Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Resume of Basic Cost - Management Concept

Caricato da

ismailkunCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Resume of Basic Cost - Management Concept

Caricato da

ismailkunCopyright:

Formati disponibili

2014

COST MANAGEMENT POLITEKNIK NEGERI BATAM

[RESUME : BASIC COST MANAGEMENT CONCEPT]

Abi Hamdani - Ismail Wardhana Ikromi Abdul Ghani Muhammad Luthfi Yasin

Basic Cost-Management Concepts

Basic Definitions: A cost is incurred when a firm uses a resource for some purpose Costs are assembled into meaningful groups called cost pools (e.g., by type of cost or source) Any factor that has the effect of changing the level of total cost is called a cost driver A cost object is any product, service, customer, activity, or organizational unit to which costs are assigned for some management purpose There are four main ways to classify costs (different costs for different purposes): For product and service costing (GAAP) For strategic decision-making (cost-driver analysis) For planning and decision-making For control/feedback

The process of assigning costs to cost pools or from cost pools to cost objects Direct costs can be conveniently and economically traced to a cost pool or a cost object Indirect costs cannot be traced conveniently or economically to a cost pool or a cost object Because indirect costs cannot be traced, assignment is made through the use of cost drivers (cost allocation) These cost drivers are often called allocation bases Product and Service Costing Concepts (GAAP) Product costs include only the costs necessary to complete the product at the manufacturing step in the value chain (manufacturing) or to purchase and transport the product to the location of sale (merchandising) Period costs include all other costs incurred by the firm in managing or selling the product (indirect costs outside the manufacturing step of the value chain) Direct and Indirect Product Costs for a Manufacturer Direct material costs = cost of materials that can be readily traced to outputs = purchase price of materials + freight purchase discounts + reasonable allowance for scrap and defective units Indirect material costs = cost of materials that cannot readily be traced to outputs (e.g., rags, lubricants, and small tools) Direct labor costs = labor that can be readily traced to outputs = wages paid plus a reasonable allowance for nonproductive time Indirect labor costs = labor costs that cannot be readily traced to outputs (i.e., they are manufacturing support costs)

Direct and Indirect Product Costs: Further Comments All indirect costs for the manufacturer, including indirect materials, indirect labor, and other indirect items are often combined in a cost pool referred to as overhead (or, factory overhead, or indirect manufacturing costs) The three main types of costs, direct materials, direct labor, and overhead, are often condensed even further: Direct materials + Direct labor = Prime costs Direct labor + Overhead = Conversion costs Costs for Strategic Decision-Making Cost drivers provide two roles for the management accountant Assigning costs to cost objects Explaining cost behavior, i.e., how total cost changes as the cost driver changes There are four types of cost drivers: Activity-based Volume-based Structural Executional

What is meant by cost behavior? Common classifications of cost behavior: Fixed (capacity) cost is the portion of total cost that does not change with changes in output Variable cost is the change in total cost associated with each change in quantity of the cost driver Mixed cost is used to refer to a total cost figure that includes both a fixed and variable component Step costs vary with the cost driver but do so in steps Applications: Budgeting Cost-Volume-Profit analysis (profit planning) Short-Run Decision-Making Cost Concepts Relevance is the most important characteristic for information used in decision making Relevant costs have two properties: they differ for each decision option and they will be incurred in the future Opportunity cost is the benefit lost when choosing one option precludes receiving the benefits from the alternative option Sunk costs are costs that have been incurred or committed in the past and are therefore irrelevant in current decision making

Qualitative Characteristics of Cost Information for Planning and Decision-Making There are three other characteristics that are important for planning and decision making Accuracy (and the need to monitor internal accounting controls) Cost and value of cost information (the cost of information should be monitored by the management accountant to ensure that costs do not outweigh the associated benefits) Timeliness (often involves sacrificing in the other two areas) Cost Information for Control/Feedback Purposes Controllability is a basic consideration in evaluating managers and providing feedback A cost is considered controllable if the manager or employee has discretion in choosing to incur it or can influence the amount in a short period of time There are different ways to classify (or categorize) cost information, depending on the information needs of management (different costs for different purposes): To prepare financial statements (GAAP) For strategic decision-making For short-term planning For short-term decision-making For control/feedback purposes

Product and service costing (GAAP) focuses on differentiating product costs from period costs Costs flow through three inventory accounts in a manufacturing firm; merchandising firms have one inventory account

Potrebbero piacerti anche

- Summary Chapter 1Documento13 pagineSummary Chapter 1Danny FranklinNessuna valutazione finora

- Chapter 2-8 Managerial AccountingDocumento29 pagineChapter 2-8 Managerial AccountingEnrique Miguel Gonzalez ColladoNessuna valutazione finora

- Construction Vibrations and Their Impact On Vibration-Sensitive FacilitiesDocumento10 pagineConstruction Vibrations and Their Impact On Vibration-Sensitive FacilitiesKwan Hau LeeNessuna valutazione finora

- Management Accounting 2 SummaryDocumento47 pagineManagement Accounting 2 SummaryDanny FranklinNessuna valutazione finora

- Objectives:: Semester Cost and Management AccountingDocumento87 pagineObjectives:: Semester Cost and Management AccountingJon MemeNessuna valutazione finora

- Cost ConceptsDocumento24 pagineCost ConceptsAshish MathewNessuna valutazione finora

- Best Practice for BDoc Message AnalysisDocumento27 pagineBest Practice for BDoc Message AnalysisChandra SekharNessuna valutazione finora

- Cost AccountingDocumento55 pagineCost Accountinghimanshugupta6100% (2)

- Cost AccntgDocumento36 pagineCost AccntgRoselynne GatbontonNessuna valutazione finora

- 2nd Perdev TestDocumento7 pagine2nd Perdev TestBETHUEL P. ALQUIROZ100% (1)

- SQL Server DBA Daily ChecklistDocumento4 pagineSQL Server DBA Daily ChecklistLolaca DelocaNessuna valutazione finora

- Accellos - Guide - V60WebDispatch PDFDocumento112 pagineAccellos - Guide - V60WebDispatch PDFcaplusinc100% (1)

- Instructional Module Training PlanDocumento5 pagineInstructional Module Training Planapi-246767803100% (1)

- Data Capture Form Environmental ManagementDocumento1 paginaData Capture Form Environmental ManagementDonavel Nodora JojuicoNessuna valutazione finora

- Cost Concepts, Cost Analysis, and Cost EstimationDocumento2 pagineCost Concepts, Cost Analysis, and Cost EstimationGêmTürÏngånÖNessuna valutazione finora

- Qualitative Data AnalysisDocumento62 pagineQualitative Data AnalysisCes Aria100% (2)

- Manuel Quezon's First Inaugural AddressDocumento3 pagineManuel Quezon's First Inaugural AddressFrancis PasionNessuna valutazione finora

- cost management allDocumento26 paginecost management allranveer78krNessuna valutazione finora

- 2018 Mod Chap003 - BASIC CONCEPT COST - BLOCHERDocumento20 pagine2018 Mod Chap003 - BASIC CONCEPT COST - BLOCHERDhyon YunazarNessuna valutazione finora

- Manager and Management AccountingDocumento35 pagineManager and Management AccountingAurangzeb ChaudharyNessuna valutazione finora

- U03 Cost Management Terminology and ConceptsDocumento15 pagineU03 Cost Management Terminology and ConceptsHamada Mahmoud100% (1)

- Atp 106 LPM Accounting - Topic 6 - Costing and BudgetingDocumento17 pagineAtp 106 LPM Accounting - Topic 6 - Costing and BudgetingTwain JonesNessuna valutazione finora

- Assignment 1 BUSI 3008Documento21 pagineAssignment 1 BUSI 3008Irena MatuteNessuna valutazione finora

- Managers Accounting (Unit 1,2,3,4)Documento6 pagineManagers Accounting (Unit 1,2,3,4)Amit Vikram OjhaNessuna valutazione finora

- Summary Cost Accounting Horngren Et AllDocumento35 pagineSummary Cost Accounting Horngren Et AllFreya EvangelineNessuna valutazione finora

- 79 52 ET V1 S1 - Unit - 6 PDFDocumento19 pagine79 52 ET V1 S1 - Unit - 6 PDFTanmay JagetiaNessuna valutazione finora

- ManagementAccounting - ALL CHAPTERSDocumento27 pagineManagementAccounting - ALL CHAPTERSHAOYU LEENessuna valutazione finora

- Cost Accounting DefinationsDocumento7 pagineCost Accounting DefinationsJâmâl HassanNessuna valutazione finora

- Module 2 - Introduction To Cost ConceptsDocumento51 pagineModule 2 - Introduction To Cost Conceptskaizen4apexNessuna valutazione finora

- Lecturer: Diana Weekes-Marshall Bsc. (Hons), Fcca, FcaDocumento26 pagineLecturer: Diana Weekes-Marshall Bsc. (Hons), Fcca, FcaNella KingNessuna valutazione finora

- Cost Classification and Procedures ReportDocumento11 pagineCost Classification and Procedures Reportreyman rosalijosNessuna valutazione finora

- Cost ConceptDocumento6 pagineCost ConceptDeepti KumariNessuna valutazione finora

- Acct 522.3Documento27 pagineAcct 522.3zahra barakatNessuna valutazione finora

- Managerial Accounting Overview:: Group MembersDocumento52 pagineManagerial Accounting Overview:: Group MembersAdeel RanaNessuna valutazione finora

- Cost AccountingDocumento21 pagineCost Accountingridon mbayiNessuna valutazione finora

- Cost Classification and TerminologyDocumento13 pagineCost Classification and TerminologyHussen AbdulkadirNessuna valutazione finora

- Cost Concepts and Behavior ChapterDocumento3 pagineCost Concepts and Behavior ChapterPattraniteNessuna valutazione finora

- Cost Terminology and Classification ExplainedDocumento8 pagineCost Terminology and Classification ExplainedKanbiro Orkaido100% (1)

- AM TutorDocumento73 pagineAM TutorSebastian FernandoNessuna valutazione finora

- Principles of Cost AccountingDocumento20 paginePrinciples of Cost AccountingpraveenthamizharasuNessuna valutazione finora

- COST ACCOUNTING CONCEPTSDocumento9 pagineCOST ACCOUNTING CONCEPTSnavbaigNessuna valutazione finora

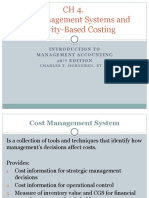

- CH 4. Cost Management Systems and Activity-Based Costing: Introduction To Management Accounting 1 6 EditionDocumento21 pagineCH 4. Cost Management Systems and Activity-Based Costing: Introduction To Management Accounting 1 6 EditionMEGA NURWANINessuna valutazione finora

- Managerial Accounting DefinitionsDocumento15 pagineManagerial Accounting Definitionskamal sahabNessuna valutazione finora

- Managerial Accounting - An OverviewDocumento29 pagineManagerial Accounting - An OverviewZoiba EkramNessuna valutazione finora

- Intro To Managerial and Cost Accounting. CostsDocumento19 pagineIntro To Managerial and Cost Accounting. Costsmehnaz kNessuna valutazione finora

- Note of Cost Accounting IncomDocumento5 pagineNote of Cost Accounting IncomAdam AbdullahiNessuna valutazione finora

- Cost Analysis Tools for Manufacturing FirmsDocumento41 pagineCost Analysis Tools for Manufacturing Firmsali imranNessuna valutazione finora

- Cost Accounting EssentialsDocumento28 pagineCost Accounting Essentialssaerah_8899Nessuna valutazione finora

- Chap 003Documento5 pagineChap 003abhinaypradhanNessuna valutazione finora

- Group 8 - Chap 2 an Introduction to Cost Terms and PurposeseDocumento39 pagineGroup 8 - Chap 2 an Introduction to Cost Terms and Purposeseqgminh7114Nessuna valutazione finora

- 02 Basic Cost Management Concept 1Documento49 pagine02 Basic Cost Management Concept 1DALUMPINES, John EverNessuna valutazione finora

- Kuliah 3 AkmenDocumento14 pagineKuliah 3 AkmentutiNessuna valutazione finora

- Class Presentation Cost Accounting-1Documento310 pagineClass Presentation Cost Accounting-1KANIKA GOSWAMINessuna valutazione finora

- Basics of Management Accounting ConceptsDocumento3 pagineBasics of Management Accounting Conceptsnur eka ayu danaNessuna valutazione finora

- Operations NotesDocumento25 pagineOperations NotesAnirban BanerjeeNessuna valutazione finora

- MA NotesDocumento47 pagineMA NotesPeiyi TayNessuna valutazione finora

- (2330) M Abdullah Amjad BCOM (B)Documento9 pagine(2330) M Abdullah Amjad BCOM (B)Amna Khan YousafzaiNessuna valutazione finora

- Akmen Bab 2 PDFDocumento3 pagineAkmen Bab 2 PDFHafizh GalihNessuna valutazione finora

- Elements of Cost: Management Accounting Costs Profitability GaapDocumento8 pagineElements of Cost: Management Accounting Costs Profitability GaapstefdrocksNessuna valutazione finora

- Chapter2-Colin DruryDocumento3 pagineChapter2-Colin DruryMarioNessuna valutazione finora

- Management Accounting GlossaryDocumento10 pagineManagement Accounting GlossaryPooja GuptaNessuna valutazione finora

- Cost and Management Acc.Documento50 pagineCost and Management Acc.azeb asmareNessuna valutazione finora

- Chapter 5 An Introduction To Cost Terms and PurposesDocumento4 pagineChapter 5 An Introduction To Cost Terms and PurposesGosaye DesalegnNessuna valutazione finora

- CA BUSINESS SCHOOLEXECUTIVE DIPLOMA IN BUSINESS AND ACCOUNTINGSEMESTER 3: Cost Control in BusinessDocumento22 pagineCA BUSINESS SCHOOLEXECUTIVE DIPLOMA IN BUSINESS AND ACCOUNTINGSEMESTER 3: Cost Control in BusinessMohamaad SihatthNessuna valutazione finora

- MGT Acctg Cost ConceptDocumento30 pagineMGT Acctg Cost ConceptApril Pearl VenezuelaNessuna valutazione finora

- ACG2071 - Chapter 1Documento4 pagineACG2071 - Chapter 1Fabian NonesNessuna valutazione finora

- Cost AccountingDocumento28 pagineCost AccountingVirendra JhaNessuna valutazione finora

- Cost AccountingDocumento25 pagineCost AccountingkapilmmsaNessuna valutazione finora

- PI IK525、IK545Documento32 paginePI IK525、IK545beh XulNessuna valutazione finora

- Equipment BrochureDocumento60 pagineEquipment BrochureAmar BeheraNessuna valutazione finora

- SK08A Addressable Loop-Powered Siren Installation Sheet (Multilingual) R2.0Documento12 pagineSK08A Addressable Loop-Powered Siren Installation Sheet (Multilingual) R2.0123vb123Nessuna valutazione finora

- Developing and Validating a Food Chain Lesson PlanDocumento11 pagineDeveloping and Validating a Food Chain Lesson PlanCassandra Nichie AgustinNessuna valutazione finora

- AbDocumento13 pagineAbSk.Abdul NaveedNessuna valutazione finora

- The STP Guide To Graduate Student Training in The Teaching of PsychologyDocumento101 pagineThe STP Guide To Graduate Student Training in The Teaching of PsychologyNeilermindNessuna valutazione finora

- Dry Docking Ships Training Course for DockmastersDocumento7 pagineDry Docking Ships Training Course for DockmastersSunil Kumar P GNessuna valutazione finora

- Textual Equivalence-CohesionDocumento39 pagineTextual Equivalence-CohesionTaufikNessuna valutazione finora

- NPTEL Managerial Economics Video CourseDocumento3 pagineNPTEL Managerial Economics Video CourseAmanda AdamsNessuna valutazione finora

- Project SELF Work Plan and BudgetDocumento3 pagineProject SELF Work Plan and BudgetCharede BantilanNessuna valutazione finora

- Training Program On: Personality Development Program and Workplace SkillsDocumento3 pagineTraining Program On: Personality Development Program and Workplace SkillsVikram SinghNessuna valutazione finora

- Propagating Trees and Fruit Trees: Sonny V. Matias TLE - EA - TeacherDocumento20 paginePropagating Trees and Fruit Trees: Sonny V. Matias TLE - EA - TeacherSonny MatiasNessuna valutazione finora

- Controversial Aquatic HarvestingDocumento4 pagineControversial Aquatic HarvestingValentina RuidiasNessuna valutazione finora

- Thinking Maps in Writing Project in English For Taiwanese Elementary School StudentsDocumento22 pagineThinking Maps in Writing Project in English For Taiwanese Elementary School StudentsThilagam MohanNessuna valutazione finora

- List of indexed conferences from Sumatera UniversityDocumento7 pagineList of indexed conferences from Sumatera UniversityRizky FernandaNessuna valutazione finora

- Variable frequency drives for electric submersible pumpsDocumento34 pagineVariable frequency drives for electric submersible pumpshermit44535Nessuna valutazione finora

- HA200Documento4 pagineHA200Adam OngNessuna valutazione finora

- Personal Philosophy of Education-Exemplar 1Documento2 paginePersonal Philosophy of Education-Exemplar 1api-247024656Nessuna valutazione finora

- Write Hello in The PDFDocumento95 pagineWrite Hello in The PDFraghupulishettiNessuna valutazione finora

- Ascension 2010 04Documento12 pagineAscension 2010 04José SmitNessuna valutazione finora

- AufEx4 02 02Documento28 pagineAufEx4 02 02BSED SCIENCE 1ANessuna valutazione finora