Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Personal Finance 30 Budgeting (Day 09) - Lesson Plan

Caricato da

mrmclauchlinCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Personal Finance 30 Budgeting (Day 09) - Lesson Plan

Caricato da

mrmclauchlinCopyright:

Formati disponibili

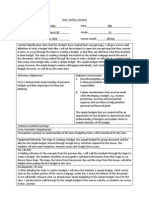

Budget Elements Name: Subject: Semester: Todd McLauchlin Personal Finance 30 Winter 2014 Date: Grade: Lesson Length:

TBD 12 60 min

Content Identification: Today's class will serve as both an introduction to the coming units and a way to help connect the concept of budgeting to other personal financial topics. This lesson is not meant to be a thorough lesson in investing, credit, savings, purchasing, fraud or taxation, but instead introduce the elements as aspects of budgeting. To begin it will be helpful to have a definition of some of these terms; therefore the first portion of the class will be spent defining investing, credit, loans, savings, fraud, risk, taxation and purchasing. The definitions will be placed on the students portion of the course webpage (for future reference), but are also included at the end of this lesson plan. We will then spend the second half of the class creating a Google Doc, which will help us form connections between budgeting and the topics to come. The students will add how they think each topic connects to budgeting, in the Google Doc, which can be found at http://goo.gl/fb5VQv The students will also add any points they already know about these topics, either from the definitions we just explored or from prior knowledge. I am budgeting 25 minutes for this exercise, as I expect we can easily spend 5 minutes on each of the 5 topics. However, if we have extra time at the end of class, the students will be given the remaining time to work on their projects. The purpose of this exercise is twofold, first to diagnose what the students already know about a number of personal finance topics, and second, to help connect budgeting to the rest of the course, as budgeting will become the continuous and connecting concept throughout the semester. Outcomes (Objectives): PF(L) 5-Demonstrate understanding of personal budgets and their importance for financial planning. Indicators (Assessment): a. Describe budgeting and explain how it relates to financial problem solving and financial responsibility. b. Identify and describe the key terminology associated with budgeting such as assets, budgets and liabilities.

The students will be able to identify key terms and concepts of personal finance and connect them to the concept of budgeting. The Google Doc will serve as a simple, informal, diagnostic of the overall classes understanding of personal financial topics. Common Essential Learnings: Critical and Creative Thinking Cross-Curricular Competencies: Developing Thinking Prerequisite Learning: An understanding of budgets, budgeting terminology and layout, need vs. wants and long-term and short-term goal will be required for this lesson. Additionally, an understanding of how the items on a budget are connected to each will be beneficial.

Equipment/Materials: The Creating a Budget: Personal Budget assignment and rubric, Google Drive access, internet/computer access and Word Press will all be required. Set: (9 min) 1) The class will begin with a brief summary of the budgeting terms and concepts we have already seen. This will help the student prepare for the budgeting elements we will discuss in this class. We will briefly review income, expense (fixed, variable, required and optional), short/long-term goals and need/wants. Development: (25 min + 25 min) 1) I will move directly from the review into the new material. Terminology can be rather dry at times, and we will break this into two parts to help with that. This class will help serve as a bridge between budgeting and the rest of the course, as well as, it will give me an opportunity to diagnose the overall class knowledge of personal finance topics. 2) I will share with the students the definitions of investing, credit, loans, savings, fraud, risk, taxation and purchasing. These definitions will also be available to the students on the course webpage. 3) Once we have briefly introduced each term, we will conduct an activity, which will ask all the students to sign into one Google Doc at the same time. 4) The students will then contribute ideas, thoughts and comments on how they think each concept is connected with budgeting. They will also add in any knowledge they already have about the topic, including what we just discussed in the definitions. Closure: (1 min) 1) If this exercise is done early, then the students will have the remainder of the class time to work on their budgets. Otherwise, I will inform the students that the next two classes are work periods on the two budgeting assignments, following which we will move on two unit 2. Terms for Defining: Investment: An investment is an asset or position that is purchased with the belief that it will improve the overall financial position of its owner. It hopes it that asset will appreciate, that is they will grow in value, then the investment can later be sold, at a higher price, because of this growth, making the owner a profit. Some examples of investments are investing in your education, by paying to go to university, investing in property by buying a house or land or investing in a business by buying direct ownership of the business. Investments, in a financial sense can also include bonds, savings accounts, Guaranteed Investment Certificates (GICs), Mutual Funds, Index Funds, Stocks, Commodities, etc. Credit: The term credit is a very broad term, it can describe loans, equity to shareholder and even praise for doing something well. The portion of a line of credit, which is currently available to use, is also called credit. This is most commonly seen in credit cards, but can also be found in bank lines of credit. A person can also have bad credit, which means that the person is a high risk to extend credit (such as a credit card). You can also have a credit limit, which is the amount a financial institution is willing to extend to you. Loans: A loan is provided to you by a financial institution, private individual or enterprise. There are many types, some secured and some unsecured. Secured loans are supported by collateral, such as a house, in order to balance against the loan, while unsecured loans do not require collateral and are granted based on the credit of the individual.

Savings: Savings occur when your monthly income is higher than your monthly expenses. Savings can be invested, and the most common way is in a savings account. Savings accounts will pay you interest to have the money held in the savings account and used by the bank, but this amount is typically rather small. Savings can also occur when a projected set of personal expenses come in at a lower value than expected. Fraud: Fraud is defined as the wrongful deception that is intended to cause financial or personal gain for the fraudster. There are many different types of frauds but some of the most common are investment fraud and identity fraud. Investment fraud is when someone creates deliberate falsehoods in financial data or financial information to ensure the investment is in their favor. Identity fraud involves the deliberate use of someone else's personal identity, either for financial gain, directly from the person, or with the intent of fraudulent activities, to gain financial position from someone else. Risk: Risk is being exposed to, or having something of value exposed to, something dangerous, harmful or that can cause loss. In finance, risk involves the possibility of losing the original investment. Risk is tied closely with the thought of return, and it is thought to increase your return potential you need to increase the risk you are exposed to, when investing. The simple reason for this is that in order to encourage investment in riskier positions, the investor must be compensated. To compensate the investor for the increased risk, the return potential must also increase. Taxation: As covered before, a tax is imposed on your income generated through employment, by the government. Under the law, both businesses and individuals must file an income tax return each year to determine whether they owe any taxes or are eligible for a tax refund. Income tax will be covered in greater detail in the coming units. In general, however, a tax is a strain on your powers or resources, and goes beyond income tax to include sales tax, capital gains tax (which is the tax you pay when you sell an item for a higher price than you purchased it for) and property tax. There are also items or investments that are tax free, such as a Tax Free Savings Account, where the contributions, interest and withdrawal of funds does not incur a tax charge. Purchasing: Purchasing is intuitively the act of buying something; however, it can be contrasted against renting and leasing. Renters do not own the item or property, as the purchaser does; instead, they pay the owner a fee for usage of that item. Leases are the legal contracts that lay out the renting details and guarantee that the owner is paid and the renter has usage of the item.

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- UBS 2023 M&A OutlookDocumento21 pagineUBS 2023 M&A Outlooktan weihong7370Nessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Bank of America Global Equity ValuationDocumento56 pagineBank of America Global Equity Valuationrichard100% (1)

- Equity Investments PPT PresentationDocumento80 pagineEquity Investments PPT PresentationRupal Rohan Dalal100% (1)

- Smithson Rediscovering WDGanns Method of Forecasting The Financial MarketsDocumento24 pagineSmithson Rediscovering WDGanns Method of Forecasting The Financial Marketsmadeoff100% (2)

- Literature ReviewDocumento13 pagineLiterature ReviewSukhraj Kaur Chhina100% (5)

- Personal Finance 30 Budgeting (Day 10-11) - Lesson PlanDocumento2 paginePersonal Finance 30 Budgeting (Day 10-11) - Lesson PlanmrmclauchlinNessuna valutazione finora

- Personal Finance 30 Budgeting (Day 03) - Lesson PlanDocumento2 paginePersonal Finance 30 Budgeting (Day 03) - Lesson PlanmrmclauchlinNessuna valutazione finora

- Todd S. McLauchlin: Business Educator ResumeDocumento3 pagineTodd S. McLauchlin: Business Educator ResumemrmclauchlinNessuna valutazione finora

- Creating A Personal Household AssignmentDocumento5 pagineCreating A Personal Household AssignmentmrmclauchlinNessuna valutazione finora

- Personal Finance 30 Budgeting (Day 02) - Lesson PlanDocumento2 paginePersonal Finance 30 Budgeting (Day 02) - Lesson PlanmrmclauchlinNessuna valutazione finora

- Personal Finance 30 Budgeting (Day 05) - Lesson PlanDocumento3 paginePersonal Finance 30 Budgeting (Day 05) - Lesson PlanmrmclauchlinNessuna valutazione finora

- Personal Finance 30 Budgeting (Day 07) - Lesson PlanDocumento2 paginePersonal Finance 30 Budgeting (Day 07) - Lesson PlanmrmclauchlinNessuna valutazione finora

- Personal Finance 30 Budgeting (Day 08) - Lesson PlanDocumento2 paginePersonal Finance 30 Budgeting (Day 08) - Lesson PlanmrmclauchlinNessuna valutazione finora

- Personal Finance 30 Budgeting (Day 06) - Lesson PlanDocumento3 paginePersonal Finance 30 Budgeting (Day 06) - Lesson PlanmrmclauchlinNessuna valutazione finora

- Creating A Personal Budget AssignmentDocumento3 pagineCreating A Personal Budget Assignmentmrmclauchlin100% (2)

- Sample BudgetDocumento2 pagineSample BudgetmrmclauchlinNessuna valutazione finora

- Visual Connections Assignment & RubricDocumento3 pagineVisual Connections Assignment & RubricmrmclauchlinNessuna valutazione finora

- Personal Finance 30 Budgeting (Day 04) - Lesson PlanDocumento3 paginePersonal Finance 30 Budgeting (Day 04) - Lesson PlanmrmclauchlinNessuna valutazione finora

- Personal Finance 30 Budgeting (Day 01) - Lesson PlanDocumento4 paginePersonal Finance 30 Budgeting (Day 01) - Lesson PlanmrmclauchlinNessuna valutazione finora

- Todd McLauchlin Business Educator: ResumeDocumento3 pagineTodd McLauchlin Business Educator: ResumemrmclauchlinNessuna valutazione finora

- Photography Scale - Best Directional LightingDocumento4 paginePhotography Scale - Best Directional LightingmrmclauchlinNessuna valutazione finora

- Unit Plan Personal Finance 30Documento119 pagineUnit Plan Personal Finance 30mrmclauchlinNessuna valutazione finora

- Local Entrepreneur Presentation Assignment & RubricDocumento3 pagineLocal Entrepreneur Presentation Assignment & RubricmrmclauchlinNessuna valutazione finora

- Unit Plan Accounting 20: Posting To General and Subsidiary LedgersDocumento81 pagineUnit Plan Accounting 20: Posting To General and Subsidiary LedgersmrmclauchlinNessuna valutazione finora

- Case Study - The Merger Continues (Pasqua Moostoos High School Classroom Layout)Documento5 pagineCase Study - The Merger Continues (Pasqua Moostoos High School Classroom Layout)mrmclauchlinNessuna valutazione finora

- Social Studies 9 - Why Should We Learn About HistoryDocumento47 pagineSocial Studies 9 - Why Should We Learn About HistorymrmclauchlinNessuna valutazione finora

- Nvestment Consulting: A Conversation With Peter BernsteinDocumento13 pagineNvestment Consulting: A Conversation With Peter BernsteinPavankumar KaredlaNessuna valutazione finora

- 7 Intraday TricksDocumento15 pagine7 Intraday TricksAnonymous 5mSMeP2jNessuna valutazione finora

- B7110-001 Financial Statement Analysis and Valuation PDFDocumento3 pagineB7110-001 Financial Statement Analysis and Valuation PDFLittleBlondie0% (2)

- Msci Malaysia IndexDocumento2 pagineMsci Malaysia IndexRahul RaiNessuna valutazione finora

- Boda Boda Business Plan: Sholinke Smart Boooda (SSB)Documento11 pagineBoda Boda Business Plan: Sholinke Smart Boooda (SSB)omadiNessuna valutazione finora

- HW2 - Preparing Statement of Cash FlowsDocumento2 pagineHW2 - Preparing Statement of Cash FlowsDeepak KapoorNessuna valutazione finora

- Chapter 2-Commercial Banks: Bank Put NameDocumento3 pagineChapter 2-Commercial Banks: Bank Put NameYeane FeliciaNessuna valutazione finora

- DDU Risk Management &derivativesDocumento27 pagineDDU Risk Management &derivativesgauravNessuna valutazione finora

- Bhel Ratio AnalysisDocumento5 pagineBhel Ratio AnalysisPuja AryaNessuna valutazione finora

- 1-Ravi Kishore Manual (MYRAO)Documento402 pagine1-Ravi Kishore Manual (MYRAO)Ahsan RazaNessuna valutazione finora

- Chapter 2 2 Risk Structure and Term Structure of Interest RatesDocumento38 pagineChapter 2 2 Risk Structure and Term Structure of Interest RatesLâm BullsNessuna valutazione finora

- Impact of Changes in Accounting PoliciesDocumento16 pagineImpact of Changes in Accounting Policiessantosh kumar mauryaNessuna valutazione finora

- Northern RockDocumento15 pagineNorthern RockÁi PhươngNessuna valutazione finora

- Ra 9829Documento21 pagineRa 9829JayMichaelAquinoMarquezNessuna valutazione finora

- BCG MatrixDocumento2 pagineBCG Matrixpallav86Nessuna valutazione finora

- Effects of Unemployment On Economic Growth of Pakistan: Roll No: NamesDocumento10 pagineEffects of Unemployment On Economic Growth of Pakistan: Roll No: NamesAyesha BakhtawarNessuna valutazione finora

- Exercise 2.2Documento18 pagineExercise 2.2Stephanie Xie100% (1)

- Weath ManagementDocumento116 pagineWeath ManagementKalpeshNessuna valutazione finora

- IDirect Motogaze Aug16Documento16 pagineIDirect Motogaze Aug16umaganNessuna valutazione finora

- Accounting Chap 10 - Sheet1Documento2 pagineAccounting Chap 10 - Sheet1Nguyễn Ngọc Mai100% (1)

- FortuneDocumento27 pagineFortuneSatish PenumarthiNessuna valutazione finora

- Jonathan Barrett Resume - Harlem Link Charter School Board Application - Vol 2 of 3 - PG 431-432Documento2 pagineJonathan Barrett Resume - Harlem Link Charter School Board Application - Vol 2 of 3 - PG 431-432Fuzzy PandaNessuna valutazione finora

- Cap BudDocumento3 pagineCap BudRarajNessuna valutazione finora

- Shadow Banking SystemDocumento1 paginaShadow Banking SystemSeanNessuna valutazione finora

- Long-Term Liabilities: QuestionsDocumento74 pagineLong-Term Liabilities: QuestionsChu Thị ThủyNessuna valutazione finora