Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Final Project of Portfolio Managament

Caricato da

asddffff1558Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Final Project of Portfolio Managament

Caricato da

asddffff1558Copyright:

Formati disponibili

Table 1

Banks Included in the Sample S No. 1 2 3 4 5 6 Islamic Banks Albaraka Bank (Pakistan) Ltd (ABPL) Bank Alfalha (BA) Bank Islami Pakistan Limited (BIP) Burj bank (BB) Dubai Islamic bank (DIB) Mezan Bank (MB) Conventional Banks Allied Bank Limited (ABL) Askari Bank limited (ASBL) Bank Alfalha Commercial (BAC) KASB Bank (KASBB) Muslim Commercial Bank (MCB) Standard Chartered Bank (SCB)

GROWTH OF ISLAMIC BANKING INDUSTRY IN PAKISTAN: 2003-071 1. From 2003 to 2007, average numbers of full fledge Islamic Banks in Pakistan was 3.8. This appears to be a substantial growth due to the fact that the total number of scheduled banks in Pakistan is around 44. This number will continue to decrease owing to mergers and acquisition of banks as inspired by SBP for consolidation of banking in Pakistan. 2. As per research regarding the progress of Islamic banking industry in Pakistan from 2003-07 was as follow: A. Full fledge Islamic Banks: 6 times B. Branches of Islamic Banks: 19 times C. Conventional Banks with Islamic Banking branches: 4 times D. Branches of conventional Banks: 15 times E. Total Islamic Banking institutions: 4.5 times F. Total number of branches: 17 times 3 Trends in Islamic Banking from June 2004 to June 2008 are reported below: A. Deposits: 12.5 times B. Financing & investment: 12.5 times C. Total assets: 12.5 times

___________________________________________________________________________________

1

Prof. Dr. Kawaka Ajman Saied, Founder Principal, Hailey College of Banking & Finance, University of the Punjab, Lahore Pakistan; A Review on Islamic Banking in Pakistan

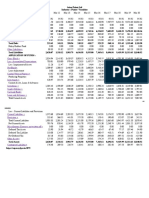

Table 2 Average Annual Growth Rates of Some Key Variables: 2009-12 BANKS Total Deposits Total Assets Total Total Revenue Total Equity Investment Islamic Banks 144.32 1476.83 149.25 121.50 157.03 200.20 31.50 -4.39 36.14 186.15 -7.84 21.05 121.02 466.55 105.98 91.77 175.91 328.48 64.86 26.74 126.88 531.64 68.75 51.33 55.02 53.28 56.42 51.67 31.97 11.02 40.87 17.22 47.30 79.14 31.87 42.28 47.35 -58.39 28.45 46.20

ABPL BIP DIB MB BB Average Standard deviation ABL ASBL MCB BAL KASBB Average Stnd Deviation

168.32 231.53 37.43 124.91 273.68 167.17 82.59 35.68 58.09 38.96 27.78 53.26 42.75 11.26

48.76 483.35 Conventional Banks 37.68 103.48 53.48 214.48 40.66 184.30 29.32 87.11 36.60 114.61 39.55 140.80 7.90 49.56

CHART: 1

600 500 400 300 200 100 0 Total deposit Total Assets Total Total Investment Revenue Total Equity

Islamic Banks Conventional Banks

Total Deposits: During period of 2003-07, trend in Islamic banking was in growing up process which is still growing as we see in chart 1. The key variable, total deposit of Islamic banks was grown up to 12.5 times of the last five years. Whereas, the Islamic banks have an average growth rate of 167.17 during 2008-12. This growth rate of Islamic banks is almost 4 times of the conventional banks during the same period. Total Asset: It is an important key variable which is the worth of any corporation. Total asset of Islamic banks during 2008-12 have also been a growing trend which has value of 126.88 on average. The asset of the Islamic banks comprises 3 times of the conventional banks in this period. Total Investment: Since trend of the people to deposit their saving in the Islamic banks is increased which result in huge pool of deposits. That is why investment of the banks has grown substantially as compared to conventional banks. The growth rate of Islamic banks is 531.64 percent which comprises almost 3.8 times of the conventional banks. Total Revenue: Chart 1 shows that growth rate of total revenue of Islamic banks have increased from period 2008 to 2012. Total Equity: Growth rate of Islamic banks as compared to conventional banks has increased to 1.8 times greater. Table 3 Period Averages for Some Key Ratios: 2008 -12 Bank Cap/Asst Ratio Deployment Deployment Ratio 1 Ratio 2 Islamic Banks 9.12 25.03 30.17 30.41 14.37 4.08 5.14 21.24 11.72 15.95 31.47 34.35 21.70 13.14 35.15 41.14 6.74 12.17 45.40 43.92 12.73 14.07 29.47 34.21 5.16 13.562 8.78 6.75 Liquidity Ratio Cost/Income Ratio 71.60 50.79 54.26 62.82 50.26 57.95 8.17 ROA ROE

ABIP DIB BIP BB MB Average Standard Deviation ABL

7.48 6.21 4.68 8.02 8.23

82.35 43.41 34.13 37.22 125.61 6.92 64.55 1.32 35.11 27.8

13.29 8.06 Conventional Banks 36.92 35.14 42.96

1.808

Askari BL MCB BAL KASBB Average Standard Deviation

10.886 20.31 5.46 6.23 11.29 5.41

13.52 11.52 17.55 12.42 12.76 2.86

37.00 47.32 32.96 36.11 38.06 4.86

34.84 47.04 31.65 31.22 35.98 5.76

63.27 29.72 62.84 93.15

0.372 3.22 9.026 8.07 58.39 4.50 21.50 3.44

6.67 26.36 165.467 129.54 71.17 63.79

CHART 2

80 70 60 50 40 30 20 10 0 Islamic Banks Conventional Banks

Capital Asset Ratio This is perhaps the most important ratio especially for financial firms. This reflects the strength of a bank and its ability to meet its obligations in a crisis situation. There are three major reasons for a bank to watch its capital asset ratio. First, regulatory authorities require a minimum amount of bank capital. Second, the size of the bank capital has some safety implications as it provides some cushioning, albeit limited, against the possibility that the bank cannot satisfy its obligations to its creditors. Third, the amount of capital affects the rate of return to the bank equity holders. Growth in Capital asset ratio of Islamic banks as per chart 2 is little bit increase as compared to conventional banks. Liquidity Ratio:

This ratio measures the ability of a firm to meet its current liabilities. In the case of banks, the current liabilities are the demand deposits. Therefore, In the case of banks, the equivalent of what is known as "Current Ratio9 in financial statement analysis would be the ratio of liquid assets to demand deposits. However, since time deposits could also be of short maturity and in many cases, withdrawals from such accounts are possible by means of a short advance notice of withdrawal; we have calculated the liquidity ratio as follows: Liquidity Ratio= Cash and Accounts with Banks/Total Deposits Liquidity of Islamic banks is not as efficient as conventional banking, because there are various types of accounts in conventional banks that are not in Islamic banks. Secondly, the conventional banks are too much large banking network across the world and thus have large source of cash and account. But still Islamic banks have better capital asset ratio. Deployment Ratio: Another aspect of performance evaluation is to see how best a bank is using its resources. For this purpose we have calculated two ratios. The first, Deployment Ratio 1 is defined as follows: Deployment Ratio 1 = Total Investment/Total Equity + Total Deposits Though the ratio is less than conventional banks ratio, yet the deployment ratio of Islamic banks is competing their ratio. It shows that Islamic banks up to what degree exploit their customers deposits and how efficiently they invest their deposits amount. Realizing that for short periods of time, 'margin' deposits and the depositors share of profits also remain with the banks in addition to customer deposits and equity, a second deployment ratio was calculated as follows: Deployment Ratio 2 = Total Investment/Total Liabilities This of course is a much more stringent test of efficiency in the use of resources at the disposal of banks because it includes the use of amounts deposited for short periods of time and that too not for return. It turns out that Islamic banks are doing a fairly good job in the utilization of their resources. Since both possess nearly the same ratio of 34 to 35 percent for Islamic and conventional respectively.

Cost to Income Ratio: This is a measure of overall efficiency. Theoretically, no standard for these ratios are available in the literature. However, The Banker magazine, which publishes a list of Top 1000 banks in the World every year, is reporting this ratio for the last three years. We calculated the average ratios for the 1000 banks for these years and they came out to be 62.1, 60.5 and 62.0 respectively for 1996, 1997 and 1998. We should also point out here that several studies have shown that there are economies of scale in the banking business just like other lines of business. Considering this evidence and the fact that Islamic banks are generally of a smaller size, we can use65 percent as the "benchmark" for this ratio. Against this standard, the overall cost/income ratio for the Islamic banks during 2008-12 was 57 percent which is not an alarming situation.

Profitability Ratios There are several ratios, which are used to measure the profitability of firms. The two most often used are Rate of Return on Assets (ROA) and the Rate of Return on Equity (ROE). We will now analyze the profitability of Islamic banks on the basis of these two ratios. Rate of return on assets (ROA): The average return on asset for Islamic banks during 2008-12 was 6.92 percent as compared to conventional banks which have 4.50 percent. It shows that the Islamic banks are utilizing their resource better. Islamic banks have different resource of investment and products etc.

Rate of return on equity (ROE): During period of 2008-12, return on equity of Islamic banks have less percentage of 64.55 as compared to conventional banks that have 71.17 percent. This is because, reserve portion of conventional banks is large than share capital issued.

Potrebbero piacerti anche

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Chapt 25 Bonds PayableDocumento124 pagineChapt 25 Bonds PayablelcNessuna valutazione finora

- Bilbliography FinalDocumento4 pagineBilbliography Finalpoojagopwani3413Nessuna valutazione finora

- Final Paper 2 Strategic Financial Management Chapter 2 Part 4 CA. Anurag SingalDocumento54 pagineFinal Paper 2 Strategic Financial Management Chapter 2 Part 4 CA. Anurag SingalPrasanni RaoNessuna valutazione finora

- Chapter 13 - Capital StructureDocumento24 pagineChapter 13 - Capital StructurePriyanka KulshresthaNessuna valutazione finora

- Excel of Corporate FinanceDocumento3 pagineExcel of Corporate FinanceRafia TasnimNessuna valutazione finora

- Dwnload Full Business Ethics Ethical Decision Making and Cases 12th Edition Ferrell Solutions Manual PDFDocumento36 pagineDwnload Full Business Ethics Ethical Decision Making and Cases 12th Edition Ferrell Solutions Manual PDFtrichitegraverye1bzv8100% (16)

- Application of Money - Time RelationshipsDocumento8 pagineApplication of Money - Time RelationshipsMahusay Neil DominicNessuna valutazione finora

- Day Trade Pairs Using Intraday Spread BandsDocumento4 pagineDay Trade Pairs Using Intraday Spread BandsKaustubh KeskarNessuna valutazione finora

- SG - FSDocumento20 pagineSG - FSRoxieNessuna valutazione finora

- Accounts Project JK TyreDocumento16 pagineAccounts Project JK Tyresj tjNessuna valutazione finora

- AFM 2021-23 End-Term QuestionDocumento2 pagineAFM 2021-23 End-Term QuestionNimish TarikaNessuna valutazione finora

- Chap016 Financial Reporting AnalysisDocumento15 pagineChap016 Financial Reporting AnalysisThalia SandersNessuna valutazione finora

- Additional Information: Ratio AnalysisDocumento7 pagineAdditional Information: Ratio Analysisashokdb2kNessuna valutazione finora

- FM212 Principles of FinanceDocumento4 pagineFM212 Principles of Financejackie.chanNessuna valutazione finora

- Chap 10 IM Common Stock ValuationDocumento97 pagineChap 10 IM Common Stock ValuationHaziq Shoaib MirNessuna valutazione finora

- Revision II (Ratio Analysis)Documento6 pagineRevision II (Ratio Analysis)Allwin GanaduraiNessuna valutazione finora

- AirThread G015Documento6 pagineAirThread G015Kunal MaheshwariNessuna valutazione finora

- Q3 2022 - Sequoia Fund LetterDocumento2 pagineQ3 2022 - Sequoia Fund LetterjshethNessuna valutazione finora

- Procter and GambleDocumento29 pagineProcter and Gamblepanchitoperez2014Nessuna valutazione finora

- Share Capital + Reserves Total +Documento2 pagineShare Capital + Reserves Total +Pitresh KaushikNessuna valutazione finora

- F2 một số dạng BTDocumento15 pagineF2 một số dạng BTdohanh0512Nessuna valutazione finora

- Modules 1.1-1.5 PDFDocumento187 pagineModules 1.1-1.5 PDFElijah MendozaNessuna valutazione finora

- HFOF Letter To Ivy ClientsDocumento1 paginaHFOF Letter To Ivy ClientsAbsolute ReturnNessuna valutazione finora

- Elliot Wave Cheat SheetsDocumento12 pagineElliot Wave Cheat SheetsmidoNessuna valutazione finora

- Top Investment Banking Interview Questions (And Answers)Documento31 pagineTop Investment Banking Interview Questions (And Answers)Rohan SaxenaNessuna valutazione finora

- Free Cash FlowsDocumento2 pagineFree Cash FlowsMuhammad Awais SabirNessuna valutazione finora

- Ec 1723 Problem Set 3Documento5 pagineEc 1723 Problem Set 3tarun singhNessuna valutazione finora

- David Einhorn Grant's ConferenceDocumento89 pagineDavid Einhorn Grant's ConferenceCanadianValueNessuna valutazione finora

- Tugas 2 Eksi 4204 - Dini Nur Lathifah - 030995277Documento4 pagineTugas 2 Eksi 4204 - Dini Nur Lathifah - 030995277Doni Jogja0% (1)

- Synopsis - Stock Market Book - FDocumento1 paginaSynopsis - Stock Market Book - Fkhantil ShahNessuna valutazione finora