Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Tele PDF

Caricato da

Sandhya91Descrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Tele PDF

Caricato da

Sandhya91Copyright:

Formati disponibili

How global telcos can profit from Indias wireless experience

Global wireless companies can reduce costs if they follow three strategies from Indias wireless playbook.

As many wireless telecommunications operators around the world reach saturation points in consumer penetration, they fear hitting a growth wall. These companies face mounting competition, declining average revenue per user (ARPU) and steeply rising costs. All these factors put tremendous pressure on their margins. Increasingly, wireless companies must hunt for ways to squeeze more from their business modelbut where and how? To find answers they might consider dialing the country code for India. Indian telcos continue to thrive despite serving users at bare minimum rates. Their ARPU is a fraction of comparable

telcos in developed countries (see Figure 1). For example, in 2009, Indian wireless ARPU averaged just $2.90 a month. Compare that with about $50 a month in the US, a little over $22 a month in Germany and nearly $58 in Japan. Even in developing countries like Brazil and Mexico, ARPU averages close to $13 and $14 a month, respectively. Yet, Indian wireless companies excel in eking substantial returns from thin soil. Leading Indian players like Reliance Communications and Bharti Airtel (Airtel) enjoy EBITDA (earnings before interest, taxes, depreciation and amortization) margins of more than 30 percent. These compare well with global competitors such as AT&T, Verizon, Deutsche Telekom, Vodafone Group and Telefnica, despite having ARPUs of one-tenth or less of these giants (see Figure 2). Only some of this wide variance can be explained by scale and the relatively lower wages of the Indian labor force. Much more hinges on a unique business model.

Figure 1: Indian wireless players have less than one-tenth the ARPU of telecom companies in developed countries

Wireless ARPU (2009, monthly) $60 57.8 52.0 50.2

40 34.4 33.6

22.3 20 17.6 16.3 13.8

12.8

10.0

9.4 3.0 2.9 India

0 Japan France USA UK Korea Germany Hong Malaysia Mexico Kong Brazil China Russia Pakistan

Note: APRU mentioned is overall APRU (divided by 12 for monthly ARPU) Source: Ovum (mobile regional and country forecast pack: 201015, May 2010)

How global telcos can profit from Indias wireless experience

How do Indias young telcos generate superior returns and make calls so inexpensive for consumers? The true secret of their success lies in a rock-bottom cost model that aims to achieve the most optimal economics at three levels: First, Indian providers have learned how to manufacture very low-cost minutes. Second, they continually strive for high levels of network utilization. All this amounts to a telecom breakthrough in achieving high minutes of use (MOU) rates while radically de-layering traditional telco operations. Third, they have a customer acquisition and distribution model that ignores the traditional norms created in more mature markets. Lets consider these factors in detail.

help them achieve their high MOU totals. India has one of the largest mobile subscriber bases in the world. In 2010, the country had 752 million mobile subscribers, second only to Chinas 842 millionand more than double the 305 million subscribers in the US, whose total population is around 310 million. India also has some of the highest minutes of use per connection globally (see Figure 3): nearly 4,000 MOU per year per connection compared with nearly 2,500 in China and just over 1,600 in Japan. Indias total annual minutes of usage are also very high at 3,000 billion versus 1,450 billion MOUs for the US and 150 billion MOUs for Germany. One key reason for high mobile usage: the low penetration and lack of sophistication of fixed-line services in India when mobile phones first arrived. Consumers shifted their pent-up demand for communications to mobile phones. Culturally, Indian consumers enjoy communicating frequently, and at length, whether through conversations or texting. Lower prices further encouraged

Manufacturing very low-cost minutes

Indias mammoth population of 1.17 billion people creates a unique market, but it can provide universal lessons. Its telcos huge scale of mobile operations and integrated networks

Figure 2: Leading Indian wireless comp anies are as p rofita b le as their Euro p ean and US p eers

EBITDA margins 50% 45 40 35 30 25 20 0 FY03 FY04 FY05 FY06 FY07 FY08 FY09

Verizon AT&T Vodafone Deutsche Telekom Telefnica Telstra Idea Cellular Reliance Bharti Airtel

Note: FY05 for Indian telecom players implies year ending March 2005 Source: CapIQ company reports; analyst reports

Potrebbero piacerti anche

- MVNO Whitepaper The Path Towards MVNO SuccessDocumento25 pagineMVNO Whitepaper The Path Towards MVNO SuccessCheify White100% (2)

- Arcadis IT GuideDocumento48 pagineArcadis IT Guidemujeeb.alam4Nessuna valutazione finora

- Microeconomics AssignmentDocumento22 pagineMicroeconomics Assignmentgovind prakashNessuna valutazione finora

- Redefining Place and Promotion in MCommerceDocumento23 pagineRedefining Place and Promotion in MCommerceSolomon TommyNessuna valutazione finora

- Telecoms Renewable Energy Vendors/Escos Landscape in India: in Partnership With The NetherlandsDocumento51 pagineTelecoms Renewable Energy Vendors/Escos Landscape in India: in Partnership With The Netherlandsteju2812Nessuna valutazione finora

- A Study of Telecommunication Service Provider in Indian MarketDocumento28 pagineA Study of Telecommunication Service Provider in Indian MarketMehreen Munaf ShaikhNessuna valutazione finora

- Blue Ocean Strategy ExampleDocumento11 pagineBlue Ocean Strategy Exampleheavenly_tears92100% (1)

- Executive SummaryDocumento15 pagineExecutive SummaryShubham SharmaNessuna valutazione finora

- Human Resource Management HR Practices of Two Organizations Airtel & Vodafone Profile of Airtel & VodafoneDocumento15 pagineHuman Resource Management HR Practices of Two Organizations Airtel & Vodafone Profile of Airtel & Vodafoneaashis8355Nessuna valutazione finora

- 1.1 Telecom Sector: A Global Scenario: Mobile TelephonyDocumento23 pagine1.1 Telecom Sector: A Global Scenario: Mobile TelephonyNeha KumarNessuna valutazione finora

- Study of Competitive Rivalry in Indian Telecom SectorDocumento18 pagineStudy of Competitive Rivalry in Indian Telecom Sectorarnabnitw100% (1)

- Top 20 countries account for nearly 75% of global internet users in 2014Documento7 pagineTop 20 countries account for nearly 75% of global internet users in 2014Arvind ShuklaNessuna valutazione finora

- Priya Total Project of ApbDocumento44 paginePriya Total Project of ApbsathvikaNessuna valutazione finora

- Indian Telecom IndustryDocumento35 pagineIndian Telecom Industrymini244100% (4)

- Manish Vodafone FinalDocumento116 pagineManish Vodafone FinalPooja SharmaNessuna valutazione finora

- Reliance Jio Internship Report on Employee MotivationDocumento51 pagineReliance Jio Internship Report on Employee MotivationSahas ShettyNessuna valutazione finora

- Company Analysis Report On AirtelDocumento39 pagineCompany Analysis Report On AirtelSUDEEP KUMAR69% (13)

- NTT DOCOMO - Technology Strategy AnalysisDocumento7 pagineNTT DOCOMO - Technology Strategy AnalysisMadhuranath RNessuna valutazione finora

- Current Trends in Indian Telecom: 1. New Players Entering Rural MarketsDocumento7 pagineCurrent Trends in Indian Telecom: 1. New Players Entering Rural MarketsRishabh KantNessuna valutazione finora

- Project AzharDocumento8 pagineProject AzharAdnan DarNessuna valutazione finora

- Chapter - 1: (Type Text)Documento21 pagineChapter - 1: (Type Text)vineet tiwariNessuna valutazione finora

- INTRO TO INDIAN TELECOMDocumento21 pagineINTRO TO INDIAN TELECOMvineet tiwariNessuna valutazione finora

- CAN THE TELECOM INDUSTRY WELCOME THE NEW ENTRANTSDocumento8 pagineCAN THE TELECOM INDUSTRY WELCOME THE NEW ENTRANTSPijush Kanti DolaiNessuna valutazione finora

- Main Project of NokiaDocumento37 pagineMain Project of NokiaAnkur JaiswalNessuna valutazione finora

- Nirma Institute of ManagementDocumento34 pagineNirma Institute of ManagementKaran ZalaNessuna valutazione finora

- Chapter1 PDFDocumento5 pagineChapter1 PDFDARK SUNNessuna valutazione finora

- BISHAL SynopsisDocumento6 pagineBISHAL SynopsisAshish JaiswalNessuna valutazione finora

- Indian Telecom Sector AnalysisDocumento19 pagineIndian Telecom Sector AnalysisfarahmemonNessuna valutazione finora

- Research MethodologyDocumento52 pagineResearch MethodologyManwinder Singh Gill100% (4)

- Index: Executive Summary 2Documento60 pagineIndex: Executive Summary 2imadNessuna valutazione finora

- Telecommunication Marketing in IndiaDocumento14 pagineTelecommunication Marketing in Indiagupta_gk4uNessuna valutazione finora

- Impact of Mobile1Documento25 pagineImpact of Mobile1Pankaj KotwaniNessuna valutazione finora

- Advertising Effectiveness On Telecom Ind - ProjectDocumento51 pagineAdvertising Effectiveness On Telecom Ind - Projecttina_18Nessuna valutazione finora

- BSNL customer satisfaction study examines mobile service qualityDocumento54 pagineBSNL customer satisfaction study examines mobile service qualityishfana ibrahimNessuna valutazione finora

- Project Report On Pentration in Indian Rural Telecom IndusryDocumento21 pagineProject Report On Pentration in Indian Rural Telecom Indusryambesh Srivastava100% (1)

- Compare Vodafone & Airtel Marketing StrategiesDocumento75 pagineCompare Vodafone & Airtel Marketing StrategiesSunny RekhiNessuna valutazione finora

- Synopsis: " On Marketing Strategies of Bharti Airtel"Documento8 pagineSynopsis: " On Marketing Strategies of Bharti Airtel"Gaurav NahataNessuna valutazione finora

- AirtelDocumento71 pagineAirtelHarshit0% (1)

- Telecommunication Industry in India AnalysisDocumento9 pagineTelecommunication Industry in India AnalysisambujsinhaNessuna valutazione finora

- NIKHIL Project FinalDocumento42 pagineNIKHIL Project FinalASHISH PODDARNessuna valutazione finora

- Airtel India's Largest Telecom ProviderDocumento94 pagineAirtel India's Largest Telecom Providermaddy madhavanNessuna valutazione finora

- Chapter-1 Introduction: 1058.01 Million (May 2016)Documento47 pagineChapter-1 Introduction: 1058.01 Million (May 2016)kunal dasNessuna valutazione finora

- Pradeeep AIRTELDocumento83 paginePradeeep AIRTELsandeepNessuna valutazione finora

- Summer Training Project: M A R K ETI N G S T R A T E Gies OF A I R T ELDocumento93 pagineSummer Training Project: M A R K ETI N G S T R A T E Gies OF A I R T ELvps9044Nessuna valutazione finora

- Statement of The ProblemDocumento67 pagineStatement of The ProblemArafath ArnoldNessuna valutazione finora

- Religion and Caste Politics in India (Tamal)Documento4 pagineReligion and Caste Politics in India (Tamal)Tamal DasNessuna valutazione finora

- SESSION 2012-2013": M.J.P.R. University BareillyDocumento16 pagineSESSION 2012-2013": M.J.P.R. University BareillyfakrhaNessuna valutazione finora

- Presentation On Airtel and Cell Phone Service IndustryDocumento37 paginePresentation On Airtel and Cell Phone Service Industrygagan15095895Nessuna valutazione finora

- Literature ReviewDocumento4 pagineLiterature ReviewAnkit SinhaNessuna valutazione finora

- Indian Telecom IndustryDocumento12 pagineIndian Telecom IndustryGaurav SinghNessuna valutazione finora

- TelecomDocumento13 pagineTelecomAbdellah SamadiNessuna valutazione finora

- Report - Contemporary IssuesDocumento5 pagineReport - Contemporary IssuesNiha SayyadNessuna valutazione finora

- Airtel Brand Awareness Bob PDFDocumento75 pagineAirtel Brand Awareness Bob PDFbobbyNessuna valutazione finora

- Vodafone India Evaluation and Entry StrategyDocumento15 pagineVodafone India Evaluation and Entry StrategySadia AnumNessuna valutazione finora

- New PPT TelecomDocumento19 pagineNew PPT Telecomsuku1983Nessuna valutazione finora

- Mba ProjectDocumento46 pagineMba ProjectsatishNessuna valutazione finora

- Project Report Final1.1Documento74 pagineProject Report Final1.1adsfdgfhgjhkNessuna valutazione finora

- Airtel Strategic ManagementDocumento29 pagineAirtel Strategic ManagementSandeep George80% (5)

- Table of ContentDocumento88 pagineTable of Contentvikas guptaNessuna valutazione finora

- Cellular Technologies for Emerging Markets: 2G, 3G and BeyondDa EverandCellular Technologies for Emerging Markets: 2G, 3G and BeyondNessuna valutazione finora

- Papers on the field: Telecommunication Economic, Business, Regulation & PolicyDa EverandPapers on the field: Telecommunication Economic, Business, Regulation & PolicyNessuna valutazione finora

- Emerging FinTech: Understanding and Maximizing Their BenefitsDa EverandEmerging FinTech: Understanding and Maximizing Their BenefitsNessuna valutazione finora

- Variable Pay Plan Boosts MoraleDocumento12 pagineVariable Pay Plan Boosts MoraleSandhya91Nessuna valutazione finora

- Piramal Health CareDocumento4 paginePiramal Health CareAjay Sahu50% (2)

- Session 1 - Interpersonal Dilemmas For A New ManagerDocumento4 pagineSession 1 - Interpersonal Dilemmas For A New ManagerSandhya91Nessuna valutazione finora

- 2011quiz4-Deferred Tax PDFDocumento2 pagine2011quiz4-Deferred Tax PDFSandhya91Nessuna valutazione finora

- Mumbai Train MapDocumento1 paginaMumbai Train MapSandhya91Nessuna valutazione finora

- The Bajaj Group Is Amongst The Top 10 Business Houses in IndiaDocumento2 pagineThe Bajaj Group Is Amongst The Top 10 Business Houses in IndiaSandhya91Nessuna valutazione finora

- C08 Group DynamicsDocumento6 pagineC08 Group DynamicsSandhya91Nessuna valutazione finora

- C08 Group DynamicsDocumento6 pagineC08 Group DynamicsSandhya91Nessuna valutazione finora

- Presentation On Airtel and Cell Phone Service IndustryDocumento37 paginePresentation On Airtel and Cell Phone Service Industrygagan15095895Nessuna valutazione finora

- CV of Kavita Patel - ITDocumento6 pagineCV of Kavita Patel - ITmiss_jyoti_kapoorNessuna valutazione finora

- Review Center QA on Philippine Engineering Laws and RegulationsDocumento4 pagineReview Center QA on Philippine Engineering Laws and RegulationsAlbert AlemaniaNessuna valutazione finora

- Introduction To Information Technology: The Future NowDocumento47 pagineIntroduction To Information Technology: The Future NowBonzowoNessuna valutazione finora

- LG L80 Dual - Schematic Diagarm PDFDocumento97 pagineLG L80 Dual - Schematic Diagarm PDFzombie z0% (1)

- Mobile Games PDFDocumento6 pagineMobile Games PDFJoseph ArekianNessuna valutazione finora

- New Case Study LG ElectronicsDocumento28 pagineNew Case Study LG ElectronicsKanish SoniNessuna valutazione finora

- Full Cytrain CyberDocumento166 pagineFull Cytrain CyberParamjeet SinghNessuna valutazione finora

- SSP 648 Audi Second Generation Modular Infotainment SystemDocumento44 pagineSSP 648 Audi Second Generation Modular Infotainment SystemBogdan GabrielNessuna valutazione finora

- Student Discusses Studies, Hometown & Internet ImportanceDocumento3 pagineStudent Discusses Studies, Hometown & Internet ImportancesumbalNessuna valutazione finora

- Android Mobile Operating System and ArchitectureDocumento7 pagineAndroid Mobile Operating System and ArchitectureVIVA-TECH IJRINessuna valutazione finora

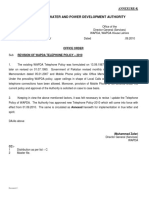

- Wapda Telephone Policy PDFDocumento5 pagineWapda Telephone Policy PDFKhan Khwar Control Room100% (1)

- An Android App for Online Bus Ticketing of Edsa CarouselDocumento39 pagineAn Android App for Online Bus Ticketing of Edsa CarouselDaryll TorresNessuna valutazione finora

- TRY OUT UJIAN NASIONAL SMA KOTAMADYA JAKARTA PUSAT Mata Pelajaran ...Documento10 pagineTRY OUT UJIAN NASIONAL SMA KOTAMADYA JAKARTA PUSAT Mata Pelajaran ...Iloel Zink SsLowNessuna valutazione finora

- NokiaDocumento70 pagineNokiaJyoti SinghNessuna valutazione finora

- GSM Mobile Phone Based LED Scrolling Message Display System: Project TitleDocumento9 pagineGSM Mobile Phone Based LED Scrolling Message Display System: Project TitleAl Moazer Abdulaal AbdulateefNessuna valutazione finora

- Seminarsonly: Electronics Seminar TopicsDocumento10 pagineSeminarsonly: Electronics Seminar TopicsarjitsharmaNessuna valutazione finora

- 4 HCI Unit IVDocumento33 pagine4 HCI Unit IVgopivrajan100% (1)

- Fancier Manual (UK)Documento26 pagineFancier Manual (UK)jorgesilva061969Nessuna valutazione finora

- Legal and Ethical Issues in Computing Week 2 Lecture 3 & 4Documento44 pagineLegal and Ethical Issues in Computing Week 2 Lecture 3 & 4Sana KhanNessuna valutazione finora

- Results 4.1 OPPO's STP Strategy 4.1.1 Market SegmentationDocumento22 pagineResults 4.1 OPPO's STP Strategy 4.1.1 Market SegmentationJay SharmaNessuna valutazione finora

- Study of Consumer Behaviour With Reference To AircelDocumento72 pagineStudy of Consumer Behaviour With Reference To AircelSugandha VardhanNessuna valutazione finora

- M-6700 User ManualDocumento33 pagineM-6700 User ManualKoushik KarmakarNessuna valutazione finora

- Golden Bridge Technology v. DellDocumento7 pagineGolden Bridge Technology v. DellPriorSmartNessuna valutazione finora

- The Future Internet: International Telecommunication UnionDocumento17 pagineThe Future Internet: International Telecommunication UnionRajkumar JaiswarNessuna valutazione finora

- Mobile MarketingDocumento30 pagineMobile MarketingDipendrasinh RanaNessuna valutazione finora

- The Use of Smartphone On English Learning Quality of The First Grade Student at SMP Negeri 3 BanawaDocumento12 pagineThe Use of Smartphone On English Learning Quality of The First Grade Student at SMP Negeri 3 BanawaLidya AfistaNessuna valutazione finora