Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

How Landed Cost Management and Accounts Payable Accounting Flow

Caricato da

jazharscribdCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

How Landed Cost Management and Accounts Payable Accounting Flow

Caricato da

jazharscribdCopyright:

Formati disponibili

How Landed Cost Management and Accounts Payable Accounting flow [ID 1310019.

1]

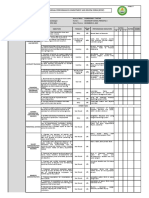

For Landed Cost Management, the accounts should be set up in the following hierarchy: Define Landed Accounts (can be expense or Accruals based on the business need) Landed Cost Account (parent) Landed Cost Absorption (Child) Invoice Price Variance a/c (Child) Exchange Rate Variance a/c (Child) Tax Variance a/c (Child) Default Charges a/c (Child) When the invoices are created in AP for LCM enabled receipts, the AP accrual account is debited. The Landed cost absorption account is used in Receiving to credit the difference between the PO price and the estimated landed cost. For reconciliation users need to run following 2 reports: AP-PO reconciliation report (in Costing) SLA Open Account balances listing for LCM absorption a/c (in SLA) My Note: When running the Open Account balances listing report, the parameter Report Definition has not LoV.

Taking an example: At PO creation Item PO Price: $9 (invoice matching: receipt) Tax set up; exclusive tax: 10%; recoverable rate: 50% Item cost (estimated): $9, Tax Non Recoverable $ 0.45 Freight (estimate): $1 Landed Cost calculation Item cost: $9/ each Tax (non recoverable): $0.45/each Freight: $1/each Estimated landed cost: $10.45/each In this case difference of $1 (10.45 -9.45) is credited to the Landed Cost Absorption account.

LCM ------For LCM only the below mentioned changes are proposed in AP: When the Invoices are matched to LCM receipts, the default account code combinations for certain accounts must be changed. These accounts are IPV, ERV and Tax variance accounts. For these Code Combinations, the default accounts must be derived and defaulted with the respective LCM specific account code combinations setup in the receiving parameters of Inventory Organization. For Freight, Miscellaneous and Tax Invoices matched to LCM receipts the account code combination must be defaulted to Charge Account setup in the receiving parameters of Inventory organization for LCM. This field must be non editable for invoices matched to LCM enabled shipments. AP ---From AP perspective we do not try to balance the Landed Absorption account. We still debit the accrual at the PO price and the difference goes to the LCM charge accounts for LCM enabled (instead of the normal accounts for IPV, ERV TRV etc.). You may need to take care as to what accounts they are giving at various level in the LCM screen and accordingly they need to reconcile. Please find the example: This shows how the accounting will happen and how the absorption account will be balanced. Following is the landed cost example with taxes Costing Method: average costing At PO creation Item PO Price: $9 (invoice matching: receipt) Tax set up; exclusive tax: 10%; recoverable rate: 50% At receipt: Receipt qty = 10 each Item cost (estimated): $9/each Freight (estimate): $1/each Landed Cost calculation Item cost: $9/ each Tax (non recoverable): $0.45/each Freight: $1/each Estimated landed cost: $10.45/each

Invoice Side Item Invoice comes at $110 (Item $100 + Tax $10, $5 recoverable and $5 non recoverable), and Freight Invoice $20 Actual Landed Cost = $125 (Item 105 + Freight $20), Unit LC = 12.5. Calculated by LCM and this creates a record in costing interface which is processed by costing to create adjustments) On hand at the time of Cost update is 5 each: Event Receipt Account AP Accrual (at PO price) Landed Cost Absorption Delivery Organization Inventory Valuation Receiving Inspection Item Invoice AP Accrual (Item Price on PO) AP Accrual (Non recoverable tax) $90 $4.5 $115 $115 Debit Credit $94.5 $10

Receiving Inspection $104.5

Tax Variance (Tax $0.5 Variance Account Provided by LCM will be defaulted here) Recoverable Tax IPV (Provided by LCM will be defaulted here) AP Liability Freight/Misc./ Tax Invoice Charge (Charge $20 Account Provided by LCM will be $5 $10

$110

defaulted here) AP Liability Landed Cost adjustment transaction: Receipt Receiving Inspection $20.5 = 10 * (12.5 10.45) Landed Cost Absorption Landed Cost Receiving Inspection adjustment transaction: Delivery Landed Cost Absorption Average Cost adjustment transaction (triggered by LCM Adjustment) Landed Cost Absorption $20.5 $20.5 $20.5 $20.5 $20

Organization Inventory Valuation Landed cost Variance

$10.25 $10.25

Regarding Actual Freight Invoice: When LCM is enabled the PPV is with respect to Landed Cost and not PO Price. So it doesn't matter if the PO price is same as Invoice price or not. For inventory the incoming cost is Landed Cost and the difference between landed cost and std inventory cost goes to PPV. When customer uses LCM they want inventory cost to be equal to Landed Cost in avg/fifo/lifo costing. When the customer uses the LCM with Std costing they expect Landed Cost = Inventory + PPV Now, in the example at the end of the cycle Landed Cost = 7300

Inventory std = 5000 so the PPV should be 2300 . When LCM is enabled the PPV is with respect to Landed Cost and not PO Price. So it doesn't matter if the PO price is same as Invoice price or not. For inventory the incoming cost is Landed Cost and the difference between landed cost and std inventory cost goes to PPV. According to the design currently by default in oracle apps what we have is for the example Landed COst = 7300 Inventory Std = 5000 Liability Cr (5,500+1800) = Cr 7300 Inventory Dr 5000 PPV Dr (500+300+1500)= Dr 2300 Landed Cost Absorption Cr (1500+1800) = Cr 3300 IPV DR 1500 LCM Default Charge Dr 1800 What normally customers do is have Landed Cost Absorption, IPV and LCM Default Charge account to point to same parent and do the reconciliation at the parent level so that the Total value at that parent level is 0. If the customer wants to have any change to this default behavior they should engage their technical contacts to have custom solution.

Potrebbero piacerti anche

- LCM EntriesDocumento8 pagineLCM EntriesMuhammad Faysal100% (1)

- Accounting Entries LCM ORACLE R12Documento4 pagineAccounting Entries LCM ORACLE R12ali iqbalNessuna valutazione finora

- How Does The Landed Cost Management Impacts The Accounting Flow in A Procure To Pay CycleDocumento5 pagineHow Does The Landed Cost Management Impacts The Accounting Flow in A Procure To Pay CycleTito247100% (1)

- R12 LCM Setup Flow (Including Profile)Documento184 pagineR12 LCM Setup Flow (Including Profile)Babu Chalamalasetti67% (3)

- EBS R12 Cost Accounting Integrated With SLADocumento50 pagineEBS R12 Cost Accounting Integrated With SLAchinbom100% (2)

- Oracle Sourcing in Oracle Ebs - PART IIDocumento77 pagineOracle Sourcing in Oracle Ebs - PART IIgopikrishna8843Nessuna valutazione finora

- Oracle SCM Functional Interview FAQDocumento40 pagineOracle SCM Functional Interview FAQSravaniMeessaragandaMNessuna valutazione finora

- EAM Accounting EntriesDocumento5 pagineEAM Accounting EntriesTejeshwar KumarNessuna valutazione finora

- Oracle Internal Order SetupDocumento31 pagineOracle Internal Order SetupMuhammad ImtiazNessuna valutazione finora

- Oracle R12 BOM-WIP - SyllabusDocumento5 pagineOracle R12 BOM-WIP - SyllabusNidhi SaxenaNessuna valutazione finora

- P2P - Oracle Procure To Pay Life Cycle Training ManualDocumento45 pagineP2P - Oracle Procure To Pay Life Cycle Training ManualCA Vara Reddy100% (1)

- Standard Costing Oracle AppsDocumento26 pagineStandard Costing Oracle Appsapi-3717169100% (1)

- Oracle R12 Internal Requisition and Internal Sales Order ProcessDocumento14 pagineOracle R12 Internal Requisition and Internal Sales Order Processsijsalami100% (3)

- Interview QuestionsDocumento58 pagineInterview QuestionsRipu Daman SinghNessuna valutazione finora

- Back To BcakDocumento44 pagineBack To BcakBrajesh KumarNessuna valutazione finora

- Capital Project AccountingDocumento2 pagineCapital Project AccountingDhaval GandhiNessuna valutazione finora

- Non Standard Discrete JobDocumento43 pagineNon Standard Discrete JobKyonika Singh100% (4)

- LCM Shipments ReceivingDocumento64 pagineLCM Shipments ReceivingskumaaranNessuna valutazione finora

- ORACLE MASTERMINDS - IR & ISO - Internal Sales Order Cycle With Setup Steps in R12.2Documento12 pagineORACLE MASTERMINDS - IR & ISO - Internal Sales Order Cycle With Setup Steps in R12.2appsloader100% (1)

- Oracle OM R12 New FeaturesDocumento3 pagineOracle OM R12 New FeaturesMike BuchananNessuna valutazione finora

- Drop Shipment Process in Oracle AppsDocumento12 pagineDrop Shipment Process in Oracle AppsAnonymous wxcuiDWiGNessuna valutazione finora

- R12: Introduction To Asset TrackingDocumento9 pagineR12: Introduction To Asset TrackingAymen HamdounNessuna valutazione finora

- 29616-Non Standard Jobs UsesDocumento10 pagine29616-Non Standard Jobs UsesPritesh MoganeNessuna valutazione finora

- Order Management Setup QuestionDocumento3 pagineOrder Management Setup QuestionDeepak KhoslaNessuna valutazione finora

- Oracle R12 Internal Requisition and Internal Sales Order Process FlowDocumento7 pagineOracle R12 Internal Requisition and Internal Sales Order Process FlowrajNessuna valutazione finora

- Iproc CatalogDocumento8 pagineIproc CatalogManmohan KulkarniNessuna valutazione finora

- Apps - Iprocurement Interview Questions in Oracle PDFDocumento5 pagineApps - Iprocurement Interview Questions in Oracle PDFprabahar_c8265Nessuna valutazione finora

- Iprocurement Setup Document and It'S Basic Flows in R12.2Documento61 pagineIprocurement Setup Document and It'S Basic Flows in R12.2Cloud ASNessuna valutazione finora

- Internal Sales Order Setup in R12Documento19 pagineInternal Sales Order Setup in R12Shrey BansalNessuna valutazione finora

- 09 Oracle Discrete MFG Cost ManagementDocumento6 pagine09 Oracle Discrete MFG Cost ManagementDo Van TuNessuna valutazione finora

- Interview Questions Oracle Apps Functional and TechnicalDocumento41 pagineInterview Questions Oracle Apps Functional and Technicalcrecyken@gmail.comNessuna valutazione finora

- TDS Setup For Suppliers in R12Documento11 pagineTDS Setup For Suppliers in R12kalpeshjain2004100% (1)

- Drop Shipment AccountingDocumento28 pagineDrop Shipment AccountingIbbu Mohd0% (1)

- p2p Cycle in Oracle Apps r12Documento16 paginep2p Cycle in Oracle Apps r12Nageswara Reddy100% (1)

- Oracle Diiference Between Asset and Expense ItemsDocumento5 pagineOracle Diiference Between Asset and Expense ItemsmogaNessuna valutazione finora

- R12 OM Setup Flow (Including Profile)Documento95 pagineR12 OM Setup Flow (Including Profile)Babu ChalamalasettiNessuna valutazione finora

- OPM Standard CostingDocumento21 pagineOPM Standard Costingootydev2000Nessuna valutazione finora

- Overview of Oracle Cost ManagementDocumento4 pagineOverview of Oracle Cost ManagementphoganNessuna valutazione finora

- Drop Shipment - Oracle MetalinkDocumento28 pagineDrop Shipment - Oracle MetalinkjeedNessuna valutazione finora

- Accounting Entries (OPM)Documento8 pagineAccounting Entries (OPM)Ghani7100% (3)

- Oracle E-Business Suite 12 Financials CookbookDa EverandOracle E-Business Suite 12 Financials CookbookValutazione: 3 su 5 stelle3/5 (3)

- ASCP Quick Read Document PDFDocumento29 pagineASCP Quick Read Document PDFprabhu181Nessuna valutazione finora

- Internal Order CycleDocumento16 pagineInternal Order CycleprathkulkarniNessuna valutazione finora

- Flow of Accounting Entries in Oracle ApplicationsDocumento20 pagineFlow of Accounting Entries in Oracle ApplicationsDEEPU_SCM50% (2)

- O2C With Table DetailsDocumento4 pagineO2C With Table Detailsannurbala100% (1)

- Oracle Cost Management (Rollup) 11i R12 ComparedDocumento97 pagineOracle Cost Management (Rollup) 11i R12 ComparedKCS100% (2)

- Oracle Landed Cost ManagementDocumento38 pagineOracle Landed Cost Managementjimbo2267Nessuna valutazione finora

- How To Create A PR Based On A BPA and Automatically Generate ReleasesDocumento3 pagineHow To Create A PR Based On A BPA and Automatically Generate ReleasesnitinNessuna valutazione finora

- Oracle EBS - Fixed Assets Overview - r12Documento3 pagineOracle EBS - Fixed Assets Overview - r12CarolynNessuna valutazione finora

- TE040 IprocurementDocumento50 pagineTE040 IprocurementjinfaherNessuna valutazione finora

- OPM Costing11i & R12 The Concepts and Setups For Standard Costs in Oracle Process ManufacturingDocumento8 pagineOPM Costing11i & R12 The Concepts and Setups For Standard Costs in Oracle Process ManufacturingMohmed BadawyNessuna valutazione finora

- Oracle Purchasing PPTDocumento30 pagineOracle Purchasing PPTGanesh Vijay100% (2)

- Discrete Manufacturing Period CloseDocumento19 pagineDiscrete Manufacturing Period ClosePritesh MoganeNessuna valutazione finora

- Oracle E-Business Suite R12 Core Development and Extension CookbookDa EverandOracle E-Business Suite R12 Core Development and Extension CookbookNessuna valutazione finora

- Oracle Fusion Complete Self-Assessment GuideDa EverandOracle Fusion Complete Self-Assessment GuideValutazione: 4 su 5 stelle4/5 (1)

- Oracle Fusion Cloud Erp A Complete Guide - 2020 EditionDa EverandOracle Fusion Cloud Erp A Complete Guide - 2020 EditionNessuna valutazione finora

- Oracle E-Business Suite The Ultimate Step-By-Step GuideDa EverandOracle E-Business Suite The Ultimate Step-By-Step GuideNessuna valutazione finora

- Oracle Fusion Applications The Ultimate Step-By-Step GuideDa EverandOracle Fusion Applications The Ultimate Step-By-Step GuideNessuna valutazione finora

- Example With AccountingDocumento4 pagineExample With Accountingali iqbalNessuna valutazione finora

- Intercompany InvoicingDocumento32 pagineIntercompany InvoicingjazharscribdNessuna valutazione finora

- How To Change A LOV Query Using Forms PersonalizationDocumento15 pagineHow To Change A LOV Query Using Forms PersonalizationjazharscribdNessuna valutazione finora

- Modifications To Oracle Mobile Applications Graphical User Interface Client White Paper For R12Documento2 pagineModifications To Oracle Mobile Applications Graphical User Interface Client White Paper For R12jazharscribdNessuna valutazione finora

- Dual UoMdocxDocumento8 pagineDual UoMdocxjazharscribdNessuna valutazione finora

- Projects APIsDocumento11 pagineProjects APIsjazharscribdNessuna valutazione finora

- BP080 Future Process ModelDocumento10 pagineBP080 Future Process ModeljazharscribdNessuna valutazione finora

- Smalley AuditDocumento13 pagineSmalley AuditMNCOOhioNessuna valutazione finora

- Aia305 - Contractors QualificationDocumento6 pagineAia305 - Contractors Qualificationapi-324291104Nessuna valutazione finora

- Training, Teaching and Learning Materials (TTLM) : EIS ABS4160812 EIS ABS4 M 16 0812Documento10 pagineTraining, Teaching and Learning Materials (TTLM) : EIS ABS4160812 EIS ABS4 M 16 0812NabuteNessuna valutazione finora

- BPLM Group AssignmentDocumento3 pagineBPLM Group AssignmentGeorge MhinaNessuna valutazione finora

- T Codes in ExcelDocumento417 pagineT Codes in Excelsreeven9Nessuna valutazione finora

- IT-AE-36-G01 - Quick Guide On How To Complete The IT12EI Return For Exempt Organisations - External GuideDocumento13 pagineIT-AE-36-G01 - Quick Guide On How To Complete The IT12EI Return For Exempt Organisations - External GuideThapeloNessuna valutazione finora

- McLean Hospital Annual Report 2011Documento32 pagineMcLean Hospital Annual Report 2011mcleanhospitalNessuna valutazione finora

- Accounting Concepts and ConventionsDocumento40 pagineAccounting Concepts and ConventionsAmrita TatiaNessuna valutazione finora

- Chapter1 Final 1Documento96 pagineChapter1 Final 1Mạnh Đỗ ĐứcNessuna valutazione finora

- Bos 54380 CP 6Documento198 pagineBos 54380 CP 6Sourabh YadavNessuna valutazione finora

- State Bank of Patiala Balance Sheet Department Welcomes Participants To SeminarDocumento19 pagineState Bank of Patiala Balance Sheet Department Welcomes Participants To SeminarKunal ParmarNessuna valutazione finora

- 602910-EdiEnterprise Account Operational GuideDocumento363 pagine602910-EdiEnterprise Account Operational GuideAndrés Karabin100% (3)

- O-Level-Accounts NotesDocumento58 pagineO-Level-Accounts NotesKamranKhan100% (1)

- Local Governments Financial and Accounting Manual 2007Documento248 pagineLocal Governments Financial and Accounting Manual 2007markogenrwot100% (1)

- Xero Training ManualDocumento84 pagineXero Training Manualroneyewu100% (3)

- Accounting Aptitude TestDocumento5 pagineAccounting Aptitude TestCarmel AlgabreNessuna valutazione finora

- Unit 5: Current Liabilities and ContingenciesDocumento21 pagineUnit 5: Current Liabilities and Contingenciessamuel kebedeNessuna valutazione finora

- Chapter 4 - Fundamentals of AccountingDocumento75 pagineChapter 4 - Fundamentals of AccountingThuy Tien DinhNessuna valutazione finora

- SLA Setup R12Documento9 pagineSLA Setup R12Muthumariappan21100% (1)

- CH 03Documento122 pagineCH 03Mar Sih100% (1)

- Problems CompiledDocumento67 pagineProblems CompiledRosh ClementeNessuna valutazione finora

- Lecture 2 - Receivables (Students' Copy - Diy) - 5Documento297 pagineLecture 2 - Receivables (Students' Copy - Diy) - 5JOSCEL SYJONGTIANNessuna valutazione finora

- Fundamentals DeptalsDocumento7 pagineFundamentals DeptalsSamantha Nicole BonitoNessuna valutazione finora

- Pricing Procedure - Accrual Key Functionality Process FlowDocumento11 paginePricing Procedure - Accrual Key Functionality Process FlowRajesh Swathi PromotersNessuna valutazione finora

- Govt 5Documento15 pagineGovt 5Belay MekonenNessuna valutazione finora

- Applied Applied Auditing Auditing With CDocumento340 pagineApplied Applied Auditing Auditing With CRaca DesuNessuna valutazione finora

- Individual Performance Commitment and Review Form (Ipcrf) : Annex FDocumento2 pagineIndividual Performance Commitment and Review Form (Ipcrf) : Annex FBeverly Donato100% (2)

- Accounting ConceptsDocumento12 pagineAccounting Conceptssuneetcool007Nessuna valutazione finora

- Adjusting EntriesDocumento3 pagineAdjusting Entriesnreid2701Nessuna valutazione finora

- Appendic 5C-1 - Summarized Disclosure ChecklistDocumento8 pagineAppendic 5C-1 - Summarized Disclosure ChecklistLuis Enrique Altamar RamosNessuna valutazione finora