Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Bookkeeping Lab

Caricato da

Proff MjiCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Bookkeeping Lab

Caricato da

Proff MjiCopyright:

Formati disponibili

IBSS Week 3 Bookkeeping Lab/Assignment Value: 1 mark Due: At end of class or as allowed by instructor Purpose: To implement a simple set

t of accounting records using an example of accounting software At the end of the lab, the student should be able to: 1. 2. 3. 4. Download and/or install the GnuBooks software Start the software and open a previously saved accounts file Properly enter a series of accounting transactions Given a set of proper entries, use the software to produce a Trial Balance, a Balance Statement and a Statement of Profit and Loss

Before Starting 1. Review the document on Common Transactions 2. Make sure you understand the basics of a. Which accounts are involved in a transaction b. Where the money moves from (credit) c. Where the money moves to (debit) Scenario Mr. N. E. Mann has started a business and wants you to set up the bookkeeping using GnuCash. The following transactions happen during January (student should use current month). The student is to enter the transactions properly and produce a Balance Sheet, and a Statement of Profit or Loss. The accounting for Cost of Goods Sold will reflect Periodic Inventory accounting (i.e. the COGS will be calculated at the end of the month and posted against the end of month value of Inventory.) Please note: The transaction entries will have dates in January. When you do the exercise, change the month to the current month. The scenario is taken from a book written in 1962 (Blackstone, 1973), so the amounts in the transactions may not reflect todays dollar amounts.

Steps (Please read the steps carefully!) 1. Download and install the software from http://gnucash.org/download.phtml 2. Download the N E Mann Startup file from SLATE. You should create a special folder for your GnuCash files, because a number of files will be created in the course of using the tool. 3. Open the file by double-clicking the icon in the file folder. Immediately save a copy as N E Mann Books <yourname> where yourname is just that your name. Use this file for the exercise.

Page 1

4. You will see a pre-made set of accounts:

5. The first transaction is to show that to start the business, the owner deposits $12,000 of his own money in the bank. In this case, the money is considered to come from the owners Capital Account and going to Cash. The date for this is Jan. 1. a. The amount being increased is Cash, so open the Cash account by double-clicking on the account name b. Enter the date as Jan 1. c. Enter Start-up Cash in the Description Field d. Move to the Transfer field. Pick N. E. Mann, Capital using the drop-down list e. Move to the Increase field and enter the amount 12,000 f. So far, things should look like (with the list shown):

g. Press the Enter icon to save the transaction h. Close the transaction window

Page 2

6. Your accounts should now be updated with the transaction:

7. Next, a series of transactions are needed in order to get the business set up: Jan 2 Withdrew cash from the bank and paid it out for the following: Store Equipment, $2.600; Inventory, $2,800; Office Supplies, $30; Store rent for the month, $750 Notice that in all of these, we are spending money (Cash) a. The first transaction is to buy Store Equipment for $2,600. Once again, the money is flowing from Cash (credit to Cash) to an Expense (Debit to Store Equipment) i. Open the Store Equipment account (where the money is going) ii. Enter the date: Jan 2 iii. Enter the reason for the transaction in the Memo column iv. Set the Transfer account to Cash (where the money is coming from) v. Enter the amount, $2,600 (entered as 2600). Since we are increasing the amount of the Store Equipment, this goes in the Increasing column vi. Ensure you have everything right, then click the ENTER button or key. vii. Your entry window should look something like this:

viii. Close the Transaction view.

Page 3

b. Next we will pay $2800 to buy some inventory (goods for sale). Once again, the money is coming from cash (CR to Cash), and going to increase our Inventory account (DR to Inventory) i. Open the Inventory account ii. Enter the date as Jan 2 iii. Enter the reason for the transaction iv. Choose Cash as the Transfer Account (thats where the money is coming from) v. Enter the amount of 2800 in the Increase column (once again we are decreasing cash and increasing the amount of assets vi. Enter the transaction (Enter button or key), and close the transaction view. c. Next, we are paying $30 for office supplies. The first two transactions were to increase our Store Equipment and Inventory assets. Office Supplies is an Expense account. However, we are still increasing the amount of our expenses (DR to Office Supplies) and decreasing the amount of our cash (CR to Cash). i. Open the Office Supplies account ii. Enter the date (Jan 2) and reason iii. Once again the Transfer account is Cash. iv. Enter the amount of $30 in the Expense column v. Enter the transaction and close the view d. Finally, we are paying $750 for renting the place for the store. Once again, Rent is an expense that we are increasing (DR), and Cash is the asset we are decreasing (CR) i. Open the Rent account ii. Enter the date and reason iii. The money comes from Cash, so that is the Transfer account. iv. Enter the amount, 750, into the Expense column v. Accept the transaction and close the Transaction view 8. If you have completed the steps properly so far, the Accounts window should look like:

Page 4

9. Now, enter the following transactions. Remember: a. You need to: i. Select the account where the money is going ii. Put in the date and reason for the transaction in the Date and Memo columns respectively iii. Select the account where the money is coming from as the Transfer account iv. Pick the amount column that matches the transaction, and put in the proper amount v. Enter the transaction. b. Jan 5 - Bought inventory costing $4,500 on credit, to be paid in 10 days i. The account is Inventory ii. The transfer account is Cash iii. The amount goes in the Increase column c. Jan 8 - Paid $450 to place advertisements in newspapers i. The account is Advertising ii. The transfer account is Cash iii. The amount goes in the Expense column d. Jan 10 - Sold goods for $2,100 cash, and for $4,300 to be paid for by customers in 30 days. Two separate amounts are moving from Sales (the source of the money) to Cash and to Accounts Receivable. Therefore there are two transactions. Note to those with experience: do not be concerned for issues of Inventory and Cost of Goods Sold; that is handled at the end. i. Sales are the opposite of Expenses as money is coming into the business from a sale. However, the Sale is the focal point, so we open Sales. The money coming in from a sale adds to our Cash or Receivables assets. ii. For the cash sale, the money is transferred to Cash, and is posted to the Income column in Sales. iii. For the credit sale, the transfer account is Accounts Receivable, and the amount is, once again, posted in the Income column in Sales e. Jan 15 - Paid $4,500 for the inventory previously purchased on credit i. Here, we are paying what we owe, not for an expense. ii. Use the Accounts Payable account iii. We are paying with cash, so the transfer account is Cash iv. We are reducing the amount we owe, so the amount paid goes in the Decrease column f. Jan 17 - Paid the telephone bill, $15 i. Account is Telephone ii. Transfer account is Cash iii. Amount goes into the Expense column g. Jan 19 - Sold inventory for $1,800 cash i. Another cash sale ii. Account is Sales Page 5

iii. Transfer account is Cash iv. Amount goes to Income column h. Jan 23 - Bought inventory for $2,400, to be paid next month i. Another credit sale ii. Account is Sales iii. Transfer account is Accounts Payable iv. Amount goes in the Income column i. Jan 25 - Received $2,800 from customer who previously bought goods on credit. (This is a partial payment of the total amount owing) i. This is a payment from a customer of an amount they owe the company ii. The account is Accounts Receivable iii. The transfer account is Cash iv. The amount goes in the Decrease column because we are decreasing the amount owed j. Jan 26 - Sold inventory for $1,200 to a customer who will pay next month. i. This is another sale on credit ii. The account is Sales iii. The transfer Account is Accounts Receivable iv. The amount goes into the Income column 10. On Jan 31, Mr. Mann wants to reconcile his Inventory with Cost of Goods Sold (COGS) to make his report of Profit and Loss correct. He has checked his current inventory, and finds that his unsold inventory has a cost value (what he paid for it) of $3,200. If we subtract that from the total of Inventory, we get the value called Cost of Goods Sold, the expense of the inventory that has been sold. This is an Expense type account. a. Calculate the Cost of Goods Sold = Inventory Total at end of month inventory value at end of month. ($9,700 - $3,200 = $6,500) b. Enter a transaction for Jan 31 that moves $6,500 from Inventory to COGS i. The account is Cost of Goods Sold ii. The transfer is from Inventory iii. The amount goes into the Expense column.

Page 6

11. Your final Accounts page should look like this:

Reports It is customary to produce reports showing the financial state of the business. These include: Trial Balance a report produced periodically that will show whether all the debits match all the credits, and therefore whether all the accounts are in proper balance Balance Sheet A report, typically produced at the end of the financial cycle, but useful at any time, showing what the business is worth. This is organized in line with the Accounting equation: Assets = Liabilities + Equity Profit and Loss Statement A report that summarizes the operations of the business, showing whether the business has made a profit or taken a loss over the reporting period.

Steps 1. Create a Word document. a. Name the file Accounting Statements b. Give the document an appropriate title (e.g. N. E. Mann Financial Statements) c. Add your name at the top of the page. WARNING: If you are using someone elses computer to do your work, you MUST make note of this, and you must clearly show that you did the assignment by yourself and did not copy it from the other person. d. Skip one line and set the spacing to No Spacing 2. Produce the Trial Balance a. Open the Trial Balance report using the Reports->Income & Expense->Trial Balance menu Page 7

b. If no accounts show up, use the Accounts tab in the Options tool to select all the accounts. c. First, ensure that the totals on the bottom line are the same. This means the accounts are in balance, and you can continue. If the totals are not the same, close the report, and go back to the Accounts to find out where the problem is occurring. d. Highlight all the lines in the report and copy them as plain text to the document. e. Close the Trial Balance Report 3. Produce the Balance Sheet a. Open the Balance Sheet report using the Reports->Assets & Liabilities->Balance Sheet menu. b. Once again, if no accounts show up, use the Options tool to select all the accounts c. When the report shows up properly, copy and paste the report contents to the Word document. 4. Produce the Profit & Loss Statement a. Open the report using the Reports->Income &Expense->Profit & Loss menu. b. Ensure the report is showing the correct accounts. c. Copy and paste the text of the report to the Word document 5. Go over the document and make any changes you think are needed to make it more presentable to a client. The Word document is your assignment deliverable. Submit it to your professor in whatever manner they normally specify.

Bibliography

Blackstone, M. D. (1973). Accounting: A Self-Instruction Guide to Procedures and Theory. New York, NY: Macmillan Publishing.

Page 8

Potrebbero piacerti anche

- Assessor Script: Journalize TransactionsDocumento5 pagineAssessor Script: Journalize TransactionsNova CabigNessuna valutazione finora

- DRAFT - OMNIBUS GUIDELINES ON THE PACKAGING OF DIPLOMA 05VIII20 - PPT - EMYDocumento35 pagineDRAFT - OMNIBUS GUIDELINES ON THE PACKAGING OF DIPLOMA 05VIII20 - PPT - EMYmarven estinozoNessuna valutazione finora

- Coc Script Tm1 RoxiiDocumento2 pagineCoc Script Tm1 RoxiiDEJIE FELIZARTA - UNIFIED ENG'G WMPCNessuna valutazione finora

- Maintain Training Facilities-TemplatesDocumento19 pagineMaintain Training Facilities-TemplatesCris VillapanaNessuna valutazione finora

- SAG For 2d Animation NC IIIDocumento5 pagineSAG For 2d Animation NC IIIMike AnthonyNessuna valutazione finora

- Maintain Training FacilitiesDocumento185 pagineMaintain Training Facilitiesjoey regelisaNessuna valutazione finora

- 3 - Trainees Record BookDocumento4 pagine3 - Trainees Record BookValcy MadzNessuna valutazione finora

- TWSP Orientation Le PrimeDocumento14 pagineTWSP Orientation Le PrimeanneNessuna valutazione finora

- Templates: Sector: TourismDocumento20 pagineTemplates: Sector: TourismSerc Yabla100% (1)

- Competency Assessor's ScriptDocumento4 pagineCompetency Assessor's ScriptRubenNessuna valutazione finora

- Self-Assessment Checklist FORM 4.1 Self - Assessment Checklist INSTRUCTIONS: This Self-Check Instrument Will Give The Trainer NecessaryDocumento38 pagineSelf-Assessment Checklist FORM 4.1 Self - Assessment Checklist INSTRUCTIONS: This Self-Check Instrument Will Give The Trainer NecessaryRoNnie RonNieNessuna valutazione finora

- Data Gathering Instrument For Trainee and Self-Assessment Check of Advance and Beginner TraineesDocumento23 pagineData Gathering Instrument For Trainee and Self-Assessment Check of Advance and Beginner TraineesJeremy OrtegaNessuna valutazione finora

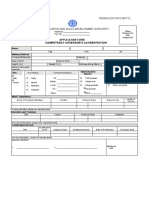

- TESDA Application FormDocumento3 pagineTESDA Application FormAngel Cayanan0% (1)

- Task Sheet 1.2.1 PDFDocumento2 pagineTask Sheet 1.2.1 PDFregan barenaNessuna valutazione finora

- INSTRUCTION: Put A Tick ( ) Mark On The Appropriate Column. Write YourDocumento3 pagineINSTRUCTION: Put A Tick ( ) Mark On The Appropriate Column. Write YourGejel MondragonNessuna valutazione finora

- Common Competency 3 - Apply Quality StandardsDocumento30 pagineCommon Competency 3 - Apply Quality StandardsAngel CastilloNessuna valutazione finora

- 10 Principles of CBTDocumento3 pagine10 Principles of CBTALWIN P. INGUANessuna valutazione finora

- Jean-Script Facilitate Learning SessionDocumento6 pagineJean-Script Facilitate Learning SessionJean Pampilo-dela Cruz MaravillasNessuna valutazione finora

- Technical Education and Skills Development AuthorityDocumento1 paginaTechnical Education and Skills Development AuthorityRodolfo B. CanariaNessuna valutazione finora

- CBLM Programming NC IVDocumento13 pagineCBLM Programming NC IVownlinkscribdNessuna valutazione finora

- Cca PropsDocumento8 pagineCca PropsJenni JopiaNessuna valutazione finora

- Coc 2 Demonstration ScriptDocumento5 pagineCoc 2 Demonstration ScriptTeacher JPNessuna valutazione finora

- JOB SHEET No. 1.3-1 Title: Prepare Journal Entry Performance ObjectiveDocumento3 pagineJOB SHEET No. 1.3-1 Title: Prepare Journal Entry Performance ObjectiveIL MareNessuna valutazione finora

- Institutional ADocumento5 pagineInstitutional Aevangeline batacanNessuna valutazione finora

- Script For Conduct of AssessmentDocumento8 pagineScript For Conduct of AssessmentDeocares MarkdaveNessuna valutazione finora

- Maintain Training Facilities TemplateDocumento8 pagineMaintain Training Facilities TemplateCami Lyn LigmayoNessuna valutazione finora

- COC2.Conduct Competency AssessmentDocumento14 pagineCOC2.Conduct Competency Assessmentian dave semacioNessuna valutazione finora

- Trainee's Record BookDocumento6 pagineTrainee's Record BookJether Pactol Tero0% (1)

- TESDA-OP-CO-04 - Accreditation - Assessors FormsDocumento1 paginaTESDA-OP-CO-04 - Accreditation - Assessors FormsValcy MadzNessuna valutazione finora

- Trainers' Methodology I: Trainer / Facilitator Arch. Jan Nikolai D. Gongora, RMP Module: Supervise Work-Based LearningDocumento27 pagineTrainers' Methodology I: Trainer / Facilitator Arch. Jan Nikolai D. Gongora, RMP Module: Supervise Work-Based LearningjohnnycollideNessuna valutazione finora

- Ems Jasmin ManalacDocumento125 pagineEms Jasmin ManalacEmmerNessuna valutazione finora

- UC 6 - Perform Computer OperationsDocumento104 pagineUC 6 - Perform Computer OperationsRow RowNessuna valutazione finora

- Rating SheetDocumento11 pagineRating SheetRowelyn LinteNessuna valutazione finora

- Job LinkagingDocumento1 paginaJob LinkagingFemee JisonNessuna valutazione finora

- Maintain Training FacilitiesDocumento14 pagineMaintain Training FacilitiesAbbey DawnfanNessuna valutazione finora

- Graduate School: - Business AdministrationDocumento3 pagineGraduate School: - Business AdministrationAlexandra SarmuyanNessuna valutazione finora

- TR - Scaffolding Works - NC II - For Website (2!19!19)Documento102 pagineTR - Scaffolding Works - NC II - For Website (2!19!19)JKFuentesNessuna valutazione finora

- Jho Nejar FLS ScriptDocumento4 pagineJho Nejar FLS ScriptJefferson Gomez50% (2)

- Trainee'S Record Book: Technical Education and Skills Development AuthorityDocumento12 pagineTrainee'S Record Book: Technical Education and Skills Development AuthorityVirgil Keith Juan Pico100% (2)

- CBLM (Repaired)Documento37 pagineCBLM (Repaired)Dave FontejonNessuna valutazione finora

- Self-Assessment Guide - Bookkeeping NC IIIDocumento3 pagineSelf-Assessment Guide - Bookkeeping NC IIIMichael V. MagallanoNessuna valutazione finora

- Philippine Electronics and Communication Institute of TechnologyDocumento1 paginaPhilippine Electronics and Communication Institute of TechnologyJay-Ar Cuevas Salve100% (1)

- Evidence Plan COC 3Documento2 pagineEvidence Plan COC 3John Carlo CapistranoNessuna valutazione finora

- Trainee'S Record Book: Technical Education and Skills Development AuthorityDocumento10 pagineTrainee'S Record Book: Technical Education and Skills Development AuthorityVirgil Keith Juan PicoNessuna valutazione finora

- F-1 Housekeeping ScheduleDocumento3 pagineF-1 Housekeeping ScheduleAmir M. VillasNessuna valutazione finora

- Tesda Tm1x Self Check LuisDocumento158 pagineTesda Tm1x Self Check LuisLuis S Alvarez JrNessuna valutazione finora

- FacilitateDocumento14 pagineFacilitateEngel Racraquin Bristol0% (1)

- FILE Procedures in Obtaining and Carrying Out Work InstructionsDocumento3 pagineFILE Procedures in Obtaining and Carrying Out Work InstructionsEmmerNessuna valutazione finora

- Insert Picture Related To Qualification: TM 1: Plan Training SessionDocumento27 pagineInsert Picture Related To Qualification: TM 1: Plan Training Sessionmark anthony marallagNessuna valutazione finora

- 3.CBLM Trial Balance MPCDocumento11 pagine3.CBLM Trial Balance MPCAsseh AnicetoNessuna valutazione finora

- CBC-ENGLISH PROFICIENCY - NewDocumento50 pagineCBC-ENGLISH PROFICIENCY - NewVeronica Joy CelestialNessuna valutazione finora

- Planning Training Sessions: Written Exam)Documento13 paginePlanning Training Sessions: Written Exam)Valerie Joy GomezNessuna valutazione finora

- Plan Training Session SampleDocumento32 paginePlan Training Session SampleOh Den NiNessuna valutazione finora

- Cca SequenceDocumento3 pagineCca Sequencefernando_drdNessuna valutazione finora

- Welcome To General Trainees' Orientation: Technical Education and Skills Development Authority Tesda 7Documento18 pagineWelcome To General Trainees' Orientation: Technical Education and Skills Development Authority Tesda 7Oliver CalledoNessuna valutazione finora

- ScriptDocumento5 pagineScriptRodolfo B. CanariaNessuna valutazione finora

- Tesda Circular 033 2017Documento27 pagineTesda Circular 033 2017Bok PercivalNessuna valutazione finora

- Maintain Training FacilitiesDocumento10 pagineMaintain Training FacilitiesCatherine SolNessuna valutazione finora

- Double Entry Bookkeeping - T-AccountsDocumento4 pagineDouble Entry Bookkeeping - T-AccountsAbdulla Maseeh100% (1)

- Fabm M8Documento12 pagineFabm M8Rich Allen Mier UyNessuna valutazione finora

- 1588756021-1693-Allegis Servicses Final PrintDocumento9 pagine1588756021-1693-Allegis Servicses Final PrintDehradun MootNessuna valutazione finora

- YCAB Annual Report 2014Documento102 pagineYCAB Annual Report 2014windaNessuna valutazione finora

- Property Digests Consolidated 1-37 For ScribdDocumento25 pagineProperty Digests Consolidated 1-37 For ScribdEveBNessuna valutazione finora

- Cost Records and Cost AuditDocumento21 pagineCost Records and Cost AuditJimitNessuna valutazione finora

- Lesson 4 BUDGET PREPARATION AND PROJECTION FINANCIAL STATEMENTDocumento53 pagineLesson 4 BUDGET PREPARATION AND PROJECTION FINANCIAL STATEMENTlorraine barrogaNessuna valutazione finora

- NPC Vs Presiding JudgeDocumento5 pagineNPC Vs Presiding JudgekhristineNessuna valutazione finora

- MINGGU 11 B INVESTEMENT CENTER - BAHAN AM RONALDDocumento22 pagineMINGGU 11 B INVESTEMENT CENTER - BAHAN AM RONALDamoyyNessuna valutazione finora

- Investor Presentation (Company Update)Documento30 pagineInvestor Presentation (Company Update)Shyam SunderNessuna valutazione finora

- Bsi Annual Report and Financial Statements 2017 PDFDocumento140 pagineBsi Annual Report and Financial Statements 2017 PDFTejiNessuna valutazione finora

- BIR Ruling No 105-99Documento1 paginaBIR Ruling No 105-99Cristelle Elaine ColleraNessuna valutazione finora

- CXC Principles of Business Exam GuideDocumento25 pagineCXC Principles of Business Exam GuideMaryann Maxwell67% (3)

- CH10 Revised ADocumento16 pagineCH10 Revised AMaimoona Ghani0% (1)

- Investigating The Value of An MBA Education Using NPV Decision ModelDocumento72 pagineInvestigating The Value of An MBA Education Using NPV Decision ModelnabilquadriNessuna valutazione finora

- Exam 2 Study Guide: Identify The Choice That Best Completes The Statement or Answers The QuestionDocumento30 pagineExam 2 Study Guide: Identify The Choice That Best Completes The Statement or Answers The Questionsylvia_andrzejewskiNessuna valutazione finora

- FA Assignment 5: Ishani Sathish (PGP/25/331)Documento7 pagineFA Assignment 5: Ishani Sathish (PGP/25/331)ishaniNessuna valutazione finora

- Income Taxation Case DigestDocumento22 pagineIncome Taxation Case DigestCoyzz de Guzman100% (1)

- Ross 12e PPT Ch08Documento37 pagineRoss 12e PPT Ch08Qusai BassamNessuna valutazione finora

- How To Read The Annual Report of A Company - Varsity by ZerodhaDocumento25 pagineHow To Read The Annual Report of A Company - Varsity by Zerodhashekhar0050% (1)

- LMSDocumento4 pagineLMSJohn Carlo LorenzoNessuna valutazione finora

- Governement Accounting - Journal Entries-1Documento8 pagineGovernement Accounting - Journal Entries-1LorraineMartinNessuna valutazione finora

- E.D.P Project: Manufacturing of Fish /prawn Pickle IntroductionDocumento15 pagineE.D.P Project: Manufacturing of Fish /prawn Pickle IntroductionblackvenumNessuna valutazione finora

- Brookstone Ob-Gyn Associates (A) : Tthe Crimson Press Curriculum Center Tthe Crimson Group, IncDocumento5 pagineBrookstone Ob-Gyn Associates (A) : Tthe Crimson Press Curriculum Center Tthe Crimson Group, IncDr-YousefMHassan100% (1)

- PWC Vietnam Ifrs Vas PDFDocumento99 paginePWC Vietnam Ifrs Vas PDFminhNessuna valutazione finora

- Akuntansi Keuangan Lanjutan - Chap 007Documento39 pagineAkuntansi Keuangan Lanjutan - Chap 007Gugat jelang romadhonNessuna valutazione finora

- BPI vs. CIRDocumento2 pagineBPI vs. CIRNikki AndradeNessuna valutazione finora

- DTC Revised SummaryDocumento1 paginaDTC Revised SummaryChirag GanjawallaNessuna valutazione finora

- Billerud Annual Report 2010Documento120 pagineBillerud Annual Report 2010BillerudNessuna valutazione finora

- Vol 1 Iss 1Documento258 pagineVol 1 Iss 1Anonymous imSD3ArNessuna valutazione finora

- Taxes: Orduna Santos Dumalag PinesDocumento56 pagineTaxes: Orduna Santos Dumalag PinesJosh DumalagNessuna valutazione finora

- Getting to Yes: How to Negotiate Agreement Without Giving InDa EverandGetting to Yes: How to Negotiate Agreement Without Giving InValutazione: 4 su 5 stelle4/5 (652)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Da EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Valutazione: 4.5 su 5 stelle4.5/5 (14)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Da EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Valutazione: 4.5 su 5 stelle4.5/5 (15)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineDa EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNessuna valutazione finora

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindDa EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindValutazione: 5 su 5 stelle5/5 (231)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesDa EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNessuna valutazione finora

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsDa EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsValutazione: 5 su 5 stelle5/5 (1)

- Financial Accounting For Dummies: 2nd EditionDa EverandFinancial Accounting For Dummies: 2nd EditionValutazione: 5 su 5 stelle5/5 (10)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Da EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Valutazione: 4 su 5 stelle4/5 (33)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Da EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Valutazione: 4.5 su 5 stelle4.5/5 (5)

- The Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingDa EverandThe Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingValutazione: 4.5 su 5 stelle4.5/5 (760)

- Project Control Methods and Best Practices: Achieving Project SuccessDa EverandProject Control Methods and Best Practices: Achieving Project SuccessNessuna valutazione finora

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsDa EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNessuna valutazione finora

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsDa EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsValutazione: 4 su 5 stelle4/5 (7)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeDa EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeValutazione: 4 su 5 stelle4/5 (21)

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCDa EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCValutazione: 5 su 5 stelle5/5 (1)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItDa EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItValutazione: 4.5 su 5 stelle4.5/5 (14)

- Controllership: The Work of the Managerial AccountantDa EverandControllership: The Work of the Managerial AccountantNessuna valutazione finora

- Your Amazing Itty Bitty(R) Personal Bookkeeping BookDa EverandYour Amazing Itty Bitty(R) Personal Bookkeeping BookNessuna valutazione finora

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessDa EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessValutazione: 4.5 su 5 stelle4.5/5 (28)

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsDa EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsValutazione: 4 su 5 stelle4/5 (4)

- Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetDa EverandRatio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetValutazione: 4.5 su 5 stelle4.5/5 (14)