Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

2011 Explaining The Central Asian Energy Game - Complex Interdependence and How Small States Influence Their Big Neighbors PDF

Caricato da

Par TycjaDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

2011 Explaining The Central Asian Energy Game - Complex Interdependence and How Small States Influence Their Big Neighbors PDF

Caricato da

Par TycjaCopyright:

Formati disponibili

Asian Perspective 35 (2011), 381405

Explaining the Central Asian Energy Game: Complex Interdependence and How Small States Influence Their Big Neighbors

Jean A. Garrison and Ahad Abdurahmonov

Dominant voices in the energy security debate describe the competition for energy resources as a zero-sum, realist game that will lead to future resource wars among prominent system-shaping states. However, the complex set of interlinked political, economic, and security issues that make up energy security involves big and small states. Complex interdependence provides a different lens to view power in situational and relational terms and thus a more comprehensive way to measure a states potential influence. This article examines the foreign-policy behavior of energy-rich small states in Central Asia, specifically Kazakhstan and Turkmenistan, in the context of their big neighbors, particularly Russia and China. The goal is to begin to explain the energy dynamic within Central Asia and the bargaining process that is reshaping Central Asias interlinked political, economic, and security relationships. KEYWORDS: energy security, complex interdependence, Central Asia, China, Russia, Kazakhstan, Turkmenistan.

THE WORLD COMMUNITY HAS ENTERED THE TWENTY-FIRST CENTURY WITH ever-growing energy demands, increasing energy costs and volatility of supply, and the perception of shrinking access to secure energy resources. These realities, and the fact that energy resources are found only in a few countries, take trade in energy out of the realm of ordinary low policy in which it is assumed that basic laws of supply and demand are determining. Due to their scarcity and link to future development, energy resources take on some of the strategic characteristics of high policy. The ongoing competition for energy resources leads many to see a future of resource wars, particularly in the context of large producing states such as Russia and large consumers such as the United States and China that fuel global demand. But this

381

382

Explaining the Central Asian Energy Game

zero-sum lens misses the growing interdependent political, economic, and security relationships among producing, consuming, and energy transit countries. In fact, the high-versus-low policy distinction presents a false dichotomy. The reality is a complex set of fluid, asymmetrical relationships in which all states have a certain level of dependency and influence. By the numbers, the importance of the Caspian Sea region in the global energy equation is quite small. For example, its oil accounts for only 23 percent of the worlds known resources, and its gas for only 45 percent. However, its relative proximity to Russian, European, and Chinese markets and the tightness of the world energy market make these resources a source of potentially critical leverage. The possession of vital, expensive, and sought-after energy resources in large amounts provides certain small states with foreignpolicy choices and strategic advantages that they would not normally possess. But the Central Asian energy equation is not a simple one. Given the vast distances involved, the process of extracting and transporting these resources requires a big commitment by the parties involved. Russia has the advantage of long-term cultural and political ties to the region and a ready, although aging, pipeline and grid infrastructure that routes Central Asian energy exports through Russia. In contrast, Chinas ready cash reserves that are available for investment in new pipelines and infrastructure vital to the region have changed the nature of the game. These circumstances give new options and opportunities to Central Asias energy-rich states. In this context, Central Asian states forge ahead to re-create their identity as important regional actors rather than just remaining a place acted upon by outside great powers such as Russia and China. This article asks how energy-rich Central Asian states work to avoid being sandwiched between the regional giants or to become victims of a new resource great game. To address this question, we examine the impact of the foreign-policy behavior of energy-rich small states in Central Asia, specifically Kazakhstan and Turkmenistan, in the context of their big neighbors, particularly Russia and China. Given their relative poverty, geographic isolation, and close historical and functional ties to Russia, these states seek to step

Jean A. Garrison and Ahad Abdurahmonov

383

out of the shadow of their former master. Chinas rapid rise offers the opportunity for new markets and ties that may balance Russian influence and potentially change the geopolitical dynamic in Central Asia. The goal is to begin to explain the energy dynamic within Central Asia, and the bargaining process that is shaping current (and future) Asian political, economic, and security relationships. We address a number of interrelated questions focusing on the broader geopolitical context and the tools available to energy-rich states: How has the complex energy-interdependent system developing in Central Asia changed regional relationships? What strategy and tools do small states such as Kazakhstan and Turkmenistan use to increase their control over their energy resources and future? How has their growing activism influenced the energy game in Central Asia? How do Russia and China guarantee access to Central Asias energy resources in a situation of complex interdependence?

Understanding Energy Security in a World of Complex Interdependence

Currently the world is facing a new security challenge due to growing energy demands, decreasing cheap fossil fuel resources, and emerging energy nationalism. According to the 2010 World Energy Outlook, world primary energy demand will increase by 36 percent between 2008 and 2035, or 1.2 percent per year on average (International Energy Agency 2010). In this context, many security scholars see a future in which states compete for scarce resources, reinforcing the zero-sum nature of global politics in general. This perspective often shapes the discussion of energy as a strategic commodity. Scholars such as Michael Klare and Paul Roberts, for example, argue that the condition of rising powers and diminishing energy resources can produce a dangerous competition among countries, since energy resources have acquired a prominence in world politics that rivals military power in importance. Klare (2008) suggests that a New International Energy Order is developing that divides countries into competing energy-surplus and energy-deficient nations (Roberts

384

Explaining the Central Asian Energy Game

2004). The nationalization of key energy sectors in several energyproducing statesreflected, for example, in Russias pipeline politics or Chinas go forth policiesillustrates this mercantilist tendency (Noreng 2006; Lieberthal and Herberg 2006; Ebel 2005). These writers often predict a process in which conflict over energy is imminent unless preventive actions are taken. This sentiment gets press in periodicals such as the Oil and Gas Journal regarding the Central Asian context. For example, Gawdat G. Bahgat in June 2009 noted the intense and growing competition among China, Europe, and Russia over oil and gas from Central Asia. The Russian advantage is noted in terms of decades-long cultural and political ties. China is the emerging competitor given its deep pockets, while European companies offer more advanced technology than is available from either of these competitors (Bahgat 2009). The energy equation is complicated by the geographically uneven distribution of energy deposits across the globe and within regional contexts. From the perspective of security of supply for importing states, the difficult transportation routes that make energy shipments go through a few chokepoints is a major concern (Caldwell and Williams 2006). But energy-exporting countries share similar concerns, such as the security of demand and transportation to get their commodity to the market. Long-term demand security is important to ensure a predictable flow of revenues. These countries also heavily depend on limited transportation choices and routes, which means that they share the concerns of energy-importing countries on the security of supply (Garrison 2009). For those who embrace the age of globalization and the perceived opportunities that come with economic interdependence, security analyses provide an incomplete picture of the energy game. From both a security studies and an international political economy (IPE) perspective, little literature deals with energy security beyond how some scholars apply the major international relations paradigms to explain the function of energy markets (Ozdamar 2010; Wilson 1987). Security studies provide the basis for the zero-sum lens. The IPE literature is guided by the premise that economic systems rest on a particular political order with certain values, norms, and expectations, and that these interdependent relations change the behavior of the actors involved (Gilpin 2001).

Jean A. Garrison and Ahad Abdurahmonov

385

Maneuvering amid Complex Interdependence

The concept of complex interdependence, coined by Robert Keohane and Joseph Nye, describes a world in between these two perspectives. Nations are calculating actors but also are so interconnected through a web of interdependence that common interests and shared vulnerabilities shape opportunities for cooperation and prospects for competition. In the age of complex interdependence, modern states are interlinked with each other to such an extent that the notion of hierarchy diffuses and the use of (military) force is discouraged and counterproductive. While states that are interdependent are sensitive to external change, their vulnerability to the system is measured by their ability to respond to changes effectively (Keohane and Nye 2001; Keohane and Nye 1998). Power is measured by their ability to manipulate asymmetrical relationships. In this vein, shared vulnerabilities and shared interests give leaders opportunities and constraints in the choices they make. Even though fossil fuels are a vital source of influence, other factors such as markets and technology, investments, and trade, which are central to promoting energy extraction, are important because they entangle countries in a web of complex interdependence. Despite the inclination toward energy nationalism, energy-surplus countries have their own vulnerabilities, such as the difficulty of exploration, extraction, and transportation of fossil fuels as well as internal and regional instabilities. They also can be constrained by a lack of technology and limited ability to control demand and production. Ultimately, the energy-exporting countries heavily depend on energy revenues and foreign investments as well as long-term security of demand. These constraints and vulnerabilities can compel states and their leaders (with or without significant energy deposits) to search for shared interests and common ground for collaboration. Russia, for example, needs Chinese investments and Japanese technology to take advantage of its vast energy resources (Aron 2006; Ivanov 2003). A number of countries engage in strategic energy dialogues with this interdependent reality in mind. China engages in a number of bilateral strategic dialogues and uses organizations such as the Shanghai Cooperation Organization (SCO) as vehicles to promote energy

386

Explaining the Central Asian Energy Game

cooperation with Central Asian states. Similarly, the Organization of Petroleum Exporting Countries (OPEC) has strategic dialogues with other producers as well as with consumers, noting the interests that are shared. The president of the European Commission, Jose Manuel Durao Barroso, echoes this sentiment by noting the shared interests of consuming, producing, and transiting countries, all of which are becoming increasingly dependent on one another. Security of supply is important for us, but other countries seek security of demand. This is the age of energy interdependence (Bahgat 2010). This brief discussion of geopolitics and complex interdependence illustrates that states are constrained actors in regional and global contexts. But energy resources provide new options. For example, in explaining the change that took place in the international oil regime after 1973, Joseph Nye notes that the OPEC embargo and oil crisis led to an enormous shift of power and wealth from the industrialized world to the developing world (Nye 2005). The decline of US power altered the stability of the existing energy regime. Further domestic political responses shaped how deeply the United States and others were affected by external shocks. Acknowledging both the domestic and foreign sides of the energy security coin, Daniel Yergin (2005) incorporates factors such as building cooperative relations with producer and consumer states, a proactive foreign policy that prevents disruptions of the chain of supply, and domestic strategies to promote energy security.

The Possibilities for Small States

Within the realist tradition in the international relations literature, the size of a state often is used to explain its potential for independent foreign policy behavior. The distinction made among great powers, middle powers, and small powers is an attempt to ascribe different levels of potential influence within the global system. In this context, the great powers hold undisputable potential power advantages over small states (often industrialized versus developing states). Historically, those who have focused on small-state foreign policy take the structural perspective that small states are limited in the foreign policy choices they have vis--vis big powers and in shaping policy outcomes to fit their goals. The principal finding of

Jean A. Garrison and Ahad Abdurahmonov

387

the field is that small statesas measured by the size of the military, population, or areaare more vulnerable than others to the vagaries of international and regional systems. They are assumed to go along with the system rather than attempt to change it. Some analysts, such as Annette Baker Fox, claim that small states have persuasive power, meaning they aspire to neutrality and limited alignments. Similarly, Peter Katzenstein notes that smallness will result in active participation and promotion of the international system rather than gamechanging behavior (Baker Fox 1959; East 1973; Katzenstein 2003; Neumann and Gstohl 2007; Payne 2004; Randma-Liiv 2002; Sutton 1993). Jeanne Hey, on the other hand, explains how perceptions of smallness are what matter. Essentially, if you and others perceive yourself as a small state, then you see yourself with limited choices and ability to affect policy outcomes (Hey 2002). But the concept also leaves room for flexibility. However, in a world of complex interdependence, which is the focus of this analysis, smaller states also have their own strengths and resources and can seize new opportunities. Laura Neack sees the presence of critical natural resources (in combination with insightful leaders) as one such source of leverage to pursue more independent foreign policies (Neack 2002; Snyder, Bruck, and Sapin 1965). From this perspective, the potential influence of states, and their proxies in the game (the national oil and gas companies), depend on various features of the host country as well as the companies themselves. These features include the size of the investment, its share of the project, the percentage of a host countrys oil or gas exports taken by a particular country or company, the relative strength of a host countrys economy, the extent of its diversification, and its reliance on energy exports for influence. The vulnerability to the dictates of outside countries and national energy companies hinges on factors such as the political stability and capabilities of the host state and the international alignment of forces around them (Ziegler 2008, 139). Central Asia offers a look at smaller states that have traditionally been beholden to their wealthier neighbors but now are coping with relatively new energy wealth. They offer a context to evaluate how energy wealth has changed the nature of their traditional dependent relationships with Russia.

388

Explaining the Central Asian Energy Game

Putting Central Asia into Context: Changing Historical Alignments and the Energy Game Competition for Oil

In the Central Asian context, zero-sum perspectives have dominated the analyses of the region as a whole. This perspective was especially popular in the early years of the independence of Central Asian states when scholars perceived Central Asia as a grand chessboard, reminiscent of the eighteenth-century Russian-British rivalry and the struggle of the great powers for influence and dominance. Central Asian governments were viewed merely as pawns unable to influence the course of the game. Scholars such as Zbigniew Brzezinski and Frederick Starr had little trust in the ability of these countries to stay stable without being guided and dominated by one or another great power (Brzezinski 1997; Starr 1996). With the collapse of the Soviet Union, the newly independent energy-rich republics again were seen as a playground for great-power rivalry: a new great game was predicted to describe the rivalry between the West and a weakened Russia for control of Eurasias energy resources (Kleveman 2003). The geography of Central Asia has contributed to the analyses categorizing them as weak states acted upon by outsiders. Central Asia is a landlocked geographic region located in the strategic heart of the Eurasian landmass. This regions importance is primarily connected to its location between great powers and its natural resources, which its neighbors covet. Since the independence of these states, outside interest in their resources has grown. It is precisely this competition for the regions resources that provides various Central Asian states with new leverage. Petroleum is the natural resource that we think about first as the game changer in the Central Asian context because it has received the greatest amount of Western investment. Based on oil reserves, production figures, and geography, Kazakhstan is the coveted prize in the oil game. Kazakhstan has about half of Russias total of 60 billion barrels in reserves and holds more than the 21.8 billion barrels that the United States is estimated to have (see Table 1). This oil is also geopolitically well placed because Kazakhstan is the only country that China can import it from directly overland without it passing through

Jean A. Garrison and Ahad Abdurahmonov

389

Russia first. In 2009 Kazakhstan produced 1.54 million barrels per day (bpd), and with the continued expansion of its large Tengiz, Karachaganak, and Kashagan fields this output is expected to double by 2019 (Energy Information Administration 2009a). Large-scale Western investment in the oil sector began in the early 1990s with formation of the Caspian Basin Consortium, which has exported millions of barrels to the European market. The most lucrative oil field, Tengiz, with estimated recoverable reserves of 7.3 billion barrels, began to be exploited by US-based Chevron-Texaco and Kazakhstan in a consortium in 1993. The Kazakhs welcomed Western international oil companies (IOCs) because the Kazakhs needed expertise and equipment, which the Russians lacked, to develop the field. The government saw such joint ventures as helpful to Kazakhstans

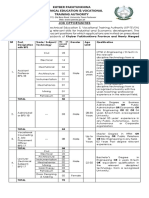

Table 1 Selected Asian Oil and Gas Figures, 20082009 Production and Reserves of Crude Oil Production of Crude Oil (thousand bpd), 2009 3,790.18 1,455.15 9,495.36 176.26 43.45 Proved Oil Reserves (billion barrels), 2008 16.00 30.00 60.00 0.60 0.59 Proved Oil Reserves (billion barrels), 2009 16.00 30.00 60.00 0.60 0.59

Country

China Kazakhstan Russia Turkmenistan Uzbekistan

Production and Reserves of Natural Gas Natural Gas Production (billion cm), 2009 82.94 10.95 5,836.10 38.11 61.42 Proved Reserves of Natural Gas (trillion cm), 2008 2.27 2.83 47.57 2.83 1.84 Proved Reserves of Natural Gas (trillion cm), 2009 2.27 2.40 47.57 2.66 1.84

Country China Kazakhstan Russia Turkmenistan Uzbekistan

Sources: Energy Information Administration, World Proved Reserves of Oil and Natural Gas, Most Recent Estimates, June 30, 2010, www.eia.doe.gov. Data is from Natural Gas in the World, July 2008, and Oil and Gas Journal, January 1, 2009.

390

Explaining the Central Asian Energy Game

modernization efforts and proof that Kazakhstan welcomed outside investment. Despite this, getting the oil out has been an ongoing challenge. Under a 1998 deal, the Russian government agreed to build a pipeline from Tengiz in two phases. The first, with a capacity of 650,000 barrels a day, has been built, but Moscow has refused to complete the second phase, which would more than double the pipelines capacity to over 1.4 million barrels a day (Kramer 2010). In 2002 another prominent consortium led by Italys Eni reported that the new Kashagan offshore field in the Caspian rivaled Tengiz with 79 billion barrels of proven oil reserves. This oil reaches multiple international markets with destinations in Russia, China, Europe, and Turkey. In late 2010, 23.2 percent of its oil flowed to Italy, 15 percent to China, 11.5 percent to France, and 7.5 percent to Austria (Oil and Gas Information Agency 2010; Nichol 2007).1 Kazakhstan has followed a strategy that diversifies transportation routes in a multivectored energy export policy. As such, the Kazakh government seeks multiple pipelines and markets to ensure that no regional power can exercise strategic control over its energy exports and its broader economic future (Blank 2005).2

Natural Gas Exporting

Natural gas is the newcomer in the Central Asian energy export game. Just a few short years ago Central Asian gas was a commodity considered too difficult to produce except by Russia. Central Asias three natural gas providers with the greatest potentialUzbekistan, Turkmenistan, and Kazakhstanall have faced the challenge to diversify their markets to make planned natural gas exports viable beyond Russia (see Table 1). Both Uzbekistan and Turkmenistan have significant reserves but have needed a new infusion of funds to increase production. Uzbekistan is the second-largest producer of natural gas in the Commonwealth of Independent States (CIS) after Russia, and has sped up production at existing fields and sought to develop new fields primarily with the help of Russias giant state gas company, Gazprom. With Gazprom, Uzbekistan plans to spend $1.5 billion to revamp natural gas pipelines in the region to boost exports through Russia. In contrast, Turkmenistan has sought to open new opportunities beyond Russia (Energy Information Administration 2009a).

Jean A. Garrison and Ahad Abdurahmonov

391

Getting the resource to markets beyond Russia has required significant political and economic effort because of the existing grid structure that has gas routed north through Russia. For example, Chinas President Hu Jintaos efforts to link a gas field in Turkmenistan to its western Xinjiang region succeeded in getting broad regional support. This required the cooperation of the presidents of Kazakhstan, Uzbekistan, and Turkmenistan in a joint commissioning of a pipeline that transected each of their countries. The opening of this pipeline marked the end of Russias near-monopoly over Central Asian natural gas exports. It is the first high-volume export route for Turkmen gas that does not go through Russia. The new pipeline handles 3040 billion cubic meters (bcm) per year, while the Turkmenistan pipeline to Russia handles between 50 and 70 bcm per year. Full capacity is slated to be reached by 2012, but Turkmenistan and China have already completed preliminary agreements to add another 10 bcm in the future (Asia Pulse 2009; Garrison 2007). A closer look at the Kazakh oil equation and Turkmenistans natural gas game from a complex interdependence perspective will show Kazakhstans and Turkmenistans efforts to gain control over their own energy resources. Regional alignments are undergoing significant shifts. Analysts who ignore the role of small states miss a significant piece of the energy puzzle.

Changing the Rules in the Kazakh Petroleum Equation

Kazakhstans massive reserves and potential as a major exporter provide it with greater potential influence.3 Its oil and gas production have tripled in the last decade, and its Kashagan field is the largest field outside the Middle East and the fifth largest in terms of world reserves. Multiple investor opportunities, particularly in the context of high energy prices and high demand, have helped Kazakhstan tap its wealth. The astute manipulation of new opportunities has helped it gain leverage vis--vis its neighbors. No longer do Western and Russian energy investors dominate Kazakh energy investments as they did during the 1990s. One reason for this is the growing presence of China in the mix.

392

Explaining the Central Asian Energy Game

China and New Diversification Opportunities

For over a decade China has played a growing role in Central Asia, and frequent energy discussions have provided greater opportunities for both sides. Chinas first deal came in 1997, when its China National Petroleum Corporation (CNPC) bought a 60 percent share of the Aktobemunaigaz oil company for $4.3 billion. Later that year CNPC won the controlling interest in Uzen, the second-largest oil field in Kazakhstan. The next year the two countries agreed in principle to build a nearly 3,000-kilometer oil pipeline linking Kazakh oil fields with Chinas Xinjiang Province in a deal to be financed by CNPC over twenty years (Lee 2005, 271272). Despite initial enthusiasm for these deals, however, projects were delayed for several years. The discovery of Kazakhstans giant Kashagan oil field, Chinas disappointments with Russias unwillingness to open access to its oil and gas reserves, and domestic energy shortages spurred the Chinese leadership again to look to Central Asia for energy. This context provided a new opportunity for Kazakhstan. As a result, in March 2003 CNPC and the Kazakh state oil company, KazMunaiGaz (KMG), moved forward to jointly construct the westernmost section of the cross-border oil pipeline, running 448 kilometers from Atyrau to Kenkiyak in Kazakhstan. The easternmost part of the pipeline, running 988 kilometers from Atasu in Kazakhstan to Alashankou at the Chinese border, was completed at the end of 2005 and became operational in May 2006 with a total investment of just under $800 million (Liao 2006, 6268). The final section, the Kenkiyak-to-Kumkol piece, started operations in October 2009 with completion of the 761kilometer Kenkiyak-to-Kumkol pipeline section. These joint ventures are hardly an even split in terms of resources expended. While the Kazakh-China pipeline project was billed as a fifty-fifty joint venture between KMG and CNPC, the Chinese company paid 85 percent of the cost. Only 12.9 million barrels flowed through it in 2006, but capacity was reached in 2010 with 73.3 million barrels of crude exported as of the end of the year. With the completion of the second phase of the project in 2013 the capacity can increase to 146.7 million barrels per year (Silk Road Intelligencer 2011). The pipeline can accept crude oil deliveries from the north (Russian sources in western Siberia), the west, or the south from

Jean A. Garrison and Ahad Abdurahmonov

393

Kazakhstans Turgai basin. To function effectively, the pipeline needs Russian oil to supplement Kazakh contributions because of insufficient fill and viscosity issues (Lee 2005, 271272). The purpose of the pipeline may be to provide a long-term, strategically secure source of oil rather than to meet immediate demand requirements. Still, Kazakh oil now provides 15 percent of Chinas imports. Chinas purchase of PetroKazakhstan (Petrokaz) and its new assets in the Turgai basin (including full ownership of Kumkol South and joint ownership with Lukoil of Kumkol North) will improve the pipelines efficiency because the oil fields feed the pipeline at its midpoint. For example, Petrokazs combined assets in the Turgai basin produce around 150,000 bpd of crude, which could go directly into the pipeline (Liao 2006, 6268). Through the Petrokaz acquisition, CNPC also gained a 50 percent stake in the Kazgermunai field (the other 50 percent belongs to state-owned Kamunaigas). To secure these deals, CNPC has agreed to invest nearly $4 billion more over the next twenty years to develop other areas (Eurasia Group 2006, 15; Energy Information Administration 2009b). China has become a more attractive partner because its government-backed national oil companies (NOCs) also have been more willing to invest up front in big infrastructure projects. For example, Chinas CNPC agreed to foot the whole bill for the oil pipeline from Central Asia when no one else would. Chinas NOCs aggressively follow an acquisition strategy in which they purchase stakes in exploration and production activities and whole firms, and where needed partner in joint ventures, finance infrastructure projects, market petroleum products, and operate facilities (Department of Energy 2006, 3). China also has begun to invest more broadly in Kazakhstan and other Central Asian states and now rivals Russia in terms of its foreign trade with Kazakhstan. In 2009 Chinas share of Kazakh trade was 21.4 percent, compared to Russias 17.5 percent, a gap that continues to widen over time (International Monetary Fund, 2010a). Chinese trade is vital for Kazakhstan and other Central Asian states because it fills a void in consumer goods and provisions to the region. Chinas goods are cheaper than the Wests and of higher quality than Russias (Garrison 2009, 5256). These agreements and ties are significant and demonstrate the Chinese determination to develop closer ties with Kazakhstans energy industry. The increase in exports to China also reflects a Kazakh

394

Explaining the Central Asian Energy Game

calculation that closer ties to Chinas energy markets (and general market) provide the country with greater security and diversified revenue streams.

Kazakhstans Efforts to Seek Better Deals

Seeking diversification has allowed Kazakhstan to gain greater control over (and even the upper hand in) its energy security policy. The government in Astana now has greater confidence that it can set more favorable investment terms, and it is not afraid to use its leverage with the oil majors and NOCs. For example, the CNPC takeover of Petrokaz, noted above, with its investment of $4.2 billion in 2005, led the Kazakh government to pressure CNPC to sell a 33 percent share of the company (for $1.4 billion) to Kazakhstans KMG for a huge loss. The sale price undervalued Petrokaz as it gave advantageous terms to the Kazakh company (Liao 2006; Department of Energy 2006). The Kazakh government forced CNPC to pay above market value for Petrokaz (by about 20 percent) in the first place and forced it to undersell some of its assets to the government (Ziegler 2006, 12). Foreign firms can expect to be junior partners in future energy deals in Kazakhstan. This behavior reflects government dissatisfaction with previous production sharing agreements (PSAs) signed during desperate times in the 1990s when oil prices were low and foreign companies had the advantage. New practices reflect a new balance of power as old agreements are revisited. The Chinese multibilliondollar investments to develop Kazakhstans energy resources, as well as investments in various pipeline projects, are not immune to a more active Kazakh government seeking better terms. The Kazakh government has taken specific steps to solidify its position vis--vis its energy partners. Following the Russian model of energy nationalism, which insists on state control of strategic assets, Astana introduced new laws in October 2007 that allow the Kazakh government to break natural resources contracts and force renegotiation. This puts pressure on projects involving both IOCs and NOCs in new and well-established partnerships. For example, the consortium of companies producing at its Kashagan-Caspian fields had an ongoing dispute with the government over production delays and cost overruns. The older PSAs for the Agip consortium (which includes ExxonMobil, ConocoPhillips, Shell, Total, and Japans Inpex)

Jean A. Garrison and Ahad Abdurahmonov

395

delayed royalty payments until after its costs were recovered (estimated to be well beyond 2011). These terms have been renegotiated. Further, KMG doubled its stake in the Kashagan venture to 16.81 percent while the other shareholders were asked to take a cut (Upstream Online 2009). In this investment model, described by some as market-friendly resource nationalism, the state company renegotiates to become the dominant partner. This arrangement allows partners to co-invest in the countrys oil sector (Gorst 2007, 12). This change in Kazakh business practices indicates that a smaller state that has a resource its neighbors covet can take advantage of changed circumstances. Kazakhstan has leverage because it is one of the few places with untapped oil and gas reserves still open to investment. And it has neighbors and companies (both NOCs and IOCs) desperate to invest. The government gambles that new power asymmetries provide new opportunities and that companies will remain interested despite the new regulations. In 2010 Kazakh president Nursultan Nazarbayev announced new practices that continue the pattern of asserting greater government control of the energy sector. He noted that foreign ventures enjoying special protective status may lose their immunity from changes in tax legislation. Times are changing and life is changing in the entire world, and state interests are pushing us in this direction. We have to work more thoroughly and constructively. Kazakhstan continues to carefully reclaim its influence over its vast hydrocarbon wealth and to seek a greater role for the state oil and gas company (Silk Road Intelligencer 2010). The Kazakh energy equation shows that the context for these relationships between states has changed. The government has successfully taken advantage of the Chinese market and high energy prices to create new options for its valuable energy resources and for foreign policy. From a leadership perspective we can anticipate continuity as Nazarbayev has been declared president for another ten years through 2020.

Turkmenistans Shifting Natural Gas Equation

Commercially, Central Asian natural gas has faced greater challenges than the Caspian oil sector due to its historic low prices, underdeveloped markets, and the remote location of its gas fields. Russias state

396

Explaining the Central Asian Energy Game

gas company, Gazprom, retains a near monopoly on Central Asian gas exports despite Chinas inroads; today 92 percent goes through Russia via the Central AsiaCenter pipeline system, which feeds the Gazprom system. Through November 2007 Russia accounted for all of Turkmenistans exports and most of its gas production (International Crisis Group 2007, 1518). Turkmenistan is the prize in Central Asias natural gas game, given its potential growth in production and lack of use for domestic purposes. Russias dominance of the pipeline grid reflects an asymmetrical dependence equation with Russia on top and gas distribution largely dependent on the system built during the Soviet period, which routes all Turkmen exports through Russia.4 The Central AsiaCenter pipeline that connects Turkmen and Uzbek gas to the Druzhba pipeline going to Europe (through Ukraine) became a system of energy import and export operations between different countries after the breakup of the Soviet Union. This change made Russia an intermediary country with a pipeline monopoly over Turkmen gas exports. Historically Russia has bought Turkmen gas at low rates and sold at higher prices to Europe along with its own gas. Until 2003 Turkmenistan used to sell its gas at the rate of around $25/tcm (trillion cubic meters), but the prices rose sharply, especially after Turkmenistan signed a twenty-five-year supply deal with Gazprom in 2003 at the rate of $44/tcm. Since then, the sides periodically renegotiate the prices; in the first quarter of 2009 the price reached $301/tcm. This was a high point, and the price has settled closer to $250/tcm since (EurasiaNet 2009a; EurasiaNet 2009b; Socor 2009).5 Turkmenistan does have some leverage vis--vis Russia. Turkmenistan is the single major source of natural gas that can help keep the supply sufficient for European markets. While the mutually converging interests for exports and imports seem to bind these two countries together, there are tensions (Fee 2007).6 However, frequent price disputes and the vulnerability Turkmenistan faces regarding the potential manipulation of its pipeline monopoly by Russia make the diversification of gas pipelines a desirable energy strategy for Turkmen leaders. Recent losses suffered due to a stoppage of exports to Russia in 2009 meant that its gas production fell to 38 bcm from 70.5 bcm the previous year. This stoppage translated into a one-quarter drop in Turkmenistans gross domestic product (Tynan 2010). Events

Jean A. Garrison and Ahad Abdurahmonov

397

such as the April 9, 2009, pipeline explosion near the Turkmen-Uzbek border demonstrate the tensions. In that case, Turkmenistan accused Gazprom of deliberately arranging the explosion. Russia attempted to leverage Turkmenistan either to reduce the price or the volume of gas or a combination of both prior to resuming the gas flow (Socor 2009). This is an example of complex interdependence in that Russias role as the primary importer of Turkmen gas has actually given Turkmenistan some leverage.

Turkmenistans Diversification Options

Turkmenistans diversification options rest with new European Union market access and deals with China. For example, Turkmenistan has explored the feasibility of the Nabucco project, which would bring Caspian gas to Europe outside the Russian-controlled pipeline structure. In November 2008 Turkmenistan attended the Baku summit in Azerbaijan, which was dedicated to diversification of the Caspian basin energy resources beyond Russia. Later on, the Turkmen president met with the presidents of Turkey and Azerbaijan in Turkmenbashi to discuss the prospects for the trans-Caspian part of the Nabucco pipeline (Cohen 2008). More importantly, recent inroads with China show the clear goal to diversify more aggressively. Frequent top-level diplomatic visits between Turkmenistan and China, especially since April 2006 when they signed a thirty-year gas export deal, have cemented a closer relationship.7 The most significant example of this objective is the launch of the Turkmenistan-China gas pipeline in December 2009. The pipeline, which runs through Uzbekistan and Kazakhstan, had the full backing of Turkmenistan and China when proposed in 2007. The pipeline currently carries gas from Turkmenistan. It was expected to transport 4 bcm by the end of 2010, rising to 15 bcm in 2011 (Interfax 2010; Vershinin 2010). The thirty-year supply deal with Turkmenistan signed in April 2006 exports gas from Turkmenistan via the new seventhousand-kilometer-long, $7.3 billion pipeline (SinoThaiYouth 2009). The deal has weathered a leadership change in Turkmenistan. In 2008 President Berdymukhammedov reassured his Chinese counterparts that the pipeline to China would go into operation as scheduled (Du 2008). In June 2009 Turkmenistan pledged to export 40 bcm per year, 10 bcm

398

Explaining the Central Asian Energy Game

more than the original agreement. In exchange China provided $4 billion in soft loans to Turkmenistan to develop and improve its gas fields (Turkmenistan, China Sign Gas Agreement 2009). The new gas pipeline came into operation in December 2009 (RIA Novosti 2010). This pipeline helps to support the rapid increase in Chinas natural gas consumption, a harbinger for the need for large future imports. Official estimates put Chinas natural gas consumption at 10 percent of its annual total primary energy consumption by 2020; currently consumption is at 3.9 percent of the total (International Energy Agency 2010). Compared with other fossil fuels such as coal and oil, Chinas consumption of natural gas will grow more rapidly, in line with the governments plan to use more clean energy (China Daily 2010). As with its oil deals, China incentivizes its gas deals with broader trade and infrastructure investments. Along with the soft loan noted above, China announced a nearly $2.2 billion investment in the pipeline from Turkmenistan to China, involving CNPC and PetroChina (Energy Information Adminstration 2009b). Moreover, China agreed to a loan of $3 billion to Turkmenistan to assist in developing the South Iolotan gas field to feed the Central Asian Gas Pipeline (Energy Information Adminstration 2009a). Such deals sit within a broader economic and political fabric, which helps to overcome any resistance from the Turkmen side. Further, China has the cash for investment, unlike other countries, including Russia, that have been strapped for cash during the current credit crunch. This and other deals demonstrate Chinas forward-looking foreign policy and point to a future date when China will need to import natural gas. In 2009 China also surpassed Russia to be Turkmenistans second-leading trade partner after Turkey. China accounts for 12.8 percent while Russia accounts for 11.6 percent of Turkmenistans trade (International Monetary Fund 2010b). Chinas advantage is that its goods cannot be matched by Russian goods in quality and are cheaper than goods from the United States or Japan. China also has a consistent record of providing other much-needed sweeteners that other countries do not, such as loans to buy Chinese commercial goods (Socor 2009). China regularly funds infrastructure projects as well, including the billions of dollars in pipelines already noted and nearly $2 billion more destined to construct Central Asian connector highways. As a result, the economic ties that were in their infancy in the mid-1990s have expanded

Jean A. Garrison and Ahad Abdurahmonov

399

tremendously. In 1995, for instance, bilateral trade between China and the five Central Asian states totaled only $847 million, accounting for a modest 0.03 percent of Chinas total foreign trade. By 2008 Chinas overall trade with the region grew significantly to reach just under $31 billion (China National Bureau of Statistics 2009). Since then China has topped Russia in its trade with Central Asia. The complex interdependent nature of the relationships among Central Asian states and their big neighbors shows that strategic energy perspectives provide a much too unidimensional and static view of the natural gas energy equation.

Conclusion

The Central Asian oil and gas game necessitates a closer look at the complex interdependent relationships that have developed here and in other places. More than ever, traditional security analyses miss the dynamic nature of energy relationships and the factors that have empowered small energy states to influence their neighbors. The set of interdependencies illustrated just in the few energy deals noted here illustrates a more fluid decisionmaking context that challenges simple assumptions about how states should behave. The mercantilist tendencies of these states are not in doubt, but the circumstances that lead to a future of resource wars does not hold up. The energy game is much more than a competition between great powers over the resources of their weaker neighbors. While Russia and China are clearly locked in a competition for influence in Central Asia, what is debatable is their ability to influence outcomes in the traditional sense. Without taking the host states, such as Kazakhstan and Turkmenistan, into account, too much of the policy puzzle is missed. In a system of complex energy interdependence, these small states are poised to play one country off the other. Their energy resources give them some ability to influence the asymmetries of the relationships, and increasingly they use this leverage to promote their foreign-policy interests. Countries such as Kazakhstan and Turkmenistan have tangible resources at their fingertips that provide specific tools of influence. The combination of a strategic commodity such as needed energy resources, and a self-perception that

400

Explaining the Central Asian Energy Game

they are not small, makes them more confident in their ability to manipulate their circumstances to their benefit. Energy is not just a regular trade commodity in this sense. Looking at small states as actors, rather than as merely those acted upon, demonstrates how states are mutually dependent and must constantly work to maintain working agreements. The choices that states make and ongoing broader bilateral relationships are better predictors of the energy game than deterministic zero-sum energy game assumptions. These games are volatile and involve a host of other related issues, including access to appropriate technology and financing for expensive pipeline projects. Thus, the security debate that dominates energy policy discussions fails to capture the nuances or the important everyday parts of the energy game. State behavior results from a series of foreign-policy choices. Looking inside the black box of state behavior is important to understand the energy equation and to analyze any small states behavior. From a foreign-policy analysis perspective, this is essential if we want to understand how policy choices are made. While this approach is a challenge, more in-depth case studies can go a long way to improve our understanding of energy politics within the Central Asian context and beyond.

Notes

Jean A. Garrison is director of international studies and professor of political science at the University of Wyoming. Her books include China and the Energy Equation in Asia: Determinants of Policy Choice (2009), Making China Policy: Nixon to G. W. Bush (2005), and Games Advisors Play: Foreign Policy in the Nixon and Carter Administrations (1999). Her research and teaching interests intersect national energy policy, climate security, and US foreign policy, particularly the US relationship with China and East Asia. She can be reached at garrison@uwyo.edu. Ahad Abdurahmonov is project coordinator for the Wyoming Geriatric Education Center at the University of Wyoming. His research interests are energy security and political change in post-Soviet countries. He can be reached at aabdurah@uwyo.edu. 1. For the Kazakhstan oil success story told from an industry and regional perspective, see Ten Years of Tengiz Chevroil 2003. 2. For example, a Sino-Iranian network of oil pipelines already gives the Central Asian states an alternative route for oil trade, which decreases their dependence on Russia. Completion of the Neka-Tehran pipeline offers the chance

Jean A. Garrison and Ahad Abdurahmonov

401

for oil swaps of Caspian and Iranian crude, which cut transport costs from the Caspian basin to China. In this plan, Caspian crude would go to Iran while Iranian crude would go by ship to China. 3. The discussion of the Kazakh petroleum equation draws from chap. 3 in Garrison 2009, 4164. 4. Turkmenistan is a relatively poor country whose income and stability are largely due to ensuring the steady production and export of natural gas, the main source of its revenues. Until recently its economy was almost totally dependent on its ties to Russia. 5. Traditionally Turkmenistan maintained a balance in its foreign policy and avoided alignments with any particular regional faction. Its choice for positive neutrality in the 1990s, its own description of its foreign-policy approach, shows an attempt to stay away from antagonism and competition among various groupings and alignments (Shikhmuradov 1997). However, due to the growing strategic significance of its energy resources, Turkmenistan has expanded its multilateral and bilateral connections. For example, in December 2010 Turkmenistan signed an intergovernmental agreement for constructing the TAPI (Turkmenistan-Afghanistan-Pakistan-India) pipeline with its Afghan, Pakistani, and Indian partners (Iqbal 2010). 6. There have been a number of strains in the relationship, including accusations of Russian attempts to assassinate Turkmenistans president; Russian, Ukrainian, and Armenian use of Turkmen gas without payment, which led to Turkmenistan halting its exports in 1994; and Turkmenistans refusal to join a variety of new initiatives such as the Collective Security Treaty Organization (CSTO) and the Eurasian Economic Community (EurASEC), as well as limiting its participation in the CIS. Turkmenistan also maintains an independent position from Russia on the legal status and division of the Caspian Sea. The status of the Caspian Sea, which was shared by Iran and the Soviet Union until 1991, became complicated after the dissolution of the Soviet Union. The five littoral states Azerbaijan, Iran, Kazakhstan, Russia, and Turkmenistancannot come to an agreement on the division of the energy-rich Caspian seabed. Russia, along with Azerbaijan and Kazakhstan, maintains that it should be divided based on shoreline lengths of each state, whereas Iran and Turkmenistan argue that it should be divided into five equal sectors. See Fee 2007. 7. Currently China, compared to the European Union, is a significantly smaller natural gas market, because the EU consumes 496.1 bcm per year and China consumes only 55.6 bcm per year. The EU imports 361.2 bcm per year, and China imports less than one bcm per year (976 mcm). However, Chinas energy demand is growing very quickly due its fast-paced economic growth (CIA World Factbook 2009).

References

Allison, Graham. 1971. Essence of Decision: Explaining the Cuban Missile Crisis. Boston: Little, Brown.

402

Explaining the Central Asian Energy Game

Aron, Leon. 2006. Russias Oil: Natural Abundance and Political Shortages. American Enterprise Institute for Public Policy Research (Spring), at www.aei.org. Asia Pulse. 2009. Turkmenistan, Uzbekistan, Kazakhstan, and China Launch Gas Pipeline. Energy-pedia News (December 12), at www.energypedia.com. Bahgat, Gawdat G. 2009. Central Asian, Caucasus Energy Rivalries Intensify. Oil and Gas Journal (June 22), at www.lexisnexis.com. . 2010. EU, OPEC Strategic Dialog Highlights Shared Interests. Oil and Gas Journal (May 17), at ftp://64.14.13.138. Baker Fox, Annette. 1959. The Power of Small States: Diplomacy in World War II. Chicago: University of Chicago Press. Blank, Stephen. 2005. China, Kazakh Energy, and Russia. China and the Eurasia Forum Quarterly, vol. 3, no. 3 (November), pp. 99110. Brzezinski, Zbigniew. 1997. The Grand Chessboard: American Primacy and Its Geostrategic Imperatives. New York: Basic Books. Caldwell, Dan, and Robert E. Williams Jr. 2006. Seeking Security in an Insecure World. Lanham, MD: Rowman & Littlefield. China Daily. Chinas Natural Gas Short of Demand. February 2010, at www.chinadaily.com.cn. China National Bureau of Statistics. 2009. Value of Imports and Exports by Country (Region) of Origin/Destination, at www.stats.gov.cn. CIA World Factbook. 2009. Natural Gas, at www.cia.gov. Cohen, Ariel. 2008. Baku, Ankara, Ashgabat Give Green Light for Diversifying Caspian Energy Exports. Trend Capital (December 8), at http:// en.trend.az. Department of Energy (DOE). 2006. Energy Policy Act 2005, Section 1837. National Security Review of International Energy Requirements (February). Du Guodong. 2008. Turkmenistan-China Natural Gas Pipeline to Go into Operation on Schedule. Xinhua (September 20), at news.xinhuanet.com. East, Maurice A. 1973. Size and Foreign Policy Behavior: A Test of Two Models. World Politics, vol. 25, no. 4 (July), pp. 556576. Ebel, Robert E. 2005. Chinas Energy Future: The Middle Kingdom Seeks Its Place in the Sun. Washington, DC: Center for Strategic International Studies. Energy Information Administration, US (EIA). 2009a. Country Analysis BriefsChina, at www.eia.doe.gov. . 2009b. Country Analysis BriefsKazakhstan, at www.eia.doe.gov. Eurasia Group. 2006. Chinas Overseas Investments in Oil and Gas Production. Report for the U.S.-China Economic and Security Review Commission (October). EurasiaNet. 2009a. Gazprom Squeezed by Central Asian Contracts (March 24), at www.eurasianet.org. . 2009b. Turkmenistan: EU to Expand Contracts with Turkmenistan (January 22), at www.eurasianet.org. Fee, Florence C. 2007. The Russian-Iranian Energy Relationship. Middle East Economic Survey vol. 49, no. 11 (March), pp. 2632.

Jean A. Garrison and Ahad Abdurahmonov

403

Garrison, Jean A. 2007. Author Discussions with Energy Executives and Experts in Almaty, Kazakhstan (May 2325). . 2009. China and the Energy Equation in Asia: The Determinants of Policy Choice. Boulder, CO: Lynne Rienner. Gilpin, Robert. 2001. Global Political Economy: Understanding the International Economic Order. Princeton, NJ: Princeton University Press. Gorst, Isabel. 2007. Tougher Times for Investors. Petroleum Economist, vol. 74, no. 12 (December), p. 12. Hey, Jeanne A. K. 2002. Luxembourgs Foreign Policy: Does Small Size Help or Hinder? Innovation, vol. 15, no. 3, pp. 211225. . 2003. Introducing Small State Foreign Policy. In Jeanne A. K. Hey, ed., Small States in World Politics: Explaining Foreign Policy Behavior. Boulder, CO: Lynne Rienner. Interfax. 2010. Uzbekistan Commissions Phase Two of Turkmenistan to China Gas Pipeline Section. Steel Guru (December 28), at www.steelguru.com. International Crisis Group. 2007. Central Asias Energy Risks, Asia Report No. 133 (May). International Energy Agency. 2010. World Energy Outlook 2010 Factsheet, at www.worldenergyoutlook.org. International Monetary Fund. 2010a. Kazakhstans Trade with Main Partners. European Union Trade Report 2009 (September 15), at trade.ec.europa.eu. . 2010b. Turkmenistans Trade with Main Partners (2009). European Union Trade Report 2009 (September 15), at trade.ec.europa.eu. Iqbal, Shanzeh. 2010. TAPI, Harbinger of Peace, Prosperity. Pakistan Times, at www.pakistantimes.net. Ivanov, Vladimir I. 2003. Russia Emerging as Energy Powerhouse. Daily Yomiuri in Johnsons Russia List (June 13), at www.cdi.org. Katzenstein, Peter J. 2003. Small States and Small States Revisited. New Political Economy, vol. 8, no. 1, pp. 930. Keohane, Robert O., and Joseph Nye. 1998. Power and Interdependence in the Information Age. Foreign Affairs, vol. 77, no. 5 (September/October), pp. 8194. . 2001. Power and Interdependence: World Politics in Transition. 3rd ed. Boston: Little Brown. Klare, Michael T. 2008. Rising Powers Shrinking Planet: The New Geopolitics of Energy. New York: Metropolitan Books. Kleveman, Lutz. 2003. The New Great Game: Blood and Oil in Central Asia. New York: Atlantic Monthly. Kramer, Andrew E. 2010. In Asia, a Gulfs Worth of Oil Awaits Transport. New York Times (July 22), at www.nytimes.com. Lee, Pak K. 2005. Chinas Quest for Oil Security. Pacific Review, vol. 18, no. 2 (June), pp. 265301. Liao, Xuanli. 2006. Central Asia and Chinas Energy Security. China and Eurasian Forum Quarterly, vol. 4, no. 4, pp. 6169. Lieberthal, Kenneth, and Mikkal E. Herberg. 2006. Chinas Search for Energy Security: Implications for U.S. Policy. NBR Analysis, vol. 17, no. 1 (April), pp. 142.

404

Explaining the Central Asian Energy Game

Neack, Luara. 2002. The New Foreign Policy: U.S. and Comparative Foreign Policy in the 21st Century. Lanham, MD: Rowman & Littlefield. Neumann, Iver, and Seiglindge Gstohl. 2007. Lilliputians in Gullivers World? In C. Ingebritsen, S. Gstohl, and I. Neumann, eds., Small States in International Relations. Seattle: University of Washington Press. Nichol, Jim. 2007. Central Asias Security: Issues and Implications for U.S. Interest. Congressional Research Service Report to Congress (April 26). Noreng, Oystein. 2006. The Rise of Asia and the Restructuring of International Oil Trading: Neo-mercantilism Versus Globalization? Journal of Energy and Development, vol. 31, no. 1, p. 35. Nye, Joseph. 2005. Understanding International Conflicts: An Introduction to Theory and History. New York: Pearson/Longman. Oil and Gas Information Agency. 2010. Kazakhstan Increases Oil Exports 1.2 Percent. Oil and Gas Eurasia, at www.oilandgaseurasia.com. Ozdamar, Ibrahim. 2010. Energy, Security, and Foreign Policy. In Robert Denemark, ed., International Studies Encyclopedia. New York: Wiley Blackwell, pp. 14151433. Payne, Anthony. 2004. Small States in the Global Politics of Development. Round Table, vol. 93, no. 376 (September), pp. 623635. Randma-Liiv, Tiina. 2002. Small States and Bureaucracy: Challenges for Public Administration. Trames, vol. 6, no. 3, pp. 374389. RIA Novosti. 2009. Turkmenistan-China Gas Pipeline Inaugurated (December), at en.rian.ru/business/20091214/157228750.html. Roberts, Paul. 2004. The End of Oil: On the Edge of a Perilous New World. Boston: Houghton Mifflin. Rothstein, Robert L. 1968. Alliances and Small Powers. New York: Columbia University Press. Shikhmuradov, Boris. 1997. Positive Neutrality as the Basis of the Foreign Policy of Turkmenistan. Center for Strategic Research (Turkey) (Summer), at www.sam.gov.tr. Silk Road Intelligencer. 2010. Key Energy Projects May Lose Special Tax StatusNazarbayev (January 25), at http://silkroadintelligencer.com. . 2011. Kazakhstan-China Pipeline Hits Capacity (January 5), at http:// silkroadintelligencer.com. SinoThaiYouth. 2009. China, Turkmenistan Signed Energy Deals (July 18), at www.sinothaiyouth.com. Snyder, Richard C., H. W. Bruck, and Burton Sapin. 1965. Foreign Policy Decision Making. New York: Free Press. Socor, Vladimir. 2009. Turkmenistan Pressured by Gazproms Halt on Turkmen Gas Imports. Eurasia Daily Monitor, vol. 6, no. 125 (June), at www .jamestown.org. Starr, Frederick S. 1996. Making Eurasia Stable. Foreign Affairs, vol. 75, no. 1, pp. 8092. Sutton, Paul. 1993. Lilliput Under Threat: The Security Problems of Small Island and Enclave Developing States. Political Studies, vol. 41, no. 4, pp. 579593. Ten Years of Tengiz Chevroil. 2003. Atrau and London: Anglo-Caspian Publishers.

Jean A. Garrison and Ahad Abdurahmonov

405

Turkmenistan, China Sign Gas Agreement. 2009. Turkmenistan.ru (June 25), at http://www.turkmenistan.ru. Tynan, Deirdre. 2010. Turkmenistan: Gas Flows Again to Russia, While Discontent Simmers (January 13), at www.eurasianet.org. Upstream Online. 2009. Change of Guard at Kashagan Helm (January 23), at www.upstreamonline.com. Vershinin, Alexander. 2010. Turkmenistan, Iran Set to Open New Gas Pipeline. Bloomberg BusinessWeek (January 5), at www.businessweek.com. Wang Guanqun. 2010. Chinas Natural Gas Consumption to Skyrocket in Coming Ten Years: PetroChina. China English News (June 8), at http://news .xinhuanet.com. Wilson, Ernest J. 1987. World Politics and International Energy Markets. International Organization, vol. 41, no. 1, pp. 125149. Yergin, Daniel. 2005. Energy Security and Markets. In J. H. Kalicki and D. L. Goldwyn, eds., Energy and Security: Toward a New Foreign Policy Strategy. Washington, DC: Woodrow Wilson Center Press, pp. 5164. Ziegler, Charles E. 2006. The Energy Factor in Chinas Foreign Policy. Journal of Chinese Political Science, vol. 11, no. 1 (Spring), pp. 123. . 2008. Competing for Markets and Influence: Asian National Oil Companies in Eurasia. Asian Perspective, vol. 32, no. 1, pp. 129163.

Reproduced with permission of the copyright owner. Further reproduction prohibited without permission.

Potrebbero piacerti anche

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- IMS Objectives Targets 2Documento2 pagineIMS Objectives Targets 2FaridUddin Ahmed100% (3)

- Lesson 6 ComprogDocumento25 pagineLesson 6 ComprogmarkvillaplazaNessuna valutazione finora

- NDY 9332v3Documento8 pagineNDY 9332v3sulphurdioxideNessuna valutazione finora

- Radiation Safety Densitometer Baker PDFDocumento4 pagineRadiation Safety Densitometer Baker PDFLenis CeronNessuna valutazione finora

- 15.053/8 February 7, 2013: More Linear and Non-Linear Programming ModelsDocumento42 pagine15.053/8 February 7, 2013: More Linear and Non-Linear Programming ModelsShashank SinglaNessuna valutazione finora

- Stress-Strain Modelfor Grade275 Reinforcingsteel With Cyclic LoadingDocumento9 pagineStress-Strain Modelfor Grade275 Reinforcingsteel With Cyclic LoadingRory Cristian Cordero RojoNessuna valutazione finora

- 2SB817 - 2SD1047 PDFDocumento4 pagine2SB817 - 2SD1047 PDFisaiasvaNessuna valutazione finora

- Introduction-: Microprocessor 68000Documento13 pagineIntroduction-: Microprocessor 68000margyaNessuna valutazione finora

- Business Plan 3.3Documento2 pagineBusiness Plan 3.3Rojin TingabngabNessuna valutazione finora

- Laboratory Manual (CIV 210) Engineering Surveying (2018-19) (For Private Circulation Only)Documento76 pagineLaboratory Manual (CIV 210) Engineering Surveying (2018-19) (For Private Circulation Only)gyanendraNessuna valutazione finora

- The Homework Song FunnyDocumento5 pagineThe Homework Song Funnyers57e8s100% (1)

- Specificities of The Terminology in AfricaDocumento2 pagineSpecificities of The Terminology in Africapaddy100% (1)

- Movie Piracy in Ethiopian CinemaDocumento22 pagineMovie Piracy in Ethiopian CinemaBehailu Shiferaw MihireteNessuna valutazione finora

- Nutrition and CKDDocumento20 pagineNutrition and CKDElisa SalakayNessuna valutazione finora

- Chemistry: Crash Course For JEE Main 2020Documento18 pagineChemistry: Crash Course For JEE Main 2020Sanjeeb KumarNessuna valutazione finora

- Countries EXCESS DEATHS All Ages - 15nov2021Documento21 pagineCountries EXCESS DEATHS All Ages - 15nov2021robaksNessuna valutazione finora

- Time-Sensitive Networking - An IntroductionDocumento5 pagineTime-Sensitive Networking - An Introductionsmyethdrath24Nessuna valutazione finora

- Outdoor Air Pollution: Sources, Health Effects and SolutionsDocumento20 pagineOutdoor Air Pollution: Sources, Health Effects and SolutionsCamelia RadulescuNessuna valutazione finora

- 74HC00D 74HC00D 74HC00D 74HC00D: CMOS Digital Integrated Circuits Silicon MonolithicDocumento8 pagine74HC00D 74HC00D 74HC00D 74HC00D: CMOS Digital Integrated Circuits Silicon MonolithicAssistec TecNessuna valutazione finora

- PR KehumasanDocumento14 paginePR KehumasanImamNessuna valutazione finora

- E MudhraDownload HardDocumento17 pagineE MudhraDownload HardVivek RajanNessuna valutazione finora

- AlpaGasus: How To Train LLMs With Less Data and More AccuracyDocumento6 pagineAlpaGasus: How To Train LLMs With Less Data and More AccuracyMy SocialNessuna valutazione finora

- Ricoh IM C2000 IM C2500: Full Colour Multi Function PrinterDocumento4 pagineRicoh IM C2000 IM C2500: Full Colour Multi Function PrinterKothapalli ChiranjeeviNessuna valutazione finora

- Electro Fashion Sewable LED Kits WebDocumento10 pagineElectro Fashion Sewable LED Kits WebAndrei VasileNessuna valutazione finora

- MASONRYDocumento8 pagineMASONRYJowelyn MaderalNessuna valutazione finora

- Theory GraphDocumento23 pagineTheory GraphArthur CarabioNessuna valutazione finora

- Aptitude Number System PDFDocumento5 pagineAptitude Number System PDFharieswaranNessuna valutazione finora

- Hamstring - WikipediaDocumento21 pagineHamstring - WikipediaOmar MarwanNessuna valutazione finora

- Android Developer PDFDocumento2 pagineAndroid Developer PDFDarshan ChakrasaliNessuna valutazione finora

- KP Tevta Advertisement 16-09-2019Documento4 pagineKP Tevta Advertisement 16-09-2019Ishaq AminNessuna valutazione finora