Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Erp Study Guide 2013

Caricato da

Ashutosh KumarCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Erp Study Guide 2013

Caricato da

Ashutosh KumarCopyright:

Formati disponibili

2013

ERP Examination Study Guide

The designation for risk professionals in the energy sector

2013 Energy Risk Professional (ERP) Examination Study Guide

ERP Examination Approach The ERP Examination is a comprehensive, practice-oriented assessment that spans both the physical and financial energy markets. Candidates are expected to demonstrate an understanding of important concepts associated with several broad areas of study: Exploration, production, distribution, and storage of physical hydrocarbon resources and refined products. Electric power generation, distribution and market trading instruments. Sources of renewable power generation, project finance, trends in carbon pricing and global emissions trading. Financially traded energy commodity products, including exchange traded contracts, over-the-counter derivatives and other structured products. Market risk measurement, including energy spot and forward price formation, volatility, financial option valuation, real options; fundamental probability, statistics and modeling principles. Credit and counterparty risk assessment and management. Operational risk evaluation, strategic risk management and corporate governance. Current issues affecting the physical and financial energy markets. 2013 ERP Curriculum and Core Readings The 2013 ERP Study Guide sets forth primary topics and readings that cover physical energy commodities, physical operations, and financially

traded energy products; as well as the tools used to identify, measure and manage risk across the energy value chain. Several new readings have been added to ensure that the 2013 ERP Examination remains both timely and relevant. In many cases new readings have been sourced online as energy risk management is not always covered in traditional textbooks. All topics and readings were selected in conjunction with the Energy Oversight Committee (EOC) after assessing the fundamental knowledge, skills and abilities necessary for professionals that manage risk in the energy industry.

Exam Preparation Questions for the ERP Examination are related and supported by the readings listed under each topic outlined in the Study Guide. To assist candidates in their preparation for the exam, we have separately published the 2013 Applying Instructional Material Statements (AIMS) and the ERP Exam Preparation Handbook. The Study Guide and AIMs together form the blueprint for developing the 2013 ERP Exam. It is strongly suggested that candidates review these documents in conjunction with the 2013 Exam Preparation Handbook as they prepare for the exam.

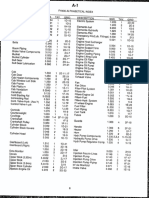

Test Weights and Question Allocation for the 2013 ERP Examination Test weights and question allocation for the 2013 ERP examination have been structured to create an exam that balances intellectual rigor against exam validity and reliability, two important characteristics of any professional certification exam. Physical Energy Commodities and Markets Hydrocarbon Resources Electricity Production and Distribution Renewable Energy Section Total Financial Products and Risk Management Financially Traded Products Price Formation, Market Risk and Valuation Credit and Counterparty Risk Operational Risk and Strategic Risk Management Section Total Current Issues in Energy Exam Total 15% 15% 10% 10% 50% 5% 24 questions 24 questions 16 questions 16 questions 80 questions 8 questions 25% 10% 10% 45% 40 questions 16 questions 16 questions 72 questions

100% 160 questions

2013 Global Association of Risk Professionals. All rights reserved.

2013 Energy Risk Professional (ERP) Examination Study Guide

PHYSICAL ENERGY COMMODITIES AND MARKETS HYDROCARBON RESOURCESExam Weight | 25%

Exploration and Production Crude Oil Transportation, Refining and Industry Trends Crude Oil Market Dynamics and Pricing Natural Gas Liquefied Natural Gas (LNG) Unconventional Products Global Gas Price Formation Coal

Readings for Hydrocarbon Resources40 Questions

1.1 Exploration and Production 1. Joseph Hilyard. The Oil and Gas Industry: A Non-Technical Guide. (Tulsa, OK: PennWell, 2012). 2. Chapter 1......................Origins of Oil and Gas Chapter 2.....................Oil Overview

Andrew Inkpen and Michael H. Moffett. The Global Oil and Gas Industry: Management, Strategy and Finance (Tulsa, OK: PennWell, 2012). Chapter 4 ....................Developing Oil and Gas Projects

3.

Charlotte Wright and Rebecca Gallun. Fundamentals of Oil & Gas Accounting, 5th Edition (Tulsa, OK: PennWell, 2008). Chapter 1......................Upstream Oil and Gas Operations Chapter 15 ...................Accounting for International Petroleum Operations

4.

Peter A. Nolan and Mark C. Thurber. On the States Choices of Oil Company: Risk Management and the Frontier of the Petroleum Industry (PESD Stanford). Freely available on the GARP Digital Library.

1.2

Crude Oil Transportation, Refining and Industry Trends 5. Andrew Inkpen and Michael H. Moffett. The Global Oil and Gas Industry: Management, Strategy and Finance. 6. Chapter 11 ....................Transportation Chapter 12 ...................Refining

William L. Leffler. Petroleum Refining in Nontechnical Language, 3rd Edition (Tulsa, OK: PennWell, 2000). Chapter 20..................Simple and Complex Refineries

2013 Global Association of Risk Professionals. All rights reserved.

2013 Energy Risk Professional (ERP) Examination Study Guide

1.3

Crude Oil Market Dynamics and Pricing 7. Bassam Fattouh. An Anatomy of the Crude Oil Pricing System (The Oxford Institute for Energy Studies). Freely available on the GARP Digital Library.

1.4

Natural Gas 8. Davis W. Edwards. Energy Trading and Investing (New York: McGraw-Hill, 2010). 9. Chapter 2.1 ..................Natural Gas

Vivek Chandra. Fundamentals of Natural Gas: An International Perspective (Tulsa, OK: PennWell Books, 2006). Chapter 1......................The Basics Chapter 2.....................Transport and Storage Chapter 4 ....................Contracts and Project Development

1.5

Liquefied Natural Gas (LNG) 10. Inkpen and Moffett. The Global Oil and Gas Industry: Management, Strategy and Finance. 11. Chapter 9.....................Liquefied Natural Gas (LNG)

PriceWaterhouseCoopers. Todays LNG Market Dynamics (May 2010). Freely available on the GARP Digital Library.

1.6

Unconventional Products 12. Deutsche Bank. Oil and Gas for Beginners: A Guide to the Oil and Gas Industry (September 2010). Sections on Canadas Oil Sands, Gas-to-Liquids (GTL), Coal Bed Methane, and Tight & Shale Gas only. Freely available on the GARP Digital Library. 13. Michael Toman, Aimee E. Curtright, David S. Ortiz, Joel Darmstadter, Brian Shannon. Unconventional FossilBased Fuels: Economic and Environmental Trade-Offs (Santa Monica, CA: Rand, 2008). Chapter 4 ....................Oil Sands and Synthetic Crude Oil Freely available on the GARP Digital Library.

1.7

Global Gas Price Formation 14. International Gas Union. Wholesale Gas Price FormationA Global View of Price Drivers and Regional Trends. (June 2011). Sections: 1, 2, 3, 4, 5, 8, 9 and 10 only. Freely available on the GARP Digital Library.

1.8

Coal 15. James Speight. Handbook of Coal Analysis (Wiley-Interscience, 2005). Chapter 1......................Coal Analysis

2013 Global Association of Risk Professionals. All rights reserved.

2013 Energy Risk Professional (ERP) Examination Study Guide

ELECTRICITY PRODUCTION AND DISTRIBUTIONExam Weight | 10%

Generation and Distribution of Power Practical Application of Electricity Spot Market Models Hydro and Nuclear Power Generation

Readings for Electricity Production and Distribution16 Questions

2.1 Generation and Distribution of Power 1. Davis W. Edwards. Energy Trading and Investing (New York: McGraw-Hill, 2010). 2. Chapter 2.2 .................Electricity Chapter 4.2 .................The Generation Stack Chapter 4.3 .................Tolling Agreements

Chris Harris. Electricity Markets: Pricing, Structures and Economics (West Sussex, U.K.: John Wiley & Sons, 2006). Chapter 7.....................Location Models (Sections 7.4 and 7.5 only)

2.2

Practical Application of Electricity Spot Market Models 3. Sally Hunt. Making Competition Work in Electricity (New York: John Wiley & Sons, Inc., 2002). 4. Chapter 8.....................Details of the Integrated Trading Model

PJM Interconnection. How RTOs Establish Spot Market Prices (September 2007). Freely available on the GARP Digital Library.

5.

Henry Louie and Kai Strunz. Locational Marginal Pricing in North American Power Systems. Freely available on the GARP Digital Library.

6.

PJM Interconnection. Financial Transmission Rights (July 2009). Sections 1, 2, 6 and 8 only.

7.

Nord Pool Spot. The Nordic Electricity Exchange and Model for a Liberalized Electricity Market. Freely available on the GARP Digital Library.

2.3

Hydro and Nuclear Power Generation 8. Tom Fogarty and Robert Lamb. Investing in the Renewable Power Market (Hoboken, NJ: John Wiley & Sons, Inc., 2012). Chapter 14 ...................Nuclear Chapter 15 ...................Hydropower

2013 Global Association of Risk Professionals. All rights reserved.

2013 Energy Risk Professional (ERP) Examination Study Guide

RENEWABLE ENERGYExam Weight | 10%

Overview of Renewable Markets Wind and the European Electricity Market Project Finance for Renewable Energy Trends in Carbon Pricing and Emissions Trading

Readings for Renewable Energy16 Questions

3.1 Overview of Renewable Markets 1. Geoffrey Heal. The Economics of Renewable Energy (2009). Freely available on the GARP Digital Library. 2. Govinda Timilsina and Ashish Shrestha. Biofuels: Markets, Targets and Impacts (The World Bank, July 2010). Sections 1, 2, 3, 4 and 5 only. Freely available on the GARP Digital Library. 3. Tom Fogarty and Robert Lamb. Investing in the Renewable Power Market (Hoboken, NJ: John Wiley & Sons, Inc., 2012). 3.2 Chapter 16 ...................Geothermal

Wind and the European Electricity Market: A Practical Application of Renewable Power 4. European Wind Energy Association. The Economics of Wind Energy (March 2009). Freely available on the GARP Digital Library. 5. European Wind Energy Association. Creating the Internal Energy Market in Europe (September 2012). Freely available on the GARP Digital Library.

3.3

Project Finance for Renewable Energy 6. Chris Grobey, John Pierce, Michael Faber and Greg Broome. Project Finance Primer for Renewable Energy and Clean Tech Projects (August 2010). Freely available on the GARP Digital Library.

3.4

Trends in Carbon Pricing and Emissions Trading 7. Joseph E. Aldy and Robert N. Stavins. The Promise and Problems of Carbon Pricing: Theory and Experience (Harvard Environmental Economics Program, October 2011). Freely available on the GARP Digital Library. 8. Larry Parker. Climate Change and the EU-Emissions Trading Scheme (ETS): Looking to 2020 (U.S. Congressional Research Service, January 2010). Freely available on the GARP Digital Library.

2013 Global Association of Risk Professionals. All rights reserved.

2013 Energy Risk Professional (ERP) Examination Study Guide

FINANCIAL PRODUCTS AND RISK MANAGEMENT FINANCIALLY TRADED PRODUCTSExam Weight | 15%

Forwards and Exchange Traded Futures Energy Commodity Swaps Energy Options Exotic Options and Structured Products Hedging Energy Commodity Risk Spread Trading in Energy Commodities OTC Derivative Trade Process Real Options

Readings for Financially Traded Products and Real Options24 Questions

4.1 Forwards and Exchange Traded Futures 1. Helyette Geman. Commodities and Commodity Derivatives, Modeling and Pricing for Agriculture, Metals and Energy (New York, NY: John Wiley & Sons, Inc., 2005). 2. Chapter 1......................Futures (Sections 1.1, 1.2, 1.3 and 1.4 only)

Robert McDonald. Derivatives Markets 3rd Edition (Boston, MA: Addison-Wesley, 2013). Chapter 5.....................Futures Contracts (Section 5.4 only) Chapter 6.....................Commodity Forwards and Futures (Sections 6.1, 6.2, 6.3, 6.6, 6.7 and 6.8 only)

4.2

Energy Commodity Swaps 3. McDonald. Derivatives Markets, 3rd Edition. 4. Chapter 8.....................Swaps (Sections 8.1 and 8.2 only)

Vincent Kaminski (ed). Managing Energy Price Risk (London: Risk Books, 2004). Chapter 1......................Energy Swaps

5.

Fletcher Sturm. Trading Natural Gas, Cash, Futures, Options and Swaps (Tulsa, OK: Pennwell, 1997). Chapter 4 ....................(Sections on Basis Swaps, Index Swaps, Swing Swaps and Exchange for Physicals only)

2013 Global Association of Risk Professionals. All rights reserved.

2013 Energy Risk Professional (ERP) Examination Study Guide

4.3

Energy Options 6. Kaminski (ed). Managing Energy Price Risk. Chapter 2.....................Energy Options

4.4

Exotic Options and Structured Products 7. Kaminski (ed). Managing Energy Price Risk. Chapter 3.....................Energy Exotic Options

4.5

Spread Trading in Energy Commodities 8. Steven Errera and Stewart L. Brown. Fundamentals of Trading Energy Futures & Options, 2nd Edition (Tulsa, OK: PennWell Books, 2002). Chapter 4 ....................Speculation and Spread Trading

4.6

OTC Derivative Trade Process 9. Nichole Framularo. OTC Commodity Derivatives Trade Processing Lifecycle Events (ISDA Working Paper, April 2012). Freely available on the GARP Digital Library.

4.7

Real Options 10. McDonald. Derivatives Markets, 3rd Edition. 11. Chapter 17 ...................Real Options

William Bailey, Benoit Couet, Ashish Bhandari, Soussan Faiz, Sunaram Srinivasan and Helen Weeds. Unlocking the Value of Real Options (Oilfield Review Winter 2003/2004). Freely available on the GARP Digital Library.

2013 Global Association of Risk Professionals. All rights reserved.

2013 Energy Risk Professional (ERP) Examination Study Guide

PRICE FORMATION, MARKET RISK AND VALUATIONExam Weight | 15%

Fundamental Probability, Statistics and Modeling Principles Energy Spot Price Formation Energy Forward Curves Modeling Energy Forward Curves Energy Price Volatility Market Risk Evaluation Financial Option Valuation Models

Readings for Price Formation, Market Risk and Valuation24 Questions

5.1 Fundamental Probability, Statistics and Modeling Principles 1. Michael Miller. Mathematics and Statistics for Financial Risk Management (Hoboken, NJ: John Wiley & Sons, Inc., 2012). 2. Chapter 2.....................Probabilities Chapter 3.....................Basic Statistics

Dragana Pilipovic. Energy Risk: Valuing and Managing Energy Derivatives, 2nd Edition (New York, NY: McGraw Hill, 2007). Chapter 3.....................Modeling Principles and Market Behavior (Sections 3.6 and 3.7 only) Chapter 4 ....................Essential Statistical Tools

5.2

Energy Spot Price Formation 3. Les Clewlow and Chris Strickland. Energy Derivatives: Pricing and Risk Management (London: Lacima Publications, 2000). 4. Chapter 2.....................Understanding and Analyzing Spot Prices

Pilipovic. Energy Risk: Valuing and Managing Energy Derivatives, 2nd Edition. Chapter 5.....................Spot Price Behavior

5.3

Energy Forward Curves 5. Clewlow and Strickland. Energy Derivatives: Pricing and Risk Management. 6. Chapter 4 ....................Energy Forward Curves

Pilipovic. Energy Risk: Valuing and Managing Energy Derivatives, 2nd Edition. Chapter 6.....................The Forward Price Curve (Sections 6.1, 6.2, 6.3, 6.4 and 6.5 only)

7.

Helyette Geman (ed). Risk Management in Commodity Markets: From Shipping to Agriculturals and Energy (Hoboken, NJ: John Wiley & Sons, Inc., 2008). Chapter 2.....................Forward Curve Modeling in Commodity Markets

2013 Global Association of Risk Professionals. All rights reserved.

2013 Energy Risk Professional (ERP) Examination Study Guide

5.4

Energy Price Volatility 8. Clewlow and Strickland. Energy Derivatives: Pricing and Risk Management. 9. Chapter 3.....................Volatility Estimation in Energy Markets (Sections 3.1 and 3.2 only)

Pilipovic. Energy Risk: Valuing and Managing Energy Derivatives, 2nd Edition. Chapter 8.....................Volatilities (Sections 8.1, 8.2, 8.3, 8.4 and 8.5 only)

5.5

Market Risk Measurement and Management 10. Clewlow and Strickland. Energy Derivatives: Pricing and Risk Management. 11. Chapter 10...................Value-at-Risk

Alessandro Mauro. Price Risk Management in the Energy Industry: The Value at Risk Approach, Proceedings of the XXII Annual International Conference of the International Association for Energy Economics (June 9-12, 1999). Freely available on the GARP Digital Library.

12. Louis Guth and Kristina Sepetys. Value at Risk: Variations on a Theme (Global Energy Business (May/June 2001). Freely available on the GARP Digital Library. 13. Jose Ramon Aragones, Carlos Blanco, and Kevin Dowd. Incorporating Stress Tests into Market Risk Modeling (Institutional Investor, Inc. Spring 2001). Freely available on the GARP Digital Library. 14. Allan Malz, Financial Risk Management: Models, History, and Institutions (Hoboken, NJ: John Wiley & Sons, 2011). Chapter 12 ...................Liquidity and Leverage (Sections 12.4, 12.5 and 12.6 only)

15. Frank Fabozzi. The Handbook of Commodity Investing (Hoboken, NJ: John Wiley & Sons, Inc., 2008). Chapter 13 ...................Effective Risk Management Strategies for Commodity Portfolios

16. Ludwig Chincarini. A Case Study on Risk Management: Lessons from the Collapse of Amaranth Advisors L.L.C. Freely available on the GARP Digital Library. 5.6 Option Valuation Models 17. Pilipovic. Energy Risk: Valuing and Managing Energy Derivatives, 2nd Edition. Chapter 10...................Option Valuation

2013 Global Association of Risk Professionals. All rights reserved.

2013 Energy Risk Professional (ERP) Examination Study Guide

CREDIT AND COUNTERPARTY RISKExam Weight | 10%

Credit and Counterparty Risk Assessment and Management Fundamentals of Central Counterparty Clearing

Readings for Credit and Counterparty Risk16 Questions

6.1 Credit and Counterparty Risk Assessment and Management 1. John Fraser and Betty Simkins. Enterprise Risk Management: Todays Leading Research and Best Practices for Tomorrows Executives (Hoboken, NJ: John Wiley & Sons, 2010). 2. Chapter 15 ...................Credit Risk Management

Burger, Graeber, and Schindlmayr. Managing Energy Risk: An Integrated View on Power and Other Energy Markets (West Sussex, U.K.: John Wiley & Sons, 2007). Chapter 6.3 .................Risk Management (Credit Risk)

3.

Allan Malz, Financial Risk Management: Models, History, and Institutions (Hoboken, NJ: John Wiley & Sons, 2011). Chapter 6.....................Credit and Counterparty Risk

4.

Jon Gregory, Counterparty Credit Risk: The New Challenge for Global Financial Markets (West Sussex, U.K.: John Wiley & Sons, 2010). Chapter 2.....................Defining Counterparty Credit Risk Chapter 3.....................Mitigating Counterparty Credit Risk Chapter 4 ....................Quantifying Counterparty Exposure I (Sections 4.1 and 4.2 only) Chapter 5.....................Quantifying Counterparty Exposure II Chapter 7.....................Pricing Counterparty Credit Risk I (Sections 7.1 and 7.2 only) Chapter 8.....................Pricing Counterparty Credit Risk II (Sections 8.1, 8.2 and 8.3 only)

6.2

Fundamentals of Central Counterparty Clearing 5. Craig Pirrong. The Economics of Central Counterparty Clearing: Theory and Practice (ISDA Working Paper). Freely available on the GARP Digital Library.

10

2013 Global Association of Risk Professionals. All rights reserved.

2013 Energy Risk Professional (ERP) Examination Study Guide

OPERATIONAL RISK AND STRATEGIC RISK MANAGEMENTExam Weight | 10%

Operational Risk Evaluation Strategic Risk Management and Corporate Governance Ethics and the GARP Code of Conduct

Readings for Operational Risk and Strategic Risk Management 16 Questions

7.1 Operational Risk Evaluation 1. John Fraser and Betty Simkins. Enterprise Risk Management: Todays Leading Research and Best Practices for Tomorrows Executives (Hoboken, NJ: John Wiley & Sons, 2010). 2. Chapter 8.....................Identifying and Communicating Key Risk Indicators Chapter 16 ...................Operational Risk Management

Mark A. Cohen, Madeline Gottlieb, Joshua Linn, and Nathan Richardson. Deepwater Drilling: Law, Policy and Economics of Firm Organization and Safety (January 2011). Freely available on the GARP Digital Library.

3.

NERA Economic Consulting. Lessons from the BP Deepwater Horizon Oil Spill (September 2010). Freely available on the GARP Digital Library.

4.

Robert Bea, Ian Mitroff, Daniel Farber, Howard Foster and Karlene H. Roberts. A New Approach to Risk: The Implications of E3 (Palgrave Macmillan 2009). Freely available on the GARP Digital Library.

5.

Senior Supervisors Group. Observations on Developments in Risk Appetite Frameworks and IT Infrastructure (December 2010). Freely available on the GARP Digital Library.

7.2

Strategic Risk Management and Corporate Governance 6. International Finance Corporation (IFC). Risk Taking: A Corporate Governance Perspective (June 2012). Freely available on the GARP Digital Library.

7.3

Ethics and the GARP Code of Conduct 7. Global Association of Risk Professionals (GARP) Code of Conduct. Freely available on the GARP website.

2013 Global Association of Risk Professionals. All rights reserved.

11

2013 Energy Risk Professional (ERP) Examination Study Guide

CURRENT ISSUES IN ENERGY CURRENT ISSUES IN ENERGYExam Weight | 5%

NOTE ON THE CURRENT ISSUES IN ENERGY SECTION: Global energy risk managers must remain abreast of evolving regulation and new developments in energy markets to effectively manage risk in their businesses. The Current Issues section is designed to familiarize ERP candidates with current trends that are likely to have a long-term impact on the global energy markets. Information contained within each current issues reading is relevant as of November 15, 2012 and candidates can expect to be tested on these readings throughout 2013. Subsequent developments in these topics, or any new areas of focus, will be captured on the 2014 ERP Examination.

Readings for Current Issues in Energy8 Questions

8.1 Impact of Russias Refinery Upgrade Plans on Global Fuel Oil Markets 1. Bassam Fattouh and James Henderson. The Impact of Russias Refinery Upgrade Plans on Global Fuel Oil Markets (The Oxford Institute for Energy Studies). Freely available on the GARP Digital Library. Current Trends in the Refining Industry 2. Ernst & Young. The Oil Downstream: Vertically Challenged? Freely available on the GARP Digital Library. Europes Energy Security: Options and Challenges to Natural Gas Supply Diversification 3. Michael Ratner, Paul Belkin, and Jim Nochal. Europes Energy Security: Options and Challenges to Natural Gas Supply Diversification (U.S. Congressional Research Service). Freely available on the GARP Digital Library. Economic Incentives and the Impact on Renewable Power Generation 4. Frank Huntowski, Aaron Patterson, and Michael Schnitzer. Negative Electricity Prices and the Production Tax Credit (The Northbridge Group). Freely available on the GARP Digital Library. Market Manipulation 5. Shaun Ledgerwood, Gary Taylor, Romkaew Broehm and Dan Arthur. Losing Money to Increase Profits: A Proposed Framework for Defining Market Manipulation (The Brattle Group, March 2011). Freely available on the GARP Digital Library. Dodd-Frank Regulatory Update 6. Sherman & Sterling LLP. A Corporate End-Users Handbook for Dodd-Frank Title VII Compliance. Freely available on the GARP Digital Library. 7. Baker Botts. CFTC Adopts Final Swap Definition, Interprets Statutory Exclusion for Physical Delivery Forwards. Freely available on the GARP Digital Library.

12

2013 Global Association of Risk Professionals. All rights reserved.

2013 Energy Oversight Committee (EOC) Members Ken Abbott .........................................Morgan Stanley & Company Richard Apostolik ............................Global Association of Risk Professionals Mark Galicia .......................................BP North America, Inc. Gordon E. Goodman.......................Retired, Occidental Petroleum Corporation James Brown .....................................Morgan Stanley & Company Mark Jenner .......................................BG Group Jeff Jewell...........................................DTE Energy Glenn Labhart, EOC Chair ............Labhart Risk Advisors Spyros Maragos ................................Direct Energy Alessandro Mauro............................Litasco SA Mark D. May ........................................Phillips 66 Jeff Parke ............................................Koch Industries, Inc. Jonathan C. Stein.............................Hess Corporation Andrew D. Sunderman...................Direct Energy Glen Swindle ......................................Scoville Risk Partners John Wengler ....................................Hess Corporation

Creating a culture of risk awareness.

Global Association of Risk Professionals 111 Town Square Place Suite 1215 Jersey City, New Jersey 07310 U.S.A. + 1 201.719.7210 2nd Floor Bengal Wing 9A Devonshire Square London, EC2M 4YN U.K. + 44 (0) 20 7397 9630 www.garp.org

About GARP | The Global Association of Risk Professionals (GARP) is a not-for-profit global membership organization dedicated to preparing professionals and organizations to make better informed risk decisions. Membership represents over 150,000 Members and Affiliates from banks, investment management firms, government agencies, academic institutions, and corporations from more than 195 countries and territories. GARP administers the Financial Risk Manager (FRM) and the Energy Risk Professional (ERP) Exams; certifications recognized by risk professionals worldwide. GARP also helps advance the role of risk management via comprehensive professional education and training for professionals of all levels. www.garp.org.

2012 Global Association of Risk Professionals. All rights reserved. 12-5-12

Potrebbero piacerti anche

- Erp 2017 Studyguide FinalDocumento20 pagineErp 2017 Studyguide Finalken_ng333Nessuna valutazione finora

- Garp Erp Study Guide 2015 12115Documento20 pagineGarp Erp Study Guide 2015 12115Sakthivel BalakrishnanNessuna valutazione finora

- 2011 Erp Study GuideDocumento12 pagine2011 Erp Study GuideRomeo NandrajogNessuna valutazione finora

- PMI RMP HandbookDocumento0 paginePMI RMP HandbookKarina Moscoso ArangoNessuna valutazione finora

- Object Oriented Programming FundamentalsDocumento642 pagineObject Oriented Programming FundamentalsDennis VladuNessuna valutazione finora

- Ricardo Vargas Program Flow Color A1 enDocumento1 paginaRicardo Vargas Program Flow Color A1 ensalvgranNessuna valutazione finora

- 02 RMP EXAM Prep - Abdullah Al Kwaiti PDFDocumento126 pagine02 RMP EXAM Prep - Abdullah Al Kwaiti PDFnaveedNessuna valutazione finora

- 2019 Erp Pe P1Documento104 pagine2019 Erp Pe P1simi263Nessuna valutazione finora

- PMI RMP HandbookDocumento39 paginePMI RMP HandbooksrisujaNessuna valutazione finora

- Robert W Kolb Series Energy Finance and Economics Analysis and Valuation Risk Management and The Future of Energy 1Documento12 pagineRobert W Kolb Series Energy Finance and Economics Analysis and Valuation Risk Management and The Future of Energy 1Jerry ChiangNessuna valutazione finora

- Quantlib ExercisesDocumento71 pagineQuantlib ExercisesMauricio BedoyaNessuna valutazione finora

- PmiDocumento8 paginePmisalman1arif1Nessuna valutazione finora

- Manegerial Economics (Risk Analysis Presentation)Documento39 pagineManegerial Economics (Risk Analysis Presentation)Faheem Ul HassanNessuna valutazione finora

- The Monte Carlo Method For Modeling Mitigating Systemic Risk PDFDocumento46 pagineThe Monte Carlo Method For Modeling Mitigating Systemic Risk PDFJorgeNessuna valutazione finora

- Tesla Motors (In 2013) - Will Sparks Fly in The Automobile IndustryDocumento26 pagineTesla Motors (In 2013) - Will Sparks Fly in The Automobile IndustryNathan GellinNessuna valutazione finora

- Cyclomatic Complexity Guru99Documento8 pagineCyclomatic Complexity Guru99qabiswajitNessuna valutazione finora

- Graphical Kernel System (GKS)Documento107 pagineGraphical Kernel System (GKS)EDTIALNessuna valutazione finora

- Chapter Four: Database Concepts, 6 EditionDocumento54 pagineChapter Four: Database Concepts, 6 Editionjeremy saputraNessuna valutazione finora

- Learning To LEED: Day 2 Materials & Resources QuizDocumento5 pagineLearning To LEED: Day 2 Materials & Resources Quizvico1982Nessuna valutazione finora

- McCabe's Cyclomatic Complexity MetricDocumento14 pagineMcCabe's Cyclomatic Complexity MetriciamtoocooolNessuna valutazione finora

- QML CPP IntegrationDocumento74 pagineQML CPP Integrationmetalcomando114421Nessuna valutazione finora

- Visual Basic 6.0 Lec1 To Lec3Documento25 pagineVisual Basic 6.0 Lec1 To Lec3Hussein AlkafajiNessuna valutazione finora

- Quantitative Investment Analysis CFA Institute Investment SeriesDocumento159 pagineQuantitative Investment Analysis CFA Institute Investment SeriesMuhamad ArmawaddinNessuna valutazione finora

- List of Data Sets and Examples from Basic Econometrics 5eDocumento6 pagineList of Data Sets and Examples from Basic Econometrics 5eVishal B PanchalNessuna valutazione finora

- Excel RS1 MethodDocumento32 pagineExcel RS1 MethodOscar Zapata Jr100% (2)

- Ghana Housing ProfileDocumento242 pagineGhana Housing ProfileFox Tam0% (1)

- Bootstrap Methods for Estimating Standard Errors and Confidence IntervalsDocumento7 pagineBootstrap Methods for Estimating Standard Errors and Confidence Intervalshytsang123Nessuna valutazione finora

- Annual Report Real Estate Sector Performance 2021Documento45 pagineAnnual Report Real Estate Sector Performance 2021Sanaa BelNessuna valutazione finora

- Follow These Steps To Export and Import A Web Content LibraryDocumento4 pagineFollow These Steps To Export and Import A Web Content LibrarytinceevermaNessuna valutazione finora

- VisionMobile-Developer Economics 2011Documento60 pagineVisionMobile-Developer Economics 2011John WesongaNessuna valutazione finora

- Mishkin PPT Ch17Documento22 pagineMishkin PPT Ch17atulkirarNessuna valutazione finora

- Factoring PracticeDocumento6 pagineFactoring PracticeJeanalmiraNessuna valutazione finora

- Standard and Poors Property Condition Assessment CriteriaDocumento196 pagineStandard and Poors Property Condition Assessment CriteriabhaskarjalanNessuna valutazione finora

- Certified Estimating Professional (CEP) References: Portfolio, Program, and Project Management, AACE InternationalDocumento1 paginaCertified Estimating Professional (CEP) References: Portfolio, Program, and Project Management, AACE Internationalkeight_NNessuna valutazione finora

- Wiley 2009 EngineeringDocumento20 pagineWiley 2009 Engineeringmerve_acarNessuna valutazione finora

- StatsDocumento816 pagineStatsmarlonekeila0% (1)

- Dependency Injection With UnityDocumento142 pagineDependency Injection With UnitycervantesjcNessuna valutazione finora

- Renewable Energy Discount Rate Survey Results 2018 PDFDocumento36 pagineRenewable Energy Discount Rate Survey Results 2018 PDFMario AdityaNessuna valutazione finora

- IST 4030A Normalisation ExerciseDocumento4 pagineIST 4030A Normalisation ExerciseHuzeifa Musajee100% (1)

- 1993-00 A Closed-Form Solution For Options With Stochastic Volatility With Applications To Bond and Currency Options - HestonDocumento17 pagine1993-00 A Closed-Form Solution For Options With Stochastic Volatility With Applications To Bond and Currency Options - Hestonrdouglas2002Nessuna valutazione finora

- Dotnet SyllabusDocumento2 pagineDotnet Syllabuskkumar_876069Nessuna valutazione finora

- Davis Langdon Africa Handbook Jan 2009Documento94 pagineDavis Langdon Africa Handbook Jan 2009Caesar 'Dee' Rethabile SerumulaNessuna valutazione finora

- Advanced Java SecurityDocumento10 pagineAdvanced Java SecurityArunendu MajiNessuna valutazione finora

- Erp Practice Quiz 2 2013Documento18 pagineErp Practice Quiz 2 2013caroweNessuna valutazione finora

- COM Tutorial Breaks Down COM FundamentalsDocumento61 pagineCOM Tutorial Breaks Down COM FundamentalsVaraprasad Pottumurthy100% (1)

- ContractDocumento98 pagineContractneoNessuna valutazione finora

- The Normal Distribution Is The DistributionDocumento34 pagineThe Normal Distribution Is The DistributionKevin Pineda100% (1)

- 12 Data Analytics Strategies Where and When Big Data MattersDocumento13 pagine12 Data Analytics Strategies Where and When Big Data MattersRakesh SanthapurNessuna valutazione finora

- Professional Real Estate Development: The ULI Guide to the BusinessDa EverandProfessional Real Estate Development: The ULI Guide to the BusinessNessuna valutazione finora

- Experimentation for Engineers: From A/B testing to Bayesian optimizationDa EverandExperimentation for Engineers: From A/B testing to Bayesian optimizationNessuna valutazione finora

- Project Engineering A Complete Guide - 2020 EditionDa EverandProject Engineering A Complete Guide - 2020 EditionValutazione: 5 su 5 stelle5/5 (1)

- Business alliance The Ultimate Step-By-Step GuideDa EverandBusiness alliance The Ultimate Step-By-Step GuideNessuna valutazione finora

- 2010 ERPStudy GuideDocumento16 pagine2010 ERPStudy GuideWinston Kasongo100% (1)

- Study Guide Changes: Energy Risk ProfessionalDocumento10 pagineStudy Guide Changes: Energy Risk ProfessionalReba SarkarNessuna valutazione finora

- 2016 Erp Studyguide Finalv3Documento20 pagine2016 Erp Studyguide Finalv3Marock RajwinderNessuna valutazione finora

- ERP 2016 LearningObjectives FinalV4 2Documento35 pagineERP 2016 LearningObjectives FinalV4 2L Prakash JenaNessuna valutazione finora

- 2017 Erp Study Guide ChangesDocumento10 pagine2017 Erp Study Guide ChangesKitty FitzgeraldNessuna valutazione finora

- Electricity Markets and Renewable Generation RevisedDocumento334 pagineElectricity Markets and Renewable Generation RevisedMuhammad Anwar Ul Haq100% (1)

- Jinkosolar Holding Co., LTD.: Q3 2017 Earnings Call PresentationDocumento10 pagineJinkosolar Holding Co., LTD.: Q3 2017 Earnings Call PresentationAshutosh KumarNessuna valutazione finora

- JinkoSolar Q4 2016 Earnings Call Highlights Cost Cuts and 2017 OutlookDocumento11 pagineJinkoSolar Q4 2016 Earnings Call Highlights Cost Cuts and 2017 OutlookAshutosh KumarNessuna valutazione finora

- Study Guide: Energy Risk ProfessionalDocumento19 pagineStudy Guide: Energy Risk ProfessionalasasNessuna valutazione finora

- DHPC UI May 08-14Documento2 pagineDHPC UI May 08-14Ashutosh KumarNessuna valutazione finora

- TPTCL Form IV July 2013 IIDocumento15 pagineTPTCL Form IV July 2013 IIAshutosh KumarNessuna valutazione finora

- Consumer Behaviour in Services Lecture2Documento26 pagineConsumer Behaviour in Services Lecture2Ashutosh KumarNessuna valutazione finora

- Introduction To Business-to-Business Marketing: Vitale A ND Gig LieranoDocumento17 pagineIntroduction To Business-to-Business Marketing: Vitale A ND Gig LieranoAshutosh KumarNessuna valutazione finora

- Rent AgreementDocumento3 pagineRent AgreementAshutosh KumarNessuna valutazione finora

- Love Lock 01Documento34 pagineLove Lock 01api-3698751100% (2)

- TPTCL Form IV February 2014Documento13 pagineTPTCL Form IV February 2014Ashutosh KumarNessuna valutazione finora

- Report For The Second Quarter Ended September 30, 2009: Letter To The ShareholderDocumento4 pagineReport For The Second Quarter Ended September 30, 2009: Letter To The ShareholderAshutosh KumarNessuna valutazione finora

- Lessard, Incorporating Country Risk...Documento12 pagineLessard, Incorporating Country Risk...Serge PizotNessuna valutazione finora

- Completion CertificateDocumento2 pagineCompletion CertificateAshutosh KumarNessuna valutazione finora

- UntitledDocumento1 paginaUntitledAshutosh KumarNessuna valutazione finora

- UntitledDocumento1 paginaUntitledAshutosh KumarNessuna valutazione finora

- Demat Benefits ExplainedDocumento3 pagineDemat Benefits ExplainedMohsin KhanNessuna valutazione finora

- Cover Letter1Documento1 paginaCover Letter1Ashutosh KumarNessuna valutazione finora

- Book 1Documento28 pagineBook 1Ashutosh KumarNessuna valutazione finora

- Microsoft Office Enterprise 2007 SerialDocumento1 paginaMicrosoft Office Enterprise 2007 SerialemilvickyNessuna valutazione finora

- The Nature and Purpose of Accounting: Mcgraw-Hill/IrwinDocumento36 pagineThe Nature and Purpose of Accounting: Mcgraw-Hill/IrwinAshutosh KumarNessuna valutazione finora

- Interpretation of Static Load Tests On The Burj Khalifa's FoundationDocumento9 pagineInterpretation of Static Load Tests On The Burj Khalifa's FoundationMALIKNessuna valutazione finora

- College of Nursing: Assignment ON Nursing ClinicDocumento5 pagineCollege of Nursing: Assignment ON Nursing ClinicPriyaNessuna valutazione finora

- The Indonesian Food Processing Industry (Final)Documento48 pagineThe Indonesian Food Processing Industry (Final)patalnoNessuna valutazione finora

- Porphyria's Lover - Robert BrowningDocumento9 paginePorphyria's Lover - Robert Browningdearkatie6688Nessuna valutazione finora

- FMDocumento12 pagineFMGajera HarshadNessuna valutazione finora

- #4 Types of Food, Ingredients and Procedures.Documento7 pagine#4 Types of Food, Ingredients and Procedures.Peter GonzálezNessuna valutazione finora

- MỘT SỐ CÂU HỎI TRẮC NGHIỆM ÁP DỤNG CHUYÊN ĐỀ GIỚI TỪ TRONG ĐỀ THI ĐHDocumento6 pagineMỘT SỐ CÂU HỎI TRẮC NGHIỆM ÁP DỤNG CHUYÊN ĐỀ GIỚI TỪ TRONG ĐỀ THI ĐHPhương ThảoNessuna valutazione finora

- Hanoi 2023 Peoples Picks AwardsDocumento113 pagineHanoi 2023 Peoples Picks AwardsNguyen Anh VuNessuna valutazione finora

- VMA 2520 eDocumento7 pagineVMA 2520 eVijaya SimhaNessuna valutazione finora

- SoalDocumento2 pagineSoalmaria_diyah4312Nessuna valutazione finora

- Comp7 - Answer Key - Dec. Exam - 1st SetDocumento2 pagineComp7 - Answer Key - Dec. Exam - 1st SetHazel Joy LusellaNessuna valutazione finora

- Product Information: Traffic Management AccessoryDocumento12 pagineProduct Information: Traffic Management AccessoryCORAL ALONSONessuna valutazione finora

- Word Trek Lesson OutlinesDocumento8 pagineWord Trek Lesson Outlinesapi-289048378Nessuna valutazione finora

- FH400 73158464 Pca-6.140Documento431 pagineFH400 73158464 Pca-6.140IgorGorduz100% (1)

- Climate Change & Disaster Risk Management: Razon, Lovelyn Rivera, Meg Anne Sta. Ines, MaricrisDocumento56 pagineClimate Change & Disaster Risk Management: Razon, Lovelyn Rivera, Meg Anne Sta. Ines, MaricrisMeg Anne Legaspi RiveraNessuna valutazione finora

- Contact Details For Medical Schools by PostcodeDocumento13 pagineContact Details For Medical Schools by PostcodeHeena R ModiNessuna valutazione finora

- PWC Verbal Past Question and Answer 1Documento130 paginePWC Verbal Past Question and Answer 1Anton PermanaNessuna valutazione finora

- University of Toronto Astronomy 101 Midterm Test QuestionsDocumento6 pagineUniversity of Toronto Astronomy 101 Midterm Test QuestionsTrash RowzanNessuna valutazione finora

- 2003 VW Jetta Wiring DiagramsDocumento123 pagine2003 VW Jetta Wiring DiagramsmikeNessuna valutazione finora

- Router ScriptDocumento10 pagineRouter ScriptfahadNessuna valutazione finora

- Strategic Capacity ManagementDocumento36 pagineStrategic Capacity ManagementRahul KhannaNessuna valutazione finora

- Tabel Benkelman Beam Baru - AsisDocumento21 pagineTabel Benkelman Beam Baru - AsisAsisNessuna valutazione finora

- Fakeaway - Healthy Home-Cooked Takeaway MealsDocumento194 pagineFakeaway - Healthy Home-Cooked Takeaway MealsBiên Nguyễn HữuNessuna valutazione finora

- 1625-De Dwks Parts ListDocumento69 pagine1625-De Dwks Parts ListSasan AbbasiNessuna valutazione finora

- Alimak AustraliancontractminingDocumento5 pagineAlimak AustraliancontractminingmanudemNessuna valutazione finora

- AC Circuit 2 (Three-Phase)Documento2 pagineAC Circuit 2 (Three-Phase)marlon desaculaNessuna valutazione finora

- Reservoir Engineering Handbook Tarek Ahmed Solution ManualDocumento36 pagineReservoir Engineering Handbook Tarek Ahmed Solution ManualMohamad Hasen japerNessuna valutazione finora

- Cap Tikus As Symbol of Social Closeness in The Life of The Minahasa PeopleDocumento3 pagineCap Tikus As Symbol of Social Closeness in The Life of The Minahasa PeopleEdwinNessuna valutazione finora

- Team Handball SG Pratt v2Documento2 pagineTeam Handball SG Pratt v2Peter StonesNessuna valutazione finora

- Coyle Chapter 2 PowerPoint SlidesDocumento33 pagineCoyle Chapter 2 PowerPoint SlidesKhaled Sheykh0% (1)