Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Call Conference Papers

Caricato da

Naveen LawrenceCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Call Conference Papers

Caricato da

Naveen LawrenceCopyright:

Formati disponibili

BaNcoN 2013

BANCON 2013

November 2013

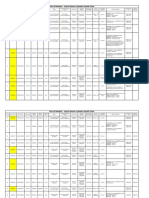

CALL FOR CONFERENCE PAPERS

The Bankers Conference 2013 is organised on the Theme:

Bank of the future - gearing up to meet the emerging environment

Host institutions welcome papers from professionals in the Indian banking industry, policy making institutions, related

institutions of the Indian and international finance on the topics of significance to above theme of the conference and/or

on the sub-themes slated to be debated in the panel discussion tracks during the conference.

While conceptual issues and policy perspectives are very important, the organisers in particular invite innovative thinking,

ideas and viable solutions on theareas of business importance for the Indian banks as they need to gear up for the future to

meet the emerging environment.

Those interested in submitting papers to the conference may please take note of the following:

Articles could be submitted in main theme or any of the topics listed below and other topics of relevance and

significance to the theme.

The articles should be submitted in electronic form in MS Word format. (use Century Gothic- font size 11)

Authors are requested to keep the articles brief and precise. While we do not insist on any restriction on the length of

the article at the cost of clarity, we request the authors to avoid lengthy descriptions. Generally, the length of the article

could vary between 2000 4000 words.

Authors will be intimated on the acceptance and publication of the same in the Conference Volume.

Articles may be edited to suit the presentations and the design of the Conference Volume. The decisions of the

Secretariat will be final in this regard.

Articles may be submitted by sending email to: bancon2013@iba.org.in. Also CD/Floppy of the article along with the

manuscript may please be sent to: BANCON 2013 Secretariat, Indian Banks Association, World Trade Centre, Centre I,

6th floor, Cuffe Parade, Mumbai 400 005.

Articles sent on fax will not be accepted.

Last date for submission of articles: September 15, 2013.

For any further information or assistance, please contact:

Ms Malti Ashar

Vice President, IBA

Tel: 022 22174020

Email: malti@iba.org.in

32

The Indian Banker

Mr Suresh Shroff

Manager, IBA

Tel: 022 22174019

Email: shroff@iba.org.in

Vol VIII No. 8 - August 2013

BaNcoN 2013

THEME: Bank of the future - gearing up to meet the emerging environment

Banking sector is a true barometer of any economy. The Indian banking sector,with an expected growth rate of 17 percent CAGR over the

next decade, will be one of the primary drivers of growth in the Indian economy. Among the sectors, Retail and SME banking will be the

primary drivers with mass affluent and above segments emerging as the primary targets. However, there are certain imperatives which need

to be ensured as prerequisites robust risk management and efficient capital management. Risk management - Average NPA has increased

from 1.63 percent in FY09 to 1.98 percent in FY12 and this has put bottom-lines under tremendous stress. This clearly highlights the

urgency with which Banks need to invest in their risk management capabilities. In addition,capital lock-up due to higher RWA, inadequate

pricing, misaligned performance management and stricter regulatory requirements like Basel III, is limiting ability to drive further growth.

Efficient capital management now needs to be part of the banks discipline in order to maintain the growth trajectory. Eight key sub-themes

have been chosen as part of BANCON 2013.

1. Building a customer centric retail banking model: Retail banking is quickly becoming commoditised and thus efficiency

improvements, while necessary, may not be sufficient for banks to create a distinctive positioning. This panel discussion will focus on what

banks could do to create a profitable customer centric retail banking model in face of rapidly changing consumer behaviour, demographic

trends and technology disruptions.

2. Cracking the SME riddle: Driving profitable growth in SME:SME is one of the fastest growing segments. However, banks have

suffered heavy losses in this segment due to high NPAs. This discussion will focus on how players can undertake granular sub-segmentation,

product innovation, better risk management and other initiatives to grow profitability in this segment.

3. Capturing the mass market banking opportunity profitably: Mass market is one of the largest customer segments

from a banking perspective. However given smaller ticket sizes associated with this segment and the dispersed nature of the opportunity,

using traditional channels is usually cost inefficient to serve this segment. This challenge of cost efficiency is multi-fold in case of financial

inclusion. Hence, the discussion would focus on how banks can use innovative models leveraging technology to serve this segment

profitably.

4. Corporate banking transformation - Accelerating mid and large corporate growth to boost economy:

Most Indian banks significantly developed their corporate banking model in the last decade. However, there is significant scope for

improvement to most parameters to reach global best-practice levels. The panel would discuss what are next set of innovations that a player

need to do to build a fast-growing and highly profitable corporate business.

5. Digital 2.0 - Digital channel strategy as a means to tap multi-channel behaviour: Today in India, 60-70

percent internet users do some research online while buying financial products. Almost 70 percent of these customers change their mind

about product or brand after conducting online research. However, majority (>90 percent) of these customer complete their purchase offline

through traditional channels. Given this, players need to create a digital channel strategy with suitable online-offline linkages to completely

tap this multi-channel behaviour.

6. Risk & compliance management and capital optimisation due to increasing stress on assets: In last 23 years, banks have seen a continuous deterioration in the credit quality of their assets. The ongoing monetary tightening, the slowdown in

economic growth magnified by the present day crisis in Europe may put further stress on customers especially Corporates and SMEs. This

could manifest itself in upward pressure on these key ratios. In this environment, it is critical that banks build robust risk management

systems and undertake systematic capital optimisation programmes.

7. Big data and analytics - key to unlock hidden value: Consumer behaviour has undergone significant shifts over the

years and a proper understanding of its implications will be an imperative to align growth strategy accordingly. Leveraging the rapid

technology innovations like big data and analytics is the key to unlock the underlying levers and hence capture the hidden value while

achieving improved cost efficiencies. This discussion will focus on how banks can leverage big data and analytics to achieve sustained

competitive advantage.

8. Gearing up the human capital - building for the scarce skills: Driving sustainable growth in this dynamic

environment will require banks to focus on proactive and focused human capital management. Existing methodologies may need to be redesigned in the context of prevalent trends - talent scarcity, significant attrition/retirements and ever-growing requirement of advanced skills

to drive sales and operational excellence. The panel will discuss on how banks adopt comprehensive leadership development & capability

building approach to systematically build and sustain desired skills.

Vol VIII No. 8 - August 2013

The Indian Banker

33

Potrebbero piacerti anche

- Mastering Financial Analysis: Techniques and Strategies for Financial Professionals: Expert Advice for Professionals: A Series on Industry-Specific Guidance, #1Da EverandMastering Financial Analysis: Techniques and Strategies for Financial Professionals: Expert Advice for Professionals: A Series on Industry-Specific Guidance, #1Nessuna valutazione finora

- The Berkeley Review: MCAT Chemistry Atomic Theory PracticeDocumento37 pagineThe Berkeley Review: MCAT Chemistry Atomic Theory Practicerenjade1516Nessuna valutazione finora

- August 03 2017 Recalls Mls (Ascpi)Documento6 pagineAugust 03 2017 Recalls Mls (Ascpi)Joanna Carel Lopez100% (3)

- Books of AccountsDocumento18 pagineBooks of AccountsFrances Marie TemporalNessuna valutazione finora

- Embracing Change EbookDocumento35 pagineEmbracing Change EbookNaveen LawrenceNessuna valutazione finora

- Accenture - Winning in New Banking Era PDFDocumento20 pagineAccenture - Winning in New Banking Era PDFapritul3539100% (1)

- Lecture Ready 01 With Keys and TapescriptsDocumento157 pagineLecture Ready 01 With Keys and TapescriptsBảo Châu VươngNessuna valutazione finora

- Post Event Report - DCD HyderabadDocumento23 paginePost Event Report - DCD HyderabadNaveen LawrenceNessuna valutazione finora

- Intro To Banking M3 BankBusinessAndOperatingModels FINALDocumento17 pagineIntro To Banking M3 BankBusinessAndOperatingModels FINALanuj guptaNessuna valutazione finora

- C6 RS6 Engine Wiring DiagramsDocumento30 pagineC6 RS6 Engine Wiring DiagramsArtur Arturowski100% (3)

- Standerd ChartedDocumento58 pagineStanderd ChartedashishgargNessuna valutazione finora

- Rohit Final P-1Documento113 pagineRohit Final P-1SpUnky RohitNessuna valutazione finora

- IoT BASED HEALTH MONITORING SYSTEMDocumento18 pagineIoT BASED HEALTH MONITORING SYSTEMArunkumar Kuti100% (2)

- Final Project Neft Rtgs PDFDocumento82 pagineFinal Project Neft Rtgs PDFMehul Patel58% (12)

- Corporate BankingDocumento122 pagineCorporate Bankingrohan2788Nessuna valutazione finora

- 2015iciee - India3 Challenges PDFDocumento7 pagine2015iciee - India3 Challenges PDFVishakha RathodNessuna valutazione finora

- GP CoreDocumento133 pagineGP CoreDivya GanesanNessuna valutazione finora

- Banking Products and Operations: Session 6Documento30 pagineBanking Products and Operations: Session 6Vaidyanathan RavichandranNessuna valutazione finora

- Credit AppraisalDocumento9 pagineCredit Appraisalyogi2416Nessuna valutazione finora

- Approach Paper: It-Enabled Financial InclusionDocumento28 pagineApproach Paper: It-Enabled Financial InclusionAbdoul FerozeNessuna valutazione finora

- Consolidation of Indian Banks: Benefits and ChallengesDocumento15 pagineConsolidation of Indian Banks: Benefits and ChallengesChinmay ShirsatNessuna valutazione finora

- Emerging Trends in Banking and FinanceDocumento3 pagineEmerging Trends in Banking and FinanceSwarnim GottliebNessuna valutazione finora

- Chapter No Page NoDocumento55 pagineChapter No Page NoAnand RoseNessuna valutazione finora

- Innovation in BankingDocumento9 pagineInnovation in BankingHardik AraniyaNessuna valutazione finora

- 5 Porter's Forces Analysis - VuHueDocumento2 pagine5 Porter's Forces Analysis - VuHueHana VũNessuna valutazione finora

- KPMG CII Indian BankingDocumento32 pagineKPMG CII Indian BankingMukesh Pareek100% (1)

- e-CRM in Indian Banking SurveyDocumento43 paginee-CRM in Indian Banking SurveyAmit mehlaNessuna valutazione finora

- Ndian Banking of TomorrowDocumento4 pagineNdian Banking of TomorrowadagooodNessuna valutazione finora

- Banking Sector in India - Challenges and OpportunitiesDocumento6 pagineBanking Sector in India - Challenges and OpportunitiesDeepika SanthanakrishnanNessuna valutazione finora

- Project On Credit Appraisal For Sme SectorDocumento33 pagineProject On Credit Appraisal For Sme Sectoranish_10677953Nessuna valutazione finora

- [123doc] - script-should-anz-bank-abandon-the-physical-branch-model-and-transition-all-its-services-onlineDocumento15 pagine[123doc] - script-should-anz-bank-abandon-the-physical-branch-model-and-transition-all-its-services-onlineMai AnhNessuna valutazione finora

- Research Paper On Retail Banking in IndiaDocumento8 pagineResearch Paper On Retail Banking in Indiakrqovxbnd100% (1)

- Success in SME FinancingDocumento33 pagineSuccess in SME FinancingSachin GuptaNessuna valutazione finora

- Unit - 1: Retail Banking - IntroductionDocumento3 pagineUnit - 1: Retail Banking - IntroductionZara KhatriNessuna valutazione finora

- Chapter-4 Customer Relationship Management in Indian BanksDocumento46 pagineChapter-4 Customer Relationship Management in Indian BanksAryan SharmaNessuna valutazione finora

- Punjab & Sind Bank Working Capital AnalysisDocumento23 paginePunjab & Sind Bank Working Capital AnalysisSrishti SinghNessuna valutazione finora

- Banking Sector Dissertation TopicsDocumento6 pagineBanking Sector Dissertation TopicsHelpOnWritingAPaperUK100% (1)

- Annamalai 2nd Year MBA FINANCIAL MANAGEMENT 349 Solved Assignment 2020 Call 9025810064Documento5 pagineAnnamalai 2nd Year MBA FINANCIAL MANAGEMENT 349 Solved Assignment 2020 Call 9025810064Palaniappan NNessuna valutazione finora

- Thesis Topics in Banking SectorDocumento8 pagineThesis Topics in Banking Sectorarianadavishighpoint100% (2)

- Victoria and Mah Boob CRMDocumento16 pagineVictoria and Mah Boob CRMAhnaf AkifNessuna valutazione finora

- Impact of Globalization On Indian Banking Sector: AbhinavDocumento8 pagineImpact of Globalization On Indian Banking Sector: AbhinavDivyesh GandhiNessuna valutazione finora

- TMP DAFEDocumento11 pagineTMP DAFEnithiananthiNessuna valutazione finora

- Research Paper On Indian Banking IndustryDocumento4 pagineResearch Paper On Indian Banking Industrygazqaacnd100% (1)

- Research Paper On Indian Banking SectorDocumento7 pagineResearch Paper On Indian Banking Sectoriimytdcnd100% (1)

- Introduction To The IndustryDocumento18 pagineIntroduction To The Industrynikunjsih sodhaNessuna valutazione finora

- Commercial Bank Research PaperDocumento5 pagineCommercial Bank Research Paperjppawmrhf100% (1)

- Business Models of Banking in FutureDocumento5 pagineBusiness Models of Banking in FuturebishwajitNessuna valutazione finora

- Standerd Charted BankDocumento118 pagineStanderd Charted BanktosifjaibunNessuna valutazione finora

- Marketing of Bank Products Emerging Challenges & Strategies - Usha Kiran Rai - AcademiaDocumento9 pagineMarketing of Bank Products Emerging Challenges & Strategies - Usha Kiran Rai - AcademiaSoviljot SinghNessuna valutazione finora

- Service Quality of Public Sector Banks To SME Customers: An Empirical Study in The Indian ContextDocumento24 pagineService Quality of Public Sector Banks To SME Customers: An Empirical Study in The Indian Contextvikas_chourasiaNessuna valutazione finora

- Recent Mergers and Acquisition in Indian Banking Sector-A StudyDocumento9 pagineRecent Mergers and Acquisition in Indian Banking Sector-A StudyAjith AjithNessuna valutazione finora

- MA0044Documento11 pagineMA0044Mrinal KalitaNessuna valutazione finora

- Ijaresm-Retail Banking Trends in IndiaDocumento3 pagineIjaresm-Retail Banking Trends in IndiaDr Bhadrappa HaralayyaNessuna valutazione finora

- Thesis On Indian BanksDocumento4 pagineThesis On Indian Bankslizbrowncapecoral100% (2)

- Thesis BankDocumento5 pagineThesis Bankserenafayenewyork100% (2)

- Need and Importance of The Study: Indian Society of Agricultural MarketingDocumento8 pagineNeed and Importance of The Study: Indian Society of Agricultural Marketingdhavalshah99Nessuna valutazione finora

- Banking Industry-Final Report Group 18Documento14 pagineBanking Industry-Final Report Group 18Pranav KumarNessuna valutazione finora

- Report On Kotak Mahindra BankDocumento23 pagineReport On Kotak Mahindra BankJayesh Bhandarkar100% (1)

- Finacle Connect Jan Mar 08Documento32 pagineFinacle Connect Jan Mar 08Dinesh RaghavendraNessuna valutazione finora

- KhanDocumento10 pagineKhanZohair KhanNessuna valutazione finora

- Tina Kathatala FinalDocumento13 pagineTina Kathatala FinalSuket DarjiNessuna valutazione finora

- Marketing Action PlanDocumento2 pagineMarketing Action PlanAmbashe Dek100% (2)

- Net Profit (Review and Analysis of Cohan's Book)Da EverandNet Profit (Review and Analysis of Cohan's Book)Nessuna valutazione finora

- Toward Inclusive Access to Trade Finance: Lessons from the Trade Finance Gaps, Growth, and Jobs SurveyDa EverandToward Inclusive Access to Trade Finance: Lessons from the Trade Finance Gaps, Growth, and Jobs SurveyNessuna valutazione finora

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Da EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Nessuna valutazione finora

- The Role of Central Bank Digital Currencies in Financial Inclusion: Asia–Pacific Financial Inclusion Forum 2022Da EverandThe Role of Central Bank Digital Currencies in Financial Inclusion: Asia–Pacific Financial Inclusion Forum 2022Nessuna valutazione finora

- Asia Small and Medium-Sized Enterprise Monitor 2020: Volume III: Thematic Chapter—Fintech Loans to Tricycle Drivers in the PhilippinesDa EverandAsia Small and Medium-Sized Enterprise Monitor 2020: Volume III: Thematic Chapter—Fintech Loans to Tricycle Drivers in the PhilippinesNessuna valutazione finora

- Public Financing for Small and Medium-Sized Enterprises: The Cases of the Republic of Korea and the United StatesDa EverandPublic Financing for Small and Medium-Sized Enterprises: The Cases of the Republic of Korea and the United StatesNessuna valutazione finora

- Cheers Interactive - An Overview - Ver 2.0Documento2 pagineCheers Interactive - An Overview - Ver 2.0Naveen LawrenceNessuna valutazione finora

- Ahmad Abou Zaher - India Smart Cities v1.2Documento14 pagineAhmad Abou Zaher - India Smart Cities v1.2Naveen LawrenceNessuna valutazione finora

- Media Kit 2021Documento23 pagineMedia Kit 2021Naveen LawrenceNessuna valutazione finora

- IT Operations and Server Management TopicsDocumento1 paginaIT Operations and Server Management TopicsNaveen LawrenceNessuna valutazione finora

- India Infographic v3-2Documento4 pagineIndia Infographic v3-2Naveen LawrenceNessuna valutazione finora

- 2021 Brochure v2.2Documento10 pagine2021 Brochure v2.2Naveen Lawrence100% (1)

- Good Housekeeping Manual (GHK) : September 2006Documento114 pagineGood Housekeeping Manual (GHK) : September 2006Naveen LawrenceNessuna valutazione finora

- Media Kit 2021Documento23 pagineMedia Kit 2021Naveen LawrenceNessuna valutazione finora

- Telangana Data Centres PolicyDocumento28 pagineTelangana Data Centres PolicyNaveen Lawrence100% (1)

- Post Event Coverage - HyderabadDocumento21 paginePost Event Coverage - HyderabadNaveen LawrenceNessuna valutazione finora

- All About NextGen Green Datacenters Conference 2010Documento1 paginaAll About NextGen Green Datacenters Conference 2010Naveen LawrenceNessuna valutazione finora

- Rate Card DCD IndiaDocumento2 pagineRate Card DCD IndiaNaveen LawrenceNessuna valutazione finora

- EY ToC January 31Documento1 paginaEY ToC January 31Naveen LawrenceNessuna valutazione finora

- Creating Vibrant Groups: What Does A "Vibrant" Group Look Like?Documento4 pagineCreating Vibrant Groups: What Does A "Vibrant" Group Look Like?Naveen LawrenceNessuna valutazione finora

- Cobra Top 10Documento30 pagineCobra Top 10prasenjeetdas4467Nessuna valutazione finora

- WSales & Sponsorship StrategyDocumento3 pagineWSales & Sponsorship StrategyNaveen LawrenceNessuna valutazione finora

- Strategies and Knowledge Sharing - TemplateDocumento7 pagineStrategies and Knowledge Sharing - TemplateNaveen LawrenceNessuna valutazione finora

- ITEchDocumento12 pagineITEchNaveen LawrenceNessuna valutazione finora

- Inter Awards EntryFormDocumento2 pagineInter Awards EntryFormNaveen LawrenceNessuna valutazione finora

- Saikrishna Rajagopal: "IP Litigation in India"Documento13 pagineSaikrishna Rajagopal: "IP Litigation in India"Naveen LawrenceNessuna valutazione finora

- Delegate Registration FormDocumento2 pagineDelegate Registration FormNaveen LawrenceNessuna valutazione finora

- The Rules For Being Amazing PDFDocumento1 paginaThe Rules For Being Amazing PDFAkshay PrasathNessuna valutazione finora

- Cards E-Paymensts and Settlement SystemsDocumento31 pagineCards E-Paymensts and Settlement SystemsNaveen LawrenceNessuna valutazione finora

- Mumbai HotelsDocumento8 pagineMumbai HotelsNaveen LawrenceNessuna valutazione finora

- A Minute To Winte It - RULESDocumento2 pagineA Minute To Winte It - RULESNaveen LawrenceNessuna valutazione finora

- Annexure NCIS FormDocumento1 paginaAnnexure NCIS FormVijaya Krishna PondalaNessuna valutazione finora

- MPICor Broch 2012Documento8 pagineMPICor Broch 2012Naveen LawrenceNessuna valutazione finora

- Card Epayments & Settlements 2014 Conference AgendaDocumento3 pagineCard Epayments & Settlements 2014 Conference AgendaNaveen LawrenceNessuna valutazione finora

- Level 3 Repair PBA Parts LayoutDocumento32 pagineLevel 3 Repair PBA Parts LayoutabivecueNessuna valutazione finora

- HCW22 PDFDocumento4 pagineHCW22 PDFJerryPNessuna valutazione finora

- En dx300lc 5 Brochure PDFDocumento24 pagineEn dx300lc 5 Brochure PDFsaroniNessuna valutazione finora

- Leaked David Fry II Conversation Regarding Loopholes and Embezzlement at AFK Gamer LoungeDocumento6 pagineLeaked David Fry II Conversation Regarding Loopholes and Embezzlement at AFK Gamer LoungeAnonymous iTNFz0a0Nessuna valutazione finora

- Malware Reverse Engineering Part 1 Static AnalysisDocumento27 pagineMalware Reverse Engineering Part 1 Static AnalysisBik AshNessuna valutazione finora

- Unit-1: Introduction: Question BankDocumento12 pagineUnit-1: Introduction: Question BankAmit BharadwajNessuna valutazione finora

- Nama: Yetri Muliza Nim: 180101152 Bahasa Inggris V Reading Comprehension A. Read The Text Carefully and Answer The Questions! (40 Points)Documento3 pagineNama: Yetri Muliza Nim: 180101152 Bahasa Inggris V Reading Comprehension A. Read The Text Carefully and Answer The Questions! (40 Points)Yetri MulizaNessuna valutazione finora

- 1.2 - Venn Diagram and Complement of A SetDocumento6 pagine1.2 - Venn Diagram and Complement of A SetKaden YeoNessuna valutazione finora

- ConductorsDocumento4 pagineConductorsJohn Carlo BautistaNessuna valutazione finora

- Hyper-Threading Technology Architecture and Microarchitecture - SummaryDocumento4 pagineHyper-Threading Technology Architecture and Microarchitecture - SummaryMuhammad UsmanNessuna valutazione finora

- Final Thesis Report YacobDocumento114 pagineFinal Thesis Report YacobAddis GetahunNessuna valutazione finora

- (23005319 - Acta Mechanica Et Automatica) A Study of The Preload Force in Metal-Elastomer Torsion SpringsDocumento6 pagine(23005319 - Acta Mechanica Et Automatica) A Study of The Preload Force in Metal-Elastomer Torsion Springsstefan.vince536Nessuna valutazione finora

- CMC Ready ReckonerxlsxDocumento3 pagineCMC Ready ReckonerxlsxShalaniNessuna valutazione finora

- TWP10Documento100 pagineTWP10ed9481Nessuna valutazione finora

- 2023-Physics-Informed Radial Basis Network (PIRBN) A LocalDocumento41 pagine2023-Physics-Informed Radial Basis Network (PIRBN) A LocalmaycvcNessuna valutazione finora

- Rohit Patil Black BookDocumento19 pagineRohit Patil Black BookNaresh KhutikarNessuna valutazione finora

- Service and Maintenance Manual: Models 600A 600AJDocumento342 pagineService and Maintenance Manual: Models 600A 600AJHari Hara SuthanNessuna valutazione finora

- Math5 Q4 Mod10 DescribingAndComparingPropertiesOfRegularAndIrregularPolygons v1Documento19 pagineMath5 Q4 Mod10 DescribingAndComparingPropertiesOfRegularAndIrregularPolygons v1ronaldNessuna valutazione finora

- Personalised MedicineDocumento25 paginePersonalised MedicineRevanti MukherjeeNessuna valutazione finora

- Unit 3 Computer ScienceDocumento3 pagineUnit 3 Computer ScienceradNessuna valutazione finora

- Striedter - 2015 - Evolution of The Hippocampus in Reptiles and BirdsDocumento22 pagineStriedter - 2015 - Evolution of The Hippocampus in Reptiles and BirdsOsny SillasNessuna valutazione finora

- FX15Documento32 pagineFX15Jeferson MarceloNessuna valutazione finora

- Table of Specification for Pig Farming SkillsDocumento7 pagineTable of Specification for Pig Farming SkillsYeng YengNessuna valutazione finora

- DIN Flange Dimensions PDFDocumento1 paginaDIN Flange Dimensions PDFrasel.sheikh5000158Nessuna valutazione finora

![[123doc] - script-should-anz-bank-abandon-the-physical-branch-model-and-transition-all-its-services-online](https://imgv2-2-f.scribdassets.com/img/document/721476023/149x198/7e457dc0b6/1712669991?v=1)