Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Terminology 10

Caricato da

Lili Beth LoriaCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Terminology 10

Caricato da

Lili Beth LoriaCopyright:

Formati disponibili

Terminology Ad hoc discount: a price concession made under competitive pressure (real or imagined) that does not relate

to the location of the merchandising chain or volume purchased Common Expense: costs incurred for the benefit of the company as a whole but are allocated to indivisual product lines or business segments Differential cost: (see incremental cost) Differential revenue: (see incremental revenue) Incremental cost: the amount of cost that differs across decision choices Incremental revenue: is the amount of revenue that differs across decision choices Linear programming (LP : a method used to find the optimal allocation of scarce resources in a situation involving one objective and multiple limiting factors !a"e#or#$uy decision: (see outsourcing decision) !athematical programming: a variety of techniques used to allocate limited resources among activities to achieve a specific goal or purpose %ffshoring: the practice of sending jobs formerly performed in the home country to other countries %pportunity cost: a potential benefit that is foregone because one course of action is chosen over another %utsourcing: the practice of having work performed for one company by an off-site nonaffiliated supplier; it allows a company to buy a product (or service) from an outside supplier rather than making the product or performing the service in-house %utsourcing decision: an analysis that compares internal production and opportunity costs with external purchase cost and assesses the best uses of facilities &elevant costing: a process which focuses managerial attention on a decisions relevant (or pertinent) information &o$inson#Patman Act: a law that prohibits companies from pricing the same products at different amounts when those amounts do not reflect related cost differences 'ales mix: the relative product quantities composing a companys total sales 'carce resource: a resource that is essential to production activity or service provision but that has limited availability 'egment margin: the excess of revenues over direct variable expenses and avoidable fixed expenses for a particular segment 'pecial order decision: a situation in which management must determine a sales price to charge for manufacturing or service jobs outside the companys normal production service market 'un" costs: costs incurred in the past to acquire an asset or a resource

e" Lecture %utline L%(): *hat factors determine the relevance of information to decision ma"ing+ !" #ntroduction $" #n decision making% managers should consider all relevant costs and revenues associated with each decision alternative" &here are four steps in this decision process' a" (tep $' &he necessity of making a decision becomes evident" (tep )' *ecision choices or alternatives are identified" (tep +' &he relevant costs and benefits associated with each decision alternative in step ) are calculated" (tep ,' &he decision alternative providing the largest net benefit to the organi-ation is selected" ," +" f"

3anagement can compare the incremental benefits of various alternatives to decide on the most profitable or least costly alternative or set of alternatives" (ome relevant factors% such as sales commissions or direct production costs% are easily identified and quantified because they are captured by the accounting system" i" 4ther factors% such as opportunity costs% may be relevant and quantifiable% but are not captured by the accounting system" !n opportunity cost represents the potential benefit foregone because one course of action is chosen over another"

ii"

b" c"

#mportance to *ecision 3aker a" &he need for specific information depends on how important the information is relative to management objectives"

d"

)"

&elevant costing is an approach that focuses managerial attention on a decisions relevant (or pertinent) information" &his chapter introduces relevant costing by examining several recurring business decisions such as replacing an asset% outsourcing a product or component% allocating scarce resources% manipulating sales mix% and evaluating special orders"

.earing on the 2uture a" #nformation can be based on past or present data% but it can only be relevant if it pertains to a future decision" &he future may be the short run or the long run; future costs are the only costs that can be avoided; and the longer into the future a decisions time hori-on extends% the more costs are controllable% avoidable% and relevant" 4nly information that has a bearing on future events is relevant in decision making"

+"

b"

."

&he /oncept of 0elevance $" 1eneral a" &here is a relationship between time and relevance" i" !s the decision time hori-on is reduced% fewer costs and revenues are relevant" c"

L%(,: *hat are sun" costs- and .hy are they not relevant in ma"ing decisions+ /" (unk /osts $" ! sun" cost is a cost incurred in the past to acquire an asset or resource that is not relevant to any future courses of action" (unk costs cannot be changed no matter what future course of action is taken because historical transactions cannot be reversed currently" &ext Exhi$it )/() (p( 012 provides data for a basic keep-orreplace decision while text Exhi$it )/(, (p( 012 presents the relevant costs that should be considered in making the decision" a" ! common analytical tendency is to include the historical cost of the old system but this cost does not differ between the decision alternatives" &he relevant factors for making the keep-or-replace decision include' i" ii" iii" cost of the new system; current resale value of the original system; and annual operating savings associated with the new system"

b"

2or information to be relevant% it must possess three characteristics' i" be associated with the decision under consideration; be important to the decision maker; and have a connection to% or bearing on some future endeavor"

ii" iii"

)"

+"

)"

!ssociation with *ecision a" &o be relevant% information must be associated with the decision or question under consideration" Incremental revenue (or differential revenue) is the amount of revenue that differs across decision choices" Incremental cost (or differential cost is the amount of cost that varies across decision choices" i" #ncremental costs can be either variable or fixed" 3ost variable costs are relevant while most fixed costs are not relevant"

b"

b"

c"

d"

&he difference between the incremental revenue and incremental cost of a particular alternative is the incremental profit (incremental loss) of that course of action"

*"

0elevant /osts for (pecific *ecisions

$"

3anagers routinely make decisions on alternative courses of action that have been identified as feasible solutions to problems or feasible methods to use in the attainment of objectives" f" a" !ll incremental revenues% costs% and benefits of all courses of action are measured against a baseline alternative in determining which course of action is best" 5hen evaluating alternative courses of action% managers should select the alternative that provides the highest incremental benefit to the company" &he 6change nothing7 alternative has a -ero incremental benefit since it represents current conditions from which all other alternatives are measured% and it should be chosen only when it is perceived to be the best available alternative solution" 0ational decision-making behavior includes a comprehensive evaluation of the quantifiable and nonquantifiable effects of all alternative courses of action" &he chosen course should be one that will make the business better off than it is currently" j" g"

iii"

issues such as product service quality% time of delivery% flexibility of use% or reliability of supply cannot be resolved to the companys satisfaction"

0efer to text Exhi$it )/(3 (p( 016 for information about a product (door hinges) made by ?andry 3echanical" &he text describes the process of determining whether the company should continue making the product or buy it from an outside supplier" 0elevant costs% regardless of whether they are variable or fixed% are avoidable because one decision alternative was chosen over another" #n an outsourcing decision% variable production costs are relevant" 2ixed production costs are relevant only if they can be avoided if production is discontinued" &he opportunity cost of the facilities being used by production are also relevant since outsourcing will allow the company to use its facilities for an alternative purpose" #f a more profitable alternative is available% management should consider diverting the capacity to this use" &ext Exhi$it )/(4 (p( 011 presents the calculations relating to this decision on both a per-unit and a total cost basis (indicating a :9",) per set of hinges advantage to outsourcing over insourcing)" i" !nother opportunity cost that can be associated with insourcing is an increase in plant production activity (or throughput) that is lost because a component is being made"

b"

c"

h"

d"

i"

e"

L%(0: *hat information is relevant in an outsourcing decision+ 8" 4utsourcing *ecisions $" 1eneral a" %utsourcing refers to having work performed by an off-site nonaffiliated supplier; it allows the company to buy a product (or service) from an outside supplier rather than making the product or performing the service in-house" %ffshoring sends jobs formerly performed in the home country to other countries" i" #n )9$9% financial services (:);") billion)% manufacturing (:$<"$ billion) and energy (:="; billion) were the most common types of work taken offshore"

k"

8ven if quantitative analysis supports outsourcing% qualitative factors (e"g"% financial health of the supplier) may overrule" ! theoretically short-run decision can have many potential long-run effects thus suggesting that the term fixed cost may actually be a misnomer because% while such costs do not vary with volume in the short-run% they will vary in the long-run" &hus% fixed costs are relevant for long-run decision making" 3any service organi-ations (accounting and law firms% medical practices% and schools) also need to make outsourcing decisions" 4utsourcing can include product and service design activities% accounting (e"g"% preparation of income tax returns) and legal services% utilities% engineering services% and employee health services"

b"

l"

m"

c"

&he outsourcing (or ma"e#or#$uy decision is a decision that compares internal production and opportunity costs to external purchase cost and then assesses the best use of facilities" i" 0elevant information for this type of decision includes both quantitative and qualitative factors" (ee text Exhi$it )/(0 (p( 013 for the primary motivations for companies to pursue outsourcing"

n"

ii"

L%(2: 7o. can management achieve the highest return from use of a scarce resource+ )" (carce 0esources *ecisions a" ! scarce resource is a resource that is essential to a production or service activity but is available only in some limited quantity" i" (carce resources create constraints on producing goods or providing services and can include machine hours% skilled labor hours% raw materials% and production capacity"

d"

>umerous factors% such as those included in text Exhi$it )/(2 (p( 014 % should be considered in making the outsourcing decision" &he pyramid in text Exhi$it )/(5 (p( 016 is one model for assessing outsourcing risk" 2actors to consider include whether' i" a function is considered critical to the organi-ations long-term viability (such as product research and development); the organi-ation is pursuing a core competency relative to this function; or

e"

ii"

b"

3anagement may desire and be able to obtain a greater abundance of a scarce resource in the long run%

but management must make the best current use of the scarce resources it has in the short run" c" &he determination of the best use of a scarce resource requires that specific company objectives be recogni-ed by management" i" #f an objective is to maximi-e company profits% a scarce resource is best used to produce and sell the product having the highest contribution margin per unit of the scarce resource. &ext Exhi$it )/(6 (p( 2/) provides information for two products produced by ?andry 3echanical" !t first glance% it appears that the table saw would be the most profitable of the two products because its unit contribution margin is significantly higher than that of the drill" @owever% because the table saw requires three times as many switches (the limiting factor) as the drill% drill production generates a higher contribution margin per switch" b"

demonstrate the impact of the new product on the companys sales mix" (ales Brice /hanges and 0elative Brofitability of Broducts i" 3anagers must constantly monitor the relative selling prices of company products% both in respect to each other as well as to competitors prices" 2actors that might influence price changes include fluctuations in demand% changes in production distribution cost% changes in economic conditions% and changes in competition" !ny shift in the selling price of one product in a multiproduct firm normally causes a change in sales mix of that firm because of the economic law of demand elasticity with respect to price"

ii"

ii"

d"

/ompany management must consider qualitative aspects of the problem in addition to the quantitative ones" i" 2or example% how will customers react if the company only offers one productA 5ill concentrating on a single product result in market saturationA

!s illustrated in text Exhi$it )/()/ (p( 2/2 % to maximi-e profits% management must maximi-e total contribution margin rather than per-unit contribution margin" (ince a products sales volume typically is related to its selling price% generally% when the price of a product or service increases and demand is elastic with respect to price% demand for that product decreases as illustrated in text Exhi$it )/()) (p( 2/2 " #n making decisions to raise or lower prices% relevant quantitative factors include the following' new contribution margin per unit of product% shortterm and long-term changes in product demand and production volume because of the price change% and best use of the companys scarce resources" (ome relevant qualitative factors involved in pricing decisions include the following' impact of changes on customer goodwill toward the company% customer loyalty toward company products% and competitors responses to the firms new pricing structure"

iii"

ii"

iv"

e"

5hen one limiting factor is involved% the outcome of a scarce resource decision indicates which single type of product should be manufactured and sold" i" 3ost situations% however% involve several limiting factors that compete in striving to attain business objectives" &o solve these types of problems requires the use of mathematical programming which refers to a variety of techniques used to allocate limited resources to achieve a specific purpose" Linear programming (LP is one method used to find the optimal allocation of scarce resources when there are multiple limiting factors"

v"

ii"

c"

(ales /ompensation /hanges i" 3any companies compensate salespeople by paying a fixed rate of commission on gross sales dollars" #f a company has a profit maximi-ation objective% then sales commission should be based on products with highest contribution margin% not highest sales price" &ext Exhi$it )/(), (p( 2/3 illustrates the impact on profits of a compensation based on sales price versus compensation based on contribution margins"

L%(5: *hat varia$les do managers use to manipulate sales mix+ +" (ales mix decisions a" 1eneral i" 'ales mix is the relative combination of quantities of sales of the various products that make up the total sales of a company" (ome important factors that affect the appropriate sales mix of a company are product selling prices% sales force compensation% and advertising expenditures; a change in one or all of these factors may cause a companys sales mix to shift" &ext Exhi$it )/(1 (p( 2/0 provides information on a new product line for ?andry 3echanical to d"

ii"

iii"

ii"

!dvertising .udget /hanges i" !djusting the advertising budgets of specific products or increasing the companys total advertising budget could lead to shifts in the sales mix"

iii"

ii"

#ncreased advertising can cause changes in the sales mix or in the number of units sold by targeting advertising efforts at specific products" (ales can also be influenced by opportunities that allow companies to obtain business at a sales price that differs from the normal price" (ee text Exhi$it )/()0 (p( 2/4 for calculations of the expected increase in contribution margin if the company makes an additional advertising expenditure"

i"

!d hoc discounts do not normally require detailed legal justification since they are based on a competitive market environment"

L%(4: 7o. do managers determine .hether a product line should $e retained or discontinued+ ;" Broduct ?ine and (egment *ecisions a" 4perating results of multiproduct environments are frequently presented in a disaggregated format that depicts results for separate product lines within the organi-ation or division" 3anagers% in reviewing such statements% must distinguish relevant from non-relevant information regarding individual product lines" (ee text Exhi$its )/()5 (p( 2/1 and )/()3 (p( 2)/ for an example of how product lines should be analy-ed when deciding whether some lines should be discontinued" &he segment margin represents the excess of revenues over direct variable expenses and avoidable fixed expenses; the amount remaining is available to cover unavoidable direct fixed expenses and common expenses% and to provide profits" i" &he segment margin figure is the appropriate one on which to base continuation or elimination decisions since it measures the segments contribution to the coverage of indirect and unavoidable expenses"

iii"

L%(3: 7o. are special prices set- and .hen are they used+ ," (pecial order decisions a" ! special order decision is a situation that requires management to compute a reasonable sales price for production or service jobs outside the companys normal realm of operations" i" (pecial prices may be justified when orders are unusual% because the products are being tailormade to customer specifications% or when goods are produced for a one-time job" b"

c"

d"

b"

/ompanies sometimes price a special order job with a 6low-ball7 bid that produces no profit by barely covering costs or that is below cost" (uch low-balling is used to penetrate a certain market segment with the companys products or services" &he sales price quoted on a special order job typically should be high enough to generate a positive contribution margin" e" &ext Exhi$it )/()2 (p( 2/6 illustrates a special order decision" 5hen setting a special order price% managers must consider qualitative as well as quantitative issues" &he following questions should be asked' i" 5ill setting a low bid price establish a precedent for future pricesA; 5ill the contribution margin be sufficient to justify the additional burdens placed on management and employeesA;

c"

d"

e"

.efore deciding to discontinue a product line% management should carefully consider what resources would be required to turn the product line around and consider the long-term ramifications of product line elimination" 3anagements task is to allocate effectively and efficiently its finite stock of resources to accomplish its objectives" i" 3anagers must have a reliable quantitative basis on which to analy-e problems% compare viable solutions% and choose the best course of action" .ecause management is a social rather than a natural science% it has no fundamental truths and few related problems are susceptible to black or white solutions" 0elevant costing is a process of making human approximations of the costs of alternative decision results"

f"

ii"

ii" iii" 5ill the additional production activity require the use of bottleneck resources and reduce company throughputA; @ow will special order sales affect normal salesA; and #f production of the order is scheduled during a slow period% is management willing to take the business at a lower contribution margin simply to keep a trained workforce employedA iii"

iv"

v"

f"

&he &o$inson#Patman Act is a federal law% passed in $C+D% that prohibits companies from pricing the same products at different levels when those amounts do not reflect related cost differences" !n ad hoc discount is a price concession that relates to real (or imagined) competitive pressures rather than to location of the merchandising chain or volume purchased"

g"

Potrebbero piacerti anche

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Standard HVAC Service AgreementDocumento2 pagineStandard HVAC Service Agreementdhurt2011100% (2)

- CV of Marissa Mayer BEST CV EVERDocumento2 pagineCV of Marissa Mayer BEST CV EVERAbenezer0% (1)

- Group 3: Case Study Chapter 4Documento2 pagineGroup 3: Case Study Chapter 4Nguyen NgocloiNessuna valutazione finora

- SCM Chap-9 Group-4 PDFDocumento5 pagineSCM Chap-9 Group-4 PDFHannah CapidosNessuna valutazione finora

- (The New Rules of Internet Marketing (55 Pages)Documento55 pagine(The New Rules of Internet Marketing (55 Pages)antonello_camilettiNessuna valutazione finora

- SILOPDocumento3 pagineSILOPVishal BinodNessuna valutazione finora

- DebaPratim - Technical Project ManagerDocumento12 pagineDebaPratim - Technical Project ManagerDeba Pratim SinhaNessuna valutazione finora

- Digital Marketing Course Training Institute PDFDocumento2 pagineDigital Marketing Course Training Institute PDFdeepika joshNessuna valutazione finora

- Chapter 1Documento4 pagineChapter 1avinashgoyalNessuna valutazione finora

- Seven Rules of International DistributionDocumento11 pagineSeven Rules of International DistributionKhon LinNessuna valutazione finora

- Summary On Senior Inspector Manpower Per VesselsDocumento18 pagineSummary On Senior Inspector Manpower Per VesselsGarlin MunarNessuna valutazione finora

- 05 Output DeterminationDocumento11 pagine05 Output Determinationmad13boy100% (1)

- Customer Journey Map-V2-example PDFDocumento1 paginaCustomer Journey Map-V2-example PDFUsman Nadeem100% (1)

- SD Mock TestDocumento35 pagineSD Mock TestSAPCertificationNessuna valutazione finora

- Management Information System ToyotaDocumento2 pagineManagement Information System ToyotaAsCreations DesignerClothingNessuna valutazione finora

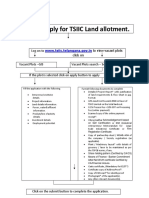

- How To Apply For TSIIC Land AllotmentDocumento4 pagineHow To Apply For TSIIC Land AllotmentthotaumaNessuna valutazione finora

- EXAM2 SampleDocumento13 pagineEXAM2 SampleayeteepeaNessuna valutazione finora

- 2008 AllDocumento62 pagine2008 AlljorgecloneNessuna valutazione finora

- Current Controller For Resistive Heating Element (US Patent 4549073)Documento19 pagineCurrent Controller For Resistive Heating Element (US Patent 4549073)PriorSmartNessuna valutazione finora

- Trade Promotion PlanningDocumento2 pagineTrade Promotion PlanningchaitanyaNessuna valutazione finora

- SROI Methodology. An IntroductionDocumento14 pagineSROI Methodology. An IntroductionDiagram_ConsultoresNessuna valutazione finora

- SBR Current IssueDocumento61 pagineSBR Current IssueJony SaifulNessuna valutazione finora

- YouTube - Diante Da Cruz - Aline BarrosDocumento3 pagineYouTube - Diante Da Cruz - Aline Barrosanon-791816Nessuna valutazione finora

- Topic 5 Ethics Fraud and Security in AISDocumento157 pagineTopic 5 Ethics Fraud and Security in AISMuhammad Rusydan100% (4)

- Comparing CRM Software FinalDocumento8 pagineComparing CRM Software Finalichagroovy15Nessuna valutazione finora

- The Audit Process (Part 1 & 2)Documento39 pagineThe Audit Process (Part 1 & 2)NguyenThanhDuy100% (2)

- Executive SummaryDocumento32 pagineExecutive SummaryDipak BarikNessuna valutazione finora

- Checklist License AgreementDocumento3 pagineChecklist License AgreementAditya LakhaniNessuna valutazione finora

- Roula - Bechelani CV-2018 PDFDocumento3 pagineRoula - Bechelani CV-2018 PDFroulaNessuna valutazione finora

- Medieval Fantasy Mechs: A New Frontier For Fantasy d20Documento6 pagineMedieval Fantasy Mechs: A New Frontier For Fantasy d20LuciusthetraitorNessuna valutazione finora