Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Forum IT SEZ Draft 29.10.10

Caricato da

sampuran.das@gmail.comCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Forum IT SEZ Draft 29.10.10

Caricato da

sampuran.das@gmail.comCopyright:

Formati disponibili

Market Research & Demand Assessment for IT SEZ at Kolkata

Market Survey & Demand Assessment Study

TABLE OF CONTENTS 1.0 EXECUTIVE SUMMARY ............................................................................................................................................. 6

BACKGROUND ......................................................................................................................................................................... 6 OBJECTIVE .............................................................................................................................................................................. 6 APPROACH & METHODOLOGY ................................................................................................................................................ 6 MARKET ANALYSIS & DEVELOPMENT OPTIONS ..................................................................................................................... 6 PROJECT RETURNS................................................................................................................................................................. 6 CONCLUSION & RECOMMENDATIONS ..................................................................................................................................... 6 2.0 CITY OVERVIEW ......................................................................................................................................................... 7

2.1 INTRODUCTION ............................................................................................................................................................ 7 2.2 DEMOGRAPHICS .......................................................................................................................................................... 7 2.3 ECONOMIC INDICATORS .............................................................................................................................................. 8 2.3.1 GDP overview ................................................................................................................................................... 8 2.3.2 Income overview ............................................................................................................................................... 9 2.4 ECONOMIC BASE AND DRIVERS FOR THE CITY .......................................................................................................... 9 2.5 EXISTING & UPCOMING INFRASTRUCTURE ............................................................................................................... 13 2.5.1 Existing Infrastructure .................................................................................................................................... 13 2.5.2 Upcoming Infrastructure Initiatives ............................................................................................................... 15 3.0 4.0 4.1 4.2 5.0 5.1 5.2 5.3 5.4 6.0 6.1 6.2 6.3 6.4 6.5 6.6 6.7 6.8 7.0 PAN INDIA COMMERCIAL REAL ESTATE OVERVIEW ................................................................................... 16 KOLKATA REAL ESTATE OVERVIEW ................................................................................................................ 18 OVERVIEW OF MAJOR COMMERCIAL IT/ITES REAL ESTATE IN KOLKATA ................................................................ 18 PREVAILING RENTALS AND CAPITAL VALUES IN KOLKATA AND SUBJECT MICRO MARKET ........................................ 18 SITE AND LOCATION ANALYSIS ......................................................................................................................... 20 ASSESSMENT OF SITE LOCATION ............................................................................................................................. 20 IMPORTANT DEVELOPMENTS IN THE SURROUNDING AREA ....................................................................................... 20 INFRASTRUCTURE AROUND SUBJECT SITE................................................................................................................ 21 SWOT ANALYSIS ...................................................................................................................................................... 22 EVALUATING THE PROPOSED IT SEZ ............................................................................................................... 23 OUTLOOK FOR IT SEZ IN CURRENT POLICY ENVIRONMENT ..................................................................................... 23 MARKET RESEARCH AND DEMAND ESTIMATION ...................................................................................................... 24 VACANCY RATE TREND .............................................................................................................................................. 28 ANALYSIS OF SUPPLY & ABSORPTION ...................................................................................................................... 29 POTENTIAL IT/ITES COMPANIES LOOKING AT KOLKATA FOR FUTURE EXPANSION & NATURE OF THEIR EXPANSION 34 COMMENTARY ON QUANTUM OF DEVELOPMENT WITH RESPECT TO MARKET DYNAMICS......................................... 35 OPINION ON DEVELOPMENT AND LEASE PHASING .................................................................................................... 35 STEPS TO IMPROVE MARKETABILITY OF THE PROJECT ............................................................................................. 36 FINANCIAL ANALYSIS ............................................................................................................................................ 37

7.1 ASSUMPTIONS ........................................................................................................................................................... 37 7.1.1 Area Assumptions ........................................................................................................................................... 37 7.1.2 Project Development key dates .................................................................................................................... 37 7.1.3 Project Structure Assumptions ..................................................................................................................... 37 7.1.4 Construction cost ............................................................................................................................................ 38 7.1.5 Other cost assumptions ................................................................................................................................. 38 7.1.6 Land development cost .................................................................................................................................. 38 7.1.7 Revenue assumptions.................................................................................................................................... 38 7.1.8 Phasing assumptions ..................................................................................................................................... 38 7.1.9 Project Returns................................................................................................................................................ 39 7.1.10 Project Balance Sheet ...................................................................................................................................... 1 7.1.11 Project P&L ........................................................................................................................................................ 2 7.1.12 Project Cash Flows ........................................................................................................................................... 3

2

Nov 2010

Market Survey & Demand Assessment Study

7.1.13 7.1.14 8.0

Project Costing .................................................................................................................................................. 1 Project Cost ....................................................................................................................................................... 1

CONCLUSION / RECOMMENDATION .................................................................................................................... 1

CAVEATS AND LIMITATION ................................................................................................................................................ 4 ANNEXURE 3 SITE PHOTOGRAPHS .............................................................................................................................. 6

3

Nov 2010

Market Survey & Demand Assessment Study

Index of Tables

Table 1: List of Abbreviations ................................................................................................................................................. 5 Table 2: List of Measurements ............................................................................................................................................... 5 Table 3: Project Returns of Proposed Development Options ............................................................................................ 6 Table 4: Projected Population Density in KMA in persons per sq. km.: Census 2001 ................................................... 8 Table 5: Economic indicators of Kolkata as on 2001-02 .................................................................................................... 8 Table 6: Key Industries .......................................................................................................................................................... 12 Table 7: Existing Infrastructure ............................................................................................................................................. 13 Table 8: Upcoming Infrastructure Initiatives ....................................................................................................................... 15 Table 9: Pan India IT SEZ Supply & Absorption ................................................................................................................ 16 Table 10: Pan India STPI Supply & Absorption ................................................................................................................. 16 Table 11: Occupied Office Space KeyIT Vendors in Kolkata ........................................................................................ 18 Table 12: Delayed Projects ................................................................................................................................................... 18 Table 13: IT SEZ Exports ...................................................................................................................................................... 26 Table 14: Demand Estimation .............................................................................................................................................. 28 Table 13: Grade A IT Building Supply ................................................................................................................................. 31 Table 16: Grade A Building Absorption ............................................................................................................................... 34 Table 17: Development & Lease Phasing........................................................................................................................... 35 Table 18: Area assumptions ................................................................................................................................................. 37 Table 19:Development key dates ......................................................................................................................................... 37 Table 20: Project Structure assumptions ............................................................................................................................ 37 Table 21: Construction cost assumptions ........................................................................................................................... 38 Table 22: Other cost assumptions ....................................................................................................................................... 38 Table 23: Land development cost assumptions................................................................................................................. 38 Table 24: Revenue assumptions .......................................................................................................................................... 38 Table 25: Phasing assumptions ........................................................................................................................................... 38 Table 26: Project Returns ...................................................................................................................................................... 39 Table 27: Projected Balance Sheet ....................................................................................................................................... 2 Table 28: Projected Profit & Loss ........................................................................................................................................... 3 Table 29: Project Cash Flows ................................................................................................................................................. 4 Table 30: Project Cost Summary .......................................................................................................................................... 1 Table 17: Comparative Tax Regimes .................................................................................................................................... 2

Index of Figures

Figure 1:Kolkata ........................................................................................................................................................................ 7 Figure 2: Growth in Working Population .............................................................................................................................. 8 Figure 3: Sector-wise GDP contribution of Kolkata ............................................................................................................. 9 Figure 4: FDI Inflows from FY 2000 to FY 2007 ............................................................................................................... 10 Figure 5: Infrastructure Map .................................................................................................................................................. 14 Figure 6: Kolkata Metro Expansion Map ............................................................................................................................. 14 Figure 7: SEZ Supply in Top Seven Cities ........................................................................................................................ 17 Figure 8: Comparative upcoming SEZ & STPI Supply .................................................................................................... 17 Figure 9: Comparative of SEZ and STPI Absorption ....................................................................................................... 17 Figure 10: Rental Value Trend.............................................................................................................................................. 19 Figure 11: Capital Value Trend ............................................................................................................................................. 19 Figure 12: Location Map of Bantala SEZ ........................................................................................................................... 20 Figure 13: Site Plan Bantala SEZ ........................................................................................................................................ 21 Figure 14: STPI Exports Trend ............................................................................................................................................ 24 Figure 15: SPTI Growth in Exports Trend .......................................................................................................................... 24 Figure 16: Vacancy figures in major IT buildings ............................................................................................................... 29 Figure 17: Supply & Absorption Trend ................................................................................................................................ 29

4

Nov 2010

Market Survey & Demand Assessment Study

List of Abbreviations & Measurements

Abbreviations Approx. BHK BUA SBUA CBD FAR FSI Ft. Govt. INR Km M RCC Sq. ft Sq. m Approximately Bedroom Hall Kitchen Built Up Area Super Built Up Area Central Business District Floor Area Ratio Floor Space Index Feet Government Indian Rupee Kilometer Meter Reinforced Cement Concrete Square Feet Square Meter

Table 1: List of Abbreviations

Measurements 1 Acre 1 Hectare 1 Square Meter 1 Square Yard 43560 Square Feet 2.471 Acres 10.764 Square Feet 9 Square Feet

Table 2: List of Measurements

5

Nov 2010

Market Survey & Demand Assessment Study

1.0 EXECUTIVE SUMMARY

Background

Cushman & Wakefield (C&W) has been appointed by Forum IT Parks to undertake Commercial Market Survey & Business Plan assessment for setting up of IT SEZ on their 10.5 acres property located in Bantala. The study evaluates the overall real estate scenario in Kolkata with focus on the real estate dynamics in the subject micro market. This has been done in order to assess the market prospects for the proposed development. The study evaluates the subject property on various parameters such as location dynamics, competitiveness and demand prospects to ascertain/ assess the sustainability of the proposed development.

Objective

The primary objective of this assignment is to Ascertain the commercial IT real estate market dynamics in Kolkata (and specifically in the subject micro market), considering the local market development patterns and trends to enable the client to come up with the optimal development and phasing of the subject property.

Approach & Methodology

A physical inspection of the subject site & market survey was carried out in Bantala. Assessment of commercial IT/ITeS real estate trends in and around micro market of Bantala, Salt Lake and Rajarhat was mainly based on interaction with local industry players and leveraging on C&W services knowledge base and networks. Secondary research covered the review of existing reports and studies including publications by government agencies; publications by research firms for statistical data; & publications by various industry associations. C&W also conducted a review of the dynamics of the commercial IT/ITeS real estate in terms of the overall growth direction, existing and proposed development hubs, and the infrastructure initiatives in the region to establish the development framework for the subject property.

Market Analysis & Development Options

The subject micro-market of Bantala has been analyzed to understand the existing and proposed development patterns to gauge potential for development of an IT SEZ. As a result of the detailed analysis, we are of the opinion that: The subject site is suitable for development of IT SEZ. This segment is expected to witness further demand post the STPI sunset clause comes into force in FY 2011, this demand is expected to continue in the long term

Project Returns

We have undertaken financial assessment for the development options indicated above to arrive at the highest and best use development on the subject property. The same is summarized below:

Development Options Commercial Project IRR 22.6% Project NPV INR 2611 m

Table 3: Project Returns of Proposed Development Options

Conclusion & Recommendations

Based on market & financial assessment undertaken, we recommend development option of Retail, Hotel and Commercial on the subject property enabling estimated returns of 22.6% as project IRR (post tax). Please note that the values derived are indicative. Depending on transactional peculiarities, the achievable values can vary broadly in the range of 3% of the values indicated.

6

Nov 2010

Market Survey & Demand Assessment Study

2.0 CITY OVERVIEW

2.1 Introduction

Kolkata the capital of West Bengal is the main business, commercial and financial hub of eastern India and the northeastern states. The city is situated in the Eastern part of India on the bank of river Ganges and is the worlds 8th largest urban agglomeration. A city with one foot in its 300 year old heritage and a richly mixed culture, and the other forward to grab the best of today, Kolkata tends to be a city that delights with stunning glimpses into a rich culture, history, with amazing oasis of natural beauty in the heart of the city.

Figure 1:Kolkata

2.2

Demographics

As per Census 2001, the Kolkata Metropolitan Area (KMA) houses a population of 14,720,000. Of this, nearly 4.7 million people reside within the Kolkata Municipal Area (KMC). The urban agglomeration Kolkata Metropolitan Area is 1851 sq. km. in size whereas the Municipal Area within this region is about 185 sq. km1. By 2025, the population in KMA is expected to be approximately 22 million. The present density of urban population of Kolkata is 24,760 persons / sq. km. The following table provides a perspective of Kolkatas existing and emerging demographics as stipulated in the Vision 2025 document:

Area/District Kolkata Municipal Area (KMC) Hooghly Howrah 1961 16,740 1,937 4,234 1971 18,813 2,487 4,591 1981 20,891 3,170 5,805 1991 22,273 3,993 7,429 2001 23,149 4,734 8,604 2011 25,257 5,394 9,606 2021 26,620 6,169 11,056

KMA (Kolkata Metropolitan Area) refers to the overall administrative area under KMDA (Kolkata Metropolitan Development Authority) which includes the core city within the KMC (Kolkata Municipal Corporation) and surrounding urban sprawl (outgrowth areas defined by the planning authority).

7

Nov 2010

Market Survey & Demand Assessment Study

Nadia North 24 Parganas South 24 Parganas Kolkata Metropolitan Area (KMA)

505 2,964 1,008 3,817

685 4,256 1,465 4,651

1,279 5,687 1,821 5,666

1,783 7,415 2,430 6,826

2,256 9,385 3,201 7,950

2,682 10,742 3,590 8,914

3,228 12,498 4,191 10,045

Table 4: Projected Population Density in KMA in persons per sq. km.: Census 2001

At present, the average literacy rate in Kolkata is 81.31%. The Age Sex Ratio in Kolkata is currently 956 females per 1000 males. The annual growth rate of population for Kolkata is estimated to be approximately 4%. In order to meet the demands of the growing city population, the Kolkata Metropolitan Development Authority has proposed a few satellite townships around the city. These large developments shall act as counter-magnets and help in effectively reducing the burden on the core areas of the city. The working age population of the state is set to increase by 17 million by 2016, thereby leading to further urbanization.

30 25 20 15 10 5 0 2006 2011 2016 Figure 2: Growth in Working Population

Entering Workforce

Working Age Population in million

2.3

Economic Indicators

2.3.1 GDP overview Kolkata is a major economic centre of India. It is one among the fastest growing cities in the world. Following are the key economic indicators for the city:

Area/Item West Bengal ( Net State Domestic Product in US Mn $ ) KMA ( District Domestic Product in US Mn $) KMAs share in West Bengal (%) Distribution of SDP in KMA by Sector (%) Primary 7,766.55 50.14 0.65 0.63 Secondary 7,310.76 2,362.18 33.95 29.53 Tertiary 14,802.16 5,586.96 33.70 69.84 Total 29,879.47 7,999.28 _ 100

Table 5: Economic indicators of Kolkata as on 2001-02

8

Nov 2010

Market Survey & Demand Assessment Study

The figure represents sector-wise contribution of Kolkatas GDP to the total GDP of West Bengal. Kolkata has a major share of contribution in the Secondary and Tertiary sector GDP of West Bengal. As of 2001-02, Secondary and Tertiary sector contributed about 30% and 70% respectively to the states GDP. Under The Tertiary sector, the service sector, chiefly IT&ITeS, Real estate, Business Services had a major contribution of nearly 45% to the total GDP of Kolkata3.

2.3.2 Income overview

Figure 3: Sector-wise GDP contribution of Kolkata2

25,000.00 20,000.00 15,000.00 10,000.00 5,000.00 0.00 Primary

Secondary

Tertiary

GDP West Bengal

GDP Kolkata

The Annual Survey of Industries data show that 1990-91 onwards there has been a significant increase in the quantum of Productive Capital base of KMA-districts, registering a growth of about 35.5 percent per annum in the KMA-districts, as against a much lower rate of growth of 19.7 percent per annum for the state as a whole. KMA-districts accounted for an investment of Rs.5591 crores in the large and medium industry projects implemented between 1991 and 2002. This constituted 25 percent of total investment of Rs.22,101 crores in West Bengal during the same period. On the contrary, the labour-output ratios have experienced a declining trend during the last decade in both the state as well as in KMA-districts. This could be explained by increasing adoption of capital-intensive or labour-saving technologies in manufacturing processes.

2.4

Economic Base and Drivers for the City

Trade & Industry in Kolkata has played a significant role in developing the economic scenario of West Bengal. The prominent industrial sectors in Kolkata are Information Technology, Real Estates, Electronics, Apparel and Plastic products. Information Technology is the most developing industry in Kolkata that accounts for a major portion to the overall trade in West Bengal. Some of the other significant industries in Kolkata include construction, chemicals, cosmetics & jewellery, furniture, sports goods, tourism, rubber, media and advertising. Kolkata is also base to several industrial units with produce ranging from jute to electronics. Some of the renowned Indian companies headquartered in Kolkata include Bata India, ITC Limited, Coal India Limited,

2 3

Source: Statistical Abstract, BAE&S GoWB,: data as of 2001-02 www.indiastat.com

Market Survey & Demand Assessment Study

Birla Corporation, Bengal Peerless, National Insurance Company, Orient fans, Exide, Berger Paints and Tata Tea. Stagnation in the major traditional industries in KMA like jute, engineering, cotton and chemicals had been caused by a number of factors including the ownership structure of industries, the national policy of freight equalization for iron and steel, promotion of similar industries in other parts of the country to achieve regional balance etc. However, the knowledge based IT and ITES industries have witnessed year on year higher growth in terms of both annual turnover and exports. The magnitude of software exports from Kolkata rising from Rs. 3.5 billion in 1999-2000 to Rs.12 billion during 2002-03 and further to Rs.16 billion in 2003-04, have clearly reinstated the fact that IT&ITeS industry is the economic spine of Kolkata. Industrial revival of the state is faced with the following challeges; Bengal has 37,574 hectares of barren land most of it is in areas far from demand centers. The government has 9073 hectares available for industry while pending industrial proposals before West Bengals commerce and industries department would require 36,437 hectares. The acquisition of such vast amount of land could potentially displace about 619 thousand persons. On the other hand large government spending on infrastructure may not be feasible, given Bengal's economy reels under huge debt; about 97 per cent of the state's revenue is spent on paying interests for loans and salaries. Therefore the state would have to attract FDI Inflows coupled with high dose of private investments to sustain future growth. According to Nasscom Deloitte Study 2008, for every job created in the IT Sector four indirect employment is created 75% of those employees are SSC/HSC educated. Further output multiplier of IT industry on other sectors is 2, through non- wage operating expenses and Cap-ex. Therefore the IT Sector is expected to be a major growth driver for Bengal since (a) it is not land intensive (b) knowledge workers are not unionized (c) healthy supply of highly skilled manpower (d) lower cost of living and wage cost (e) existing urban/telecom infrastructure can sustain growth of IT sector. WEBEL is the facilitator for development of Information Technology (IT) and IT Enabled Services (ITES) in the state, besides being the nodal agency for development of electronic industries. Principally located in Salt Lake (chiefly in Sector V area), Rajarhat and to some extent in areas around EM Bypass currently, there are approximately 250 IT companies in Kolkata employing over 75,000 IT professionals.

FDI Inflows FY 2000-2010

200000 180000 160000 140000 120000 100000 80000 60000 40000 20000 0

FDI

Rs Cr

Figure 4: FDI Inflows from FY 2000 to FY 2007

10

Nov 2010

Market Survey & Demand Assessment Study

IT/ITES The IT sector in Kolkata had grown at a CAGR of 88% between 1996-97 and 2002-03. During 2001-2005, it has witnessed 70% growth against the national average of 37%. The IT/ITeS Sector witnessed an export turnover of Rs 35 billion in 2006-07. Even during the recent global slowdown, the IT/ITeS growth in Kolkata is currently at 12% in the year 2008-09, which is still higher than the national average. Kolkata had an advantage of lower commercial lease rentals/ capital rates, availability of large talent pool, lower attrition rates, adequate support infrastructure, adequate social infrastructure, affordable housing, which has been the major attraction for IT players looking for expansion plans with cheaper overhead costs.

Industry Overview

MNCs like Pricewaterhouse Coopers, IBM, TCS, Cognizant, Wipro, Skytech, Lexmark, AIG and HSBC including Indian corporate houses like ITC Infotech and Reliance are operational in the city. Some other IT companies in Kolkata include Acumen Soft Technologies, Ambujex Technologies (P) Ltd, Alliant Technologies Private Limited, Apt Software Avenues Pvt Ltd, Bright Soft Solutions, Calinnovations, ChaiONE, Digital care Pvt. Ltd, Kris Systems Pvt Ltd, MaxMobility PVT LTD, Ontrack Systems Limited, Re-Life Digital Solution Pvt Ltd and Webel Technology Limited. Some of the prominent IT campuses in Kolkata are the Wipro SEZ, the DLF IT Park at Rajarhat, Infinity Benchmark, Godrej Waterside, the Technopolis building, RMZ Ecospace mostly concentrated in Rajarhat & Salt Lake Sector V.

Government Initiatives

The West Bengal Government had earmarked IT Industry as the priority sector for Industrial Development in the State. A number of initiatives have been taken by the government to attract IT companies in the state, viz.: Setting up of a dedicated IT department within the ministry in year 2000, Empowering agencies like WEBEL in facilitating the IT sector in Sector V, Salt Lake, Bringing IT within the ambit of Public Utility Services, Procurement and facilitating in land acquisition, Providing land at cross subsidy, Creating requisite physical infrastructure for the IT Industry.

Heavy-engineering Casting, forging, metallic articles, machinery, generators, transformers, electric motors, ships and vessels and related accessories, railway wagons and coaches and accessories have been the dominant traditional industries in KMA in terms of contributing substantially to state domestic product and also providing considerable employment. More than 3 lakh persons are employed in this industry in the state. The metal-based foundry industry and a large number of small engineering units in Howrah have been among the oldest heritage industries of India. This industry manufactures a wide range of products, serves the requirement of automobile industries, railways, agriculture, mining, various parts and components of jute, cotton, cement, rolling mills etc., and is highly labour intensive in nature. This industry has been passing through severe crisis due to a number of reasons, important among them being decentralization of procurement by Indian Railways, shortage of inputs like coal, lack of technological up gradation and diversification and freight equalization policy of the Government of India. Although the number of units is seen to be rising in recent years, there is a need for modernization of this industry to render itself more competitive.

Industry Overview

11

Nov 2010

Market Survey & Demand Assessment Study

Construction Construction Industry constitutes the second major activity after manufacture and engineering. The SDP generated in this sector in KMA-districts registered an annual average rate of growth of around 6.3 percent in the present decade (2001 onwards). A major part of the construction activities in KMA is accounted for by real estate and infrastructure development activities. Real estate activities have witnessed a significant jump in recent years within KMA, registering an annual growth of 9.5 percent in the same decade.

Industry Overview

Chemicals and Small Scale Industries West Bengal has been among the leaders in production of Chemicals, Drugs & Pharmaceuticals. The recent increasing popularity of herbal drugs has provided a great opportunity for drugs & pharmaceuticals industry in the State and also in KMA. The recently established Haldia Petrochemicals Complex 120 kilometres away from KMA has opened up opportunity for both chemical and drugs & pharmaceuticals industries within KMA.

Industry Overview

The growth of registered Small Scale Industry (SSI) units has been significant in KMA, the total number of registered SSI units in KMA being approximately 6000 employing roughly 33,000 people. The major small-scale units in KMA are metal-based engineering, leather, chemicals and food based industries. However, most of these industries have been plagued by problems like inadequate supply of raw materials, absence of application of modern technology and lack of institutional financing facility.

Table 6: Key Industries

12

Nov 2010

Market Survey & Demand Assessment Study

2.5

Existing & Upcoming Infrastructure

2.5.1 Existing Infrastructure

Infrastructure

Description Kolkatas airport provides both domestic and international connectivity and is located in the north of Kolkata City in Dum Dum. Kolkata is currently serviced by 14 international, 8 domestic airlines and 5 Cargo Airlines. The number of domestic & international passengers in 2006-07 was around 6 million.

Airport

Calcutta Airport has been ranked as the 7th spot much ahead of Hyderabad International Airport (10th Spot), Chennai International Airport (14th Spot) and New Delhi Indira Gandhi International Airport (25th spot) in an official statistics regarding the "Top 25 fastest growing airports 2007" worldwide with a 28.2% increase in the passenger traffic, according to the World Airport Traffic 2007 report released by the Airports Council International. Kolkata has a road space at just 6% of the total city area as against the standard 20% in wellplanned cities like Delhi. The major road developments in KMA are: Belghoria Expressway Kona Expressway Acharya Jagadish Chandra Bose Road Eastern Metropolitan Bypass VIP Road Rajarhat Arterial Road Diamond Harbour Road Basanti Highway National Highway 2 National Highway 6 National Highway 117 National Highway 34 National Highway 35 National Highway 41 The Rabindra Setu, the Vivekananda Setu, the Dakshineshwar Bridge and the Second Vivekananda Bridge, are the vital parts of linkages over the river Hooghly that create better accessibility to the entire KMA and its periphery. Two recent significant developments are the SVTB (Second Vivekananda Tollway Bridge) and the Garia Metro Extension (operational by 2009) both of which have made a significant impact on traffic mobilization by improving connectivity and reducing travel-time. Kolkata has two major long distance railway stations at Howrah Station and Sealdah. Howrah station connects to rest of India and Sealdah station to north of Bengal and northeastern part of the country. It also has The Suburban Railway connecting to the suburbs surrounding the city of Kolkata. The Kolkata Metro is the underground rail network in Kolkata, India. It is run by the Indian Railways and is the first underground built in India with service starting in 1984. The line begins at Dum Dum in the north and continues south through Park Street, Esplanade in the heart of the city till the southern end in Kavi Nazrul. The Port of Kolkata is a riverine port in the city of Kolkata, India. It is the oldest operating port in India, having originally been constructed by the British East India Company. The Port has two distinct dock systems - Kolkata Docks at Kolkata and a deep-water dock at Haldia Dock Complex, Haldia.

Table 7: Existing Infrastructure

Roads

Railways

Port

13

Nov 2010

Market Survey & Demand Assessment Study

Figure 5: Infrastructure Map

Figure 6: Kolkata Metro Expansion Map

Market Survey & Demand Assessment Study

2.5.2 Upcoming Infrastructure Initiatives

Projects Description Several new highways have been proposed in KMA, some major projects are mentioned below with the running length in kilometres: Dum-Dum Barrackpore Expressway - Madhyamgram to Belghoria: 6.0 km Eastern Expressway - NH 34 to Taki: 8.0 km - Taki to B N Dey Road: 22.5 km - B N Dey Road to Baruipur and NH 34 to Barrackpore-Kalyani Road: 30.1 km Southern Expressway - Baraipur to Diamond Harbor Road: 15.5 km - Diamond Harbour Road to Budge Budge to Bauria to NH 6: 22.7 km - Bridge over / tunnel under Hooghly Serampur-Barrackpore-Barasat Expressway - Connecting NH 2 and Eastern Expressway: 22.5 km Western Riverfront Expressway - Andul Road to Bauria Connector: 14.0 km The proposed East-West Metro Corridor will run 13 km from Salt Lake to Howrah station and is set to be operational by 2012. Metro Rail Project The 12 stations on the route will be Howrah, Mahakaran, Central, Bowbazar, Sealdah, Phoolbagan, Salt Lake stadium, Bengal Chemical, City Centre, Central Park, Karunamoyee and Sector V. The route will intersect the existing North-South Metro Corridor at Central Station. KMDA along with international fund houses like JBIC (Japan Bank of International Cooperation) has proposed construction of several flyovers/ bridges at critical junctions some of which have been shown below: Over crossing of Jessore Road and Dum Dum Road (2007-2012) Salt Lake Bypass across J K Saha Bridge (2007-2012) Along Anwar Shah Road across Raja Subodh Mallick Road (2007-2012) Esplanade RA Kidwai Road

New Metropolitan Highways

Bridges/ Flyovers

Across Park Street (2012 onwards) Across Loudon Street (2012 onwards) Across Camac Street (2012 onwards)

Elevated Ring Road Corridor around Kolkata with entry and exit ramps

Across Strand Bank Road-Strand Road-Diamond Harbor Road-AliporePrince Anwar Shah Road-EM Bypass-VIP Road-Circular Canal-Bagabazar (2012 onwards)

Elevated Road from Park Circus to Parama Island (2012 onwards) Patipukur Underpass on Jessore Road (2012 onwards) EM Bypass to VIP Road (2012 onwards) Vivekananda Road Flyover Phase I : Howrah to CR Avenue crossing (2012 onwards) Vivekananda Road Flyover Phase II : CR Avenue crossing to Airport (2012 onwards)

Table 8: Upcoming Infrastructure Initiatives

15

Nov 2010

Market Survey & Demand Assessment Study

3.0 PAN INDIA COMMERCIAL REAL ESTATE OVERVIEW

The table below highlights SEZ supply and absorption across India over the period of last 2 years, including the projected figures for 2010. The current vacancy rate being high correction in new supply is expected, as reflected in the figures for FY 2010.

IT SEZ Absorption (mn sq ft)

NCR Mumbai Pune Kolkata Hyderabad Bangalore Chennai

IT SEZ Supply (mn sq ft)

NCR Mumbai Pune Kolkata Hyderabad Bangalore Chennai

2008

2.00 1.60 3.57 1.29 5.72 3.87

2009

2.62 1.96 0.70 2.25 2.83 3.38

2010 (P)

0.50 1.65 0.60 1.86 4.40 2.97

2008

1.70 1.50 2.51 0.58 5.14 3.25

2009

2.18 1.05 0.69 0.85 1.10 1.59

2010 (P)

1.05 0.60 0.74 1.67

Total

18.75

13.04

7.73

Total

14.67

7.46

4.05

Table 9: Pan India IT SEZ Supply & Absorption

The table below highlights STPI supply and absorption across India over the period of last 2 years, including the projected figures for 2010. FY 2009 was a tough year for the IT Industry and the industry clocked single digit growth of 5.4% consequently the absorption levels dropped sharply as compared to FY 2008. Due to changes in policy environment particularly STPI sunset clause projected absorption for FY 2010 is expected to fall further. The STPI supply for FY 2010 is on the higher side mainly because of delayed prior IT projects which are nearing completion.

STPI Absorption (mn sq ft)

NCR Mumbai Pune Kolkata Hyderabad Bangalore Chennai

STPI Supply (mn sq ft)

NCR Mumbai Pune Kolkata Hyderabad Bangalore Chennai

2008

7.22 3.21 8.84 1.28 1.61 5.46 4.40

2009

4.17 6.78 2.71 3.58 2.48 3.90

2010 (P)

8.97 7.67 3.50 9.15 3.93

2008

5.76 0.58 3.02 0.48 0.90 5.22 2.11

2009

1.30 3.37 0.86 1.31 4.63 1.70

2010 (P)

0.96 3.76 1.79

Total

32.01

23.62

33.23

Total

18.07

13.17

6.51

Table 10: Pan India STPI Supply & Absorption

16

Nov 2010

Market Survey & Demand Assessment Study

SEZ SUPPLY - BIG 7

20.00 18.00 3.87 16.00 14.00 12.00 s q .ft. 10.00 3.88 8.00 6.00 2.98 4.00 0.96 0.00 2.00 0.00 2.32 0.00 0.50 2007

NCR

5.72 3.38

1.29 0.70 3.57

2.83 2.97 0.75 1.86 1.65 0.50 2010 (P)

Hyderabad

2.25 1.96

4.00 2.37 0.40 2.13 2011 (P)

Bangalore Chennai

1.60 2.00 2008

Mum bai

2.62

2.40 2012 (P)

2009

Pune Kolkata

Figure 7: SEZ Supply in Top Seven Cities

Figure 8: Comparative upcoming SEZ & STPI Supply

Figure 9: Comparative of SEZ and STPI Absorption

17

Nov 2010

Market Survey & Demand Assessment Study

4.0 KOLKATA REAL ESTATE OVERVIEW

4.1 Overview of Major commercial IT/ITeS real estate in Kolkata

Kolkata commercial market is relatively in its nascent and emerging stage. Currently there is only one operational SEZ development in the market. Most of these commercial developments are coming up in the eastern quadrant of the city. Aggregate office space occupied by some of the key IT Vendors:

Occupier

IBM/Daksh TCS Cognizant Genpact One Source HSBC

Area (sq ft)

850000 800000 530000 200000 150000 200000

Occupier

Lexmark Bharti Global Tele HCL ABN Amro

Area (sq ft)

150000 80000 40000 20000 18000

Table 11: Occupied Office Space KeyIT Vendors in Kolkata

Though in nascent stage, Kolkata also had its share of recessionary effect on the commercial space. Table below highlights IT projects that are delayed due to the economic recession. On account of limited response from the market DLF had to de notify its SEZ development in Rajarhat in FY2009-10; however due to improvement in market sentiments DLF has applied to the Board of Approval, for re-notification of Rajarhat SEZ in May 2010.

Builder Name Type Project Details 50 acres IT SEZ has been postponed, of which 25 acres has been de-notified 1.5 m sq ft Genesis scheduled to be completed by 2010, is now on hold Waterside Phase II of this 1.8 m sq ft project is delayed 4.2 m sq ft Infospace SEZ was to be completed by 2010, however only Phase I is complete, Phase-II 700,000 sq ft is under construction delayed by 3 years 420,000 Tech Square is delayed by 2 years Micro Market

Shapoorji Pallonji

IT SEZ

Rajarhat

Godrej Properties Godrej Properties

IT Park IT Park

Salt Lake Salt Lake

Unitech Vipul

IT SEZ IT Park

Rajarhat Salt Lake

Table 12: Delayed Projects

4.2

Prevailing rentals and capital values in Kolkata and subject micro market

The rental values in Kolkata have been highest in the CBD area followed by suburban region and peripheral. However, in the Suburban & Peripheral areas the prices are likely weaker due to the large-scale infusions in the supply level and greater availability of space. Kolkata witnessed significant correction in rental values across almost all micro-markets pursuant to the general slowdown in the economys corporate activities in late 2008. The lowering of rentals stabilized in mid 2009 and by end 2009, there was a new demand for fresh commercial spaces.

18

Nov 2010

Market Survey & Demand Assessment Study

Rental values across most micro markets remained stable during 4Q 2009 except for a minor appreciation in Salt Lake. This was primarily attributed to the reinstatement of developers confidence in wake of increased enquiries and subsequent rise in the absorption level in the micro market. Following graph highlights the rental & capital value trend in various micro-markets of Kolkata:

Kolkata Rental Value Trend

120 100 INR/SFT/Month 80 60 40 20 0 2006 2007 Saltlake Sec V / Rajarhat (IT) Topsia/Ruby (Non IT) 2008 Park Street / Camac Street (Non IT) Saltlake Sec V / Rajarhat (Non IT) 2009 2010 Dalhousie Square (Non IT)

Figure 10: Rental Value Trend

Kolkata Capital Value Trend

12,000 10,000 INR/SFT 8,000 6,000 4,000 2,000 0 2006 2007 2008 2009 2010 (E)

Saltlake Sec V / Rajarhat (IT) Dalhousie Square (Non IT) Saltlake Sec V / Rajarhat (Non IT)

Park Street / Camac Street (Non IT) Topsia/Ruby (Non IT)

Figure 11: Capital Value Trend

Rental values in the peripheral locations are likely to witness minor appreciation on account of increased enquiries and demand mainly from IT and telecom sector. Developers are also likely to initiate delivery of under construction projects. Vacancy level is however, likely to remain at the higher side due to significant supply remaining unabsorbed. Moreover, the market is expected to witness increased competition to capitalize on the increased enquiries and revival of demand in the market

19

Nov 2010

Market Survey & Demand Assessment Study

5.0 SITE AND LOCATION ANALYSIS ALYSIS

5.1 Assessment of Site Location

Bantala is located on the eastern fringes of the city. ML Dalmiya & Co notified IT SEZ also know as Kolkata IT Park is located 15 km from Science City. The two lanes Basanti Highway connect the site to EM Bypass.

Figure 12: Location Map of Bantala SEZ

5.2

Important developments in the surrounding ar area

The 130 acres Kolkata IT Park was carved out of the Calcutta Leather Complex. Companies that have acquired land are Cognizant (20acres), Patni (14 acres), Tech Mahindra (12.12 acres) and developers of built-up up space like Forum Projects (10.56 acres), Dhuns Dhunseri Group (10 acres) and Infinity Park (11.6acres). Three years back it was poised to become an upcoming growth corridor for the city, competing with Rajarhat. However since then not much development has been seen in this micro-market market except the Rs 188 crs Cognizant Tech Campus. Proposed development in the area include 1.2 million sq ft residential development by Srijan Developers and Mani Square II retail mall are also currently on hold.

Market Survey & Demand Assessment Study

Figure 13: 13 Site Plan Bantala SEZ

5.3

Infrastructure around subject site

The accessibility to the Kolkata IT Park from EM Bypass on Basanti Highway has improved however congestion during peak hours is still a concern. The widening of Basanti Highway to 4 lanes is on the anvil. Construction on the two proposed flyovers that would have connected it to Rajarhat and Ruby has not commenced yet.

Market Survey & Demand Assessment Study

5.4

SWOT Analysis

Strengths Weaknesses

Road, Power and Telecom Infrastructure inside ML Dalmiya & Co SEZ are adequate. Concerns of waste disposal from tanneries have been resolved with canal segregation. Land cost being lower than Rajarhat rentals are expected to be competitive The site is in the outer fringes of the city distant from major residential & commercial hubs Being adjacent to Leather Complex

Opportunities

Threats

IT majors are setting up their own campuses The proposed project has the potential to be the first multi-tenanted IT SEZ after Unitech SPTI Sunset clause and favorable impact on SEZ Relative attractiveness of Rajarhat due to integrated development , closeness to existing IT Corridor of Salt Lake Postponed projects like widening of Basanti-Highway, Rajarhat & Ruby Flyover

22

Nov 2010

Market Survey & Demand Assessment Study

6.0 EVALUATING THE PROPOSED IT SEZ

6.1 Outlook for IT SEZ in current policy environment

The union budget 2010-11 does not provide for extension of STPI benefits. Further MAT (minimum alternative tax) applicable on STPI units has been increased from 15% to 18% in the financial year 2010-11. It is interesting to learn that most of the large IT firms have already enjoyed STPI benefits for an entire 10-year timeframe, and consequently would not be eligible for tax rebates. There is lack of clarity on the extension of tax benefits to IT SME and newer firms who are yet to enjoy the full term of the earlier tax benefit scheme. On the other hand the latest notification issued by the Ministry of Commerce relaxes the 80:20 ratios for the transfer of old assets into SEZ. Further SEZ units are exempt from exemption from Minimum Alternative Tax (MAT) and Service Tax. The concerns for units shifting from STPI setups into IT SEZs is the fact that such units will have to forego the corporate tax exemptions and obtain new licenses for old operations. If the Goods and Services Tax (GST) and the Direct Tax Code (DTC) come into force in 2011, it might be a cause for concern for firms and developers and co-developers operating out of SEZs. Some of the key points considered in the DTC draft include no income tax benefits for SEZ units, tax holiday becoming investment-linked and not profit linked for developers and co-developer, as well as MAT becoming applicable for a developer and co-developer. But there is a lack of clarity as to whether the DTC will be implemented from April 2011, and whether all the points mentioned above will be taken into consideration or not. Since the inception of SEZs, key IT companies such as Infosys, Wipro, TCS,CTS and HCL, to name a few have been the early birds to receive final SEZ notifications, with a few already having commenced operations too. Captive Multi National Corporations (GENPACT, American Express, Texas Instruments, Philips, Siemens, etc.),on the other hand, are in tax neutral positions, willing to operate either from a STPI or a SEZ, with their focus on expanding in India with maximum cost advantages. It is also interesting to know that MNCs like IBM, Accenture, Metlife, Cisco, I-flex, WNS, EDS, Honeywell, Perot Systems, etc., have already started operating out of SEZs to avail various benefits. SMEs and other mid-cap IT companies are the ones who have been affected the most with no extension in STPI and at the same time are skeptical of moving into SEZ. With ambiguity on the extension of benefits to STPI units, as well as the lack of clarity on the guidelines for DTC (applicable from April 2011), several corporate are currently sitting on the fence; and are apprehensive about taking either route. Please refer to Annexure-I for a comparative tax regimes and its implications for SEZs.

23

Nov 2010

Market Survey & Demand Assessment Study

6.2

Market Research and Demand Estimation

Kolkata accounts for only 2.5 % of the India Indias IT Exports from STPI and its share has remained constant since FY 2007-08. Although the state had envisioned increasing Bengals share to 10%, but political and economic uncertainty has impacted growth projections.

STPI Growth (%) 50.0 40.0 30.0 20.0 10.0 0.0 -10.0 -20.0

2008 2007

Figure 14: STPI Exports Trend

250000

SPTI Exports (Rs crs)

200000

150000

2008-09

100000

2007-08 2006-07

50000

0 All India 2008-09 2007-08 2006-07 207357 180155 144214 Karnataka 70375 55000 48700 Maharashtra 42360 35374 27625

Andhra Pradesh 31039 26122 18582

Tamilnadu 28355 28295 20745

NCR 24436 26919 21886

Bengal 5129 4500 3500

Figure 15: SPTI Growth in Exports Trend

The global economic recession had severe impact on the IT Sector and for the first time the industry clock clocked single digit growth of 5.4% during ing FY 2009 2009-10. The IT export port target for the current fiscal has been revised by NASSCOM to $ 54 billion against an earlier projection of $ 62 billion. In spite of the recession and policy

Market Survey & Demand Assessment Study

uncertainty exports from notified IT SEZs has grown at a phenomenal 400%. Although the official STPI annual report for FY 2009-10 has not been published our estimates suggests SPTI exports has declined by about 5% during the same period. In light of SPTI sun set clause incremental exports are expected to come from SEZ, thus declining trend in STPI exports should continue. The table below highlights the growth of IT exports from operational SEZ across India. IT Exports notified SEZ (Rs Cr)

Andhra Pradesh APIIC APIIC CMC Limited DivyaSree NSL DLF L&T Phoenix Infopark Lanco Hills Maytas Hill Serene Properties Sundew Wipro Limited Navayuga Legal Chandigarh 21 Rajiv Gandhi Tech Park Gujarat Larsen & Toubro Haryana DLF Cyber City DLF Limited Gurgaon Infospace Karnataka Manyata Embassy Business Park WIPRO Limited Varthur Hobli, WIPRO Infosys Vikas Telecom Adarsh Prime Divyashree SEZ Cessna Garden Bangalore, Tanglin Devp (Global Village SEZ) HCL Information Tech Park Primal Projects Banglore, Bagmane Kerala Infopark SEZ Electronic Tech Park SEZ-I Electronic Park Maharashtra Hiranandani Business Park Infosys EON Kharadi DLF Akruti Dynasty Developers

Location

FY2009-10

FY2008-09

Nanakramguda Madhurwara, Hill IT Ranga Reddy Ranga Reddy Ranga Reddy Mandal, Andhra IT Manikonda Bachupally Pocharam Madhapur, RR Manikonda Serilingampally Chandigarh Distt. Vadodara Gurgaon, Gurgaon, Gurgaon,

146.84 34.28 570.98 87.85 652.2 150.73 8.81 68.27 8.43 101.86 853.94 24.17 289.97 5.11 587.88 88 342.9

72.83 57.3 100 26.78 300.3 69.5 UI UI UI 9.83 300 UI 14.54 UI 66.45 UI 220

Bangalore, Varthur Hobli, Sarjapur Road, Bantwal Taluk, Mangalore Bangalore, Devarabeesanaha IT Krishnarajapura, Bangalore

3582.8 4129.44 1671.58 642.36 587.31 1029.91 1514 1885.8 1063.12 13.29 2572.16 115.49 768.74 317.816 13.397 14.98 839.3 649.72 726.53 329.691 164.22

268.98 UI UI 94.32 9.6 225 245 600 80 UI 317 UI UI 110 79.83 56.59 UI 24.29 190 200 UI

Pattengere/Mylas IT Bangalore Bangalore Bangalore Bangalore North, IT Kochi Trivandrum Trivandrum Powai, Rajiv Gandhi Info Park, Pune Taluka Haveli, Hinjewadi, Pune,

25

Nov 2010

Market Survey & Demand Assessment Study

The Manjari MIDC Syntel Magarpatta Township Serene WIPRO Orissa Orissa Ind dev Rajasthan Mahindra World City Tamil Nadu TCS ETL Infra Hexaware DLF Infocity Arun Excello ETA Technopark Electronics Corp of TN Coimbatore Hitech Infra Shriram Uttar Pradesh HCL WIPRO Ltd. Seaview West Bengal Unitech Hi-tech Rajarhat, M L Dalmiya & Kolkata Exports-SEZ estd prior to SEZ Act 05 WIPRO,Salt Lake Electronic City Mahindra City TOTAL

Pune, Pune, Pune, Pune, Kalwa Trans

58.58 762.73 30.53 108.51 82.87 NA 75.65 90.79 2213.95 1229.788 127.29 1200.766 13.88 486.74 622.85 105.02

UI 772 129 UI UI 156 UI 24.19 UI UI UI UI UI UI UI UI UI UI UI UI 95 UI

Bhubaneswar Jaipur, IT Siruseri and Tambaram Taluk, IT SIPCOT IT Park Manapakkam IT Vallncheri and Old Kancheepuram, Coimbatore Perungalathur Noida Greater Noida Noida, Sector-135,

437.3 578.7 73.66 109.15 6.21

Kolkata, West Tamil Nadu

739.94 2,163.82 37,9723

400 2209 7523

Table 13: IT SEZ Exports4

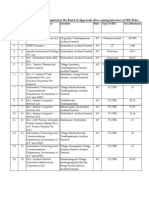

We have derived demand for multi-tenanted SEZs based on macro level data in our demand estimation model (Refer to Table: 16). Bengals overall share in pan India SEZ exports (2009-10) is around 2.3%.we have assumed its share of pan India SEZ exports would increase from current 2.3% to 3% by FY 2012-13. This can be attributed to political stability after impending election in 2011 and relative cost competitiveness of Kolkata.

India IT/ITeS Exports

Bengals share in SEZ exports

Share of Bengals Multitenated SEZ developments

Total employee requirement

Total Multitenanted SEZ space required

Share of subject project

It is important to note that IT/ITeS majors like TCS, Wipro, Cognizant, Tech Mahindra and HCL who contribute bulk of the IT Exports from Kolkata, already have land parcels to setup their own campuses. Currently only Cognizant Bantala SEZ is operational. TCS & Wipro Rajarhat SEZ and Tech Mahindra Bantala SEZ are expected to be operational FY2012-13. The share of exports from multitenant IT SEZ office space has been assumed to

4

http://sezindia.nic.in/writereaddata/updates/Exports_3st_March09-%20.pdf

Market Survey & Demand Assessment Study

remain at 55% of total IT SEZ exports from Kolkata, this is inline with other mature markets like Bangalore and Hyderabad. Further we have assumed weighted average space for IT services and BPO to be 100 sq ft per employee. Based upon the past trends the average export productivity per employee in IT/ITeS sector is estimated to be around Rs 14.2 lacs/year. The table below provides demand estimates for the subject property at Bantala 567:

PAN INDIA IT EXPORTS DATA

IT Services/Engg,R&D Exports (INR cr) A BPO Exports (INR cr) B IT Software/BPO Services Exports (INR cr) (A+B) STPI Exports E SEZ Exports F Total IT/ITeS Exports (SPTI+SEZ) (INR cr) Software Exports Growth Assumption YoY BENGAL IT DEMAND ESTIMATION Bengal's Share of Total SEZ Exports % P SEZ Exports Bengal (Q= F*P) (INR cr) Share of multi tenanted building (U=R/Q)

FY2008-09

FY2009-10

FY201011(E)

FY2011-12 (E)

FY2012-13 (E)

FY2013-14 (E)

FY2014-15 (E)

FY2015-16 (E)

156,978.73 58,752.27

176,428.25 58,651.75

197317 65596

226914.55 75435.4

260951.7 86750.7

313142.1 104100.9

375770.5 124921.0

450924.6 149905.2

216,190 207,357 7,523 214,880

235,080 197,107 37,973 235,080

262,913 187,252 75,661 262,913

302,350 177,889 124,461 302,350

347,702 168,995 178,708 347,702

417,243 160,545 256,698 417,243

500,692 152,518 348,174 500,692

600,830

600,830 600,830

16%

6%

FY2008-09

6.6 495

FY2009-10

2.3 855 13%

15% FY201011(E) 2.5 1,892 52%

15% FY2011-12 (E) 2.5 3,112 60%

15% FY2012-13 (E) 3.0 5,361 55%

20% FY2013-14 (E) 3.0 7,701 55%

20% FY2014-15 (E) 3.0 10,445 55%

20% FY2015-16 (E) 3.0 18,025 55%

Multi-tenated SEZ Total area operational sft (T*100) Total employment generation (T=R*100/S) Total export revenue generated /employee wt avg (Lacs) S Revenue generated by multi tenanted SEZs (INR Cr) (R= Q*U) Incremental Space reqd -1

Less: Existing vacant stock op balance V Unitech Infospace Phase-II (Tower 1,2,3) Rajarhat -2

78000 780

690000 6900

1318071 13181

2081815 20818

2990344 29903

4055970 40560

6999227 69992

14.2

14.2

14.2

14.2

14.2

14.2

14.2

110

977

1867

2949

4236

5745

9914

628,071

763,744

908,529

1,065,626

2,943,256

60000

660000

268929

192185

170656

162030

750000

600,000

237,000

237,000

237,000

237,000

600000

http://www.nasscom.in/upload/5216/IT_Industry_Factsheet-Mar_2009.pdf http://www.mit.gov.in/document-publications http://www.stpi.in/index1.php?langid=1&level=0&linkid=134&lid=192

27

Nov 2010

Market Survey & Demand Assessment Study

Dhunseri Bantala Total available stock for the year

200,000

250,000

270,000

SUBJECT PROJECT SUPPLY - Available Stock LEASE PHASING Total estimated Absorption of at Bantala SEZ -W (1-V-2) Leased Area in Subject Project (60%) X= V*60%+ W*60% Leased Area in Dhunseri SEZ (40%)

250,000 FY2012-13 (E)

400,000 FY2013-14 (E)

550,000 FY2014-15 (E)

350,000 FY2015-16 (E)

257,815

479,344

657,970

2,181,227

154,689

103,126

402,917

497,176

495,218

268,612 331,451 Table 14: Demand Estimation

The risk in this demand estimation model primarily stems from upcoming SEZ supply. Unitech Infospace Phase-I has about 750,000 sq ft and is the largest operational SEZ in Kolkata with tenants like IBM, Capgemini, Genpact and PWC. Unitech Infospace Phase-II would add about 600,000 sq ft in the current fiscal. While the total development potential for Unitech Infospace in about 4.2 million sq ft, we have assumed one tower of 237,000 sq ft to be added every year. Unitech being an operational SEZ in the more established IT corridor is in a better position to capitalize on incremental demand; subsequent demand should come to Bantala. There is considerable uncertainty with respect to DLF IT Park II re-notification process; if notified it would add another 1 million sq ft of SEZ supply. Further Shapoorji Pallonji Infocity SEZ in Rajarhat is still on hold; supply for these two projects has not been considered in our model. Dhunseri IT SEZ at Bantala is under construction and would add 720,000 sq ft FY 2012-13 onwards, and would put the subject project in direct competition.

6.3

Vacancy rate trend

Since 2006, supply of commercial office space has been exceeding yearly absorption on a year on year basis leading to significantly high vacancy levels as is being witnessed currently. Average Grade A vacancy in the city has increased from 8% levels in 2007 period to upwards of 23% in 2009. The overall vacancy level in the city remained at approximately 23% in 4Q 2009. Peripheral locations continued to register highest vacancy level at approximately 36% on account of recurrent infusion of new supply in the micro market. CBD also witnessed a minor rise in vacancy level due to the infusion of new supply during the quarter. Over all vacancy trend witnessed in the city for commercial office is represented in the table below:

2007 Vacancy Levels 8% 2008 11% 2009 23%

28

Nov 2010

Market Survey & Demand Assessment Study

The average vacancy levels at the end of Q1 2010 for major Commercial and IT and SEZ buildings in Salt Lake and Rajarhat is 39%.

Vacant Stock 3793150 IT Parks (inc DLF Phase-II) IT SEZ 60,000 700,000 Total BUA 11592454 33% 9% Vacancy Rate

BUA (Sq ft)

1,400,000 1,200,000 1,000,000 800,000 600,000 400,000 200,000 -

Vacancy (Sq ft)

Figure 16: Vacancy figures in major IT buildings

6.4

Analysis of Supply & Absorption

Commercial office segment has been at the centre of real estate activity in Kolkata over the last 3 years. Within the segment, majority of the demand is driven by IT/ITeS & BFSI occupiers. Over the years the city has witnessed significant supply of commercial office space in the IT SEZ and non SEZ segment being infused into the city. The graph shows the supply absorption dynamics of commercial IT office space primarily in Salt Lake and Rajarhat.

2500000 2000000 1500000 Supply ( Sq Ft) 1000000 500000 0 2008 2009 2010

Figure 17: Supply & Absorption Trend

Absorption ( Sq Ft)

29

Nov 2010

Market Survey & Demand Assessment Study

The tables below highlights the supply and absorption of Grade A office space on a quarterly basis since FY 2008. It should be mentioned that grade A developments form a significant percentage of the over all absorption witnessed in the city. This can be attributed to majority of space being absorbed by IT & BFSI tenants who seek good quality developments in line with standards of operations suited to their international offices or clients serviced by these occupiers. Supply Analysis of Grade A Commercial IT buildings can be detailed as follows:

KOLKATA TOTAL SUPPLY IN 2008

Project Name

Unitech Rajarhat SEZ

Developer

Unitech

Location

Rajarhat

Micro market

PD

Estimated Supply (Sq.Ft.)

700,000

Estimated time of Supply

Q1 2008

Type of Development

SEZ

SUPPLY 1Q 2008 TOTAL SUPPLY 2Q 2008

Globsyn Crystals EP-Y9, (Unnamed) PTI, DP- 9 The Matrix, DN-24 Globsyn Crystals Window Technology Nangalia Group Salt Lake Salt Lake Salt Lake Salt Lake PD PD PD PD 220,000 40,000 98056 70,000 Q2 2008 Q2 2008 Q2 2008 Q2 2008 IT/Commercial IT/Commercial IT/Commercial IT/Commercial

700,000

TOTAL SUPPLY 3Q 2008 TOTAL SUPPLY 4Q 2008

South City Pinnacle IT SEZ South City Pinnacle DLF Salt Lake Rajarhat PD PD

428,056 0

276000 90,000 Q4 2008 Q4 2008 IT/Commercial SEZ

TOTAL KOLKATA TOTAL SUPPLY IN 2008

366,000 1,494,056

KOLKATA TOTAL SUPPLY IN 2009 Estimated Project Size (Sq.Ft.)

400,000 150,000 400000

Developer

Project Name SUPPLY 1Q 2009

Location

Micro Market

Estimated time of Supply

Type of Development

PS Srijan Bhimrajka Impex Ltd DLF

PS Srijan Tech Park Infinium Digispace DLF IT PARK II TOTAL

Sector V, Salt Lake Sector V, Salt Lake Rajarhat

PD PD PD

1Q 2009 1Q 2009 1Q 2009

IT IT SEZ

950,000

SUPPLY 2Q 2009 TOTAL -

SUPPLY 3Q 2009

Godrej Properties Saltee Group DLF Godrej Waterside DN - 18 DLF IT PARK II Sector V, Salt Lake Sector V, Salt Lake Rajarhat PD PD PD 615,000 90,000 600,000 3Q 2009 3Q 2009 3Q 2009 IT IT SEZ

30

Nov 2010

Market Survey & Demand Assessment Study

TOTAL SUPPLY 4Q 2009 TOTAL KOLKATA TOTAL SUPPLY IN 2009

1,305,000

2,255,000

KOLKATA TOTAL SUPPLY IN 2010 Developer Project Name SUPPLY 1Q 2010 Unitech SEZ Phase-II

India Design Centre

Location

Micro Market

PD PD

Estimated Project Size (Sq.Ft.)

600,000 100,000

Estimated time of Supply

2Q 2010 2Q 2009

Type of Development

IT IT

Unitech WEBEL JV

Rajarhat Rajarhat

TOTAL

700,000

Table 15: Grade A IT Building Supply

A number of intended IT buildings in Salt Lake and Rajarhat got converted to commercial office space due to lack demand from IT sector on account of global economic recession. Therefore a significant part of the absorption came from emerging sectors like telecom, R&D and engineering services.

Supply Analysis of Grade A Commercial IT buildings on basis of industry/sector of the tenants can be detailed as follows:

KOLKATA TOTAL ABSORPTION 2008

Project Name

Location

Micro market

Lessee

Nature of Transaction

Quarter

Area Leased (Sq.Ft.)

Industry /Sector

Unitech Infospace Unitech Infospace Unitech Infospace

Rajarhat Rajarhat Rajarhat

ABSORPTION 1Q 2008 Cap gemini & IBM PD Daksh

PD PD HCL Genpact

Absorption Absorption Absorption

1Q 2008 1Q 2008 1Q 2008

200,000 120000 40000

IT IT IT

TOTAL ABSORPTION 2Q 2008

Eternity, DN - 1 DLF IT Park Sector V, Salt Lake Rajarhat PD PD Airtel Bharti Infratel Absorption Absorption 2Q 2008 2Q 2008

360,000

7800 8000

Telecom Telecom

TOTAL

15800

31

Nov 2010

Market Survey & Demand Assessment Study

ABSORPTION 3Q 2008

DN 14 DN 14 DN 14 Infinity Benchmark Sugam Business Park Sugam Business Park Sugam Business Park Sugam Business Park Sector V, Salt Lake Sector V, Salt Lake Sector V, Salt Lake Sector V, Salt Lake Sector V, Salt Lake Sector V, Salt Lake Sector V, Salt Lake Sector V, Salt Lake PD PD PD PD PD PD PD PD Tyco Engineering Shapoorji Paloonji Bank of Baroda Quotient Engineering Adhunik (Reliance Comm) 3i Infotech Diageo Schindler Electric Absorption Absorption Absorption Absorption Absorption Absorption Absorption Absorption 3Q 2008 3Q 2008 3Q 2008 3Q 2008 3Q 2008 3Q 2008 3Q 2008 3Q 2008 5000 10,000 5500 20000 13400 6700 6700 13400 Engineering Engineering Financial Engineering Telecom IT Commercial Engineering

TOTAL ABSORPTION 4Q 2008

Infinity Benchmark RDB Boulevard Globsysn Crystal I DN 14 DLF IT Park DLF IT Park EP/Y-13 (Peecon Building) BIPL Omega Sector V, Salt Lake Sector V, Salt Lake Sector V, Salt Lake Sector V, Salt Lake Rajarhat Rajarhat Sector V, Salt Lake Sector V, Salt Lake PD PD PD PD PD PD PD PD KPMG MN Dastur Ericsson Johnson Control IBM Daksh Lexmark Spanco Telesystems ABB Absorption Absorption Absorption Absorption Absorption Absorption Absorption Absorption 4Q 2008 4Q 2008 4Q 2008 4Q 2008 4Q 2008 1Q 2009 4Q 2008 4Q 2008

80700

8815 15000 30,000 5000 63,438 100,000 20000 36000

IT Engineering IT Engineering IT R&D IT Engineering

TOTAL KOLKATA TOTAL ABSORPTION IN 2008

278253 734,753

KOLKATA TOTAL ABSORPTION 2009 Nature of Transaction Area Leased (Sq.Ft.) Industry /Sector of Lessee

Project Name

Location

Micromarket

Lessee

Quarter

1Q 2009 1Q 2009 2Q 2008 1Q 2009

PS Srijan PS Srijan South City Pinnacle South City Pinnacle

ABSORPTION 1Q 2009 Salt Lake Sector V PD Shyam-Sistema Salt Lake Sector V PD Idea Cellular Salt Lake Sector PD V PWC Salt Lake Sector Outotec PD V Engineering TOTAL ABSORPTION 2Q 2009

Lease Lease Precommited Lease

22000 50000 110000 17000

Telecom Telecom ITeS Engineering

199000

2Q 2009 2Q 2009 2Q 2009

DLF IT Park Tower C Ground Floor DLF IT Park Tower C Ground Floor RMZ

Rajarhat Rajarhat Rajarhat

PD PD PD

Tech Mahindra HP Mc Nally Bharat Engineering

Lease Lease Lease

30000 9000 150000

IT IT Engineering

32

Nov 2010

Market Survey & Demand Assessment Study

Sunrise Towers PS Srijan

Salt Lake Sector V Salt Lake Sector V

PD PD

Airtel Tata Teleservices

Lease Precommited

2Q 2009 1Q 2009

9000 150000

Telecom Telecom

TOTAL ABSORPTION 3Q 2009 Salt Lake Sector Pinnacle (Dynamic V PD Securities) Salt Lake Sector V PD Mahua TV Salt Lake Sector V PD Usha Telecom Salt Lake Sector V PD Sparsh BPO Salt Lake Sector Orange Business V PD Services Salt Lake Sector V PD Lexplosion Salt Lake Sector V PD Kobel Co. Engg. TOTAL ABSORPTION 4Q 2009 Salt Lake Sector V PD Unitech Wireless Salt Lake Sector V PD Unitech Wireless Salt Lake Sector V PD Sterling Wilson

Rajarhat Rajarhat Rajarhat Rajarhat Rajarhat Rajarhat Rajarhat Salt Lake Sector V Salt Lake Sector V Salt Lake Sector V Salt Lake Sector V Rajarhat Salt Lake Sector V Salt Lake Sector V Salt Lake Sector V Salt Lake Sector V Salt Lake Sector V PD PD PD PD PD PD PD PD PD PD PD PD PD PD PD PD PD EX 3 Kolkata Info Va Tech Wabag Geotech Informatics Tech Mahindra Sparsh BPO L&T Voith Astha Technology Services Aegis BPO Met Life Tata Tele Com (WTTIL) TCS Infosoft Global Pearl Studios Limtex Info Castle Rock BRG Iron & Steel 4Q 2009 4Q 2009 4Q 2009 4Q 2009 4Q 2009 4Q 2009 4Q 2009 3Q 2009 4Q 2009 4Q 2009 4Q 2009 4Q 2009 4Q 2009 4Q 2009 4Q 2009 4Q 2009 4Q 2009 3Q 2009 3Q 2009 4Q 2009 3Q 2009 3Q 2009 3Q 2009 3Q 2009 3Q 2009 3Q 2009 3Q 2009

348000

Infinity Benchmark Infinity Benchmark PS Srijan Asyst Park Advantage Towers Infinity Benchmark Infinity Benchmark

Lease Sale Lease Lease Lease Lease Lease

12500 45000 20000 11500 10400 4500 3390

IT Entertainment Telecom IT IT IT Engineering

107290

Southcity Pinnacle Southcity Pinnacle GN - 31, (Benfish) DLF IT Park I DLF IT Park I DLF IT Park I DLF IT Park I DLF IT Park I DLF IT Park II Ambuja Ecospace GN - 31, (Benfish) Globsyn Crystals-I CD - 16 Asyst Park Unitech Infospace Infinity Benchmark Infinity Benchmark Sunrise Towers Technopolis Godrej Waterside

Lease Lease Lease Lease Lease Lease Lease Lease Lease Outright Lease Lease Lease Lease Lease Lease Lease Lease Lease Lease

27554 13777 13292 2600 1000 2470 2930 40000 29000 32000 13292 96000 3200 11500 250000 4500 17500 12000 6500 31000

Telecom Telecom Engineering IT IT Engineering IT IT IT Engineering Engineering IT Financial Telecom IT IT Entertainment IT Research Metal & Minerals

TOTAL KOLKATA TOTAL ABSORPTION IN 2009

610115 1264405

KOLKATA TOTAL ABSORPTION 2010

33

Nov 2010

Market Survey & Demand Assessment Study

Project Name

Location

Micromarket

Lessee

Nature of Transaction

Quarter

1Q 2010 1Q 2010 1Q 2010 1Q 2010 1Q 2010 1Q 2010 1Q 2010 2Q 2010

Area Leased (Sq.Ft.)

Industry /Sector of Lessee

ABSORPTION 1Q 2009

DLF IT Park-II Godrej Waterside Godrej Waterside DN-14 Ashram Building South City Pinnacle South City Pinnacle Rajarhat Salt Lake Sector V Salt Lake Sector V Salt Lake Sector V Salt Lake Sector V Salt Lake Sector V Salt Lake Sector V PD PD PD PD PD PD CBD I-Nova Solutions ZTE Royal Infra CMC Aditya Birla Minacs Arcelor Mittal NSN Lease Lease Lease Lease Lease Lease Lease 11,500 32,000 4,300 17,000 40,000 16,000 13,777 IT Telecom Telecom IT IT Steel Telecom

ABSORPTION 2Q 2009

Unitech SEZ Rajarhat PD Bridge Tree Lease 11,000 IT

KOLKATA TOTAL ABSORPTION IN 2009

145,577

Table 16: Grade A Building Absorption

6.5

Potential IT/ITeS companies looking at Kolkata for future expansion & nature of their expansion

Tech Mahindra has decided to surrender the 2.77-acre plot in Salt Lake, Sector-V, indications are there for development of 12-acre campus in the Bantala IT SEZ., to be operational by December 2010. Estimated 2,000 IT professionals from Telecom software delivery and BPO units will be housed initially.

TCS has about 8000 IT professionals in Kolkata, distributed 8 development centers in the Salt Lake Electronics Complex., of which 6 are leased facilities. Tata Realty Infrastructure Ltd has mandate build 40 acres Rajarhat campus over the next two years. It is expected to house 15,000 employees and a section of TCS employees operating at some of out leased facilities may be relocated.

Infosys proposal to develop Rs 5000 Mn. development centre with 5,000 people has not materialized, since 2004. In September 2009 the state government offered 45 acres each to Infosys and Wipro at Rajarhat. Infosys which had postponed the project due to economic meltdown and political climate may be evaluating the offer again.

Wipro has 7000 people in BPO and Development Centre in Salt Lake; it has got possession of 45 acres land at Rajarhat, proposed to be developed as SEZ.

HSBC Global Resourcing had planned to develop 2 Sunrise City project status is unknown.

nd

center in Nonadanga off EM-Bypass, the

34

Nov 2010

Market Survey & Demand Assessment Study

Rolta had taken possession of 5 acres at Nonadanga, to set up a Rs 2500 m campus in 2007, however the same has not materialized. The project had the potential to create 5000 IT jobs.

Accenture was scouting for 2 m sq ft lease at Unitech Infospace in 2007, may be reviewing possibility to set up a centre here.

Atos Origin a French IT firm is set double its India headcount from 3,300 to 6,000 by 2010. It operates two development centers in Salt Lake

Cap Gemini is making Kolkata Retail Centre of Excellence with its new 200,000 sq ft facility at Rajarhat, which will house 1700 people. The company currently has 80,000 sq ft at Asyst Park in Salt Lake, the IT hub of the city.

Aegis BPO has about 80,000 sq ft space in Globsyn Crystal, Zensar BPO the IT arm of RPG is looking to set up a 1000 seat call center in Kolkata. ITC Infotech has delivery hub in Kolkata is planning to add 1800 employees in India by 2011.

6.6

Commentary on quantum of development with respect to market dynamics

In accordance with our demand estimate for the subject site we dont foresee development before FY 201213 due to over supply in the IT SEZ space. The potential development of 1.55 m sq ft can be achieved within a horizon of next six years. However entry of large IT/BPO into the Kolkata can favorably alter demand dynamics. Based on current market dynamics, if the project needs to be completely leased out within a period of next 5 years then the development size would need to come down to about 1 million sq ft.

6.7

Opinion on development and lease phasing

Table below depicts proposed development and lease phasing:

PHASING (sq ft)

Development Lease

FY201011(E) -

FY2011-12 (E)

FY2012-13 (E) 250,000 154,689

FY2013-14 (E) 400,000 402,917

FY2014-15 (E) 550,000 497,176

FY201516 (E) 350,000 495,218

Table 17: Development & Lease Phasing

Lease phasing has been calculated in the following manner (Refer to Table: 12 Demand Estimation):

For the year FY 2012-13 the absorption of new supply in Bantala SEZs = 257,815 sq ft; it has been arrived at after deducting existing vacant stock and Unitech SEZ supply from Incremental SEZ space required i.e. 763,744 sq ft. The subject project (Forum) has been assumed to get 60% of the remaining demand share.

35

Nov 2010

Market Survey & Demand Assessment Study