Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

BUS 310 - Exam 2

Caricato da

Nerdy Notes Inc.Copyright

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

BUS 310 - Exam 2

Caricato da

Nerdy Notes Inc.Copyright:

nerdy-notes.

com

submitted by user Yuyumon Class: School: Lecture/Exam: Professor: BUS 310 Fall 2012 Exam 2 Holod

Chapter 5

Leverage

Special force, used to magnify or increase results of a given action Amplifies both beneficial or negative results

Leverage in business

Fixed operational costs: 1) Plant & Equipt. eliminates labor in production cycle. At high levels you will do well as most cost are fixed, at low volume difficult making payment cuz cost are fixed 2) Expensive labor Lessens profit but reduces risk (lay of workforce), more adaptable Fixed financial costs: Debt financing Huge profits, but failure -> bankruptcy because you have fixed debt to pay back Selling equity Reduces profits because you are sharing profit, but minimizes risk, because you only lose other peoples equity

Operating leverage

Extent to which fixed assets and associated fixed costs are utilized in a business Operational costs include: Fixed and variable Fixed: Lease, depreciation, executive salaries, property taxes Variable: Raw material, factory labor, sales commissions Break even analysis Where total cost and total revenue intersect BE-Analysis = Fixed costs/contribution margin = Fixed costs/(Price-Variable costs per unit) Volume-cost-profit analysis: Leveraged firm

Approaches to BE Conservative approach Firm operate with less operating leverage 1) More expensive variable costs substituted for automated plant and equipment 2) Cuts into profit

3) BUT! Lower break-even point

Leveraged firm - Firm works with a lot of debt. Potential profits larger, more risky Risk factor Factors influencing making it a conservative or leveraged stance Includes: Economic condition, competitive position in industry, future position in industry, matching acceptable return with desired level of risk Cash break even analysis For short-term outlook of a firm Non-cash items excluded (depreciation, sales (acc. Rec. rather than cash), purchase of materials, accounts payable) Degree of operating leverage DOL = % change in operating income/% change in unit volume Occurs as result of percentage change in units sold Computed only over a profitable range of operations Proportional to firms break-even point Comparison of a leveraged and conservative firm Units sold 0 20,000 40,000 60,000 80,000 Leveraged Firm (60,000) (36,000) (12,000) 12,000 (breaks even last) 36,000 (more profit) Conservative Firm (12,000) (4,000) 4,000 (breaks even first!) 12,000 20,000

DOL = (quantity at which dol is computed)*(price per unit variable cost per unit)/((quantity at which dol is computed)*(price per unit variable cost) Fixed cost) Limits of analysis Weakening of price in an attempt to capture an increasing market Cost overruns when moving beyond an optimum-size operation Relationships not necessarily fixed -> non-linear break even Financial leverage Reflects the amount of debt used in a capital structure of the firm

How operation is to be financed Determines the performance between two firms having equal operating capabilities Impact on earnings: Leverage (more debt) has more EPS Degree of Fin leverage DFL = Delta% EPS/ Delta% EBIT or DFL = EBIT/ (EBIT-I) Limits of fin leverage Beyond point debt financing is detrimental to firm (greater risk, stockholders drive down price Good for firms that are in stable industry, positive stage of growth, in favorable economic conditions Comb op and fin lev Both leverages combined allow a firm to maximize returns Operating leverage affects the asset structure of firm and determines return from operations Financial leverage Affects the debt-equity mix and determines how the benefits received will be allocated

The 2 Types of leverage 1) Operating leverage - leverage through the usage of fixed and variable cost Sales (total revenue) (60,000 units @ $3) -- Fixed costs -- Variable Cost ($.60 per unit) Operating Income (Fixed and variable cost used is the op. leverage) $180,000 $80,000 $64,000 $36,000

2) Financial leverage Earnings before Interest and Taxes -- Interest Earnings before Taxes --Taxes $36,000 $10,000 $26,000 $10,000

Earnings after Taxes Shares Earnings per share

$16,000 8,000 $2

Leverage Chart

Sales effecting leverage 60,000 units Sales (total revenue) (units @ $3) -- Fixed costs -- Variable Cost ($1.07 per unit) $180,000 $80,000 $64,000 100,000 units $300,000 $80,000

$107,000 $113,000

Operating Income (Fixed and variable cost used is the op. leverage)

$36,000

Earnings before Interest and Taxes -- Interest Earnings before Taxes --Taxes Earnings after Taxes Shares Earnings per share

$36,000 $10,000 $26,000 $10,000 $16,000 8,000 $2

$113,000 $10,000 $103,000 $20,000 $83,000 $8,000 $10.4

Degree of combined lev

Uses entire income statement Shows impact of a change in sales or volume on bottom-line earnings per share

DCL = % Delta EPS/ % Delta sales (or volume) DCL = Quantity*(price-variable costs per unit)/(Quantity(P-VC)-FC-1) Leverage means risk Leverage is a double edged sword Magnifies profits as well as losses High leveraged firm has high fixed costs (high break-even point) Conservative, non-leverage has low fixed costs (low break-even point)

Chapter 6 Working capital management Financing and management of current assets of a firm Important for achieving long-term objectives of the firm or its failure Requires immediate action Matching of forecasted sales and production schedules Difference with forecast Due to: Unexpected buildups or reduction in inventory affecting receivables and cash flow Firms current assets could be self-liquidating, or permanent current

assets Matching sales and production 1.Fixed assets grow slowly with increase in productive capacity. Replacement of old equiptment 2.Current assets fluctuate in the short run level of production vs. level of sales, when production is higher than sales the inventory rises or when sales are higher than production, inventory declines and receivables increase Cash budgeting process Level production method includes smooth production schedules, use of manpower and equipment efficiently to lower cost. Match sales and production as closely as possible in the short run by allowing current assets to increase or decrease with the level of sales Sales fluctuate -> Decision: Apply level production method for 12 month sales forecast. Result: Level production and seasonal sales combine to produce fluctuating inventory Comparison of cash receipt and payment schedules to determine cash flow

Temp assets under level prod

Cash budget

Patterns of financing

External sources to fund assets Appropriate: Matching of asset buildup and length of financing pattern

Alternative

Important to consider: Challenge is to prioritize current assets into temporary and permanent, exact timing of asset liquidation is hard to predict, difficult to judge amount of short and long term financing available Using long term funds such as long term debt and equity capital Use long term to cover short term Use long term to fund fixed assets, permanent current assets, part of temporary current assets Disadvantage: Usually more expensive

Long-Term Financing

Short-term financing

Short term such as bank and trade credit Small business do not have easy access to long-term financing Advantage: Low interest rates Disadvantage: No guarantee of funding when needed Use short-term to finance temporary current assets, part of the permanent working capital needs

Financing decision

Manager has to choose right mix of short-term and long-term on basis of composition of firms assets, willingness to accept risk, relative cost of short-

term and long term financing -> need to understand the term structure of interest rates Term structure of intr. Term structure of interest rates is also known as the yield curve Shows relative level of short-term and long-term interest rates Build on basis of US gov securities since they are free of default risks Corporate debt securities entail higher interest rates for every maturity due to more financial risks Yield curve changes daily to reflect: Current competitive conditions, expected inflation, changes in economic conditions Theories Liquidity premium theory long term rates should be higher than short-term rates -> upward sloping yield curve Market segmentation theory treasury securities are divided into market segments by various financial institutions investing in the market, shape of yield curve is uncertain Expectations hypothesis Yields on long-term securities is a function of current and expected future short-term rates, shape of yield curve is uncertain US Gov Securities Treasury bills (T-bills) short-term IOUs, 3 months to 1 year in maturity Treasury Notes, intermediate term 1 to 10 years in maturity Treasury Bonds, long term 10 to 40 years in maturity Short term v long term Short-term financing is less expensive but riskier, long term more expensive but less risky Firm must decide the appropriate mix, similar to the risk-return trade-off Alternative financing A decision process: comparing alternative financing plans for working capital Short term more earnings but riskier Impact of eco cond. Tight money periods: Capital is scarce making short-term financing difficult or at very high rates, inadequate financing may mean loss of sales or financial embarrassment Expected value: Represents the sum of the expected outcomes under both conditions Case study - Monroe Corporation (low risk)

1. Normal conditions

Case 1 - Expected high return $8000 X

Probability of happening .60 =

Expectation $4,800 Expectation ($4,000) $800

2. Tight money

Case 2 - Expected low return ($10,000) X

Probability of happening .40 = =

Expected Return

Case study - Welt Corporation (high risk) 1. Normal conditions Case 1 - Expected high return $8000 2. Tight money X Probability of happening .60 = Expectation $4,800 Expectation ($8,000) ($3,200)

Case 2 - Expected low return ($20,000) X

Probability of happening .40 = =

Negative Expected Return

Optimal policy

Firm should relate asset liquidity to financing patterns and vice versa. Decide how wishes to combine asset liquidity and financing needs Risk oriented short-term borrowings and low degree of liquidity Conservative long-term financing and high degree of liquidity

Asset Liquidity Financing plan Short term Long term Low Liquidity High profit, high risk Moderate profit, risk High liquidity Moderate profit, moderate risk Low profit, low risk

Optimal policy

Company needs must be met by structuring working capital position and the risk-return trade-off The ultimate concern: maximize the overall valuation of the firm by using analysis of risk-return options

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Strategic Financial Management 1 70Documento70 pagineStrategic Financial Management 1 70Tija NaNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Jan. 11 Joint Meeting Feasibility Study PresentationDocumento34 pagineJan. 11 Joint Meeting Feasibility Study PresentationinforumdocsNessuna valutazione finora

- BIO 203 - Full Semester PackageDocumento80 pagineBIO 203 - Full Semester PackageNerdy Notes Inc.100% (7)

- ACCA p3 ModelsDocumento73 pagineACCA p3 ModelsImranRazaBozdarNessuna valutazione finora

- BIO 310 Midterm 1 PackageDocumento28 pagineBIO 310 Midterm 1 PackageNerdy Notes Inc.100% (1)

- Barangay Transmittal LetterDocumento3 pagineBarangay Transmittal LetterHge Barangay100% (3)

- Insurance CompaniesDocumento59 pagineInsurance CompaniesParag PenkerNessuna valutazione finora

- ANP 300 Exam 2 ReviewDocumento20 pagineANP 300 Exam 2 ReviewNerdy Notes Inc.Nessuna valutazione finora

- Investment DecisionsDocumento39 pagineInvestment DecisionsQwertyNessuna valutazione finora

- Business Newsletter Template 2Documento2 pagineBusiness Newsletter Template 2dragongenetics321100% (1)

- BIO 328 Full Semester PackageDocumento25 pagineBIO 328 Full Semester PackageNerdy Notes Inc.Nessuna valutazione finora

- Eir January2018Documento1.071 pagineEir January2018AbhishekNessuna valutazione finora

- Regioalism and MultilateralismDocumento42 pagineRegioalism and MultilateralismalfiyaNessuna valutazione finora

- Product IdeationDocumento13 pagineProduct IdeationHenry Rock100% (1)

- HUI 216 - Midterm In-Class ReviewDocumento2 pagineHUI 216 - Midterm In-Class ReviewNerdy Notes Inc.Nessuna valutazione finora

- BIO 358 - Full Semester PackageDocumento56 pagineBIO 358 - Full Semester PackageNerdy Notes Inc.100% (14)

- HUI 216 - Midterm PackageDocumento6 pagineHUI 216 - Midterm PackageNerdy Notes Inc.Nessuna valutazione finora

- SOC/POL 374 Final Exam PackageDocumento10 pagineSOC/POL 374 Final Exam PackageNerdy Notes Inc.Nessuna valutazione finora

- SOC/POL 374 Final Exam Review SessionDocumento3 pagineSOC/POL 374 Final Exam Review SessionNerdy Notes Inc.0% (1)

- SOC 340 Full Semester PackageDocumento19 pagineSOC 340 Full Semester PackageNerdy Notes Inc.Nessuna valutazione finora

- SOC 361 Final Exam PackageDocumento7 pagineSOC 361 Final Exam PackageNerdy Notes Inc.Nessuna valutazione finora

- SOC 361 Midterm PackageDocumento14 pagineSOC 361 Midterm PackageNerdy Notes Inc.Nessuna valutazione finora

- AMS 315 - Exam 2 & Final Exam PackageDocumento46 pagineAMS 315 - Exam 2 & Final Exam PackageNerdy Notes Inc.Nessuna valutazione finora

- BIO 362 Exam 4 PackageDocumento120 pagineBIO 362 Exam 4 PackageNerdy Notes Inc.Nessuna valutazione finora

- SOC 374 / POL 374 Midterm PackageDocumento14 pagineSOC 374 / POL 374 Midterm PackageNerdy Notes Inc.100% (1)

- BIO 362 Exam 2 PackageDocumento62 pagineBIO 362 Exam 2 PackageNerdy Notes Inc.100% (1)

- BIO 362 Exam 1 PackageDocumento66 pagineBIO 362 Exam 1 PackageNerdy Notes Inc.Nessuna valutazione finora

- POL 319 Exam 1 PackageDocumento23 paginePOL 319 Exam 1 PackageNerdy Notes Inc.Nessuna valutazione finora

- BIO 310 Midterm 2 + Final Exam PackageDocumento44 pagineBIO 310 Midterm 2 + Final Exam PackageNerdy Notes Inc.Nessuna valutazione finora

- AMS 315 Exam 1 PackageDocumento63 pagineAMS 315 Exam 1 PackageNerdy Notes Inc.Nessuna valutazione finora

- ANP 300 Exam 3 ReviewDocumento15 pagineANP 300 Exam 3 ReviewNerdy Notes Inc.Nessuna valutazione finora

- ATM 102 / EST 102 Full Semester PackageDocumento25 pagineATM 102 / EST 102 Full Semester PackageNerdy Notes Inc.100% (1)

- POL 327 Final Exam PackageDocumento20 paginePOL 327 Final Exam PackageNerdy Notes Inc.50% (2)

- ANP 300 Exam 1 ReviewDocumento8 pagineANP 300 Exam 1 ReviewNerdy Notes Inc.Nessuna valutazione finora

- JRN 101 Full Semester PackageDocumento19 pagineJRN 101 Full Semester PackageNerdy Notes Inc.Nessuna valutazione finora

- SOC 392 Full Semester PackageDocumento22 pagineSOC 392 Full Semester PackageNerdy Notes Inc.Nessuna valutazione finora

- WST 398 Midterm PackageDocumento16 pagineWST 398 Midterm PackageNerdy Notes Inc.Nessuna valutazione finora

- PHI 108 Full Semester PackageDocumento22 paginePHI 108 Full Semester PackageNerdy Notes Inc.Nessuna valutazione finora

- BUS 111 Midterm 1 PackageDocumento17 pagineBUS 111 Midterm 1 PackageNerdy Notes Inc.Nessuna valutazione finora

- SOC 248 Full Semester PackageDocumento46 pagineSOC 248 Full Semester PackageNerdy Notes Inc.100% (7)

- How to Become a Successful EntrepreneurDocumento43 pagineHow to Become a Successful EntrepreneurKyla Francine Tiglao100% (1)

- Ghani Glass AccountsDocumento28 pagineGhani Glass Accountsumer2118Nessuna valutazione finora

- Merger of UBS and SBC in 1997Documento20 pagineMerger of UBS and SBC in 1997Zakaria SakibNessuna valutazione finora

- LTL Panel Track Shipment DetailsDocumento3 pagineLTL Panel Track Shipment DetailsAlok Kumar BiswalNessuna valutazione finora

- Guidelines for Granting IT Course PermitsDocumento20 pagineGuidelines for Granting IT Course Permitsanislinek15Nessuna valutazione finora

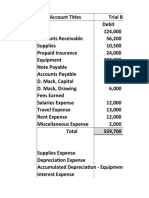

- Trial Balance Accounting RecordsDocumento8 pagineTrial Balance Accounting RecordsKevin Espiritu100% (1)

- MHRA Inspectorate and Enforcement Division Site Master FileDocumento9 pagineMHRA Inspectorate and Enforcement Division Site Master FileRambabu komati - QANessuna valutazione finora

- (En) 7-Wonders-Cities-RulebookDocumento12 pagine(En) 7-Wonders-Cities-RulebookAntNessuna valutazione finora

- Entrepreneurship and Enterprise Development Final ExamDocumento3 pagineEntrepreneurship and Enterprise Development Final ExammelakuNessuna valutazione finora

- Balance Sheet Analysis FY 2017-18Documento1 paginaBalance Sheet Analysis FY 2017-18AINDRILA BERA100% (1)

- Advertisers Snub Murdoch Tabloid: Stop Your Rate in Its TracksDocumento28 pagineAdvertisers Snub Murdoch Tabloid: Stop Your Rate in Its TracksCity A.M.Nessuna valutazione finora

- Strategic Change ManagementDocumento38 pagineStrategic Change ManagementFaisel MohamedNessuna valutazione finora

- History of JollibeeDocumento8 pagineHistory of JollibeeMailene Almeyda CaparrosoNessuna valutazione finora

- United States Bankruptcy Court Southern District of New YorkDocumento2 pagineUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNessuna valutazione finora

- File 2022 08 09T20 - 01 - 19Documento2 pagineFile 2022 08 09T20 - 01 - 19Kumar AmanNessuna valutazione finora

- IT project scope management, requirements collection challenges, defining scope statementDocumento2 pagineIT project scope management, requirements collection challenges, defining scope statementYokaiCONessuna valutazione finora

- Consumer Advice On Buying Shoes & Lost CardsDocumento2 pagineConsumer Advice On Buying Shoes & Lost Cardsgülnarə dadaşovaNessuna valutazione finora

- Asturias Sugar Central, Inc. vs. Commissioner of CustomsDocumento12 pagineAsturias Sugar Central, Inc. vs. Commissioner of CustomsRustom IbanezNessuna valutazione finora

- Business Summit Proposal 2019Documento5 pagineBusiness Summit Proposal 2019Geraldine Pajudpod100% (1)

- Investors PerceptionDocumento30 pagineInvestors PerceptionAmanNagaliaNessuna valutazione finora