Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Coke Vs Pepsi, 2001

Caricato da

Bibhu Prasad BiswalTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Coke Vs Pepsi, 2001

Caricato da

Bibhu Prasad BiswalCopyright:

Formati disponibili

14th March, 2013

Coke vs PepsiCo, 2001

Strategic Corporate Finance Case Analysis

ADITYA GHOSE (7) | ATHUL GEORGE (31) | BIBHU PRASAD BISWAL (40) | SOHINI BHATTACHARYYA (145) | SOMYA SHARMA (146) XIME, BANGALORE

Coke vs PepsiCo, 2001 | 14th March, 2014

WHAT IS EVA? WHAT ARE THE ADVANTAGES AND DISADVANTAGES OF USING EVA AS A MEASURE OF COMPANY PERFORMANCE? EVA is a value-based financial performance measure based on Net Operating Profit after Taxes (NOPAT), the Invested Capital required to generate that income, and the Weighted Average Cost of Capital (WACC). EVA is the after-tax cash flow a firm derives from its invested capital less the cost of that capital. EVA represents the owners' earnings, as opposed to paper profits. The formula to measure EVA is: EVA = NOPAT - (Invested Capital x WACC) or EVA = (ROIC WACC) x Invested Capital ADVANTAGES EVA allows a good way for companies to set a reward system that is not overly expensive to implement because is not too difficult for top management to monitor. EVA makes the cost of capital visible to operating managers. EVA is better than conventional ways because it takes into account the total cost of the operating capital. EVA allows a good way for companies to set a reward system that is not overly expensive to implement because is not too difficult for top management to monitor. Stock prices track EVA more closely than they track other popular measures. Ways to improve EVA Increase earnings Reduce capital employed Invest capital in high-return projects DISADVANTAGES EVA does not involve forecasts of future cash flows and does not measure present value. EVA therefore rewards managers who take on projects with quick paybacks and penalize those who invest in projects with long gestation period. Need to make changes in income statements and the balance sheet to measure economic value.

Coke vs PepsiCo, 2001 | 14th March, 2014

EXAMINE THE HISTORICAL PERFORMANCE OF COCA-COLA AND PEPSICO IN TERMS OF EVA. WHAT TRENDS DO YOU OBSERVE? WHAT ARE THE FACTORS BEHIND THOSE TRENDS? WHAT DO YOU THINK ARE THE KEY DRIVERS OF EVA? Coca-Cola's EVA has been slowly decreasing while PepsiCo's EVA has been increasing. REASONS Coca-Cola's NOPAT has decreased in recent years as a result of slowing sales growth and worsening profit margins If it were not for Coca-Cola's decreasing WACC, its EVA would decrease more rapidly. If Coca-Cola used a WACC of 12%, about the average of the past seven years, its EVA would have been $445,000,000 in 2000. PepsiCo was able to more than double their EVA in 2000 due to higher NOPAT and lower WACC. The higher NOPAT, was mainly a result of improved margins which lead to a higher ROI. THE KEY DRIVERS OF EVA The key to EVA is the spread between ROI and WACC. It is important to invest capital at a higher rate than the capital is obtained at. In theory, as long as there are enough projects that produce ROI > WACC and enough capital supplied, EVA can grow indefinitely. WHAT IS WEIGHTED AVERAGE COST OF CAPITAL (WACC) AND WHY IS IT IMPORTANT TO ESTIMATE IT? IS THE COST OF CAPITAL SOMETHING THAT MANAGERS SET? WHO SETS IT? Firms must use capital for operations. We want to know what the cost of that capital is to that firm. Therefore we look at the cost of the companies debt, the companies equity, and other costs when applicable such as preferred. Once we determine these costs we calculate the weighted average of them so that they reflect the true structure of the company. IMPORTANCE It is the opportunity cost of capital It is what the owners would expect to earn on their money in an equally risky project elsewhere. It is the financial managers who usually set the WACC. They do so with the aid of published sources, financial advisors, and other sources to estimate values for Beta, risk free rate, and market premium. A new company that faces potential bankruptcy will often take that cost into account and will be much more equity financed. A company that is relatively certain of profits will lean toward more debt to take advantage of the tax shields available.

Coke vs PepsiCo, 2001 | 14th March, 2014

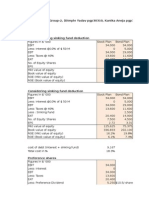

CALCULATE EVA FOR 2001 TO 2003 USING THE FORECASTS GIVEN IN THE CASE AND THE WACCS YOU HAVE ESTIMATED. WACC CALCULATION

Coke

2001 % Debt % Equity Beta Risk free rate Market risk premium Cost of Debt Cost of Equity Tax Rate WACC

32.50% 67.50% 0.88 6.15% 7.50% 7.10% 12.75% 35.00% 10.11%

PepsiCo

2003

28.45% 71.55% 0.88 6.15% 7.50% 7.10% 12.75% 35.00% 10.44%

2002

30.30% 69.70% 0.88 6.15% 7.50% 7.10% 12.75% 35.00% 10.29%

2001

42.40% 57.60% 0.88 6.15% 7.50% 6.97% 12.75% 35.00% 9.26%

2002

36.89% 63.11% 0.88 6.15% 7.50% 6.97% 12.75% 35.00% 9.72%

2003

35.64% 64.36% 0.88 6.15% 7.50% 6.97% 12.75% 35.00% 9.82%

Source: Exhibit 6 & 7 => D/E Structure.

Exhibit 8 => Beta, Risk Free Rate, Market Risk Premium & Cost of Debt (Bond Yield to Maturity) Cost of Equity = CAPM, Tax Rate = 35% (Assumption)

EVA CALCULATION

Coke

2001 Pre-Tax Income Equity Income Goodwill Cash Taxes Interest Income Interest Expense NOPAT Debt Equity Acc. Goodwill Cash and Equivalents Invested Capital

5605 -197 295 -1738 -295 310 3980 5426 11267 487 -2238 14942

PepsiCo

2003

6874 -261 295 -2131 -254 264 4787 4919 12368 1077 -2432 15932 30.05% 10.44% 19.61% 3124

2002

6313 -227 295 -1957 -244 280 4460 5172 11898 782 -2406 15446 28.87% 10.29% 18.59% 2871

2001

4394 -157 236 -1142 0 148 3479 6833 9282 987 -2241 14861 23.41% 9.26% 14.15% 2102

2002

4979 -186 295 -1245 0 92 3935 6810 11648 1282 -4143 15597 25.23% 9.72% 15.51% 2419

2003

5571 -239 295 -1504 0 37 4160 6304 11382 1577 -2923 16340 25.46% 9.82% 15.64% 2555

ROI 26.64% WACC 10.11% Spread 16.53% EVA

2470

Source: Exhibit 7 => Income Details.

Coke vs PepsiCo, 2001 | 14th March, 2014

INTERPRET THE RESULTS OF YOUR EVA CALCULATION. IF YOU HAD TO CHOOSE BETWEEN COCA-COLA AND PEPSICO, WHICH ONE WOULD YOU CHOOSE? WHY? Both Firms EVAs are increasing from 2001 to 2003 EVAs of Coca Cola is significantly higher than those of PepsiCo. EVAs insures that management perspective and objective is to maximize shareholders wealth, as such we would choose Coca Cola. The reason is because EVA is a measure of added value, and since Coca Colas EVA is obviously greater than that of PepsiCo, it would be a good investment to choose Coca Cola as it has a higher potential. In the long run, Coca Cola can survive more efficiently than PepsiCo, as PepsiCo didnt face any near bankruptcy cases, while Coca Cola did and succeeded in recovering from them.

Potrebbero piacerti anche

- PRIMO BENZINA Financial Ratios 2006-2009Documento13 paginePRIMO BENZINA Financial Ratios 2006-2009P3 Powers100% (1)

- Jennifer Gaston HRMDocumento9 pagineJennifer Gaston HRMvrj1091Nessuna valutazione finora

- Uncle Grumps' Budgeting ChallengesDocumento17 pagineUncle Grumps' Budgeting Challengesmanya100% (1)

- AirTex Aviation Case StudyDocumento9 pagineAirTex Aviation Case StudyGabriella Anggita Dea ChristinNessuna valutazione finora

- Caso Jackson Automotive SystemDocumento7 pagineCaso Jackson Automotive SystemDiego E. Rodríguez100% (2)

- Cartwright Lumber CompanyDocumento6 pagineCartwright Lumber Companykiki0% (2)

- Euro Disneyland Case StudyDocumento15 pagineEuro Disneyland Case StudyBibhu Prasad Biswal84% (25)

- Jackson Automotive Systems ExcelDocumento5 pagineJackson Automotive Systems Excelonyechi2004Nessuna valutazione finora

- Always Use 2 Decimal Places (When % As Percent - Not As Fractions) and Provide Detail of The Calculations MadeDocumento2 pagineAlways Use 2 Decimal Places (When % As Percent - Not As Fractions) and Provide Detail of The Calculations MadeKirtiKishanNessuna valutazione finora

- Ashish Inter Build PVT LTDDocumento3 pagineAshish Inter Build PVT LTDSanket BaxiNessuna valutazione finora

- Restaurant Social Media Marketing PlanDocumento8 pagineRestaurant Social Media Marketing PlanFarah Al-ZabenNessuna valutazione finora

- Financial Management Case Study of O.M. Scott & Sons Company (YP50BDocumento3 pagineFinancial Management Case Study of O.M. Scott & Sons Company (YP50BMurni Fitri FatimahNessuna valutazione finora

- Common Size Income Statement Gilbert Lumber CompanyDocumento2 pagineCommon Size Income Statement Gilbert Lumber CompanySiddharth BendaleNessuna valutazione finora

- Caso American GreetingsDocumento11 pagineCaso American GreetingsPaulo4255Nessuna valutazione finora

- Compagnie Du Froid S ADocumento8 pagineCompagnie Du Froid S Avtiwari10% (3)

- Deutsche Brauerei CaseDocumento2 pagineDeutsche Brauerei CaseIrma Martinez100% (1)

- Toy World, Inc - Projected Balance Sheet and Income StatementDocumento4 pagineToy World, Inc - Projected Balance Sheet and Income StatementMartin Perrone0% (1)

- DEUTSCHE BRAUERI Deutsche Brauerei's Ukraine ExpansionDocumento22 pagineDEUTSCHE BRAUERI Deutsche Brauerei's Ukraine ExpansionjfcortezNessuna valutazione finora

- Leadership Style of Indra NooyiDocumento16 pagineLeadership Style of Indra NooyiBibhu Prasad Biswal67% (3)

- Good Money After BadDocumento1 paginaGood Money After BadBibhu Prasad BiswalNessuna valutazione finora

- CASE 14 Coke Vs PepsiDocumento15 pagineCASE 14 Coke Vs PepsiAlyaYusofNessuna valutazione finora

- Coke Vs PepsiDocumento9 pagineCoke Vs Pepsidivakar62100% (1)

- Case Study Coca Cola Vs PepsiDocumento13 pagineCase Study Coca Cola Vs PepsiAlyaYusof50% (2)

- Bally Capital Due Diligence and Negotiation AnalysisDocumento2 pagineBally Capital Due Diligence and Negotiation AnalysisRoberto DistintoNessuna valutazione finora

- 03 Gilbert Lumber CompanyDocumento36 pagine03 Gilbert Lumber CompanyEkta Derwal PGP 2022-24 BatchNessuna valutazione finora

- Cartwright Lumber Company Paper EXAMPLEDocumento5 pagineCartwright Lumber Company Paper EXAMPLEJose SermenoNessuna valutazione finora

- Dynashears Inc CaseDocumento4 pagineDynashears Inc Casepratik_gaur1908Nessuna valutazione finora

- SybilaDocumento2 pagineSybilaragastrmaNessuna valutazione finora

- Destin Brass Products Co Case WorksheetDocumento2 pagineDestin Brass Products Co Case WorksheetManishNessuna valutazione finora

- Fuel SalesDocumento11 pagineFuel SalesFabiola SE100% (1)

- Hospital Corporation Of America Maintains A RatingDocumento16 pagineHospital Corporation Of America Maintains A RatingDhruv Kalia50% (2)

- Shouldice Hospitals CanadaDocumento21 pagineShouldice Hospitals CanadaNeel KapoorNessuna valutazione finora

- Pioneer Petroleum Case: Single vs Divisional WACCDocumento4 paginePioneer Petroleum Case: Single vs Divisional WACCShivam BoseNessuna valutazione finora

- Sherman Motor Compant Case Analysis Sherman Motor Compant Case AnalysisDocumento5 pagineSherman Motor Compant Case Analysis Sherman Motor Compant Case AnalysisChristian CabariqueNessuna valutazione finora

- Welcome To Our PresentationDocumento38 pagineWelcome To Our PresentationTamanna ShaonNessuna valutazione finora

- Should Bank Approve Loan to Struggling Company With SecuritiesDocumento2 pagineShould Bank Approve Loan to Struggling Company With Securitieslika rukhadze100% (1)

- Glaxo ItaliaDocumento11 pagineGlaxo ItaliaLizeth RamirezNessuna valutazione finora

- Superior ManufacturingDocumento5 pagineSuperior ManufacturingCordel TwoKpsi TaildawgSnoop Cook100% (4)

- Deutsche BraueraiDocumento5 pagineDeutsche BraueraiSilvia CoranNessuna valutazione finora

- Friendly CS SolutionDocumento8 pagineFriendly CS SolutionEfendiNessuna valutazione finora

- Continental CarriersDocumento6 pagineContinental CarriersVishwas Nandan100% (1)

- El Desenlace de VicenteDocumento4 pagineEl Desenlace de VicenteCarlos Daniel Rodriguez Sanchez0% (1)

- Case Questions: Managing Orthepedics at Rittenhouse Medical CenterDocumento4 pagineCase Questions: Managing Orthepedics at Rittenhouse Medical Centerfirstname lastnameNessuna valutazione finora

- D'o PDFDocumento3 pagineD'o PDFAnonymous ZiwkfEKujwNessuna valutazione finora

- GMP Analysis of Crocs Share PriceDocumento6 pagineGMP Analysis of Crocs Share PriceKshitishNessuna valutazione finora

- Blaine Kitchenware financial analysis and capital structure optimizationDocumento11 pagineBlaine Kitchenware financial analysis and capital structure optimizationBala GNessuna valutazione finora

- KramerDocumento4 pagineKramerChandanMatoliaNessuna valutazione finora

- Case: Tofee Inc. Demand Planning For Chocolate Bars: Assignment - 2Documento2 pagineCase: Tofee Inc. Demand Planning For Chocolate Bars: Assignment - 2Nitin ShankarNessuna valutazione finora

- Assignment Gilbert LumbertDocumento6 pagineAssignment Gilbert LumbertHenri De sloovereNessuna valutazione finora

- How Southwest Airlines Reduces Costs with Rapid Turnaround TimesDocumento2 pagineHow Southwest Airlines Reduces Costs with Rapid Turnaround TimesAli MalikNessuna valutazione finora

- Panera BreadDocumento23 paginePanera BreadtomNessuna valutazione finora

- Case Study: Delwarca Software Remote Support UnitDocumento2 pagineCase Study: Delwarca Software Remote Support UnitrjNessuna valutazione finora

- Ben & Jerry's Homemade Ice Cream Inc: A Period of Transition Case AnalysisDocumento5 pagineBen & Jerry's Homemade Ice Cream Inc: A Period of Transition Case AnalysisSaad JavedNessuna valutazione finora

- Eric Corwin Excercise - Christian Iñiguez CarbóDocumento3 pagineEric Corwin Excercise - Christian Iñiguez CarbóAdministración FinanzasNessuna valutazione finora

- Toy World Inc.Documento11 pagineToy World Inc.Ivaner CentenoNessuna valutazione finora

- Blaine Kitchenware Inc: Capital Structure Case StudyDocumento23 pagineBlaine Kitchenware Inc: Capital Structure Case StudyMai PhamNessuna valutazione finora

- AIRTHREAD ACQUISITION Revenue Projections and Operating AssumptionsDocumento7 pagineAIRTHREAD ACQUISITION Revenue Projections and Operating AssumptionsAlex Wilson0% (1)

- Accounting For Frequent Fliers CaseDocumento15 pagineAccounting For Frequent Fliers CaseGlenPalmer50% (2)

- SCOTTDocumento20 pagineSCOTTOliviaNessuna valutazione finora

- Hilton Case1Documento2 pagineHilton Case1Ana Fernanda Gonzales CaveroNessuna valutazione finora

- By by Kelly Kelly Natch Natch Louis Louis Sven Sven Spring 2012 Spring 2012 Financial Administration Financial AdministrationDocumento9 pagineBy by Kelly Kelly Natch Natch Louis Louis Sven Sven Spring 2012 Spring 2012 Financial Administration Financial Administrationhhjj111220% (1)

- Compagnie Du Froid PDFDocumento18 pagineCompagnie Du Froid PDFGunjanNessuna valutazione finora

- Toy World 2014 JPSDocumento14 pagineToy World 2014 JPSp13tejpNessuna valutazione finora

- Case Study Coca Cola Vs PepsiDocumento13 pagineCase Study Coca Cola Vs PepsiAnonymous Rj03OnbNessuna valutazione finora

- Case Analysis - Growing ConcernsDocumento6 pagineCase Analysis - Growing ConcernsBibhu Prasad BiswalNessuna valutazione finora

- Indian Solar Energy SectorDocumento12 pagineIndian Solar Energy SectorBibhu Prasad BiswalNessuna valutazione finora

- Magnolia Venture Capital Fund Case AnalysisDocumento7 pagineMagnolia Venture Capital Fund Case AnalysisBibhu Prasad BiswalNessuna valutazione finora

- SupercapacitorsDocumento3 pagineSupercapacitorsRajesh JunghareNessuna valutazione finora

- Understanding the key components of a balance sheetDocumento4 pagineUnderstanding the key components of a balance sheetAjay PratapNessuna valutazione finora

- Solicitor 2014Documento1.086 pagineSolicitor 2014rickiNessuna valutazione finora

- The Digital Project Manager Communication Plan ExampleDocumento2 pagineThe Digital Project Manager Communication Plan ExampleHoney Oliveros100% (1)

- LiabilitiesDocumento15 pagineLiabilitiesegroj arucalamNessuna valutazione finora

- The Blackwell Guide To Business Ethics PDFDocumento349 pagineThe Blackwell Guide To Business Ethics PDFJeremy Neufeld75% (4)

- Research Report Sample Format EditedDocumento13 pagineResearch Report Sample Format EditedRajveer KumarNessuna valutazione finora

- DebenturesDocumento7 pagineDebenturesHina KausarNessuna valutazione finora

- Consumer Behavior in Relation To Insurance ProductsDocumento52 pagineConsumer Behavior in Relation To Insurance Productsprarthna100% (1)

- Affordable Lawn Care Financial StatementsDocumento8 pagineAffordable Lawn Care Financial StatementsTabish TabishNessuna valutazione finora

- FABIZ I FA S2 Non Current Assets Part 4Documento18 pagineFABIZ I FA S2 Non Current Assets Part 4Andreea Cristina DiaconuNessuna valutazione finora

- Analisis Pengaruh Privasi, Keamanan Dan Kepercayaan Terhadap Niat Untuk Bertransaksi Secara Online Di Olx - Co.IdDocumento26 pagineAnalisis Pengaruh Privasi, Keamanan Dan Kepercayaan Terhadap Niat Untuk Bertransaksi Secara Online Di Olx - Co.IdNabillah DeriefcaNessuna valutazione finora

- Life-Cycle Cost Analysis in Pavement DesignDocumento1 paginaLife-Cycle Cost Analysis in Pavement DesignSergio McNessuna valutazione finora

- FilaDocumento27 pagineFilaAhmed BaigNessuna valutazione finora

- MIT's Mission: Supporting World-Class Education and Cutting-Edge ResearchDocumento11 pagineMIT's Mission: Supporting World-Class Education and Cutting-Edge ResearchDingo BingoNessuna valutazione finora

- Ducati Group Growingsalesrevenuesandearningsin2015Documento2 pagineDucati Group Growingsalesrevenuesandearningsin2015cherikokNessuna valutazione finora

- Labor Law (Recruitment and Placement)Documento3 pagineLabor Law (Recruitment and Placement)Quejarra De AsisNessuna valutazione finora

- FAM FormulaDocumento19 pagineFAM Formulasarthak mendirattaNessuna valutazione finora

- Student Assignment Answer ALIDocumento9 pagineStudent Assignment Answer ALIasadullahqureshi2Nessuna valutazione finora

- MM-Last Day AssignmentDocumento18 pagineMM-Last Day AssignmentPratik GiriNessuna valutazione finora

- Chapter 1 problem 3 exercisesDocumento18 pagineChapter 1 problem 3 exercisesAlarich CatayocNessuna valutazione finora

- Valuing Metallwerke S Contract With Safe Air Inc Consider TheDocumento1 paginaValuing Metallwerke S Contract With Safe Air Inc Consider TheAmit PandeyNessuna valutazione finora

- ACLC College Tacloban Marketing PrinciplesDocumento70 pagineACLC College Tacloban Marketing PrinciplesSherwin HidalgoNessuna valutazione finora

- Internship Report on BankIslami Pakistan LimitedDocumento37 pagineInternship Report on BankIslami Pakistan LimitedTalha Iftekhar Khan SwatiNessuna valutazione finora

- Sapm QBDocumento8 pagineSapm QBSiva KumarNessuna valutazione finora

- 2.1 Chapter 2 - The Fundamental Concepts of AuditDocumento21 pagine2.1 Chapter 2 - The Fundamental Concepts of AuditĐức Qúach TrọngNessuna valutazione finora

- Starbucks Success Built on Ethics and QualityDocumento19 pagineStarbucks Success Built on Ethics and QualityReuben EscarlanNessuna valutazione finora

- Case Study 2 Part 1: The StoryDocumento5 pagineCase Study 2 Part 1: The StoryMary Jane InsigneNessuna valutazione finora

- Caterpillar Tractor Co. FinalDocumento11 pagineCaterpillar Tractor Co. FinalSanket Kadam PatilNessuna valutazione finora