Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Cir v. Sekisui

Caricato da

Francis Xavier SinonDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Cir v. Sekisui

Caricato da

Francis Xavier SinonCopyright:

Formati disponibili

Business enterprises registered with the Philippine Export Zone Authority (PEZA) may choose between two fiscal

incentive schemes: (1) to pay a five percent preferential tax rate on its gross income and thus be exempt from all other taxes; or (b) to enjoy an income tax holiday, in which case it is not exempt from applicable national revenue taxes including the value-added tax (V !)" !he present respondent, which availed itself of the second tax incentive scheme, has proven that all its transactions were export sales" #ence, they should be V ! $ero-rated"

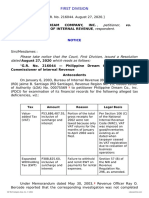

CIR VS. Sekisui Jushi Philippines, Inc. .R. !". #$%&'#, Jul( )#, )**&

Tax; VAT Zero-rated Transactions +rancis ,a-ier Sinon

+ACTS. Respondent is a do/estic corporation duly organized and existing under and by virtue of the laws of the Philippines with principal office located at the Special Export Processing Zone, Laguna Technopar , !i"an, Laguna# Se isui $ushi is a P0ZA entit( engaged in %anufacture and export of strapping bands and other pac aging %aterials see ing for refund of unutilized input taxes# &aving registered with the !ureau of 'nternal Revenue (!'R) as a value*added tax (+,T) taxpayer, respondent filed its -uarterly returns with the !'R, reflecting therein input taxes in the a%ount of P.,/01,102#34 paid by it in connection with its do%estic purchase of capital goods and services# Said input taxes re%ained unutilized since respondent has not engaged in any business activity or transaction for which it %ay be liable for output tax and for which said input taxes %ay be credited# 5n 6ove%ber 11, 1778, respondent filed with the 5ne*Stop*Shop 'nter*,gency Tax 9redit and :uty :rawbac 9enter of the :epart%ent of ;inance (9E6TER*:5;) two (2) separate applications for tax credit<refund of +,T input taxes paid# There being no action on its application for tax credit<refund under Section 112 (!) of the 1773 6ational 'nternal Revenue 9ode (Tax 9ode), as a%ended, private respondent filed, within the two (2)*year prescriptive period under Section 227 of said 9ode, a petition for review with the 9ourt of Tax ,ppeals# The 9T, ruled that respondent was entitled to the refund# =hile the co%pany was registered with the PEZ, as an ecozone and was, as such, exe%pt fro% inco%e tax, it availed itself of the fiscal incentive under Executive 5rder 6o# 22/# 't thereby sub>ected itself to other internal revenue taxes li e the +,T# The 9T, then found that only input taxes a%ounting to P.,033,142#2/ were duly substantiated by invoices and 5fficial Receipts# The 9ourt of ,ppeals upheld the :ecision of the 9T,# ,ccording to the 9,, respondent had co%plied with the procedural and substantive re-uire%ents for a clai% by 1) sub%itting receipts, invoices, and supporting papers as evidence? 2) paying the sub>ect input taxes on capital goods? 0) not applying the input taxes against any output tax liability? and .) filing the clai% within the two*year prescriptive period under Section 227 of the 1773 Tax 9ode# &ence, this Petition# ISS10. =hether the respondent is entitled to the refund or issuance of tax credit certificate in the a%ount of P.,033,142#2/ as alleged unutilized input taxes paid on do%estic purchase of capital goods and services# 2034. 50S. Since 144 percent of the products of respondent are exported, all its transactions are dee%ed export sales and are thus +,T zero*rated# 't has been shown that respondent has no output tax with which it could offset its paid input tax# Since the su67ect input tax it paid 8or its do/estic purchases o8 capital 9oods and ser-ices re/ained unutili:ed, it can clai/ a re8und 8or the input VAT pre-iousl( char9ed 6( its suppliers. The a%ount of P.,033,142#2/ is excess input taxes that >ustify a refund# 6otably, while an ecozone is geographically within the Philippines, it is dee%ed a separate custo%s territory and is regarded in law as foreign soil# Sales by suppliers fro% outside the borders of the ecozone to this separate custo%s territory are dee%ed as exports and treated as export sales# These sales are zero*rated or sub>ect to a tax rate of zero percent#

Potrebbero piacerti anche

- Cir vs. Sekisui JushiDocumento6 pagineCir vs. Sekisui JushiPrecy De VillaNessuna valutazione finora

- CIR VS. Sekisui Jushi Philippines, Inc.Documento1 paginaCIR VS. Sekisui Jushi Philippines, Inc.Abdulateef SahibuddinNessuna valutazione finora

- Kepco v. CIRDocumento4 pagineKepco v. CIRWhere Did Macky GallegoNessuna valutazione finora

- 38 CIR Vs SEA GATEDocumento4 pagine38 CIR Vs SEA GATEIshNessuna valutazione finora

- Mondragon vs. The People of The Philippines, G.R. No. L-17666. June 30, 1966.Documento2 pagineMondragon vs. The People of The Philippines, G.R. No. L-17666. June 30, 1966.Anna BarbadilloNessuna valutazione finora

- 35 Philippine Dream Company Inc. V.20210424-12-1jxqs4iDocumento11 pagine35 Philippine Dream Company Inc. V.20210424-12-1jxqs4iervingabralagbonNessuna valutazione finora

- DigestDocumento1 paginaDigestpaokaeNessuna valutazione finora

- CIR v. Acesite Hotel CorporationDocumento2 pagineCIR v. Acesite Hotel CorporationJemima FalinchaoNessuna valutazione finora

- Estate and Donor's TaxDocumento6 pagineEstate and Donor's TaxKimberly SendinNessuna valutazione finora

- Local TaxationDocumento240 pagineLocal TaxationJulia Inez BlandoNessuna valutazione finora

- Tax DigestDocumento4 pagineTax DigestAnton FortichNessuna valutazione finora

- Tax Doctrines in Dimaampao CasesDocumento3 pagineTax Doctrines in Dimaampao CasesDiane UyNessuna valutazione finora

- Cir Vs Sekisui Jushi PH: Doctrine/SDocumento2 pagineCir Vs Sekisui Jushi PH: Doctrine/SIshNessuna valutazione finora

- XII. CIR vs. Secretary of Justice & PAGCORDocumento17 pagineXII. CIR vs. Secretary of Justice & PAGCORStef OcsalevNessuna valutazione finora

- COMMISSIONER OF INTERNAL REVENUE Vs METRO STAR SUPERAMADocumento1 paginaCOMMISSIONER OF INTERNAL REVENUE Vs METRO STAR SUPERAMACharles Roger RayaNessuna valutazione finora

- Silkair (Singapore) Pte., Ltd. vs. Commissioner of Internal Revenue (February 6, 2008 November 14, 2008 and January 20, 2012)Documento3 pagineSilkair (Singapore) Pte., Ltd. vs. Commissioner of Internal Revenue (February 6, 2008 November 14, 2008 and January 20, 2012)Vince LeidoNessuna valutazione finora

- AZNAR Vs CTADocumento2 pagineAZNAR Vs CTAMCNessuna valutazione finora

- Civil Law Review 2 - Atty. Legarda Case Digest 2018 - PREFERENCE OF CREDIT 1Documento7 pagineCivil Law Review 2 - Atty. Legarda Case Digest 2018 - PREFERENCE OF CREDIT 1BoletPascuaNessuna valutazione finora

- Cancio V CtaDocumento1 paginaCancio V CtaAaron Gabriel SantosNessuna valutazione finora

- Commissioner of Internal Revenue vs. Hambrecht & Quist Philippines, IncDocumento1 paginaCommissioner of Internal Revenue vs. Hambrecht & Quist Philippines, IncMary AnneNessuna valutazione finora

- CIR Vs Standard CharteredDocumento2 pagineCIR Vs Standard CharteredFatzie MendozaNessuna valutazione finora

- Labor-Case Digests-Marquez-P7-9Documento52 pagineLabor-Case Digests-Marquez-P7-9NiellaNessuna valutazione finora

- Commissioner of Internal Revenue vs. de La Salle University, Inc., 808 SCRA 156, November 09, 2016Documento11 pagineCommissioner of Internal Revenue vs. de La Salle University, Inc., 808 SCRA 156, November 09, 2016Jane BandojaNessuna valutazione finora

- CIR vs. Silicon Philippines, GR 169778Documento5 pagineCIR vs. Silicon Philippines, GR 169778Ma. Consorcia GoleaNessuna valutazione finora

- Manila Electric Company vs. VeraDocumento14 pagineManila Electric Company vs. VeraMrln VloriaNessuna valutazione finora

- People Vs Mejares ValenciaDocumento7 paginePeople Vs Mejares ValenciaMarc Cedric CaabayNessuna valutazione finora

- Manila Memorial Park VS DSWDDocumento2 pagineManila Memorial Park VS DSWDJohn Dy Castro FlautaNessuna valutazione finora

- Abiad Vs AlbaydaDocumento2 pagineAbiad Vs AlbaydaDwight Anthony YuNessuna valutazione finora

- MGC Vs Collector SitusDocumento5 pagineMGC Vs Collector SitusAira Mae P. LayloNessuna valutazione finora

- Landmark Cases On Value-Added Tax (VAT) : Taxation II Juderick RamosDocumento12 pagineLandmark Cases On Value-Added Tax (VAT) : Taxation II Juderick RamosJudeRamosNessuna valutazione finora

- Tax 2 Case Digest 5Documento1 paginaTax 2 Case Digest 5Leo NekkoNessuna valutazione finora

- CIR v. CA, CTA and YMCA of The PhilippinesDocumento2 pagineCIR v. CA, CTA and YMCA of The PhilippinesKelsey Olivar MendozaNessuna valutazione finora

- Ungab Doctrine and Fortune Tobacco Doctrine TAXDocumento2 pagineUngab Doctrine and Fortune Tobacco Doctrine TAXGeorge PandaNessuna valutazione finora

- Hydro vs. CADocumento10 pagineHydro vs. CAColeen Navarro-RasmussenNessuna valutazione finora

- Taxation Bar QuestionsDocumento11 pagineTaxation Bar Questionsjstin_jstinNessuna valutazione finora

- CIR V Raul Gonzales DigestDocumento3 pagineCIR V Raul Gonzales DigestEstelle Rojas TanNessuna valutazione finora

- Bagatsing Vs San Juan (Simbillo)Documento3 pagineBagatsing Vs San Juan (Simbillo)Joshua Rizlan SimbilloNessuna valutazione finora

- ToledoDocumento1 paginaToledotantum ergumNessuna valutazione finora

- CIR v. AcesiteDocumento4 pagineCIR v. AcesiteTheresa BuaquenNessuna valutazione finora

- CIR v. Seagate Technology (Philippines), G.R. No. 153866, Feb. 11, 2005Documento22 pagineCIR v. Seagate Technology (Philippines), G.R. No. 153866, Feb. 11, 2005samaral bentesinkoNessuna valutazione finora

- Diaz vs. Secretary of FinanceDocumento17 pagineDiaz vs. Secretary of FinanceBethany MangahasNessuna valutazione finora

- Phil Journalists Inc V CIRDocumento2 paginePhil Journalists Inc V CIRsmtm06Nessuna valutazione finora

- City of Manila vs. Coca Cola BottlersDocumento2 pagineCity of Manila vs. Coca Cola BottlersMyla RodrigoNessuna valutazione finora

- CIR Vs HantexDocumento20 pagineCIR Vs HantexDarrel John SombilonNessuna valutazione finora

- Bpi vs. Cir, GR No. 139736Documento11 pagineBpi vs. Cir, GR No. 139736Ronz RoganNessuna valutazione finora

- Republic vs. Patanao (GR No. L-22356, July 21, 1967)Documento3 pagineRepublic vs. Patanao (GR No. L-22356, July 21, 1967)anaNessuna valutazione finora

- Pointers in Taxation Law 2015 Bar Examinations: Chanrobles Internet Bar Review: Chanrobles Professional Review, IncDocumento19 paginePointers in Taxation Law 2015 Bar Examinations: Chanrobles Internet Bar Review: Chanrobles Professional Review, IncBrokenNessuna valutazione finora

- Torts Case DigestDocumento9 pagineTorts Case DigestAndrew GallardoNessuna valutazione finora

- 22d G.R. No. 163583 April 15, 2009 British American Tobacco Vs CamachoDocumento2 pagine22d G.R. No. 163583 April 15, 2009 British American Tobacco Vs CamachorodolfoverdidajrNessuna valutazione finora

- 3m 2017 2018 Tax 2 3rd Exam Trans PartialDocumento28 pagine3m 2017 2018 Tax 2 3rd Exam Trans PartialCyndall J. WalkingNessuna valutazione finora

- CIR Vs Benguet Corp. - GR 145559, 14 July 2006Documento2 pagineCIR Vs Benguet Corp. - GR 145559, 14 July 2006ewnesssNessuna valutazione finora

- Diaz vs. Secretary of Finance, 654 SCRA 96, G.R. No. 193007 July 19, 2011Documento24 pagineDiaz vs. Secretary of Finance, 654 SCRA 96, G.R. No. 193007 July 19, 2011Alfred GarciaNessuna valutazione finora

- Cir Vs Metro Super Rama DigestDocumento2 pagineCir Vs Metro Super Rama DigestKobe BryantNessuna valutazione finora

- Pirovano Vs CIRDocumento2 paginePirovano Vs CIRgeorge almedaNessuna valutazione finora

- Tax Cases Page 6Documento5 pagineTax Cases Page 6MikhailFAbzNessuna valutazione finora

- Villanueva Vs City of IloiloDocumento7 pagineVillanueva Vs City of IloilocharmssatellNessuna valutazione finora

- CIR Vs Far East BankDocumento1 paginaCIR Vs Far East BankRodney SantiagoNessuna valutazione finora

- CIR vs. Seagate Technology (G.R. No. 153866 February 11, 2005) - H DIGESTDocumento4 pagineCIR vs. Seagate Technology (G.R. No. 153866 February 11, 2005) - H DIGESTHarlene0% (1)

- COMMISSIONER OF INTERNAL REVENUE V Cebu Toyo CorpDocumento5 pagineCOMMISSIONER OF INTERNAL REVENUE V Cebu Toyo CorpAustin Viel Lagman MedinaNessuna valutazione finora

- CIR vs. Sekisui Jushi Philippines, IncDocumento2 pagineCIR vs. Sekisui Jushi Philippines, IncCombat GunneyNessuna valutazione finora

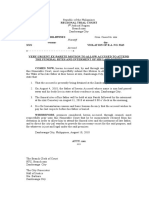

- Compromise Agreement SampleDocumento2 pagineCompromise Agreement SampleFrancis Xavier SinonNessuna valutazione finora

- Release, Waiver and Quitclaim Covid-19 ComplicationsDocumento1 paginaRelease, Waiver and Quitclaim Covid-19 ComplicationsFrancis Xavier SinonNessuna valutazione finora

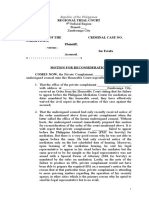

- Motion For Preliminary Investigation SampleDocumento2 pagineMotion For Preliminary Investigation SampleFrancis Xavier Sinon80% (5)

- SPA1Documento1 paginaSPA1Shane EdrosolanoNessuna valutazione finora

- Motion For Reconsideration Reinstatement of Bail BondDocumento2 pagineMotion For Reconsideration Reinstatement of Bail BondFrancis Xavier SinonNessuna valutazione finora

- Email Complaint Maria Socorro Macaso 09-15-2020Documento4 pagineEmail Complaint Maria Socorro Macaso 09-15-2020Francis Xavier SinonNessuna valutazione finora

- Manifestation and Undertaking Notarial Commission SampleDocumento1 paginaManifestation and Undertaking Notarial Commission SampleFrancis Xavier SinonNessuna valutazione finora

- PNP Ops Manual 2013Documento222 paginePNP Ops Manual 2013ianlayno100% (2)

- Last Will and Testament of (Sample)Documento3 pagineLast Will and Testament of (Sample)Francis Xavier SinonNessuna valutazione finora

- Sanlakas v. Executive SecreatryDocumento1 paginaSanlakas v. Executive SecreatryFrancis Xavier SinonNessuna valutazione finora

- Very Urgent Ex-Parete Motion To Allow Accused To Attend The Funeral Rites and Interment of His Late FatherDocumento2 pagineVery Urgent Ex-Parete Motion To Allow Accused To Attend The Funeral Rites and Interment of His Late FatherFrancis Xavier SinonNessuna valutazione finora

- Ampatuan v. PunoDocumento1 paginaAmpatuan v. PunoFrancis Xavier Sinon100% (1)

- Writ of Possession SampleDocumento3 pagineWrit of Possession SampleFrancis Xavier Sinon100% (6)

- Urgent Omnibus Motion For ReinvestigationDocumento3 pagineUrgent Omnibus Motion For ReinvestigationFrancis Xavier Sinon100% (2)

- Motion To Allow Accused To Be Brought To The Hospital For Medical Check Up SampleDocumento2 pagineMotion To Allow Accused To Be Brought To The Hospital For Medical Check Up SampleFrancis Xavier Sinon100% (2)

- SPA1Documento1 paginaSPA1Shane EdrosolanoNessuna valutazione finora

- Sample Affidavit of DesistanceDocumento1 paginaSample Affidavit of DesistanceFrancis Xavier Sinon0% (1)

- Motion For Determination of Probable Cause BlankDocumento2 pagineMotion For Determination of Probable Cause BlankFrancis Xavier Sinon100% (4)

- Contract of Lease Blank SampleDocumento5 pagineContract of Lease Blank SampleFrancis Xavier SinonNessuna valutazione finora

- Sample Probationary Employee ContractDocumento4 pagineSample Probationary Employee ContractFrancis Xavier Sinon67% (3)

- Motion For Reconsideration For Failure To Appear For Mandatory ConciliationDocumento3 pagineMotion For Reconsideration For Failure To Appear For Mandatory ConciliationFrancis Xavier SinonNessuna valutazione finora

- 2004 Rules On Notarial Practice - AM 02-8-13-SC PDFDocumento20 pagine2004 Rules On Notarial Practice - AM 02-8-13-SC PDFirditchNessuna valutazione finora

- Joint-Affidavit of Two Disinterested PersonsDocumento1 paginaJoint-Affidavit of Two Disinterested PersonsFrancis Xavier SinonNessuna valutazione finora

- Affidavit of Loss SampleDocumento1 paginaAffidavit of Loss SampleFrancis Xavier SinonNessuna valutazione finora

- Roberts v. LeonidasDocumento2 pagineRoberts v. LeonidasFrancis Xavier SinonNessuna valutazione finora

- Wilson v. RearDocumento1 paginaWilson v. RearFrancis Xavier SinonNessuna valutazione finora

- Rafael A. Dinglasan, Et Al., V. Ang ChiaDocumento2 pagineRafael A. Dinglasan, Et Al., V. Ang ChiaFrancis Xavier SinonNessuna valutazione finora

- Allan Sheker v. Estate of Alice ShekerDocumento2 pagineAllan Sheker v. Estate of Alice ShekerFrancis Xavier SinonNessuna valutazione finora

- Albenson v. CADocumento2 pagineAlbenson v. CAFrancis Xavier Sinon100% (3)

- Ombudsman v. Estandarte, GR No. 168670, April 13, 2007 - DigestDocumento1 paginaOmbudsman v. Estandarte, GR No. 168670, April 13, 2007 - DigestFrancis Xavier Sinon0% (1)

- Philippine National Police, Police Regional Office 3 Bulacan Police Provincial OfficeDocumento2 paginePhilippine National Police, Police Regional Office 3 Bulacan Police Provincial OfficeCh R LnNessuna valutazione finora

- Escheat (Rule 91)Documento2 pagineEscheat (Rule 91)CyrusNessuna valutazione finora

- 4rthsummativequizes 140317015553 Phpapp01Documento19 pagine4rthsummativequizes 140317015553 Phpapp01Edal SantosNessuna valutazione finora

- Masterfile Vs Eastern Memorials/Delgallo Studio: ComplaintDocumento8 pagineMasterfile Vs Eastern Memorials/Delgallo Studio: ComplaintExtortionLetterInfo.comNessuna valutazione finora

- List of MoviesDocumento7 pagineList of Moviesmanoj batraNessuna valutazione finora

- QuitclaimDocumento2 pagineQuitclaimKrizzy Gayle0% (1)

- Macenas V CADocumento24 pagineMacenas V CACathy BelgiraNessuna valutazione finora

- m1934 Subject ListDocumento279 paginem1934 Subject ListPierre Abramovici100% (1)

- STD Facts - Syphilis (Detailed)Documento4 pagineSTD Facts - Syphilis (Detailed)Dorothy Pearl Loyola PalabricaNessuna valutazione finora

- WordbuilderDocumento9 pagineWordbuilderPHAT PHAM KIMNessuna valutazione finora

- DBT Mar BayDocumento2 pagineDBT Mar BayJoannaNessuna valutazione finora

- Crim 2 Midterm ReviewerDocumento13 pagineCrim 2 Midterm ReviewerMit Skro100% (1)

- Letra de La Canción de AdeleDocumento2 pagineLetra de La Canción de AdeleEli MirandaNessuna valutazione finora

- NepotismDocumento2 pagineNepotismMay Larkspur TadeoNessuna valutazione finora

- The Act of Supremacy - DocumentDocumento2 pagineThe Act of Supremacy - DocumentmlNessuna valutazione finora

- Legal Ethics - Notarial Practice CasesDocumento24 pagineLegal Ethics - Notarial Practice CasesMercy Lingating100% (1)

- Edmund Kemper Case Study Edmund Kemper Case StudyDocumento8 pagineEdmund Kemper Case Study Edmund Kemper Case StudythaliaNessuna valutazione finora

- The ProprietorDocumento3 pagineThe ProprietorBernard Nii Amaa100% (1)

- Polly's P's and Q'sDocumento4 paginePolly's P's and Q'sABHISHRE100% (4)

- United States v. George Uzzell, United States of America v. Vernon Uzzell, 780 F.2d 1143, 4th Cir. (1986)Documento5 pagineUnited States v. George Uzzell, United States of America v. Vernon Uzzell, 780 F.2d 1143, 4th Cir. (1986)Scribd Government DocsNessuna valutazione finora

- Free RecallDocumento10 pagineFree RecallMarcelli T. MerinoNessuna valutazione finora

- EvidenceDocumento3 pagineEvidenceEricha Joy Gonadan100% (1)

- 7 People V TemporadaDocumento152 pagine7 People V TemporadaFrench TemplonuevoNessuna valutazione finora

- 60mm Long Ra Ge MortarDocumento2 pagine60mm Long Ra Ge MortarSebastian RentschNessuna valutazione finora

- Intuisi 101: Vol 1 No, 2 Jurnal IlmiahDocumento8 pagineIntuisi 101: Vol 1 No, 2 Jurnal IlmiahrukhailaunNessuna valutazione finora

- Defending Jacob: & The Hermeneutic CodeDocumento12 pagineDefending Jacob: & The Hermeneutic CodeTamara EzquerraNessuna valutazione finora

- Rancho Santa Margarita Gross Vehicular ManslaughterDocumento3 pagineRancho Santa Margarita Gross Vehicular ManslaughterAshley LudwigNessuna valutazione finora

- Internal Security WorkbookDocumento56 pagineInternal Security WorkbookSam PitraudaNessuna valutazione finora

- BDC Assessment FormDocumento4 pagineBDC Assessment Formsadz100% (20)

- Laudon Ess7 ch07Documento26 pagineLaudon Ess7 ch07bjiNessuna valutazione finora

- How to get US Bank Account for Non US ResidentDa EverandHow to get US Bank Account for Non US ResidentValutazione: 5 su 5 stelle5/5 (1)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesDa EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNessuna valutazione finora

- Lower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderDa EverandLower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderNessuna valutazione finora

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationDa EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationNessuna valutazione finora

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProDa EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProValutazione: 4.5 su 5 stelle4.5/5 (43)

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsDa EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNessuna valutazione finora

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyDa EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNessuna valutazione finora

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesDa EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesValutazione: 4 su 5 stelle4/5 (9)

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionDa EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionValutazione: 5 su 5 stelle5/5 (27)

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyDa EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyValutazione: 4 su 5 stelle4/5 (52)

- Taxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipDa EverandTaxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipNessuna valutazione finora

- Lower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderDa EverandLower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderValutazione: 5 su 5 stelle5/5 (4)

- Decrypting Crypto Taxes: The Complete Guide to Cryptocurrency and NFT TaxationDa EverandDecrypting Crypto Taxes: The Complete Guide to Cryptocurrency and NFT TaxationNessuna valutazione finora

- The Hidden Wealth of Nations: The Scourge of Tax HavensDa EverandThe Hidden Wealth of Nations: The Scourge of Tax HavensValutazione: 4 su 5 stelle4/5 (11)

- Taxes Have Consequences: An Income Tax History of the United StatesDa EverandTaxes Have Consequences: An Income Tax History of the United StatesNessuna valutazione finora

- Public Finance: Legal Aspects: Collective monographDa EverandPublic Finance: Legal Aspects: Collective monographNessuna valutazione finora

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessDa EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessValutazione: 5 su 5 stelle5/5 (5)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingDa EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingValutazione: 5 su 5 stelle5/5 (3)

- Beat Estate Tax Forever: The Unprecedented $5 Million Opportunity in 2012Da EverandBeat Estate Tax Forever: The Unprecedented $5 Million Opportunity in 2012Nessuna valutazione finora

- The Great Multinational Tax Rort: how we’re all being robbedDa EverandThe Great Multinational Tax Rort: how we’re all being robbedNessuna valutazione finora

- The Long Hangover: Putin's New Russia and the Ghosts of the PastDa EverandThe Long Hangover: Putin's New Russia and the Ghosts of the PastValutazione: 4.5 su 5 stelle4.5/5 (76)

- U.S. Taxes for Worldly Americans: The Traveling Expat's Guide to Living, Working, and Staying Tax Compliant AbroadDa EverandU.S. Taxes for Worldly Americans: The Traveling Expat's Guide to Living, Working, and Staying Tax Compliant AbroadNessuna valutazione finora

- Bookkeeping for Small Business: The Most Complete and Updated Guide with Tips and Tricks to Track Income & Expenses and Prepare for TaxesDa EverandBookkeeping for Small Business: The Most Complete and Updated Guide with Tips and Tricks to Track Income & Expenses and Prepare for TaxesNessuna valutazione finora

- Canadian International Taxation: Income Tax Rules for ResidentsDa EverandCanadian International Taxation: Income Tax Rules for ResidentsNessuna valutazione finora