Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

LTCC Exercises

Caricato da

porbedaDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

LTCC Exercises

Caricato da

porbedaCopyright:

Formati disponibili

PROBLEM A. On June 1, 2013, Nelly Builders obtained a contract to build a bridge.

The bridge was to be built at a total cost of P12,500,000 and is scheduled for completion by May 31, 2015. The contract contains a penalty clause to the effect that the client will deduct P25,000 from the P15,000,000 contract price for each week of delay. Completion was delayed by five weeks. Pertinent information are as follows: Costs incurred to date Estimated costs to complete Cash collections 2013 P1,250,000 5,000,000 1,000,000 2014 P5,850,000 650,000 10,875,000 2015 P6,625,000 7,437,500

1. How much is the realized gross profit (loss) for the year 2015? 2. What is the ending balance of the construction in progress account at the end of 2014? 3. How much is the construction revenue for the year 2014 and 2015? PROBLEM B. On January 31, 2013, North Construction won a bidding to build an athletic stadium. The project was to be built at a total cost of P5,500,000 and was scheduled for completion by September 30, 2015. One of the stipulations was that the client will deduct P15,000 from the P6,600,000 contract price for each week that the completion was delayed. Completion was delayed six weeks. Data related to the project were as follows: Costs incurred each year Estimated costs to complete Contract billings each year Cash collections each year Operating expenses 2013 P1,782,000 3,618,000 1,200,000 1,000,000 100,000 2014 P2,068,000 1,650,000 1,900,000 1,800,000 90,000 2015 P1,650,000 ? 3,710,000 70,000

A. Using the percentage of completion method: 1. How much is the net income for the year 2013? 2. What is the balance of construction in progress net of progress billings at December 31, 2013? 3. How much is the construction revenue for the year 2013? 4. How much is the net income for the year 2014? 5. What is the balance of construction in progress net of progress billings at December 31, 2014? 6. How much is the construction revenue for the year 2014? 7. How much is the net income for the year 2015? 8. How much is the construction revenue for the year 2015? B. Using the zero profit method: 1. How much is the net income for the year 2013? 2. What is the balance of construction in progress net of progress billings at December 31, 2013? 3. How much is the construction revenue for the year 2013? 4. How much is the net income for the year 2014?

5. What is the balance of construction in progress net of progress billings at December 31, 2014? 6. How much is the construction revenue for the year 2014? 7. How much is the net income for the year 2015? 8. How much is the construction revenue for the year 2015? PROBLEM C. On January 2, 2013, Star Construction Company enters into a contract to construct a 15-storey building for P40,000,000. During the construction period many change orders are made to the original contract. Both the customer and the contractor accepted all of the changes. The following schedule summarizes the change orders in 2013: Cost incurred in 2013 P8,000,000 50,000 300,000 125,000 Estimated costs to complete P28,000,000 50,000 50,000 300,000 Contract price P40,000,000 125,000 600,000 100,000

Basic contract Change order #1 Change order #2 Change order #3 Change order #4

1. How much is the gross profit to be recognized for the year 2013 under the percentage of completion method? PROBLEM D. A construction company has landed a contract for the construction of an office building. At the beginning of 2013, one project is in progress. The following data describes the status of the building at the beginning of the year: Contract price Cost incurred to 1/1/13 (including P50,000 worth of materials stored at the site to be used in 2014 to complete the project) Estimated costs to complete, 1/1/13 P6,300,000 1,425,000 4,075,000

During 2013, the following data were obtained with respect to the same building: Cost incurred to date Cost to complete, 12/31/13 P3,040,000 1,960,000

1. What is the realized gross profit (loss) to be reported for the year 2013 using the percentage of completion?

Potrebbero piacerti anche

- Ho P2 06Documento2 pagineHo P2 06Kriza Sevilla Matro50% (2)

- Practical Accounting 2 ReviewDocumento42 paginePractical Accounting 2 ReviewJason BautistaNessuna valutazione finora

- ADVACC1 Construction Contracts August 29 2015Documento5 pagineADVACC1 Construction Contracts August 29 2015Lester John Mendi0% (1)

- Construction ContractsDocumento2 pagineConstruction ContractsLordson Ramos50% (2)

- Const PDF FreeDocumento15 pagineConst PDF FreeMichael Brian TorresNessuna valutazione finora

- Construction IllustrationDocumento54 pagineConstruction IllustrationCatherine Joy Vasaya100% (3)

- Construction Accounting and FranchiseDocumento3 pagineConstruction Accounting and FranchiseAdam SmithNessuna valutazione finora

- LTCC - ExamDocumento5 pagineLTCC - ExamLouise Anciano100% (1)

- LTCC Exam PDF FreeDocumento5 pagineLTCC Exam PDF FreeMichael Brian TorresNessuna valutazione finora

- ConstDocumento15 pagineConstJemson YandugNessuna valutazione finora

- Long Term Construction Quiz PDF FreeDocumento4 pagineLong Term Construction Quiz PDF FreeMichael Brian TorresNessuna valutazione finora

- Long-Term Construction QuizDocumento4 pagineLong-Term Construction QuizCattleyaNessuna valutazione finora

- Long Term ConstructionDocumento6 pagineLong Term ConstructionJohnAllenMarilla78% (9)

- Ho P2 06 PDFDocumento2 pagineHo P2 06 PDFcerapyaNessuna valutazione finora

- Quiz Long Term ContractsDocumento7 pagineQuiz Long Term ContractsDeanna GicaleNessuna valutazione finora

- LTCCDocumento2 pagineLTCCZerjo CantalejoNessuna valutazione finora

- Construction ContractsDocumento3 pagineConstruction Contractskat kaleNessuna valutazione finora

- PRACTICAL ACCOUNTING II P2.1406-Long TermDocumento4 paginePRACTICAL ACCOUNTING II P2.1406-Long TermKristine DominiqueNessuna valutazione finora

- Construction ContractsDocumento4 pagineConstruction ContractsAnjelica MarcoNessuna valutazione finora

- Seat Work 2 PDF FreeDocumento2 pagineSeat Work 2 PDF FreeMichael Brian TorresNessuna valutazione finora

- Revenue RecognitionDocumento6 pagineRevenue RecognitionnaserNessuna valutazione finora

- 08 Long Term Construction ContractsDocumento2 pagine08 Long Term Construction ContractsErineNessuna valutazione finora

- Construction ProblemsDocumento31 pagineConstruction ProblemsCatherine Joy VasayaNessuna valutazione finora

- Special Revenue Recognition Special Revenue RecognitionDocumento4 pagineSpecial Revenue Recognition Special Revenue RecognitionCee Gee BeeNessuna valutazione finora

- Long-Term Construction - Type ContractsDocumento14 pagineLong-Term Construction - Type ContractsMarco UyNessuna valutazione finora

- LongDocumento3 pagineLongKath ChuNessuna valutazione finora

- Long Term Construction ContractsDocumento4 pagineLong Term Construction ContractsAnalynNessuna valutazione finora

- LTCC Master TestbankDocumento8 pagineLTCC Master TestbankPrankyJelly0% (1)

- Long-Term Construction Contracts and FranchisingDocumento7 pagineLong-Term Construction Contracts and FranchisingEpal AkoNessuna valutazione finora

- Lecture Notes On Borrowing Costs - 000Documento3 pagineLecture Notes On Borrowing Costs - 000judel ArielNessuna valutazione finora

- Midterm Quiz 1 Construction Contracts and FranchisesDocumento12 pagineMidterm Quiz 1 Construction Contracts and Franchisesareum leeNessuna valutazione finora

- Final Exam in Advanced Financial Accounting IDocumento6 pagineFinal Exam in Advanced Financial Accounting IYander Marl BautistaNessuna valutazione finora

- ACC 305 Week 3 Quiz 02 Chapter 18Documento6 pagineACC 305 Week 3 Quiz 02 Chapter 18LereeNessuna valutazione finora

- LTCC Short QuizDocumento3 pagineLTCC Short QuizMecha Tresha MoninNessuna valutazione finora

- LongDocumento18 pagineLongGem Kristel ManayNessuna valutazione finora

- LTCC QuizDocumento3 pagineLTCC QuizJamhel MarquezNessuna valutazione finora

- AFAR-03 Revenue RecognitionDocumento3 pagineAFAR-03 Revenue RecognitionRamainne RonquilloNessuna valutazione finora

- Cost To CostDocumento1 paginaCost To CostAnirban Roy ChowdhuryNessuna valutazione finora

- Finals 3Documento8 pagineFinals 3Patricia Jane CabangNessuna valutazione finora

- Activity 6 - Long-Term Construction ContractsDocumento2 pagineActivity 6 - Long-Term Construction ContractsDe Chavez May Ann M.Nessuna valutazione finora

- Afar QuestionsDocumento16 pagineAfar Questionspopsie tulalianNessuna valutazione finora

- BA 118.1 Q23 LT ConstructionDocumento1 paginaBA 118.1 Q23 LT ConstructionDavid MonNessuna valutazione finora

- Multiple Choice: - ComputationalDocumento5 pagineMultiple Choice: - ComputationalCarlo ParasNessuna valutazione finora

- Construction ContractDocumento17 pagineConstruction ContractYvonne Gam-oyNessuna valutazione finora

- Long-Term Construction Contracts (Pfrs 15) : Start of DiscussionDocumento3 pagineLong-Term Construction Contracts (Pfrs 15) : Start of DiscussionErica DaprosaNessuna valutazione finora

- Activity 5 Long Term Construction ContractsDocumento4 pagineActivity 5 Long Term Construction ContractsSharon AnchetaNessuna valutazione finora

- Auditing Problems With AnswersDocumento12 pagineAuditing Problems With Answersaerwinde79% (34)

- QUIZ2Documento5 pagineQUIZ2LJ AggabaoNessuna valutazione finora

- Diagnostic Exam 1.23 AKDocumento13 pagineDiagnostic Exam 1.23 AKmarygraceomacNessuna valutazione finora

- Quiz No. 2Documento3 pagineQuiz No. 2abbyNessuna valutazione finora

- Managing Successful Projects with PRINCE2 2009 EditionDa EverandManaging Successful Projects with PRINCE2 2009 EditionValutazione: 4 su 5 stelle4/5 (3)

- Irregularities, Frauds and the Necessity of Technical Auditing in Construction IndustryDa EverandIrregularities, Frauds and the Necessity of Technical Auditing in Construction IndustryNessuna valutazione finora

- Handbook for Developing Joint Crediting Mechanism ProjectsDa EverandHandbook for Developing Joint Crediting Mechanism ProjectsNessuna valutazione finora

- Integrated Project Planning and Construction Based on ResultsDa EverandIntegrated Project Planning and Construction Based on ResultsNessuna valutazione finora

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionDa EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNessuna valutazione finora

- International Public Sector Accounting Standards Implementation Road Map for UzbekistanDa EverandInternational Public Sector Accounting Standards Implementation Road Map for UzbekistanNessuna valutazione finora

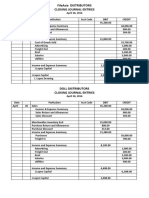

- Closing Entries ExercisesDocumento2 pagineClosing Entries ExercisesRodolfo CorpuzNessuna valutazione finora

- Ch13-Cash Flow STMDocumento44 pagineCh13-Cash Flow STMAnonymous zXWxWmgZENessuna valutazione finora

- Balance Sheet of Dabur India LTDDocumento15 pagineBalance Sheet of Dabur India LTDAshish JainNessuna valutazione finora

- Accounting For PartnershipsDocumento28 pagineAccounting For PartnershipsMila ComendadorNessuna valutazione finora

- Psak Vs Ifrs 2022Documento11 paginePsak Vs Ifrs 2022kiswonoNessuna valutazione finora

- Skripsi Tanpa Bab Pembahasan PDFDocumento80 pagineSkripsi Tanpa Bab Pembahasan PDFDesni Verita PurbaNessuna valutazione finora

- ACC2007 - Seminar 9 - Complex Group StructuresDocumento47 pagineACC2007 - Seminar 9 - Complex Group StructuresCeline LowNessuna valutazione finora

- 12 Acc 1 ModelDocumento11 pagine12 Acc 1 ModeljessNessuna valutazione finora

- Class Test 2b - AnswerDocumento5 pagineClass Test 2b - AnswerTrần Thanh XuânNessuna valutazione finora

- Llours 1) 2) A ' Q1) : Aat,' - Alo 071 AccountingDocumento2 pagineLlours 1) 2) A ' Q1) : Aat,' - Alo 071 AccountingAkshayNessuna valutazione finora

- Dampak Revolusi Industri 4.0 Era Covid-19 Pada Sistem Informasi Akuntansi Terhadap Struktur Modal PerusahaanDocumento16 pagineDampak Revolusi Industri 4.0 Era Covid-19 Pada Sistem Informasi Akuntansi Terhadap Struktur Modal PerusahaanRadhial KautsarNessuna valutazione finora

- Adjusted Trial Balance To StatementDocumento5 pagineAdjusted Trial Balance To StatementShesharam ChouhanNessuna valutazione finora

- College Accounting A Contemporary Approach 4th Edition Haddock ISBN Test BankDocumento16 pagineCollege Accounting A Contemporary Approach 4th Edition Haddock ISBN Test Bankeddie100% (21)

- Absorption and Variable CostingDocumento1 paginaAbsorption and Variable CostingAngelica PatagNessuna valutazione finora

- Acco 440 AP Solutions Lectures 1 To 5Documento41 pagineAcco 440 AP Solutions Lectures 1 To 5arhamohNessuna valutazione finora

- Glenmark - MacquarieDocumento11 pagineGlenmark - MacquarieSomendraNessuna valutazione finora

- NEE Stock Price Forecasts-3Documento16 pagineNEE Stock Price Forecasts-3arjuNessuna valutazione finora

- CHAPTER 19 BORROWING COSTS - For Distribution - PDF PDFDocumento13 pagineCHAPTER 19 BORROWING COSTS - For Distribution - PDF PDFemman neriNessuna valutazione finora

- DocumentDocumento8 pagineDocumentmohab abdelhamedNessuna valutazione finora

- Horngren Fin7 Inppt 13 Stockholders EquityDocumento78 pagineHorngren Fin7 Inppt 13 Stockholders Equityhassaanaslam2003Nessuna valutazione finora

- Accounting For Business CombinationDocumento22 pagineAccounting For Business CombinationaragonkaycyNessuna valutazione finora

- Acct 2 Problem 3Documento1 paginaAcct 2 Problem 3Alfie boy100% (1)

- Answer 4 - "Answers Only For Vaughn Company, Bennett Enterprise"Documento3 pagineAnswer 4 - "Answers Only For Vaughn Company, Bennett Enterprise"Rheu ReyesNessuna valutazione finora

- Ez 14Documento2 pagineEz 14yes yesnoNessuna valutazione finora

- IA3 Chapter 2Documento7 pagineIA3 Chapter 2Juliana ChengNessuna valutazione finora

- 1 Modigliani MillerDocumento3 pagine1 Modigliani MillerVincenzo CassoneNessuna valutazione finora

- The Alpine House, Inc., Is A Large Retailer of Snow Skis.Documento13 pagineThe Alpine House, Inc., Is A Large Retailer of Snow Skis.Cinema RecappedNessuna valutazione finora

- Sample Financial Aspect of FeasibilityDocumento12 pagineSample Financial Aspect of Feasibilitywarren071809100% (2)

- Preparing Financial Stat. Cemba 560Documento172 paginePreparing Financial Stat. Cemba 560nanapet80Nessuna valutazione finora

- Task 21Documento3 pagineTask 21Ton VossenNessuna valutazione finora