Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Lecture 2 - How Time and Interest Affect Money

Caricato da

Danar AdityaCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Lecture 2 - How Time and Interest Affect Money

Caricato da

Danar AdityaCopyright:

Formati disponibili

HowTime and Interest HowTime and Interest How Time and Interest How Time and Interest

Affect Money Affect Money Affect Money Affect Money

Engineering Economy Engineering Economy

Lecture no. 2 Lecture no. 2

Thursday, J une 13, 2013 Thursday, J une 13, 2013

ECONOMIC EQUIVALENCE ECONOMIC EQUIVALENCE

Two sums of money at two different points Two sums of money at two different points

in time can be made economically

equivalent if: equivalent if:

We consider an interest rate and,

No. of time periods between the two

sums

Equality in terms of Economic Value

Interest Rate Interest Rate

INTEREST - MANIFESTATION OF THE

TIME VALUE OF MONEY. THE AMOUNT

PAID TO USE MONEY.

INVESTMENT INVESTMENT

INTEREST = VALUE NOW - ORIGINAL AMOUNT

LOAN LOAN

INTEREST = TOTAL OWED NOW - ORIGINAL

AMOUNT

RENTAL FEE PAID FOR THE USE OF SOMEONE

ELSESMONEY EXPRESSEDASA% ELSES MONEYEXPRESSED AS A %

Interest Rates and Returns Interest Rates and Returns

AMOUNT ORIGINAL

UNIT TIME PER INTEREST

RATE INTEREST =

Interest can be viewed from two

perspectives:

Lending situation e d gs tuat o

Investing situation

I t t L di E l Interest Lending: Example

You borrow $10,000 for one full year

Must pay back $10 700 at the endof one year Must pay back $10,700 at the end of one year

Interest Amount (I) = $10,700 - $10,000

Interest Amount = $700 for the year

Interest rate (i) = 700/ $10,000 = 7%/ Yr Interest rate (i) 700/ $10,000 7%/ Yr

I t t R t N t ti Interest Rate - Notation

the interest rate is Expressed as a per cent

per year per year

Notation

I = the interest amount is $

i = the interest rate (%/ interest period)

N= No. of interest periods (1 for this problem)

Interest Investing Perspective Interest Investing Perspective

Assume you invest $20,000 for one year in a

venture that will return to you, 9% per year.

At the end of one year, you will have:

Original $20,000 back Original $20,000 back

Plus..

The 9% return on $20 000 = $1 800 The 9% return on $20,000 = $1,800

We say that you earned 9%/ year on the investment!

This is your RATE of RETURNon the investment This is your RATE of RETURNon the investment

Engineering Economy Factors

1. F/ P and P/ F Factors

2 P/ AandA/ PFacto s 2. P/ A and A/ P Factors

3. F/ A and A/ F Factors

4. Interpolate Factor Values

5. P/ G and A/ G Factors

6. Geometric Gradient

F/P factor F/P factor

To find F given P To find F given P

F

n

To FindFgiven P To Find F given P

N

.

P

0

Compound forward in time

F/P factor

F

1

= P(1+i)

F/P factor

1

( )

F

2

= F

1

(1+i)..but:

F

2

=P(1+i)(1+i) =P(1+i)

2

F

2

P(1+i)(1+i) P(1+i)

F

3

= F

2

(1+i) =P(1+i)

2

(1+i)

=P(1+i)

3

= P(1+i)

3

In general:

F P(1 i)

n

F

N

= P(1+i)

n

F

N

= P(F/P,i%,n)

N

( )

P/F factor discounting back in time P/F factor discounting back in time

Discounting back fromthe future Discounting back from the future

F

n

N

.

P/ Ffactor brings a single

P

P/ F factor brings a single

future sum back to a specific

point in time.

Present Worth Factor fromF/P Present Worth Factor from F/P

Since F

N

=P(1+i)

n

Since F

N

P(1+i)

We solve for P in terms of F

N

P = F{1/ (1+i)

n}

= F(1+i)

-n

Thus: Thus:

P = F(P/F,i%,n) where

(P/F,i%,n) = (1+i)

-n

Example F/P Analysis Example- F/P Analysis

Example: P=$1,000;n=3;i=10% Example: P $1,000;n 3;i 10%

What is the future value, F?

F ??

0 1 2 3

F = ??

0 1 2 3

P=$1,000

i=10%/ year

F

3

= $1,000[F/ P,10%,3] = $1,000[1.10]

3

= $1,000[1.3310] = $1,331.00 $ , [ ] $ ,

UniformSeries Present Worth Uniform Series Present Worth

and Capital Recovery Factors

Annuity Cash Flow

P ?? P = ??

0

..

n

1 2 3 .. .. n-1

$A per period

UniformSeries Present Worth Uniform Series Present Worth

and Capital Recovery Factors

Write a Present worth expression

1 2 1

1 1 1 1

..

(1 ) (1 ) (1 ) (1 )

n n

P A

i i i i

(

= + + + +

(

+ + + +

[1]

1 2 1

(1 ) (1 ) (1 ) (1 )

n n

i i i i

(

+ + + +

Term inside the brackets is a geometric progression.

Mult. This equation by 1/ (1+i) to yield a second equation

UniformSeries Present Worth Uniform Series Present Worth

and Capital Recovery Factors

The second equation

1 1 1 1 P (

[2]

2 3 1

1 1 1 1

..

1 (1 ) (1 ) (1 ) (1 )

n n

P

A

i i i i i

+

(

= + + + +

(

+ + + + +

To isolate an expression for P in terms of A, subtract

Eq [1] from Eq. [2]. Note that numerous terms will

ddrop out.

UniformSeries Present Worth Uniform Series Present Worth

and Capital Recovery Factors

Setting up the subtraction

1 1 1 1

P A

(

= + + + +

(

[2]

1 1 1 1 (

2 3 1

..

(1 ) (1 ) (1 ) (1 )

n n

P A

i i i i

+

= + + + +

(

+ + + +

[2]

1 2 1

1 1 1 1

..

(1 ) (1 ) (1 ) (1 )

n n

P A

i i i i

(

= + + + +

(

+ + + +

[1]

-

1

1 1

1 (1 ) (1 )

n

i

P A

i i i

+

(

=

(

+ + +

=

[3]

1 (1 ) (1 ) i i i + + +

UniformSeries Present Worth Uniform Series Present Worth

and Capital Recovery Factors

Simplifying Eq. [3] further

(

1

1 1

1 (1 ) (1 )

n

i

P A

i i i

+

(

=

(

+ + +

( ) ( )

1

1

A

P

(

=

(

(1 ) 1

0

n

i

P A f i

(

+

=

(

1

1

(1 )

n

P

i i

+

=

(

+

( )

0

(1 )

n

P A for i

i i

= =

(

+

UniformSeries Present Worth Uniform Series Present Worth

and Capital Recovery Factors

This expression will convert an annuity cash

flow to an equivalent present worth amount one

period to the left of the first annuity cash flow.

(

(1 ) 1

0

(1 )

n

n

i

P A for i

i i

(

+

= =

(

+

/ %, P A i n factor

Capital Recovery Factor: Capital Recovery Factor:

A/P, i%, n

The present worth point of

an annuity cash flow is

always one periodto the

Given the P/A factor

(1 ) 1

0

n

i

P A f i

(

+

=

(

Solve for Ain terms of P

always one period to the

left of the first A amount

( )

0

(1 )

n

P A for i

i i

= =

(

+

Solve for A in terms of P

Yielding.

(1 )

n

i i

A P

(

+

=

(

Yielding.

A/ P i% f t

(1 ) 1

n

A P

i

=

(

+

A/ P,i%,n factor

F/A and A/F Derivations

$F

F/A and A/F Derivations

Annuity Cash Flow

$F

Annuity Cash Flow

0

..

N

0

$A per period

Find $A given the

Future amt. - $F

Si ki F d d S i C d Sinking Fund and Series Compound

amount factors (A/F and F/A)

Recall:

Al

1

P F

(

=

(

Substitute P and

simplify!

Also:

(1 )

n

P F

i

=

(

+

(

(1 )

(1 ) 1

n

n

i i

A P

i

(

+

=

(

+

A/F F t A/F Factor

1 (1 )

n

i i

( ( +

By substitution we

see:

1 (1 )

(1 ) (1 ) 1

n

n n

i i

A F

i i

( ( +

=

( (

+ +

Simplifying we have:

(

Which is the

(A/F,i%,n) factor

(1 ) 1

n

A

i

i

F =

(

(

+

(1 ) 1 i +

F/A f t f th A/F F t F/A factor from the A/F Factor

i

(

Given:

(1 ) 1

n

i

A F

i

(

=

(

+

Solve for F in terms of

) (1 1

n

i

(

A

)

=A

(1 1

F

n

i

i

(

+

(

i

(

F/A and A/F Derivations

$F

F/A and A/F Derivations

Annuity Cash Flow

$F

Annuity Cash Flow

0

..

N

0

$A per period

Find $F given thethe

$A amounts

E l Example

Formasa Plastics has major fabrication j

plants in Texas and Hong Kong.

It is desired to know the future worth of

$1,000,000 invested at the end of each year

for 8 years, starting one year from now.

The interest rate is assumed to be 14% per

year.

E l Example

A= $1 000 000/ yr; n = 8 yrs i = 14%/ yr A = $1,000,000/ yr; n = 8 yrs, i = 14%/ yr

F

8

= ??

E l Example

Solution:

Solution:

The cash flow diagram shows the annual

payments starting at the end of year 1 and

ending in the year the future worth is desired.

Cash flows are indicated in $1000 units. The F

value in 8 years is value in 8 years is

F = l000(F/ A,14%,8) = 1000( 13.23218)

$13 232 80 13 232 illi 8 = $13,232.80 = 13.232 million 8 years

from now/

Interpolation of Factors

All texts on Engineeringeconomy will provide All texts on Engineering economy will provide

tabulated values of the various interest factors

usually at the end of the text in an appendix

Refer to the back of your text for those tables.

I t l ti f F t Interpolation of Factors

Typical Format for Tabulated Interest Tables

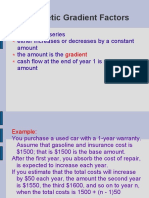

Arithmetic Gradient Factors

In applications the annuity cash flowpattern is In applications, the annuity cash flow pattern is

not the only type of pattern encountered

Two other types of endof periodpatterns are Two other types of end of period patterns are

common

The Linear or arithmetic gradient g

The geometric (% per period) gradient

An arithmetic (linear) Gradient is a cash flow

Arithmetic Gradient Factors

An arithmetic (linear) Gradient is a cash flow

series that either increases or decreases by a

contestant amount over n time periods.

A linear gradient is always comprised of TWO

components:

The Gradient component

The base annuity component y p

The objective is to find a closed form expression

for the Present Worth of an arithmetic gradient

Linear Gradient Example

A +n 1G

Linear Gradient Example

Assume the following:

A

1

+n-2G

A

1

+n-1G

g

A +2G

A

1

+G

A

1

+2G

0 1 2 3 n-1 N

This represents a positive, increasing arithmetic gradient

E l Li G di t Example: Linear Gradient

Typical Negative IncreasingGradient: G=$50 Typical Negative, Increasing Gradient: G=$50

The Base Annuity

= $1500

A ith ti G di t F t Arithmetic Gradient Factors

The G amount is the constant arithmetic change

from one time period to the next.

The G amount may be positive or negative!

The present worth point is always one time The present worth point is always one time

period to the left of the first cash flow in the

series or,

Two periods to the left of the first gradient cash

flow!

The A/G Factor

Convert G to an equivalent A

( / , , )( / , , ) A G P G i n A P i n =

How to do it

Gradient Example Gradient Example

Consider the followingcash flow Consider the following cash flow

$300

$400

$500

$100

$200

$300

0 1 2 3 4 5

Present Worth Point is here!

Find the present worth if i = 10%/yr; n = 5 yrs

And the Gamt. = $100/ period

Gradient Example- Base Annuity Gradient Example Base Annuity

First The Base Annuity of $100/ period First, The Base Annuity of $100/ period

A = +$100

0 1 2 3 4 5

PW(10%) of the base annuity = $100(P/ A,10%,5)

PW

Base

= $100(3.7908)= $379.08

Not Finished: We need the PW of the gradient component

and then add that value to the $379.08 amount

The Gradient Component The Gradient Component

$300

$400

$0

$100

$200

$300

0 1 2 3 4 5

We desire the PW of the Gradient Component at t = 0

P

G@t=0

= G(P/ G,10%,5) = $100(P/ G,10%,5) P

G@t=0

G(P/ G,10%,5) $100(P/ G,10%,5)

Th G di t C t The Gradient Component

$300

$400

$0

$100

$200

$300

0 1 2 3 4 5

P

G@t=0

= G(P/ G,10%,5) = $100(P/ G,10%,5)

G (1 ) 1

N

i N

(

Couldsubstituten=5, i=10%

G (1 ) 1

P=

i (1 ) (1 )

N

N N

i N

i i i

(

+

(

+ +

Could substitute n 5, i 10%

and G = $100 into the P/ G

closed form to get the value

of the factor.

PW f th G di t C t PW of the Gradient Component

P

G@t=0

= G(P/ G,10%,5) = $100(P/ G,10%,5)

P/ G,10%,5)

Sub. G=$100;i=0.10;n=5

G (1 ) 1

P=

i (1 ) (1 )

N

N N

i N

i i i

(

+

(

+ +

6.8618

Calculating or looking up the P/ G,10%,5 factor

yields the following:

P

t=0

= $100(6.8618) = $686.18 for the gradient

PW

G di t E l Fi l R lt Gradient Example: Final Result

PW(10%)

BaseAnnuity

= $379.08 ( )

Base Annuity

PW(10%)

Gradient Component

= $686.18

T t l PW(10%) $379 08 $686 18 Total PW(10%) = $379.08 + $686.18

Equals $1065.26

Note: The two sums occur at t =0 and can be

added together concept of equivalence

Example Summarized Example Summarized

$500

This Cash Flow

$200

$300

$400

$500

This Cash Flow

$100

$200

0 1 2 3 4 5

Is equivalent to $1065.26 at time 0 if the interest rate

is 10% per year!

Wh th i t i k When the i rate is unknown

A class of problems may deal with all of the p y

parameters know except the interest rate.

For many application-type problems, this can

become a difficult task

Termed, rate of return analysis

In some cases:

i can easily be determined y

In others, trial and error must be used

E l i k Example: i unknown

Assume one can invest $3000 now in a venture $

in anticipation of gaining $5,000 in five (5)

years.

If these amounts are accurate, what interest

rate equates these two cash flows?

$5,000

0 1 2 3 4 5

F = P(1+i)

n

$3,000

( )

5,000 = 3,000(1+i)

5

(1+i)

5

= 5,000/ 3000 = 1.6667

E l i k Example: i unknown

Assume on can invest $3000 now in a venture in $

anticipation of gaining $5,000 in five (5) years.

If these amounts are accurate, what interest

rate equates these two cash flows?

$5,000

0 1 2 3 4 5

(1+i)

5

= 5,000/ 3000 = 1.6667

$3,000

( ) , /

(1+i) = 1.6667

0.20

i = 1.1076 1 = 0.1076 = 10.76%

F i k For i unknown

In general, solving for i in a time value g , g

formulation is not straight forward.

More often, one will have to resort to some form

of trial and error approach as will be shown in

future sections.

l d h d l f hi bl A sample spreadsheet model for this problem

follows.

U k N b f Y Unknown Number of Years

Some problems require knowing the number of p q g

time periods required given the other

parameters

Example:

How long will it take for $1,000 to double in

l if h di i value if the discount rate is 5% per year?

Draw the cash flow diagram as.

F

n

= $2000

i = 5%/ year; n is unknown!

0 1 2 . . . . . . . n

P = $1,000

U k N b f Y Unknown Number of Years

Solving we have..

F = $2000

g

F

n

= $2000

0 1 2 . . . . . . . n

P $1 000 P = $1,000

F

n=?

= 1000(F/ P,5%,x): 2000 = 1000(1.05)

x

Solve for x in closed form

U k N b f Y Unknown Number of Years

Solving we have.. g

(1.05)

x

= 2000/ 1000

Xln(1.05) =ln(2.000)

X = ln(1.05)/ ln(2.000)

X = 0.6931/ 0.0488 = 14.2057 yrs

With discrete compoundingit will take 15 With discrete compounding it will take 15

years to amass $2,000 (have a little more that

$2,000)

Potrebbero piacerti anche

- Oil & Gas GlossaryDocumento31 pagineOil & Gas Glossarytulks100% (2)

- Barangay Budget FormsDocumento31 pagineBarangay Budget FormsNonielyn Sabornido100% (1)

- Personal Development Planning and Career Planning FinalDocumento19 paginePersonal Development Planning and Career Planning FinalDanar AdityaNessuna valutazione finora

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsDa EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNessuna valutazione finora

- Closing OperationsDocumento88 pagineClosing OperationsNavyaKmNessuna valutazione finora

- Simple AnnuitiesDocumento33 pagineSimple Annuitieselma anacletoNessuna valutazione finora

- John L Person- Forex Conquered Pivot Point Analysis NotesDocumento2 pagineJohn L Person- Forex Conquered Pivot Point Analysis Notescalibertrader100% (1)

- Project Report BobDocumento30 pagineProject Report Bobmegha rathore100% (1)

- Solutions To Derivative Markets 3ed by McDonaldDocumento28 pagineSolutions To Derivative Markets 3ed by McDonaldRiskiBiz13% (8)

- Civil Engineering Cost Analysis ReviewDocumento67 pagineCivil Engineering Cost Analysis ReviewAnonymous PkeI8e84Rs100% (1)

- INFINITI RETAIL LIMITED (Trading As Cromā) : Tax InvoiceDocumento3 pagineINFINITI RETAIL LIMITED (Trading As Cromā) : Tax Invoice2018hw70285Nessuna valutazione finora

- Business PlanDocumento30 pagineBusiness PlanAisyah Nabiha Binti HusinNessuna valutazione finora

- Clean and Dirty PriceDocumento4 pagineClean and Dirty PriceAnkur GargNessuna valutazione finora

- Sam Strother and Shawna Tibbs Are Vice Presidents of MutualDocumento2 pagineSam Strother and Shawna Tibbs Are Vice Presidents of MutualAmit PandeyNessuna valutazione finora

- Statement of Account: State Bank of IndiaDocumento10 pagineStatement of Account: State Bank of IndiaPriya ShindeNessuna valutazione finora

- Lesson 3 - AnnuitiesDocumento58 pagineLesson 3 - AnnuitiesCarlo EdolmoNessuna valutazione finora

- Annuities - A Series of Equal Payments Occurring at Equal Periods of TimeDocumento5 pagineAnnuities - A Series of Equal Payments Occurring at Equal Periods of TimeMarcial MilitanteNessuna valutazione finora

- 5 Time Value of Money 1Documento33 pagine5 Time Value of Money 1jnfzNessuna valutazione finora

- CONSTRUCTION EconomicsDocumento27 pagineCONSTRUCTION Economicshema16100% (1)

- GE 161 Fall 2011 Printed: 10/4/2011 Page 1: Time Value of Money - 1Documento14 pagineGE 161 Fall 2011 Printed: 10/4/2011 Page 1: Time Value of Money - 1John ZhaoNessuna valutazione finora

- Chapter 2Documento13 pagineChapter 2ObeydullahKhanNessuna valutazione finora

- Dec 4 MeetingDocumento45 pagineDec 4 MeetingTrice GelineNessuna valutazione finora

- Factors: How Time and Interest Affect MoneyDocumento64 pagineFactors: How Time and Interest Affect MoneyOrangeNessuna valutazione finora

- Chapter 4 The Time Value of MoneyDocumento39 pagineChapter 4 The Time Value of MoneyQuỳnh NguyễnNessuna valutazione finora

- AnnuityDocumento29 pagineAnnuityChristed aljo barroga100% (1)

- D076288233Documento20 pagineD076288233Sulaim Al KautsarNessuna valutazione finora

- Factors: How Time and Interest Affect Money: Engineering EconomyDocumento33 pagineFactors: How Time and Interest Affect Money: Engineering Economymudassir ahmadNessuna valutazione finora

- Chapter 2 Engineering EconomyDocumento33 pagineChapter 2 Engineering Economymudassir ahmadNessuna valutazione finora

- GL4102-07-Equivalence and Compound Interest-BaruDocumento34 pagineGL4102-07-Equivalence and Compound Interest-BaruVicky Faras Barunson PanggabeanNessuna valutazione finora

- ENGINEERING ECONOMY CHAPTER 4 KEY CONCEPTSDocumento39 pagineENGINEERING ECONOMY CHAPTER 4 KEY CONCEPTSKhánh ngân Lê vũNessuna valutazione finora

- Week 4 PDFDocumento23 pagineWeek 4 PDFKHAKSARNessuna valutazione finora

- Chapter 4 The Time Value of MoneyDocumento39 pagineChapter 4 The Time Value of Moneygar fieldNessuna valutazione finora

- Lesson 6 Compound InterestDocumento14 pagineLesson 6 Compound InterestDaniela CaguioaNessuna valutazione finora

- How time and interest affect the value of moneyDocumento11 pagineHow time and interest affect the value of moneyBeverly PamanNessuna valutazione finora

- Economics (AF and FA, PG and AG)Documento14 pagineEconomics (AF and FA, PG and AG)api-26367767Nessuna valutazione finora

- Chapter 2 BDocumento29 pagineChapter 2 BKenDaniswaraNessuna valutazione finora

- Engineering Economics: Presented by Dr. ZahoorDocumento38 pagineEngineering Economics: Presented by Dr. ZahoorumairNessuna valutazione finora

- 9) Lecture 9) Combining Costs Benefits Using LCCADocumento46 pagine9) Lecture 9) Combining Costs Benefits Using LCCAasad04354Nessuna valutazione finora

- Module 4: Time Value of MoneyDocumento79 pagineModule 4: Time Value of MoneySyafiq JaafarNessuna valutazione finora

- ENGINEERING ECONOMY Chapter 4: Time Value of MoneyDocumento39 pagineENGINEERING ECONOMY Chapter 4: Time Value of Moneythuy duongNessuna valutazione finora

- Energy EconomicsDocumento27 pagineEnergy EconomicsJemuel MarkNessuna valutazione finora

- AnnuityDocumento43 pagineAnnuityJoeron Caezar Del Rosario (Joe)Nessuna valutazione finora

- AnnuityDocumento23 pagineAnnuityCathleen Ann TorrijosNessuna valutazione finora

- The Interest Formulas Derived in This Section Apply To The CommonDocumento30 pagineThe Interest Formulas Derived in This Section Apply To The CommonBelay ShibruNessuna valutazione finora

- PDF-Chapter 4 The Time Value of MoneyDocumento36 paginePDF-Chapter 4 The Time Value of MoneyMinh AnhNessuna valutazione finora

- Chapter 3 Understanding Money and Its Management Last PartDocumento28 pagineChapter 3 Understanding Money and Its Management Last PartSarah Mae WenceslaoNessuna valutazione finora

- Topic 2 Time Value of MoneyDocumento6 pagineTopic 2 Time Value of Moneysalman hussainNessuna valutazione finora

- Engineering Economy Factors: How Time and Interest Affect MoneyDocumento48 pagineEngineering Economy Factors: How Time and Interest Affect Moneymichelleromac100% (1)

- Chapter 2 Part 1 of 2 PDFDocumento49 pagineChapter 2 Part 1 of 2 PDFASAD ULLAHNessuna valutazione finora

- Module 2 FactorsDocumento45 pagineModule 2 FactorsMeifrinaldiGamaBizenNessuna valutazione finora

- EconomyDocumento11 pagineEconomyJoanna Luz BagnolNessuna valutazione finora

- EMP5102B - Week 6 PresentationDocumento66 pagineEMP5102B - Week 6 PresentationUdhaykiran RangineniNessuna valutazione finora

- Engineering Economy 1 (MNG 151) ديزوبأ سابع ىنسح / دDocumento45 pagineEngineering Economy 1 (MNG 151) ديزوبأ سابع ىنسح / دRommelBaldagoNessuna valutazione finora

- Money - Time Relationships & Equivalence: Harris Widya Adi Nugroho Fauzan Very Budiman Erny Apriany SylwanaDocumento25 pagineMoney - Time Relationships & Equivalence: Harris Widya Adi Nugroho Fauzan Very Budiman Erny Apriany SylwanaErny A Sylwana RasulongNessuna valutazione finora

- Time Value of MoneyDocumento37 pagineTime Value of MoneyMinh HiếuNessuna valutazione finora

- Lecture2-1 231011 123124Documento60 pagineLecture2-1 231011 123124duygualsan1Nessuna valutazione finora

- MNG111 Financial Math Lecture 2Documento17 pagineMNG111 Financial Math Lecture 2Alexis ParrisNessuna valutazione finora

- Mng111 Lecture 2Documento17 pagineMng111 Lecture 2Alexis ParrisNessuna valutazione finora

- Module 3 InterestDocumento11 pagineModule 3 InterestGurtejSinghChana100% (1)

- Business Investment Appraisal (3375)Documento54 pagineBusiness Investment Appraisal (3375)Armudin PurbaNessuna valutazione finora

- 5.1 Usage of Compound Interest Tables. Feb 8-12 - 1Documento11 pagine5.1 Usage of Compound Interest Tables. Feb 8-12 - 1John GarciaNessuna valutazione finora

- CV6216 2123 S2 TPwwf1A-FundamentalsDocumento10 pagineCV6216 2123 S2 TPwwf1A-FundamentalsZJ XNessuna valutazione finora

- How Time and Interest Affect MoneyDocumento11 pagineHow Time and Interest Affect MoneySevilla, Jazelle Kate Q.Nessuna valutazione finora

- Review CH - 02 AnnuityDocumento30 pagineReview CH - 02 AnnuityNelson Cabingas100% (1)

- Introduction e 2010Documento34 pagineIntroduction e 2010catherinen_65Nessuna valutazione finora

- 604 ch3Documento72 pagine604 ch3Hazel Grace SantosNessuna valutazione finora

- 411_Chapter02_66-761520-16911405009257Documento85 pagine411_Chapter02_66-761520-16911405009257Ken TheeraNessuna valutazione finora

- CHAPTER 2 - Presentation - For - TeachersDocumento125 pagineCHAPTER 2 - Presentation - For - TeachersReffisa JiruNessuna valutazione finora

- Kuliah Ekonomi Teknik: Ir. Sidharta Sahirman MS, Msie, PHDDocumento22 pagineKuliah Ekonomi Teknik: Ir. Sidharta Sahirman MS, Msie, PHDAdham KurniawanNessuna valutazione finora

- CALCULATING ANNUITIES AND FUTURE VALUESDocumento10 pagineCALCULATING ANNUITIES AND FUTURE VALUESLyzette LeanderNessuna valutazione finora

- CE 561 Lecture Notes: Engineering Economic AnalysisDocumento21 pagineCE 561 Lecture Notes: Engineering Economic AnalysisIyoi ShumiNessuna valutazione finora

- Handbook of Capital Recovery (CR) Factors: European EditionDa EverandHandbook of Capital Recovery (CR) Factors: European EditionNessuna valutazione finora

- Review Jur Nal 2012Documento12 pagineReview Jur Nal 2012Danar AdityaNessuna valutazione finora

- Shutoku High School CaseDocumento4 pagineShutoku High School CaseDanar AdityaNessuna valutazione finora

- Transesterifikasi Menggunakan NaOHDocumento12 pagineTransesterifikasi Menggunakan NaOHDanar AdityaNessuna valutazione finora

- 2006 Euromonitor Packaged Foods - IndonesiaDocumento252 pagine2006 Euromonitor Packaged Foods - IndonesiaDanar Aditya100% (2)

- Katalis HDODocumento4 pagineKatalis HDODanar AdityaNessuna valutazione finora

- HT Model Liquid Density Deviations for Nitrogen, Methane, AmmoniaDocumento122 pagineHT Model Liquid Density Deviations for Nitrogen, Methane, AmmoniaPhilip GloverNessuna valutazione finora

- Petrobras Biofuels May2007Documento18 paginePetrobras Biofuels May2007Danar AdityaNessuna valutazione finora

- Final Process DescriptionDocumento2 pagineFinal Process DescriptionDanar AdityaNessuna valutazione finora

- Jurnal 3 - EP Titanium Oksida Pada Tegangan RendahDocumento2 pagineJurnal 3 - EP Titanium Oksida Pada Tegangan RendahDanar AdityaNessuna valutazione finora

- Katalis HDODocumento4 pagineKatalis HDODanar AdityaNessuna valutazione finora

- Final Process DescriptionDocumento2 pagineFinal Process DescriptionDanar AdityaNessuna valutazione finora

- Emission and Fuel Consumption Characteristics of A Heavy Duty Diesel Engine Fueled With Hydroprocessed Renewable Diesel and Biodiesel PDFDocumento7 pagineEmission and Fuel Consumption Characteristics of A Heavy Duty Diesel Engine Fueled With Hydroprocessed Renewable Diesel and Biodiesel PDFDanar AdityaNessuna valutazione finora

- Calculating covariance and correlation between variables using sample dataDocumento6 pagineCalculating covariance and correlation between variables using sample dataDanar AdityaNessuna valutazione finora

- Name: Iago Adhyaksa Class: 2-B: French Beans LettuceDocumento1 paginaName: Iago Adhyaksa Class: 2-B: French Beans LettuceDanar AdityaNessuna valutazione finora

- Supply Chain Bagian DanarDocumento39 pagineSupply Chain Bagian DanarDanar AdityaNessuna valutazione finora

- Misc Subroutine For StudentsDocumento12 pagineMisc Subroutine For StudentsDanar AdityaNessuna valutazione finora

- PetroBowl Regional Qualifiers 2015 Schedule and LocationsDocumento1 paginaPetroBowl Regional Qualifiers 2015 Schedule and LocationsDanar AdityaNessuna valutazione finora

- Blankchapter 17Documento137 pagineBlankchapter 17Danar AdityaNessuna valutazione finora

- Drilling ProblemsDocumento13 pagineDrilling ProblemsDanar AdityaNessuna valutazione finora

- PP Lect 01 Pendahuluan & NeedsDocumento55 paginePP Lect 01 Pendahuluan & NeedsDanar AdityaNessuna valutazione finora

- Tugas EkotekDocumento9 pagineTugas EkotekElvansyah FajriNessuna valutazione finora

- Upstream Oil and Gas ArticleDocumento2 pagineUpstream Oil and Gas ArticleDanar AdityaNessuna valutazione finora

- Benefit Cost Analysis and Public Sector Economics: Session IxDocumento45 pagineBenefit Cost Analysis and Public Sector Economics: Session IxDanar AdityaNessuna valutazione finora

- Pengolahan Data Percobaan 1 FluidisasiDocumento2 paginePengolahan Data Percobaan 1 FluidisasiDanar AdityaNessuna valutazione finora

- Assignments4 Kelas02 DanarAditya PDFDocumento18 pagineAssignments4 Kelas02 DanarAditya PDFDanar AdityaNessuna valutazione finora

- Lecture 1 - Introduction To Engineering EconomyDocumento38 pagineLecture 1 - Introduction To Engineering EconomyDanar AdityaNessuna valutazione finora

- Data PPDocumento2 pagineData PPDanar AdityaNessuna valutazione finora

- Mandatory Requirements of PCP CertificationDocumento4 pagineMandatory Requirements of PCP CertificationsherazalimemonNessuna valutazione finora

- Vamsi Krishna Velaga - ITDocumento1 paginaVamsi Krishna Velaga - ITvamsiNessuna valutazione finora

- Adidas Anual Report 2011Documento242 pagineAdidas Anual Report 2011EricNyoniNessuna valutazione finora

- Critique of PDP 2017-2022 on Monetary and Fiscal PoliciesDocumento19 pagineCritique of PDP 2017-2022 on Monetary and Fiscal PoliciesKarlRecioBaroroNessuna valutazione finora

- Zalando Prospectus PDFDocumento446 pagineZalando Prospectus PDFVijay AnandNessuna valutazione finora

- Krisna Mae Macabenta ResumeDocumento4 pagineKrisna Mae Macabenta ResumeKrisna MacabentaNessuna valutazione finora

- N - Chandrasekhar Naidu (Pronote)Documento3 pagineN - Chandrasekhar Naidu (Pronote)raju634Nessuna valutazione finora

- LIC Jeevan Anand Plan PPT Nitin 359Documento11 pagineLIC Jeevan Anand Plan PPT Nitin 359Nitin ShindeNessuna valutazione finora

- 3732 8292 1 PBDocumento15 pagine3732 8292 1 PBRasly 28Nessuna valutazione finora

- Arbaminch University College of Business and Economics Department of Accounting and FinancDocumento8 pagineArbaminch University College of Business and Economics Department of Accounting and FinancbabuNessuna valutazione finora

- Is Banking Becoming More CompetitiveDocumento42 pagineIs Banking Becoming More CompetitiveSwarnima SinghNessuna valutazione finora

- Entre November 16Documento42 pagineEntre November 16Charlon GargantaNessuna valutazione finora

- Spanish Town High Entrepreneurship Unit 2 Multiple Choice QuestionsDocumento4 pagineSpanish Town High Entrepreneurship Unit 2 Multiple Choice Questionspat samNessuna valutazione finora

- Pledge From Atty BontosDocumento7 paginePledge From Atty BontosarielramadaNessuna valutazione finora

- Abakada v. ErmitaDocumento351 pagineAbakada v. ErmitaJm CruzNessuna valutazione finora

- EH Agreement & Payment Plan Form PDFDocumento2 pagineEH Agreement & Payment Plan Form PDFJonathan GavantNessuna valutazione finora

- 2 PDFDocumento5 pagine2 PDFSubrat SahooNessuna valutazione finora

- Republic of The Philippines Quezon City: Court of Tax AppealsDocumento4 pagineRepublic of The Philippines Quezon City: Court of Tax Appealssidangel0Nessuna valutazione finora

- Asia Pacific MarketView Q1 2018 FINALDocumento18 pagineAsia Pacific MarketView Q1 2018 FINALPrima Advisory SolutionsNessuna valutazione finora

- SPE 82028 A "Top Down" Approach For Applying Modern Portfolio Theory To Oil and Gas Property InvestmentsDocumento8 pagineSPE 82028 A "Top Down" Approach For Applying Modern Portfolio Theory To Oil and Gas Property InvestmentsWaleed Barakat MariaNessuna valutazione finora