Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Ifrs

Caricato da

Basavaraj MtTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Ifrs

Caricato da

Basavaraj MtCopyright:

Formati disponibili

IFRS - ITS PROBLEMS AND CHALLENGES IN INDIA

Dr. SANGAPPA S RAMPURE1 HOD and Research Guide Department of commerce GFGC Shorapur, Dist: Yadgir rampuress@gmail.com;+919480606666 Mr. RAJESH S KINNI2 Research Scholar Dept. of Commerce Gulbarga University, Gulbarga ksrajesh.kinni65@gmail.com; +919901781659

ABSTRACT These days are the era of globalization. The Globalization has given up a way for all the countries to adopt a single set of accounting standards. Recent years have seen major changes in financial reporting worldwide under which the most apparent is the continuing adoption of IFRS worldwide. IFRS are the globally accepted accounting standards and interpretations adopted by the IASB. In India, ICAI has decided to adopt the IFRS by April 2011. This study employed descriptive as well as conceptual study. This paper has sections. First section gives the introduction. The second section says about the methodology of the study. The third section deals with the need for IFRS in India. The problems and challenges faced by the stakeholders and its impact on India are discussed in the fourth section. The measures taken to address the challenges of IFRS are dealt in the section fifth. The paper is concluded in the section sixth.

Keywords:

Globalisation, International Financial Reporting Standards (IFRS), IASB,

stakeholders, Accounting Standards.

INTRODUCTION The full abbreviation of the term IFRS is international financial reporting standard (IFRS). IFRS has been developed by International accounting standard board (IASB). As per IASB IFRS refers to a set of international accounting standard stating how particular type of transactions and other events should be reported in financial statement or, in other words IFRS refers to guidelines and rules that companies and organizations are required to follow in preparing and presenting their financial statements. Globalization has changed the close economy into open economy. Now a day's national economy is integrating in international market with other countries by spreading their trade and business outside their own country. Foreign Direct Investments, Foreign Institutional Investors, Merger and Acquisition, Franchising and Business Outsourcing are some example of international transaction in global business. For the integrity of different county's business together in the world market it was necessary for the business to adopt a common set of accounting standard, since accounting is the language of a business. Therefore in 1973, international professionals from different countries established the International Accounting Standard Committee. In 2001 International Accounting Standard Committee are superseded as International Accounting Standard Board. Now the board issues the International Financial Reporting Standard formerly known as International Accounting Standards. Accounting Standards were prepared for some benefits in global market which are compelling. A constant use of

accounting standards provide higher quality information which enables the investors to make a better decision, indirectly fund will allocate in more efficient manner in the market and the company can reduce its overall cost of capital. The use of common set of accounting standards throughout the world provides an easy way of comparability and transparency of financial information. It also reduces the cost of preparing financial statements. WHAT IS INTERNATIONAL FINANCIAL REPORTING STANDARDS (IFRS)? International Financial Reporting Standards (IFRS) is a single set of high quality, understandable and enforceable global accounting standards that require high quality, transparent and comparable information in financial statements and other financial reporting to help participants in the world's capital markets and other users make economic decisions.

International Financial Reporting Standards (IFRS) are designed as a common global language for business affairs so that company accounts are understandable and comparable across international boundaries. They are a consequence of growing international shareholding and trade and are particularly important for companies that have dealings in several countries. They are progressively replacing the many different national accounting standards. The rules to be followed by accountants to maintain books of accounts which are comparable, understandable, reliable and relevant as per the users internal or external.

OBJECTIVES OF THE STUDY To study the problems and challenges of IFRS in India. To focus on the Measures taken to address the Challenges.

METHODOLOGY The present study is mainly based on descriptive as well as conceptual study and secondary data has been used. The required secondary data was collected from the authorized Annual Reports and Official Website of ICAI and IFRS, various Journals and Research Papers, diagnostic study reports and newspaper articles etc.

NEED FOR INTERNATIONAL FINANCIAL REPORTING STANDARDS (IFRS) IN INDIA The IFRS in Indian context at present, Accounting Standards Board (ASB) formulates and issues accounting standards in India which are more or less in line with IFRS except for a few instances where departure is necessary to comply with the legal, regulatory and economic environment. Council of the Institute of Chartered Accountants of India (ICAI) opined in May 2006 that adopting IFRS was considered and supported by the ASB. IFRS task force was set up to provide a road map for convergence and it decided to converge with IFRS from the accounting period commencing on or after 1 April 2011. In India, Ministry of Corporate Affairs carried out the process of convergence of Indian Accounting Standards with IFRS after a wide range of consultative process with all the stakeholders in pursuance of G-20 commitment and as result thirty five Indian Accounting Standards converged with

International Financial Reporting Standards. Following are the arguments in favour of IFRS implementation in India. Globalization of Economies: Since today most of economies have been globalized and India is also not the exception. This has created the need for a uniform practice to bring more transparency and for satisfying the need for wider and demanding users. To Comply With Increasing Corporate Awareness: today corporate awareness and corporate governance requirements have increased many folds which require an advanced and uniform accounting practice. For Reducing Costs and Time: The Indian companies which are operating in two or more countries of the world are preparing financial statements separately for each country which is wasting time and money. Thus, the implementation of uniform accounting practice will reduce time and cost considerably. Better Quality of Information: the implementation of uniform accounting practice will provide much better quality of information. For Raising Capital from Overseas: Indian companies are raising capital from overseas which requires all information in International standard understandable to them. For Better Comparability of Financial Statements: For better comparability of financial statements it is necessary that accounting practices in different countries of the world are uniform. For assisting the MNCs to Prepare Consolidated Financial Statements: The MNCs which are operating in different countries of the world are finding it difficult to prepare consolidated financial statements due to different accounting rules and practices in different countries of the world.

PROBLEMS AND CHALLENGES INTERNATIONAL FINANCIAL REPORTING STANDARDS (IFRS) IN INDIA: IFRS are formulated by International Accounting Standard Board. However, the responsibility of convergence with IFRS vests with local government and accounting and regulatory bodies, such as the ICAI in India. Thus ICAI need to invest in infrastructure to ensure compliance with IFRS. India has several constraints and practical challenges to adoption and compliance with IFRS. So there is a need to change some laws and regulations governing financial accounting and reporting in India. There are some legal requirements

which determine the manner in which financial information are presented in financial statements. Under IFRS, accounting is done for all assets including hidden intangibles at fair value. As the assets are recognized at fair value, amortization of these assets will reduce future year profits under IFRS. Other problem is there is lack of adequate professionals with practical experience of IFRS conversion; therefore Indian Companies have to rely upon external advisors and auditors which are costly. Another issue is Indian GAAP should have been formulated on the basis of the principles of IFRS which may shows differences between Indian GAAP and IFRS. At the end some principles need to be amended, implements or remove in the Indian GAAP. For example, use of pooling of interests method in accounting for business combination is not available in the principles of IFRS. Thus it should be eliminated from Indian GAAP. Every coin has two sides. In spite of several benefits as may be looked out by the different professionals, people and employees there will be some challenges and problems that will be faced on the way of IFRS convergence by the Indian firm. Variations in GAAP and IFRS: The differences between GAAP and IFRS are wide and very deep routed. Bringing awareness about IFRS and its impact among the people who prepares financial statements is a challenging task. Issue of GAAP Reconciliation: The Securities Exchange Commission (SEC) came out with two options in its proposal-firstly calling for the traditional IFRS first time adoption process, secondly requiring that step plus an on-going unaudited reconciliation of the financial statements from IFRS to US GAAP. Clearly the second one is a more costly approach for firms and its users. Awareness of international practices: The entire set of financial reporting practices needs to undergo a drastic change after the adoption of IFRS to overcome the number of differences between the two GAAPs. It would be a challenge to take about awareness of IFRS and its impact among the users of financial statements. Legal and Regulatory: Presently, the financial reporting requirements are authorized by various regulatory authorities in India and their provisions override other laws and regulators. The IFRS taking care for not doing such overriding laws. So, such laws and regulatory in India will create challenges to IFRS and its application. Fair value Measurement: IFRS uses fair/ true value to measure majority of transaction in financial statements. By using fair value accounting can lead lot of flexibility and

subjectivity to the financial statements. The professionals have to work hard to arrive at the fair value and valuation exerts have to be used. Training and Development: Lack of training and education courses about the implementation IFRS and its use have raised challenge in India. So, it is essential need to provide training and education on the operations of IFRS. Risk in adoption: Implementing IFRS has increased financial reporting risk due to technical complexities, manual workarounds and management time taken up with implementation. Another risk involved is that the IFRS do not recognize the adjustments that are prescribed through court schemes and consequently all such items will be recorded through income statements. Taxation: The adoption of IFRS in India will not only affect the Financial Statements but also the tax liabilities would also get changed. Present scenario, Indian Tax laws do not recognize the Accounting Standards. To entertain immediate change in the Indian Tax Law is the major challenge faced by the Indian Law makers. Re-negotiation of Contract: The contracts would have to be re-negotiated which is also a big challenge. This is because the financial results under IFRS are likely to be very different from those under the Indian GAAP. Reporting systems: The disclosure and reporting requirements under IFRS are completely different from the Indian reporting requirements. Companies would have to ensure that the existing business reporting model is amended to suit the reporting requirements of IFRS. The information systems should be designed to capture new requirements related to fixed assets, segment disclosures, and related party transactions. Existence of proper internal control and minimizing the risk of business disruption should be taken care of while modifying or changing the information systems.

MEASURES TAKEN TO ADDRESS THE CHALLENGES: The major measures taken to address the challenges and problems of Financial Reporting Standards (IFRS) they are, The ICAI issued 30 interpretations of accounting standards, with a view to resolve various intricate interpretational issues arising in the implementation of new accounting standards.

In order to resolve several rigid interpretational issues arising in the implementation of new accounting standards, the ICAI issued thirty interpretations of these standards. For the purpose of assisting its members, the ICAI council has formed an expert advisory committee to answer queries from its members. .Guidance notes have been issued by ICAI for providing immediate guidance on accounting issues. For changes required in rules and regulations of various regulatory bodies, draft recommendations have been placed before Accounting Standard Board. To facilitate discussions at seminar, workshops, etc., ICAI has issued background material on newly issued accounting standards. To help its members, the ICAI council has formed an expert advisory committee to respond the queries from its members. To provide instance guidance on accounting issues and problems, the ICAI has issued guidance notes. Moreover to face the challenges we want to take more effective steps like we should build adequate IFRS skills professionals by investing in training processes for Indian accounting professionals to manage the conversion projects for Indian corporate. This can be done by research on effect of IFRS conversion in different countries and brief knowledge of IFRS should be added into the studies for professional courses with worldwide latest examples.

CONCLUSION International Financial Reporting Standards (IFRS) are designed as a common global language for business affairs so that company accounts are understandable and comparable across international boundaries. They are a consequence of growing international shareholding and trade and are particularly important for companies that have dealings in several countries. From the above discuss it is very much clear that conversion from Indian GAAP to IFRS will face many difficulties but at the same time looking at the advantages that this adoption will confer, the convergence with IFRS is strongly recommended because the measures taken by ICAI and the other regulatory bodies to facilitate the smooth convergence to IFRS are creditable and give the positive idea that the country is ready for convergence.

REFERENCES 1. Mahender K. Sharma, IFRS & India its problems and challenges, International Multidisciplinary Journal of Applied Research Vol: 1/Issue: 4/ July 2013. 2. Poria, Saxena, Vandana, 2009, IFRS Implementation and Challenges in India, MEDC Monthly Economic Digest. Retrieved on Dec 12, 2013. 3. Barth M.E., Landsman W.R. and Lang M.H., International Accounting Standards and accounting quality, Journal of Accounting Research, Vol. 46, No. 3, 2008. 4. Epstein, and J, Barry, The Economic Effects of IFRS Adoption, The CPA Journal, 2009. 5. Convergence of Accounting Standard World over with IFRS By Rajkumar S.Adukia (CA) - The Chartered Accountant -Journal of the ICAI-Vol.56, No.11, May 2008.

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Test Bank MidtermDocumento56 pagineTest Bank MidtermmeriemNessuna valutazione finora

- BUS 5910 Written Assignment Unit 1Documento5 pagineBUS 5910 Written Assignment Unit 1AliNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- EM 221 Case Study HR SolutionsDocumento6 pagineEM 221 Case Study HR SolutionsMark Magracia67% (12)

- CRM Project PlanDocumento12 pagineCRM Project Planwww.GrowthPanel.com100% (5)

- Cambridge SummaryDocumento1 paginaCambridge SummaryMausam Ghosh100% (1)

- Village Panchayat President and Secrataries Contact DetailsDocumento10 pagineVillage Panchayat President and Secrataries Contact DetailsBasavaraj Mt33% (3)

- Operational Efficiency: Improvement TermsDocumento56 pagineOperational Efficiency: Improvement TermsLuis Javier0% (1)

- PHD ListDocumento2 paginePHD ListBasavaraj MtNessuna valutazione finora

- 30.04.16 (Online) - HALDocumento6 pagine30.04.16 (Online) - HALSrinivasulu PuduNessuna valutazione finora

- Research Funding Agencies: Annexure - 3.1 Criterion - 03 Metric - 3.1.1 & 3.1.2Documento3 pagineResearch Funding Agencies: Annexure - 3.1 Criterion - 03 Metric - 3.1.1 & 3.1.2Basavaraj MtNessuna valutazione finora

- Ph.D. NotificationDocumento4 paginePh.D. NotificationBasavaraj MtNessuna valutazione finora

- Chap VDocumento16 pagineChap VBasavaraj MtNessuna valutazione finora

- Prerequisite Format 1ocxDocumento2 paginePrerequisite Format 1ocxBasavaraj MtNessuna valutazione finora

- Application 2020 21Documento1 paginaApplication 2020 21Basavaraj MtNessuna valutazione finora

- Procedure For Submission of Eforms For Creation of NIC E-Mail IDDocumento10 pagineProcedure For Submission of Eforms For Creation of NIC E-Mail IDKrishNessuna valutazione finora

- SSR Stock Analysis SpreadsheetDocumento4 pagineSSR Stock Analysis SpreadsheetBasavaraj MtNessuna valutazione finora

- BSQMDocumento2 pagineBSQMremus94144Nessuna valutazione finora

- Savitha PDocumento1 paginaSavitha PBasavaraj MtNessuna valutazione finora

- PH.D Entrance Exam Instructions & Q.P. PatternDocumento2 paginePH.D Entrance Exam Instructions & Q.P. PatternBasavaraj MtNessuna valutazione finora

- Report Adm TicketDocumento1 paginaReport Adm TicketBasavaraj MtNessuna valutazione finora

- IDP TemplateDocumento9 pagineIDP TemplateBasavaraj MtNessuna valutazione finora

- DemontisationDocumento4 pagineDemontisationBasavaraj MtNessuna valutazione finora

- Karnataka Administrative Tribunal dismisses lecturer qualification caseDocumento2 pagineKarnataka Administrative Tribunal dismisses lecturer qualification caseBasavaraj MtNessuna valutazione finora

- Work Load KUD Guest Faculty or Teaching Asst PostsDocumento3 pagineWork Load KUD Guest Faculty or Teaching Asst PostsBasavaraj MtNessuna valutazione finora

- Statistics PDFDocumento2 pagineStatistics PDFBasavaraj MtNessuna valutazione finora

- Top Banks (Pmjjby, Pmsby & Apy) Including Their RrbsDocumento1 paginaTop Banks (Pmjjby, Pmsby & Apy) Including Their RrbsBasavaraj MtNessuna valutazione finora

- Rural EducationDocumento32 pagineRural EducationusavelNessuna valutazione finora

- Interview PDFDocumento1 paginaInterview PDFBasavaraj MtNessuna valutazione finora

- Fac Com JMGDocumento17 pagineFac Com JMGBasavaraj MtNessuna valutazione finora

- K B Rangappa PDFDocumento13 pagineK B Rangappa PDFBasavaraj MtNessuna valutazione finora

- Written CommunicationDocumento2 pagineWritten CommunicationnsutariaNessuna valutazione finora

- An Overview of The Required Tests: Sat, Act, Toefl, IeltsDocumento107 pagineAn Overview of The Required Tests: Sat, Act, Toefl, IeltsBasavaraj MtNessuna valutazione finora

- 207ijstm 3Documento7 pagine207ijstm 3Basavaraj MtNessuna valutazione finora

- 1468-0297 00271Documento18 pagine1468-0297 00271Basavaraj MtNessuna valutazione finora

- Assessing Your Entrepreneurial PotentialDocumento32 pagineAssessing Your Entrepreneurial PotentialBasavaraj MtNessuna valutazione finora

- Sharekhan Summer Internship Report on Sales ProcessDocumento26 pagineSharekhan Summer Internship Report on Sales ProcessSandeep SharmaNessuna valutazione finora

- Materials Set A Part 1. Theory (1pt Each)Documento3 pagineMaterials Set A Part 1. Theory (1pt Each)Trixie HicaldeNessuna valutazione finora

- Implementation of EU Directives On Work-Life Balance and On Transparent and Predictable Working ConditionsDocumento38 pagineImplementation of EU Directives On Work-Life Balance and On Transparent and Predictable Working ConditionsAdelina Elena OlogeanuNessuna valutazione finora

- Staisch Brand 2007Documento113 pagineStaisch Brand 2007chengehNessuna valutazione finora

- QUESTION 1 Moo & Co. in Ipoh, Engaged The Services of A Carrier, BZDocumento5 pagineQUESTION 1 Moo & Co. in Ipoh, Engaged The Services of A Carrier, BZEllyriana QistinaNessuna valutazione finora

- Chevron Attestation PDFDocumento2 pagineChevron Attestation PDFedgarmerchanNessuna valutazione finora

- Indonesia Banking Booklet 2017Documento244 pagineIndonesia Banking Booklet 2017ntc7035100% (1)

- MY AnnualReport 2019 PDFDocumento164 pagineMY AnnualReport 2019 PDFSivaram KumarNessuna valutazione finora

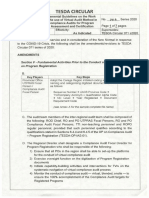

- TESDA Circular No. 071-A-2020Documento7 pagineTESDA Circular No. 071-A-2020Dyrah DonnaNessuna valutazione finora

- Final Report of Engro PDF FreeDocumento58 pagineFinal Report of Engro PDF FreeMadni Enterprises DGKNessuna valutazione finora

- Exclusions From Gross IncomeDocumento63 pagineExclusions From Gross IncomegeorgeNessuna valutazione finora

- Chapter 16 Employee Safety and HealthDocumento13 pagineChapter 16 Employee Safety and HealthAmmarNessuna valutazione finora

- Minggu 8 Chapter 09 Other Analysis Techniques - 12e XE - RevDocumento34 pagineMinggu 8 Chapter 09 Other Analysis Techniques - 12e XE - RevPutriska RazaniNessuna valutazione finora

- Chapter Real Project MiDocumento72 pagineChapter Real Project Mimayowa alexNessuna valutazione finora

- Green Marketing: Consumers' Attitudes Towards Eco-Friendly Products and Purchase Intention in The Fast Moving Consumer Goods (FMCG) SectorDocumento98 pagineGreen Marketing: Consumers' Attitudes Towards Eco-Friendly Products and Purchase Intention in The Fast Moving Consumer Goods (FMCG) SectorJonyNessuna valutazione finora

- TEXCHEM AnnualReport2014Documento146 pagineTEXCHEM AnnualReport2014Yee Sook YingNessuna valutazione finora

- Disclosure Regimes and Corporate Governance SystemsDocumento11 pagineDisclosure Regimes and Corporate Governance SystemskaligelisNessuna valutazione finora

- This Study Resource Was: Tourism and Hospitality MidtermDocumento9 pagineThis Study Resource Was: Tourism and Hospitality MidtermMark John Paul CablingNessuna valutazione finora

- Llb-Dissertation FinalDocumento38 pagineLlb-Dissertation FinalRudy KameereddyNessuna valutazione finora

- Term Paper: On A Rising Market Giant of BangladeshDocumento46 pagineTerm Paper: On A Rising Market Giant of BangladeshSanjeed Ahamed SajeebNessuna valutazione finora

- Idea Generation and Business DevelopmentDocumento13 pagineIdea Generation and Business DevelopmentbitetNessuna valutazione finora

- On GoodwillDocumento23 pagineOn GoodwillNabanita GhoshNessuna valutazione finora

- Steps in Registering Your Business in The PhilippinesDocumento5 pagineSteps in Registering Your Business in The PhilippinesSherie Joy MercadoNessuna valutazione finora

- HRM Exam QuestionsDocumento1 paginaHRM Exam QuestionsMani MaranNessuna valutazione finora