Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Unitech - Indiabulls

Caricato da

sh_niravTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Unitech - Indiabulls

Caricato da

sh_niravCopyright:

Formati disponibili

UNITECH LIMITED RESEARCH

EQUITY RESEARCH December 03, 2008

RESULTS REVIEW

Share Data Market Cap Price BSE Sensex Reuters Bloomberg Avg. Volume (52 Week) 52-Week High/Low Shares Outstanding Valuation Ratios (Consolidated) Year to 31 March EPS (Rs.) +/- (%) PER (x) EV/ Sales (x) EV/ EBITDA (x) 2009e 5.8 (43.0%) 4.5x 3.7x 6.8x 2010e 5.0 (14.5%) 5.3x 3.8x 8.3x Rs. 42.5 bn Rs. 26.20 8,747.43 UNTE.BO UT IN 3.3 mn Rs. 546.80 / 21.65 1,623.4 mn

Unitech Limited

Strong asset base offsets short-term liquidity concerns

Buy

Unitech reported a moderate financial performance in Q209 due to the liquidity crisis and a slowdown in the real estate sector. The EBIDTA margin improved considerably because of a drop in the construction cost. We upgrade our rating from Hold to Buy due to the following reasons: Huge land bank spread across the country: Unitech has 13,923 acres of land spread across all major cities of the country. Nearly 70% of the land has been purchased from the government with clear titles. Approximately 70% of the land bank spreads across the four cities of Kolkata (35%), NCR (14%), Chennai (12%), and Vizag (9%). Operating margins likely to fall but remain at higher levels: The operating margin is likely to decline from the current 59.9% due to the expected fall in property prices and a shift in focus towards low-margined middle income housing. However, lower steel and cement prices are expected to partially offset the decline in the margins. Short-term liquidity likely to improve: Unitech is struggling with short-

Shareholding Pattern (%) Promoters FIIs Public & Others 75 5 20

term liquidity concerns due to its high leverage and debt obligation of Rs. 27 bn due by the end of FY09. We believe that it can tide over the current situation through the sale and monetization of its assets. Attractive valuation: Unitechs stock currently trades at a 43.4% discount to our fair value estimate of Rs. 46, which incorporates the substantial decline in real estate prices across all segments. We believe that the stock has a long-term upside potential as the Company has a huge land bank at diversified locations, a strong asset base, and the

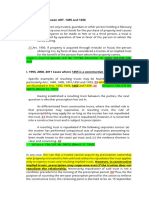

Relative Performance

600 500 400 300 200 100 0

May-08

Aug-08

Apr-08

Sep-08

Nov-08

Dec-07

Dec-08

Jan-08

Feb-08

Mar-08

Jun-08

Oct-08

Jul-08

expertise and execution skills. Key Figures (Consolidated)

Quarterly Data Q2'08 Q1'09 Q2'09 YoY% QoQ%

(Figures in Rs. mn, except per share data)

UT

Rebased BSE Index

Net Sales EBITDA Net Profit Margins(%) EBITDA NPM

10,135 5,071 4,101

10,317 6,084 4,233

9,831 6,092 3,589

(3.0%) 20.2% (12.5%)

(4.7%) 0.1% (15.2%)

50.0% 40.5%

59.0% 41.0%

62.0% 36.5% (12.6%) (15.2%) -1-

Per Share Data (Rs.) EPS 2.5 2.6 2.2 Please see the end of the report for disclaimer and disclosures.

UNITECH LIMITED RESEARCH

EQUITY RESEARCH Result Highlights Unitechs consolidated revenue declined 3% yoy, from Rs. 10.1 bn in Q208 to Rs. 9.8 bn in Q209, due to the slowdown in the construction and real estate sales. Construction revenue declined 64% yoy, from Rs. 517.9 mn in Q208 to Rs. 186.7 mn in Q209. However, revenue increased 6.9% yoy in H109. We expect revenue to fall at a CAGR of 15.4% between 2008 and 2010, due to the liquidity crisis and the slowdown in demand. In spite of the decline in revenue, the EBIDTA margin increased considerably to 62% in Q209, from 50% in Q208, due to a drop in cement and steel prices, resulting in a significant 28.3% drop in the real estate construction cost. The margin for H109 increased 6.5 pts on a yoy basis, from 53.4% in H108 to 59.9% in H109. We believe that the margin will come under pressure due to the expected fall in property prices. Unitechs second quarter net profit declined 12.5% yoy to Rs. 3.6 bn (Rs. 2.2 per share) in Q209, from Rs. 4.1 bn (Rs. 2.5 per share) in Q208. Net profit margin declined by 396 bps from 40.5% in Q208 to 36.5% in Q209. This was mainly driven by a 69.8% yoy rise in interest expenses, from Rs.0.79 bn in Q208 to Rs.1.3 bn in Q209. We believe that the net profit margin will drop further because of the high interest cost and the shift towards low-margined middle income housing. December 03, 2008

Key Risks Failure to secure private equity deals in projects may result in a lack of funding and could lead to delays in execution. This may also exert pressure on funding costs, thereby negatively affecting the net margins. Delays in project completion and a slowdown in residential demand due to high interest rates would hurt the Companys growth prospects.

Please see the end of the report for disclaimer and disclosures.

-2-

UNITECH LIMITED RESEARCH

EQUITY RESEARCH December 03, 2008

Quarterly Data

Q2'08

Q1'09

Q2'09

YoY%

QoQ%

TTM Ended TTM Ended Q2'08 Q2'09

YoY%

(Figures in Rs. mn, except per share data) Revenue

Real Estate Construction Consulting Hospitality Electrical Others Total

8,303 518 772 26 140 377 10,135 6,049 42 251 2 8 24 6,376

9,140 316 251 31 206 373 10,317 6,049 42 251 2 8 24 6,376

8,077 187 990 32 208 336 9,831 5,257 37 984 0 (22) 7 6,264

(2.7%) (11.6%) (64.0%) (40.9%) 28.3% 294.3% 26.7% 4.9% 49.1% 1.3% (10.9%) (9.9%)

39,242 2,338 1,131 103 720 792 44,326 27,249 116 733 10 45 96 28,250 69.4% 5.0% 64.8% 10.0% 6.2% 12.2%

37,331 1,739 1,883 132 790 1,294 43,169

(4.9%) (25.6%) 66.5% 28.3% 9.7% 63.3%

EBIT

Real Estate Construction Consulting Hospitality Electrical Others Total

(13.1%) (10.6%) 292.1% (89.5%) NM (72.4%)

(13.1%) (10.6%) 292.1% (89.5%) NM (72.4%)

24,769 (9.1%) 156 34.9% 1,789 144.1% (4) (135.0%) 30 (33.9%) 139 44.4% 26,880 66.3% 9.0% 95.0% (2.7%) 3.7% 10.8%

EBIT margins 72.9% 66.2% 65.1% Real Estate 8.0% 13.1% 19.9% Construction 32.5% 99.9% 99.4% Consulting 7.5% 6.2% 0.6% Hospitality 5.6% 3.8% (10.4%) Electrical 6.4% 6.5% 2.0% Others Source: Company data, Indiabulls Research Note: Figures are presented on a consolidated basis TTM - Trailing twelve months

Outlook The real estate market is facing a deep-rooted slowdown due to the combination of the liquidity crisis and the high interest rates. Residential Real estate prices are expected to fall in the near term due to the liquidity crisis and high interest rates prices have declined up to 25% from their peaks in the last few months, while commercial and retail rentals have declined nearly 20% in some major metropolitan areas. Besides, banks have tightened the credit and reduced the loan-to-value amount for home loans. Therefore, we expect the real estate market to respond with reduced demand and a significant price downswing over the next 1224 months.

Unitechs second quarter financial performance was adversely affected due to the liquidty crisis and the slump in real estate demand. The Company is highly leveraged with a debt-equity ratio of 2.4x and a trailing 6-month interest coverage ratio of 5.0. Its debt stood at Rs. 85.5 bn as of Please see the end of the report for disclaimer and disclosures. -3-

UNITECH LIMITED RESEARCH

EQUITY RESEARCH December 03, 2008 March 31, 2008. The Company has a debt obligation of Rs. 27 bn, due by March 2009. The recent deal with Telenor, a Norwegian-based telecom The Company has a debt obligation of Rs. 27 bn, due by March 2009 company, to divest a 60% stake in its telecom venture for Rs 61 bn will act as a small breather, allowing the Company to partially reduce its debt burden on its balace sheet. We believe that in the prevailing low liquidity environment, the Company may not be able to mobilise funds from commercial banks as the latter have stopped lending to realty firms due to the high-risk weightage of the sector. Therefore, the Company is actively looking to raise debt through private equity in the current financial year to Unitech is highly dependant on private equity for external financing fund the ongoing development projects. Further, it is also planning to reduce its debt burden through the the sale of office space, land, and a hotel in the next 34 months. We expect that the aggressive capital structure may force it to monetize some of its projects before they become economically optimal, thereby sacrificing some returns.

We believe that the Companys operating margin will fall from the present 59.9% due to its strategic shift of focus towards the low-margined middle income housing (affordable homes) and the expected fall in property prices. In addition, housing projects in locations such as Vizag will further EBIDTA margin is likely to fall due to the strategic shift in focus towards low-margined middle income housing and the expected fall in property prices pressurise the margin. However, construction costs are falling due to the decline in cement and steel prices. We expect these costs to come down further as commodity prices are decreasing because of the expected global recession. Hence, the fall in property prices is likely to offset the gains expected from the lower raw material costs. As a result, the operating margin is expected to fall from the current levels.

We have arrived at the NAV per share of Rs. 62, which incorporates the substantial decline in real estate prices and a 15% dilution of Unitechs stake at the project level. We have used a 17.2% cost of equity to value the Company and have arrived at a WACC of 15.4%.

Unitech is one the large listed companies that does not disclose its quarterly balance sheet and cash flow statement to the investors. As a result, we have limited visibility of the Companys earnings growth and current liquidity situation. Considering the weak demand scenario and the Please see the end of the report for disclaimer and disclosures. -4-

UNITECH LIMITED RESEARCH

EQUITY RESEARCH December 03, 2008 limited financial information available, we believe the stock will trade at a discount to its NAV, which we have assumed at 25%. Our fair value estimate for the Company is therefore Rs. 46 per share, which represents a 76.6% upside to the current share price. Hence, we upgrade our rating on the stock from Hold to Buy.

Key Figures (Consolidated) Year to March FY05 FY06 (Figures in Rs mn, except per share data) Net Sales EBITDA Net Profit Margins(%) EBITDA NPM Per Share Data (Rs.) EPS PER (x) 12.1% 5.2% 19.5% 10.0% 61.2% 38.5% 57.2% 40.1% 54.0% 30.7% 46.5% 27.3% 6,452 779 335 9,266 1,806 925 FY07 FY08 FY09E FY10E CAGR (%) (FY08-10E) 29,635 13,780 8,101 (15.4%) (23.7%) (30.2%)

32,883 20,109 12,667

41,404 23,687 16,619

30,909 16,691 9,475

0.2 14.2x

0.6 40.7x

7.8 62.6x

10.2 2.6x

5.8 4.5x

5.0 5.3x

(30.2%)

Please see the end of the report for disclaimer and disclosures.

-5-

UNITECH LIMITED RESEARCH

EQUITY RESEARCH December 03, 2008

Disclaimer

This report is not for public distribution and is only for private circulation and use. The Report should not be reproduced or redistributed to any other person or person(s) in any form. No action is solicited on the basis of the contents of this report. This material is for the general information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be considered as an offer to sell or the solicitation of an offer to buy any stock or derivative in any jurisdiction where such an offer or solicitation would be illegal. It is for the general information of clients of Indiabulls Securities Limited. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. You are advised to independently evaluate the investments and strategies discussed herein and also seek the advice of your financial adviser. Past performance is not a guide for future performance. The value of, and income from investments may vary because of changes in the macro and micro economic conditions. Past performance is not necessarily a guide to future performance. This report is based upon information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon as such. Any opinions expressed here in reflect judgments at this date and are subject to change without notice. Indiabulls Securities Limited (ISL) and any/all of its group companies or directors or employees reserves its right to suspend the publication of this Report and are not under any obligation to tell you when opinions or information in this report change. In addition, ISL has no obligation to continue to publish reports on all the stocks currently under its coverage or to notify you in the event it terminates its coverage. Neither Indiabulls Securities Limited nor any of its affiliates, associates, directors or employees shall in any way be responsible for any loss or damage that may arise to any person from any error in the information contained in this report. The analyst for this report certifies that all of the views expressed in this report accurately reflect his or her personal views about the subject stock and no part of his or her compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this report. No part of this material may be duplicated in any form and/or redistributed without Indiabulls Securities Limited prior written consent. The information given herein should be treated as only factor, while making investment decision. The report does not provide individually tailor-made investment advice. Indiabulls Securities Limited recommends that investors independently evaluate particular investments and strategies, and encourages investors to seek the advice of a financial adviser. Indiabulls Securities Limited shall not be responsible for any transaction conducted based on the information given in this report, which is in violation of rules and regulations of National Stock Exchange or Bombay Stock Exchange.

Indiabulls (H.O.), Plot No- 448-451, Udyog Vihar, Phase - V, Gurgaon - 122 001, Haryana. Ph: (0124) 3989555, 3989666

-6-

Potrebbero piacerti anche

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- FICCI EY Report Healthcare ReportDocumento72 pagineFICCI EY Report Healthcare Reportsh_niravNessuna valutazione finora

- Ten Baggers - AmbitDocumento18 pagineTen Baggers - Ambitsh_niravNessuna valutazione finora

- Accounting Thematic - AmbitDocumento24 pagineAccounting Thematic - Ambitsh_niravNessuna valutazione finora

- CARE Outstanding Rating Oct 2013Documento250 pagineCARE Outstanding Rating Oct 2013sh_niravNessuna valutazione finora

- Tax Implics of Mergers Acquisitions PDFDocumento35 pagineTax Implics of Mergers Acquisitions PDFsh_niravNessuna valutazione finora

- A New World Order - 01 - 12 - 09 - 14 - 52Documento130 pagineA New World Order - 01 - 12 - 09 - 14 - 52sh_niravNessuna valutazione finora

- ENAM - India 2020 Stars PDFDocumento45 pagineENAM - India 2020 Stars PDFsh_niravNessuna valutazione finora

- Capital Goods MarketDocumento121 pagineCapital Goods MarketPartho GangulyNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Ratio AnalysisDocumento36 pagineRatio AnalysisHARVENDRA9022 SINGHNessuna valutazione finora

- BailmentDocumento3 pagineBailmentanoos04Nessuna valutazione finora

- Konde Zimula V Byarugaba Anor (HCCS 66 of 2007) 2014 UGHCLD 68 (10 November 20Documento14 pagineKonde Zimula V Byarugaba Anor (HCCS 66 of 2007) 2014 UGHCLD 68 (10 November 20murungimarvin98Nessuna valutazione finora

- IT Security Threats Vulnerabilities and CountermeasuresDocumento35 pagineIT Security Threats Vulnerabilities and Countermeasureschristian may noqueraNessuna valutazione finora

- The Legislat Ive Departm ENT: Atty. Ryan Legisniana Estevez, MPPDocumento19 pagineThe Legislat Ive Departm ENT: Atty. Ryan Legisniana Estevez, MPPAj Labrague SalvadorNessuna valutazione finora

- Installation of Baikal On Synology DSM5Documento33 pagineInstallation of Baikal On Synology DSM5cronetNessuna valutazione finora

- A Coming Out Guide For Trans Young PeopleDocumento44 pagineA Coming Out Guide For Trans Young PeopleDamilare Og0% (1)

- Art 1455 and 1456 JurisprudenceDocumento7 pagineArt 1455 and 1456 JurisprudenceMiguel OsidaNessuna valutazione finora

- Credit, Background, Financial Check Disclaimer2Documento2 pagineCredit, Background, Financial Check Disclaimer2ldigerieNessuna valutazione finora

- Entrant Status Check Web SiteDocumento1 paginaEntrant Status Check Web SitetoukoalexandraNessuna valutazione finora

- Board of Commissioners V Dela RosaDocumento4 pagineBoard of Commissioners V Dela RosaAnonymous AUdGvY100% (2)

- Jawaban Kieso Intermediate Accounting p19-4Documento3 pagineJawaban Kieso Intermediate Accounting p19-4nadiaulyNessuna valutazione finora

- Cases-CompDocumento169 pagineCases-CompDavid John MoralesNessuna valutazione finora

- Vocabulary Quiz 5 Group ADocumento1 paginaVocabulary Quiz 5 Group Aanna barchukNessuna valutazione finora

- 2013 Interview SheetDocumento3 pagine2013 Interview SheetIsabel Luchie GuimaryNessuna valutazione finora

- RA 8042 As Amended by RA 10022Documento28 pagineRA 8042 As Amended by RA 10022Benjamin Hernandez Jr.50% (8)

- Eacsb PDFDocumento297 pagineEacsb PDFTai ThomasNessuna valutazione finora

- Improving The Citizen Experience: How The Anti-Red Tape Act Is Shaping Public Service Delivery in The PhilippinesDocumento12 pagineImproving The Citizen Experience: How The Anti-Red Tape Act Is Shaping Public Service Delivery in The PhilippinesMary Jane Araza CastilloNessuna valutazione finora

- Legal and Constitutional Rights of Women in IndiaDocumento8 pagineLegal and Constitutional Rights of Women in Indiamohitegaurv87100% (1)

- ASME Steam Table PDFDocumento32 pagineASME Steam Table PDFIsabel Pachucho100% (2)

- Accounting-Dr - Ahmed FarghallyDocumento113 pagineAccounting-Dr - Ahmed FarghallySofi KhanNessuna valutazione finora

- Intel Core I37100 Processor 3M Cache 3.90 GHZ Product SpecificationsDocumento5 pagineIntel Core I37100 Processor 3M Cache 3.90 GHZ Product SpecificationshexemapNessuna valutazione finora

- Oman Foreign Capital Investment LawDocumento8 pagineOman Foreign Capital Investment LawShishir Kumar SinghNessuna valutazione finora

- Pra05 TMP-301966624 PR002Documento3 paginePra05 TMP-301966624 PR002Pilusa AguirreNessuna valutazione finora

- Rajamahendravaram Municipal CorporationDocumento3 pagineRajamahendravaram Municipal CorporationVIJAY KUMARNessuna valutazione finora

- 20 Rules of Closing A Deal PDFDocumento21 pagine20 Rules of Closing A Deal PDFbioarquitectura100% (9)

- POCSODocumento12 paginePOCSOPragya RaniNessuna valutazione finora

- Water Quality Categorization Using WQI in Rural Areas of Haridwar, IndiaDocumento16 pagineWater Quality Categorization Using WQI in Rural Areas of Haridwar, IndiaESSENCE - International Journal for Environmental Rehabilitation and ConservaionNessuna valutazione finora

- 101, Shubham Residency, Padmanagar PH ., Hyderabad GSTIN:36AAFCV7646D1Z5 GSTIN/UIN: 36AAFCV7646D1Z5 State Name:, Code: Contact: 9502691234,9930135041Documento8 pagine101, Shubham Residency, Padmanagar PH ., Hyderabad GSTIN:36AAFCV7646D1Z5 GSTIN/UIN: 36AAFCV7646D1Z5 State Name:, Code: Contact: 9502691234,9930135041mrcopy xeroxNessuna valutazione finora

- PNR V BruntyDocumento21 paginePNR V BruntyyousirneighmNessuna valutazione finora