Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

+ COVER SHORT FXY: Buying To Cover 172 Shares of

Caricato da

RCS_CFATitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

+ COVER SHORT FXY: Buying To Cover 172 Shares of

Caricato da

RCS_CFACopyright:

Formati disponibili

!

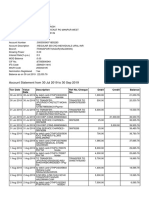

March 14, 2014 Portfolio Adjustment on Global Macro Aggressive Portfolio + COVER SHORT FXY: Buying to cover 172 Shares of Guggenheim CurrencyShares Japanese Yen Trust at market open today (roughly $15,492). + BUY LONG: GDX: With available capital, at market open today I am entering into a long position in Market Vectors Gold Miners worth roughly $16,000. Rationale for closing FXY position: Yen continues to show characteristics of safe haven currency in times of risk aversion. Rationale for establishing GDX position: Continued deterioration of macro data + geopolitical risk increases probability of central bank action in the future. Break of $27.19 yesterday is technically bullish. Risks to GDX position: Geopolitical tensions between the U.S. and Russia ease; macro data improves in China.

| Rodrigo C. Serrano, CFA | SIPA | Columbia University Master of International Affairs 14 Candidate | New York City, NY | 01-305-510-0181 | rcs2164@columbia.edu !

Deteriorating data in China over the past week includes disappointing fixed asset investment, industrial production, retail sales, new loans, and exports. Its becoming increasingly difficult to ignore weakening economic reports from the country. Meanwhile in Europe, ECB chief Mario Draghi has become concerned with the strength of the euro, due to it acting as a headwind for Europes nascent recovery and inciting deflationary forces. In the US, economic momentum in the fourth quarter was overstated and Q1 GDP estimates have been slashed. Japan has also produced economic data worse than expected. In addition, a potentially powerful bearish geopolitical catalyst lies in this weekends referendum in Crimea. A yea vote to secede from the Ukraine (plausible) could escalate tensions between Russia and the West. The possibility of sanctions on Russia and countersanctions would be bearish for economic growth. These developments bring into focus the possibility that central bankers may need to ease monetary policy (in the case of the Eurozone and Japan) or delay the tapering process, in the case of the U.S, a bullish prospect for gold. Markets may have already begun to price in this possibility. Gold has rallied 15% since the beginning of the year, while gold miners have rallied 33%. A bullish technical event occurred yesterday when GDX broke through resistance at $27.19. The Japanese yen, despite worsening debt dynamics, which I covered extensively in my macro outlook, continues to exhibit characteristics of the safe haven currency. A look at the USDJPY chart suggests that the currency may strengthen further should geopolitical tensions increase or economic data worsen. Over the longer term, I remain firm in my belief that the island nation is at an increasing risk of a crisis of confidence in its paying ability given its projected debt load of 242% of GDP. Recent news of Japans largest pension fund feeling uneasy towards its holdings of Japanese government debt1 tells me my thesis remains intact. A small portion of the portfolio remains short Japanese government bonds. Note that the portfolio in general remains tilted in a slightly bullish posture; however, should these trends continue, it will be adjusted accordingly. (Charts on next page) --

!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

"

!#$$%&''()$*+,)-.)%*$)-*/$/%0.1-)$+(2$134-(2.+3'%+/$'565"78"595:';)%),<%0,/*+,<=1,><31/$<.1$<4+,><#+->*,?/<=$<.+3!

! ! ! !

Break through resistance is a bullish technical event.

Yen showing strength as risk aversion increases.

@*/.-)*30(&!!A-0)/0!=*(/$!.+,/1-$!B+1(!=*,),.*)-!)>C*/+(!=+(!)--!*3%+($),$!*,C0/$30,$!(0-)$0>!>0.*/*+,/!

9!

Potrebbero piacerti anche

- The Dollar Trap: How the U.S. Dollar Tightened Its Grip on Global FinanceDa EverandThe Dollar Trap: How the U.S. Dollar Tightened Its Grip on Global FinanceValutazione: 4 su 5 stelle4/5 (1)

- NISMDocumento167 pagineNISMprashant_agharkar9257Nessuna valutazione finora

- DSE ClearingDocumento6 pagineDSE ClearingMohammed Anwaruzzaman100% (1)

- Foreign Exchange Daily ReportDocumento5 pagineForeign Exchange Daily ReportPrashanth Goud DharmapuriNessuna valutazione finora

- Weekly Investment Commentary en UsDocumento4 pagineWeekly Investment Commentary en UsbjkqlfqNessuna valutazione finora

- Monthly Outlook GoldDocumento10 pagineMonthly Outlook GoldKapil KhandelwalNessuna valutazione finora

- FX Daily: High Bar To Reverse The Dollar Bear TrendDocumento3 pagineFX Daily: High Bar To Reverse The Dollar Bear Trenddbr trackdNessuna valutazione finora

- Japan Asia AugustDocumento27 pagineJapan Asia AugustIronHarborNessuna valutazione finora

- Lunch With Dave: David A. RosenbergDocumento18 pagineLunch With Dave: David A. Rosenbergwinstonchen5Nessuna valutazione finora

- Breakfast With Dave 082310Documento13 pagineBreakfast With Dave 082310chibondkingNessuna valutazione finora

- US Fixed Income Markets WeeklyDocumento96 pagineUS Fixed Income Markets Weeklyckman10014100% (1)

- Assignment OF IF: Dollar Vs RupeeDocumento7 pagineAssignment OF IF: Dollar Vs RupeeManinder Vadhrah VirkNessuna valutazione finora

- Apanese Onetary Olicy: HAT S Aking This Experiment So XperimentalDocumento2 pagineApanese Onetary Olicy: HAT S Aking This Experiment So Xperimentalkatdoerr17Nessuna valutazione finora

- April Stock Market Outlook Report CtaDocumento38 pagineApril Stock Market Outlook Report CtaGerman BriceñoNessuna valutazione finora

- BlackRock 2014 OutlookDocumento8 pagineBlackRock 2014 OutlookMartinec TomášNessuna valutazione finora

- JPM US Market Intelligence Morning Briefing Futs HigherDocumento25 pagineJPM US Market Intelligence Morning Briefing Futs HigherLuanNessuna valutazione finora

- The Feds March MadnessDocumento1 paginaThe Feds March Madnessrichardck61Nessuna valutazione finora

- Commodity Markets: 1. Default ImminentDocumento5 pagineCommodity Markets: 1. Default Imminentapi-100874888Nessuna valutazione finora

- Hadrian BriefDocumento11 pagineHadrian Briefspace238Nessuna valutazione finora

- ATFX 2023Q2 EN MY ADocumento58 pagineATFX 2023Q2 EN MY Anguyen thanhNessuna valutazione finora

- Q3 - 2015 Commentary: 5.1% and 10.3%, RespectivelyDocumento5 pagineQ3 - 2015 Commentary: 5.1% and 10.3%, RespectivelyJohn MathiasNessuna valutazione finora

- Morgan Stanley Emerging Markets Are Less Sensitive To DollarDocumento9 pagineMorgan Stanley Emerging Markets Are Less Sensitive To DollarNgYuk NgYukNessuna valutazione finora

- 9/29/14 Global-Macro Trading SimulationDocumento12 pagine9/29/14 Global-Macro Trading SimulationPaul KimNessuna valutazione finora

- DM House ViewDocumento2 pagineDM House ViewBolajoko OlusanyaNessuna valutazione finora

- BlackRock Midyear Investment Outlook 2014Documento8 pagineBlackRock Midyear Investment Outlook 2014w24nyNessuna valutazione finora

- Capital Watch (LR)Documento5 pagineCapital Watch (LR)Scott TranNessuna valutazione finora

- 10/8/14 Global-Macro Trading SimulationDocumento19 pagine10/8/14 Global-Macro Trading SimulationPaul KimNessuna valutazione finora

- Ranges (Up Till 11.47am HKT) : Currency CurrencyDocumento4 pagineRanges (Up Till 11.47am HKT) : Currency Currencyapi-290371470Nessuna valutazione finora

- Rate Rises As Hopes For Easing Uk Social Distancing Rules Grow 48118Documento4 pagineRate Rises As Hopes For Easing Uk Social Distancing Rules Grow 48118Pratik ChourasiaNessuna valutazione finora

- A Rising Dollar Is Hurting Other Currencies. Central Banks Are Stepping In. - The New York TimesDocumento4 pagineA Rising Dollar Is Hurting Other Currencies. Central Banks Are Stepping In. - The New York TimesSunny YaoNessuna valutazione finora

- BarCap July8 The Emerging Markets Weekly Sunshine Behind The CloudsDocumento36 pagineBarCap July8 The Emerging Markets Weekly Sunshine Behind The Cloudsr3vansNessuna valutazione finora

- Rally Momentum Fades After US GDP Data DisappointsDocumento6 pagineRally Momentum Fades After US GDP Data DisappointsgkapurNessuna valutazione finora

- 11/14/14 Global-Macro Trading SimulationDocumento17 pagine11/14/14 Global-Macro Trading SimulationPaul KimNessuna valutazione finora

- Weekly Market Commentary 4/8/2013Documento4 pagineWeekly Market Commentary 4/8/2013monarchadvisorygroupNessuna valutazione finora

- Global Investment Perspective: in This Issue HighlightsDocumento19 pagineGlobal Investment Perspective: in This Issue HighlightsJohn SmithNessuna valutazione finora

- Fasanara Capital Investment Outlook - May 3rd 2016Documento17 pagineFasanara Capital Investment Outlook - May 3rd 2016Zerohedge100% (1)

- Top Trading Opportunities FOR 2021: Dailyfx Research TeamDocumento38 pagineTop Trading Opportunities FOR 2021: Dailyfx Research TeamKgoadi KgNessuna valutazione finora

- 29 July 2011 FX WEEKLY Dollar Ambiguities Amplified COMPLETEDocumento18 pagine29 July 2011 FX WEEKLY Dollar Ambiguities Amplified COMPLETEtimurrsNessuna valutazione finora

- Breakfast With Dave June 1Documento15 pagineBreakfast With Dave June 1variantperception100% (1)

- Breakfast With Dave 082010Documento15 pagineBreakfast With Dave 082010richardck50Nessuna valutazione finora

- 9/22/14 Global-Macro Trading SimulationDocumento10 pagine9/22/14 Global-Macro Trading SimulationPaul KimNessuna valutazione finora

- Stumbling Blocks: HighlightsDocumento3 pagineStumbling Blocks: Highlightsjoemar625Nessuna valutazione finora

- 9/30/14 Global-Macro Trading SimulationDocumento13 pagine9/30/14 Global-Macro Trading SimulationPaul KimNessuna valutazione finora

- 10/1/14 Global-Macro Trading SimulationDocumento15 pagine10/1/14 Global-Macro Trading SimulationPaul KimNessuna valutazione finora

- The Globe Assets or Cash Bonds or StocksDocumento7 pagineThe Globe Assets or Cash Bonds or Stocksmi.ahmadi1996Nessuna valutazione finora

- Ranges (Up Till 11.38am HKT) : Currency CurrencyDocumento3 pagineRanges (Up Till 11.38am HKT) : Currency Currencyapi-290371470Nessuna valutazione finora

- Global - Macro - Weekly - 8 March 2019 PDFDocumento60 pagineGlobal - Macro - Weekly - 8 March 2019 PDFchaotic_pandemoniumNessuna valutazione finora

- Degussa Marktreport Engl 22-07-2016Documento11 pagineDegussa Marktreport Engl 22-07-2016richardck61Nessuna valutazione finora

- Rosenberg - What Would Happen Without QE3?Documento7 pagineRosenberg - What Would Happen Without QE3?afonteveNessuna valutazione finora

- 0320 US Fixed Income Markets WeeklyDocumento96 pagine0320 US Fixed Income Markets WeeklycwuuuuNessuna valutazione finora

- SPEX Issue 17Documento10 pagineSPEX Issue 17SMU Political-Economics Exchange (SPEX)Nessuna valutazione finora

- II EM After Brexit 072016Documento6 pagineII EM After Brexit 072016ranjan1491Nessuna valutazione finora

- The Global Outlook Isn't Bad. But When Will It Be Good?Documento6 pagineThe Global Outlook Isn't Bad. But When Will It Be Good?api-227433089Nessuna valutazione finora

- Ranges (Up Till 11.45am HKT) : Currency CurrencyDocumento3 pagineRanges (Up Till 11.45am HKT) : Currency Currencyapi-290371470Nessuna valutazione finora

- Asia Maxima (Delirium) - 3Q14 20140703Documento100 pagineAsia Maxima (Delirium) - 3Q14 20140703Hans WidjajaNessuna valutazione finora

- 文章打印Documento2 pagine文章打印d_stepien43098Nessuna valutazione finora

- Daily Currency Briefing: Agreement But No Happy EndDocumento4 pagineDaily Currency Briefing: Agreement But No Happy EndtimurrsNessuna valutazione finora

- Review & Focus: The Currencies at A GlanceDocumento4 pagineReview & Focus: The Currencies at A GlanceSanjay SilwadiyaNessuna valutazione finora

- Market Insight - The Unbearable Lightness of Money 12-14-12-1Documento2 pagineMarket Insight - The Unbearable Lightness of Money 12-14-12-1pgrat10Nessuna valutazione finora

- Bar Cap 3Documento11 pagineBar Cap 3Aquila99999Nessuna valutazione finora

- CIO Weekly Letter - Anxiety Amid Monetary Policy UncertaintyDocumento4 pagineCIO Weekly Letter - Anxiety Amid Monetary Policy UncertaintyRCS_CFANessuna valutazione finora

- CIO CMO - The Pressure's On Emerging Market Central BanksDocumento9 pagineCIO CMO - The Pressure's On Emerging Market Central BanksRCS_CFANessuna valutazione finora

- RCS CIO Report Catalogue LatAmDocumento1 paginaRCS CIO Report Catalogue LatAmRCS_CFANessuna valutazione finora

- CIO CMO - Approving Fiscal BoostersDocumento10 pagineCIO CMO - Approving Fiscal BoostersRCS_CFANessuna valutazione finora

- RCSI Report Catalogue LatAmDocumento2 pagineRCSI Report Catalogue LatAmRCS_CFANessuna valutazione finora

- CIO Monthly Letter - Market Disconnects Real or Head FakeDocumento11 pagineCIO Monthly Letter - Market Disconnects Real or Head FakeRCS_CFANessuna valutazione finora

- RCS CIO Report Catalogue Global MacroDocumento1 paginaRCS CIO Report Catalogue Global MacroRCS_CFANessuna valutazione finora

- RCS CIO Report Catalogue Global MacroDocumento1 paginaRCS CIO Report Catalogue Global MacroRCS_CFANessuna valutazione finora

- CIO CMO - A Look at International MarketsDocumento10 pagineCIO CMO - A Look at International MarketsRCS_CFANessuna valutazione finora

- CIO CMO - A Waiting GameDocumento10 pagineCIO CMO - A Waiting GameRCS_CFANessuna valutazione finora

- CIO CMO - Rocks & Buoys Potential Second-Half CatalystsDocumento9 pagineCIO CMO - Rocks & Buoys Potential Second-Half CatalystsRCS_CFANessuna valutazione finora

- CIO ToW - China's Fifth Plenum Quality, Self-Reliance, LeadershipDocumento9 pagineCIO ToW - China's Fifth Plenum Quality, Self-Reliance, LeadershipRCS_CFANessuna valutazione finora

- CIO ToW - American Exceptionalism, With A CaveatDocumento8 pagineCIO ToW - American Exceptionalism, With A CaveatRCS_CFANessuna valutazione finora

- LatAm Insights - Balancing ActsDocumento7 pagineLatAm Insights - Balancing ActsRCS_CFANessuna valutazione finora

- CMO - A Golden DiversifierDocumento8 pagineCMO - A Golden DiversifierRCS_CFANessuna valutazione finora

- LatAm Insights - Playing To Greener StrengthsDocumento7 pagineLatAm Insights - Playing To Greener StrengthsRCS_CFANessuna valutazione finora

- CIO ToW - Diverging Paths in EuropeDocumento9 pagineCIO ToW - Diverging Paths in EuropeRCS_CFANessuna valutazione finora

- LatAm Insights - Rules Based or Jungle LawDocumento7 pagineLatAm Insights - Rules Based or Jungle LawRCS_CFANessuna valutazione finora

- CMO - Policing The FutureDocumento7 pagineCMO - Policing The FutureRCS_CFANessuna valutazione finora

- LatAm Insights - Receding TidesDocumento7 pagineLatAm Insights - Receding TidesRCS_CFANessuna valutazione finora

- CMO - at A Golden CrossroadsDocumento9 pagineCMO - at A Golden CrossroadsRCS_CFANessuna valutazione finora

- LatAm Insights - Demographic DesignsDocumento8 pagineLatAm Insights - Demographic DesignsRCS_CFANessuna valutazione finora

- CMO - Fiscal To The RescueDocumento9 pagineCMO - Fiscal To The RescueRCS_CFANessuna valutazione finora

- CMO - The Pros and Cons of Soe'sDocumento8 pagineCMO - The Pros and Cons of Soe'sRCS_CFANessuna valutazione finora

- CMO - Us Midterms A Guardrail of SortsDocumento6 pagineCMO - Us Midterms A Guardrail of SortsRCS_CFANessuna valutazione finora

- LatAm Insight's Mexico and ArgentinaDocumento7 pagineLatAm Insight's Mexico and ArgentinaRCS_CFANessuna valutazione finora

- Latam Insights - A Battle For InfluenceDocumento7 pagineLatam Insights - A Battle For InfluenceRCS_CFANessuna valutazione finora

- CMO - Mid-Season Snapshot Earnings Struggle To Clear A Lowered BarDocumento7 pagineCMO - Mid-Season Snapshot Earnings Struggle To Clear A Lowered BarRCS_CFANessuna valutazione finora

- CMO - Mexico Cheap For A ReasonDocumento7 pagineCMO - Mexico Cheap For A ReasonRCS_CFANessuna valutazione finora

- LatAm Insights - Brazil For Now An Unbeautiful GameDocumento8 pagineLatAm Insights - Brazil For Now An Unbeautiful GameRCS_CFANessuna valutazione finora

- Introduction of Banking SystemDocumento10 pagineIntroduction of Banking SystemMasy1210% (1)

- Sandip Voltas ReportDocumento43 pagineSandip Voltas ReportsandipNessuna valutazione finora

- Chyna's Dreamland Chase SeptDocumento5 pagineChyna's Dreamland Chase SeptJonathan Seagull Livingston100% (1)

- BRPAT00098400000056652 NewDocumento8 pagineBRPAT00098400000056652 NewWorld WebNessuna valutazione finora

- Reimbursement Expense ReceiptDocumento2 pagineReimbursement Expense ReceiptCheryl AquinoNessuna valutazione finora

- Ripple + XRP HistoryDocumento55 pagineRipple + XRP Historymikedudas100% (2)

- Vikram Singh Negi SBI Bank StatementDocumento4 pagineVikram Singh Negi SBI Bank StatementArushi SinghNessuna valutazione finora

- Tax Invoice: Account For Professional FeesDocumento1 paginaTax Invoice: Account For Professional FeesVinh DuongNessuna valutazione finora

- IDEX 2022 Q4 Interim ReportDocumento26 pagineIDEX 2022 Q4 Interim ReportMaria PolyuhanychNessuna valutazione finora

- Plastic Money: By: Sunaina Verma Shashikant Mohd. Zeeshan Shashank TripathiDocumento25 paginePlastic Money: By: Sunaina Verma Shashikant Mohd. Zeeshan Shashank Tripathitarunavasyani100% (3)

- Navarro v. SolidumDocumento6 pagineNavarro v. SolidumJackelyn GremioNessuna valutazione finora

- Sealand Coins ListDocumento6 pagineSealand Coins Listsubrata.chakrabarti2544Nessuna valutazione finora

- CourseMarial - Ca11cinvestment Analysis and Portfolio ManagementDocumento4 pagineCourseMarial - Ca11cinvestment Analysis and Portfolio Managementfash selectNessuna valutazione finora

- GDC RCP Office Case v3Documento7 pagineGDC RCP Office Case v3api-251521127Nessuna valutazione finora

- Annex E.1 (Cir1030 - 2019)Documento2 pagineAnnex E.1 (Cir1030 - 2019)michael lababoNessuna valutazione finora

- We Won The Revolution & We Own The Knowledge of ItDocumento311 pagineWe Won The Revolution & We Own The Knowledge of ItSusan100% (1)

- Simple Interest Compounded Interest Population Growth Half LifeDocumento32 pagineSimple Interest Compounded Interest Population Growth Half LifeCarmen GoguNessuna valutazione finora

- Financial and Management Accounting Excercise 1Documento2 pagineFinancial and Management Accounting Excercise 1LemiNessuna valutazione finora

- Summary of The General Provisions Law and Tax ProceduresDocumento7 pagineSummary of The General Provisions Law and Tax ProceduresAndhika Bella PrawitasariNessuna valutazione finora

- Secured Transactions: UCC Title 9Documento17 pagineSecured Transactions: UCC Title 9Rebel X86% (7)

- Individual Assign - Ibf301 - Ib17b01 - Su23Documento3 pagineIndividual Assign - Ibf301 - Ib17b01 - Su23Quỳnh Lê DiễmNessuna valutazione finora

- Lautan Luas Sep 2019Documento116 pagineLautan Luas Sep 2019justinliem06Nessuna valutazione finora

- Forwards FuturesDocumento29 pagineForwards FuturesAmeen ShaikhNessuna valutazione finora

- DocxDocumento9 pagineDocxReiah RongavillaNessuna valutazione finora

- AFME Guide To Infrastructure FinancingDocumento99 pagineAFME Guide To Infrastructure Financingfunction_analysisNessuna valutazione finora

- Capital StructureDocumento15 pagineCapital StructurePriyanka SharmaNessuna valutazione finora

- Banking & Business Review May '10Documento78 pagineBanking & Business Review May '10Fa HianNessuna valutazione finora

- Financial Position of The STCDocumento13 pagineFinancial Position of The STCSalwa AlbalawiNessuna valutazione finora