Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

td140421 2

Caricato da

Joyce SampoernaTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

td140421 2

Caricato da

Joyce SampoernaCopyright:

Formati disponibili

PT Trimegah Securities Tbk - www.trimegah.

com

1 DAILY

TRIM Daily

This week we expect market to be focused on earnings. Among large caps, we

expect BBRI, BBCA, BBNI to post good earnings results. We also highlight dividend

plays as we are near the ex dates now: MPPA 7% yield, PTBA 5%, TLKM 4.4%,

PGAS 3.9%, ITMG 3.8% (excl. interim). We also publish BKSL non-rated note

- highest discount to NAV at 74%! Potential catalyst: Resorts, universities, and

other facilities to be constructed in Bukit Sentuls new CBD, which should help

raise overall land price, implying potential upside risk to NAV (despite already big

discount).

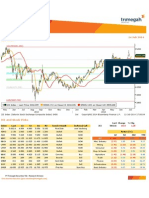

Jakarta Composite Index (JCI) was up by 24.0 points or 0.49% to 4,897.1 yesterday.

Index movers were mostly driven by Agricultural (+1.74%), Consumer Goods

(+1.58%), and Misc. Industries (+0.73%). Total transaction value was Rp5.2tr

with regular market transaction Rp4.6tr. IDX recorded Rp673bn net buy by foreign

investors. We expect JCI to further strengthen, with todays trading range of 4864-

-4933

JCI 4,897.1

STOCK PRICE Rec Details

PTBA 9700 Buy

We expect PTBA to trade up today in the range of

9575-9825. Buy at level 9600 with target price 9825

(resistance)

ITMG 25325 Buy

With stochastic indicator to form a golden cross, we

expect a upware movement for ITMG today in the range

of 25100-25700

ADRO 980 Buy

ADRO is a short term bullish. We expect ADRO to further

strengthen, with todays trading range of 930-1125

INCO 3555 Buy

INCO remains strong with potential upside in the range

of 3500-3695 for today.

AALI 28350 Buy

If 28400 break, Buy AALI at level 28400 with potential

upside to level 29400

GGRM 50600 Spec Buy

Spec Buy GGRM at level 49550 with target price today

at level 51200

MPPA 2640 Spec Buy

Stochastic Oscilator indicates positive signal of a

potential technical rebound for MPPA. Spec Buy at level

2400 with target price 2715 (resistance)

WIKA 2230 Sell

WIKA formed a Overbought, we expect a technical

correction for WIKA today in the range of 2050-2315

PTPP 1800 Sell

PTPP today is expected to continue its weakening trend

and trade in 1700-1940 range

ASRI 555 Sell

Based on technical analysis, as its Stochastic Ochilator

formed a dead cross, we expect ASRI to move

downward today within the range of 530-570

TRIM Highlights

Market View

Traders Pick

REKSA DANA TRIMEGAH

ASSET MANAGEMENT

NAB Chg %

Trim Kapital 8,318.9 66.5 0.81

Trim Kapital + 3,082.0 18.0 0.59

Trim Syariah SHM 1,541.9 12.2 0.80

Tram Consumption + 1,353.5 5.6 0.41

Trim Komb 2 1,832.7 8.1 0.44

Trim Syariah B 2,191.1 17.3 0.80

Trim Dana Stabil 2,089.7 1.1 0.05

Trim Dana Tetap 2 1,662.4 1.1 0.07

Tram PDPT USD 1.1 0.0 0.02

Tram Reguler INC 994.7 0.0 0.00

Tram Strategic Fund 1,075.5 0.3 0.03

Trim Kas 2 1,072.3 0.3 0.02

APRIL 21, 2014

Change : 0.49%

Transaction Volume (m) : 3,576.7

Transaction Value (Rpbn) : 5,200.4

Mkt Cap (Rptr) : 4,848.9

Market P/E (x) : 15.5

Market Div. Yield (%) : 2.0

Price Chg %

Dow Jones 16,408.5 -16.3 -0.1

Nasdaq 4,095.5 9.3 0.2

Nikkei 14,516.3 98.6 0.7

ST Times 3,253.8 0.6 0.0

FTSE 6,625.3 41.1 0.6

Hang Seng 22,760.2 64.2 0.3

GLOBAL INDICES

(USD) (Rp) Chg %

41.0 11,715.3 0.07 0.2 X.X

DUAL LISTING (NYSE )

Chg %

USD IDR 11,424 -12.0 -0.1

10 yr Indo Govr bond (%) 7.95 0.1 0.7

10 yr US govt bond (%) 2.7 0.09 3.6

Spread (%) 5.22 -0.04 -2.9

EIDO 28.3 0.1 0.5

Foreign YtD (USDmn) 2,828 58.9 2.1

OTHERS

Global Wrap

In U.S., the U.S. initial jobless claims rose to 304,000 in April 12 week (vs

consensus: 315,000), following an upwardly revised 302,000 in prior week.

Meanwhile, the U.S. Philadelphia Fed business outlook jumped to 16.6 in April (vs

consensus: 9.5) from 9.0 in March.

PT Trimegah Securities Tbk - www.trimegah.com

2 DAILY

News of the Day

PLN: Worried about gas supply

Amid heightened demand for electricity, PT PLN is struggling

to source gas to feed its power plants. The company would

need 28 cargos of lique!ed gas this year. The number will

double to 56 cargos in 2012 and is expected to increase to 60

the following year. Of the total cargos needed next year, PLN

has secured 22 from the Bontang plant in East Kalimantan

and 12 from the Tangguh plant in Papua. Indonesia has a

signi!cant amount of natural gas resources, around 104

trillion standard cubic feet (tscf) in proven and 48 tscf in

potential gas reserves. That !gure makes the country the 13th

largest owner of proven natural gas reserves in the world.

The government has called for higher domestic utilization of

gas in an attempt to reduce dependency on oil. Figures from

SKKMigas showed that domestic and gas distribution reached

52.1% of total production in 2013. This year, SKKMigas in

targeting 57.3% of total gas produced to be sold to the

domestic market. Source: The Jakarta Post

GJTL: Seeking to increase export contribution

GJTL seeks to have its export business contributes 30-35%

from total revenue. In 2013, it recorded revenue of Rp9.1tr,

a 2.9% decrease YoY. Its export contribution in 2013 was

at 32.2%, down from 36.8% YoY. Its net income decreased

by 44.9% YoY to Rp375bn due to mainly foreign exchange

difference. Target revenue growth for 2014 is set at 5-10%

and GJTL has set aside USD120-25mn capex for this year.

Source: Kontan

GIAA: Trans Airways ownership increased to 28%

PT Trans Airways ownership in GIAA increased by 2.75bn

shares to 3.65bn shares, giving it 28% ownership from

previously 16%. Previously GIAA has rights issue amounting

to 3.23bn shares, of which was not exercised by the

government. Source: Bisnis Indonesia

AALI: Expanding into rubber plantation of 2,000ha

AALI is set to expand its rubber planted area up to 2,000ha

this year. Currently it has 500ha of rubber plantation located

in Muara Teweh, Central Kalimantan. The rubber plantation

would be used to support tire production of its sister company,

AUTO. AALI allocates Rp3tr in capex this year, which would be

mostly used for expansion of its palm oil business. Source:

Investor Daily

TICKER

dividend

(Rp/shares)

Price

(17-apr-14)

Rating

Target

price

Dividend

yield

EX Date TYPE Pay Date

MPPA 186 2,640 Buy 3,000 7.0% 6-May-14 Regular + Special Cash 19-May-14

PTBA 462 9,700 Buy 12,000 4.8% 4/29/2014 Regular Cash 5/16/2014

TLKM 102 2,325 Buy 2,497 4.4% 4/30/2014 Regular + Special Cash 5/19/2014

PGAS 210 5,350 Hold 5,100 3.9% 4/29/2014 Regular Cash 5/19/2014

ITMG 975 25,325 Buy 32,000 3.8% 4/29/2014 Regular Cash 5/14/2014

MLPL 21 640 NA NA 3.3% 5/19/2014 Regular Cash 6/5/2014

BBNI 146 5,050 Buy 5,600 2.9% 4/29/2014 Regular Cash 5/19/2014

BDMN 127 4,470 Hold 4,250 2.8% 5/30/2014 BDVD Forecast -

SMGR 407 15,825 Hold 17,000 2.6% 4/29/2014 Regular Cash 5/19/2014

BBRI 257 10,000 Buy 11,600 2.6% 4/29/2014 Regular Cash 5/14/2014

BMRI 234 9,850 Buy 11,200 2.4% 3/27/2014 Regular Cash 4/15/2014

INDF 165 7,200 NA 7,781 2.3% 7/17/2014 BDVD Forecast -

ASII 166 7,825 NA 7,560 2.1% 5/20/2014 BDVD Forecast -

INTP 470 23,450 Buy 27,400 2.0% 6/20/2014 BDVD Forecast -

GGRM 900 50,600 Hold 54,760 1.8% 7/31/2014 BDVD Forecast -

UNTR 350 21,600 Buy 24,000 1.6% 5/17/2014 BDVD Forecast -

WSKT 11 740 Buy 690 1.5% 4/29/2014 Regular Cash 5/19/2014

PTPP 26 1,800 Buy 1,800 1.4% 4/22/2014 Regular Cash 5/7/2014

KLBF 20 1,545 Hold 1,535 1.3% 6/13/2014 BDVD Forecast -

WIKA 28 2,230 Buy 2,850 1.2% 4/29/2014 Regular Cash 5/13/2014

ADRO 11 980 Buy 1,300 1.2% 5/29/2014 BDVD Forecast -

UNVR 320 30,800 Hold 28,404 1.0% 6/30/2014 BDVD Forecast -

AALI 290 28,350 Hold 25,732 1.0% 5/8/2014 BDVD Forecast -

BBCA 75 11,200 Buy 12,200 0.7% 4/30/2014 Final 5/20/2014

Dividend Table

PT Trimegah Securities Tbk - www.trimegah.com

3 DAILY

Indices Region +/- (%) YTD (%)

5.75 0.35 0.57

2.54 0.14 0.89

-16.31 -0.10 -1.01

-1.94

1.61 0.49 1.27

-1.83

-1.49

26.15 0.59 3.16

52.38 0.63 2.10

911.3 1.78 1.17

-9.77

351.61 1.58 7.04

Market Div. Yield (%)

0.5

1.0

1.4

1.6

1.9

2.1

2.3

3.0

4.6

4.7

BBRI

ASII

BBCA

UNTR

PGAS

INDF

UNVR

GGRM

AALI

INCO

JCI

351.61 1.58 7.04

104.10 1.56 7.58

-7.37 -0.35 -0.86

3.13 0.29 3.00

-10.90

-9.90

-2.34

-0.35

22.50 0.25 4.12

0.60 0.02 2.73

0.40 0.03 8.51

0.00 0.00 13.27

-0.76

12.03

Market Div. Yield (%)

-0.8

-1.3

-1.3

-1.9

-2.3

-2.8

-2.8

-7.9

-17.6

-22.7

SMGR

BMRI

BDMN

PWON

CTRA

MPPA

BBTN

BJBR

TFCO

GEMS

1,018,014

340,785

306,408

267,758

153,411

150,692

148,012

144,070

125,848

115,470

BMRI

SILO

ASII

TRAM

BBRI

UNTR

TLKM

BBCA

SMGR

BBNI

JCI ####

326,817

304,004

296,656

207,723

188,625

180,624

162,932

160,578

153,611

127,373

126,840

CPGT

TMPI

TRAM

BUMI

BKSL

NIRO

BBTN

SSMS

META

TLKM

SUGI

Market Div. Yield (%)

13,963

8,637

6,426

4,552

4,402

3,496

3,248

3,227

3,221

3,212

PRAS

CPGT

SSMS

BMRI

BBTN

TLKM

ASII

BUMI

KLBF

BBRI

YTD (Rp) 14.57% 3,576.7 MXWO MSCI Word 1,670.6 5.75 0.35 0.57

YTD (USD) 20.66% 5,200.4 SPX S&P 500 1,864.9 2.54 0.14 0.89

Moving Avg 20day 4,814.4 4,848.9 US

Moving Avg 50day 4,688.4 15.5 16,408.5 -16.31 -0.10 -1.01

Moving Avg 200day 4,480.1 2.0 Nasdaq US 4,095.5 9.29 0.23 -1.94

Europe

Indonesia & Sectors +/- (%) YTD (%) EURO 50 Europe 332.4 1.61 0.49 1.27

MSCI Indonesia 5,767.2 42.5 0.74 17.50 FTSE London 6,625.3 41.08 0.62 -1.83

JII 663.6 5.7 0.87 13.41 DAX Jerman 9,409.7 91.89 0.99 -1.49

LQ45 829.6 6.2 0.75 16.66 CAC France 4,431.8 26.15 0.59 3.16

JAKFIN Index 654.6 0.9 0.14 21.14 SMI Swiss 8,375.1 52.38 0.63 2.10

JAKINFR Index 1,028.1 7.1 0.70 10.51 BRIC

-4.8 -0.34 -0.50 BOVESPA Brazil 52,111.9 911.3 1.78 1.17

JAKCONS Index 2,019.1 31.4 1.58 13.30 MICEX Russia 1,356.5 26.87 2.02 -9.77

JAKTRAD Index 879.6 3.7 0.43 13.24 SENSEX India 22,628.8 351.61 1.58 7.04

JAKMIND Index 1,352.4 9.9 0.73 12.23 NIFTY India 6,779.4 104.10 1.56 7.58

13.13 SHCOMP China 2,097.7 -7.37 -0.35 -0.86

28.91 SZCOMP China 1,089.4 3.13 0.29 3.00

JAKAGRI Index 2,357.8 40.2 1.74 10.18

Nikkei Japan 14,516.3 98.7 0.68 -10.90

Commodities +/- (%) YTD (%) TPX Japan 1,173.4 6.78 0.58 -9.90

Hong kong 22,760.2 64.23 0.28 -2.34

CRB Index 311.5 1.7 0.56 11.17 KOSPI S.Korea 2,004.3 12.23 0.61 -0.35

TAIEX Taiwan 8,966.7 22.50 0.25 4.12

Crude Oil (USD/bbl) 104.3 0.5 0.52 5.97 FSSTI Singapore 3,253.8 0.60 0.02 2.73

Natural Gas 4.7 0.2 4.66 12.08 ASEAN

-0.2 -0.20 -14.84 SET Thailand 1,409.2 0.40 0.03 8.51

-13.96 PCOMP Philipines 6,671.2 0.00 0.00 13.27

KLCI Malaysia 1,852.7 2.15 0.12 -0.76

4.58 VNINDEX Vietnam 565.3 -14.98 -2.58 12.03

Nickel (USD/tonne) 17,925 65.0 0.36 28.96

Market Div. Yield (%)

Dow Jones Industrial

Developed ASIA

-17.6

-22.7

JCI

HSI

Indices

YTD (Rp) 14.57% 3,576.7 MXWO MSCI Word 1,670.6

YTD (USD) 20.66% 5,200.4 SPX S&P 500 1,864.9

Moving Avg 20day 4,814.4 4,848.9

Moving Avg 50day 4,688.4 15.5

Moving Avg 200day 4,480.1 2.0

Nilai (Rpbn)

Mkt Cap (Rptr)

4,897.05 24.04 0.49%

Market P/E (x)

Volume (m)

Dow Jones Industrial

JCI

Market Div. Yield (%)

Indonesia & Sectors +/- (%) YTD (%)

MSCI Indonesia 5,767.2 42.5 0.74 17.50 FTSE London 6,625.3

JII 663.6 5.7 0.87 13.41 DAX Jerman 9,409.7

LQ45 829.6 6.2 0.75 16.66 CAC France 4,431.8

JAKFIN Index 654.6 0.9 0.14 21.14 SMI Swiss 8,375.1

JAKINFR Index 1,028.1 7.1 0.70 10.51

JAKMINE Index 1,422.1 -4.8 -0.34 -0.50

JAKCONS Index 2,019.1 31.4 1.58 13.30 MICEX Russia 1,356.5

JAKTRAD Index 879.6 3.7 0.43 13.24 SENSEX India 22,628.8

JAKMIND Index 1,352.4 9.9 0.73 12.23 NIFTY India 6,779.4

JAKBIND Index 543.9 -0.8 -0.15 13.13 SHCOMP China 2,097.7

JAKPROP Index 434.4 -0.8 -0.18 28.91 SZCOMP China 1,089.4

JAKAGRI Index 2,357.8 40.2 1.74 10.18

Commodities +/- (%) YTD (%)

Developed ASIA

CRB Index 311.5 1.7 0.56 11.17 KOSPI S.Korea 2,004.3

Oil & Gas

Crude Oil (USD/bbl) 104.3 0.5 0.52 5.97 FSSTI Singapore 3,253.8

Natural Gas 4.7 0.2 4.66 12.08

COAL (AUS Daily) 74.3 -0.2 -0.20 -14.84

COAL (Australia,wk) 72.8 0.0 0.00 -13.96

Industrial Metals

Alumunium (USD/tonne) 1,842.5 -10.0 -0.54 4.58 VNINDEX Vietnam 565.3

Nickel (USD/tonne) 17,925 65.0 0.36 28.96

Tin (USD/tonne) 23,405 -45 -0.19 4.72

Precious Metal Kurs Region +/- (%) YTD (%)

Gold (USD/t oz.) 1,293.9 -9.6 -0.74 7.62 USDEUR Euro 0.724

Silver (USD/t oz.) 19.6 -0.0 -0.19 1.33 USDGBP 0.596

Soft Commodities USDCHF Switzerland 0.884

CPO (Malaysia - Rm/tonne) 2,694.0 -42.0 -1.54 2.51 USDCAD Canada 1.102

Rubber (JPY/kg) 2,019.9 -139.9 -6.48 -24.02 USDAUD Australia 1.072

Corn (USD/bu.) 494.8 -2.8 -0.55 17.24 USDNZD New Zealand 1.165

Wheat (USD/bu.) 691.3 3.3 0.47 14.21 USDJPY Japan 102.43

Soybeans (USD/bu.) 1,514.0 -4.8 -0.31 15.35 USDCNY China 6.22

Rice (Indonesia) (Rp/kg) 8,600.0 0.0 0.00 0.00 USDHKD Hongkong 7.754

USDSGD Singapore 1.253

Kurs Region +/- (%) YTD (%)

7.62 USDEUR Euro 0.724 0.000 0.01 -0.40

1.33 USDGBP 0.596 0.000 0.02 -1.34

USDCHF Switzerland 0.884 0.002 0.19 -0.91

2.51 USDCAD Canada 1.102 0.001 0.12 3.57

-139.9 -6.48 -24.02 USDAUD Australia 1.072 0.005 0.42 -4.78

17.24 USDNZD New Zealand 1.165 0.006 0.52 -4.48

Wheat (USD/bu.) 691.3 3.3 0.47 14.21 USDJPY Japan 102.43 0.200 0.20 -2.68

15.35 USDCNY China 6.22 0.00 0.04 2.79

Rice (Indonesia) (Rp/kg) 8,600.0 0.0 0.00 0.00 USDHKD Hongkong 7.754 0.000 0.00 0.00

USDSGD Singapore 1.253 0.002 0.16 -0.82

Rupiah Indonesia 11,424 -12.00 -0.10 -6.14

Market Div. Yield (%)

United Kingdom

Statistics

INDONESIA & SECTORS +/- (%) YTD(%)

COMMODITIES +/- (%) YTD(%)

INDICES REGION +/- (%) YTD(%)

KURS REGION +/- (%) YTD(%)

JCI WINNERS (%) JCI LOSERS (%) JCI VOLUME (Lot) JCI FREQ (X) JCI VALUE (Rpmn)

PT Trimegah Securities Tbk - www.trimegah.com

4 DAILY

World Economic Calendar

Date Time Country Event Period Survey Actual Prior

16-Apr-14 US Housing Starts (000's) Mar 970 946 920

US Building Permits (000's) Mar 1,010 990 1,014

US Industrial Production MoM (%) Mar 0.5 0.7 1.2

CH GDP YoY (%) 1Q 7.3 7.4 7.7

EC CPI MoM (%) Mar 1.0 0.9 0.3

EC CPI YoY (%) Mar F 0.5 0.5 0.5

JN Industrial Production MoM (%) Feb F -- -2.3 -2.4

17-Apr-14 US Philadelphia Fed Business Outlook Apr 9.5 16.6 9.0

US Initial Jobless Claims (000's) 12-Apr 315 304 302

21-Apr-14 JN Trade Balance (JPY bn) Mar -1,066.0 -- -802.5

JN Exports YoY (%) Mar 7.2 -- 9.8

JN Imports YoY (%) Mar 15.5 -- 9.0

22-Apr-14 US Existing Home Sales (USD mn) Mar 4.55 -- 4.60

US Existing Home Sales MoM Mar -1.1 -- -0.40

EC Consumer Con!dence Apr A -9.3 -- -9.3

23-Apr-14 US Markit US Manufacturing PMI Apr P 56.3 -- 55.5

US New Home Sales (000's) Mar 455 -- 440

US New Home Sales MoM (%) Mar 3.4 -- -3.30

CH HSBC China Manufacturing PMI Apr P 48.5 -- 48.0

EC Markit Eurozone Manufacturing PMI Apr P 53.0 -- 53.0

GE Markit/BME Germany Mfg PMI Apr P 53.7 -- 53.7

24-Apr-14 US Durable Goods Orders (%) Mar 1.0 -- 2.2

GE IFO Business Climate Apr 110.4 -- 110.7

GE IFO Expectations Apr 105.8 -- 106.4

25-Apr-14 US Univ. of Michigan Con!dence Apr F 83.0 -- 82.6

US Markit US Composite PMI Apr P -- -- 55.7

US Markit US Services PMI Apr P -- -- 55.3

JN Natl CPI YoY (%) Mar 1.7 -- 1.5

27-Apr-14 GE Retail Sales MoM (%) Mar -- -- 1.3

GE Retail Sales YoY (%) Mar -- -- 2.0

28-Apr-14 US Pending Home Sales MoM (%) Mar -- -- -0.8

US Pending Home Sales YoY (%) Mar -- -- -10.2

US Dallas Fed Manf. Activity Apr -- -- 4.9

29-Apr-14 US Consumer Con!dence Index Apr -- -- 82.3

GE CPI MoM (%) Apr P -- -- 0.30

GE CPI YoY (%) Apr P -- -- 1.0

JN Industrial Production MoM (%) Mar P -- -- -2.3

30-Apr-14 US ADP Employment Change (000's) Apr -- -- 191

US GDP Annualized QoQ (%) 1Q A 1.0 -- 2.6

US Personal Consumption (%) 1Q A -- -- 3.3

US Core PCE QoQ (%) 1Q A -- -- 1.3

US ISM Milwaukee Apr -- -- 56.03

US Chicago Purchasing Manager Apr -- -- 55.9

GE Unemployment Change (000's) Apr -- -- -12000

GE Unemployment Rate (%) Apr -- -- 6.7

PT Trimegah Securities Tbk - www.trimegah.com

5 DAILY 5

RESEARCH TEAM

Sebastian Tobing, CFA

Head of Research & Institutional Sales

(sebastian.tobing@trimegah.com)

Frederick Daniel Tanggela

Equity Analyst

(frederick.daniel@trimegah.com)

Robby Ha!l

Equity Analyst

(robby.ha!l@trimegah.com)

Melvina Wildasari

Equity Analyst

(melvina.wildasari@trimegah.com)

EQUITY CAPITAL MARKET TEAM

JAKARTA

Nathanael Benny Prasetyo

Head of Retail ECM

(benny.prasetyo@trimegah.com)

Ariawan Anwar

Artha Graha, Jakarta

(ariawan.anwar@trimegah.com)

Windra Djulnaily

Pluit, Jakarta

(windra.djulnaily@trimegah.com)

Musji Hartono

Mangga Dua, Jakarta

(musji.hartono@trimegah.com)

Ferry Zabur

Kelapa Gading, Jakarta

(ferry.zabur@trimegah.com)

Very Wijaya

BSD, Jakarta

(very.wijaya@trimegah.com)

SUMATRA

Juliana Effendy

Medan, Sumatera Utara

(juliana.effendi@trimegah.com)

Tantie Rivi Watie

Pekanbaru, Riau

(tantierw@trimegah.com)

Hari Mulyono Soewandi

Palembang, Sumatra Selatan

(hari.mulyono@trimegah.com)

Maria Renata

Equity Analyst

(maria.renata@trimegah.com)

Gina Novrina Nasution, CSA

Equity Analyst

(gina.nasution@trimegah.com)

Hapiz Sakti Azi

Research Associate

(hapiz.azi@trimegah.com)

Paula Ruth

Research Associate

(paula@trimegah.com)

EAST INDONESIA

Wiranto Sunyoto

Branch Area Manager

(wiranto.sunyoto@trimegah.com)

Sonny Muljadi

Surabaya, Jawa Timur

(sonny.muljadi@trimegah.com

Ni Made Dwi Hapsari Wijayanti

Denpasar, Bali

(dwihapsari.wijayanti@trimegah.com)

Ivan Jaka Perdana

Malang, Jawa Timur

(ivan.perdana@trimegah.com)

Agus Jatmiko

Balikpapan, Kalimantan Timur

(agus.jatmiko@trimegah.com)

Ari!n Pribadi

Ujung Pandang, Sulawesi Selatan

(ari!n.pribadi@trimegah.com)

CENTRAL JAVA

Agus Bambang Suseno

Solo, Jawa Tengah

(agus.suseno@trimegah.com)

Andrew Jatmiko

Yogyakarta, Jawa Tengah

(andrew.jatmiko@trimegah.com)

Muhammad Ishaq

Semarang, Jawa Tengah

muhammad.ishaq@trimegah.com)

Joshua N.C. Tjeuw

Research Associate

(joshua.tjeuw@trimegah.com)

Rovandi

Research Associate

(rovandi@trimegah.com)

WEST JAVA

Asep Saepudin

Bandung, Jawa Barat

(asep.saepudin@trimegah.com)

Arif!anto

Cirebon, Jawa Barat

(arif!anto@trimegah.com)

INSTITUTIONAL SALES

Daniel Dwi Seputro

Head of Institutional Equity Sales

daniel.dwi@trimegah.com

Dewi Yusnita

Equity Institutional Sales

dewi.yusnita@trimegah.com

Meitawati

Equity Institutional Sales

meitawati.edianingsih@trimegah.com

Fachruly Fiater

Equity Institutional Sales

fachruly.!ater@trimegah.com

Henry Sidarta

Equity Institutional Sales

henry.sidarta@trimegah.com

Raditya Andyono

Equity Institutional Sales

raditya.andyono@trimegah.com

Nancy Pardede

Equity Institutional Sales

nancy.pardede@trimegah.com

DISCLAIMER:

This report has been prepared by PT Trimegah Securities Tbk on behalf of itself and its afliated companies

and is provided for information purposes only. Under no circumstances is it to be used or considered as

an offer to sell, or a solicitation of any offer to buy. This report has been produced independently and the

forecasts, opinions and expectations contained herein are entirely those of Trimegah Securities. While all

reasonable care has been taken to ensure that information contained herein is not untrue or misleading at

the time of publication, Trimegah Securities makes no representation as to its accuracy or completeness and

it should not be relied upon as such. This report is provided solely for the information of clients of Trimegah

Securities who are expected to make their own investment decisions without reliance on this report. Neither

Trimegah Securities nor any ofcer or employee of Trimegah Securities accept any liability whatsoever for

any direct or consequential loss arising from any use of this report or its contents. Trimegah Securities and/or

persons connected with it may have acted upon or used the information herein contained, or the research or

analysis on which it is based, before publication. Trimegah Securities may in future participate in an offering

of the companys equity securities.

PT Trimegah Securities Tbk

Gedung Artha Graha 18

th

Floor

Jl. Jend. Sudirman Kav. 52-53

Jakarta 12190, Indonesia

t. +62-21 2924 9088

f. +62-21 2924 9150

www.trimegah.com

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Trimegah CF 20151117 Silo Reduces Estimates Maintain Buy 2Documento6 pagineTrimegah CF 20151117 Silo Reduces Estimates Maintain Buy 2Joyce SampoernaNessuna valutazione finora

- Audit Forensik Sesi 01 Dosen LainDocumento29 pagineAudit Forensik Sesi 01 Dosen LainJoyce SampoernaNessuna valutazione finora

- 2Documento15 pagine2Joyce SampoernaNessuna valutazione finora

- Trimegah CF 20151117 Silo Reduces Estimates Maintain Buy 2Documento6 pagineTrimegah CF 20151117 Silo Reduces Estimates Maintain Buy 2Joyce SampoernaNessuna valutazione finora

- TRIM DailyDocumento9 pagineTRIM DailyJoyce SampoernaNessuna valutazione finora

- TRIM DailyDocumento14 pagineTRIM DailyJoyce SampoernaNessuna valutazione finora

- 2Documento15 pagine2Joyce SampoernaNessuna valutazione finora

- TRIM DailyDocumento14 pagineTRIM DailyJoyce SampoernaNessuna valutazione finora

- TRIM DailyDocumento16 pagineTRIM DailyJoyce SampoernaNessuna valutazione finora

- 2Documento15 pagine2Joyce SampoernaNessuna valutazione finora

- Trimegah Economy 20151120 Economy Outlook 2016 2Documento20 pagineTrimegah Economy 20151120 Economy Outlook 2016 2Joyce SampoernaNessuna valutazione finora

- Trimegah CF 20151117 Silo Reduces Estimates Maintain Buy 2Documento6 pagineTrimegah CF 20151117 Silo Reduces Estimates Maintain Buy 2Joyce SampoernaNessuna valutazione finora

- TRIM DailyDocumento15 pagineTRIM DailyJoyce SampoernaNessuna valutazione finora

- TRIM DailyDocumento17 pagineTRIM DailyJoyce SampoernaNessuna valutazione finora

- TRIM DailyDocumento15 pagineTRIM DailyJoyce SampoernaNessuna valutazione finora

- TRIM DailyDocumento9 pagineTRIM DailyJoyce SampoernaNessuna valutazione finora

- Created by Trial Version: Market ShareDocumento1 paginaCreated by Trial Version: Market ShareJoyce SampoernaNessuna valutazione finora

- Press Release Agen Penjual Ori012 2015 Eng Final 17sep15 Website 1Documento2 paginePress Release Agen Penjual Ori012 2015 Eng Final 17sep15 Website 1Joyce SampoernaNessuna valutazione finora

- TRIM Technical Call: JCI ChartDocumento5 pagineTRIM Technical Call: JCI ChartJoyce SampoernaNessuna valutazione finora

- td140414 2Documento6 paginetd140414 2Joyce SampoernaNessuna valutazione finora

- td140502 2Documento12 paginetd140502 2Joyce SampoernaNessuna valutazione finora

- BT 28 MeiDocumento4 pagineBT 28 MeiJoyce SampoernaNessuna valutazione finora

- TRIM Technical Call: JCI ChartDocumento5 pagineTRIM Technical Call: JCI ChartJoyce SampoernaNessuna valutazione finora

- 2Documento8 pagine2Joyce SampoernaNessuna valutazione finora

- TRIM DailyDocumento7 pagineTRIM DailyJoyce SampoernaNessuna valutazione finora

- td140417 2Documento8 paginetd140417 2Joyce SampoernaNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- RM - Cia 3Documento14 pagineRM - Cia 3KULDEEP SINGH 2228327Nessuna valutazione finora

- 12 Things Not To Do in M&ADocumento15 pagine12 Things Not To Do in M&Aflorinj72Nessuna valutazione finora

- Summary - CAIIBDocumento9 pagineSummary - CAIIBbinalamitNessuna valutazione finora

- Edu 2009 Spring Exam Mfe QaDocumento154 pagineEdu 2009 Spring Exam Mfe QaYan David WangNessuna valutazione finora

- Glasanay BF Q3W3Documento4 pagineGlasanay BF Q3W3Whyljyne Mary GlasanayNessuna valutazione finora

- Annexure-B: Format - Daily Margin Statement To Be Issued To Clients Client Code: Clientname: ExchangeDocumento1 paginaAnnexure-B: Format - Daily Margin Statement To Be Issued To Clients Client Code: Clientname: ExchangeenamsribdNessuna valutazione finora

- The Quintessential PragmatistDocumento47 pagineThe Quintessential PragmatistdivashreebNessuna valutazione finora

- Stock Screener PDFDocumento4 pagineStock Screener PDFchintanghadiyaliNessuna valutazione finora

- IFRS 15 Part 2 Performance Obligations Satisfied Over TimeDocumento26 pagineIFRS 15 Part 2 Performance Obligations Satisfied Over TimeKiri chrisNessuna valutazione finora

- Q4FY23 Financial ResultsDocumento21 pagineQ4FY23 Financial ResultsRiya ThakurNessuna valutazione finora

- Entity Annual Reports IDC 2016Documento50 pagineEntity Annual Reports IDC 2016mubiana777Nessuna valutazione finora

- Bharti School of Engineering ENGR 3426-Engineering Economics Project (DCF and Risk Analysis)Documento23 pagineBharti School of Engineering ENGR 3426-Engineering Economics Project (DCF and Risk Analysis)Victor NwaborNessuna valutazione finora

- Bank Reconciliation StatementDocumento8 pagineBank Reconciliation StatementSyed Adnan HossainNessuna valutazione finora

- Case 1: Impairment On Local Level: Tax Rate 25% Change in Value T 1 vs. T 2Documento1 paginaCase 1: Impairment On Local Level: Tax Rate 25% Change in Value T 1 vs. T 2singhsanjNessuna valutazione finora

- SBIDocumento11 pagineSBIsourav khandelwalNessuna valutazione finora

- K Limited WorksheetDocumento4 pagineK Limited WorksheetHamdan MushoddiqNessuna valutazione finora

- e-StatementBRImo 157901013063500 Mar2023 20230626 152453Documento3 paginee-StatementBRImo 157901013063500 Mar2023 20230626 152453PoncolFc TVNessuna valutazione finora

- Qualifying Job Titles For FRM CertificationDocumento6 pagineQualifying Job Titles For FRM CertificationAnoop TyagiNessuna valutazione finora

- Original Cost Depreciation Expenses Salvage Value Useful Life Book Value Start Depreciation Expenses Acummulated Depreciation Book Value EndDocumento9 pagineOriginal Cost Depreciation Expenses Salvage Value Useful Life Book Value Start Depreciation Expenses Acummulated Depreciation Book Value EndAnonymous jlLBRMAr3ONessuna valutazione finora

- DDMPR Q1 2021 Quarterly ReportDocumento36 pagineDDMPR Q1 2021 Quarterly ReportChristian John RojoNessuna valutazione finora

- 5 6188064231535936141Documento95 pagine5 6188064231535936141SRISAI SURYANessuna valutazione finora

- BNR-National Bank of Rwanda - Exchange RatesDocumento1 paginaBNR-National Bank of Rwanda - Exchange RatesPaulo GóisNessuna valutazione finora

- MCQS On Financial ManagementDocumento3 pagineMCQS On Financial ManagementAnonymous kwi5IqtWJNessuna valutazione finora

- Executive SummeryDocumento18 pagineExecutive SummeryImtiaz RashidNessuna valutazione finora

- Chapter 4Documento22 pagineChapter 4Hussien NizaNessuna valutazione finora

- Accounting of Share Capital: CA Navaraj Lamichhane CAP-II, "Dec-2020" Ca, MbsDocumento9 pagineAccounting of Share Capital: CA Navaraj Lamichhane CAP-II, "Dec-2020" Ca, MbsbinuNessuna valutazione finora

- Synopsis On Capital StructureDocumento11 pagineSynopsis On Capital StructureSanjay MahadikNessuna valutazione finora

- M&A StudyDocumento90 pagineM&A Studyapp04127Nessuna valutazione finora

- Review Questions and ProblemsDocumento13 pagineReview Questions and ProblemsLalaina EnriquezNessuna valutazione finora

- Financial Institutions Management A Risk Management Approach 9Th Edition Saunders Test Bank Full Chapter PDFDocumento50 pagineFinancial Institutions Management A Risk Management Approach 9Th Edition Saunders Test Bank Full Chapter PDFclubhandbranwq8100% (11)