Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Venture Capital Fund Project

Caricato da

Adii AdityaCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Venture Capital Fund Project

Caricato da

Adii AdityaCopyright:

Formati disponibili

Venture Capital Fund

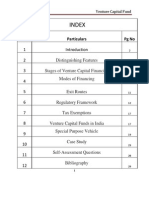

INDEX

Sr No 1 2 3 4 5 6 7 8 9 10 11 12 Particulars Introduction Distinguishing Features Stages of Venture Capital Financing Modes of Financing Exit Routes Regulatory Framework Tax Exemptions Venture Capital Funds in India Special Purpose Vehicle Case Study Self-Assessment Questions Bibliography

29 1

Pg No

2

10

11

12

17

17

19

23

28

Venture Capital Fund

INTRODUCTION

Venture capital is a type of private equity capital typically provided for early-stage, high-potential, growth companies in the interest of generating a return through an

eventual realization event such as an IPO or trade sale of the company. Venture capital investments are generally made as cash in exchange for shares in the invested company. V enture capital finance is often used as the early stage financing of new and young enterprises seeking to grow rapidly.

A venture capitalist is a person or investment firm that makes venture investments, and these venture capitalists are expected to bring managerial and technical expertise as well as capital to their investments.

A venture capital fund refers to a pooled investment vehicle that primarily invests the financial capital of third-party investors in enterprises that are too risky for the standard capital markets or bank loans. The term Venture Capital is understood in many ways. In a narrow sense, it refers to, investment in new and tried enterprises that are lacking a stable record of growth. In a broader sense, venture capital refers to the commitment of capital as shareholding, for the formulation and setting up of small firms specializing in new ideas or new technologies. It is not merely an injection of funds into a new firm, it is a simultaneous input of skill needed to set up the firm, design its marketing strategy and organize and manage it. It is an association with successive stages of firms development with distinctive types of financing appropriate to each stage of development.

2

Venture Capital Fund

According to International Finance Corporation (IFC), venture capital is equity or equity featured capital seeking investment in new ideas, new companies, new production, new process or new services that offer the potential of high returns on investments.

As defined in Regulation 2(m)of SEBI (Venture Capital Funds) Regulation , 1996 "venture capital fund means a fund established in the form of a company or trust which raises monies through loans, donations issue of securities or units as the case may be, and makes or proposes to make investments in accordance with these regulations. Venture capitalists generally: Finance new and rapidly growing companies; Purchase equity securities; Assist in the development of new products or services; Add value to the company through active participation; Take higher risks with the expectation of higher rewards; Have a long-term orientation

Meaning of Venture Capital

Venture capital is long-term risk capital to finance high technology projects which involve risk but at the same time has strong potential for growth. Venture capitalist pools their resources including managerial abilities to assist new entrepreneur in the early years of the project. Once the project reaches the stage of profitability, they sell their equity holdings at high premium.

Definition of the Venture Capital Company

A venture capital company is defined as a financing institutions which joints an entrepreneur as a co-promoter in a project and shares the risks and rewards of the enterprise.

3

Venture Capital Fund

The Origin of Venture Capital

USA is the birth place of Venture Capital Industry as we know it today. During most its historical evolution, the market for arranging such financing was fairly informal, relying primarily on the resources of wealthy families.

In 1946, American Research and Development Corporation (ARD), a publicly traded, closed-end investment company was formed. ARD's best known investment was the start-up financing it provided in 1958 for computer maker Digital Equipment Corp.

ARD was eventually profitable, providing its original investors with a 15.8 percent annual rate of return over its twenty-five years as an independent firm. General Doriot, a professor at Harvard Business School, set up the ARD, the first firm, as opposed to private individuals, at MIT to finance the commercial promotion of advanced technology developed in the US Universities. ARD's approach was a classic VC in the sense that it used only equity, invested for long term, and was prepared to live with losers. ARD's investment in Digital Equipment Corporation (DEC) in 1957 was a watershed in the history of VC financing.

Characteristics of Venture Capital

The three primary characteristics of venture capital funds which may them eminently suitable as a source of risk finance are: (1) that it is equity or quasi equity investments; (2) it is long-term investment; and (3) it is an active from of investment.

Venture Capital Fund

First, venture capital is equity or quasi equity because the investor assumes risk. There is no security for his investment. Venture capital funds by participating in the equity capital institutionalize the process of risk taking which promotes successful domestic technology development.

Secondly, venture capital is long-term investment involving both money and time.

Finally, venture capital investment involves participation in the management of the company. Venture capitalist participates in the Board and guides the firm on strategic and policy matters. The features of venture capital generally are, financing new and rapidly growing companies; purchase of equity shares; assist in transformation of innovative technology based ideas into products and services; and value to company by active participation; assume risks in the expectation of large rewards; and possess a long-term perspective. These features of venture capital render it eminently suitable as a source of risk capital for domestically developed technologies

DISTINGUISHING FEATURES

Venture Capital can be distinguished from other forms of finance on the basis of its special characteristics which are as follows: 1 ) The most distinguishing feature of Venture Capital is that it is provided largely in the form of equity, when the investee company is unable to float its equity shares independently in the market, or from other sources in the initial stage. Thus risk capital is provided, which is not available otherwise due to the high degree of risk involved in the venture.

Venture Capital Fund

2) The venture capitalist, though participates in the equity, does not intend to act as the owner of the enterprise. The venture capitalist does not participate in the day-to-day management, but aids and guides the management by providing the benefit of his skill, experience and expertise. He nurtures the new enterprise till it enters the profitearning stage. 3) The Venture Capitalist does not intend to retain his investment in the investee company for ever. He intends to divest his shares, as soon as the company becomes a profitable business and the returns from the business are high as per expectations. At this stage he withdraws himself from the venture and in turn provides finance for another venture. 4) A Venture Capitalist intends to earn largely by way of capital gains arising out of sale of his equity holdings, rather than through regular returns in the form of interest on loans. 5) A Venture Capitalist also provides conditional loans which entitles him to earn royalties on sales depending upon the expected profitability of the business. (Such loan is partly or fully waived if the business enterprise does not prove to be a success).

EQUITY PARTICIPATION:

Venture financing is potential equity participation through direct purchase of shares, options or convertible securities. However, it can also be made in the form of convertible debt and therefore, it is not exclusively equity investment.

LONG-TERM INVESTMENT:

Venture financing requires long-term investment attitude that necessitates the venture capital firms to wait for a long period say 5 to 10 yrs, to make large profits.

PARTICIPATION IN MANAGEMENT:

It ensures continuing participation of the venture capitalist in the management of entrepreneurs business. It also provides business skills to the investee firms which is termed as hands on approach.

6

Venture Capital Fund HIGH RISK RETURN:

Some of the ventures yield very high profitable returns. The returns are essentially through capital gains at the time of exits from disinvestments in the capital market.

PRIVATE EQUITY:

Private equity can be used to develop new products and technologies, to expand working capital, to make acquisitions, or to strengthen a company's balance sheet.

WIDE SCOPE:

Technology finance is a sub-set of VC financing. Besides financing high-technology oriented companies, it also involves financing of small and medium sized firms until they are established.

STAGES OF VENTURE CAPITAL FINANCING

A venture capital fund provides finance to the venture capital undertaking at different stages of its life cycle according to requirements. These stages are broadly classified into two, viz. (i) Early stage financing, and (ii) Later stage financing. Each of them is further sub-divided into a number of stages. We shall deal with them individually. 1. Early Stage Financing includes: (i) Seed capital stage, (ii) Start-up stage, and (iii) Second round financing. Seed Capital stage/pre-commercialization financing : The venture is still in the idea formation stage and its product or service is not fully developed. It's rare for a venture capital firm to fund this stage. The main risk at this stage is marketing related.

7

Venture Capital Fund

Promoters must take the advantage of market opportunity, timing of launching of product etc. In most cases, the money must come from the founder's own pocket, from the "3 Fs" (Family, Friends, and Fools), and occasionally from angel investors. Risk perception is very high. Start-Up Stage : In this stage, the commercial manufacturing has to commence.VC is provided for product development and initial marketing. Product/service is commercialized for the first time and some indication of the potential market for new product is available. New projects such as those based on new or high technology or in which the entrepreneur has good knowledge and working experience are included. Second Round Financing: The Stage at which the process has already been launched in the market but the business has not yet become profitable enough for the public offering to attract new investors. Promoter has invested his own funds but more funds are required to be infused by VCIs than at the early stage of financing. 2. Later stage financing: Even when the business of the entrepreneur is established it requires additional finance, which cannot be secured by offering shares by way of the public issue. Venture capital funds prefer later stage financing as they anticipate income at a shorter duration and capital gains subsequently. Later stage financing may take the following forms: i) Expansion Finance: Expansion finance may be needed by an enterprise for adding production capacity once it has successfully gained market share and

8

Venture Capital Fund

expects growth in demand for its product. Expansion of an enterprise may take the form of an organic growth or by way of acquisition or takeover. ii) Replacement Finance: In this form of financing, the venture capitalist purchases the shares from the existing shareholders of the company who are willing to exit from the company. Such a course is often adopted with the investors who want to exit from the investee company, and the promoters do not intend to list its shares in the secondary market, the venture capitalist perceives growth of the company over 3 to 5 years and expects to earn capital gain at a much shorter duration. iii) Turn Around: Subset of buy-outs and involve buying the control of a sick company. Two kinds of inputs are required-money and management. VCIs have to identify good management and operations leadership. Time frame-3 to 5 years and involves medium to high risk iv) Buyout Deals: These refer to the transfer of management control. Two types Management Buy-Outs: VCIs provide funds to enable current operating management /investors to acquire an existing business. Management buy-ins: Funds provided to enable an outside group(of managers)to buy an ongoing company. They usually bring three things together-a management team, a target company and an investor(VCI). More risky than MBOs because management comes from outside and find it difficult to assess the actual potential of the target company. Buy-Outs involve a time frame from investment to IPO of 1 to 3 years with low risk perception

9

Venture Capital Fund

MODES OF FINANCING

The venture capital funds provide finance to venture capital undertakings through different modes/instruments which are traditionally divided into: (i) equity, and (ii) debt instruments. Investment is also made partly by way of equity and partly as debt. The VCFs select the instrument of finance taking into account the stage of financing, the degree of risk involved and the nature of finance required. These instruments are detailed below:

a) Equity Instruments: Equity instruments are ownership instruments and bestow the rights of the owner on the investor/VCFs. They are:

i) Ordinary Shares on which no dividend is assured. Non-voting equity shares may also be issued, which carry a little higher dividend, but no voting rights are enjoyed by the investors. There may be different variants of equity shares also, e.g. deferred equity shares on which the ordinary shares rights are deferred till a certain period or happening of an event. Moreover, preferred ordinary shares carry an additional fixed income. ii) Preference Shares carry an assured dividend at a specified rate. Preference shares may be cumulative/non-cumulative, participating preference shares which provide for an additional dividend, after payment of dividend to equity shareholders. Convertible preference shares are exchangeable with the equity shares after a specified period of time. Thus, the venture capital fund can select the instrument with flexibility.

b) Debt Instruments: VCFs prefer debt instruments to ensure a return in the earlier years of financing when the equity shares do not give any return. The debt instruments are of various types, as explained below:

10

Venture Capital Fund

i) Conditional Loans: On conditional loans, no interest rate as lower rate of interest and no payment period is prescribed. The VC funds, recover their funds, along with the return thereon by way of a share in the sales of the undertaking for a specified period of time. This percentage is pre-determined by VCFs. The recovery by the VCFs depends upon the success of the business enterprise. Hence, such loans are termed as conditional loans . ii) Convertible Loans: Sometimes loans are provided with the stipulation that they may be converted into equity at a later stage at the option of the lender or as agreed upon between the two parties. iii) Conventional Loans: These loans are the usual term loans carrying a specified rate of interest and are repayable in installments over a number of years.

EXIT ROUTES

The venture capital company/fund after financing a venture capital undertaking nurtures it to make it a successful proposition, but it does not intent to retain its investment therein forever. As the venture capital undertaking starts its commercial operations and reaches the profit-earning stage, the venture capitalist endeavours to disinvest its investments in the company at the earliest. The primary aim of the venture capitalist happens to realize appreciation in the value of the shares held by him and thereafter to finance another venture capital undertaking. This is called the exit route. There are several alternatives before venture capitalist to exit from an investee company, as stated below: i) Initial Public Offering: When the shares of the investee company are listed on the stock exchange(s) and are quoted at a premium, the venture capitalist offers his holdings for public sale through public issue. ii) Buy back of Shares by the Promoters: In terms of the agreement entered into with the investee company, promoters of the company are given the first opportunity to buy

11

Venture Capital Fund

back the shares held by the venture capitalist, at the prevailing market price. In case they refuse to do so, other alternatives are resorted to by the venture capitalist. iii) Sale of Enterprise to another Company: Venture capitalist can recover his investments in the investee company by selling the holdings to outsider who is interested in buying the entire enterprise from the entrepreneur. iv) Sale to New Venture Capitalist: A venture capitalist can sell his equity holdings in the enterprise to a new venture capital company, who might be interested in buying the ownership portion of the venture capital. Such sale may be distress sale by the venture capitalist to realize the investments and exit from the enterprise. Alternatively, such sale may be for inducting a willing venture capitalist who wishes to take the existing liability in the company to provide second round of funding. v) Self-liquidating Process: In case of debt financing by the venture capitalist, the process is self-liquidating in nature, as the principal amount, along with interest is realized in installments over a specified period of time. vi) Liquidation of the Investee Company: If the investee company does not become profitable and successful and incurs losses, the venture capitalist resorts to recover his investment by negotiation or settlement with the entrepreneur. Failing which the recovery is resorted to by means of winding up of the enterprise through the court.

REGULATORY FRAMEWORK

The venture capital funds and venture capital companies in India were regulated by the Guidelines issued by the Controller of Capital Issues, Government of India, in 1988. In 1995, Securities and Exchange Board of India Act was amended which empowered SEBI to register and regulate the Venture Capital Funds in India. Subsequently, in December, 1996 SEBI issued its regulations in this regard .These

12

Venture Capital Fund

regulation replaced the Government Guidelines issued earlier. The SEBI guidelines, as amended in 2000, are as follows: 1) Definitions A Venture Capital Fund has been defined to mean a fund established in the form of a trust or a company including a body corporate and registered with SEBI which i) Has a dedicated pool of capital, raised in the specified manner, and ii) Invests in venture capital undertakings in accordance with these regulations. A Venture Capital Fund may be set up either as a trust or as a company. The purpose of raising funds should be to invest in Venture Capital Undertakings in the specified manner. A Venture Capital Undertaking means a domestic company i) Whose shares are not listed on a recognized stock exchange in India, and ii) Which is engaged in the business for providing services, production or manufacture of articles or things and does not include such activities or sectors which have been included in the negative list by the Board. The negative list of activities includes real estate, non-banking financial services, gold financing, activities not permitted under Governments Industrial Policy and any other activity specified by the Board.

2) Registration of Venture Capital Funds A venture capital fund may be set up either by a company or by a trust. SEBI is empowered to grant a certification of registration to the fund on an application made to it. The applicant company or trust must fulfill the following conditions: i) The memorandum of association of the company must specify, as its main objective, the carrying of the activity of a venture capital fund. ii) It is prohibited by its memorandum of association and Articles of Association from making an invitation to the public to subscribe to its securities.

13

Venture Capital Fund

iii) Its director, or principal officer or employee is not involved in any litigation connected with the securities market. iv) Its director, principal officer or employee has not been at any time convicted of an offence involving moral turpitude or any economic offence. v) The applicant is a fit and proper person. 3) Resources for Venture Capital Fund A Venture Capital Fund may raise moneys from any investor India, foreign or non Resident Indian by way of issue of units, povided the minimum amount accepted from an investor is Rs. 5 lakh. This restriction does not apply to the employees, principal officer or directors of the venture capital fund, or non-Resident Indians or persons or institutions of Indian Origin. It is essential that the venture capital fund shall not issue any document or advertisement inviting offers from the public for subscription to its securities/units. Moreover, each scheme launched or fund set up by a venture capital fund shall have firm commitment from the investors to contribute at least Rs. 5 crore before the start of its operations. 4) Investment Restrictions While making investments, the venture capital fund shall be subject to the following conditions: a) A Venture Capital Fund shall disclose the investment strategy at the time of application for registration. b) A Venture Capital Fund shall not invest more than 25% of its corpus in one venture capital undertaking. c) It shall not invest in the associated companies.

14

Venture Capital Fund

d) It shall make investment in the venture capital undertakings as follows: i) at least 75% of the investible funds shall be invested in unlisted equity shares or equity-linked instruments (i.e., instruments convertible into equity shares or share warrants, preference shares, debentures compulsorily convertible into equity), ii) not more than 25% of the investible funds may be invested by way of a) subscription to initial public offer of a venture capital undertaking whose shares are proposed to be listed, subject to a lock in period of one year. b) debt or debt instruments of a venture capital undertaking in which the venture capital fund has already made investment by way of equity. 5) Prohibition on Listing The securities or units issued by a venture capital fund shall not be entitled to be listed on any recognized stock exchange till the expiry of 3 years from the date of issuance of such securities or units. 6) Private

Placement of Securities/Units

A venture capital fund may receive moneys for investment in the venture capital undertakings only through private placement of its securities/units. For this purpose the venture capital fund/company shall issue a placement memorandum which shall contain details of the terms subject to which moneys are proposed to be raised. Alternatively, it shall enter into contribution or subscription agreement with the investors, which shall specify the terms and conditions for raising money.

7) Winding up of Venture Capital Fund Scheme A Scheme of a Venture Capital Fund set up as a Trust shall be wound up, in any of the following circumstances, namely:

15

Venture Capital Fund

i) ii) when the period of the scheme, if any is over or if the trustees are of the opinion that the winding up shall be in the interest of the

investors, or iii) 75% of the investors in the scheme pass a resolution for the winding up, or iv)

SEBI so directs in the interest of investors. A Venture Capital Company shall be wound up in accordance with the provisions of the Companies Act. 8) Powers of the Securities and Exchange Board of India SEBI has the following powers: a) to appoint inspecting/investigating officers to undertake inspection/investigation of the books of accounts, records and documents of Venture Capital Fund. b) to suspend the certificate granted to a Venture Capital Fund if it contravenes any provisions of the SEBI Act or these guidelines or fails or defaults in submitting any information as required by SEBI or submits false/misleading information, etc. c) to cancel the certificate in the following cases: i) Venture capital fund is guilty of fraud or has been convicted of an offence involving moral turpitude. ii) Venture capital fund has been guilty of repeated defaults mentioned in (b) above. iii) Venture capital fund contravenes any of the provisions of the Act or the Regulations

16

Venture Capital Fund

TAX EXEMPTIONS

Clause 23F was inserted in Section 10 of the Income Tax Act in the year 1995 to exempt income by way of dividends or long term capital gains of a venture capital fund/company, derived from investments in equity shares of venture capital undertakings, subject to fulfillment of certain conditions.

Since the financial year 2000-01 under clause 23FB the entire income of venture capital funds has been granted exemption from taxation as these incomes merely pass through the dividends to investors. Hence, from the assessment year 2001-02 any income of venture capital fund/company has been exempted. Such exemption continues even after the shares of venture capital undertaking are listed on a recognized stock exchange. Income distributed by the venture capital funds will be taxed in the hands of the investors at rates applicable to them.

Services sector has also been included under the venture capital functions

VENTURE CAPITAL FUNDS IN INDIA

This concept was introduced in India in 1987. It was operated by Industrial Development bank of India. In the same year Industrial Credit and Investment Corporation of India had also started venture capital activity. Government started levied 5% cess on all payments related to venture fund.

Venture capital funds are comparatively of recent origin in India. As new technological developments and growth of entrepreneurship have started in India during the last

17

Venture Capital Fund

two/three decades, a number of venture capital funds have been set up in India. These funds have been promoted by institutions at the national and state levels, banks and private sector individuals, as shown in the following chart. In 2003 there were 43 domestic venture capital funds and 6 foreign capital funds registered with SEBI. Amongst the Commercial Banks, ANZ Grindlays Bank set up the first private sector venture capital fund, namely; India Investment Fund with an initial capital of Rs. 10 crore subscribed by Non-Resident Indians. Amongst the Indian banks, the subsidiaries of State Bank of India and Canara Bank have floated venture capital funds. Gujarat Venture Capital Finance Ltd., set up by Gujarat Industrial and Investment Corporation Ltd. in association with the World Bank, is a pioneer venture capital firm in India. Its investors include the World Bank, Gujarat Industrial and Investment Corporation, Industrial Development Bank of India, CDC (UK) SIDBI and other private and public sector organisations. Currently, it is managing four funds. IL&FS Vcnture Corporation Ltd. is a fund management company. It is a subsidiary of Infrastructure Leasing and Financial Services Ltd. set up jointly with Bank of India and multilateral development agencies. It was earlier known as Credit Capital Venture Fund (India) Ltd. At present the company is managing 7 domestic venture capital funds. IFB Venture Capital Finance Ltd: This company has been promoted by IFB Industries Ltd. jointly with IDBI and ICICI. IFCI Venture Capital Funds Ltd. (IVCF): In 1975, the IFCI Ltd. established Risk Capital Foundation as a society to provide risk capital assistance in the form of soft loans to professionals and technocrats setting up their own industrial ventures. In 1988, this society was converted into a company named Risk Capital and Technology Finance Corporation Ltd. primarily to provide direct equity to the companies (instead of providing soft loans to promoters). It introduced Technology Finance and Development

18

Venture Capital Fund

Scheme in 1988 to provide finance for improvement of technology. Subsequently, it took up the management of a venture fund to provide finance for innovative projects. The earlier two schemes were discontinued and its entire focus was laid on management of venture capital. The company is now known as IFCI Venture Capital Funds Ltd. Venture Capital Fund of IDBI IDBI has constituted a Venture Capital Fund with the objective to encourage commercial application of indigenous technologies or adoption of imported technologies, development of innovative products and services, holding substantial potential for growth and bankable ventures involving higher risk including those in the Information Technology sector.

SPECIAL PURPOSE VEHICLE

The Definition An account, administered by a third party that holds shares bought back by the management in trust.

19

Venture Capital Fund

ADVANTGES DISADVANTAGES Most venture capitalists seek to realize their investment in a company in 3-5 years. If an entrepreneurs business plan contemplates a longer timetable before providing liquidity, venture capital may not be appropriate. Entrepreneurs should also consider: Pricing Intrusion Control

They allow entrepreneurs to build their company with OPM (other people's money).

Mentoring Alliances Facilitate exit

Pros and Quos of VCF

Success factors of VCFs

1. Industry-specific concentration of investments yields better returns than geographically concentrated investments. 2. Networking with industrial partners is important since these target companies are potential clients and exit partners. 3. Networking with universities and research institutes helps identify new technologies and investment targets. 4. Concentrating investments in carefully selected companies showing international promise will yield better returns than distributing the capital across several smaller investments. It is crucial that venture capitalists actively support the growth and internationalization of the companies through their industry-specific know-how and international contacts. 5. With respect to the returns from the fund, it is vital that adequate capital is reserved for further investment in the best investment targets and for maintaining the holdings until the exit.

20

Venture Capital Fund

Critical Factors In 1999, SEBI (Securities and Exchange Board of India) had set up a committee under the Chairmanship of Mr. K. B. Chandrasekhar to look into the issues of venture capital in India. The Report of the K. B. Chandrasekhar Committee on venture capital identified the following as critical factors for the success of VC industry in India: The regulatory, tax and legal environment should play an enabling role. This emphasizes the facilitating and promotional role of regulation. Internationally, venture funds have evolved in an atmosphere of structural flexibility, fiscal neutrality and operational adaptability. And we need to provide regulatory simplicity and structural flexibility on the same lines. There is also the need for a level playing field between domestic and offshore venture capital investors. This has already been done for the mutual fund industry in India. Investment, management and an exit option should provide flexibility to suit the business requirements and should also be driven by global trends. Venture capital investments have typically come from high net worth individuals who have risk taking capacity. Since high risk is involved in venture financing, venture investors globally seek investment and exit on very flexible terms, which provides them with certain levels of protection. Such exit should be possible through IPOs and mergers / acquisitions on a global basis and not just within India.

21

Venture Capital Fund

Problems generally associated with Venture Capital

1. The risk associated with true venture capital is greater than when providing capital to an established business. Despite the best efforts and intentions, some start-ups will not succeed. That is simply part of the game. In today's market, though, especially if dealing with highly leveraged corporations, we have seen there is substantial risk associated with well established businesses as well as with start-ups. The risk is different, though, and people providing true venture capital recognizes this risk- reward trade-off. 2. Most investors have an unrealistic view of venture capital. They expect the high returns publicized with respect to successful new ventures but do not want to take the attendant risk. Consequently, such investors go into the marketplace looking for opportunities, claiming to offer venture capital, but never finding an investment that meets their requirements. 3.Most venture fund managers come from banking, professional money management or corporate management; while some come directly from business school and have been employees of venture capital firms for their entire career. Consequently, the vast majority of venture capital company employees - at any level - have no actual "venture" or entrepreneurial experience, particularly with start-ups. A lack of experience and understanding translates into a lack of comfort with the creation phase of a business and a reluctance to invest in such deals. 4. Entrepreneurs, in general, have different goals, motivations and personalities than bankers or corporate executives, who may expect to see people like themselves as clients. These differences can often create a gap between the venture capitalist and the entrepreneur sufficient to result in a rejection of the business proposal irrespective of the merits of the business.

22

Venture Capital Fund

Case Study-1: Rise of UK economy

The economic impact of private equity and venture capital on the UK: Keeping London and the UK the centre of the European industry Private Equity and venture capital makes a valuable contribution to the economy generally by having a positive effect on the companies in which private equity is invested. In addition, the industry makes a very significant contribution to the financial services industry and in particular plays an important role in maintaining the City of London as Europe's premier financial centre and helping to build it as the world's premier financial centre. The industry has shown incredible growth over the last few years, both in terms of the funds it has raised and the capital it manages and in the level of investment that is made, with growth comes responsibility as well as opportunity. The growth of the industry has increased its profile and with that profile comes a legitimate interest in what the industry is doing from the public, the press and of course the regulatory authorities. The industry is currently facing two major reviews - by the FSA in the Discussion paper they recently published and by the Treasury focusing on the taxation, not just of capital gains made by the industry, but also the capital gains made by the risk-taking entrepreneurs and management team that as an industry VCF back. Achieving the right outcome for the industry from the tax review and continuing to ensure regulation is appropriate and not burdensome are two vital tasks the British Venture Capital Association (BVCA) and the industry faces.

The BVCA and its work The BVCA is the industry body that represents the UK private equity and venture capital industry. Private equity means the equity financing of companies at many stages in the life of a company from start-up through expansion all the way through to buy-outs

23

Venture Capital Fund

of established companies that in today's world can be very significant and large transactions. Venture capital as a term typically covers early stages of start-up or growth funding or expansion capital. The term buy-outs (MBO, MBI, etc) refers to using - private equity to finance the change in ownership of a company. The common threads - and hence the term private equity - is that the investments made in unquoted equity (i.e. not publicly quoted equity) and into companies that have real growth potential which can be turned around or transformed under private equity ownership as opposed to being constantly in the spotlight that having a quoted share price means for a public company. The BVCA represents the whole cross section of the private equity industry in the UK - from small seed stage venture funds all the way through to the large private equity firms who focus almost exclusively on buy-outs and who are almost becoming household names today. BVCA membership comprises well over 90% of all UK-based private equity and venture capital funds and their advisors. The role of the BVCA is to ensure that the UK industry is properly represented to politicians and policy makers here at Westminster, across the UK and in Brussels. The industry's economic impact The survey shows once again that private equity-backed companies are a significant driver in the UK economy and its global competitiveness. Key findings of this report show once again that in the five years to 2005/2006: The growth of employment in private equity-backed companies was faster than both FTSE 100 and FTSE 250 companies (9% pa vs 1% and 2% respectively) Sales grew faster in private equity-backed companies compared with FTSE 100 and 250 companies (9% vs. 7% and 5%)

24

Venture Capital Fund

Exports from private equity-backed companies grew at a faster rate than the national growth rate (6% vs. 2%) Investment grew faster than the national average (18% vs 1%) It is now well established that the performance of private equity-backed companies significantly strengthens the UK economy and improves international competitiveness and creates jobs at a considerably faster rate than other private sector companies. It is now estimated that companies that have received private equity funding account for the employment of around 2.8 million people in the UK, equivalent to 19% of UK private sector employees. It is also significant to note that 92% of companies that responded to the survey said that without private equity the business would not have existed at all or would have developed less rapidly. The reason for this is that private equity investment is more than just the provision of capital. Respondents to the survey noted that strategic direction, financial advice and help with contacts were key ways in which private equity firms had helped with the development of their businesses. It is estimated that companies which have been private equity-backed generated total sales of 424 billion, exports of 48 billion and contributed over 26 billion in taxes. The figures in the Economic Impact Survey demonstrate clearly that private equitybacked businesses are active across all regions of the UK and are valuable contributors to the wealth of these regions.

The impact of the private equity industry as a UK financial service The UK private equity industry is playing an increasingly significant role as a source of revenue for firms operating within the broader financial and professional services industry, contributing to the overall impetus that these industries provide to the UK economy.

25

Venture Capital Fund

2005 data shows that: Private equity-related activities generated estimated fee revenue for financial and professional services firms of over 3.3 billion, representing around 7% of the total annual turnover of the UK financial services industry. There are more than 5,500 individuals (3,500 of which are investment professionals) employed in some 260 private equity, venture capital, funds-of-funds and secondaries investment firms in the UK. The UK has a network of around 750 financial, professional and business services firms providing advisory and financial support to private equity and venture capital firms. They employ a full time equivalent pool of close to 6,700 executives engaged in private equityrelated activities. Taken together, there are over 10,000 highly skilled professionals employed across over 1,000 firms engaged either directly or indirectly in private equity-related activities. For every private equity executive investing directly in UK companies, there are 2.3 full time equivalent advisors or finance executives providing specialist advice and services. Financial, professional and other business services executives working on private equity-related mandates in 2005 generated an average of 500,000 per head in fees. Private equity-backed transactions account for a significant proportion of total M&A activity in the UK with almost 30% of all UK investment banking fees from M&A and loan financing being derived from private equity backed transactions in 2005. The UK private equity industry has long attracted capital investment from outside its own shores, with almost 50 billion of foreign investment into UK private equity funds over the past six years. Investment activity BVCA are an industry that invests across all sectors, from start-ups to buy-outs, all around the UK, across continental Europe and around the world. In 2005, UK private equity activity increased to its highest ever levels, in terms of

26

Venture Capital Fund

funds raised, private equity investments made and also divestments. Here are a few key figures that illustrate the scale of what we do: Funds raised from investors reached 27.3 billion. 1,535 companies were financed. Worldwide investment by UK private equity firms increased by 21% in 2005 to 11.7 billion from 9.7 billion in 2004. Companies financed at start-up stage increased by 9% to 208. By any measure, the UK private equity and venture capital industry is a UK success story. And yet it is disappointing that despite the fact that the benefits of private equity as an asset class are so clear that last year 80% of BVCA investors came from overseas, with 45% coming from the US. The primary objective of the private equity industry is to drive returns to its investors and while it is a good thing that we can attract inward investment, it is a pity that the beneficiaries of the capital gains created by this industry predominantly accrue to overseas investors. Major investment attract into the UK from overseas, BVCA make major investment around the UK investing in companies, creating jobs and building businesses, and they invest across continental Europe and around the world bringing returns home for the benefit of their investors. This industry has benefited from a strong cross Party consensus that understands the important role BVCA play in keeping the UK economy competitive and dynamic. This support is much appreciated. Private equity investment should not be regarded as an end in itself, but rather as part of a life cycle of a business. The private equity model brings together absolute alignment of interest between investor and management. This enables absolute focus on agreed purpose, the ability to achieve change swiftly and efficiently and a complete concentration on the direction of the business.

27

Venture Capital Fund

SELF ASSESSMENT QUESTIONS

1) What do you understand by Venture Capital? Describe its distinguishing features. 2) Explain the various stages at which the venture capitalist provide finance. 3) Distinguish between conditional loans and convertible loans and explain their significance. 4) What do you understand by Exit Routes? Enumerate the important exit routes and explain the important ones. 5) What are Investment Restrictions imposed by SEBI on venture capital funds in India. 6) Explain the provision of Income Tax Act, granting tax concessions to venture capital

funds in India.

28

Venture Capital Fund

BIBLIOGRAPHY

Books

Bhole, L.M. Financial Institutions and Markets, 4th ed. 2004, Tata McGraw Hill Publishing Co. Ltd. Khan, M.Y. Financial Services, 3rd ed. 2004, Tata McGraw Hill Publishing Co. Ltd. Rustagi, R.P. Financial Analysis and Financial Management, 2005 ed., Sultan Chand & Sons. Varshney, P.N. and Mittal, O.K. Indian Financial System, 6th ed. 2005, Sultan Chand & Sons.

Websites Google : Wikipedia www.sebi.gov.in www.wikipedia.com www.economicstimes.com www.venturecapital.com www.investopedia.com

29

Potrebbero piacerti anche

- The Masters of Private Equity and Venture CapitalDocumento307 pagineThe Masters of Private Equity and Venture CapitalRamon George Atento75% (12)

- How To Raise A Venture Capital Fund: The Essential Guide on Fundraising and Understanding Limited PartnersDa EverandHow To Raise A Venture Capital Fund: The Essential Guide on Fundraising and Understanding Limited PartnersNessuna valutazione finora

- VENTURE CAPITAL FUND Financial ModelDocumento11 pagineVENTURE CAPITAL FUND Financial ModelManuel Lacarte67% (6)

- Summary of Mahendra Ramsinghani's The Business of Venture CapitalDa EverandSummary of Mahendra Ramsinghani's The Business of Venture CapitalNessuna valutazione finora

- Venture Capital 101 PDFDocumento38 pagineVenture Capital 101 PDFPhuong Chi Nguyen100% (2)

- Startup Success: Funding the Early Stages of Your VentureDa EverandStartup Success: Funding the Early Stages of Your VentureNessuna valutazione finora

- Road to a Venture Capital Career: Practical Strategies and Tips to Break Into The IndustryDa EverandRoad to a Venture Capital Career: Practical Strategies and Tips to Break Into The IndustryValutazione: 5 su 5 stelle5/5 (2)

- A Pragmatist's Guide To Leveraged Finance NotesDocumento36 pagineA Pragmatist's Guide To Leveraged Finance Notesvan07075% (4)

- Joint Development Agreement THIS JOINT DEVELOPMENT AGREEMENT Is Made and Executed OnDocumento32 pagineJoint Development Agreement THIS JOINT DEVELOPMENT AGREEMENT Is Made and Executed Onnagesh gowdaNessuna valutazione finora

- CaseDocumento6 pagineCaseGlaiza Dalayoan Flores67% (3)

- Venture CapitalDocumento12 pagineVenture Capitalmtasci100% (1)

- Various Stages of Venture Capital FinancingDocumento68 pagineVarious Stages of Venture Capital Financingjoy9crasto91% (11)

- The Venture Capital MethodDocumento3 pagineThe Venture Capital Methodsidthefreak809100% (1)

- Venture Capital ValuationDocumento8 pagineVenture Capital Valuationgnachev_4100% (4)

- Handbook of Venture CapitalDocumento455 pagineHandbook of Venture CapitalAlabancheto100% (3)

- Company List - Venture Capital DirectoryDocumento210 pagineCompany List - Venture Capital Directoryleonnox0% (1)

- Startup Fundraising 101Documento8 pagineStartup Fundraising 101CrowdfundInsiderNessuna valutazione finora

- A Guide To Venture Capital in The Middle East and North Africa1Documento40 pagineA Guide To Venture Capital in The Middle East and North Africa1moemikatiNessuna valutazione finora

- The Way of the VC: Having Top Venture Capitalists on Your BoardDa EverandThe Way of the VC: Having Top Venture Capitalists on Your BoardNessuna valutazione finora

- Quick Study For Computer Keyboard Short CutsDocumento2 pagineQuick Study For Computer Keyboard Short Cutsmahazari100% (3)

- Scaling Operations Worksheet2Documento56 pagineScaling Operations Worksheet2olusegun0% (2)

- NO DUE CERTIFICATE-pages-deletedDocumento2 pagineNO DUE CERTIFICATE-pages-deletedmanoj khathumria80% (5)

- Venture CapitalDocumento7 pagineVenture CapitalRag LakNessuna valutazione finora

- Summary of Jason A. Scharfman's Private Equity Operational Due DiligenceDa EverandSummary of Jason A. Scharfman's Private Equity Operational Due DiligenceNessuna valutazione finora

- Venture CapitalDocumento48 pagineVenture CapitalErick Mcdonald100% (2)

- Venture CapitalDocumento71 pagineVenture CapitalSmruti VasavadaNessuna valutazione finora

- Healthtech Venture CapitalDocumento28 pagineHealthtech Venture CapitalFelipe Hernan Herrera SalinasNessuna valutazione finora

- Start Fund 12012008Documento37 pagineStart Fund 12012008MOOGANNessuna valutazione finora

- Venture Capital - MithileshDocumento88 pagineVenture Capital - MithileshTejas BamaneNessuna valutazione finora

- Venture Capital FundsDocumento95 pagineVenture Capital FundsEsha ShahNessuna valutazione finora

- Corporate Venture CapitalDocumento32 pagineCorporate Venture CapitalgalatimeNessuna valutazione finora

- Venture Capital Fund and Venture Capital FinancingDocumento5 pagineVenture Capital Fund and Venture Capital Financingpavitra AcharyaNessuna valutazione finora

- Sequoia Capital India FinalDocumento14 pagineSequoia Capital India FinalPallavi TirlotkarNessuna valutazione finora

- Venture CapitalDocumento16 pagineVenture CapitalAditya100% (1)

- Venture CapitalDocumento62 pagineVenture CapitalNikhil Thakur0% (1)

- IAVC - Venture Capital Training PDFDocumento77 pagineIAVC - Venture Capital Training PDFvikasNessuna valutazione finora

- Stages of Company Development and Investor TypesDocumento5 pagineStages of Company Development and Investor TypesLuis DiazNessuna valutazione finora

- Study On Venture CapitalDocumento31 pagineStudy On Venture CapitalShaheen Books50% (2)

- Venture CapitalDocumento34 pagineVenture CapitalAnu NigamNessuna valutazione finora

- Equity List in About 525 Startups - Lebret - October 2019Documento543 pagineEquity List in About 525 Startups - Lebret - October 2019Herve Lebret100% (2)

- Wharton Venture CapitalDocumento9 pagineWharton Venture CapitalMarthy RavelloNessuna valutazione finora

- Venture CapitalDocumento88 pagineVenture Capitaldipsi123Nessuna valutazione finora

- Private Equity Insiders GuideDocumento13 paginePrivate Equity Insiders GuidemsmetoNessuna valutazione finora

- Guide To Venture Capital 2011Documento35 pagineGuide To Venture Capital 2011graceenggint8799Nessuna valutazione finora

- Private EquityDocumento42 paginePrivate EquitySahitha KusumaNessuna valutazione finora

- Guide Venture CapitalDocumento22 pagineGuide Venture CapitalAnand ArivukkarasuNessuna valutazione finora

- Angel Investor ListDocumento10 pagineAngel Investor Listluvisfact7616Nessuna valutazione finora

- Investment Process - Private EquityDocumento32 pagineInvestment Process - Private Equitykunal_desai7447Nessuna valutazione finora

- Captable Guide Formation To ExitDocumento24 pagineCaptable Guide Formation To ExitV100% (1)

- Venture CapitalDocumento51 pagineVenture Capitaljravish100% (6)

- Venture CapitalDocumento42 pagineVenture CapitalKellaNessuna valutazione finora

- The Business Accelerator Vs HubDocumento68 pagineThe Business Accelerator Vs HubAlina Comanescu100% (1)

- Venture Capital Valuation ModelDocumento4 pagineVenture Capital Valuation ModelSivakumar KrishnamurthyNessuna valutazione finora

- Venture CapitalDocumento116 pagineVenture CapitalasdfNessuna valutazione finora

- Venture Capital: by CA Bharat Kanani COO Permionics Membranes Pvt. LTDDocumento31 pagineVenture Capital: by CA Bharat Kanani COO Permionics Membranes Pvt. LTDRagini ChopdaNessuna valutazione finora

- Inside The Black Box of Venture CapitalDocumento77 pagineInside The Black Box of Venture Capitaljeffan123Nessuna valutazione finora

- Demystifying Venture Capital Economics - Part 1Documento9 pagineDemystifying Venture Capital Economics - Part 1KarnYoNessuna valutazione finora

- Seed Funding Guide PDFDocumento24 pagineSeed Funding Guide PDFGaurav TekriwalNessuna valutazione finora

- Done Deals Venture Capitalists PDFDocumento438 pagineDone Deals Venture Capitalists PDFunclesam13Nessuna valutazione finora

- VENTURE CAPITAL An Investment Case VALUATION MODELDocumento26 pagineVENTURE CAPITAL An Investment Case VALUATION MODELManuel LacarteNessuna valutazione finora

- Raising Seed Capital: Steve Schlafman (@schlaf) RRE VenturesDocumento82 pagineRaising Seed Capital: Steve Schlafman (@schlaf) RRE Venturesrezurekt100% (2)

- Black Book - Venture Capital Most Important.Documento30 pagineBlack Book - Venture Capital Most Important.simreen0% (1)

- Venture Capital Funding, Fourth Quarter 2015Documento10 pagineVenture Capital Funding, Fourth Quarter 2015BayAreaNewsGroupNessuna valutazione finora

- Venture Capital in Emerging MarketsDocumento2 pagineVenture Capital in Emerging Marketscamilo nietoNessuna valutazione finora

- Venture Capital Mena ReportDocumento50 pagineVenture Capital Mena ReportBala SubramanianNessuna valutazione finora

- Wealth Management Group 8: Name Roll NoDocumento16 pagineWealth Management Group 8: Name Roll NoAdii AdityaNessuna valutazione finora

- TicketDocumento3 pagineTicketAdii AdityaNessuna valutazione finora

- Consumer Buyer Behaviour 724 v1Documento479 pagineConsumer Buyer Behaviour 724 v1Adii AdityaNessuna valutazione finora

- Ticket 4713990604Documento3 pagineTicket 4713990604Adii AdityaNessuna valutazione finora

- Internet MKTGDocumento469 pagineInternet MKTGMohamed Shafi OPNessuna valutazione finora

- TicketDocumento3 pagineTicketAdii AdityaNessuna valutazione finora

- FlowchartDocumento10 pagineFlowchartAdii AdityaNessuna valutazione finora

- Slf02a119020019753 PDFDocumento4 pagineSlf02a119020019753 PDFAdii AdityaNessuna valutazione finora

- Assignment On Taxation ManagementDocumento7 pagineAssignment On Taxation ManagementAdii AdityaNessuna valutazione finora

- HR Notes Notes - 1Documento99 pagineHR Notes Notes - 1Adii AdityaNessuna valutazione finora

- Venture Capital FinancingDocumento28 pagineVenture Capital FinancingAdii AdityaNessuna valutazione finora

- Curriculum VitaeDocumento2 pagineCurriculum VitaeAdii AdityaNessuna valutazione finora

- Managerial Economics - Individual AssignmentDocumento10 pagineManagerial Economics - Individual AssignmentAdii AdityaNessuna valutazione finora

- Unit 18 Venture Capital PDFDocumento12 pagineUnit 18 Venture Capital PDFKARISHMAATNessuna valutazione finora

- Money Laundering and How It Is Linked With Terrorist ActivitiesDocumento22 pagineMoney Laundering and How It Is Linked With Terrorist ActivitiesAdii AdityaNessuna valutazione finora

- Factoring ServicesDocumento32 pagineFactoring ServicesMeena MkNessuna valutazione finora

- Venture CapitalDocumento88 pagineVenture Capitaldipsi123Nessuna valutazione finora

- UploadedFile 130378715597306246Documento88 pagineUploadedFile 130378715597306246Adii AdityaNessuna valutazione finora

- Venture Capital Fund ProjectDocumento29 pagineVenture Capital Fund ProjectAdii AdityaNessuna valutazione finora

- Unit 18 Venture Capital PDFDocumento12 pagineUnit 18 Venture Capital PDFKARISHMAATNessuna valutazione finora

- Venture CapitalDocumento28 pagineVenture CapitalSurbhi10Nessuna valutazione finora

- Venture CapitalDocumento88 pagineVenture Capitaldipsi123Nessuna valutazione finora

- Venture CapitalDocumento60 pagineVenture CapitalAdii AdityaNessuna valutazione finora

- Venture CapitalDocumento28 pagineVenture CapitalAdii AdityaNessuna valutazione finora

- 2580 MicrosoftExcel2010 RTM WSG ExternalDocumento9 pagine2580 MicrosoftExcel2010 RTM WSG ExternalAdii AdityaNessuna valutazione finora

- Unit 18 Venture Capital PDFDocumento12 pagineUnit 18 Venture Capital PDFKARISHMAATNessuna valutazione finora

- Project ReportDocumento7 pagineProject ReportAdii AdityaNessuna valutazione finora

- Karvy Stock Broking LimitedDocumento5 pagineKarvy Stock Broking LimitedAdii AdityaNessuna valutazione finora

- Fund Accounting PresentationDocumento42 pagineFund Accounting Presentationmilandeep50% (2)

- Sir Mudassar Awan Lecturer COMSATS Institute of Information Technology, LahoreDocumento24 pagineSir Mudassar Awan Lecturer COMSATS Institute of Information Technology, LahoreJunaid HassanNessuna valutazione finora

- Materi 11 - Anggaran UtangDocumento4 pagineMateri 11 - Anggaran UtangNoery MutiarahimNessuna valutazione finora

- Senior High School: First Semester S.Y. 2020-2021Documento9 pagineSenior High School: First Semester S.Y. 2020-2021sheilame nudaloNessuna valutazione finora

- Ong vs. BPI Family SavingsDocumento8 pagineOng vs. BPI Family SavingsMadam JudgerNessuna valutazione finora

- Government Debt Is Described in "The Law On Public Debt Management"Documento4 pagineGovernment Debt Is Described in "The Law On Public Debt Management"Hiền LưuNessuna valutazione finora

- Chapter 3Documento21 pagineChapter 3Annalyn MolinaNessuna valutazione finora

- Commercial Law Cases DOWNLOADDocumento343 pagineCommercial Law Cases DOWNLOADVinz G. VizNessuna valutazione finora

- Impact of Monetary Policy On Interest RateDocumento97 pagineImpact of Monetary Policy On Interest Raterajib1chowdhury1mushNessuna valutazione finora

- Master Title (Bank Loan) : 258906349.xls/BLMDocumento4 pagineMaster Title (Bank Loan) : 258906349.xls/BLMAnalizza HaitherNessuna valutazione finora

- Nature and Development of Banking LawDocumento4 pagineNature and Development of Banking Lawarti50% (2)

- Credit ManagementDocumento29 pagineCredit ManagementShane DiestroNessuna valutazione finora

- Comprehensive Approach To HousingDocumento16 pagineComprehensive Approach To HousingAaron Steven PaduaNessuna valutazione finora

- Al QardhDocumento17 pagineAl QardhMahyuddin KhalidNessuna valutazione finora

- Introduction To Memorandum of Law: Life-Cycle of A "Loan" October 2010Documento18 pagineIntroduction To Memorandum of Law: Life-Cycle of A "Loan" October 2010Cairo AnubissNessuna valutazione finora

- Insurance Case StudyDocumento12 pagineInsurance Case StudySivashankar PeriyasamyNessuna valutazione finora

- Chapter 11Documento7 pagineChapter 11Xynith Nicole RamosNessuna valutazione finora

- Corporation Law ReviewerDocumento3 pagineCorporation Law ReviewerJada WilliamsNessuna valutazione finora

- The Money Masters - ReportDocumento59 pagineThe Money Masters - ReportSamiyaIllias100% (2)

- List of Lending Companies With Certificate of Authority December 31, 2019Documento57 pagineList of Lending Companies With Certificate of Authority December 31, 2019Ji BautistaNessuna valutazione finora

- Law On Credit Transactions - Reviewer PART 1Documento2 pagineLaw On Credit Transactions - Reviewer PART 1Leigh Anne AlinsodNessuna valutazione finora

- Oceanis Q3 Market ReportDocumento12 pagineOceanis Q3 Market ReportIneffAble MeloDyNessuna valutazione finora

- Project On Job SatisfcationDocumento84 pagineProject On Job Satisfcationnamitaahuja2006Nessuna valutazione finora

- Money, The Price Level, and InflationDocumento61 pagineMoney, The Price Level, and InflationGianella Zoraya Torres AscurraNessuna valutazione finora

- Policy Guidelines and Procedures For Cash AdvancesDocumento4 paginePolicy Guidelines and Procedures For Cash Advancesjack.rccorpNessuna valutazione finora