Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Non-Profit Case Study: Pregnancy Care Center

Caricato da

Geoffrey GreeneCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Non-Profit Case Study: Pregnancy Care Center

Caricato da

Geoffrey GreeneCopyright:

Formati disponibili

Accounting 57: Not-For-Profit

Pregnancy Care Center (PCC) is a privately funded faith based - non denominational community service organization chartered as a nonprofit 501(c)(3) under the United States Internal Revenue Code 26 U.S.C 501(c). PCC Mission statement: We Care The Pregnancy Care Center exists to make sure that women are provided with the support they need as they face crucial decisions regarding their pregnancy. PCC offers caring and compassionate help through education, peer counseling, and practical assistance. As part of their community outreach; all facility services are provided free of charge and confidential including the following: Free pregnancy testing with immediate results. Pregnancy option counseling with ongoing support. Ultrasound exams, Community resources and referrals. Classes on Parenting, Childbirth and Nutrition. Infant resources, clothing and care supplies. Healthy Options Prevention Education (Hope Team) Support groups for post abortion and pregnancy loss. PCC is managed by executive director and support staff members; noting that most staff work part time (4-30 hours) on flexible schedules. Organization is governed by a Board of Directors and members serving rotating 3-year terms. Board consists of area community leaders and licensed professionals including Attorneys, Doctors and Accountants. Clinical operations are supervised by board member MD who offers his services at no charge. Board Member CPA provides financial accounting supervision at no charge. PCC has two physical locations to serve the community Downtown Center is located near the City Medical Center and adjacent to a Family Planning Clinic. A new satellite location recently opened in north Professional Center. PCC also funds Hope in Action which is a fully-equipped mobile ultrasound clinic serving the rural areas of Central Valley; staffed by Pregnancy Care Center medical personnel and volunteers.

PCC is privately funded and operates on a fiscal year July June. Last year the center(s) serviced 2,884 clients with 5,000+ clinic visits. The 2012 2013 yearly budgets are funded through area Churches, Community Fundraising, Private Donations and Foundations. Limited public grants are available and have been approved, but unfortunately remain unfunded noting PCC does not actively pursue public grants due to governmental requirements and restrictions regarding faith based teaching alternatives to birth control and abortion services. As a private non-profit, Pregnancy Care Center follows basic FASB reporting guidelines and prepares operating financial reports on a full accrual accounting method with operating items. Fixed Assets and Depreciation methods and schedules are maintained by supervising CPA firm. PCC Bookkeeping Staff and Executive Director have limited accounting exposure; hence deferring to the accounting methods decision to the Board of Directors and CPA firm. Fund sources and types include: General Income general unrestricted use. Source: Churches & Private contributions. Fundraising Projects restricted / assigned uses. Source: Dedicated fundraising projects. Mobile Ultrasound Clinic restricted use. Source: Private Donations & Foundations. North Satellite Center Clinic restricted / assigned use. Source: Churches & Private Donations. Operating budget is based upon prior year revenues of forecasted donations and estimated expenses, final budget is prepared and appropriations approved by Board of Directors in May June for July fiscal year. Current Profit & Loss Budget vs. Actual financials report year to date spending exceeding revenues with the recent opening of the Satellite Center. Undertaking this expansion of services is a large financial commitment to which Executive Director and Board of Directors have fully embraced. While Balance Sheet Financials were not available, the Staff Bookkeeper and Executive Director assured that the Pregnancy Care Center has adequate reserves to continue their outreach mission unimpeded. Executive Director noted donation demographics have shifted over the past few years as large corporate block giving has decreased; however private (smaller increment / general public) and foundation donations increased. PCC Board of Directors works directly with a CPA Accounting firm for preparation of the annual financial audits noting all bookkeeping / accounting practices and tax filings are reviewed by CPA firm serving as a current board member. Center bookkeeping and accounting staff uses Quick Books Not for Profit accounting software with direct file linking to the CPA firm. Again, only limited financial information (no balance sheets) was provided by bookkeeping / accounting staff for review to prepare this written overview.

Potrebbero piacerti anche

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Guidance Letter To States Medicaid DirectorDocumento5 pagineGuidance Letter To States Medicaid DirectorBeverly TranNessuna valutazione finora

- Updated Health Bulletin Volume 2 Issue 10Documento38 pagineUpdated Health Bulletin Volume 2 Issue 10ABAliNessuna valutazione finora

- Assignment ID 242871 Bismarck HealhcareDocumento9 pagineAssignment ID 242871 Bismarck HealhcarePETER KAMOTHONessuna valutazione finora

- Malaysia Pharmaceuticals and Healthcare Report Q3 2010Documento105 pagineMalaysia Pharmaceuticals and Healthcare Report Q3 2010ali91Nessuna valutazione finora

- UndanganDocumento2 pagineUndanganBriliant Tri Anatantya LestariNessuna valutazione finora

- Information Security Handbook For EmployeesDocumento13 pagineInformation Security Handbook For EmployeesKarthikNessuna valutazione finora

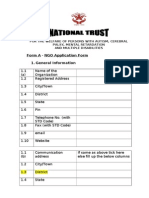

- Form - A (NGO Proforma)Documento8 pagineForm - A (NGO Proforma)Ashwani Singh ChauhanNessuna valutazione finora

- Docket No. AO 12-025 WD - Nathan and Jenny Chartier, Abigails Bakery HILITEDDocumento4 pagineDocket No. AO 12-025 WD - Nathan and Jenny Chartier, Abigails Bakery HILITEDAudra ToopNessuna valutazione finora

- IPIC 2013 Sponsorship Proposal - FINAL 2012 12 01Documento17 pagineIPIC 2013 Sponsorship Proposal - FINAL 2012 12 01Amardeep KaushalNessuna valutazione finora

- ReconsideracionDocumento4 pagineReconsideracionhenryNessuna valutazione finora

- Radio OperatorDocumento2 pagineRadio OperatorStefanNessuna valutazione finora

- 2015maud MS241Documento2 pagine2015maud MS241Raghu RamNessuna valutazione finora

- Nestle Cocoa Child LabourDocumento4 pagineNestle Cocoa Child LabourJulius Paulo ValerosNessuna valutazione finora

- Laura Hopkins EVG Final2Documento3 pagineLaura Hopkins EVG Final2Laura HopkinsNessuna valutazione finora

- 3.3 Kantian Theory - Kantian Ethics TheoryDocumento14 pagine3.3 Kantian Theory - Kantian Ethics TheoryAbdulwhhab Al-ShehriNessuna valutazione finora

- English in NursingDocumento9 pagineEnglish in NursingYuni Kurnia PrajawatiNessuna valutazione finora

- Code of Ethics For NursesDocumento11 pagineCode of Ethics For NursesPaul Andrew TugahanNessuna valutazione finora

- Mike PenceDocumento50 pagineMike PencepersonstakeplaceNessuna valutazione finora

- HDFC ERGO General Insurance Company LimitedDocumento3 pagineHDFC ERGO General Insurance Company LimitedKumar A GovindaNessuna valutazione finora

- Residency ProgramsDocumento72 pagineResidency Programsmorasaki003Nessuna valutazione finora

- Argumentative EssayDocumento4 pagineArgumentative Essaynoreen diorNessuna valutazione finora

- Fox August 2018 Complete National Topline August 23 ReleaseDocumento41 pagineFox August 2018 Complete National Topline August 23 ReleaseFox NewsNessuna valutazione finora

- Factories and Machinery (Noise Exposure) Regulations, 1989 Ve - Pua1 - 1989Documento15 pagineFactories and Machinery (Noise Exposure) Regulations, 1989 Ve - Pua1 - 1989Exsan OthmanNessuna valutazione finora

- Module 10 Air Legislation EssayDocumento3 pagineModule 10 Air Legislation EssayKeith Roche100% (1)

- Times Leader 01-23-2012Documento36 pagineTimes Leader 01-23-2012The Times LeaderNessuna valutazione finora

- The Dangers of Withdrawing A TenderDocumento2 pagineThe Dangers of Withdrawing A TenderMdms PayoeNessuna valutazione finora

- Health System Director Administrator in Columbus OH Resume Cheryl GuymanDocumento2 pagineHealth System Director Administrator in Columbus OH Resume Cheryl GuymanCherylGuymanNessuna valutazione finora

- Division of Camarines SurDocumento1 paginaDivision of Camarines SurkachirikoNessuna valutazione finora

- Construction of Covered Court MangolagoDocumento1 paginaConstruction of Covered Court MangolagoErwin Macapinlac MabutiNessuna valutazione finora

- Sitra Annual Report and Financial Statements 2017Documento64 pagineSitra Annual Report and Financial Statements 2017tarun kNessuna valutazione finora