Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Bayan Q3 2013 Update Presentation Highlights

Caricato da

Rosikh Falah Adi CandraTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Bayan Q3 2013 Update Presentation Highlights

Caricato da

Rosikh Falah Adi CandraCopyright:

Formati disponibili

0

www.bayan.com.sg

Third Quarter 2013

Update Presentation

1

Executive Summary

www.bayan.com.sg

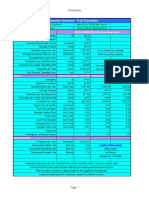

Overall financial performance in YTD September 2013 decreased compared

to YTD September 2012 as net income includes a US$32.8 million foreign

exchange loss of prepaid tax and an impairment of US$29.6 million on the

value of the inventory due to the reduction of coal price

Combined with lower sales volume and lower ASP (as a result of continued

weak market conditions) more than offsetting the reduction in costs

Revenue, Gross Profit, and Net Income include coal and non-coal sales ; 2) US$ is a convenience translation using the average yearly

exchange rate and quarterly rates

*

Sales Volume (milion MT) 16.0 16.0 to 17.0 11.9 10.7 -10%

Coal Production (million MT)

16.3 14.0 to 15.0 12.3 10.3 -16%

Average Selling Price (US$/MT) 88.9 83 to 86 91.2 79.6 -13%

Average Cash Costs (US$/MT) 78.1 74 to 77 79.1 73.6 -7%

Var 2013 B 2012

YTD Sept

2012

YTD Sept

2013

Average Selling Price includes coal and non-coal sales ; 2) US$ is a convenience translation using the average yearly exchange rate and

average quarterly exchange rate; 3) Average Cash Costs include Royalty, Barging, SGA; 4) B stands for Budget Figures

*

Revenue 1,509.3 1,422.9 1,083.4 850.0 -22%

Gross Profit 439.8 258.7 201.2 106.5 -47%

Gross Profit Margin 29% 18% 19% 13%

Net Income 213.3 54.9 57.6 (31.1) -154%

(in million USD) 2012

YTD Sept

2012

YTD Sept

2013

Var 2011

2

3Q 2013

www.bayan.com.sg

Overburden Removal

Coal Production

Weighted Average Strip Ratio

Average Cash Costs

Coal Sales

Average Selling Price

Committed & Contractual Sales

Debt and Cash Position

Capex

3

Overburden Removal (OB)

www.bayan.com.sg

(million BCM)

Overburden Removal

3Q13 Overburden removal was 40.6 million BCM which was below 2Q13 and 3Q13 Budget

65.8

41.0

40.6

3Q12 3Q13B 2Q13 3Q13

41 to 45

3Q13 OB was 40.6 million BCM

which was lower than 2Q13 and

3Q13 Budget due to the decrease

in OB activities as a result of the

overall decrease in strip ratio

which took effect in 4Q12

OB volumes went down QoQ in

WBM due to higher than expected

rainfall combined with significant

inflow of water from Arutmin; in pit

dumping was suspended due to

flooding

This was partially offset by the

increase in OB from TSA/FKP and

FSP due to contractors exceeding

their Budgeted OB volume

3Q12 3Q13

Gunungbayan Pratamacoal - Block II 26.2 16.1

Gunungbayan Pratamacoal - Block I 1.5 -

Perkasa Inakakerta 7.3 4.4

Teguh Sinar Abadi 1.2 3.3

Firman Ketaun Perkasa 11.4 4.0

Fajar Sakti Prima 1.3 1.2

Bara Tabang

Wahana Baratama Mining 15.4 11.6

Pakar South

Mamahak 1.5 -

Total 65.8 40.6

Overburden Removal

(in million BCM)

Note : B stands for Budget Figure

4

Coal Production

(million MT)

Coal Production Volume

www.bayan.com.sg

3Q13 coal production was 3.6 million MT which was within the range of the 3Q13 Budget

4.4

3.3

3.6

3Q12 3Q13B 2Q13 3Q13

3.5 to 3.7

3Q13 coal production was 3.6

million MT which was higher

than 2Q13 but it was within the

range of the 3Q13 Budget

Coal production went up in

comparison to 2Q13 principally

at FSP as a result of the

contractors exceeding their Coal

Production Budget but this was

slightly offset by the decrease in

production at WBM as a result of

poor weather conditions

3Q12 3Q13

Gunungbayan Pratamacoal - Block II 1.0 0.9

Gunungbayan Pratamacoal - Block I -

Perkasa Inakakerta 0.7 0.6

Teguh Sinar Abadi 0.1 0.3

Firman Ketaun Perkasa 0.9 0.4

Fajar Sakti Prima 0.7 0.8

Bara Tabang

Wahana Baratama Mining 0.9 0.7

Pakar South

Mamahak 0.1 0.0

Total 4.4 3.6

Production

(in million MT)

Note : B stands for Budget Figure

5

Actual Weighted Average Strip Ratio (SR)

www.bayan.com.sg

Weighted Average Strip Ratio

3Q13 actual weighted average strip ratio was 11.2 : 1 which represents a significant

reduction on 2012 levels and was reduced to below the range of the 2Q13 Budget

14.9

12.4

11.2

3Q12 3Q13B 2Q13 3Q13

11.4 to 12.0

3Q13 SR was 11.2 : 1 which was

lower than 2Q13 and 3Q13B due

to the continued reductions in SR

across all sites

SR, however, went up QoQ at

WBM due to poor weather

conditions and excess water

inflow from Arutmin

3Q12 3Q13

Gunungbayan Pratamacoal - Block II 27.0 18.7

Gunungbayan Pratamacoal - Block I 21.4

Perkasa Inakakerta 10.4 7.9

Teguh Sinar Abadi 11.1 10.3

Firman Ketaun Perkasa 12.2 9.0

Fajar Sakti Prima 2.0 1.6

Bara Tabang

Wahana Baratama Mining 17.9 16.7

Pakar South

Mamahak 14.8 0.0

Total 14.9 11.2

Weighted Average SR (:1)

Weighted Ave SR

Note : B stands for Budget Figure

6

Average Cash Costs per MT

(*)

Average Cash Costs

www.bayan.com.sg

(1) Average Cash Costs include Royalty, Barging, SGA

(2) US$ is a convenience translation using the average quarterly exchange rate

for the quarter numbers

(3) B stands for Budget Figure

(

U

S

$

/

M

T

)

3Q13 average cash costs was US$75.9 / MT which was within the range of the 2013 Budget

*

Pertamina Diesel Oil Price

(*)

3Q13 Average Cash Costs was

within the range of 2013 Budget

but higher than 2Q13 due to one

off impairment of inventory at

GBP, WBM, TSA, and FKP

(

U

S

$

/

l

i

t

e

r

)

* Published by Pertamina, including PBBKB and VAT

1.1

1.0

1.1

3Q12 2013B 2Q13 3Q13

0.9 to 1.1

71.3

71.7

75.9

3Q12 2013B 2Q13 3Q13

74 to 77

7

Coal Sales (by volume)

www.bayan.com.sg

(million MT)

Coal Sales Volume

4.0

3.8

3.0

2Q12 3Q13B 2Q13 3Q13

4.2 to 4.4

Geographic Distribution (YTD)

3Q13 coal sales volume was 3.0

million MT which was lower than

2Q13 and 3Q13 Budget due to

Low water level at Tabang which

affected barging activities and

consequently, impacted blending

Higher proportion of sales was

committed in 4Q13

Japan and India are Bayans biggest

customer in terms of YTD sales

volume

Top customers YTD (by sales

volume) are: Vitol Asia PTE LTD, J.

Aron & Co, TNB Fuel Service

ENEL, and Adani

3Q13 coal sales volume was 3.0 million MT which was below the range of the 2Q13 Budget

Note : B stands for Budget Figure

17%

8%

17%

13%

14%

9%

11%

11%

China

India

Japan

Taiwan

Philippines

Malaysia

Others

Italy

8

Average Selling Price (ASP)

www.bayan.com.sg

(

U

S

$

/

M

T

)

Average Selling Price

(*)

3Q13 ASP was US$ 74.2 / MT which was below the range of the 2013 Budget

(1) ASP includes coal and non-coal sales

(2) US$ is a convenience translation using the average quarterly

exchange rate for the quarter numbers

(3) B stands for Budget Figure

*

79.0

79.7

74.2

3Q12 2013B 2Q13 3Q13

83 to 86

3Q13 ASP was US$ 74.2 / MT

which was lower than 2Q13 and

2013 Budget due to the

continued weak market

conditions

3Q13 ASP reflect current index

pricing since a major proportion

of sales were index linked

3Q13 average CV was 5,843 GAR

kcal compared to 2Q13 at 5,834

GAR kcal

9

Committed and Contracted Sales

www.bayan.com.sg

2013

Fixed Price Floating Price

14.3 million MT

81.2%

18.8%

Note : September 2013

As at 30 September 2013

committed and contracted sales

were 14.3 million MT with an

average CV of 5,877 GAR kcal

2013 Fixed Price element of 11.6

million MT at US$ 78.3 / MT with

an average CV of 5,811 GAR kcal

10

Total Net Debt and Cash

In 2012, the Company refinanced its existing debt with a US$750 million

facility which comprises :

US$ 400 milion Term Loan Facility, amortizing over 5 years

US$ 200 million Capex Facility, amortizing over 5 years

US$ 150 million Working Capital Facility, bullet after 3 years

www.bayan.com.sg

431.2

415.0

463.6

495.1

446.4

469.4

479.7

128.2

115.9

99.5

152.8

201.2

198.7

212.2

1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13

Total Debt Cash Note : Total Debt less cash and Debt Service Reserve Account (DSRA)

(

i

n

m

i

l

l

i

o

n

U

S

$

)

11

Capital Expenditure

www.bayan.com.sg

US$ is a convenience translation using the average annual

exchange rate; B stands for Budget Figure

*

(US$ million)

CAPEX

(*)

9.4

Budget YTD Actual

45 to 55

YTD Capex was US$ 9.4 million

3Q13 Capex was principally for

the following :

Bara Tabang Haul Road

Cilong Haul Road

Majority of capex will be spent

towards the end of the year as

construction of Tabang haul road

is anticipated to gain momentum

12

www.bayan.com.sg

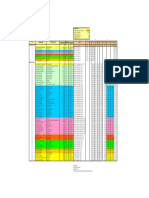

PT Perkasa Inakakerta PIK

PT Teguh Sinarabadi TSA

PT Firman Ketaun Perkasa FKP

PT Wahana Baratama Mining WBM

PT Fajar Sakti Prima FSP

PT Bara Tabang BT

PT Brian Anjat Sentosa BAS

PT Tanur Jaya TJ

PT Silau Kencana SK

PT Orkida Makmur OM

PT Tiwa Abadi TA

PT Sumber Api SA

PT Dermaga Energi DE

PT Bara Sejati BS

PT Apira Utama AU

PT Cahaya Alam CA

PT Mamahak Coal Mining MCM

PT Bara Karsa Lestari BKL

PT Mahakam Energi Lestari MEL

PT Mahakam Bara Energi MBE

PT Graha Panca Karsa GPK

Tabang

Pakar

Mamahak

Appendix

13

www.bayan.com.sg

Appendix

Kangaroo Resources Limited KRL

PT Dermaga Perkasapratama DPP

PT Indonesia Pratama IP

PT Muji Lines Muji

PT Bayan Energy BE

PT Metalindo Prosestama MP

PT Sumber Aset Utama SAU

PT Bara Karsa Lestari BKL

PT Karsa Optima Jaya KOJ

14

Disclaimer

www.bayan.com.sg

This presentation contains forward-looking statements based on assumptions and forecasts made by PT. Bayan

Resources Tbk management. Statements that are not historical facts, including statements about our beliefs

and expectations, are forward-looking statements. These statements are based on current plans, estimates and

projections, and speak only as of the date they are made. We undertake no obligation to update any of them in

light of new information or future events.

These forward-looking statements involve inherent risks and are subject to a number of uncertainties, including

trends in demand and prices for coal generally and for our products in particular, the success of our mining

activities, both alone and with our partners, the changes in coal industry regulation, the availability of funds for

planned expansion efforts, as well as other factors. We caution you that these and a number of other known

and unknown risks, uncertainties and other factors could cause actual future results or outcomes to differ

materially from those expressed in any forward-looking statement.

15

Thank You

For more information, please contact :

investor.relations@bayan.com.sg

www.bayan.com.sg

Potrebbero piacerti anche

- Machine Operating Information Report: CustomerDocumento9 pagineMachine Operating Information Report: CustomerHaris PrayogoNessuna valutazione finora

- Forecast PA Week#52Documento141 pagineForecast PA Week#52Indra PurnamaNessuna valutazione finora

- Specifications For Crawler Dozers: Manufacturer Model Horsepower Standard CapacityDocumento48 pagineSpecifications For Crawler Dozers: Manufacturer Model Horsepower Standard CapacityMongga ChipietNessuna valutazione finora

- Improve Phase: Implementation Reducing Fuel On HD785-5/7 by Dimention of ManDocumento29 pagineImprove Phase: Implementation Reducing Fuel On HD785-5/7 by Dimention of ManDidik Sugiantoro100% (1)

- AR BAYAN-12finalDocumento234 pagineAR BAYAN-12finalwiraNessuna valutazione finora

- Baru Lo LiakDocumento49 pagineBaru Lo LiakefitriNessuna valutazione finora

- Estimated Owning and Operating Cost MineplanDocumento15 pagineEstimated Owning and Operating Cost Mineplanpuput utomoNessuna valutazione finora

- Monthly Juni BNJM2Documento59 pagineMonthly Juni BNJM2fazril amalaNessuna valutazione finora

- BusinessDocumento94 pagineBusinessbipin jain0% (1)

- Equipment Plan & BGT Calculation: Base Calculation Planned Calculation PC 200 PC 300 PC 300Documento13 pagineEquipment Plan & BGT Calculation: Base Calculation Planned Calculation PC 200 PC 300 PC 300Iwan DermawanNessuna valutazione finora

- Cost Estimate PM 320 NGDocumento2 pagineCost Estimate PM 320 NGFulkan HadiyanNessuna valutazione finora

- Modular Mining Systems The Ultimate Step-By-Step GuideDa EverandModular Mining Systems The Ultimate Step-By-Step GuideNessuna valutazione finora

- PC2000 ProjectDocumento61 paginePC2000 ProjectwillianNessuna valutazione finora

- How Many Key Flexfields Are There in Oracle Financials?Documento93 pagineHow Many Key Flexfields Are There in Oracle Financials?priyanka joshiNessuna valutazione finora

- Annual Fixed Cost, P/Yr FC D+I+Hti: Net Income Generated, Ph/Yr Ni (Co - Ra-Dca) Ca OpDocumento14 pagineAnnual Fixed Cost, P/Yr FC D+I+Hti: Net Income Generated, Ph/Yr Ni (Co - Ra-Dca) Ca OpJan James GrazaNessuna valutazione finora

- DOID Delta Dunia Makmur TBK Presentation Material UBS November 2010Documento19 pagineDOID Delta Dunia Makmur TBK Presentation Material UBS November 2010Arief PermanaNessuna valutazione finora

- Production Summary - Full SimulationDocumento20 pagineProduction Summary - Full SimulationJorli Reyes SanchezNessuna valutazione finora

- Productivity BW211D-40 2,456.50 m2/hr Owning Cost BW211D-40 5.84 USD/hr Operating Cost BW211D-40 14.82 USD/hr Total OO Cost BW211D-40 20.66 USD/hrDocumento4 pagineProductivity BW211D-40 2,456.50 m2/hr Owning Cost BW211D-40 5.84 USD/hr Operating Cost BW211D-40 14.82 USD/hr Total OO Cost BW211D-40 20.66 USD/hrNur JannahNessuna valutazione finora

- Simulasi Cycle TimeDocumento2 pagineSimulasi Cycle TimeZulfikar Habib SiregarNessuna valutazione finora

- PLAN UPDATE 2020 r1Documento101 paginePLAN UPDATE 2020 r1David SusantoNessuna valutazione finora

- Hotel receipt summaryDocumento1 paginaHotel receipt summaryjetdedeNessuna valutazione finora

- Presentation - Roles Geologist 210130Documento57 paginePresentation - Roles Geologist 210130gabrielNessuna valutazione finora

- WEEKLY PLANNINGDocumento16 pagineWEEKLY PLANNINGbagus pranotoNessuna valutazione finora

- Brochure Bucket SolutionsDocumento20 pagineBrochure Bucket Solutionsmuhammad febri faizinNessuna valutazione finora

- EQUIPMENT AND FUEL COSTSDocumento6 pagineEQUIPMENT AND FUEL COSTSAchmad DjunaidiNessuna valutazione finora

- 2020 Cat DatabookDocumento21 pagine2020 Cat DatabookshivNessuna valutazione finora

- Brosur Alat BeratDocumento10 pagineBrosur Alat BeratEcha FebriyantyNessuna valutazione finora

- Reforecast 10MT 2018Documento13 pagineReforecast 10MT 2018mufqi fauziNessuna valutazione finora

- Paper 1 (SL and HL) : 1 The Foundations of EconomicsDocumento8 paginePaper 1 (SL and HL) : 1 The Foundations of EconomicsMirudhanya Ashok KumarNessuna valutazione finora

- Combined For Mining Machines Rev. 1Documento7 pagineCombined For Mining Machines Rev. 1mkpasha55mpNessuna valutazione finora

- Article DetailDocumento78 pagineArticle Detailandi_lb9453Nessuna valutazione finora

- SAP FI PracticeDocumento101 pagineSAP FI Practicenaimdelhi100% (2)

- Sukses Berkarir Di Industri TambangDocumento32 pagineSukses Berkarir Di Industri TambangFaishol UmarNessuna valutazione finora

- Report on Consulting Services for Coal Sourcing, Transportation and Handling of Power Plants in BangladeshDocumento497 pagineReport on Consulting Services for Coal Sourcing, Transportation and Handling of Power Plants in Bangladeshদেওয়ানসাহেবNessuna valutazione finora

- Rencana Dan Jadwal Produksi: Lampiran 1Documento51 pagineRencana Dan Jadwal Produksi: Lampiran 1budiman rasyidNessuna valutazione finora

- Mining Production & Cost ALEDocumento33 pagineMining Production & Cost ALEyunediNessuna valutazione finora

- Daftar Harga Sewa ExcavatorDocumento1 paginaDaftar Harga Sewa ExcavatorTiara KumalaNessuna valutazione finora

- Company Profile PT. Mathesis Global MineralDocumento12 pagineCompany Profile PT. Mathesis Global MineralJeremy lovenNessuna valutazione finora

- Form Perhitungan ProdksiDocumento22 pagineForm Perhitungan ProdksipanjiNessuna valutazione finora

- Barging Schedule LLCDocumento1 paginaBarging Schedule LLCEnergi Alam Borneo100% (1)

- Progress Transhipment Vessel MV Manalagi TisyaDocumento1 paginaProgress Transhipment Vessel MV Manalagi TisyaMuhammad Rabbil AlbadriNessuna valutazione finora

- Ar Bayan 09Documento198 pagineAr Bayan 09lpj gsvcNessuna valutazione finora

- ITM Annual Report 2009Documento200 pagineITM Annual Report 2009bolokurowoNessuna valutazione finora

- Pc850-8e0 Cen00384-03 201506Documento16 paginePc850-8e0 Cen00384-03 201506Augusto OliveiraNessuna valutazione finora

- Suitability Study of Ripper-Dozer Combination in Indian MinesDocumento58 pagineSuitability Study of Ripper-Dozer Combination in Indian MinesRavikanth AluriNessuna valutazione finora

- Tran ShipmentDocumento28 pagineTran ShipmentpriyoNessuna valutazione finora

- HBA Juli 2010Documento1 paginaHBA Juli 2010Ichsan NNNessuna valutazione finora

- EXCUTIVE SUMMARY KP PT. NUSA BARA - (New Updated 2019)Documento1 paginaEXCUTIVE SUMMARY KP PT. NUSA BARA - (New Updated 2019)agus rukmagaNessuna valutazione finora

- InventoryDocumento60 pagineInventoryArief Rahman100% (1)

- Estimasi ProjectDocumento2 pagineEstimasi ProjectSusanto HendriNessuna valutazione finora

- Presentation 2Documento11 paginePresentation 2muhammad febri faizinNessuna valutazione finora

- 05 Wilpinjong Coal Inventory Management - James Anderson &Documento14 pagine05 Wilpinjong Coal Inventory Management - James Anderson &Dwik Thesoulof VillianoNessuna valutazione finora

- PAMA KPC-Sangatta Tyre SpecificationDocumento6 paginePAMA KPC-Sangatta Tyre SpecificationMukti Ali100% (1)

- APAC ProspectusDocumento84 pagineAPAC Prospectusshare818Nessuna valutazione finora

- Plan PA Meil 2017Documento35 paginePlan PA Meil 2017HirasTindaonNessuna valutazione finora

- Site Id Site Name Tyre Size Id Tyre Brand Id Tyre Pattern Id NumtyresDocumento6 pagineSite Id Site Name Tyre Size Id Tyre Brand Id Tyre Pattern Id NumtyresMukti AliNessuna valutazione finora

- Barge Loading Schedule 83 1Documento3 pagineBarge Loading Schedule 83 1alieNessuna valutazione finora

- Uenr4223 10 00 - Manuals Service Modules - Disassembly & AssemblyDocumento94 pagineUenr4223 10 00 - Manuals Service Modules - Disassembly & Assemblymostafa aliNessuna valutazione finora

- HPP Products PT - SmsDocumento13 pagineHPP Products PT - SmsChank GeographicNessuna valutazione finora

- 215 Harga Alat DCP Test Tanah + BROSURDocumento2 pagine215 Harga Alat DCP Test Tanah + BROSURsteny worangNessuna valutazione finora

- AnceDocumento14 pagineAnceRdy SimangunsongNessuna valutazione finora

- Buku Tentang CBMDocumento18 pagineBuku Tentang CBMsalamalaikum09Nessuna valutazione finora

- Lucky Cement Limited Construction and Materials Strong Pricing To Drive GrowthDocumento10 pagineLucky Cement Limited Construction and Materials Strong Pricing To Drive GrowthZiaBilalNessuna valutazione finora

- 2013 1Q Management AnalysisDocumento14 pagine2013 1Q Management AnalysisAbel Franco Zevallos CasoNessuna valutazione finora

- Ty Syllabius ProjectDocumento94 pagineTy Syllabius ProjectAtharva ShahaneNessuna valutazione finora

- Oracle Payables Invoice Gateway Documentation SuplementDocumento121 pagineOracle Payables Invoice Gateway Documentation SuplementRolando Eduardo Erazo DuronNessuna valutazione finora

- Part 7 PDFDocumento12 paginePart 7 PDFSyed M Shahab QadirNessuna valutazione finora

- CV (Long) Gour Gobinda GoswamiDocumento31 pagineCV (Long) Gour Gobinda GoswamiKhandaker Amir EntezamNessuna valutazione finora

- Send wires from anywhere with Online BankingDocumento2 pagineSend wires from anywhere with Online BankingDani PermanaNessuna valutazione finora

- Divine Word College final exam focuses on accounting principlesDocumento7 pagineDivine Word College final exam focuses on accounting principlesIrish Joy AlaskaNessuna valutazione finora

- Understanding FOREX MarketsDocumento3 pagineUnderstanding FOREX MarketsPrineet AnandNessuna valutazione finora

- Hum1038 International-Economics TH 1.1 47 Hum1038Documento2 pagineHum1038 International-Economics TH 1.1 47 Hum1038Subhadeep JanaNessuna valutazione finora

- Chapter 7Documento13 pagineChapter 7lov3m3Nessuna valutazione finora

- Food Service - Hotel Restaurant Institutional - Guangzhou ATO - China - Peoples Republic of - 2-10-2015 PDFDocumento47 pagineFood Service - Hotel Restaurant Institutional - Guangzhou ATO - China - Peoples Republic of - 2-10-2015 PDFsudhirNessuna valutazione finora

- Ifm Tutorial 1 - StudentDocumento2 pagineIfm Tutorial 1 - StudentLisa BellNessuna valutazione finora

- Audit and Assurance CAP II Exam Suggested Answers 2010-2015Documento111 pagineAudit and Assurance CAP II Exam Suggested Answers 2010-2015shankar k.c.Nessuna valutazione finora

- Home Business Business Environment: Economic Plan - Meaning - Features - Need - TypesDocumento43 pagineHome Business Business Environment: Economic Plan - Meaning - Features - Need - TypesMafela TuallawtNessuna valutazione finora

- Edi Guide: XML - Orders01Documento9 pagineEdi Guide: XML - Orders01Avishek DattaNessuna valutazione finora

- EPS Magazine PragatiDocumento55 pagineEPS Magazine PragatiSachin DivyaveerNessuna valutazione finora

- CA Inter Accounts (New) Suggested Answer Dec2021Documento24 pagineCA Inter Accounts (New) Suggested Answer Dec2021omaisNessuna valutazione finora

- MCQS IntDocumento44 pagineMCQS IntTariq Anees100% (1)

- Yearly Plan Economics GR 11Documento4 pagineYearly Plan Economics GR 11NancyNabaAbouFarajNessuna valutazione finora

- Free Download Chapter 26 Solution Manual Financial Management by Brigham Chapter 26 Multinational Financial Management ANSWERS TO END-OF-CHAPTER QUESTIONSDocumento4 pagineFree Download Chapter 26 Solution Manual Financial Management by Brigham Chapter 26 Multinational Financial Management ANSWERS TO END-OF-CHAPTER QUESTIONSSolutionz Manual0% (2)

- Chapter 9 - The International Monetary and Financial EnvironmentDocumento11 pagineChapter 9 - The International Monetary and Financial EnvironmentLee Kelly (小嘉)Nessuna valutazione finora

- (Jan S. Prybyla) The American Way of Peace An IntDocumento265 pagine(Jan S. Prybyla) The American Way of Peace An IntManoel MoraisNessuna valutazione finora

- Malawi Consumer Goods IndustryDocumento11 pagineMalawi Consumer Goods IndustryWasili Mfungwe100% (1)

- Mcom SyllabusDocumento71 pagineMcom SyllabusS. SnehaNessuna valutazione finora

- International Business Expansion of Starbucks To PakistanDocumento8 pagineInternational Business Expansion of Starbucks To PakistanmaryamehsanNessuna valutazione finora

- Exchange Rate Systems and Arrangements in PracticeDocumento34 pagineExchange Rate Systems and Arrangements in PracticeDhular HassanNessuna valutazione finora

- Evaluation of Imf & Ibrd 22 SlidesDocumento22 pagineEvaluation of Imf & Ibrd 22 SlidesvmktptNessuna valutazione finora