Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Bill Miller Value Trust Case

Caricato da

fredeuaCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Bill Miller Value Trust Case

Caricato da

fredeuaCopyright:

Formati disponibili

Ethics We assumed that Bill Miller was an educated investor and among his intellect and investment skills

thinking long term helped him to be successful and beat the market for 14 consecutive years. Miller was a believer of Fundamental analysis and his buying strategy often involved buying low-priced high intrinsic value stock. Almost half of Value Trust assets was large cap stock that are growth stocks and are generally riskier than average stocks but offered a higher yield and paid little or no dividends. Bill Millers case proves wrong that efficient market hypothesis theory which states that all the current prices reflect the true value of the underlying securities, hence it would be impossible to beat the market with skill or intellect. This theory can also be broken down into three forms, weak, semi strong and strong form of market efficiency. Weak form stated that prices of securities are random and have no correlation with past performances. Semi strong form says that todays prices are related to past prices and public available information. The Strong form states that stock prices reflect all information relevant to the firm, even including information available only to company insiders. This version of the hypothesis is the only version that could prove that Bill Millers success was not just due to a skill, luck or Intellect. Witch could prove that Value Trust performance was unethical because they would have had access to information before it was publicly released. The SEC is the organization responsible for preventing insiders from profiting by exploiting privileged information. According to the case nothing was ever found about someone from Value Trust having inside information and making profits based on this type of information. This proves that Bill Miller success can be only explained by his market knowledge, investment skills and luck. The only conflict that could arise would be someone from one of the major companies that Bill Miller invested in started working for Value Trust and made profit using inside information from the former company where they worked. This could generate a conflict damaging Value Trusts image and credibility among investors.

Potrebbero piacerti anche

- Summary of Bruce C. Greenwald, Judd Kahn & Paul D. Sonkin's Value InvestingDa EverandSummary of Bruce C. Greenwald, Judd Kahn & Paul D. Sonkin's Value InvestingNessuna valutazione finora

- Bill MillerDocumento6 pagineBill Millerfrans leonard100% (1)

- Bill Miller Investment Strategy and Theory of Efficient Market.Documento12 pagineBill Miller Investment Strategy and Theory of Efficient Market.Xun YangNessuna valutazione finora

- Security Valuation and Risk Analysis: Assessing Value in Investment Decision-MakingDa EverandSecurity Valuation and Risk Analysis: Assessing Value in Investment Decision-MakingNessuna valutazione finora

- Case2.Bill MillerDocumento3 pagineCase2.Bill Millercalvin100% (1)

- Be Your Own ActivistDocumento11 pagineBe Your Own ActivistSwagdogNessuna valutazione finora

- Gamification in Consumer Research A Clear and Concise ReferenceDa EverandGamification in Consumer Research A Clear and Concise ReferenceNessuna valutazione finora

- Book PenmanDocumento8 pagineBook PenmanL67Nessuna valutazione finora

- Behind the Berkshire Hathaway Curtain: Lessons from Warren Buffett's Top Business LeadersDa EverandBehind the Berkshire Hathaway Curtain: Lessons from Warren Buffett's Top Business LeadersValutazione: 2 su 5 stelle2/5 (1)

- Financial Statement Analysis - Concept Questions and Solutions - Chapter 1Documento13 pagineFinancial Statement Analysis - Concept Questions and Solutions - Chapter 1ObydulRanaNessuna valutazione finora

- The Art of Vulture Investing: Adventures in Distressed Securities ManagementDa EverandThe Art of Vulture Investing: Adventures in Distressed Securities ManagementNessuna valutazione finora

- Facebook InitiationDocumento60 pagineFacebook InitiationChristina SmithNessuna valutazione finora

- Curing Corporate Short-Termism: Future Growth vs. Current EarningsDa EverandCuring Corporate Short-Termism: Future Growth vs. Current EarningsNessuna valutazione finora

- Warren Buffett's 1995 GEICO AcquisitionDocumento16 pagineWarren Buffett's 1995 GEICO AcquisitionVALUEWALK LLCNessuna valutazione finora

- PIPE Investments of Private Equity Funds: The temptation of public equity investments to private equity firmsDa EverandPIPE Investments of Private Equity Funds: The temptation of public equity investments to private equity firmsNessuna valutazione finora

- Warren Buffett and GEICO Case StudyDocumento18 pagineWarren Buffett and GEICO Case StudyReymond Jude PagcoNessuna valutazione finora

- Survival of the Fittest for Investors: Using Darwin’s Laws of Evolution to Build a Winning PortfolioDa EverandSurvival of the Fittest for Investors: Using Darwin’s Laws of Evolution to Build a Winning PortfolioNessuna valutazione finora

- CGRP38 - Corporate Governance According To Charles T. MungerDocumento6 pagineCGRP38 - Corporate Governance According To Charles T. MungerStanford GSB Corporate Governance Research InitiativeNessuna valutazione finora

- Investing in Credit Hedge Funds: An In-Depth Guide to Building Your Portfolio and Profiting from the Credit MarketDa EverandInvesting in Credit Hedge Funds: An In-Depth Guide to Building Your Portfolio and Profiting from the Credit MarketNessuna valutazione finora

- Teledyne and Henry Singleton A CS of A Great Capital AllocatorDocumento34 pagineTeledyne and Henry Singleton A CS of A Great Capital Allocatorp_rishi_2000Nessuna valutazione finora

- GM Annual Report Details Depression's ImpactDocumento37 pagineGM Annual Report Details Depression's Impactbuckybad2Nessuna valutazione finora

- Graham - Doddsville - Issue 40 - v19 PDFDocumento61 pagineGraham - Doddsville - Issue 40 - v19 PDFRofiq 4 NugrohoNessuna valutazione finora

- War of The Handbags - The Takeover Battle For Gucci Group N.V.Documento53 pagineWar of The Handbags - The Takeover Battle For Gucci Group N.V.Shonali KapoorNessuna valutazione finora

- Graham and Doddsville - Issue 9 - Spring 2010Documento33 pagineGraham and Doddsville - Issue 9 - Spring 2010g4nz0Nessuna valutazione finora

- Enron How Leadership Led To The Downfall of The Company PDFDocumento12 pagineEnron How Leadership Led To The Downfall of The Company PDFAnonymous X1NnaTp4100% (1)

- Leon Cooperman Value Investing Congress Henry Singleton PDFDocumento37 pagineLeon Cooperman Value Investing Congress Henry Singleton PDFYashNessuna valutazione finora

- Bridge With BuffetDocumento12 pagineBridge With BuffetTraderCat SolarisNessuna valutazione finora

- Progyny S-1 FilingDocumento217 pagineProgyny S-1 FilingCrain's New York BusinessNessuna valutazione finora

- GoldmanSachsDocumento12 pagineGoldmanSachsAshishNessuna valutazione finora

- Letter About Carl IcahnDocumento4 pagineLetter About Carl IcahnCNBC.com100% (1)

- Private Placement Memorandum ManagerDocumento4 paginePrivate Placement Memorandum Managersimon GICHEHANessuna valutazione finora

- ValuationsDocumento27 pagineValuationsblabitan100% (1)

- Creighton Value Investing PanelDocumento9 pagineCreighton Value Investing PanelbenclaremonNessuna valutazione finora

- JPMCDocumento320 pagineJPMCtiwariparveshNessuna valutazione finora

- Third Point Q2 16Documento11 pagineThird Point Q2 16marketfolly.com100% (1)

- Opko Health - Lakewood Short ThesisDocumento48 pagineOpko Health - Lakewood Short ThesisCanadianValueNessuna valutazione finora

- Sequoia Transcript 2012Documento20 pagineSequoia Transcript 2012EnterprisingInvestorNessuna valutazione finora

- Millennials Enjoy Sports Just As Much As Other GenerationsDocumento6 pagineMillennials Enjoy Sports Just As Much As Other GenerationsMVNessuna valutazione finora

- Importance and Uses of Weighted Average Cost of Capital (WACC)Documento2 pagineImportance and Uses of Weighted Average Cost of Capital (WACC)Lyanna MormontNessuna valutazione finora

- Morgan StanleyDocumento9 pagineMorgan StanleyNikita MaskaraNessuna valutazione finora

- Prof. Greenwald On StrategyDocumento6 pagineProf. Greenwald On StrategyMarc F. DemshockNessuna valutazione finora

- Small Cap & Special SituationsDocumento3 pagineSmall Cap & Special SituationsAnthony DavianNessuna valutazione finora

- Investor Call Re Valeant PharmaceuticalsDocumento39 pagineInvestor Call Re Valeant PharmaceuticalsCanadianValueNessuna valutazione finora

- Graham & Doddsville Spring 2011 NewsletterDocumento27 pagineGraham & Doddsville Spring 2011 NewsletterOld School ValueNessuna valutazione finora

- Berkshire HathawayDocumento10 pagineBerkshire Hathawaylanpham19842003100% (1)

- The Role of Operational Risk in Rogue TradingDocumento6 pagineThe Role of Operational Risk in Rogue TradingpsoonekNessuna valutazione finora

- Li & Fung LTDDocumento7 pagineLi & Fung LTDSai VasudevanNessuna valutazione finora

- Synopsis: Warren Buffet - Harmaein Shirlesther G. Kua FM 4-1Documento6 pagineSynopsis: Warren Buffet - Harmaein Shirlesther G. Kua FM 4-1Harmaein KuaNessuna valutazione finora

- Living LegendsDocumento8 pagineLiving LegendsTBP_Think_Tank100% (3)

- The Hidden Traps in Decision MakingDocumento1 paginaThe Hidden Traps in Decision MakingmannycarNessuna valutazione finora

- Beautiful Investment AnalysisDocumento10 pagineBeautiful Investment AnalysisJohnetoreNessuna valutazione finora

- Geico Case Study PDFDocumento22 pagineGeico Case Study PDFMichael Cano LombardoNessuna valutazione finora

- David Tepper Says Be Long Equities Market FollyDocumento4 pagineDavid Tepper Says Be Long Equities Market FollynabsNessuna valutazione finora

- Becton Dickinson BDX Thesis East Coast Asset MGMTDocumento12 pagineBecton Dickinson BDX Thesis East Coast Asset MGMTWinstonNessuna valutazione finora

- Boyar's Intrinsic Value Research Forgotten FourtyDocumento49 pagineBoyar's Intrinsic Value Research Forgotten FourtyValueWalk100% (1)

- The KKR WayDocumento7 pagineThe KKR Waydondeos100% (3)

- Distressed Value Investing (Gatto) SP2016Documento2 pagineDistressed Value Investing (Gatto) SP2016darwin12Nessuna valutazione finora

- Aquamarine - 2013Documento84 pagineAquamarine - 2013sb86Nessuna valutazione finora

- Funds Management Test1 OulineDocumento6 pagineFunds Management Test1 OulinefredeuaNessuna valutazione finora

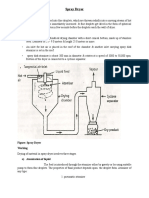

- Excel Fire 314Documento4 pagineExcel Fire 314fredeuaNessuna valutazione finora

- Walmart PresentationDocumento11 pagineWalmart PresentationfredeuaNessuna valutazione finora

- Body Shop International CaseDocumento4 pagineBody Shop International CasefredeuaNessuna valutazione finora

- Powers of Central Govt under Environment Protection ActDocumento13 paginePowers of Central Govt under Environment Protection Actsirajudeen INessuna valutazione finora

- Ce125-2500 Open FrameDocumento48 pagineCe125-2500 Open FrameRomão OliveiraNessuna valutazione finora

- Practical Finite Element Simulations With SOLIDWORKS 2022Documento465 paginePractical Finite Element Simulations With SOLIDWORKS 2022knbgamageNessuna valutazione finora

- b2 Open Cloze - Western AustraliaDocumento3 pagineb2 Open Cloze - Western Australiaartur solsonaNessuna valutazione finora

- Ubiquiti Af60-Xr DatasheetDocumento3 pagineUbiquiti Af60-Xr Datasheetayman rifaiNessuna valutazione finora

- Active Disturbance Rejection Control For Nonlinear SystemsDocumento8 pagineActive Disturbance Rejection Control For Nonlinear SystemsTrần Việt CườngNessuna valutazione finora

- The Transformation of Metaphysical ScienceDocumento7 pagineThe Transformation of Metaphysical ScienceblavskaNessuna valutazione finora

- Complete Approval List by FSSAIDocumento16 pagineComplete Approval List by FSSAIAnkush Pandey100% (1)

- PPM To Percent Conversion Calculator Number ConversionDocumento1 paginaPPM To Percent Conversion Calculator Number ConversionSata ChaimongkolsupNessuna valutazione finora

- Ex 2 6 FSC Part2 Ver3Documento16 pagineEx 2 6 FSC Part2 Ver3Usama TariqNessuna valutazione finora

- RA 5921 and RA 10918Documento32 pagineRA 5921 and RA 10918Hani Loveres100% (1)

- Download 12,000 Shed PlansDocumento27 pagineDownload 12,000 Shed PlansRadu_IS100% (2)

- WBC Study Reveals God's NatureDocumento11 pagineWBC Study Reveals God's NatureSherwin Castillo DelgadoNessuna valutazione finora

- Modesto Mabunga Vs PP (GR 142039)Documento3 pagineModesto Mabunga Vs PP (GR 142039)Ericha Joy GonadanNessuna valutazione finora

- Chapter 7 - The Political SelfDocumento6 pagineChapter 7 - The Political SelfJohn Rey A. TubieronNessuna valutazione finora

- Manual EDocumento12 pagineManual EKrum KashavarovNessuna valutazione finora

- Bahasa InggrisDocumento8 pagineBahasa InggrisArintaChairaniBanurea33% (3)

- Test Fibrain RespuestasDocumento2 pagineTest Fibrain Respuestasth3moltresNessuna valutazione finora

- Andrew Linklater - The Transformation of Political Community - E H Carr, Critical Theory and International RelationsDocumento19 pagineAndrew Linklater - The Transformation of Political Community - E H Carr, Critical Theory and International Relationsmaria luizaNessuna valutazione finora

- Snorkeling: A Brief History and Guide to This Underwater AdventureDocumento3 pagineSnorkeling: A Brief History and Guide to This Underwater AdventureBernadette PerezNessuna valutazione finora

- Dryers in Word FileDocumento5 pagineDryers in Word FileHaroon RahimNessuna valutazione finora

- Canopen-Lift Shaft Installation: W+W W+WDocumento20 pagineCanopen-Lift Shaft Installation: W+W W+WFERNSNessuna valutazione finora

- Cefoxitin and Ketorolac Edited!!Documento3 pagineCefoxitin and Ketorolac Edited!!Bryan Cruz VisarraNessuna valutazione finora

- Judges - God's War Against HumanismDocumento347 pagineJudges - God's War Against HumanismgypsylanternNessuna valutazione finora

- Indian ChronologyDocumento467 pagineIndian ChronologyModa Sattva100% (4)

- Gregory University Library Assignment on Qualities of a Reader Service LibrarianDocumento7 pagineGregory University Library Assignment on Qualities of a Reader Service LibrarianEnyiogu AbrahamNessuna valutazione finora

- Filler SlabDocumento4 pagineFiller Slabthusiyanthanp100% (1)

- Complimentary JournalDocumento58 pagineComplimentary JournalMcKey ZoeNessuna valutazione finora

- Primavera Inspire For Sap: Increased Profitability Through Superior TransparencyDocumento4 paginePrimavera Inspire For Sap: Increased Profitability Through Superior TransparencyAnbu ManoNessuna valutazione finora

- Canterburytales-No Fear PrologueDocumento10 pagineCanterburytales-No Fear Prologueapi-261452312Nessuna valutazione finora

- Digital Technical Theater Simplified: High Tech Lighting, Audio, Video and More on a Low BudgetDa EverandDigital Technical Theater Simplified: High Tech Lighting, Audio, Video and More on a Low BudgetNessuna valutazione finora

- The Business of Broadway: An Insider's Guide to Working, Producing, and Investing in the World's Greatest Theatre CommunityDa EverandThe Business of Broadway: An Insider's Guide to Working, Producing, and Investing in the World's Greatest Theatre CommunityNessuna valutazione finora

- The Long Hangover: Putin's New Russia and the Ghosts of the PastDa EverandThe Long Hangover: Putin's New Russia and the Ghosts of the PastValutazione: 4.5 su 5 stelle4.5/5 (76)

- Technical Theater for Nontechnical People: Second EditionDa EverandTechnical Theater for Nontechnical People: Second EditionNessuna valutazione finora

- What Are You Laughing At?: How to Write Humor for Screenplays, Stories, and MoreDa EverandWhat Are You Laughing At?: How to Write Humor for Screenplays, Stories, and MoreValutazione: 4 su 5 stelle4/5 (2)

- Learn the Essentials of Business Law in 15 DaysDa EverandLearn the Essentials of Business Law in 15 DaysValutazione: 4 su 5 stelle4/5 (13)

- How to Win Your Case in Small Claims Court Without a LawyerDa EverandHow to Win Your Case in Small Claims Court Without a LawyerValutazione: 5 su 5 stelle5/5 (1)

- Broadway General Manager: Demystifying the Most Important and Least Understood Role in Show BusinessDa EverandBroadway General Manager: Demystifying the Most Important and Least Understood Role in Show BusinessNessuna valutazione finora

- Ukraine: What Everyone Needs to KnowDa EverandUkraine: What Everyone Needs to KnowValutazione: 4.5 su 5 stelle4.5/5 (117)

- Starting Your Career as a Photo Stylist: A Comprehensive Guide to Photo Shoots, Marketing, Business, Fashion, Wardrobe, Off Figure, Product, Prop, Room Sets, and Food StylingDa EverandStarting Your Career as a Photo Stylist: A Comprehensive Guide to Photo Shoots, Marketing, Business, Fashion, Wardrobe, Off Figure, Product, Prop, Room Sets, and Food StylingValutazione: 5 su 5 stelle5/5 (1)

- Law of Contract Made Simple for LaymenDa EverandLaw of Contract Made Simple for LaymenValutazione: 4.5 su 5 stelle4.5/5 (9)

- Crash Course Business Agreements and ContractsDa EverandCrash Course Business Agreements and ContractsValutazione: 3 su 5 stelle3/5 (3)

- Independent Film Producing: How to Produce a Low-Budget Feature FilmDa EverandIndependent Film Producing: How to Produce a Low-Budget Feature FilmNessuna valutazione finora

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsDa EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsNessuna valutazione finora

- Fundamentals of Theatrical Design: A Guide to the Basics of Scenic, Costume, and Lighting DesignDa EverandFundamentals of Theatrical Design: A Guide to the Basics of Scenic, Costume, and Lighting DesignValutazione: 3.5 su 5 stelle3.5/5 (3)

- How to Improvise a Full-Length Play: The Art of Spontaneous TheaterDa EverandHow to Improvise a Full-Length Play: The Art of Spontaneous TheaterNessuna valutazione finora

- The Perfect Stage Crew: The Complete Technical Guide for High School, College, and Community TheaterDa EverandThe Perfect Stage Crew: The Complete Technical Guide for High School, College, and Community TheaterNessuna valutazione finora