Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

International Journal of Contemporary Practices

Caricato da

khushnuma20Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

International Journal of Contemporary Practices

Caricato da

khushnuma20Copyright:

Formati disponibili

International Journal of Contemporary Practices - Vol. 1, Issue.

12

ISSN: 2231-5608

SWOT Analysis of Credit Cards

Research Scholar, Singhania University, Pacheri Beri, Rajasthan Research Scholar, Uttarakhand Technical University,Dehradun Director, Nimbus Academy of Management, Dehradun

Rashmi Aggarwal Lalit Goyal

Dr. N.P. Sharma

Abstract SWOT is an acronym for the internal Strengths and Weaknesses of a firm and the environmental Opportunities and Threats facing that firm. SWOT analysis is a widely used technique to do the quick overview of strategic situation. The technique is based on the assumption that an effective strategy derives from a sound fit between a firms internal resources (strengths and weaknesses) and its external situation (opportunities and threats). A good fit maximizes a firms strengths and opportunities and minimizes its weaknesses and threats. Accurately applied, this simple assumption has powerful implications for the design of a successful strategy. Making a purchase with a credit card can be exhilarating and rewarding one moment and regrettable and binding the next. For many, the joy of that tiny square of plastic monetary freedom becomes a ball-and-chain of debt faster than you can say discount sale at Sears. Yet others maintain a responsible, reliable account that provides a rewarding experience. To own or not to ownthat is the credit card question. While credit card debt plagues millions of Indians, just as many thrive on the flexibility and ease of paying with credit. Obviously, the magic of the little plastic card is not right for everyone. Take a look at the following SWOT analysis for credit cards to decide whether or not you should make the swipe. Meaning of Credit Card Credit card is an invention of modern commerce. It is a plastic card that allows the card holder to purchase goods and services by paying with the card. Usually a user purchases firstly and pays back later with the interest. The credit card is issued by financial institution like commercial bank with whom the user has an agreement to repay the outstanding debt

www.aircindia.net

14

International Journal of Contemporary Practices - Vol. 1, Issue. 12

ISSN: 2231-5608

on the card. It is the most popular and convenient payment tools in the world. It is a part of payment and clearing system. From appearance, credit card is a plastic card having a magnetic strip, issued by a bank that authorizes the card holder to buy goods or services within credit limit. How credit cards work Credit cards are issued by a credit card issuer, such as a bank or credit union, after an account has been approved by the credit provider, after which cardholders can use it to make purchases at merchants accepting that card. Merchants often advertise which cards they accept by displaying acceptance marks generally derived from logos or may communicate this orally, as in "We take (brands X, Y, and Z)" or "We don't take credit cards". When a purchase is made, the credit card user agrees to pay the card issuer. The cardholder indicates consent to pay by signing a receipt with a record of the card details and indicating the amount to be paid or by entering a personal identification number (PIN). Also, many merchants now accept verbal authorizations via telephone and electronic authorization using the Internet, known as a card not present transaction (CNP). Electronic verification systems allow merchants to verify in a few seconds that the card is valid and the credit card customer has sufficient credit to cover the purchase, allowing the verification to happen at time of purchase. The verification is performed using a credit card payment terminal or point-of-sale (POS) system with a communications link to the merchant's acquiring bank. Data from the card is obtained from a magnetic stripe or chip on the card. For card not present transactions where the card is not shown (e.g., ecommerce, mail order, and telephone sales), merchants additionally verify that the customer is in physical possession of the card and is the authorized user by asking for additional information such as the security code printed on the back of the card, date of expiry, and billing address. Each month, the credit card user is sent a statement indicating the purchases undertaken with the card, any outstanding fees, and the total amount owed. After receiving the statement, the cardholder may dispute any charges that he or she thinks are incorrect. Otherwise, the cardholder must pay a defined minimum proportion of the bill by a due date, or may choose to pay a higher amount up to the entire amount owed. The credit issuer charges interest on the amount owed if the balance is not paid in

www.aircindia.net 15

International Journal of Contemporary Practices - Vol. 1, Issue. 12

ISSN: 2231-5608

full (typically at a much higher rate than most other forms of debt). In addition, if the credit card user fails to make at least the minimum payment by the due date, the issuer may impose a "late fee" and/or other penalties on the user. To help mitigate this, some financial institutions can arrange for automatic payments to be deducted from the user's bank accounts, thus avoiding such penalties altogether as long as the cardholder has sufficient funds. SWOT Analysis Strength is something an organization is good at or something that gives the organization advantage. Weakness is something an organization lacks, that means inferior aspects compared with competitors. Both strength and weakness belong to internal factors of the organization. Opportunity is a potential to advance the organization by the business development and an unfulfilled market need. Threat is something that may reduce the potential advantage of the organization. Both threat and opportunity belong to external factors of the organization. Strengths of Credit Card Accepting credit cards makes good business sense. Below are key benefits that you can receive from accepting credit cards all of which add up to a smart business decision. 1. Avoiding the risk of carrying cash. For large purchases, you do not have to withdraw a large amount from your bank and carry it around while shopping because you run the risk of being robbed. A credit card is easy, convenient, and safer than carrying so much cash in your bag or pocket. 2. Avoiding inferior products. If you purchased a product and find out that it doesnt work as expected, and the seller tells you they will just replace it, or they assure you that it is under warranty, dont waste your time. Send a letter to your credit card company that you are not honoring and will not pay for the transaction. Then tell your seller that they could get their product back and return the charge slip you signed. Dont waste your time taking the inferior product several times to the shop for warranty repair. Thats how easy it is to reject a product that has not delivered its marketing promise. 3. Keep Records of your expenses. Aside from official receipts, credit card statements make a good record of your expenses. 4. Cash Back and Rewards Points. Most credit cards have a rewards program that you will find useful in your store transactions.

16

www.aircindia.net

International Journal of Contemporary Practices - Vol. 1, Issue. 12

ISSN: 2231-5608

5. Convenient Online Purchases. Some credit card companies have begun issuing extension cards exclusively for your online purchases. This separates your online purchases from the purchases done with your main credit card. This card usually has a smaller fraction of your total credit limit. 6. Building a good Credit Standing. If you use your credit card properly, you will improve your credit score/ credit rating in the financial community. If you have a high balance in your credit card you lose your credit score points. Having a good credit standing entitles you to higher loans. 7. Cash Advance. You could get some cash from your credit card. Just stick it into your ATM machine and key in your pin; or go inside the bank and file a cash advance at the counter. 8. Various Branding offers: Most importantly credit cards offer various discounts & schemes which are associated with entertainment, travel, shopping etc. Issuing Credit Card Banks tie up with the reputed brands to sell products/services at attractive rates which you can buy through your credit cards. To check offers running on your credit card. 9. Emergencies: One of the major credit card advantages is in the case of emergencies. Unexpected auto repairs, medical bills, natural disaster damage or other financial crises may arise where individuals may not have the cash up front. Credit cards can be utilized to cover these unexpected costs without having to resort to begging family or neighbors or taking out extremely high-interest loans from payday lenders. Weaknesses There are various features of a credit card that seem to be a gift for the person using the card. But a little bit of carelessness can change the entire position and the same factor can end up being a curse for the credit card user. The cost for this has to be paid in the form of higher interest and charges that make it a costly way to use funds if due care is not taken. 1. Interest cost: The interest that a person pays while using a credit card is the highest among all the options available in the market. Specific loans come at reasonable rates, for example, a car loan can be taken at an interest rate of 14%-15% per annum. Similarly, a personal loan where there is no restriction on the end usage is available at the rate of 18%-19% per annum but when it comes to a

www.aircindia.net 17

International Journal of Contemporary Practices - Vol. 1, Issue. 12

ISSN: 2231-5608

2.

3.

4.

5.

credit card the amount paid by a user is anything between 35%-42% depending upon the exact rate charged. This makes credit cards one of the costliest ways of borrowing, and hence one has to be extra vigilant in trying to avoid this high cost. Charges: The payments made by a credit card user do not end with interest charges because there are a lot of other payments that might be required to be paid on the credit card. This is mainly in the form of penalties and charges. For example, inability to pay the required amount of the credit card in time can lead to a late payment charge that can be anything between Rs 300-Rs 500. Similarly, making expense over the credit limit might be permitted by the credit card company but this comes at a hefty price in the form of a high charge. All these can add up to a significant figure, increasing the overall cost of using the credit card. Credit trap: Things are great as far as the usage of the credit card is concerned when things are under control. In such a position, there can be no charge and no interest payment but the moment one falls into the revolving cycle there are a whole lot of factors that impact the person at the same time. For example, the moment one full payment is missed every single expense is covered by the interest rate and no credit period is available. Similarly, more and more usage of credit cards is encouraged which often makes the payback a difficult task for the user. Multiple credit cards: The other disadvantage is that people accumulate more and more credit cards as these are issued very easily by banks. This makes the problem of managing multiple credit cards a very difficult task. Remembering the payment dates and amounts for each one along with the other requirements often become a tough task leading to missing out on some occasions. This can result in a large amount of charges coming in which is an additional cost. Using multiple credit cards also leads to lower control over the overall finances because of the large amount of borrowings that pile up. Overspending: A credit card is the worst enemy of impulsive buyers. A credit card user is always liable to develop a tendency of overspending. For example, if your salary is Rs 50,000 and the credit limit on your card is Rs 1,00,000 it doesnt mean that you can afford to spend Rs 1,50,000. The additional Rs 1,00,000 is just a loan facility provided, and as all loans are repaid this one too needs to be paid off.

www.aircindia.net

18

International Journal of Contemporary Practices - Vol. 1, Issue. 12

ISSN: 2231-5608

Threats Keeping your credit card safe is harder than you think. Security threats lurk at every corner, and if you happen to be one of the millions that take your credit card online for purchasing, your security is compromised with every click. 1. Smishing is the newest type of security threat, and if refers to hacking methods through text messaging mediums. There has been an increase in these types of crimes. Consumers were instructed to call a number, where a voicemail told them to press 1. Then a fraudulent agent came on the phone and asked for the consumers sensitive bank information. Banks dont usually send out mass text messages; consumers can avoid this type of scam by always calling the number on the back of their card if there are any issues with their account. Credit cards are at constant risk. In order to keep it secure, watch out for these basic types of security threats. 2. Exposure to General Economic Trends: For the credit payment system to thrive, card holders must continuously and increasingly consume with their credit cards. A downturn in the economy will reduce overall transaction volume and in turn the profits of credit card companies. In addition, downward economic trends may cause more card holders to default on their payments, thereby forcing issuing banks to sustain losses.

3. Credit default: Credit Default is a continual risk to credit card issuers. They take responsibility for paying the acquiring banks, who then pay the merchants for the transactions, then bill the card holder for the balance. If the card holder cannot pay, however, the card issuer still must pay the acquiring bank. This risk is mitigated, however, by legal regulation that allows the credit card issuer to pursue the defaulted borrower for the money owed. Furthermore, credit card companies actually profit when people don't pay their credit card bills on time, because they earn interest on the late payments. 4. Concerns over Interchange Fees: Interchange fees represent another pressure facing the credit card industry. They have skyrocketed over recent years to become the second-largest cost after payroll at some major retailers, such as Wal-Mart Opportunities: An extensive research and prudent analysis has been done on the India credit card market to understand factors that will continue to

www.aircindia.net

19

International Journal of Contemporary Practices - Vol. 1, Issue. 12

ISSN: 2231-5608

serve as growth saviors for the market during the coming years. The report identified that various factors such as, increasing trend of e-shopping and changing consumer pattern have resulted into the higher usage of credit cards in the country. 1. Developing the Rural Market: First of all, farmers are growing richer, therefore their needs to consume more also expands accordingly. Also, during busy harvesting seasons, farmers tend to need more cash to keep up with their operations. But now credit cards are barely present in the rural area and it is difficult for farmers to borrow enough money merely from local governments. Credit cards are the best answer to their problems 2. Personal Credit Evaluation System and CRM System: Having bad debt due to customers inability to pay back is a major cause of loss in profits for credit card business. But now a personal credit evaluation system will be implemented. This allows banks to know better their customers before they decide to authorize credit cards to them. 3. Multi-Cobranded Cards: At the moment it is mostly the case that one card is only bound with one co-brander (a merchant offering goods or services such as shopping website or travel agency). As the variety of cards keep on growing wider, many customers find it becoming harder to choose one card among all the appealing options. Therefore some consumers start to demand for multi-cobranded cards. Besides, it is anticipated that the future prospects of the credit card industry will remain buoyant owing to the low credit card penetration coupled with rising income in view of its safety and easy access. There are several other benefits like reward points and discounts by merchants as well as bankers, which will lure customers to shop by their credit cards. Moreover, the increasing trend of e shopping has also provided the impetus to the growth of this industry. This huge demand for credit cards is providing tremendous growth opportunities for credit card issuers, suppliers, and manufacturers in the country. Conclusion: There has been a huge growth in the number of payment transaction using debit and credit cards. We have also studied innovations in terms of offerings and technology in payment card industry which will bring transparency, ease, and security in the use of these cards. Increasing trend of online shopping and other benefits, like reward points and discounts, offered by merchants as well as bankers attract customers

www.aircindia.net

20

International Journal of Contemporary Practices - Vol. 1, Issue. 12

ISSN: 2231-5608

to shop using payment cards. Despite the financial turmoil and decline in credit card base, the overall trend will remain positive during the forecast period backed by increasing transaction volume, innovations, and guidelines crafted by RBI.

www.aircindia.net

21

Potrebbero piacerti anche

- Credit Card BusinessDocumento51 pagineCredit Card BusinessAsefNessuna valutazione finora

- Credit Secrets: Learn the concepts of Credit Scores, How to Boost them and Take Advantages from Your Credit CardsDa EverandCredit Secrets: Learn the concepts of Credit Scores, How to Boost them and Take Advantages from Your Credit CardsNessuna valutazione finora

- Credit CardsDocumento22 pagineCredit CardsEti Prince BajajNessuna valutazione finora

- Payment Collection for Small Business: QuickStudy Laminated Reference Guide to Customer Payment OptionsDa EverandPayment Collection for Small Business: QuickStudy Laminated Reference Guide to Customer Payment OptionsNessuna valutazione finora

- Credit CardDocumento65 pagineCredit CardKrishana ThakurNessuna valutazione finora

- Personal Finacial Literacy NotesDocumento64 paginePersonal Finacial Literacy Notesmpontier123100% (1)

- Research On Credit CardDocumento22 pagineResearch On Credit CardMayank Arora0% (1)

- Presentation On Credit Card Business Opportunities and ThraeatsDocumento74 paginePresentation On Credit Card Business Opportunities and ThraeatsGarvit JainNessuna valutazione finora

- Lovely Professionaluniversity: Personal Financial PlanningDocumento12 pagineLovely Professionaluniversity: Personal Financial Planningaadi642Nessuna valutazione finora

- Musical Notes and SymbolsDocumento17 pagineMusical Notes and SymbolsReymark Naing100% (2)

- Credit Card: Presented By, Manju SDocumento28 pagineCredit Card: Presented By, Manju SDeepak R PatelNessuna valutazione finora

- Unit 2 Lab Manual ChemistryDocumento9 pagineUnit 2 Lab Manual ChemistryAldayne ParkesNessuna valutazione finora

- What Is A Credit CardDocumento6 pagineWhat Is A Credit CardPrince AschwellNessuna valutazione finora

- Debit Card Issued by A Bank Allowing The Holder To Transfer Money Electronically To Another Bank Account When Making A PurchaseDocumento9 pagineDebit Card Issued by A Bank Allowing The Holder To Transfer Money Electronically To Another Bank Account When Making A PurchaseShovan ChowdhuryNessuna valutazione finora

- An Introduction To Credit CardDocumento58 pagineAn Introduction To Credit CardAsefNessuna valutazione finora

- Athletic KnitDocumento31 pagineAthletic KnitNish A0% (1)

- S1-TITAN Overview BrochureDocumento8 pagineS1-TITAN Overview BrochureصصNessuna valutazione finora

- Frauds in Plastic MoneyDocumento60 pagineFrauds in Plastic MoneyChitra Salian0% (1)

- Plastic Money: Defination of Plastic Money:-Term: A Slang Phrase For Credit Cards, Especially When Such CardsDocumento6 paginePlastic Money: Defination of Plastic Money:-Term: A Slang Phrase For Credit Cards, Especially When Such CardsEvans VasavanNessuna valutazione finora

- Innovation in Credit Card and Debit Card Business by Indian BanksDocumento21 pagineInnovation in Credit Card and Debit Card Business by Indian BanksProf S P GargNessuna valutazione finora

- Injection Pump Test SpecificationsDocumento3 pagineInjection Pump Test Specificationsadmin tigasaudaraNessuna valutazione finora

- To Study The Nationalize Plastic Money Payment Gateway SystemDocumento39 pagineTo Study The Nationalize Plastic Money Payment Gateway SystemRajesh Singh100% (1)

- 50 Communication Activities Icebreakers and ExercisesDocumento248 pagine50 Communication Activities Icebreakers and ExercisesVaithiyanathan HaranNessuna valutazione finora

- Credit DebtDocumento41 pagineCredit Debtbns.publishing12100% (1)

- Credit CardDocumento18 pagineCredit Cardniti bhosale100% (1)

- Survey of Popularity of Credit Cards Issued by Different BanksDocumento3 pagineSurvey of Popularity of Credit Cards Issued by Different Bankspritam0000100% (2)

- You’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountDa EverandYou’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountValutazione: 2 su 5 stelle2/5 (1)

- DLL MIL Week 10-12Documento2 pagineDLL MIL Week 10-12Juanits BugayNessuna valutazione finora

- Plastic MoneyDocumento39 paginePlastic Moneydakshaangel100% (3)

- Credit Card: Dr. Yamini Sharma D.M.SDocumento31 pagineCredit Card: Dr. Yamini Sharma D.M.SJames RossNessuna valutazione finora

- On Credit CardDocumento31 pagineOn Credit Cardoureducation.in100% (1)

- Credit and Debit CardsDocumento16 pagineCredit and Debit CardsPriyal Shah100% (1)

- Credit Card PDFDocumento15 pagineCredit Card PDFTarun TiwariNessuna valutazione finora

- Features: Benefits To CustomersDocumento4 pagineFeatures: Benefits To CustomersAashi YadavNessuna valutazione finora

- Past Paper1Documento8 paginePast Paper1Ne''ma Khalid Said Al HinaiNessuna valutazione finora

- Synopsis: Study of Credit Card in Indian ScenarioDocumento12 pagineSynopsis: Study of Credit Card in Indian ScenarioHemraj PatilNessuna valutazione finora

- Learning-Module-in-Human-Resource-Management AY 22-23Documento45 pagineLearning-Module-in-Human-Resource-Management AY 22-23Theresa Roque100% (2)

- Mukkessshhh 23Documento65 pagineMukkessshhh 23Satinder ShindaNessuna valutazione finora

- Thesis About Debit CardsDocumento8 pagineThesis About Debit Cardsafkodpexy100% (2)

- Plastic MoneyDocumento105 paginePlastic Moneygkmrmanish100% (3)

- Eco 2ND YrDocumento23 pagineEco 2ND YrKrishna SaklaniNessuna valutazione finora

- Thesis Credit CardDocumento6 pagineThesis Credit Cardbk1xaf0p100% (2)

- Popularity of Credit Cards Issued by Different Banks BahrainDocumento33 paginePopularity of Credit Cards Issued by Different Banks BahrainRahul TannaNessuna valutazione finora

- Banking Practice Unit 5 What Is A 'Credit Card'Documento6 pagineBanking Practice Unit 5 What Is A 'Credit Card'Nandhini VirgoNessuna valutazione finora

- Banking Practice Unit 5 What Is A 'Credit Card'Documento6 pagineBanking Practice Unit 5 What Is A 'Credit Card'Nandhini VirgoNessuna valutazione finora

- Ecommerce Unit 4Documento12 pagineEcommerce Unit 4jhanviNessuna valutazione finora

- Credit and Debit Card Differentiation Assignment ResearchDocumento9 pagineCredit and Debit Card Differentiation Assignment Researchsaravana kumarNessuna valutazione finora

- Plastic Money: Subject - Financial ServicesDocumento24 paginePlastic Money: Subject - Financial Servicesshashikumarb2277Nessuna valutazione finora

- MFIS - Credit CardDocumento19 pagineMFIS - Credit Cardmudassar.shirgarcivilNessuna valutazione finora

- FMS ProjectDocumento16 pagineFMS ProjectVinod KumarNessuna valutazione finora

- New Credit CardsDocumento68 pagineNew Credit CardsManish GadekarNessuna valutazione finora

- Literature Review On The Credit Card IndustryDocumento4 pagineLiterature Review On The Credit Card IndustryKhushbooNessuna valutazione finora

- SynopsisDocumento20 pagineSynopsisJeetu VermaNessuna valutazione finora

- Plastic Money: By: Sunaina Verma Shashikant Mohd. Zeeshan Shashank TripathiDocumento25 paginePlastic Money: By: Sunaina Verma Shashikant Mohd. Zeeshan Shashank Tripathitarunavasyani100% (3)

- Module 1Documento16 pagineModule 1Hyacinth FNessuna valutazione finora

- Plastic Money: By: Sunaina Verma Shashikant Mohd. Zeeshan Shashank TripathiDocumento25 paginePlastic Money: By: Sunaina Verma Shashikant Mohd. Zeeshan Shashank Tripathihaz008Nessuna valutazione finora

- Plastic Money PDFDocumento25 paginePlastic Money PDFhaz00850% (2)

- Anita Mam Bank ProjectDocumento19 pagineAnita Mam Bank ProjectNisha AroraNessuna valutazione finora

- Credit Card by Urmimala MukherjeeDocumento47 pagineCredit Card by Urmimala Mukherjeeurmimala21Nessuna valutazione finora

- Credit CardDocumento5 pagineCredit CardRitesh TolaniNessuna valutazione finora

- All About CreditDocumento4 pagineAll About CreditShaira VeronicaNessuna valutazione finora

- Personal Financial Planning: Lovely ProfessionaluniversityDocumento13 paginePersonal Financial Planning: Lovely ProfessionaluniversityappuratabpappuNessuna valutazione finora

- Plastic MoneyDocumento3 paginePlastic MoneysachinremaNessuna valutazione finora

- Credit CardsDocumento11 pagineCredit CardsAleenah InayatNessuna valutazione finora

- Key BehaviorDocumento2 pagineKey Behaviorkhushnuma20Nessuna valutazione finora

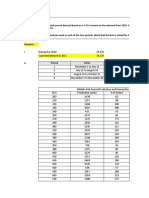

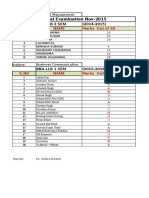

- Internal Exam Marks April 2016Documento2 pagineInternal Exam Marks April 2016khushnuma20Nessuna valutazione finora

- OkihggDocumento9 pagineOkihggkhushnuma20Nessuna valutazione finora

- Internal Exam Marks April 2016Documento2 pagineInternal Exam Marks April 2016khushnuma20Nessuna valutazione finora

- MBA Curriculum Syllabus 0 PDFDocumento56 pagineMBA Curriculum Syllabus 0 PDFkhushnuma20Nessuna valutazione finora

- Value Chain AnalysisDocumento33 pagineValue Chain AnalysismridulNessuna valutazione finora

- Amity LLB Intellectual Property Rights 2004 DecDocumento2 pagineAmity LLB Intellectual Property Rights 2004 Deckhushnuma20Nessuna valutazione finora

- Ali BhaiDocumento2 pagineAli Bhaikhushnuma20Nessuna valutazione finora

- Social Media Marketing SEMESTER PRvdsvcOJECT 2012Documento98 pagineSocial Media Marketing SEMESTER PRvdsvcOJECT 2012khushnuma20Nessuna valutazione finora

- Training & DevelpomentDocumento71 pagineTraining & Develpomentkhushnuma20Nessuna valutazione finora

- ICICI Pru Report PrabhakarcDocumento84 pagineICICI Pru Report Prabhakarckhushnuma20Nessuna valutazione finora

- FormatDocumento100 pagineFormatkhushnuma20Nessuna valutazione finora

- Mcro &mcro EcovdcDocumento10 pagineMcro &mcro Ecovdckhushnuma20Nessuna valutazione finora

- Pepsi Project OkDocumento87 paginePepsi Project Okkhushnuma20Nessuna valutazione finora

- Business CommunicationDocumento34 pagineBusiness Communicationkhushnuma20Nessuna valutazione finora

- Financial ManagementDocumento31 pagineFinancial ManagementSwati KamtheNessuna valutazione finora

- Ba 206 LPC 22Documento6 pagineBa 206 LPC 22rachna357Nessuna valutazione finora

- BC - Wea Ruyt TmjuhDocumento13 pagineBC - Wea Ruyt Tmjuhkhushnuma20Nessuna valutazione finora

- Wet DreamsDocumento2 pagineWet Dreamskhushnuma20Nessuna valutazione finora

- Ali BhaiDocumento1 paginaAli Bhaikhushnuma20Nessuna valutazione finora

- Interviewing: InterviewDocumento39 pagineInterviewing: InterviewAppu Moments MatterNessuna valutazione finora

- Unit 1 Introduction To Economics What Is An Economy?Documento8 pagineUnit 1 Introduction To Economics What Is An Economy?khushnuma20Nessuna valutazione finora

- Which School of Thought Should A Muslim FollowDocumento4 pagineWhich School of Thought Should A Muslim Followkhushnuma20Nessuna valutazione finora

- TNTPSCS Installation LogDocumento1 paginaTNTPSCS Installation Logkhushnuma20Nessuna valutazione finora

- Niyamat (Divine Blessing) and Amanat (Trust) From AllahDocumento6 pagineNiyamat (Divine Blessing) and Amanat (Trust) From Allahkhushnuma20Nessuna valutazione finora

- Why ArenDocumento4 pagineWhy Arenkhushnuma20Nessuna valutazione finora

- Dyeing OneDocumento2 pagineDyeing Onekhushnuma20Nessuna valutazione finora

- Collection of Kalmay: First KalimahDocumento3 pagineCollection of Kalmay: First Kalimahkhushnuma20Nessuna valutazione finora

- Staffing OkDocumento5 pagineStaffing Okkhushnuma20Nessuna valutazione finora

- Sajid, Aditya (Food Prossing)Documento29 pagineSajid, Aditya (Food Prossing)Asif SheikhNessuna valutazione finora

- Project Definition and DescriptionDocumento9 pagineProject Definition and DescriptionEileen VelasquezNessuna valutazione finora

- HDFCDocumento60 pagineHDFCPukhraj GehlotNessuna valutazione finora

- EXPE222Documento6 pagineEXPE222K-yanVehraaYomomaNessuna valutazione finora

- Plessy V Ferguson DBQDocumento4 paginePlessy V Ferguson DBQapi-300429241Nessuna valutazione finora

- LEARNING MODULE Entrep Lesson 1-2Documento19 pagineLEARNING MODULE Entrep Lesson 1-2Cindy BononoNessuna valutazione finora

- DockerDocumento35 pagineDocker2018pgicsankush10Nessuna valutazione finora

- CONCEPTUAL LITERATURE (Chapter 2)Documento2 pagineCONCEPTUAL LITERATURE (Chapter 2)lilibeth garciaNessuna valutazione finora

- Chelsea Bellomy ResumeDocumento1 paginaChelsea Bellomy Resumeapi-301977181Nessuna valutazione finora

- Performance Appraisal System-Jelly BellyDocumento13 paginePerformance Appraisal System-Jelly BellyRaisul Pradhan100% (2)

- Chapter 11 Towards Partition Add Pakistan 1940-47Documento5 pagineChapter 11 Towards Partition Add Pakistan 1940-47LEGEND REHMAN OPNessuna valutazione finora

- Class XI Economics 2011Documento159 pagineClass XI Economics 2011Ramita Udayashankar0% (1)

- English Holiday TaskDocumento2 pagineEnglish Holiday Taskchandan2159Nessuna valutazione finora

- Orca Share Media1579045614947Documento4 pagineOrca Share Media1579045614947Teresa Marie Yap CorderoNessuna valutazione finora

- Historical Perspective of Financial Reporting Regulations in MalaysiaDocumento2 pagineHistorical Perspective of Financial Reporting Regulations in Malaysiauglore100% (6)

- V.S.B Engineering College, KarurDocumento3 pagineV.S.B Engineering College, KarurKaviyarasuNessuna valutazione finora

- Exploring The OriginsDocumento12 pagineExploring The OriginsAlexander ZetaNessuna valutazione finora

- MYPNA SE G11 U1 WebDocumento136 pagineMYPNA SE G11 U1 WebKokiesuga12 TaeNessuna valutazione finora

- Turb Mod NotesDocumento32 pagineTurb Mod NotessamandondonNessuna valutazione finora

- Created by EDGAR Online, Inc. Dow Chemical Co /de/ Table - of - Contents Form Type: 10-K Period End: Dec 31, 2020 Date Filed: Feb 05, 2021Documento286 pagineCreated by EDGAR Online, Inc. Dow Chemical Co /de/ Table - of - Contents Form Type: 10-K Period End: Dec 31, 2020 Date Filed: Feb 05, 2021Udit GuptaNessuna valutazione finora

- Peace Corps Samoa Medical Assistant Office of The Public Service of SamoaDocumento10 paginePeace Corps Samoa Medical Assistant Office of The Public Service of SamoaAccessible Journal Media: Peace Corps DocumentsNessuna valutazione finora

- Etsi en 300 019-2-2 V2.4.1 (2017-11)Documento22 pagineEtsi en 300 019-2-2 V2.4.1 (2017-11)liuyx866Nessuna valutazione finora