Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

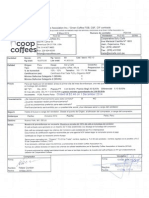

Study Guide Accrual Income Statements ABM 141 Unit 2 PDF

Caricato da

mehul_218Descrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Study Guide Accrual Income Statements ABM 141 Unit 2 PDF

Caricato da

mehul_218Copyright:

Formati disponibili

Study Guide- Cash and Accrual Formulas Pertaining to Income Statements An income statement summarizes the income and

expenses during a specific period of time and shows the profit or loss from the period. An income statement provides insight into management efficiency and for this reason is a key financial statement for managers. The cash approach implies that income and expenses will be reported when the cash is received or paid. Many businesses report net income on using the cash basis. An accrual approach says income and expenses are reported when they are earned or incurred regardless of when the cash transaction takes place. If a cash-based income statement is used, the net income can be either understated or overstated depending on the business transactions. Cash based income statements understate the net profit if the following occurs: Revenue is generated but not converted to cash. An increase in accounts receivable is an example. Expenses paid during the period were incurred during prior or later years. Examples would be a decrease in accounts payable or an increase in prepaid expenses. Cash based income statements overstate the net income for a period if: Revenue from prior years is converted to cash. Expenses are incurred this year but are not paid in cash until a later year An accrual income statement is the most accurate approach in reporting net income. Cash record systems are used to generate accrual income statements by adjusting cash revenue for changes in inventory and adjusting cash expense accounts for changes in accrued expenses. The adjustments reflect the amount changes in these accounts from the beginning and ending balance sheets for the year. Two financial statements that can be generated from any accounting package are the balance sheet and the income statement (profit and loss statement). A balance sheet is the snapshot of a business at a given point in time and shows what the business owns and owes, assets and liabilities. The income statement shows the revenue earned and expenses used to generate that revenue. Most accounting software can generate reports on a cash and accrual basis. Accrual reports provide the most accurate financial picture of the business and should be used in the analysis process. Heres list of the uses of an income statement: Summarizes revenues and expenses Determine profit and loss Explains changes in owners equity Calculates financial measures such as profitability, financial and operational efficiency Support loan applications and refinancing

ABM 141 Unit 2 Study Guide Accrual Income Statements

Study Guide: Cash and Accrual Formulas continued Formulas for determining a cash and accrual income statement are: (cash accounting) Cash revenue - cash expenses = net cash income - depreciation = net inc. from operations +/-gain/loss from sales of assets = net cash income (accrual accounting) cash revenue + changes in inventory = Gross business revenue - cash expenses - depreciation + or non-cash expenses adjustments = net inc. from business operations +/-gain/loss from sale of assets = Accrual net business income

As you see in the formulas, an accrual income statement makes adjustments to the cash revenues and cash expenses. Documents needed in the developed of accrual income statements are a cash profit and loss and beginning and ending balance sheets for the given period. The cash profit and loss provides the cash amount while the balance sheets provide the data for inventory adjustments and the accrued expenses adjustments. Gross revenue is the total revenue generated by the business in a given period of time. It is calculated by adding the cash revenue and the inventory adjustments (ending minus beginning). This amount is important to determine as it shows the true revenue generated by the business. Gross revenue is also used in calculating income statement ratios. To make it easier to see the changes in inventory and which financial statements to pull the information from consider this version of the accrual method formula.

ABM 141 Unit 2 Study Guide Accrual Income Statements

Study Guide: Cash and Accrual Formulas Continued Cash Revenue Minus Cash Expenses Equals Net Cash Incomes Additions: From Current Yr. End (Ending Bal. Sht.) Accounts Receivable Prepaid Expenses Inventory on Hand From Prior Yr (Beginning Bal. Sht.) Accounts Payable Accrued Expenses Equals Total Additions Subtractions: From Prior Yr. (Beginning Bal. Sht) Accounts receivable Prepaid Expenses Inventories On Hand From Current Yr. End (Ending Bal. Sht) Accounts Payable Accrued Expenses Equals Total Subtractions Equals Accrual Net Income Before Depreciation Subtract Depreciation Equals Net Income From Operations Gain/Loss on Sale of Capital Assets Equals Accrual Net Income

ABM 141 Unit 2 Study Guide Accrual Income Statements

Potrebbero piacerti anche

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Fin 416 Exam 2 Spring 2012Documento4 pagineFin 416 Exam 2 Spring 2012fakeone23Nessuna valutazione finora

- GA3-240202501-AA2. Presentar Funciones de Su OcupaciónDocumento2 pagineGA3-240202501-AA2. Presentar Funciones de Su OcupaciónDidier Andres Núñez OrdóñezNessuna valutazione finora

- Account StatementDocumento46 pagineAccount Statementogagz ogagzNessuna valutazione finora

- Case Study - Swiss ArmyDocumento16 pagineCase Study - Swiss Armydineshmaan50% (2)

- APSS1B17 - Contemporary Chinese Society and Popcult - L2 (Week 3)Documento28 pagineAPSS1B17 - Contemporary Chinese Society and Popcult - L2 (Week 3)Arvic LauNessuna valutazione finora

- 09 - Chapter 2 PDFDocumento40 pagine09 - Chapter 2 PDFKiran PatelNessuna valutazione finora

- Pakistan Is Not A Poor Country But in FactDocumento5 paginePakistan Is Not A Poor Country But in Factfsci35Nessuna valutazione finora

- Nike's Winning Ways-Hill and Jones 8e Case StudyDocumento16 pagineNike's Winning Ways-Hill and Jones 8e Case Studyraihans_dhk3378100% (2)

- FLIPPING MARKETS TRADING PLAN 2.0.1 KEY CONCEPTSDocumento60 pagineFLIPPING MARKETS TRADING PLAN 2.0.1 KEY CONCEPTSLentera94% (18)

- Financial Statement of A CompanyDocumento49 pagineFinancial Statement of A CompanyApollo Institute of Hospital Administration100% (3)

- Model LOC Model LOC: CeltronDocumento3 pagineModel LOC Model LOC: CeltronmhemaraNessuna valutazione finora

- SHELF CORP SECRETS 3 FLIPPING CORPORATIONSDocumento24 pagineSHELF CORP SECRETS 3 FLIPPING CORPORATIONSRamon RogersNessuna valutazione finora

- Global Marketing Test Bank ReviewDocumento31 pagineGlobal Marketing Test Bank ReviewbabykintexNessuna valutazione finora

- Pest Analysis of Soccer Football Manufacturing CompanyDocumento6 paginePest Analysis of Soccer Football Manufacturing CompanyHusnainShahid100% (1)

- ABCDocumento18 pagineABCRohit VarmaNessuna valutazione finora

- Israel SettlementDocumento58 pagineIsrael SettlementRaf BendenounNessuna valutazione finora

- Steelpipe Sales Catalogue 4th Edition May 12Documento61 pagineSteelpipe Sales Catalogue 4th Edition May 12jerome42nNessuna valutazione finora

- Marketing Quiz on Product Life Cycle, Pricing Strategies, Distribution Channels, Promotion ToolsDocumento7 pagineMarketing Quiz on Product Life Cycle, Pricing Strategies, Distribution Channels, Promotion ToolsDisha MathurNessuna valutazione finora

- Chyna Benson-Receptionist 2014Documento1 paginaChyna Benson-Receptionist 2014api-245316866Nessuna valutazione finora

- Project Management Quiz - StudentDocumento14 pagineProject Management Quiz - StudentNen Tran Ngoc100% (1)

- Kotler & Keller (Pp. 325-349)Documento3 pagineKotler & Keller (Pp. 325-349)Lucía ZanabriaNessuna valutazione finora

- Operations Management Syllabus for Kelas Reguler 60 BDocumento4 pagineOperations Management Syllabus for Kelas Reguler 60 BSeftian MuhardyNessuna valutazione finora

- Intership ReportDocumento81 pagineIntership ReportsunnyNessuna valutazione finora

- AWS Compete: Microsoft's Response to AWSDocumento6 pagineAWS Compete: Microsoft's Response to AWSSalman AslamNessuna valutazione finora

- Paper 5 PDFDocumento529 paginePaper 5 PDFTeddy BearNessuna valutazione finora

- 1 - Impact of Career Development On Employee Satisfaction in Private Banking Sector Karachi - 2Documento8 pagine1 - Impact of Career Development On Employee Satisfaction in Private Banking Sector Karachi - 2Mirza KapalNessuna valutazione finora

- Internal Quality Audit Report TemplateDocumento3 pagineInternal Quality Audit Report TemplateGVS RaoNessuna valutazione finora

- PEA144Documento4 paginePEA144coffeepathNessuna valutazione finora

- Syllabus Corporate GovernanceDocumento8 pagineSyllabus Corporate GovernanceBrinda HarjanNessuna valutazione finora

- Audit Report Under Section 49 of The Delhi Value Added Tax Act, 2004 Executive SummaryDocumento24 pagineAudit Report Under Section 49 of The Delhi Value Added Tax Act, 2004 Executive SummaryrockyrrNessuna valutazione finora