Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Howard University: Stock Valuation Project

Caricato da

Tiago Nunes Barbi CostaTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Howard University: Stock Valuation Project

Caricato da

Tiago Nunes Barbi CostaCopyright:

Formati disponibili

Howard University

Financial Modeling and Analysis FINA363 Dr. Russel M. Price

Stock Valuation Project

Student:

Tiago Nunes Barbi Costa

@02711216

Date : December 5th

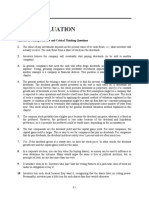

CHIPOTLE MEX. GR. NYSE-CMG STOCK VALUATION WITH DISCOUNTED FREE CASH FLOWS WEIGHTED AVERAGE COST OF CAPITAL Value Line Beta 1.00 Long Term Debt Adjusted Beta 1.00 Long Term Interest Treasury Bill Return 3.70% Cost of Debt Expected Market Return 11.74% Income Tax Rate (2015-17) Market Risk Premium 8.04% Proportion of Equity Cost of Equity 11.7400% Proportion of Debt Shares Outstanding 30,944,400 Weighted Average Cost of Capital Stock Price $526.66 Infinite FCFTF Growth Market Value of Equity 16,297,177,704 Average Annual P/E Ratio (2015-17) Current and Projected Amounts Working Capital Capital Spending per Share Common Shares Outstanding Long-Term Debt Interest Payment FREE CASH FLOWS Net Profit + Depreciation - Increase In Working Capital - Capital Spending + New Borrowing + After-tax Interest Payment STOCK VALUATION Fractional Years from Current Date Free Cash Flows to Equity (FCFTE) Terminal Value of FCFTE Total FCFTE Present Values of FCFTE Market Value of Equity (FCFTE Method) Stock Value (FCFTE Method) Free Cash Flows to Firm (FCFTF) Terminal Value of FCFTF Total FCFTF Present Values of Total FCFTF Enterprise Value Total Cash Market Value of Firm Debt Market Value of Equity (FCFTF Method) Stock Value (FCFTF Method) Estimated Stock Value 12-Month Target Price Projected 1-Year Gain Forward Annual Dividend Yield Projected 1-Year Return Treynor Index 12/31/13 $400,000,000 $6.85 30,944,400 0 0 0 (Millions of Dollars) 12/31/13 330,000,000 100,000,000 (40,300,000) (211,969,140) Date 11/26/13 12/31/13 0.10 177,730,860 177,730,860 175,823,082 4,887,592,346 157.95 177,730,860 177,730,860 175,823,082 2,703,281,883 532,170,000 3,235,451,883 3,235,451,883 104.56 Thompson/First Call Price Target High 131.25 Mean 146.66 Median -72% Low No. of Brokers -72% -76% 12/31/12 $359,700,000 12/31/14 $612,500,000.00 $7.84 $30,645,800.00 $0.00 0 12/31/14 $397,500,000.00 $112,500,000.00 (212,500,000) (240,186,458) 12/31/14 1.10 57,313,543 57,313,543 50,741,305 12/31/15 $825,000,000.00 $8.83 $30,347,200.00 $0.00 0 12/31/15 $465,000,000.00 $125,000,000.00 (212,500,000) (267,814,040) 12/31/15 2.10 109,685,960 109,685,960 86,905,398 12/31/16 $1,037,500,000.00 $9.81 $30,048,600.00 $0.00 0 12/31/16 $532,500,000.00 $137,500,000.00 (212,500,000) (294,851,888) 12/31/16 3.10 162,648,113 162,648,113 115,328,348

5.00% 40.00% 100.00% 0.00% 11.7400% 5.00% 31.50 12/31/17 $1,250,000,000 $10.80 29,750,000 0 0 12/31/17 600,000,000 150,000,000 (212,500,000) (321,300,000) 12/31/17 4.10 216,200,000 6,810,300,000 7,026,500,000 4,458,794,213

57,313,543 57,313,543 50,741,305

109,685,960 109,685,960 86,905,398

162,648,113 162,648,113 115,328,348

216,200,000 3,368,100,890 3,584,300,890 2,274,483,749

0.00%

$620.00 $515.90 $520.00 $344.00 21

QUESTIONS

1. Give one major argument for, and one major argument against, using the Treasury Bill return, instead of the Treasury Bond return, as the risk-free rate for calculating the cost of equity with the Capital Asset Pricing Model. The securities are similar in that all are issued by the United States to fund its debt, and all are backed by the full faith and credit of the U.S. government. There are two key differences between the three types of U.S. Treasuries, however: their maturity dates and the way that they pay interest. Treasury bills (or T -bills) are short-term bonds that mature within one year or less from their time of issuance. T-bills are sold with maturities of four, 13, 26, and 52 weeks, which are more commonly referred to as the one-, three-, six-, and 12-month T-bills, respectively. Due the short term maturity they offer lower interest rate than the bonds. Using bonds gives higher risk free rate standard. Although the higher return, the bonds rates are more volatile, thus the use of bonds con be more difficult due the uncertain conditions.

2. List three major strengths and three major weaknesses of the Discounted Free Cash Flows methods of Stock Valuation. The Discounted Free Cash Flows method is accurate in terms of stock valuation if the future projections will be accomplished for the business. But that is not predictable at all, and the expectations can be far from the reality. Also, the model can be sensitive and the variations can cause big changes in the stock forecasted price. Another weakness of the model is that it does not consider the future expected growth in the company, so it can under valuate a stock with great potential. Another important problem is that the model simplifies the operations into a straight line between today and the future projections. This is not always true in reality.

3. List three major characteristics of companies for which it is not appropriate to use the Discounted Free Cash Flows methods of Stock Valuation. Companies that have less than five years of operation are not good candidate for the model. Also, companies that have no debt at all can be undervalued. Another important problem is that if the company has volatile gains, so the forecast would be very inaccurate.

4. Based on the Estimated Stock Value calculated by you, would you recommend buying it at the Stock Price? Why or why not? Based on the estimations, the stock price of Chipotle Mexican Grill is evaluated by the model being $131.25 and the current stock price is $526.66. Thus, I would not recommend the stock purchase, since it is over valuated according to the model. The reason for the high stock price is the future expectations This is due the high expected market return of 11.47%, so the present value of future cash flows is lower. 5. Based on the projected 1-Year Return calculated by you, would you recommend buying the stock? Why or why not? Even considering the 1 year forward, the stock price is overvalued. The 1-year forward stock price is forecasted as $146.66, much less than the current price. Thus, I would not recommend the purchase of the stock price.

6. Does the Stock Value calculated by you appear to be reasonable? If yes, list three key features of the valuation model that provided a reasonable stock value. If not, list three key features of the valuation model that provided an unreasonable stock value. The stock price is not reasonably valuated. The first possible issue is that the expected market return of 11.47% can be higher than the investor`s perceptions, so the cash flow of the company are more valuable in the present value. This issue explains why the stock value is currently higher than the projection. Also, another important factor is that the future cash flows beyond the year 2017 are not considered. Thus, the model have a big undervaluing bias. Another important factor is that the future expectations of company growth are very high, given the EPS growth of the last quarters. The model does not considers the growth of the stock after 2017, then undervaluing even more the stock price.

Potrebbero piacerti anche

- Financial Plans for Successful Wealth Management In Retirement: An Easy Guide to Selecting Portfolio Withdrawal StrategiesDa EverandFinancial Plans for Successful Wealth Management In Retirement: An Easy Guide to Selecting Portfolio Withdrawal StrategiesNessuna valutazione finora

- Solman PortoDocumento26 pagineSolman PortoYusuf Raharja0% (1)

- FINS1612 Tutorial 5 - Forecasting Share Price MovementsDocumento7 pagineFINS1612 Tutorial 5 - Forecasting Share Price MovementsRuben CollinsNessuna valutazione finora

- Investment AnalysisDocumento9 pagineInvestment AnalysisEric AwinoNessuna valutazione finora

- Research Paper On Interest RatesDocumento8 pagineResearch Paper On Interest Ratesxfdacdbkf100% (1)

- TTP 0611 Can You Time LongDurationDocumento3 pagineTTP 0611 Can You Time LongDurationEun Woo HaNessuna valutazione finora

- Process Over Outcome: July 2011Documento4 pagineProcess Over Outcome: July 2011edoneyNessuna valutazione finora

- Learning To Play Offense and Defense: Combining Value and Momentum From The Bottom Up, and The Top DownDocumento10 pagineLearning To Play Offense and Defense: Combining Value and Momentum From The Bottom Up, and The Top Downmosqi100% (1)

- Chap 6Documento33 pagineChap 6Ajitha PrashantNessuna valutazione finora

- Thesis Stock ValuationDocumento4 pagineThesis Stock ValuationKarin Faust100% (2)

- Accelerating Dual Momentum Is Better Than Classic Dual MomentumDocumento26 pagineAccelerating Dual Momentum Is Better Than Classic Dual MomentumAyhanNessuna valutazione finora

- Stock Research Report For DISH As of 7/27/11 - Chaikin Power ToolsDocumento4 pagineStock Research Report For DISH As of 7/27/11 - Chaikin Power ToolsChaikin Analytics, LLCNessuna valutazione finora

- Financial Analysis (BIBLE) PDFDocumento23 pagineFinancial Analysis (BIBLE) PDFlampard230% (1)

- Dissertation On Sources of FinanceDocumento6 pagineDissertation On Sources of FinancePayToDoPaperUK100% (1)

- Stock Valuation HomeworkDocumento6 pagineStock Valuation Homeworkbwrfbvfng100% (2)

- Research Paper On Dividend Discount ModelDocumento4 pagineResearch Paper On Dividend Discount Modelcan3z5gx100% (1)

- BancFirst (BANF) Initiation ReportDocumento5 pagineBancFirst (BANF) Initiation ReportGeoffrey HortonNessuna valutazione finora

- Stock Research Report For DD As of 7/27/11 - Chaikin Power ToolsDocumento4 pagineStock Research Report For DD As of 7/27/11 - Chaikin Power ToolsChaikin Analytics, LLCNessuna valutazione finora

- MId Term Ent. Finance Luqmanulhakim 62386113295Documento9 pagineMId Term Ent. Finance Luqmanulhakim 62386113295ainonlelaNessuna valutazione finora

- Software AnalysisDocumento7 pagineSoftware AnalysisPrudhviRajNessuna valutazione finora

- White Paper - The Risk-Adjusted Growth Model - May 2015Documento4 pagineWhite Paper - The Risk-Adjusted Growth Model - May 2015CanadianValueNessuna valutazione finora

- CH 16 - Narrative Report-Short Term Business FinancingDocumento13 pagineCH 16 - Narrative Report-Short Term Business Financingjomarybrequillo20Nessuna valutazione finora

- Rambling Souls - Axis Bank - Equity ReportDocumento11 pagineRambling Souls - Axis Bank - Equity ReportSrikanth Kumar KonduriNessuna valutazione finora

- Delgado - Forex: The Fundamental Analysis.Documento10 pagineDelgado - Forex: The Fundamental Analysis.Franklin Delgado VerasNessuna valutazione finora

- Reading: Ifo World Economic Climate Suffers SetbackDocumento11 pagineReading: Ifo World Economic Climate Suffers SetbackWil ElvisNessuna valutazione finora

- Weekly Market Commentary 6/17/2013Documento3 pagineWeekly Market Commentary 6/17/2013monarchadvisorygroupNessuna valutazione finora

- Thesis On Demand ForecastingDocumento4 pagineThesis On Demand Forecastingdwt65fcw100% (2)

- China Outlook Update June 2011Documento4 pagineChina Outlook Update June 2011Minh NguyenNessuna valutazione finora

- Stock Valuation: Answers To Concepts Review and Critical Thinking Questions 1Documento19 pagineStock Valuation: Answers To Concepts Review and Critical Thinking Questions 1Diệu QuỳnhNessuna valutazione finora

- Dollar GeneralDocumento112 pagineDollar GeneralSajal SinghNessuna valutazione finora

- Solutions Nss NC 16Documento12 pagineSolutions Nss NC 16ELsha Santiago BroCeNessuna valutazione finora

- Investing Conservatively in Retirement: Make Your Money Work for You (For the Middle Class)Da EverandInvesting Conservatively in Retirement: Make Your Money Work for You (For the Middle Class)Nessuna valutazione finora

- Af 325 QuestionDocumento6 pagineAf 325 QuestionHiepXick100% (1)

- School of Trading Study MaterialDocumento37 pagineSchool of Trading Study Materialarpit200407Nessuna valutazione finora

- RenovatioAM DITMoHedgeStrategyMonthly Oct11-Issue3Documento12 pagineRenovatioAM DITMoHedgeStrategyMonthly Oct11-Issue3MGZeiserNessuna valutazione finora

- Finanal Revision TienteDocumento14 pagineFinanal Revision TienteJF FNessuna valutazione finora

- Corporate Finance Term PapersDocumento6 pagineCorporate Finance Term Papersafmzvaeeowzqyv100% (1)

- 4 Ways To Forecast Currency Changes - InvestopediaDocumento5 pagine4 Ways To Forecast Currency Changes - Investopediajagpreet singhNessuna valutazione finora

- CMS Inverse FloatersDocumento8 pagineCMS Inverse FloaterszdfgbsfdzcgbvdfcNessuna valutazione finora

- Stock Research Report For DFS As of 7/27/11 - Chaikin Power ToolsDocumento4 pagineStock Research Report For DFS As of 7/27/11 - Chaikin Power ToolsChaikin Analytics, LLCNessuna valutazione finora

- Importance of Demand Forecasting in Supply ChainDocumento5 pagineImportance of Demand Forecasting in Supply ChainSanta de IvanNessuna valutazione finora

- Materials Mnagement IIIDocumento63 pagineMaterials Mnagement IIISurafel YitbarekNessuna valutazione finora

- Research Paper in Finance ManagementDocumento8 pagineResearch Paper in Finance Managementggsmsyqif100% (1)

- Narsee Monjee Institute of Management Studies: Micro EconomicsDocumento8 pagineNarsee Monjee Institute of Management Studies: Micro EconomicsUDIT GUPTANessuna valutazione finora

- Chapter 6 Prospective Analysis: ForecastingDocumento10 pagineChapter 6 Prospective Analysis: ForecastingSheep ersNessuna valutazione finora

- Real Options: Strategic Financial ManagementDocumento25 pagineReal Options: Strategic Financial ManagementAnish MittalNessuna valutazione finora

- Term Paper On Investment DecisionDocumento6 pagineTerm Paper On Investment Decisioncdkxbcrif100% (1)

- Folio Add MathDocumento32 pagineFolio Add MathHazwan ArasyNessuna valutazione finora

- SFM Semi ReadyDocumento21 pagineSFM Semi ReadyDhaamel GlkNessuna valutazione finora

- Stock Market ResearchDocumento18 pagineStock Market ResearcheduNessuna valutazione finora

- 5 Investment Books For 2021Documento4 pagine5 Investment Books For 2021Yassine MafraxNessuna valutazione finora

- Fundamentals of Corporate Finance 10th Edition Ross Solutions Manual 1Documento36 pagineFundamentals of Corporate Finance 10th Edition Ross Solutions Manual 1michaelhooverspnjdgactf100% (21)

- Farmers SampleDocumento0 pagineFarmers SamplevijayhegdeNessuna valutazione finora

- Stock Research Report For HBC As of 8/17/11 - Chaikin Power ToolsDocumento4 pagineStock Research Report For HBC As of 8/17/11 - Chaikin Power ToolsChaikin Analytics, LLCNessuna valutazione finora

- Syla F552Documento7 pagineSyla F552Aiman Maimunatullail RahimiNessuna valutazione finora

- What Is Optimal Credit Policy State? 3: ACC-501 Final Term SubjectiveDocumento12 pagineWhat Is Optimal Credit Policy State? 3: ACC-501 Final Term Subjectiveshahbaz anjumNessuna valutazione finora

- CD RatesDocumento3 pagineCD RatesbankscdratesNessuna valutazione finora

- Mutual FundDocumento10 pagineMutual FundIndraneel BishayeeNessuna valutazione finora

- DIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)Da EverandDIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)Nessuna valutazione finora

- Turtle RulesDocumento38 pagineTurtle RulesTiago Nunes Barbi Costa100% (4)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- IFM Fall 2013 Final Study Guide in ClassDocumento10 pagineIFM Fall 2013 Final Study Guide in ClassTiago Nunes Barbi CostaNessuna valutazione finora

- Cost Scenarios For Hydrogen and Fuel Cells PDFDocumento13 pagineCost Scenarios For Hydrogen and Fuel Cells PDFTiago Nunes Barbi CostaNessuna valutazione finora

- The RMS Average.: David Knight Asserts The Right To Be Recognised As The Author of This WorkDocumento8 pagineThe RMS Average.: David Knight Asserts The Right To Be Recognised As The Author of This WorkharmlesdragonNessuna valutazione finora

- 55966bos45368may20 p5 cp3 PDFDocumento26 pagine55966bos45368may20 p5 cp3 PDFankush sharmaNessuna valutazione finora

- SCM - Deep Dive Cost PlanningDocumento19 pagineSCM - Deep Dive Cost PlanningSrinivasa Rao AsuruNessuna valutazione finora

- Valuation CirDocumento3 pagineValuation Cirmaha33% (6)

- Full Download Real Estate Principles A Value Approach Ling 4Th Edition Test Bank PDFDocumento43 pagineFull Download Real Estate Principles A Value Approach Ling 4Th Edition Test Bank PDFmaryann.spiller922100% (16)

- 7.2 Valuation of Contingent ClaimsDocumento27 pagine7.2 Valuation of Contingent ClaimsPunit SharmaNessuna valutazione finora

- P/E RatioDocumento10 pagineP/E Ratiosreenivas_inNessuna valutazione finora

- ASEU TESTS 2021 555906 Report 7636314769989114043.pdf 1611903888Documento66 pagineASEU TESTS 2021 555906 Report 7636314769989114043.pdf 1611903888leylaNessuna valutazione finora

- BSMA1 ACC 124 Conceptual Framework and Intermediate Accounting 1 Rev. 1 1st Sem SY 2021 2022Documento15 pagineBSMA1 ACC 124 Conceptual Framework and Intermediate Accounting 1 Rev. 1 1st Sem SY 2021 2022Trisha AlmiranteNessuna valutazione finora

- Financial Management Theory and Practice Brigham 14th Edition Solutions ManualDocumento6 pagineFinancial Management Theory and Practice Brigham 14th Edition Solutions Manualkimberlyfernandezfgzsediptj100% (42)

- Basu, Sanjib Kumar - Auditing and Assurance Explains The Concepts, Principles and Techniques of Auditing (2016, Pearson Education India) - Libgen - LiDocumento617 pagineBasu, Sanjib Kumar - Auditing and Assurance Explains The Concepts, Principles and Techniques of Auditing (2016, Pearson Education India) - Libgen - LiSiddhartha RoyNessuna valutazione finora

- Lican - PDDDocumento63 pagineLican - PDDsyahrial_chaniago4769Nessuna valutazione finora

- The Global Financial CrisisDocumento26 pagineThe Global Financial CrisisMazin AhmadNessuna valutazione finora

- Ipo Note On Mir Akhter Hossain Limited (Mahl) : Primary Market ServicesDocumento6 pagineIpo Note On Mir Akhter Hossain Limited (Mahl) : Primary Market ServicesturjoyNessuna valutazione finora

- Sap MM Config Document Real Life Project PDFDocumento182 pagineSap MM Config Document Real Life Project PDFmilosmartin100% (1)

- Introductions To Valuation Methods and Requirements 1672683839Documento51 pagineIntroductions To Valuation Methods and Requirements 1672683839v7qksq5bzg100% (1)

- SAP Period End Closing ActivitiesDocumento4 pagineSAP Period End Closing ActivitiessivasivasapNessuna valutazione finora

- Fundamentals of Accountancy, Business and Management 1 (FABM 1)Documento12 pagineFundamentals of Accountancy, Business and Management 1 (FABM 1)Angelica ParasNessuna valutazione finora

- IntangDocumento19 pagineIntangShivam SinghNessuna valutazione finora

- Equity Valuation:: Applications and ProcessesDocumento24 pagineEquity Valuation:: Applications and Processestuba mukhtarNessuna valutazione finora

- BcomDocumento76 pagineBcomshhanoorNessuna valutazione finora

- BMA5302 - Investment Analysis and Management Ravi Jain PDFDocumento4 pagineBMA5302 - Investment Analysis and Management Ravi Jain PDFNikhilNessuna valutazione finora

- RealOptions ExampleDocumento33 pagineRealOptions Exampleveda20Nessuna valutazione finora

- Policy Bazar: Valuation PerspectiveDocumento5 paginePolicy Bazar: Valuation PerspectiveSHIVANGI SINGH 21221043Nessuna valutazione finora

- Test Bank MGMT 126Documento8 pagineTest Bank MGMT 126najihachangminNessuna valutazione finora

- Valuation & ModellingDocumento440 pagineValuation & ModellingFaizan Maqsood98% (40)

- This Is The Best Risk Management Conference in The WorldDocumento18 pagineThis Is The Best Risk Management Conference in The WorldyeoktengNessuna valutazione finora

- (23005289 - Real Estate Management and Valuation) Fundamental Analysis - Possiblity of Application On The Real Estate MarketDocumento12 pagine(23005289 - Real Estate Management and Valuation) Fundamental Analysis - Possiblity of Application On The Real Estate MarketgollumNessuna valutazione finora

- Brigham ch9 Stock Edited 97 2003Documento64 pagineBrigham ch9 Stock Edited 97 2003Zee ZioaNessuna valutazione finora

- BaanERP 5 (1) .0c Manufacturing - Production Order CostingDocumento26 pagineBaanERP 5 (1) .0c Manufacturing - Production Order Costingbabuplus0% (1)

- DCF ModelDocumento6 pagineDCF ModelKatherine ChouNessuna valutazione finora