Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Final Note Sheet

Caricato da

Milind ShirolkarCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Final Note Sheet

Caricato da

Milind ShirolkarCopyright:

Formati disponibili

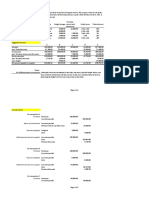

Ratio Analysis

ROE =

NetIncome Sales Assets NetIncome = Sales Assets BookShareh older ' sEquity BOP BookShareh older ' sEquity BOP ROE is a measure of efficiency If need BOP equity, use Net Worth Net Income BOP = Beginning of Period

Sustainable growth rate in sales = ROEBOP (1 payout rate) + (new equity) ROEBOP is the return on beginning of the period equity Payout rate is the firms dividend payout ratio, defined as dividends divided by earnings Sustainable growth assumes that ratios in DuPont equation are constant Binding only if you cannot or will not raise equity or let D/E ratio increase What to do when actual growth exceeds sustainable growth (need more cash) - Sell new equity - Increase financial leverage - Reduce the dividend payout - Prune away marginal activities - Outsource some or all of production - Increase Prices - Merge with Cash Cow ROA =

EBIT tax Assets Differs from ROE in that it measures profit as a percentage of money provided by owners and creditors as opposed to only the money provided by owners.

Profit Margin =

NetIncome Sales Sales Assets

Acid test =

Cash + AR + STInvestme nts CurrentLiabilities **doesnt include inventories

Asset Turnover =

Interest coverage =

EBIT InterestExpense

Financial Leverage =

Assets Shareholder ' sEquity COGS EndingInventory EBIT InterestExpense

Days receivable =

AR 365 Sales AverageInv entory 365 COGS

Inventory Turnover =

Days inventory =

Times Interest Earned =

Days payable =

AP 365 Purchases AR 365 CreditSale s

Current ratio =

CurrentAss ets CurrentLia bilities

Collection period =

Page 1 of 10

Earnings per share =

NI AvgShares

Dividend payout ratio =

Dividends NI

Ratio Analysis (1) Compare to the ratio rules of thumb (2) Compare them to industry averages (3) Look for changes in ratios over time (4) Find impact and consequences of changes (5) Ask why (6) Use sensitivity analysis Valuation DCF (APV, FCF, EVA) Earnings multiples Asset multiples Comparables Contingent claims Discounted Cash Flow Techniques FCFF EBIT(1 t) + Depreciation CapEx (Working Capital) + (Accrued Taxes) + Extras If use real CF, use real discount rate; if use nominal CF , use nominal discount rate Working capital = current assets current liabilities CapEx = net fixed assets (PP&E and other fixed) + depreciation WACC = (1 t) * kD * (%D) + kE * (%E) - MARKET value of debt and equity - Tax shield is in WACC CAPM: kE = (long governments 1%) + * (risk premium) **risk premium = 8% compare kD (market rate, not historic) to rates of various rated bonds see if it is realistic use twin firm to get numbers that dont know , target capital structure, etc. use projects cash flows, projects cost of capital, projects capital structure E D ** D usually is 0 U = E + D TC TC D TC L = U D TC E Unlever E so that it assumes no debt, no financial risk, only operating/systematic risk and relever at target capital structure for project (MARKET value of equity, BOOK value of debt get all interest-bearing debt) Assumes linear approximation for risk Asset beta measures the business risk, while the equity beta reflects the combined effect of business and financial risk Use sensitivity analysis to determine how essential each number is and how it affects the calculations WACC assumptions: - Constant debt-to-equity ratio - Perpetual debt it is never paid down - kD is the market rate (counter example: industrial revenue bonds) - As value of firm increases, value of debt increases in order to keep D/E constant Page 2 of 10

- Does not take into account other securities such as preferred stock - Assumes financial and operating risk are constant - Can adjust capital structure in ko FCFD = Interest + Sinking Funds + Debt Repayments FCFE = NI + Depreciation CapEx Working Capital + Accrued Taxes + Extras Sinking Funds Debt Repayments Terminal Value Random tips - Finding breakeven point is useful - Consider tax write off although there may be no salvage value at year end - Make sure to discount back to present Perpetuity FCFF (1 + g ) - TVF = **discount back to PV ko g Liquidation/book value - TVF = PP&E + net working capital + goodwill + other assets ** remove liabilities if want VE EBIT (1 t ) - If ROTC = > ko, then asset market value > book value BookValue - If ROE > kE, then sell equity sells above net worth Earnings multiple P NI yields TVE to get TVF, add in TVD; more debt decreases P/E multiple; may E need to subtract capital gains taxes MVF - Do this ratio for a comparable company: then multiply the ratio by the EBIT company of interest to get approximate MVF APV Values project as if it is all-equity financed Adds back PV(tax shields) = PV(kD * D * t) FCFF is the same as the WACC method Discount FCFF at unlevered cost of capital If debt is stable and one-time, use kD If D/VF is constant, use risk of the firm because debt and tax shields vary with value of firm Capital structure can change Uses hybrid securities Interest rates dont need to be market Varying discount rate can be disadvantageous Doesnt pick up additional cost of financial distress with leverage

Strategy A change in product market strategy should correspond to an appropriate change in financial policies. Page 3 of 10

Sources and Uses If an asset goes down or liability goes up it is a source of funds If an asset goes up or a liability goes down it is a use of funds Financing Options Right amount of debt look at internal (what CFs support), external (ratings), and crosssectional (industry) Set a target capital structure: if it is too low, vulnerable to takeover; if it is too high, cost of financial distress, bankruptcy Bank debt Convertible debt Private placement Convertible preferred Long term debt (rate, maturity, Capital market execution covenants, sinking funds, call provisions) Equity common and preferred Various Equations: Working capital = current assets current liabilities Capex = PP&E this time period + other LT assets this time period + depreciation PP&E last time period other LT assets this time period Accrued taxes = Last time periods taxes + new taxes (IS) payment End inventory = starting inventory + production COGS New shareholders equity (RE) = Last time periods SE (RE) + NI Total liabilities + NW w/o bank + [bank loan] = total assets w/o cash + [cash] Assets + [cash] = liabilities + common stock + RE + [bank loan] NW = ROE * (1 dividends) EBIT * (1-t) = NI + (1-t) * interest Dividends = NI - NW NW = WC + PP&E - D VF = VD + VE FCFF != FCFD + FCFE External Funding Required = Total Assets (Liabilities + Owners Equity) Capital Structure Notes Modigliani Miller Theorem (1958) - Ignores taxes, cost of financial distress, transaction costs, asymmetric information, managers decisions - Assumes complete markets (wanted asset is always available), market efficiency - Hold constant the firms investment policies - Choice of capital structure is irrelevant for firm value Miller Modigliani Theorem (1961) - Dividend policy is irrelevant Modigliani Miller Therem (1963) - Interest payments are tax exempt for the firm - Dividends and earnings are taxed for the firm - Assumes no personal taxes - Debt increases firm value by reducing the tax burden - Size of the pie stays the same, but IRS gets a slice of the pie Page 4 of 10

VF (w/debt) = VF (all equity) + PV[tax shield] PV[tax shield] = t*D Caveat: not all firms face full marginal tax rate Tax shield of debt matters and affects capital structure

Page 5 of 10

Remarks - Excess cash = negative debt - Investors dont save when they receive interest they prefer capital gains Cost of financial distress: - Legal costs - Scare off customers and suppliers - Agency costs (cash in and run, delay liquidation, excessive risk taking) - Debt overhang (shareholders of firms with high leverage are reluctant to fund +NPV investments if benefits go to creditors) - Covenants, junior debt issues, and bankruptcy can help to alleviate some of these CFDs Static trade-off theory: optimal target capital structure is determined by balancing tax shield of debt and expected costs of financial distress Asymmetric information: managers have more information about the firm than outside investors Signaling: - Cash in = negative signal (cut dividends, issue equity) - Cash out = positive signal (increase dividends, repurchase stock) Free cash flow problem: managers in firms with lots of free cash flow and bad investment opportunities may be reluctant to simply give the excess cash back to shareholders LBOs increase efficiency through improved managerial incentives and better monitoring by creditors Optimal capital structure graph:

Various Cases Wilson Lumber Ratios Sources and uses Financing with debt considerations Cash cycle Pro formas Page 6 of 10

Massey Ferguson With merger, assume debt wait until after bankruptcy so as not to assume debt Align product market strategy with financial market strategy Costs of financial distress Total risk = BBR + financial risk Play Time Toy Company Use sensitivity analysis to determine how essential the numbers are to making a profit With a change in the amount of loans from one project to another, take into account the greater or less interest expense With a change in the amount of cash from one project to another, take into account the greater or less interest income Inventory is less secure than AR Risk-return tradeoff Sure Cut Shears Pro formas Analyze sources and uses and differences between actual and expected Marriot Negative working capital is a source of interest-free financing kd < ke (generally) D (D/E) kd ke EPS (P/E) Ps = f(ke, EPS) if ke constant, EPS = Ps if ke , Ps < EPS Ps/E Too much debt: financial distress, violate covenants, ratings decrease, competitive attack Too little debt: cost of capital increases, stock price decreases, LBO target Maturity of product market strategy = maturity of financial market strategy Preferred stock behaves like debt Convertible bond and an option, lower interest rate, pays on upside, for volatile firms Too much cash (ROE > growth): - Increase dividends - Buy back stock - Acquire - Pay down debt - Reinvest in projects/grow faster Open market purchase need to announce, cheaper and slower than tender offer Always a price which makes an investment look bad; usually one that makes it look good

Page 7 of 10

Graphs:

AT&T Reluctance to issue equity: - Financial slack - Internal cap market - Sustainable growth - Debt ratio want access - Costs of false signaling In determining financing, compare to competitors, debt maturity >= product market strategy Financial policies Pecking order theory: rely on internal, then debt, then equity/dividends Intel Various types of repurchases Consider when money goes in and out, for a given financing option

Harris Seafoods Industrial revenue bonds 3 pieces to investment decision: - strategy - valuation - execution Page 8 of 10

Dixon

WACC APV method APT Fama-French factors

Diamond Lessons learned: - Cash is king - Ignore fictional accounting accrual flows (non-cash) - Ignore sunk costs - Ignore CFs of unrelated projects - Capture impact of projects CFs anywhere it occurs in company - Capture real timing of CFs - Remember TV and abandonment costs - Human nature and politics will sometime override correct analysis - Use NPV, not IRR, payback, or EPS - Real CFs at real discount rate or nominal CFs at nominal CF If option can only be used for one project at a time, then cost is to be incurred by that project; otherwise, if it can be used by multiple projects at once, then do not include it is cash flows Real options have value Arundel Real options Congoleum LBO take company private and finance with debt Value created - interest tax shield - depreciation tax shield - management incentive Kennecott Valuing firm using FCFF and FCFE Goodwill How to limit managerial discretion: - proxy fight - lawsuit - stock price decreases - takeover - board of directors My Additions

NumberofSh ares = NetIncome EPS

Page 9 of 10

Convertible debt allows you to sort of use backdoor equity. Call it debt but really its equity. This keeps from having the price of your stock decrease like it would if you offered equity.

Page 10 of 10

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- ARE144 Core ReviewDocumento50 pagineARE144 Core Reviewshanmuga8950% (2)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Short Term Trading StrategiesDocumento9 pagineShort Term Trading StrategiesMikhail Harris80% (5)

- Learning Objective 25-1: Chapter 25 Short-Term Business DecisionsDocumento93 pagineLearning Objective 25-1: Chapter 25 Short-Term Business DecisionsMarqaz Marqaz0% (2)

- HFS HOT Vendors Hfs Hot Vendors Compendium 2018 2021 RS 2106 v1.0FINALDocumento211 pagineHFS HOT Vendors Hfs Hot Vendors Compendium 2018 2021 RS 2106 v1.0FINALVidhya Charan PNessuna valutazione finora

- Handling Table Control in eCATTDocumento14 pagineHandling Table Control in eCATTMilind Shirolkar100% (1)

- AMFI Questionnaire For Due DiligenceDocumento7 pagineAMFI Questionnaire For Due DiligenceHarish Ruparel100% (2)

- How To Develop A Problem TreeDocumento19 pagineHow To Develop A Problem TreeMilind ShirolkarNessuna valutazione finora

- Project Plan TemplateDocumento1 paginaProject Plan TemplateMilind ShirolkarNessuna valutazione finora

- PVR MilindDocumento3 paginePVR MilindMilind ShirolkarNessuna valutazione finora

- SAP Master Data - OvewviewDocumento38 pagineSAP Master Data - OvewviewMilind ShirolkarNessuna valutazione finora

- Non-Cricket Sports in IndiaDocumento10 pagineNon-Cricket Sports in IndiaMilind ShirolkarNessuna valutazione finora

- SHIS, Excise Scrip Cofiguration Document in SAP MMDocumento7 pagineSHIS, Excise Scrip Cofiguration Document in SAP MMMilind ShirolkarNessuna valutazione finora

- Deferred Tax TransferDocumento7 pagineDeferred Tax TransferMilind ShirolkarNessuna valutazione finora

- Doing Business in Lao PDR: Tax & LegalDocumento4 pagineDoing Business in Lao PDR: Tax & LegalParth Hemant PurandareNessuna valutazione finora

- Case: Mired in Corruption - Kellogg Brown & Root in NigeriaDocumento9 pagineCase: Mired in Corruption - Kellogg Brown & Root in NigeriakenkenNessuna valutazione finora

- XXXXXXXXXX6781 - 20230615160830874376 (1) - UnlockedDocumento16 pagineXXXXXXXXXX6781 - 20230615160830874376 (1) - UnlockedRajendra SharmaNessuna valutazione finora

- Research Paper On Construction Management PDFDocumento7 pagineResearch Paper On Construction Management PDFj0lemetalim2Nessuna valutazione finora

- Torres Kristine Bsa 2BDocumento4 pagineTorres Kristine Bsa 2Bkristine torresNessuna valutazione finora

- MODULE 8 Learning ActivitiesDocumento5 pagineMODULE 8 Learning ActivitiesChristian Cyrous AcostaNessuna valutazione finora

- (For Individuals and Hufs Not Having Income From Profits and Gains of Business or Profession) (Please See Rule 12 of The Income-Tax Rules, 1962)Documento37 pagine(For Individuals and Hufs Not Having Income From Profits and Gains of Business or Profession) (Please See Rule 12 of The Income-Tax Rules, 1962)Devanshi GoyalNessuna valutazione finora

- Entreprunership Chapter 3Documento12 pagineEntreprunership Chapter 3fitsumNessuna valutazione finora

- SAftex Company ProfileDocumento5 pagineSAftex Company ProfileLeulNessuna valutazione finora

- Unemployment Newspaper ArticleDocumento3 pagineUnemployment Newspaper ArticleWwil DuNessuna valutazione finora

- Applied of Commercial and Quality Principles in EngineeringDocumento5 pagineApplied of Commercial and Quality Principles in EngineeringCIYA ELIZANessuna valutazione finora

- SHOPPING (EP1-week 1)Documento11 pagineSHOPPING (EP1-week 1)Athirah Fadzil100% (1)

- Handout No. 03 - Purchase TransactionsDocumento4 pagineHandout No. 03 - Purchase TransactionsApril SasamNessuna valutazione finora

- Quizzer 1 - Pas 8 and Cash/accrual, Single EntryDocumento10 pagineQuizzer 1 - Pas 8 and Cash/accrual, Single Entryjaleummein100% (1)

- Marketing StrategyDocumento3 pagineMarketing Strategyakakaka2402Nessuna valutazione finora

- Toyota Shaw Vs CA DigestDocumento2 pagineToyota Shaw Vs CA Digestda_sein32Nessuna valutazione finora

- Compromise, Arrangements, Reconstruction and AmalgamationDocumento25 pagineCompromise, Arrangements, Reconstruction and AmalgamationAshutosh Tiwari100% (1)

- Week 4 - Module (Trade Discount)Documento8 pagineWeek 4 - Module (Trade Discount)Angelica perezNessuna valutazione finora

- KudumbashreeDocumento12 pagineKudumbashreeamarsxcran100% (1)

- The Channel Tunnel An Ex Post Economic Evaluation PDFDocumento37 pagineThe Channel Tunnel An Ex Post Economic Evaluation PDFpirotte0% (1)

- LT B SWOT Analysis NUR 587Documento18 pagineLT B SWOT Analysis NUR 587Susan MateoNessuna valutazione finora

- Chapter 7 (II) - Current Asset ManagementDocumento23 pagineChapter 7 (II) - Current Asset ManagementhendraxyzxyzNessuna valutazione finora

- Module 5 Course Matterial Ipcomp Monopolies and Restrictive Trade Practices Act (MRTP)Documento18 pagineModule 5 Course Matterial Ipcomp Monopolies and Restrictive Trade Practices Act (MRTP)Ankush JadaunNessuna valutazione finora

- Labor Law MCQDocumento12 pagineLabor Law MCQalexes negroNessuna valutazione finora

- Management of Non Performing Assets - A Current Scenario: Chandan Chatterjee Jeet Mukherjee DR - Ratan DasDocumento11 pagineManagement of Non Performing Assets - A Current Scenario: Chandan Chatterjee Jeet Mukherjee DR - Ratan DasprabindraNessuna valutazione finora