Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Banco Filipino Case

Caricato da

Dave Lumasag CanumhayCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Banco Filipino Case

Caricato da

Dave Lumasag CanumhayCopyright:

Formati disponibili

BANCO FILIPINO SAVINGS AND MORTGAGE BANK vs. HON. FIDEL PURISIMA, etc., and HON.

VICENTE ERICTA and JOSE DEL FIERO, etc., FACTS: Manuel Caturla was the Customs special agent whose accusation against was filed by the Bureau of Internal Revenue for violation of Anti-Graft and Corrupt Practices Act. The Tanodbayan issued a subpoena duces tecum to the Banco Filipino Savings & Mortgage Bank, commanding its representative to appear at a specified time at the Office of the Tanodbayan and furnish the latter with duly certified copies of the records in all its branches and extension offices, of the loans, savings and time deposits and other banking transactions appearing in the names of Caturla, his wife, Purita Caturla, their children. Caturla moved to quash the subpoena duces tecum arguing that compliance would result in a violation of Sections 2 and 3 of the Law on Secrecy of Bank Deposits. Then Tanodbayan Vicente Ericta not only denied the motion for lack of merit, and directed compliance with the subpoena, but also expanded its scope through a second subpoena duces tecum, this time requiring production by Banco Filipino of the bank records in all its branches and extension offices of several other persons known by the accused. The Banco Filipino Savings & Mortgage Bank filed a complaint for declaratory relief with the CFI of Manila prayed for a judicial declaration as to whether its compliance with the subpoenae duces tecum would constitute an infringement of the provisions of Sections 2 and 3 of R.A. No. 1405 in relation to Section 8 of R.A. No. 3019. It also asked that pending final resolution of the question, the Tanodbayan be provisionally restrained from exacting compliance with the subpoenae. It is the bank's theory that the order declining to grant that remedy operated as a premature adjudication of the very issue raised in the declaratory suit, and as judicial sufferance of a transgression of the bank deposits statute, and so constituted grievous error correctible by certiorari. It further argues that subpoenae in question are in the nature of "fishing expeditions" or "general warrants" since they authorize indiscriminate inquiry into bank records; that, assuming that such an inquiry is allowed as regards public officials under investigation for a violation of the Anti-Graft & Corrupt Practices Act, it is constitutionally impermissible with respect to private individuals or public officials not under investigation on a charge of violating said Act. ISSUE: Whether or not "Law on Secrecy of Bank Deposits" precludes production by subpoena duces tecum of bank records of transactions by or in the names of the wife, children and friends of accused.

RULING: No. while Bank Secrecy Law provides that bank deposits are "absolutely confidential in nature and may not be examined, inquired or looked into, except upon written permission of the depositor, or in cases of impeachment, or upon order of a competent court in cases of bribery or dereliction of duty of public officials, or in cases where the money deposited or invested is the subject matter of litigation, the Anti-Graft Law directs in mandatory terms that bank deposits "shall be taken into consideration in the enforcement of the latter, notwithstanding any provision of law to the contrary. The inquiry into illegally acquired property or property NOT "legitimately acquired" extends to cases where such property is concealed by being held by or recorded in the name of other persons. This proposition is made clear by R.A. No. 3019 which quite categorically states that the term, "legitimately acquired property of a public officer or employee shall not include .. property unlawfully acquired by the respondent, but its ownership is concealed by its being recorded in the name of, or held by, respondent's spouse, ascendants, descendants, relatives or any other persons.

Potrebbero piacerti anche

- Motions, Affidavits, Answers, and Commercial Liens - The Book of Effective Sample DocumentsDa EverandMotions, Affidavits, Answers, and Commercial Liens - The Book of Effective Sample DocumentsValutazione: 4.5 su 5 stelle4.5/5 (13)

- Pre Trial Brief - RespondentDocumento4 paginePre Trial Brief - RespondentDave Lumasag CanumhayNessuna valutazione finora

- General Insurance V NG HuaDocumento2 pagineGeneral Insurance V NG HuaMorgana BlackhawkNessuna valutazione finora

- Manipor Vs RicafortDocumento2 pagineManipor Vs RicafortDean BenNessuna valutazione finora

- CACHO v. North StarDocumento2 pagineCACHO v. North StarBrokenNessuna valutazione finora

- 007 Magdayao Vs PeopleDocumento3 pagine007 Magdayao Vs PeopleJerome MoradaNessuna valutazione finora

- GEORG vs. HOLY TRINITY COLLEGE, INC.Documento2 pagineGEORG vs. HOLY TRINITY COLLEGE, INC.Maria Francheska GarciaNessuna valutazione finora

- BITONG V CADocumento1 paginaBITONG V CAihartjass07Nessuna valutazione finora

- 64 - Ponce v. Alsons Cement Dec. 10, 2002Documento3 pagine64 - Ponce v. Alsons Cement Dec. 10, 2002November Lily OpledaNessuna valutazione finora

- 2100 Customs Brokers, Inc., Petitioner, vs. Philam Insurance Company (Now Aig Philippines Insurance Inc.), Respondent. DECEMBER 1, 2020 DecisionDocumento8 pagine2100 Customs Brokers, Inc., Petitioner, vs. Philam Insurance Company (Now Aig Philippines Insurance Inc.), Respondent. DECEMBER 1, 2020 Decisionmieai aparecioNessuna valutazione finora

- Mariscal Vs CADocumento2 pagineMariscal Vs CAbowbingNessuna valutazione finora

- Firme V Bukal EnterprisesDocumento3 pagineFirme V Bukal EnterprisesLilu BalgosNessuna valutazione finora

- Ietts Vs CA DigestDocumento2 pagineIetts Vs CA DigestoabeljeanmoniqueNessuna valutazione finora

- Shell Oil Workers' v. Shell Company of The PhilippinesDocumento16 pagineShell Oil Workers' v. Shell Company of The PhilippinesAnisah AquilaNessuna valutazione finora

- MONTEALTO | 5Documento12 pagineMONTEALTO | 5Ruby ReyesNessuna valutazione finora

- Advance Paper Corporation Vs Arma Traders Corporation, GR. No. 176897, December 11, 2013Documento3 pagineAdvance Paper Corporation Vs Arma Traders Corporation, GR. No. 176897, December 11, 2013Maryluz CabalongaNessuna valutazione finora

- Sta. Maria vs. Hongkong and Shanghai, 89 PHIL 780Documento4 pagineSta. Maria vs. Hongkong and Shanghai, 89 PHIL 780VINCENTREY BERNARDONessuna valutazione finora

- Associated Bank v. CADocumento2 pagineAssociated Bank v. CANamiel Maverick D. BalinaNessuna valutazione finora

- Paris Manila Vs Phoenix Assurance G.R. No. L-25845 December 17, 1926Documento1 paginaParis Manila Vs Phoenix Assurance G.R. No. L-25845 December 17, 1926Emrico CabahugNessuna valutazione finora

- Heirs of Domongo Valientes v. RamasDocumento8 pagineHeirs of Domongo Valientes v. RamasAiyla AnonasNessuna valutazione finora

- Judicial Administrator's Power to Lease Estate PropertyDocumento1 paginaJudicial Administrator's Power to Lease Estate PropertyJDR JDRNessuna valutazione finora

- 2015 - Sia v. Arcenas PDFDocumento7 pagine2015 - Sia v. Arcenas PDFDerick TorresNessuna valutazione finora

- Abacus Real Estate v. Manila Banking CorpDocumento2 pagineAbacus Real Estate v. Manila Banking CorpMetsuyo BariteNessuna valutazione finora

- Labor Arbiter Jurisdiction Over Corporate Officer DismissalDocumento1 paginaLabor Arbiter Jurisdiction Over Corporate Officer DismissalLu CasNessuna valutazione finora

- Eastern Overseas Employment Center, Inc., Et. Al. v. Heirs of The Deceased Nomer P.odulioDocumento1 paginaEastern Overseas Employment Center, Inc., Et. Al. v. Heirs of The Deceased Nomer P.odulioMark Anthony ReyesNessuna valutazione finora

- Zomer Development Company vs International Exchange BankDocumento4 pagineZomer Development Company vs International Exchange BankbearzhugNessuna valutazione finora

- Marcus V R H Macy & Co - 297 NY 38 - 211119 - 142706Documento8 pagineMarcus V R H Macy & Co - 297 NY 38 - 211119 - 142706HADTUGINessuna valutazione finora

- LabRel Mcmer Vs NLRC DigestDocumento2 pagineLabRel Mcmer Vs NLRC DigestEditha RoxasNessuna valutazione finora

- NIDC v. CADocumento2 pagineNIDC v. CAluisjfg21Nessuna valutazione finora

- Republic v. CA, 107 SCRA 504 (1956) : What Need Not Be Approved? RULE 129Documento12 pagineRepublic v. CA, 107 SCRA 504 (1956) : What Need Not Be Approved? RULE 129Charlemagne Perez PapioNessuna valutazione finora

- Gokongwei v SEC ruling on director eligibility for competitorsDocumento5 pagineGokongwei v SEC ruling on director eligibility for competitorsJJNessuna valutazione finora

- Court rules president not personally liableDocumento3 pagineCourt rules president not personally liableRowela Descallar100% (2)

- Siain V CupertinoDocumento3 pagineSiain V CupertinoLilu BalgosNessuna valutazione finora

- Sulpicio Lines V SisanteDocumento1 paginaSulpicio Lines V Sisanteerikha_aranetaNessuna valutazione finora

- Leviste vs. CADocumento16 pagineLeviste vs. CAnathNessuna valutazione finora

- 10) Reicon Realty Builders Corp. v. Diamond Dragon PDFDocumento4 pagine10) Reicon Realty Builders Corp. v. Diamond Dragon PDFEffy SantosNessuna valutazione finora

- Power Homes vs. SECDocumento22 paginePower Homes vs. SEChaileyraincloudNessuna valutazione finora

- SEC Vs College Assurance Plan GR No. 202052, March 7, 2018Documento14 pagineSEC Vs College Assurance Plan GR No. 202052, March 7, 2018Duko Alcala EnjambreNessuna valutazione finora

- Nacague v. Sulpicio LinesDocumento2 pagineNacague v. Sulpicio LinesrubdrNessuna valutazione finora

- Galano V RoxasDocumento2 pagineGalano V RoxasValerie WNessuna valutazione finora

- Florete, Sr. vs. Florete, Jr.Documento22 pagineFlorete, Sr. vs. Florete, Jr.delbertcruzNessuna valutazione finora

- Digest CorpoDocumento5 pagineDigest CorpoPayumoNessuna valutazione finora

- Nego Week 15Documento13 pagineNego Week 15akosiquetNessuna valutazione finora

- BPI Case PDFDocumento15 pagineBPI Case PDFCarlo Troy AcelottNessuna valutazione finora

- Just compensation reckoning dateDocumento1 paginaJust compensation reckoning datepiptipaybNessuna valutazione finora

- Banco Filipino V Ybanez Digest2Documento3 pagineBanco Filipino V Ybanez Digest2Kenny Robert'sNessuna valutazione finora

- PNB v. IAC and Alcedo G.R. No. 66715. September 18, 1990Documento4 paginePNB v. IAC and Alcedo G.R. No. 66715. September 18, 1990Jeremiah De LeonNessuna valutazione finora

- Tegimenta v. Oco PDFDocumento1 paginaTegimenta v. Oco PDFKarla Lois de GuzmanNessuna valutazione finora

- Great Pacific Life Assurance vs. CA (Case)Documento6 pagineGreat Pacific Life Assurance vs. CA (Case)jomar icoNessuna valutazione finora

- Razon V IAC (Gaspar)Documento2 pagineRazon V IAC (Gaspar)Maria Angela GasparNessuna valutazione finora

- Ugarin V Alisoc: O Ecember Irst Division BY Quisumbing JDocumento2 pagineUgarin V Alisoc: O Ecember Irst Division BY Quisumbing JJD DXNessuna valutazione finora

- UE vs UEFA labor dispute over faculty pay computationDocumento1 paginaUE vs UEFA labor dispute over faculty pay computationAlexis Ailex Villamor Jr.Nessuna valutazione finora

- Saudia Airlines V Rebesencio (Conflict)Documento3 pagineSaudia Airlines V Rebesencio (Conflict)Yeye Farin PinzonNessuna valutazione finora

- Queensland-Tokyo Commodities, Inc., Et Al. vs. Thomas GeorgeDocumento2 pagineQueensland-Tokyo Commodities, Inc., Et Al. vs. Thomas GeorgeRoland MarananNessuna valutazione finora

- 082-Pacific Mills, Inc. v. NLRC G.R. No. 88864 January 17, 1990Documento2 pagine082-Pacific Mills, Inc. v. NLRC G.R. No. 88864 January 17, 1990Jopan SJNessuna valutazione finora

- Case 8Documento3 pagineCase 8Thely GeollegueNessuna valutazione finora

- George Vs Holy Trinity College, Inc. GR. No. 190408, July 20, 2016Documento3 pagineGeorge Vs Holy Trinity College, Inc. GR. No. 190408, July 20, 2016Maryluz CabalongaNessuna valutazione finora

- 55 - Banco Filipino Savings and Mortgage Bank v. Purisima, 161 SCRA 576 (1988)Documento3 pagine55 - Banco Filipino Savings and Mortgage Bank v. Purisima, 161 SCRA 576 (1988)November Lily OpledaNessuna valutazione finora

- Petitioner vs. vs. Respondents: First DivisionDocumento5 paginePetitioner vs. vs. Respondents: First DivisionjackyNessuna valutazione finora

- Banco Filipino case rules on bank secrecy lawDocumento5 pagineBanco Filipino case rules on bank secrecy laweunice demaclidNessuna valutazione finora

- 18 Banco Filipino Savings and Mortgage Bank v. PurisimaDocumento3 pagine18 Banco Filipino Savings and Mortgage Bank v. PurisimaGabriel LedaNessuna valutazione finora

- Philippine Deposit Insurance Corporation CaseDocumento1 paginaPhilippine Deposit Insurance Corporation CaseDave Lumasag CanumhayNessuna valutazione finora

- Karen Salvacion CaseDocumento2 pagineKaren Salvacion CaseDave Lumasag CanumhayNessuna valutazione finora

- Westmont Bank CaseDocumento2 pagineWestmont Bank CaseDave Lumasag CanumhayNessuna valutazione finora

- 2013 Bar Q&A in Political LawDocumento9 pagine2013 Bar Q&A in Political LawDave Lumasag CanumhayNessuna valutazione finora

- Simex CaseDocumento1 paginaSimex CaseDave Lumasag CanumhayNessuna valutazione finora

- Bpi Employees Union CaseDocumento2 pagineBpi Employees Union CaseDave Lumasag CanumhayNessuna valutazione finora

- Philippine Deposit Insurance Corporation Case 2Documento2 paginePhilippine Deposit Insurance Corporation Case 2Dave Lumasag CanumhayNessuna valutazione finora

- The Consolidated Bank CaseDocumento1 paginaThe Consolidated Bank CaseDave Lumasag CanumhayNessuna valutazione finora

- BANCO FILIPINO SAVINGS AND MORTGAGE BANK vs. HON. FIDEL PURISIMA, Etc., and HON. VICENTE ERICTA and JOSE DEL FIERO, Etc.Documento2 pagineBANCO FILIPINO SAVINGS AND MORTGAGE BANK vs. HON. FIDEL PURISIMA, Etc., and HON. VICENTE ERICTA and JOSE DEL FIERO, Etc.Dave Lumasag CanumhayNessuna valutazione finora

- Luis G. Peralta CaseDocumento1 paginaLuis G. Peralta CaseDave Lumasag CanumhayNessuna valutazione finora

- Philippine Deposit Insurance Corporation Case - 8Documento1 paginaPhilippine Deposit Insurance Corporation Case - 8Dave Lumasag CanumhayNessuna valutazione finora

- Government Service Insurance System CaseDocumento2 pagineGovernment Service Insurance System CaseDave Lumasag CanumhayNessuna valutazione finora

- Carmen LL Intengan CaseDocumento1 paginaCarmen LL Intengan CaseDave Lumasag CanumhayNessuna valutazione finora

- Teofisto Guingona CaseDocumento2 pagineTeofisto Guingona CaseDave Lumasag CanumhayNessuna valutazione finora

- Joseph Ejercito CaseDocumento2 pagineJoseph Ejercito CaseDave Lumasag CanumhayNessuna valutazione finora

- Bank of The Philippines Island and Grace Romero CaseDocumento1 paginaBank of The Philippines Island and Grace Romero CaseDave Lumasag CanumhayNessuna valutazione finora

- Bank of The Philippine Islands - Casa CaseDocumento1 paginaBank of The Philippine Islands - Casa CaseDave Lumasag CanumhayNessuna valutazione finora

- Regional Trial Court: Petitioner, ForDocumento5 pagineRegional Trial Court: Petitioner, ForDave Lumasag CanumhayNessuna valutazione finora

- Bpi Employees Union CaseDocumento2 pagineBpi Employees Union CaseDave Lumasag CanumhayNessuna valutazione finora

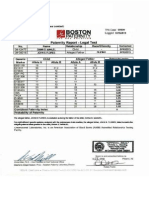

- Sample DNA Paternity Report (Exclusive)Documento1 paginaSample DNA Paternity Report (Exclusive)Dave Lumasag CanumhayNessuna valutazione finora

- Answer With CounterclaimDocumento5 pagineAnswer With CounterclaimDave Lumasag CanumhayNessuna valutazione finora

- Affidavit of LossDocumento2 pagineAffidavit of LossDave Lumasag CanumhayNessuna valutazione finora

- Regional Trial Court: Petitioner, ForDocumento5 pagineRegional Trial Court: Petitioner, ForDave Lumasag CanumhayNessuna valutazione finora

- Sample Departure-AdmittanceDocumento1 paginaSample Departure-AdmittanceDave Lumasag CanumhayNessuna valutazione finora

- Regional Trial Court: Petitioner, ForDocumento5 pagineRegional Trial Court: Petitioner, ForDave Lumasag CanumhayNessuna valutazione finora

- Sample Boarding PassesDocumento1 paginaSample Boarding PassesDave Lumasag CanumhayNessuna valutazione finora

- Resignation LetterDocumento1 paginaResignation LetterDave Lumasag CanumhayNessuna valutazione finora

- Answer With CounterclaimDocumento5 pagineAnswer With CounterclaimDave Lumasag CanumhayNessuna valutazione finora