- ARO Confidentiality and Arbitration Talk 050504Documento26 pagineARO Confidentiality and Arbitration Talk 050504Ko Ka KunNessuna valutazione finora

- Wellex Group VS SandiganbayanDocumento11 pagineWellex Group VS SandiganbayanJairus RubioNessuna valutazione finora

- BDO Vs EBCDocumento1 paginaBDO Vs EBCmargaserranoNessuna valutazione finora

- Arbitration Law in India - Development ADocumento24 pagineArbitration Law in India - Development APawan RashiNessuna valutazione finora

- Mediation Agreement On Matrimonial DisputesDocumento10 pagineMediation Agreement On Matrimonial Disputesshreya dasNessuna valutazione finora

- CA Court Ruling Re Malicious Prosecution For Trademark and False Advertising ClaimsDocumento85 pagineCA Court Ruling Re Malicious Prosecution For Trademark and False Advertising ClaimsDaniel Ballard100% (1)

- Statutes Replaced With International Law Public Notice/Public RecordDocumento5 pagineStatutes Replaced With International Law Public Notice/Public Recordin1or100% (2)

- Complaint For FraudDocumento3 pagineComplaint For FraudAldoSolsa100% (1)

- Burning Man Lawsuit Response 2Documento46 pagineBurning Man Lawsuit Response 2San Francisco ExaminerNessuna valutazione finora

- Govt of The Philippine Island Vs Monte de Piedad (35 Phil 728)Documento20 pagineGovt of The Philippine Island Vs Monte de Piedad (35 Phil 728)Maricar Grace VelascoNessuna valutazione finora

- Settlement of EstateDocumento10 pagineSettlement of EstateRen MagallonNessuna valutazione finora