Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Rossell Feb2014 Update

Caricato da

Duby RexCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Rossell Feb2014 Update

Caricato da

Duby RexCopyright:

Formati disponibili

This is not a buy or sell recommendation.

We are in the process of compiling data sheets of companies that we track / own so that in future we may use these for buying / selling stocks of such companies. Reason for sharing is hopefully somebody who has more information / insight may get in touch with us or for a healthy debate.

Rossell India Date Traded In Face Value CMP EPS (TTM) P/E Market Cap Enterprise Value 52 Week H/L Website : 14-Feb-14 : BSE B (533168) :2 : 48.10 : 6.35 : 7.6 : 176 Cr : 230 Cr : 55.5/ 26.10 : http://www.rossellindia.com/

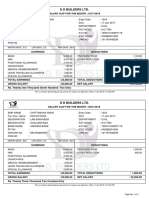

Our base report is available at http://www.scribd.com/doc/205998883/Rossell-India Q3 2013 Results Rs in Lakhs Net Sales Other oper Income Total Income Materials consumed Consumption of Green Leaf Changes in Inventory Employee benefits Total Expenses Profit from Oper Finance Costs Exchange Loss on Curr Swap Trans Exceptional Items Current Tax Net Profit EPS Diluted

31-Dec-13 3 months 30-Sep-13 3 months 31-Dec-12 3 months 31-Dec-13 9 months 31-Dec-12 9 months 31-Mar-13 12 months

5085 125 5210 59 13 805 1333 3436 1774 129 100 360 1316 3.59

4409 93 4502 36 37 (731) 1538 2226 2276 143 218 424 1599 4.36

3938 107 4045 11 12 366 1123 2460 1585 65 371 1211 3.3

11103 258 11361 161 65 (1128) 4253 7087 4274 380 411 800 2974 8.1

8146 213 8359 17 34 (897) 3254 5051 3308 158 1359 1046 3764 10.26

10158 446 10604 55 34 (67) 4437 8008 2596 218 820 3028 8.25

3nity.in@gmail.com

The results are really good considering the fact the current year data should be compared to the previous years data without taking into account the exceptional item. Segment results breakup

Revenue (Rs Cr) Tea Aviation Hospitality Segment results Tea Aviation Hospitality

Dec13 47.08 3.92 1.34 Dec13 19.37 0.08 -1.47

Sep13 41.21 3.28 0.62 Sep13 23.28 0.62 -1.05

Jun13 13.63 2.67 0.42 Jun13 3.31 0 -0.84

Mar13 16.47 4.05 0.41 Mar13 -8.89 1.24 -0.92

Dec12 38.47 2.09 0.12 Dec12 17.2 -0.31 -0.81

Sep12 31.31 2.36

Jun12 7.72 2.13

Mar12 7.24 3.31

Dec11 30.79 1.65

Sep12 17.54 -0.22 -0.47

Jun12 1.5 -0.46 -0.26

Mar12 -8.48 1.06 -0.07

Dec11 11.7 -0.15

As expected the Tea division forms the bulk of the sales and is doing better than the previous year. The aviation division quarter results also are better than the previous quarters. The hospitality division being in its infancy stage has posted negative results Kebab Xpress sales data The below data is based on back of the envelope calculation. Thus it would be more indicative than accurate Outlet Outlet No 1 Outlet No 2 Outlet No 3 Outlet No 4 Outlet No 5 Outlet No 6 Opening Date Nov 2012 18 Dec 2012 28 Sep 2013 25 Oct 2013 8 Nov 2013 16 Dec 2013

3nity.in@gmail.com

Qtr

No of Outlets 1 2 2 2 6

Sales Rs Lakhs 12 41 42 62 134

Segment results Rs Lakhs -81 -92 -84 -105 -147

No of operational months for all opened outlets 6 6 6 6 14

Avg Sales / Per Outlet / Month in Rs Lakhs 2.00 6.83 7.00 10.33 9.57

Segment result / Outlet / Month in Rs Lakhs -13.50 -15.33 -14.00 -17.50 -10.50

Dec-12 Mar-13 Jun-13 Sep-13 Dec-13

The sales at Kebab Xpress outlets seem to be picking up. The operational losses also do not seem to have drastically risen if we take into account the number of stores opened. Capex Capital Employed Rs in Lakhs Cultivation, manufacture & sale of tea Aviation products & services Hospitality Unallocated 31-Dec-13 9 months 13218 1990 710 6517 31-Dec-12 9 months 14092 1083 335 4974 31-Mar-13 12 months 11613 1495 337 6016

The company seems to be concentrating on growing its Aviation and Hospitality business. The increase in Unallocated would have been an increase in its investments. Synopsis The company seems to doing well. The results are good. The results seem to be incremental rather than big bang. It is evident that the market does not seem to think of the results as spectacular.

3nity.in@gmail.com

References 1. www.bseindia.com

Disclaimer General: This report is not a buy / sell recommendation. Buying stocks must be done after careful analysis and the above report can be used as a base for the analysis and should not be used as sole basis. Vested Interest: The author has bought the above mentioned stock at an average price of ` 37. He may purchase / sell the same in the future in the short or long term based on his conviction and his financial situation. Data Validity: The data is collated from various sites in the internet. Even though we have tried our best, there may be discrepancy due to human error while collating the data. The author should not be held responsible for such mistakes. The data can be looked up at various websites given in the reference section. Valuation: The author is not an expert and his valuation may be off the mark.

3nity.in@gmail.com

Potrebbero piacerti anche

- Premco Global Aug 2014Documento18 paginePremco Global Aug 2014Duby RexNessuna valutazione finora

- Punjab Chemicals Aug2014 UpdateDocumento16 paginePunjab Chemicals Aug2014 UpdateDuby RexNessuna valutazione finora

- PCCPL May 2014 UpdateDocumento4 paginePCCPL May 2014 UpdateDuby RexNessuna valutazione finora

- Rossell May 2014 UpdateDocumento6 pagineRossell May 2014 UpdateDuby RexNessuna valutazione finora

- PCCL Jun 2014 UpdateDocumento6 paginePCCL Jun 2014 UpdateDuby RexNessuna valutazione finora

- Rossell IndiaDocumento26 pagineRossell IndiaDuby RexNessuna valutazione finora

- Punjab Chemicals - Apr 2014Documento20 paginePunjab Chemicals - Apr 2014Duby Rex100% (1)

- Premco GlobalDocumento12 paginePremco GlobalDuby RexNessuna valutazione finora

- Adi Finechem Dec 2013 UpdateDocumento6 pagineAdi Finechem Dec 2013 UpdateDuby RexNessuna valutazione finora

- Adi FinechemDocumento14 pagineAdi FinechemDuby RexNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Informative FinalDocumento7 pagineInformative FinalJefry GhazalehNessuna valutazione finora

- 20 Years of Ecotourism Letter From DR Kelly BrickerDocumento1 pagina20 Years of Ecotourism Letter From DR Kelly BrickerThe International Ecotourism SocietyNessuna valutazione finora

- Mortgage 2 PDFDocumento5 pagineMortgage 2 PDFClerry SamuelNessuna valutazione finora

- 43-101 Bloom Lake Nov 08Documento193 pagine43-101 Bloom Lake Nov 08DougNessuna valutazione finora

- Lecture Var SignrestrictionDocumento41 pagineLecture Var SignrestrictionTrang DangNessuna valutazione finora

- How High Would My Net-Worth Have To Be. - QuoraDocumento1 paginaHow High Would My Net-Worth Have To Be. - QuoraEdward FrazerNessuna valutazione finora

- Russia and Lithuania Economic RelationsDocumento40 pagineRussia and Lithuania Economic RelationsYi Zhu-tangNessuna valutazione finora

- The Investment Method of Sir John Maynard KeynesDocumento3 pagineThe Investment Method of Sir John Maynard KeynesRiselda Myshku KajaNessuna valutazione finora

- MEC 1st Year 2020-21 EnglishDocumento16 pagineMEC 1st Year 2020-21 EnglishKumar UditNessuna valutazione finora

- Smart Beta: A Follow-Up to Traditional Beta MeasuresDocumento15 pagineSmart Beta: A Follow-Up to Traditional Beta Measuresdrussell524Nessuna valutazione finora

- High Potential Near MissDocumento12 pagineHigh Potential Near Missja23gonzNessuna valutazione finora

- ABPS Infra - Cap - Stat - Energy Efficiency & DSM - June 2013 PDFDocumento18 pagineABPS Infra - Cap - Stat - Energy Efficiency & DSM - June 2013 PDFamitsh20072458Nessuna valutazione finora

- Forecasting PDFDocumento87 pagineForecasting PDFSimple SoulNessuna valutazione finora

- Foreign Employment and Remittance in NepalDocumento19 pagineForeign Employment and Remittance in Nepalsecondarydomainak6Nessuna valutazione finora

- RenatoPolimeno Resume 2010 v01Documento2 pagineRenatoPolimeno Resume 2010 v01Isabela RodriguesNessuna valutazione finora

- CRM ProcessDocumento9 pagineCRM ProcesssamridhdhawanNessuna valutazione finora

- Social Science Class Viii WORKSHEET-1-Map WorkDocumento2 pagineSocial Science Class Viii WORKSHEET-1-Map WorkChahal JainNessuna valutazione finora

- Unit II Competitve AdvantageDocumento147 pagineUnit II Competitve Advantagejul123456Nessuna valutazione finora

- Digital Duplicator DX 2430 Offers High-Speed PrintingDocumento2 pagineDigital Duplicator DX 2430 Offers High-Speed PrintingFranzNessuna valutazione finora

- KjujDocumento17 pagineKjujMohamed KamalNessuna valutazione finora

- ACT EAST POLICY & ASEAN by Soumyabrata DharDocumento6 pagineACT EAST POLICY & ASEAN by Soumyabrata DharSoumyabrata DharNessuna valutazione finora

- A Bank Statement - Requirement 2020-21Documento26 pagineA Bank Statement - Requirement 2020-21Satyam KumarNessuna valutazione finora

- October Month Progress ReportDocumento12 pagineOctober Month Progress ReportShashi PrakashNessuna valutazione finora

- Managing DifferencesDocumento15 pagineManaging DifferencesAnonymous mAB7MfNessuna valutazione finora

- Pay - Slip Oct. & Nov. 19Documento1 paginaPay - Slip Oct. & Nov. 19Atul Kumar MishraNessuna valutazione finora

- Curriculum Vitae (CV)Documento6 pagineCurriculum Vitae (CV)Adriana DumitriuNessuna valutazione finora

- Reference BikashDocumento15 pagineReference Bikashroman0% (1)

- Is the Over-Diversified Birla Conglomerate Good for Aditya Birla GroupDocumento8 pagineIs the Over-Diversified Birla Conglomerate Good for Aditya Birla GroupDebalina Ghosh0% (1)

- Chapter 21 AppDocumento2 pagineChapter 21 AppMaria TeresaNessuna valutazione finora

- Differences & Similarities Between Anti Dumping & SafeguardsDocumento2 pagineDifferences & Similarities Between Anti Dumping & SafeguardsShalu Singh100% (3)