Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Friedman Industries, Inc.

Caricato da

sommer_ronald5741Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Friedman Industries, Inc.

Caricato da

sommer_ronald5741Copyright:

Formati disponibili

Measured Approach

FRIEDMAN INDUSTRIES (AMEX:FRD) Data as of: 10/23/2009

Industry: Construction – Supplies and Fixture

Current Data

Current Price $5.83 PEG 0.13

Market Cap ($M) $39.64 EPS TTM ($) 1.40

Shares Outstanding (M) 6.8 P/E TTM 4.2

Institutional Holdings % 32.4 EPS Estimated 2009 ($) NA

Insider Holdings % 8.8 P/Estimated EPS NA

Beta 1.62 MA Value ($) $9.79

Latest Quarter Reported 06/09 Price Value Ratio 59.6%

Friedman Industries, Incorporated is engaged in steel processing, pipe manufacturing and processing, and

steel and pipe distribution. The Company has two product groups: coil and tubular products. The

Company sells coil products to approximately 170 customers located primarily in the mid-western,

southwestern and southeastern sections of the United States. Its principal customers for coil products and

services are steel distributors and customers fabricating steel products, such as storage tanks, steel

buildings, farm machinery and equipment, construction equipment, transportation equipment, conveyors

and other similar products. During the fiscal year ended March 31, 2009 (fiscal 2009), 17 customers of coil

products, accounted for approximately 25% of the Company's sales. The Company's principal customers

for tubular products are steel and pipe distributors, piling contractors and U.S. Steel Tubular Products, Inc.

(USS).

HIGHLIGHTS

Friedman Industries is one of those rare occurrences a company that is selling at near net asset

value. For the quarter ending 06/09, the company reported current assets of $43.9 million and

total liabilities of $5.6 million.

Inventory to Sales was 9.29% at the end of FY09. For the trailing 12 months, the Inventory to

Sales ratio increased to 10.41%

The EPS growth rate for the trailing 12 months is 38.2%. The three and five year growth rates are

30.2% and 43.5% respectively.

FRD has a current ratio of 9.5 and no long term debt. This indicates that the company is

financially secure. It is also indicative of a company that may not be putting its assets to the best

use. Certainly, the company has room to employ some debt.

The company has a Price/Sales ratio of 0.2 based on trailing 12 month sales. This is very

favorable.

ANALYSIS OF THE BALANCE SHEET

The schedule presented below shows the year-end balance sheets for the years between March 31, 2005

and March 31, 2009. We also show the balance sheet as of June 30, 2009. Cash comprises 50% of the

business’s current assets as of June 23, 2009 as compared to 39.6% on March 31, 2009. Inventory

comprises 38.3% of the current assets on June 30, 2009 as compared to 45.4% on March 31, 2009.

Fixed assets include all of the company’s production machinery and equipment. As of June 30, 2009, Net

Property, Plant and Equipment made up 95.4% of non-current assets.

Please visit http://measuredapproach.wordpress.com for important disclosures.

© Copyright 2009 Ronald Sommer. All Rights Reserved.

Overall, the business’s total assets increased approximately 20.9% during the period March 31, 2005 to

June 30, 2009. The increase in total assets has been due primarily to increases in cash. During the same

period, accounts receivable decreased significantly as did inventory.

Accounts payable comprise the largest segment of current liabilities at 78.3%. Accounts payable have

decreased dramatically over the past five years, in line with the decrease in accounts receivable.

The company reports no long term debt and carries no off-balance sheet liabilities.

Balance Sheet

(Amounts in Millions)

TTM FYE FYE FYE FYE FYE

Assets 06/60/09 03/31/09 03/31/08 03/31/07 03/31/06 03/31/05

Cash 21.9 16.9 2.6 1.0 2.0 0.2

ST Investments 0.0 0.0 0.0 0.0 0.0 0.0

Accounts Receivable 3.8 5.0 16.7 17.3 17.5 16.4

Inventory 16.8 19.4 29.9 33.3 28.0 25.9

Other Current Assets 1.4 1.4 0.1 0.2 0.1 1.0

Total Current Assets 43.9 42.7 49.4 51.7 47.6 43.5

Net Property,Plant & Equip. 16.7 17.0 16.8 13.5 7.8 6.7

LT Investments 0.0 0.0 0.0 0.0 0.0 0.0

Goodwill/Intangibles 0.0 0.0 0.0 0.0 0.0 0.0

Other LT Assets 0.8 0.8 0.8 0.7 0.6 0.6

Total Assets 61.4 60.5 67.0 65.9 55.9 50.8

Liabilities

Accounts Payable 3.6 2.7 13.5 21.9 16.7 13.5

Short Term Debt 0.1 0.1 0.1 0.0 0.0 0.0

Other Current Liabilities 1.0 0.6 1.2 1.4 1.7 1.5

Total Current Liabilities 4.6 3.4 14.8 23.3 18.4 15.0

LT Debt 0.0 0.0 6.7 0.0 0.0 0.0

Other LT Liabilities 1.0 1.0 0.6 0.5 0.5 0.5

Total Liabilities 5.6 4.3 22.0 23.8 18.8 15.4

Preferred Stock 0.0 0.0 0.0 0.0 0.0 0.0

Common Stock Equity 55.7 56.1 45.0 42.1 37.1 35.4

Total Liabilities & Equity 61.3 60.4 67.0 65.9 55.9 50.8

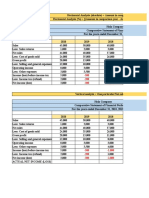

ANALYSIS OF THE INCOME STATEMENT

Presented below are the income statements for the five year period March 31, 2005 to March 31, 2009

and for the twelve month period ending June 30, 2009. Until 2009, revenues increased steadily from

$$188.0 million in FY05 to $208.8 million in FY09. Revenue growth has been 16.8%, 4.7% and 12.4% on a

one year, three year and five year basis. As of June 2009, revenue declined 14.1% year-over-year.

Operating expenses have been highly variable over the period being examined. In the 12 month period

ending 06/09, operating expenses have decreased to $147.2 million or 91.2% of sales as compared to

FY08 when operating expenses totaled $172.2 million or 96.3% of sales. Operating expenses were higher

in FY07 on higher sales.

Please visit http://measuredapproach.wordpress.com for important disclosures.

© Copyright 2009 Ronald Sommer. All Rights Reserved.

Income Statement

Amounts in Millions

TTM FYE FYE FYE FYE FYE

06/60/09 03/31/09 03/31/08 03/31/07 03/31/06 03/31/05

Sales 161.4 208.8 178.8 199.7 181.9 188.0

Cost of Goods Sold 142.2 182.1 167.3 185.1 166.8 172.3

Gross Income 19.2 26.7 11.5 14.6 15.1 15.7

Depreciation & Amortization n/a n/a n/a n/a n/a n/a

Research/Development n/a n/a n/a n/a n/a n/a

Interest Expense 0.0 0.0 0.1 0.0 0.0 0.0

Unusual Expenses/(Income) n/a n/a n/a n/a n/a n/a

Total Operating Expenses 147.2 188.1 172.2 189.0 172.1 177.9

Operating Income 14.3 20.7 6.6 10.7 9.8 10.1

Interest Expense - Non-Op. n/a n/a n/a n/a n/a n/a

Other Expenses/(Income) (0.1) (0.1) (0.2) (0.2) (0.3) (0.1)

Pretax Income 14.4 20.8 6.8 10.9 10.1 10.2

Income Taxes 4.9 7.1 2.3 3.9 3.6 4.0

Income After Taxes 9.5 13.7 4.5 7.0 6.5 6.2

Adjustments to Income 0.0 0.0 0.0 0.0 0.0 0.0

Income for Primary EPS 9.5 13.7 4.5 7.0 6.5 6.2

Nonrecurring Items 0.0 0.0 0.0 0.0 0.0 0.0

Net Income 9.5 13.7 4.5 7.0 6.5 6.2

INDUSTRY COMPARTIVE ANALYSIS

The following schedule presents a comparative ratio analysis of Friedman Industries and the median

company in the same industry. We compare FRD with the industry median in the following four

categories: profitability, liquidity, debt management and asset management.

The liquidity ratios give us an indication of FRD’s ability to meet its obligations with the use of current

assets. As indicated by the comparative ratio analysis, FRD’s liquidity ratios are superior to that of the

industry median. The company has no long term debt and sufficient cash to meet all liabilities. In addition,

the company’s payout ratio is a healthy 22.7%.

The profitability ratios tell us how well management is doing in managing the company’s assets. FRD’s

gross profit margin is less than the industry median. However, operating and net margins are better. The

company’s return on equity is about twice as good as the industry median. For the industry median,

return on assets is a negative 1.4%. FRD provides a strong ROA of 13.8%

In terms of debt management, again the company provides better than industry median experiences.

Total liabilities to total assets are a low 9.1%. The company has no long term debt.

Please visit http://measuredapproach.wordpress.com for important disclosures.

© Copyright 2009 Ronald Sommer. All Rights Reserved.

Industry Comparative Analysis

Industry Industry

PROFITABILITY Company Median LIQUIDITY Company Median

Gross Profit 11.90 19.40 Quick ratio 5.90 1.10

Operating Margin 8.80 0.70 Current Ratio 9.50 1.80

Net Profit Margin 5.90 0.10 Payout Ratio 22.70 0.00

Return on Equity 17.10 8.20 Times Interest Earned n/a 0.70

Return on Assets 13.80 (1.40)

Industry Industry

DEBT MANAGEMENT Company Median ASSET MANAGEMENT Company Median

Total Liab. / Total Assets 9.10 57.80 Receivables Turnover 14.30 7.40

LT Debt / Equity 0.00 14.40 Asset Turnover 2.30 1.20

LT Debt / Capital 0.00 17.60 Inventory Turnover 5.70 5.40

VALUATION METRICS

In determining the fair market value of Friedman Industries, I considered income statement, balance

sheet and statement of cash flow data. I give more weight to the statement of cash flows and balance

sheet than I do to the income statement and reported or estimated earnings. In my opinion, debt is the

greatest determinant of risk and nothing substitutes for cash.

I assign a fair market value of $9.79 to the shares of Friedman Industries, Inc.

Valuation Ratios

Current MA Industry

Company Value Median

Price Earnings 4.20 6.99 14.30

PE to Growth 0.13 0.16 0.40

Price to Book 0.70 1.20 1.20

Price to Sales 0.20 0.41 0.50

Price to Cash Flow 4.10 6.94 12.70

Price to Free Cash Flow 4.00 6.80 9.70

DISCLOSURE: The author has no financial interest in Friedman Industries, Inc. (FRD).

Please visit http://measuredapproach.wordpress.com for important disclosures.

© Copyright 2009 Ronald Sommer. All Rights Reserved.

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- DIY InvestingDocumento2 pagineDIY Investingsommer_ronald5741Nessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Semiconductor Automated Test Equipment SummaryDocumento1 paginaSemiconductor Automated Test Equipment Summarysommer_ronald5741Nessuna valutazione finora

- The Best in Coal SummaryDocumento1 paginaThe Best in Coal Summarysommer_ronald5741Nessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Paper & Paper Products Industry SummaryDocumento1 paginaPaper & Paper Products Industry Summarysommer_ronald5741Nessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Global Telecom Opportunities SummaryDocumento1 paginaGlobal Telecom Opportunities Summarysommer_ronald5741Nessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Semiconductor Automated Test Equipment SummaryDocumento1 paginaSemiconductor Automated Test Equipment Summarysommer_ronald5741Nessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Inter Digital ProfileDocumento2 pagineInter Digital Profilesommer_ronald5741Nessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- A Small Cap Healthcare PickDocumento1 paginaA Small Cap Healthcare Picksommer_ronald5741Nessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Starting Lineup For 2011Documento3 pagineStarting Lineup For 2011sommer_ronald5741Nessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Brinker International: Challenge For Casual DiningDocumento2 pagineBrinker International: Challenge For Casual Diningsommer_ronald5741Nessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Long Term Case For HumanaDocumento2 pagineThe Long Term Case For Humanasommer_ronald5741Nessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Profit From Western DigitalDocumento3 pagineProfit From Western Digitalsommer_ronald57410% (1)

- 2010 Win Some Lose SomeDocumento2 pagine2010 Win Some Lose Somesommer_ronald5741Nessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Dialing For Dollars in ArgentinaDocumento2 pagineDialing For Dollars in Argentinasommer_ronald5741Nessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- ComTech Telecom SummaryDocumento3 pagineComTech Telecom Summarysommer_ronald5741Nessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- GT SolarDocumento2 pagineGT Solarsommer_ronald5741Nessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- LubrizolDocumento2 pagineLubrizolsommer_ronald5741Nessuna valutazione finora

- Core Laboratories: An Oil Patch OpportunityDocumento3 pagineCore Laboratories: An Oil Patch Opportunitysommer_ronald5741Nessuna valutazione finora

- Astrazeneca SummaryDocumento1 paginaAstrazeneca Summarysommer_ronald5741Nessuna valutazione finora

- Hawkins IncDocumento2 pagineHawkins Incsommer_ronald5741Nessuna valutazione finora

- The Game Is Not Over For GameStop Corp.Documento4 pagineThe Game Is Not Over For GameStop Corp.sommer_ronald5741Nessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- DIY For Cars - Advance Auto Parts Inc.Documento3 pagineDIY For Cars - Advance Auto Parts Inc.sommer_ronald5741Nessuna valutazione finora

- Endo Pharmaceuticals - Steady GrowthDocumento3 pagineEndo Pharmaceuticals - Steady Growthsommer_ronald5741Nessuna valutazione finora

- Tractor SupplyDocumento2 pagineTractor Supplysommer_ronald5741Nessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Navigate With GarminDocumento2 pagineNavigate With Garminsommer_ronald5741Nessuna valutazione finora

- Fuqi International: Finding Gold in ChinaDocumento3 pagineFuqi International: Finding Gold in Chinasommer_ronald5741Nessuna valutazione finora

- In Hog Heaven With Hormel FoodsDocumento3 pagineIn Hog Heaven With Hormel Foodssommer_ronald5741Nessuna valutazione finora

- Stryker Corporation: Opportunity or Trap?Documento6 pagineStryker Corporation: Opportunity or Trap?sommer_ronald5741100% (1)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (120)

- Sorl Auto Parts Inc. - No Stopping HereDocumento2 pagineSorl Auto Parts Inc. - No Stopping Heresommer_ronald5741Nessuna valutazione finora

- Oracle Corporation: The Road To RecoveryDocumento7 pagineOracle Corporation: The Road To Recoverysommer_ronald5741Nessuna valutazione finora

- MAFA Case StudyDocumento4 pagineMAFA Case StudyAnimesh AnandNessuna valutazione finora

- Double Entry Accounting 2014Documento84 pagineDouble Entry Accounting 2014Study Group100% (3)

- GRIRDocumento29 pagineGRIRPromoth JaidevNessuna valutazione finora

- Act Module4 Cashflow Fabm 2 5.Documento11 pagineAct Module4 Cashflow Fabm 2 5.DOMDOM, NORIEL O.Nessuna valutazione finora

- 9 Partnership Question 21Documento11 pagine9 Partnership Question 21kautiNessuna valutazione finora

- MAS 3 SamplesDocumento10 pagineMAS 3 SamplesRujean Salar AltejarNessuna valutazione finora

- Fabm 2 ModuleDocumento8 pagineFabm 2 ModuleVeinraxzia LlamarNessuna valutazione finora

- Ch02 P20 Build A ModelDocumento6 pagineCh02 P20 Build A ModelLydia PerezNessuna valutazione finora

- CHAPTER 4 Adjusting The AccountsDocumento9 pagineCHAPTER 4 Adjusting The AccountsGabrielle Joshebed AbaricoNessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Chapter 03 - The Accounting Cycle: Capturing Economic EventsDocumento143 pagineChapter 03 - The Accounting Cycle: Capturing Economic EventsElio BazNessuna valutazione finora

- Basic Accounting For Non-Accountants (A Bookkeeping Course)Documento49 pagineBasic Accounting For Non-Accountants (A Bookkeeping Course)Diana mae agoncilloNessuna valutazione finora

- Balance Sheet - Tata Motors Annual Report 2015-16 PDFDocumento2 pagineBalance Sheet - Tata Motors Annual Report 2015-16 PDFbijoy majumderNessuna valutazione finora

- Acct615 NjitDocumento17 pagineAcct615 NjithjnNessuna valutazione finora

- Abbott Company and Its Financial Statement Analysis Using Ratios Abbott CompanyDocumento17 pagineAbbott Company and Its Financial Statement Analysis Using Ratios Abbott CompanyMaryam EjazNessuna valutazione finora

- Associated Cement Company LTD: Profit & Loss Account Balance SheetDocumento3 pagineAssociated Cement Company LTD: Profit & Loss Account Balance SheetZulfiqar HaiderNessuna valutazione finora

- Forest City Tennis Club Pro Shop and BarDocumento18 pagineForest City Tennis Club Pro Shop and BarShubham JhaNessuna valutazione finora

- Ifrs 3 Business Combinations Acca VDocumento11 pagineIfrs 3 Business Combinations Acca VArnold MoyoNessuna valutazione finora

- Government Accounting - Chap. 6, 7, 14, 16Documento10 pagineGovernment Accounting - Chap. 6, 7, 14, 16Michael Brian TorresNessuna valutazione finora

- QQAA GREEN TECH Comprehensive ExampleDocumento7 pagineQQAA GREEN TECH Comprehensive ExampleZulhelmy NazriNessuna valutazione finora

- FABM2 Module 06 (Q1-W7)Documento8 pagineFABM2 Module 06 (Q1-W7)Christian Zebua75% (4)

- FSA4&5-Analysis of AssetsDocumento110 pagineFSA4&5-Analysis of AssetsjasonprasetioNessuna valutazione finora

- REVIEWER Intangible AssetsDocumento5 pagineREVIEWER Intangible AssetsCarl DionisioNessuna valutazione finora

- Bibliography AppendixDocumento5 pagineBibliography AppendixSocialist GopalNessuna valutazione finora

- Module 2b Allowance For Bad DebtsDocumento14 pagineModule 2b Allowance For Bad DebtsChen HaoNessuna valutazione finora

- Balance Sheet Template PDFDocumento2 pagineBalance Sheet Template PDFSubha ManNessuna valutazione finora

- Crompton Greaves Consumer Electricals LTD Q4fy22 Result UpdateDocumento12 pagineCrompton Greaves Consumer Electricals LTD Q4fy22 Result Updateharsh agarwalNessuna valutazione finora

- 2016 Vol 3 CH 6 AnsDocumento6 pagine2016 Vol 3 CH 6 Ansjohn lloyd JoseNessuna valutazione finora

- Ex. WorksheetDocumento3 pagineEx. WorksheetAllysa Kim RubisNessuna valutazione finora

- Garrison FSA Solman PDFDocumento39 pagineGarrison FSA Solman PDFGeraldo Mejillano100% (1)

- Business Plan BarbershopDocumento13 pagineBusiness Plan Barbershopsunlightshines germono13Nessuna valutazione finora

- Finance Basics (HBR 20-Minute Manager Series)Da EverandFinance Basics (HBR 20-Minute Manager Series)Valutazione: 4.5 su 5 stelle4.5/5 (32)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Da EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Valutazione: 4.5 su 5 stelle4.5/5 (13)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Da EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Valutazione: 4.5 su 5 stelle4.5/5 (5)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyDa EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyValutazione: 4.5 su 5 stelle4.5/5 (37)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindDa EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindValutazione: 5 su 5 stelle5/5 (231)

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceDa EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNessuna valutazione finora

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantDa EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantValutazione: 4.5 su 5 stelle4.5/5 (146)

- Getting to Yes: How to Negotiate Agreement Without Giving InDa EverandGetting to Yes: How to Negotiate Agreement Without Giving InValutazione: 4 su 5 stelle4/5 (652)