Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Wk4A.docx - 17K - Student of Fortune

Caricato da

Dyllan HolmesTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Wk4A.docx - 17K - Student of Fortune

Caricato da

Dyllan HolmesCopyright:

Formati disponibili

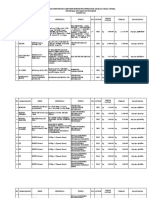

. (TCO 2) Nancy formed Green Enterprises, a proprietorship, this year.

In its first year, Green had operating income of $400,000 and operating expenses of $240,000. In addition, Green had a long-term capital loss of $10,000. Nancy, the proprietor of Green Enterprises, withdrew $75,000 from Green during the year. Assuming Nancy has no other capital gains or losses, how does this information affect her taxable income for 2011? Increases Nancy's taxable income by $75,000 Increases Nancy's taxable income by $160,000 Increases Nancy's taxable income by $150,000 ($160,000 ordinary business income-- $10,000 longterm capital loss) Increases Nancy's taxable income by $157,000 ($160,000 ordinary business income-- $3,000 longterm capital loss) None of the above

2. (TCO 2) Which of the following statements is incorrect regarding the taxation of C corporations? The highest corporate marginal tax rate is 39%. Taxable income of a personal service corporation is taxed at a flat rate of 35%. A tax return must be filed whether or not the corporation has taxable income. Similar to those applicable to individuals, the marginal tax rate brackets for corporations are adjusted for inflation. None of the above

3. (TCO 1) Ava, Irene, and Bob incorporate their respective businesses and form Dove Corporation. Ava exchanges her property (basis of $100,000 and fair market value of $400,000) for 200 shares in Dove Corporation. Irene exchanges her property (basis of $140,000 and fair market value of $600,000) for 300 shares in Dove Corporation. Bob transfers his property (basis of $250,000 and fair market value of $1,000,000) for 500 shares in Dove Corporation. Bob's transfer is not part of a prearranged plan with Ava and Irene to incorporate their businesses. What gain, if any, will Bob recognize on the transfer? (Points : 5) $1,000,000

$750,000 $250,000 $0 None of the above

4. (TCO 1) Harry and Warren form Brown Corporation. Harry transfers equipment (basis of $210,000 and fair market value of $180,000), and Warren transfers land (basis of $15,000 and fair market value of $150,000) and $30,000 of cash. Each receives 50% of Brown's stock. What occurs as a result of these transfers? Harry has a recognized loss of $30,000; Warren has a recognized gain of $135,000. Neither Harry nor Warren has any recognized gain or loss. Harry has no recognized loss; Warren has a recognized gain of $30,000. Brown Corporation has a basis in the land of $45,000. None of the above

5. (TCO 1) Joe and Kay form Gray Corporation. Joe transfers cash of $250,000 for 200 shares in Gray Corporation. Kay transfers property with a basis of $50,000 and fair market value of $240,000. She agrees to accept 200 shares in Gray Corporation for the property and for providing bookkeeping services to the corporation in its first year of operation. The value of Kay's services is $10,000. What occurs respect to the transfer? Gray Corporation has a basis of $240,000 in the property transferred by Kay. Neither Joe nor Kay recognizes gain or income on the exchanges. Gray Corporation has a business deduction under 162 of $10,000. Gray capitalizes $10,000 as organizational costs. None of the above

6. (TCO 11) Maureen, a calendar year taxpayer subject to a 35% marginal tax rate, claimed a charitable contribution deduction of $250,000 for a sculpture that the IRS later valued at $200,000. What is the applicable overvaluation penalty? $17,500 $14,000 $3,500 $0

7. (TCO 11) The privilege of confidentiality applies to a CPA tax preparer concerning the client's information relative to financial accounting tax accrual work papers. a tax research memo used to determine an amount reported on the tax return. building a defense against a penalty assessed for the use of a tax shelter. building a defense against a charge brought by the SEC. None of the above

8. (TCO 2) Lemon, Inc., has taxable income of $13 million this year. What is the maximum DPAD tax savings for this C corporation? $132,600 $265,200 $273,000 $409,500 None of the above

9. (TCO 2) Silver Corporation has average gross receipts of $5.6 million, $4.6 million, and $4.7 million in 2008, 2009, and 2010 respectively. Silver is not subject to the corporate income tax. a small corporation with respect to the AMT. subject to the AMT. not a small corporation with respect to the AMT. None of the above

10. (TCO 3) Which of the following does not increase the E & P of a corporation Dividends received deduction Collection of proceeds from an insurance policy on the life of a key employee Federal income tax refund Charitable contributions in excess of 10% limitation None of the above

11. (TCO 3) Walnut Corporation, a calendar year taxpayer, has taxable income of $110,000 for the year. In reviewing Walnut's financial records you discover the following occurred this year. Federal income taxes paid $25,000 Net operating loss carryforward deducted currently 25,000 Gain recognized this year on an installment sale from a prior year 12,000 Depreciation deducted on tax return (ADS depreciation would have been $8,000) 15,000 Interest income from Wisconsin state bonds 37,000 Walnut Corporation's current E & P is _____.

$73,000 $138,000 $142,000 $166,000 None of the above

12. (TCO 3) Which of the following statements regarding constructive dividends is not correct

Constructive dividends do not need to be formally declared or designated as a dividend. Constructive dividends need not be paid pro rata to the shareholders. Corporations that receive constructive dividends may not use the dividends received deduction. Constructive dividends are taxable as dividends only to the extent of earnings and profits. All of the above

13. (TCO 4) Five years ago, Eleanor transferred property she had used in her sole proprietorship to Blue Corporation for 100 shares of Blue Corporation in a transaction that qualified under 351. The assets had a tax basis to her of $200,000 and a fair market value of $350,000 on the date of the transfer. In the current year, Blue Corporation (E & P of $1 million) redeems 30 shares from Eleanor for $225,000 in a transaction that qualifies for sale or exchange treatment. With respect to the redemption, Eleanor will have a _____. $165,000 dividend $165,000 capital gain $225,000 dividend $225,000 capital gain None of the above

14. (TCO 4) Cardinal Corporation has 1,000 shares of common stock outstanding. John owns 400 of the shares, John's father owns 300 shares, John's daughter owns 200 shares, and Redbird Corporation owns 100 shares. John owns 70% of the stock in Redbird Corporation. How many shares is John deemed to own in Cardinal Corporation under the attribution rules of 318? 400 600 700 1,000 None of the above

15. (TCO 5) All of the following statements are true about corporate reorganization except amounts for shareholders are classified as a dividend or capital gain. reorganizations receive treatment similar to corporate formations under 351. the transfers of stock to and from shareholders qualify for like-kind exchange treatment.

taxable

the value of the stock received by the shareholder less the gain not recognized (postponed) will equal the shareholder's basis in the stock received. All of the above

16. (TCO 5) Garnet Corporation has assets worth $700,000 with an adjusted basis of $315,000. Pearl Corporation would like to acquire all of Garnet's assets in a Type C reorganization in exchange for $450,000 of voting stock, $125,000 of cash, and assumption of Garnet's liabilities of $125,000. All stock received by Garnet will be distributed to its shareholders and Garnet will then liquidate. Which, if any, of the following statements regarding this transaction is correct Garnet will realize a gain of $385,000 and recognize a gain of $0. Garnet will realize a gain of $385,000 and recognize a gain of $125,000.

Garnet will realize a gain of $385,000 and recognize a gain of $150,000. Garnet will realize a gain of $385,000 and recognize a gain of $385,000. None of the above

17. (TCO 5) An equity structure shift cannot occur with which of the following tax-free reorganizations? Type A Type B Type C Type G None of the above

18. (TCO 6) How are the members of a consolidated group affected by computations related to E & P? E & P is computed solely on a consolidated basis. Consolidated E & P is computed as the sum of the E & P balances of each of the group members. Members E & P balances are frozen as long as the consolidation election is in place. Each member keeps its own E & P account.

19. (TCO 6) ParentCo's separate taxable income was $350,000, and SubCo's was $225,000. Consolidated taxable income before contributions was $400,000. Charitable contributions made by the affiliated group included $15,000 by ParentCo and $20,000 by SubCo. Compute the group's charitable contribution deduction. $57,500 $40,000 $35,000

$0 None of the above

20. (TCO 6) Members of a controlled group share all but which of the following tax attributes? The lower tax rates on the first $75,000 of taxable income The $40,000 AMT exemption The 179 depreciation amount allowed All of the above

Potrebbero piacerti anche

- Test FormatDocumento3 pagineTest FormatDyllan HolmesNessuna valutazione finora

- Devry University: College of ( - )Documento1 paginaDevry University: College of ( - )Dyllan HolmesNessuna valutazione finora

- Chapter 17Documento42 pagineChapter 17Dyllan HolmesNessuna valutazione finora

- Chapter 11Documento42 pagineChapter 11Dyllan Holmes50% (2)

- Chapter 13Documento56 pagineChapter 13Dyllan Holmes0% (1)

- 16-35 Team EDocumento26 pagine16-35 Team EDyllan Holmes100% (2)

- ACT400 - Mastery ExerciseDocumento125 pagineACT400 - Mastery ExerciseKrystal FabianNessuna valutazione finora

- Functional ResumeDocumento2 pagineFunctional ResumeDyllan HolmesNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Sickle Cell DiseaseDocumento10 pagineSickle Cell DiseaseBrooke2014Nessuna valutazione finora

- CH 15Documento58 pagineCH 15Chala1989Nessuna valutazione finora

- Contemp Person Act.1Documento1 paginaContemp Person Act.1Luisa Jane De LunaNessuna valutazione finora

- Anthony Robbins - Time of Your Life - Summary CardsDocumento23 pagineAnthony Robbins - Time of Your Life - Summary CardsWineZen97% (58)

- Four Hour Body Experiment Tracker TemplateDocumento4 pagineFour Hour Body Experiment Tracker Templatechanellekristyweaver100% (1)

- Ice 3101: Modern Control THEORY (3 1 0 4) : State Space AnalysisDocumento15 pagineIce 3101: Modern Control THEORY (3 1 0 4) : State Space AnalysisBipin KrishnaNessuna valutazione finora

- Reference by John BatchelorDocumento1 paginaReference by John Batchelorapi-276994844Nessuna valutazione finora

- Grasa LO 915Documento2 pagineGrasa LO 915Angelo Carrillo VelozoNessuna valutazione finora

- Jota - EtchDocumento3 pagineJota - EtchRidwan BaharumNessuna valutazione finora

- Heirs of Vinluan Estate in Pangasinan Charged With Tax Evasion For Unsettled Inheritance Tax CaseDocumento2 pagineHeirs of Vinluan Estate in Pangasinan Charged With Tax Evasion For Unsettled Inheritance Tax CaseAlvin Dela CruzNessuna valutazione finora

- C++ Program To Create A Student Database - My Computer ScienceDocumento10 pagineC++ Program To Create A Student Database - My Computer ScienceSareeya ShreNessuna valutazione finora

- VerificationManual en PDFDocumento621 pagineVerificationManual en PDFurdanetanpNessuna valutazione finora

- Rab Sikda Optima 2016Documento20 pagineRab Sikda Optima 2016Julius Chatry UniwalyNessuna valutazione finora

- Pautas Anatómicas para La Inserción de Minitornillos: Sitios PalatinosDocumento11 paginePautas Anatómicas para La Inserción de Minitornillos: Sitios PalatinosValery V JaureguiNessuna valutazione finora

- Nature of Science-Worksheet - The Amoeba Sisters HWDocumento2 pagineNature of Science-Worksheet - The Amoeba Sisters HWTiara Daniel25% (4)

- Transposable Elements - Annotated - 2020Documento39 pagineTransposable Elements - Annotated - 2020Monisha vNessuna valutazione finora

- Jurnal Vol. IV No.1 JANUARI 2013 - SupanjiDocumento11 pagineJurnal Vol. IV No.1 JANUARI 2013 - SupanjiIchsan SetiadiNessuna valutazione finora

- Course DescriptionDocumento54 pagineCourse DescriptionMesafint lisanuNessuna valutazione finora

- Thesis On Retail Management of The Brand 'Sleepwell'Documento62 pagineThesis On Retail Management of The Brand 'Sleepwell'Sajid Lodha100% (1)

- Trading Journal TDA Branded.v3.5 - W - Total - Transaction - Cost - BlankDocumento49 pagineTrading Journal TDA Branded.v3.5 - W - Total - Transaction - Cost - BlankChristyann LojaNessuna valutazione finora

- Phy Mock SolDocumento17 paginePhy Mock SolA PersonNessuna valutazione finora

- Agm 1602W-818Documento23 pagineAgm 1602W-818Daniel BauerNessuna valutazione finora

- Controlled DemolitionDocumento3 pagineControlled DemolitionJim FrancoNessuna valutazione finora

- SRS Document Battle Royale Origins - V2Documento36 pagineSRS Document Battle Royale Origins - V2Talha SajjadNessuna valutazione finora

- Zambia National FormularlyDocumento188 pagineZambia National FormularlyAngetile Kasanga100% (1)

- Report-Smaw Group 12,13,14Documento115 pagineReport-Smaw Group 12,13,14Yingying MimayNessuna valutazione finora

- Ethiopian Airlines-ResultsDocumento1 paginaEthiopian Airlines-Resultsabdirahmanguray46Nessuna valutazione finora

- Watch One Piece English SubDub Online Free On Zoro - ToDocumento1 paginaWatch One Piece English SubDub Online Free On Zoro - ToSadeusuNessuna valutazione finora

- What Is Product Management?Documento37 pagineWhat Is Product Management?Jeffrey De VeraNessuna valutazione finora

- Integrator Windup and How To Avoid ItDocumento6 pagineIntegrator Windup and How To Avoid ItHermogensNessuna valutazione finora