Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Indian Life Insurance Companies-09mbi065

Caricato da

Vishnu PrasadDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Indian Life Insurance Companies-09mbi065

Caricato da

Vishnu PrasadCopyright:

Formati disponibili

Cost management&resorce Allocation

INDIAN LIFE INSURANCE COMPANIES - COST EFFICIENT

N.vishnu prasad (09mbi065)

2/26/2013

INDIAN LIFE INSURANCE COMPANIES - COST EFFICIENT

SUMMARY OF THE ARTICLE: The present paper estimated cost efficiency of the Life insurance companies operating in India. In recent years using the new cost efficiency approach suggested by Tone. Deregulations of the life insurance sector in India in end-1999, life insurance companies have made steady progress in terms of business growth. Modern form of life insurance in India can be traced back to 1818 when the British insurer. Oriental Life Insurance Company commenced business in India. Economic reforms in India initiated in the early 1990s saw the liberalisation of insurance business move up the governments policy agenda. The new regulator, Insurance Regulatory and Development Authority (IRDA) took office at the same time to oversee and regulate the market. Following the opening up of the life insurance sector, 15 new life insurance companies entered the market by 2006-07. Of late, the Indian life insurance market is drawing intense attention, fuelled in part by the fast expansion of its insurance markets. India is the second most populous country of the world with more than one billion population. The economic growth record is strong (more than 6% during the past one decade).In spite of these positive developments; the life insurance market in India is extremely under-penetrated.

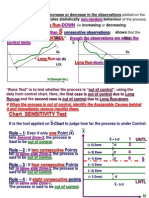

Concept of Cost Efficiency: Cost efficiency of a productive enterprise is an important indicator of its performance. The cost efficiency of a firm is defined by the ratio of minimum costs to actual costs for a given output vector is computed by measuring the distance of its observed (cost) point from an idealised cost frontier.

Estimation of Cost Efficiency: The New Approach(Measures taken) In the life insurance sector, input and output quantities are expressed in monetary terms. Further, the definition and calculation of input and output prices is rather difficult. During the eighties and nineties, the U.S. life insurance industry has experienced an unprecedented wave of mergers and acquisitions. Traditionally, the industry was characterized by high-cost distribution system and nonprice competition, However, the insurers increasingly faced with more intensive competition from non-traditional sources such as banks, mutual funds, and investment advisory firms which captured a major share of the market for asset accumulation products such as annuities and cash value life insurance. The increased competition has narrowed profit margins and motivated insurers to seek ways to reduce costs.

Technological advances in sales, pricing, underwriting, and policyholder services have forced insurers to become more innovative; and the relatively high fixed costs of the new systems may have affected the minimum efficient scale in the industry. Overall, mergers and acquisitions in the life insurance industry was found to have a beneficial effect on efficiency. A decline in performance after 19941995 can be taken as evidence of increasing allocate inefficiencies arising from the huge initial fixed cost undertaken by LIC in modernizing its operations. A significant increase in cost efficiency in 20002001 is, however, cause for optimism that LIC may now be realizing a benefit from such modernization. This will stand them in good stead in terms of future competition. For all the observed years, LIC and SBI Life have a technical efficiency score of 1. All other life Insurance firms are technically inefficient (technical efficiency score of less than 1).

Conclusion: In the present paper we have estimated cost efficiency of the Life insurance companies operating in India using the new cost efficiency approach suggested by Tone (2002). The results suggest an upward trend in cost efficiency of the observed life insurers between 2002-03 and 2004-05. However, the trend was reversed for the next two years i.e. 2005-06 and 2006-07.This has been so because of the fact that during the initial years of observation, mean cost efficiency of the private life insurers was raising but the trend was reversed in 2005-06 and 2006-07.

Reference: Banker, R, A. Charnes and W.W. Cooper, 1984, Some Models for Estimating Technical and Scale Efficiency, Management Science, 30:1078-1092. Farrell M.J.,1957, The Measurement of Productive Efficiency, Journal of The Royal Statistical Society, Series A, General, 120 (3) : 253 281

Potrebbero piacerti anche

- A Study On The Financial Performance of General Insurance Companies in IndiaDocumento7 pagineA Study On The Financial Performance of General Insurance Companies in IndiaanilNessuna valutazione finora

- Critical Analysis of Factors Affecting Life Insurance Company PerformanceDocumento24 pagineCritical Analysis of Factors Affecting Life Insurance Company PerformanceanupmidNessuna valutazione finora

- Enhancing Competitiveness: The Case of The Indian Life Insurance IndustryDocumento10 pagineEnhancing Competitiveness: The Case of The Indian Life Insurance Industryaayushgoel88Nessuna valutazione finora

- Analysis of Profitability in Indian Life InsuranceDocumento30 pagineAnalysis of Profitability in Indian Life InsuranceJenni PennyworthNessuna valutazione finora

- Impact of Operating Expenses On Life Insurance Profitability in IndiaDocumento8 pagineImpact of Operating Expenses On Life Insurance Profitability in IndiaTJPRC PublicationsNessuna valutazione finora

- Detariff 4Documento1 paginaDetariff 4GodwinChellaNessuna valutazione finora

- L ReviewDocumento18 pagineL ReviewMia SmithNessuna valutazione finora

- McKinsey Life Insurance 2.0Documento52 pagineMcKinsey Life Insurance 2.0Moushumi DharNessuna valutazione finora

- Application of Caramel Model To Life InsDocumento10 pagineApplication of Caramel Model To Life Insabhishek_mrscNessuna valutazione finora

- Study on Performance of India's Insurance IndustryDocumento9 pagineStudy on Performance of India's Insurance IndustrySubrat KumarNessuna valutazione finora

- Literature Review On Insurance CompanyDocumento25 pagineLiterature Review On Insurance Companyjusmi86% (7)

- Astudyonperformanceofinsuranceindustryin IndiaDocumento9 pagineAstudyonperformanceofinsuranceindustryin IndiaSUMIT THAKURNessuna valutazione finora

- IJREAMV05I1260085Documento7 pagineIJREAMV05I1260085Nishant SenapatiNessuna valutazione finora

- Kindler Volume XV January - June 2015Documento152 pagineKindler Volume XV January - June 2015Army Institute of Management, KolkataNessuna valutazione finora

- India Insurance Market: A Decade of TransformationDocumento4 pagineIndia Insurance Market: A Decade of TransformationparimittalNessuna valutazione finora

- Final Draft Report - 14 SeptDocumento50 pagineFinal Draft Report - 14 Septneelove1Nessuna valutazione finora

- Marketing Strategy of LicDocumento58 pagineMarketing Strategy of Licsoniharshvardhan214Nessuna valutazione finora

- Case StudyDocumento5 pagineCase StudyNaina ManeNessuna valutazione finora

- Dfin404 2114500722Documento10 pagineDfin404 2114500722mohanshivramka1936Nessuna valutazione finora

- 19438role CA InsuranceDocumento4 pagine19438role CA InsuranceThaneesh KumarNessuna valutazione finora

- A Report ON Customers Perception Towards Life Insurance After PrivatizatonDocumento44 pagineA Report ON Customers Perception Towards Life Insurance After PrivatizatonAnshita GargNessuna valutazione finora

- Iffco Tokio General Insurance CompanyDocumento9 pagineIffco Tokio General Insurance CompanyShauvik GhoshNessuna valutazione finora

- P's of Marketing and Life Insurance IndustryDocumento5 pagineP's of Marketing and Life Insurance IndustryatulbhushanNessuna valutazione finora

- INSURANCE INNOVATION REFORMSDocumento63 pagineINSURANCE INNOVATION REFORMSShaheen ShaikhNessuna valutazione finora

- Executive SummaryDocumento44 pagineExecutive SummaryAvinash LoveNessuna valutazione finora

- Customer Satisfaction of Life Insurance CompaniesDocumento7 pagineCustomer Satisfaction of Life Insurance CompaniesGudiyaNessuna valutazione finora

- Internship Report ON Study On Marketing Strategy of United India Insurance Company LimitedDocumento11 pagineInternship Report ON Study On Marketing Strategy of United India Insurance Company LimitedfordacNessuna valutazione finora

- 14 - Performance Evaluation of United India Insurance Company LimitedDocumento13 pagine14 - Performance Evaluation of United India Insurance Company LimitedDanish PathanNessuna valutazione finora

- Asset Size and Profitability of Life Insurance Companies in Nigeria. A Panel Data ApproachDocumento13 pagineAsset Size and Profitability of Life Insurance Companies in Nigeria. A Panel Data Approachhoshyjoshy2001Nessuna valutazione finora

- Insurance sector growth in IndiaDocumento26 pagineInsurance sector growth in IndiaPandya DevangNessuna valutazione finora

- 3 PDFDocumento24 pagine3 PDFRym CharefNessuna valutazione finora

- Insurance Sector Report1Documento22 pagineInsurance Sector Report1monika_kalyaniNessuna valutazione finora

- Chaneel Case ArticleDocumento6 pagineChaneel Case ArticleMangipudi SeshagiriNessuna valutazione finora

- Financial Performance of Indian Life InsurersDocumento9 pagineFinancial Performance of Indian Life InsurersSathya KamarajNessuna valutazione finora

- ICICI Lombard and New India Assurance Segment AnalysisDocumento40 pagineICICI Lombard and New India Assurance Segment AnalysisafsalmNessuna valutazione finora

- Executive Summary: M.S.R.C.A.S.C BangaloreDocumento72 pagineExecutive Summary: M.S.R.C.A.S.C BangaloreSubramanya Dg100% (2)

- New India Assurance CoDocumento59 pagineNew India Assurance CoAnandi KonarNessuna valutazione finora

- Company Profile and ProductsDocumento53 pagineCompany Profile and ProductsTarun KumarNessuna valutazione finora

- Current LIC ProjDocumento4 pagineCurrent LIC ProjAmit VinerkarNessuna valutazione finora

- IJCRT2104289Documento11 pagineIJCRT2104289Dhrumil DeliwalaNessuna valutazione finora

- Conclusion and Suggestions: 6.1.1 Strengths/Opportunities of Insurance IndustryDocumento9 pagineConclusion and Suggestions: 6.1.1 Strengths/Opportunities of Insurance IndustryRavindra KumarNessuna valutazione finora

- A Summer Training Report ON: "Designing A Strategy For Servicing Customers"Documento66 pagineA Summer Training Report ON: "Designing A Strategy For Servicing Customers"Shubham BhattNessuna valutazione finora

- Life Insurance-India 4Documento10 pagineLife Insurance-India 4sambitparija7199Nessuna valutazione finora

- HRM in InsuranceDocumento60 pagineHRM in InsuranceRiddhi GalaNessuna valutazione finora

- Efficiency of Life InsurersDocumento16 pagineEfficiency of Life InsurersDharmendra SinghNessuna valutazione finora

- Strategic Management Group Assignment: Industry Name:-InsuranceDocumento59 pagineStrategic Management Group Assignment: Industry Name:-InsuranceReemaChavan1234Nessuna valutazione finora

- A Usa Grenee Sfa 2004Documento33 pagineA Usa Grenee Sfa 2004ridwanbudiman2000Nessuna valutazione finora

- Accdintal Insurance OkDocumento67 pagineAccdintal Insurance Okdk6666Nessuna valutazione finora

- Live Project FinalDocumento25 pagineLive Project FinalAmanjotNessuna valutazione finora

- Ijems V3i1p102 PDFDocumento6 pagineIjems V3i1p102 PDFDeepali wadate:v:Nessuna valutazione finora

- Foreign Direct Investment in Indian Insurance Industry - An Analytical StudyDocumento6 pagineForeign Direct Investment in Indian Insurance Industry - An Analytical StudyDeepali wadate:v:Nessuna valutazione finora

- Rise and Fall of Ulips in Indian Life Insurance Market: Dr. K VidyavathiDocumento13 pagineRise and Fall of Ulips in Indian Life Insurance Market: Dr. K VidyavathiAnirudh Singh ChawdaNessuna valutazione finora

- Life Insurance Industry in India - Current ScenarioDocumento5 pagineLife Insurance Industry in India - Current Scenariorajanityagi23Nessuna valutazione finora

- Swot AnalysisDocumento40 pagineSwot AnalysisMohmmedKhayyumNessuna valutazione finora

- Effect of Globalization, Liberalization, Privatization: Has Globalization Helped or Hurt The Insurance Industry?Documento4 pagineEffect of Globalization, Liberalization, Privatization: Has Globalization Helped or Hurt The Insurance Industry?mansi_shah_15Nessuna valutazione finora

- Successfully Reducing Operating Costs PDFDocumento16 pagineSuccessfully Reducing Operating Costs PDFfajarz8668Nessuna valutazione finora

- Mis Selling: CompetitionDocumento3 pagineMis Selling: Competitionmeggie123Nessuna valutazione finora

- Emerging FinTech: Understanding and Maximizing Their BenefitsDa EverandEmerging FinTech: Understanding and Maximizing Their BenefitsNessuna valutazione finora

- EcoDocumento1 paginaEcoVishnu PrasadNessuna valutazione finora

- Network Analysis Techniques for Project Planning and SchedulingDocumento3 pagineNetwork Analysis Techniques for Project Planning and SchedulingVishnu PrasadNessuna valutazione finora

- 3.recruitment and SelectionDocumento36 pagine3.recruitment and SelectionVaibhav PrasadNessuna valutazione finora

- 33059706Documento2 pagine33059706Vishnu PrasadNessuna valutazione finora

- Indian Life Insurance Companies-09mbi065Documento3 pagineIndian Life Insurance Companies-09mbi065Vishnu PrasadNessuna valutazione finora

- Indian Life Insurance Companies-09mbi065Documento3 pagineIndian Life Insurance Companies-09mbi065Vishnu PrasadNessuna valutazione finora

- Service Product 2013Documento84 pagineService Product 2013Vishnu PrasadNessuna valutazione finora

- Indian Life Insurance Companies-09mbi065Documento3 pagineIndian Life Insurance Companies-09mbi065Vishnu PrasadNessuna valutazione finora

- Service Product 2013Documento84 pagineService Product 2013Vishnu PrasadNessuna valutazione finora

- RBC QuestionsDocumento3 pagineRBC QuestionsVishnu PrasadNessuna valutazione finora

- Business Growth Through People Growth 25thapr00 - tcm114-136023Documento8 pagineBusiness Growth Through People Growth 25thapr00 - tcm114-136023Vishnu PrasadNessuna valutazione finora

- Main Threats and OpportunitiesDocumento13 pagineMain Threats and OpportunitiesVishnu PrasadNessuna valutazione finora

- 46 99 1 PBDocumento6 pagine46 99 1 PBVishnu PrasadNessuna valutazione finora

- Process CostingDocumento1 paginaProcess CostingVishnu PrasadNessuna valutazione finora

- JPM TQM Course Mat-3 T-3 Imba 2013Documento15 pagineJPM TQM Course Mat-3 T-3 Imba 2013Vishnu PrasadNessuna valutazione finora

- JPM TQM Course Mat-4 T-3 Imba 2013Documento4 pagineJPM TQM Course Mat-4 T-3 Imba 2013Vishnu PrasadNessuna valutazione finora

- JPM TQM Course Mat-2 T-3 Imba 2013Documento20 pagineJPM TQM Course Mat-2 T-3 Imba 2013Vishnu PrasadNessuna valutazione finora

- JPM TQM Course Mat-5 T-3 Imba 2013Documento14 pagineJPM TQM Course Mat-5 T-3 Imba 2013Vishnu PrasadNessuna valutazione finora

- JPM TQM Course Mat-1 T-3 Imba 2013Documento32 pagineJPM TQM Course Mat-1 T-3 Imba 2013Vishnu Prasad100% (1)

- Knowledge TransferDocumento11 pagineKnowledge TransferVishnu PrasadNessuna valutazione finora

- Food and Asian IntgDocumento3 pagineFood and Asian IntgVishnu PrasadNessuna valutazione finora

- JPM TQM Course Mat-1 T-3 Imba 2013Documento32 pagineJPM TQM Course Mat-1 T-3 Imba 2013Vishnu Prasad100% (1)

- Southeast AsiaDocumento5 pagineSoutheast AsiaVishnu PrasadNessuna valutazione finora

- Knowledge Management (KM)Documento90 pagineKnowledge Management (KM)Vishnu PrasadNessuna valutazione finora

- Article Abt ChinaDocumento4 pagineArticle Abt ChinaVishnu PrasadNessuna valutazione finora

- Sharing Tacit KnowledgeDocumento15 pagineSharing Tacit KnowledgeVishnu Prasad100% (1)

- China - Business and Social News - Collection: China's Individual, Private Businesses Top 40.6mDocumento10 pagineChina - Business and Social News - Collection: China's Individual, Private Businesses Top 40.6mVishnu PrasadNessuna valutazione finora

- America Needs A Business Pivot Toward AsiaDocumento2 pagineAmerica Needs A Business Pivot Toward AsiaVishnu PrasadNessuna valutazione finora