Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

SWOT of AirWatch Feb 21 2014 by David Solomon Hadi

Caricato da

bob panicCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

SWOT of AirWatch Feb 21 2014 by David Solomon Hadi

Caricato da

bob panicCopyright:

Formati disponibili

Relationships. Understanding. Trust. Delivery www.rockstarconsultinggroup.

com helping your business rock since 98

A preliminary competitive analysis of Airwatch

By David Solomon Hadi - Chief Strategist Financial Services, Rock Star Consulting Group,

www.rockstarconsultinggroup.com

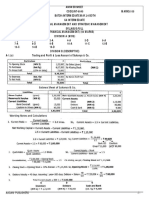

SWOT of Air-Watch by Air-Watchs Own Analysts (Published in 2013) Strengths

AirWatch is a large early player in the Mobile Device Management (MDM) space, with the ammunition to slug it out in a highly competitive market and is backed up by a sizeable R&D team to keep it on the cutting edge of EMM.

Weaknesses

There is price pressure on AirWatchs MDM solution, which is its primary product, and this may spread to services like mobile app management due to more competitors bringing their own services online.

Opportunities

AirWatch has the staying power, which only a few players have, to become one of two or three go-to vendors in what will be a very large market as EMM's reach expands into the enterprise.

Threats

There are some even larger players that are turning their eyes to mobile, which could extend this shakeout period for the EMM market.

Repeating the same analysis in language of economics: + (positives) - (negatives)

1. AirWatch is large player. (Benefit: Possibility of 1. Airwatch faces a price war in competition. monopoly prices.) (Loss: lower profit, higher costs.)

2. Airwatch is first mover in market. (Benefit: 2. Airwatch has more cost because of Large R&D.

More experience and learning to compete.) 3. Airwatch has large financial resources

(Loss: cannot lower cost easily in case of price competition)

[Partially from its 400% sales increase and 3. Other potential entrants (incumbents) are partially from significant capital investments]. larger. (Loss: more pressure on price and cost)

(Benefit: Power to meet additional needs as 4. Large profits induce incumbents to enter the they arise.) 4. Airwatch has large R&D team. (Benefit: market. (Loss: The possibility that entrants would indeed enter rises)

Innovate and perhaps monopolize the market. 5. The Burn Rate is high. This could mean once Warn new entrants.) 5. No or only few potential entrant expected. (Benefit: can keep monopoly prices. Even if they enter market is expected to remain monopolistic competition.) more that cost is high. (Loss: Reduce capacity to beat the new incumbent, competition and any new contingencies)

Logical Implications: AirWatch has large development and ongoing costs but prices for MDM technology are supposed to be low. Therefore, AirWatch cannot raise profits to a level which it might target or need. AirWatch has few very powerful potential incumbents in its market who have very large incentives (400% increase in sales) to enter market. Faced with large MDM development costs it may not be able to keep them out of market due to the lucrative nature of the MDM sector. In case of AirWatch the firm Vmware acquired it on 24 Feb 2014. Reasons for Acquisition: The high cost (especially the burn rate) left Airwatch with least amout of operating funds. (estimated time to survive was less than 06 months) [See forrestor.com]. The MDM technology, highest increasing in sales and other positives of Airwatch were an incentive to Vmware which needed to add MDM technology/solution in its portfolio to compete IBM and Citrix (that already have MDM solutions). [See CNN website]

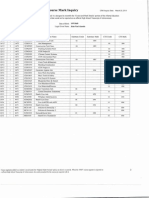

Since organizations are rapidly deploying MDM technology (It is also expected that organizations replace tactical MDM with enterprise-class suites), huge instant opportunities of profit for VMware through Airwatch are now available. [IDC website] The Economic Analysis of Acquisition Price paid today should be greater than or equal to the inflow of profit (after discounting for inflation etc) that occurs in coming days. Vmware competes against Citrix and IBM who have or acquired MDM technologies. To compete with them Vmware has bought Airwatch. Going back to the idea that $1.5b USD today should be less than or equal to whatever profit comes tomorrow and thinking of competition with Citrix means following: Either VM forecasted a loss of $1.5 Billion if it does not acquire MDM OR VM forecasts a gain of $1.5 Billion once it acquires MDM. This implies, under strict conditions of rationality1, that Vmware would keep the machinery of Airwatch for years in which it can cover at least 1.5b USD. Once we may calculate this time, we would know how long Airwatch is going enjoy VM benefits. After that, what happens cannot be known at the present time. To remain competent Airwatch would need to use its own strength and cover weaknesses/threats of VM. This, if done properly, would give incentive to the VM and to keep Airwatch may enjoy its existence in long run too. Some + for Airwatch (from IDC website) 1. AirWatch licenses are usually limited (about a hundred). Therefore, clients have to test out its enterprise mobility solution either in a pilot or in proof of concept. a. With VMware's expanding sales and services capabilities, AirWatch could start seeing more pilots and POCs becoming production deployments.

When each cent is used for net profit.

2. AirWatch operates in both channel and direct models and has a limited amount of education and marketing AirWatch can deliver to potential customer and partners. This results in smaller implementation and limited access to customers. a. VMware operates in a pure channel model. Its channel network is extensive. As a part of VMware AirWatch will be able to solve above mentioned limitation. 3. Large parts of AirWatch revenue come from its basic MDM solutions. As AirWatch tries to increase the depth of its product offering, it will face stronger competition, such as PC management. a. As a part of VMware, AirWatch can effectively increase the depth of its solutions without investing heavily into building solutions that compete with established players. Adjustments to previous SWOT Strengths Weaknesses

Airwatch can now enjoy (fore mentioned) benefits It may lose its complete autonomy in decision from Vmware. making. It would have (might have) lowered decision making powers. Opportunities The clients of Vmware are potential clients now. Threats It may lose its momentum as mobile market big

Possibility to increase depth and power to player over time (needs to be calculated). compete with new powerful rivals effectively.

Repeating the same analysis in language of economics: + (positives) 1. AirWatch is part of large player. - (negatives) 1. Airwatch faces diseconomies.

(Benefit: Diversification of risk. Now if Vmware (Loss: lower power in decision making.) faces risk, Airwatch can cover and if Airwatch face 2. Airwatch and Vmware may face agency risk .) problem.

2. Airwatch large R&D team now co-operates (Loss: what if Vmware looses interest in its new with Vmware team. (Benefit: More Innovation, and synergies.) 3. Potential entrants are warned. (Benefit: lower threats.) aquisition Airwatch and Airwatch is expecting otherwise. What if Vmwares future depends on actions that are not good for Airwatchs)

Limits of this analysis and further analysis: This analysis is based on freely available News and blog posts. No formal scientific report was consulted. No data was used if it was not available in the public domain. This analysis is also conducted at time when acquisition was being made leaving the author with problem of seeing Airwatch as an independent firm (which is needed for SWOT or any other competitive analysis). Further analysis of strengths, weaknesses, opportunities and threats etc. of Airwatch as a part of Vmware would require empirical work measuring how long Airwatch can maintain its momentum in the market (given the assumption of 1.5 Billion USD cash injection). Empirical evaluation of Airwatch as part of Vmware would be required to correctly identify the strengths and weaknesses, forecasts of next month to identify opportunities and threats in near future, empirical evaluation of previous strategies in order to know how to cope with threats and exploit opportunities and develop strength. This would require access to internal company reports, 3rd party data conducted by external organizations. Estimated time needed would be not more than 2-3 months for all a full report to be generated (if all data and previous scientific reports are readily available).

Worldwide Contact: +61 424 102 603 (24x7x365) ABN: 68 342 328 335

Potrebbero piacerti anche

- Summary of Heather Brilliant & Elizabeth Collins's Why Moats MatterDa EverandSummary of Heather Brilliant & Elizabeth Collins's Why Moats MatterNessuna valutazione finora

- The Forrester Wave™ Web Application Firewalls, Q4 2022 - Courtesy PreviewDocumento16 pagineThe Forrester Wave™ Web Application Firewalls, Q4 2022 - Courtesy PreviewGuillaume SoubielleNessuna valutazione finora

- VMware 2012 August Investor PresentationDocumento9 pagineVMware 2012 August Investor PresentationInvestorPresentationNessuna valutazione finora

- The Forrester Wave™ - Web Application Firewalls, Q3 2022Documento12 pagineThe Forrester Wave™ - Web Application Firewalls, Q3 2022Aashutosh MahajanNessuna valutazione finora

- How Companies Become Platform LeaderDocumento4 pagineHow Companies Become Platform Leaderbadal50% (2)

- SM AssignmentDocumento4 pagineSM Assignmentshreeya salunkeNessuna valutazione finora

- TOP20 Operator Funding Report ComprDocumento7 pagineTOP20 Operator Funding Report ComprAnonymous loKgurNessuna valutazione finora

- Procurement and OutsourcingDocumento50 pagineProcurement and OutsourcingSwapnil BaikerikarNessuna valutazione finora

- Name Netid Group Number: Website Link: Tutorial Details Time Spent On AssignmentDocumento10 pagineName Netid Group Number: Website Link: Tutorial Details Time Spent On AssignmentAndrewMorrisonNessuna valutazione finora

- Deep Security Coalfire PCI Solution Guide Jan2013 (1) A6E5Documento94 pagineDeep Security Coalfire PCI Solution Guide Jan2013 (1) A6E5victor1517Nessuna valutazione finora

- In 1980Documento3 pagineIn 1980Sneha ImranNessuna valutazione finora

- Accounts ProjectDocumento33 pagineAccounts Projectaradhana chauhanNessuna valutazione finora

- Magic Quadrant For Web Application FirewallsDocumento13 pagineMagic Quadrant For Web Application Firewallsnao2001Nessuna valutazione finora

- Platform Comuting Test Dev Survey Results FINALDocumento35 paginePlatform Comuting Test Dev Survey Results FINALMunish KharbNessuna valutazione finora

- Can You Hear Me Now?: Category: Telecom, Competitive ResponseDocumento5 pagineCan You Hear Me Now?: Category: Telecom, Competitive ResponseChaitanya KarwaNessuna valutazione finora

- Strategic Management Theory and Cases An Integrated Approach 12th Edition Hill Solutions ManualDocumento37 pagineStrategic Management Theory and Cases An Integrated Approach 12th Edition Hill Solutions Manualcameradeaestivalnekwz7100% (27)

- Full Download Strategic Management Theory and Cases An Integrated Approach 12th Edition Hill Solutions Manual PDF Full ChapterDocumento36 pagineFull Download Strategic Management Theory and Cases An Integrated Approach 12th Edition Hill Solutions Manual PDF Full Chapteraortitismonist4y0aby100% (16)

- Strategic Management Theory and Cases An Integrated Approach 12th Edition Hill Solutions ManualDocumento51 pagineStrategic Management Theory and Cases An Integrated Approach 12th Edition Hill Solutions ManualDomingo Mckinney100% (31)

- Strategic Management Theory and Cases An Integrated Approach 12th Edition Hill Solutions ManualDocumento51 pagineStrategic Management Theory and Cases An Integrated Approach 12th Edition Hill Solutions ManualRachelMorrisfpyjs100% (21)

- Mission & Vision of The Firm Know Yourself: SWOT Analysis Scan External EnvironmentDocumento14 pagineMission & Vision of The Firm Know Yourself: SWOT Analysis Scan External EnvironmentavijeetboparaiNessuna valutazione finora

- Upward Bound Muller ChenDocumento16 pagineUpward Bound Muller ChenTurley Muller0% (1)

- SWOT and 5 ForcesDocumento5 pagineSWOT and 5 Forcesabhi vermaNessuna valutazione finora

- Strategic Management Theory Cases Integrated Approach 12th Edition Hill Solutions ManualDocumento50 pagineStrategic Management Theory Cases Integrated Approach 12th Edition Hill Solutions ManualAkhi Junior JMNessuna valutazione finora

- Magic Quadrant For WarehouseDocumento25 pagineMagic Quadrant For WarehousePablo Plaza MuruaNessuna valutazione finora

- Full Potential Saas - TCVDocumento18 pagineFull Potential Saas - TCVJohn GonesNessuna valutazione finora

- The Nature and Sources of Competitive AdvantageDocumento45 pagineThe Nature and Sources of Competitive AdvantageRasMus' DreAmwishNessuna valutazione finora

- Information Systems A Managers Guide To Harnessing Technology 1st Edition Gallaugher Test BankDocumento17 pagineInformation Systems A Managers Guide To Harnessing Technology 1st Edition Gallaugher Test Bankbrianschultzgdocrwqymj100% (16)

- Michael Porter's AssignmentDocumento6 pagineMichael Porter's AssignmentDweep ChokshiNessuna valutazione finora

- Assignments 4Documento2 pagineAssignments 4Peter YoussefNessuna valutazione finora

- Outline For StratManDocumento6 pagineOutline For StratManJam PotutanNessuna valutazione finora

- Accounting: Aerojet Rocketdyne: WelcomeDocumento16 pagineAccounting: Aerojet Rocketdyne: WelcomeHum NjorogeNessuna valutazione finora

- Airbus A3XX PowerpointDocumento31 pagineAirbus A3XX PowerpointRashidNessuna valutazione finora

- Airbus A3XX: Developing The World's Largest Commercial JetDocumento31 pagineAirbus A3XX: Developing The World's Largest Commercial JetHarsh AgrawalNessuna valutazione finora

- Dwnload Full Strategic Management An Integrated Approach 10th Edition Hill Solutions Manual PDFDocumento36 pagineDwnload Full Strategic Management An Integrated Approach 10th Edition Hill Solutions Manual PDFsebastianwum100% (8)

- Frost Radar - Global Vulnerability Management Market, 2021 SkyboxDocumento21 pagineFrost Radar - Global Vulnerability Management Market, 2021 SkyboxTrí NguyễnNessuna valutazione finora

- Strategic Management: Pavan Gadade Sachin ChavanDocumento27 pagineStrategic Management: Pavan Gadade Sachin ChavanahmedrefeatNessuna valutazione finora

- Strategic Management Theory and Cases An Integrated Approach 12th Edition Hill Solutions ManualDocumento36 pagineStrategic Management Theory and Cases An Integrated Approach 12th Edition Hill Solutions Manualmediandorsadwl5z100% (17)

- 5StarS WhitePaper 12 6 19 PDFDocumento28 pagine5StarS WhitePaper 12 6 19 PDFChristoph SchmittnerNessuna valutazione finora

- Running Head: CONSULTING PROCESS 1Documento8 pagineRunning Head: CONSULTING PROCESS 1vinay wadhwaNessuna valutazione finora

- VEEV Short Thesis PresentationDocumento23 pagineVEEV Short Thesis PresentationSuhailCapitalNessuna valutazione finora

- Pfeffer 2005 AME Producing Sustainable Competitive Advantage Through PeopleDocumento13 paginePfeffer 2005 AME Producing Sustainable Competitive Advantage Through PeopleFarhan1561Nessuna valutazione finora

- AkamaiDocumento13 pagineAkamaimarielocm.itNessuna valutazione finora

- Full Download Strategic Management Theory and Cases An Integrated Approach 11th Edition Hill Solutions ManualDocumento36 pagineFull Download Strategic Management Theory and Cases An Integrated Approach 11th Edition Hill Solutions Manualsaumvirgen2375812100% (23)

- Full Download Strategic Management Theory An Integrated Approach 11th Edition Hill Solutions ManualDocumento36 pagineFull Download Strategic Management Theory An Integrated Approach 11th Edition Hill Solutions Manualsaumvirgen2375812100% (35)

- Gartner - Magic Quadrant For WAFDocumento41 pagineGartner - Magic Quadrant For WAFDan BarlibaNessuna valutazione finora

- Gartner Magic Quadrant For Cloud Web Application and APIDocumento32 pagineGartner Magic Quadrant For Cloud Web Application and APIdbf75Nessuna valutazione finora

- B1 Strategic PlanningDocumento10 pagineB1 Strategic Planningbernard cruzNessuna valutazione finora

- Main Aspects of Porter's Five Forces AnalysisDocumento6 pagineMain Aspects of Porter's Five Forces AnalysisRanjith ThadakamallaNessuna valutazione finora

- Marketing Requirements Document (MRD)Documento11 pagineMarketing Requirements Document (MRD)Suneel GajreNessuna valutazione finora

- Dwnload Full Strategic Management Theory An Integrated Approach 11th Edition Hill Solutions Manual PDFDocumento36 pagineDwnload Full Strategic Management Theory An Integrated Approach 11th Edition Hill Solutions Manual PDFsaucerbield61wpyn100% (11)

- 4 - WMG-Cloud-Strategy-TemplateDocumento8 pagine4 - WMG-Cloud-Strategy-TemplatesamsonadebogaNessuna valutazione finora

- Interim Report - Group 10Documento8 pagineInterim Report - Group 10Karan TewariNessuna valutazione finora

- SCM Assignment 1Documento12 pagineSCM Assignment 1Mughal777Nessuna valutazione finora

- CVTSP1120-M05-Commvault Disaster RecoveryDocumento19 pagineCVTSP1120-M05-Commvault Disaster RecoverysahiltomohitNessuna valutazione finora

- Competitive AdvantageDocumento6 pagineCompetitive AdvantageYash AgarwalNessuna valutazione finora

- Product Case Challenge 2019Documento30 pagineProduct Case Challenge 2019fireaterNessuna valutazione finora

- 27-3-24... 4110 Both... Int-6040... Fm-Sm... AnsDocumento10 pagine27-3-24... 4110 Both... Int-6040... Fm-Sm... Ansnikulgauswami9033Nessuna valutazione finora

- Vertical N Horizontal IntegrationDocumento5 pagineVertical N Horizontal Integrationrathi_shubhamNessuna valutazione finora

- Institute of Management Studies: Outsourcing and ProcurementDocumento20 pagineInstitute of Management Studies: Outsourcing and ProcurementMahath MohanNessuna valutazione finora

- Gartner WAAPDocumento38 pagineGartner WAAPRedouaneNessuna valutazione finora

- Global Workforce Solutions and Professional Services Rock Star Consulting GroupDocumento15 pagineGlobal Workforce Solutions and Professional Services Rock Star Consulting Groupbob panicNessuna valutazione finora

- Bob Panic - Solution Architect - Enterprise IT Systems & Security Architecture and GovernanceDocumento4 pagineBob Panic - Solution Architect - Enterprise IT Systems & Security Architecture and Governancebob panicNessuna valutazione finora

- Hemmant Puri: Senior Program Management ProfessionalDocumento5 pagineHemmant Puri: Senior Program Management Professionalbob panicNessuna valutazione finora

- Curriculum Vitae of Kamrul ZamanDocumento5 pagineCurriculum Vitae of Kamrul Zamanbob panicNessuna valutazione finora

- Ann Divers ResumeWORDfeb2015Documento4 pagineAnn Divers ResumeWORDfeb2015bob panicNessuna valutazione finora

- Rock Star Service CatalogueDocumento3 pagineRock Star Service Cataloguebob panic0% (1)

- Resume Adrian Nair Senior PM 2014Documento6 pagineResume Adrian Nair Senior PM 2014bob panicNessuna valutazione finora

- Australian Stock Market Drivers. A Graphical Analysis by Rock Star Consulting GroupDocumento10 pagineAustralian Stock Market Drivers. A Graphical Analysis by Rock Star Consulting Groupbob panicNessuna valutazione finora

- CV - Creagh WarrenDocumento4 pagineCV - Creagh Warrenbob panicNessuna valutazione finora

- Tibor Lovas Interface Designer ResumeDocumento1 paginaTibor Lovas Interface Designer Resumebob panicNessuna valutazione finora

- Online Recruitment Whitepaper by Bob PanicDocumento13 pagineOnline Recruitment Whitepaper by Bob Panicbob panicNessuna valutazione finora

- Problem Solving 101Documento1 paginaProblem Solving 101bob panicNessuna valutazione finora

- Anthony Robbins - Rapid Planning MethodDocumento61 pagineAnthony Robbins - Rapid Planning Methodbob panic100% (5)

- Federalist Papers 10 51 ExcerptsDocumento2 pagineFederalist Papers 10 51 Excerptsapi-292351355Nessuna valutazione finora

- NHD Process PaperDocumento2 pagineNHD Process Paperapi-203024952100% (1)

- Lesson 1 3 Transes in Reading in Philippine HistoryDocumento17 pagineLesson 1 3 Transes in Reading in Philippine HistoryNAPHTALI WILLIAMS GONessuna valutazione finora

- Test 2-Module 1 12-10-2017: VocabularyDocumento2 pagineTest 2-Module 1 12-10-2017: VocabularySzabolcs Kelemen100% (1)

- Hele Grade4Documento56 pagineHele Grade4Chard Gonzales100% (3)

- VimDocumento258 pagineVimMichael BarsonNessuna valutazione finora

- KPI AssignmentDocumento7 pagineKPI AssignmentErfan Ahmed100% (1)

- Data MiningDocumento28 pagineData MiningGURUPADA PATINessuna valutazione finora

- DJ Crypto ResumeDocumento1 paginaDJ Crypto ResumeNitin MahawarNessuna valutazione finora

- Alaba Adeyemi AdediwuraDocumento12 pagineAlaba Adeyemi AdediwuraSchahyda ArleyNessuna valutazione finora

- Engleza Referat-Pantilimonescu IonutDocumento13 pagineEngleza Referat-Pantilimonescu IonutAilenei RazvanNessuna valutazione finora

- Work Breakdown StructureDocumento8 pagineWork Breakdown StructurerenshagullNessuna valutazione finora

- SIVACON 8PS - Planning With SIVACON 8PS Planning Manual, 11/2016, A5E01541101-04Documento1 paginaSIVACON 8PS - Planning With SIVACON 8PS Planning Manual, 11/2016, A5E01541101-04marcospmmNessuna valutazione finora

- Lab 3 Arduino Led Candle Light: CS 11/group - 4 - Borromeo, Galanida, Pabilan, Paypa, TejeroDocumento3 pagineLab 3 Arduino Led Candle Light: CS 11/group - 4 - Borromeo, Galanida, Pabilan, Paypa, TejeroGladys Ruth PaypaNessuna valutazione finora

- Loctite 586 PDFDocumento9 pagineLoctite 586 PDForihimieNessuna valutazione finora

- Carnegie Mellon Thesis RepositoryDocumento4 pagineCarnegie Mellon Thesis Repositoryalisonreedphoenix100% (2)

- 0012 Mergers and Acquisitions Current Scenario andDocumento20 pagine0012 Mergers and Acquisitions Current Scenario andJuke LastNessuna valutazione finora

- Central University of Karnataka: Entrance Examinations Results 2016Documento4 pagineCentral University of Karnataka: Entrance Examinations Results 2016Saurabh ShubhamNessuna valutazione finora

- Answers For Some QuestionsDocumento29 pagineAnswers For Some Questionsyogeshdhuri22Nessuna valutazione finora

- Registration ListDocumento5 pagineRegistration ListGnanesh Shetty BharathipuraNessuna valutazione finora

- Fuzzy Gain Scheduled Pi Controller For ADocumento5 pagineFuzzy Gain Scheduled Pi Controller For AOumayNessuna valutazione finora

- Noise and DB Calculations: Smart EDGE ECE Review SpecialistDocumento2 pagineNoise and DB Calculations: Smart EDGE ECE Review SpecialistLM BecinaNessuna valutazione finora

- Li JinglinDocumento3 pagineLi JinglincorneliuskooNessuna valutazione finora

- Boundary Value Analysis 2Documento13 pagineBoundary Value Analysis 2Raheela NasimNessuna valutazione finora

- BiografijaDocumento36 pagineBiografijaStjepan ŠkalicNessuna valutazione finora

- Information Systems and Supply Chain ManagementDocumento2 pagineInformation Systems and Supply Chain Managementvipinkandpal86Nessuna valutazione finora

- Lacey Robertson Resume 3-6-20Documento1 paginaLacey Robertson Resume 3-6-20api-410771996Nessuna valutazione finora

- The Chemistry of The Colorful FireDocumento9 pagineThe Chemistry of The Colorful FireHazel Dela CruzNessuna valutazione finora

- Img 20150510 0001Documento2 pagineImg 20150510 0001api-284663984Nessuna valutazione finora

- Trina 440W Vertex-S+ DatasheetDocumento2 pagineTrina 440W Vertex-S+ DatasheetBrad MannNessuna valutazione finora