Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Marketskeptics - Hyperinflation in China

Caricato da

Xavier GuarchDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Marketskeptics - Hyperinflation in China

Caricato da

Xavier GuarchCopyright:

Formati disponibili

Link original: http://www.marketskeptics.com/2009/01/hyperinflation-will-begin-in-china-and.

html

S nday! "an ary 1#! 2009

*****Hyperinflation will begin in China and destroy the dollar*****

by Eric deCarbonnel The conventional wisdom on China is dead wrong. Specifically, there is a widespread belief, as expressed by Goldman Sachs, that "China will keep the yuan trading within a narrow range in !!" due concerns about exporters." #orse still, others are even predicting that China will devalue its currency$ The sheer wishful thinking is astounding$ The idea that "China will keep the dollar peg to help its exporters" ranks all the way up there with "%ousing prices always go up" and "&ou can spend your way to prosperity". THERE ARE NO FREE LUNCHES 'f you have learned nothing else in the last year and a half, you should have learned that if something sounds too good to be true, that is because it IS too good to be true. The media overwhelmingly presents China(s dollar peg as a win)win situation* +mericans get cheap imports and low interest rates while China gets a strong manufacturing sector. #hile commentators do sometimes debates whether China will keep lending us money forever, they never talk about the ,-+. problem with the dollar peg. /elow is a chart which shows how China(s dollar peg works. See if you can spot the downside that the media never seems to mention.

The US's trade deficit requires China to rint !one"# The little discussed downside of the dollar peg is all the money China has to print to maintain it. China(s Central /ank puts the extra dollars it receives from its trade surplus into its growing foreign reserves and then prints yuan to pay Chinese exporters. This results in an increase in China(s base money supply by an amount e0ual to the increase in its foreign exchange reserves. $hi%e China's abi%it" to &ee accu!u%ating US reser'es is end%ess( its abi%it" to &ee its !one" su %" under contro% is not) The true threat to the do%%ar eg 'f there is one development which could force China to drop its dollar peg, it is out of control inflation. ,ampant inflation would result in millions of citi1ens starving and would create widespread social unrest. 2eeping food prices low is a matter of political survival for Chinese authorities. So, facing the choice between losing their grip on power and losing the dollar peg, they will not hesitate for a second to sacrifice the dollar to save their own skin. So far China been ab%e to contain inf%ation( but* 'n recent years, China has been able to contain the inflationary effects of its trade surplus by soaking up or "sterili1ing" all the extra li0uidity 3printed yuan4. These sterili1ation efforts mostly involved* +4 ,aising the reserve re0uirements of commercial banks. 'n essence, the 5/6C 35eople(s /ank of China4 prints money to fund its trade surplus and then increases the amount of yuan banks have to keep as reserves at the Central 2

bank, preventing the printed cash from reaching the economy. +s of 7ay of last year, commercial banks( reserve re0uirements were at 89.: percent /4 Selling ,7/)denominated sterili1ation bills. The state owned and controlled banking system has been forced to absorb the ma;ority of these bills. +s of 7ay of last year, the value of sterili1ation bills reached 8! percent of bank deposits. Taken together, these two steps have immobili1ed roughly 9.: percent of Chinese commercial banks( deposits. This shows the magnitude China has had to intervene so far, as the value of sterili1ation instruments outstanding has been increasing at roughly the same rate as its foreign reserves. PBC Foreign Reserves and Sterilization Instruments (US$ Billions)

#hile China has been able to contain inflation to single digits for the last $

decade, that is about to change. +ll economic forces are aligning in China for a surge in inflation. +, China has abandoned its steri%i-ation o erations Currently, the 5/6C has abandoned its sterili1ation efforts all together* +4 The 5/6C has lowered reserve re0uirements by percentage point for China(s big banks and by < percentage point for all other banks. /4 The 5/6C has scaled back sterili1ation efforts by reducing li0uidity)draining three)month and : )week bill sales from once a week to once every two weeks. +s a result of these decreasing sales, the clearing house for China(s interbank bond market expects 5/6C(s !!" bill issues to be down over =!>, which will increase the Chinese base money supply by trillion yuan. These actions signify that the 5/6C has ceased sterili1ing its currency interventions and is focusing on 3imaginary4 deflation risks. + flood of cash has been unleashed, and a tsunami of pent)up inflation will soon hit China. ., China is running record trade sur %uses China(s imports are crashing much faster than its exports. 'n ?ecember, Chinese imports fell 8.@> while exports fell only .A>. +s a result, China has been running record trade surpluses these last three months* B@: billion, B<! billion, and @" billion. The reason for China(s surplus is obvious when you think about it. Consider the following list of goods a country can exports and ask yourself what would hold up best during a severe global economic downturn. CCC Commodities 36il, gas, steel, etc4 CCC Capital goods 3+irplanes, Caterpillars, 7achinery for new factories, 7achinery for new miningDoil exploration pro;ects, etc4 CCC ?urable goods 3SEFs, C+,s, appliances, business e0uipment, electronic e0uipment, home furnishings, etc4 CCC .uxury goods 3brand name products, designer clothing, artwork, etc...4 CCC Cheap consumer goods 3everything you buy at #al)7art4 The answer is that the demand for cheap consumer goods will hold up better than anything else. This can easily be seen in the retail sales this holiday shopping season. #al)7art, which imports =!> of its products from China, was the only retailer to post a year)on)year increase in sales. So while the world economy might be imploding spectacularly, demand for #al)7art(s cheap Chinese goods is holding up 0uite well. The implications of this is that while China(s exports will fall, they will fall less than those of any other country. The current trade surplus is still completely unsustainable. 'f China(s continues running a <! billion dollar trade surplus all year, its base money supply will double by the end of !!". +lso, since China has halted the appreciation of the

yuan, its trade surplus is unlikely to shrink as demand for cheap consumer goods is set to remain strong. /, The Chinese econo!" 0i%% shrin& in .112 Consistently ama1ing economic growth is the biggest factor which has helped China contain inflation. 'nflation happens when the money supply is growing faster than the economy, and china(s economy has been growing fast. This economic growth has helped absorb the enormous 0uantities of yuan that have been printed to support the dollar. %owever, this will change in !!". ?ue to falling global demand, China(s economy is set for 1ero, if not negative, growth which will remove a significant mitigating force against inflation and amplify the inflationary impact of China(s printing press. Side note3 China's econo!ic strength is underesti!ated 't is important to note that, while economic growth will go probably go negative, China(s economy will not crash. The strength of the Chinese economy is widely underestimated in the media today. 'n addition to the resilient worldwide demand for its cheap consumer goods, China is also benefiting from import substitution at home. This is why imports to China are falling so fast* Chinese are switching to cheap domestic products instead of expensive foreign imports. So while there has been a sharp drop in Chinese demand for big)ticket brands 3?ior, Chanel, %ermes, etcG4 and others luxury items, knock)offs and other cheap goods are still flying off the shelves. Chinese consumers are downshifting, but they are still spending strongly, as reflected by the 8> year) over)year growth in !!A. %owever, despite China(s strong fundamentals, the current worldwide downturn is too strong for it to escape. The worldwide financial carnage is so severe that even the demand for cheap consumer goods will decrease. +s a result, while China may outperform every country on -arth, its economy will still suffer in !!". 4, 5ef%ation in China 0ou%d be too good to be true China has been in a constant war with the inflation caused by the dollar peg. -conomic growth and sterili1ation operations alone have not been enough to absorb the growing li0uidity, and China has been forced to turn to ever more drastic steps in its efforts to contain inflation. These stifling policy measures together with its sterili1ation efforts have enormously suppressed domestic demand and have distracting the government from developing key services en;oyed by other developed nations. This suppressed domestic demand has also distorted China(s economy, as reflected by the undersi1ed service sector, and has lowered the 0uality of life for Chinese citi1ens. Chinese financia% re ression and !ar&et socia%is! /elow are ;ust a few of the anti)inflation measures China has adopted to suppress domestic demand and keep prices down*

&

+4 Strict price controls. 3ie* .arge wholesalers must seek central government approval if they want to raise prices by 9 percent within the space of 8! days or by 8! percent within a month.4 /4 Credit ceilings. 3limits on how much commercial banks can lend4 C4 Hloors on lending rates and ceilings on deposit rates ?4 Strict rules governing lending decisions -4 Tight land purchase and lending re0uirements H4 ?irect government intervention to limited expansion in certain industries 3ie* aluminum, steel, autos and textiles sectors in !!<4 G4 5enalty taxes on anyone buying and selling real estate in a short period of time. %4 Horcing local government to cut back spending by delaying approval of their investment pro;ects '4 %igh sales taxes. I4 -tc... Su ressed do!estic de!and has distorted China's econo!"

The distortions caused by sterili1ation operations and stifling policy measures are best seen when comparing the Chinese and ES economies* +4 ES home buyers get tax incentives FS Chinese home buyers get tax penalties /4 ES gets artificially low interest rates FS China(s artificially high interest rates C4 ES(s "service economy" FS China(s "service)less economy" ?4 -tcG 'n the ES, the overvalued dollar and easy credit environment have caused the service sector to become oversi1ed, artificially raising +merica(s standard of living. 'n contrast, China(s suppressed domestic demand has led its service sector to become undersi1ed, artificially decreasing its standard of living. Focus on inf%ation has %ead to a %ac& of &e" go'ern!ent ser'ices #ith Chinese authorities sidetracked by their export oriented focus and battle with overheating, the development of key government services en;oyed by other developed nations has been neglected. +s a result, Chinese citi1ens( lack of social security, free education, and available consumer credit, which has forced them to save far more than their #estern counterparts, leaving them with less disposable income. 5ef%ation 0ou%d be a godsend to China Chinese authorities must be thrilled about the prospect of fighting deflation instead of inflation. Highting deflation would allow China to* +4 Scale back its increasingly costly sterili1ation efforts. /4 .ower interest rates. C4 Get rid of all the controls which are distorting domestic property markets.

'

?4 5romote consumer spending without worrying about the inflationary impact. -4 ?evelop a comprehensive social security net. H4 'ncrease funding of public education. -4 +ccelerate the development of a system to rate people(s credit. H4 -ncourage growth in underdeveloped domestic sectors 3housing, health care, education, entertainment, etc4 G4 -tcG 7ost of the steps above are already being taken by Chinese authorities. Enfortunately, there are no free lunches. The probability that China can maintain a highly inflationary currency peg, reverse years of anti)inflation policies, release a flood of sterili1ed yuan back into circulation, and go on a #estern)style stimulusDbailout binge without experiencing double digit inflation is 1ero. 6, No de%e'eraging There is no chance of real deflation happening in China. Jone. The Strength of China(s /anking System makes it impossible. +4 +part from /ank of China, Chinese banks have little exposure to overseas debt. So, although toxic ES securities were sold to banks around the world, China(s capital controls protected its banking system from +merica(s bad debt /4 +s a side effect of the country(s sterili1ation operations, 9.: percent of Chinese commercial banks( deposits were placed with the central bank last year 3reserve re0uirements and forced underwriting of 5/6C bills4. C4 Enlike #estern banks, who have been en;oying a credit bonan1a for decades, Chinese banks have only recently gotten into the credit game, after years of being ridiculed for being overly cash)centric. /ecause of this late entry, Chinese banks completely missed the subprime party. ?4 China is also in the enviable position of being one of the few countries which doesn(t need to deleverage. #hile #estern banks were going insane with high leverage and off)balance sheet financial vehicles, Chinese banks were doing the opposite, as can be seen on the chart below 3from Tao #ang of E/S4.

-4 China has been waging a war against J5.s 3non)performing loans4 in the last few years. Hor example, with heavy penalties having been imposed on bank managers responsible for new J5.s, Chinese banks have become much more concerned about the loan safety than profitability. This battle again J5.s has paid off. +s of September @!, !!A, nonperforming loans totaled only percent for Chinese banks, compared to the .@ percent for H?'C)insured banks in the ES. .oan loss provisions have also improved substantially, with provisions of Chinese banks amounting to an impressive 8 @ percent of their J5.s. H4 Hinally, China(s money supply itself is underleveraged when compared to the rest of the world. Hor example, the ES(s 7 to 78 ratio is 9:> higher than China(s. The Chinese 7 to G?5 ratio is also more 89! percent, perhaps, the highest in the world. #hen considering the strength of Chinese /anks and underlying strength of China(s economy, no debt deflation is possible. If there is no chance of def%ation( then 0h" is China's c i s%o0ing do0n7 There are three main reasons for the slowdown in China(s cpi* +4 The bursting of the commodity bubble. /ecause of speculator dominated futures markets in the ES, commodity prices were boosted to artificial level going into the summer of !!A. +s these inflated commodity prices fell back down to -arth, they caused a temporary worldwide slowdown in inflation. /4 'n the second half of the year, deleveraging and hedge fund redemption caused the outflow of a large amount of hot money from China. This outflow

temporary depressed asset prices. C4 The unwinding of the commodity bubble spread deflation fears worldwide and caused the velocity of money to drop. 8, 5ef%ation fears are ara%"-ing China's !one" su %"

"deflation fears" have slowed the Chinese money supply to a crawl. #hile they are still spending, Chinese consumers are delaying big purchases and downshifting to discount stores. /usinesses are strapped for cash, and scared Chinese banks are dumping riskier borrowers, like credit)card holders. China is experiencing one of the brief deflationary periods which typically precede hyperinflation. ?eflation fears in China also provide the perfect example of how a slowdown in the "velocity of money" and makes prices fall. ,ight now, Chinese banks are hoarding cash and delaying payments on personal credit cards. 6nly a year ago, most banks paid credit)card transactions in 8< days, but now merchants are having to have to wait !, <! or even "! days to get paid. #ith lenders making credit)card transactions as unattractive as possible, many merchants are refusing to take credit cards from Chinese consumers. Think about that for a second, all that purchasing power from Chinese credit cards wiped out due to nothing but fear itself. The important point to note about the price deflation caused by the deflation fears is that it will reverse sharply once inflation picks up. /anks will begin paying credit cards normally, and merchants will start accepting them again. The enormous amount of purchasing power which disappeared will reappear ;ust as suddenly, causing a wild ;ump in inflation. 9, Steri%i-ation o erations ha'e beco!e a %oss generating 'entures Entil last year, China(s sterili1ation operations had been profitable, since the rate of interest that /ei;ing earned on foreign exchange reserves 3mainly ES Treasuries4 had been higher than the rates it was paying on its yuan) denominated sterili1ation bills at home. %owever, now that the fed has lowered ES interest rates to 1ero for the foreseeable future, China(s dollar peg has become a loss)making policy. #hen inflation hits china and interest rates rise again, China(s losses from its currency sterili1ation will become staggering. :, China %i&e%" to attract a f%ood of hot !one" in .112 China has had a problem with hot money inflows in the past, and those problems are likely to get worse this year. %ot money refers to the money that flows regularly between financial markets in search for the highest short term interest rates possible. This hot money has found ways around China(s capital controls and flows freely in and out of China to the authorities great frustration. #hen hot money flows into china, it forces the 5/6C to print money the same way as the trade surplus does. +t the beginning of last year, these hot money

inflows were one of China(s biggest problems, bringing inflation up to A.9 despite the authorities best efforts. The country(s hot money problem ended temporarily with the bursting of the commodity bubble. 'n the second half of last year, deflation fears and hedge fund deleveraging cause much of this hot money to leave China and seek the "safety" of ES treasuries. This small exodus is what is responsible for the brief fall in China(s foreign reserves. %owever, the outflow of hot money from China has ended, and it now looks set to reverse. 'n the next month or so, rising inflation will start pushing up Chinese interest rates at a time when central banks around the world have set their rates at or near 1ero. Since the entire world knows that the yuan is undervalued, these higher rates will make China the most attractive destination on -arth for those seeking safe high yielding interest rates, and the hot money problem will return with a vengeance. 2, Chinese authorities are u%%ing out a%% the sto s Chinese authorities are pulling out all the stops to get the country back on track. 'n order to prop up economic growth, Chinese authorities have* +4 ,aised tax rebates for exporters of everything from high)tech and electronic products 3motorcycles, sewing machines and robots, etc4 to some rubber and wood products. /4 scraped export taxes for some steel products, aluminum, rice, wheat, flour and fertili1ers C4 Cut the lock)up period beyond which people can resell their property without paying a business tax from five years to two years. ?4 scraped the urban property tax for foreign firms and individuals -4 +llowed people to buy second homes on the same preferential terms normally reserved for first time buyers. H4 +nnounced plan to spend "!! billion yuan over three years to build affordable housing G4 Cut the deed tax payable by first)time buyers of homes smaller than "! s0 m is to 8 percent. %4 +nnounced measures such as cash subsidies and tax cuts to encourage home purchases '4 +nnounced plans for a < trillion yuan 3:A9 billion4 stimulus package to boost domestic demand through !8!. I4 +nnounced plans to invest : trillion yuan roads, waterways and ports in the next three to five years 3over trillion yuan more than originally planned4. 24 +pproved trillion yuan for railway investment 74 +nnounced a tax break for public infrastructure pro;ects. J4 +bolished the : percent withholding tax on interest income. 64 Scraped the !.8 percent tax on purchases of e0uities. 54 'nstructed Central %ui;in 3a government investment arm4 to buy shares of listed Chinese firms. K4 -ncouraged state)owned firms to buy back shares. ,4 ,aised minimum grain purchase prices by 8: percent

10

S4 +pproved landmark reforms that give peasants the right to lease or transfer their land)use rights T4 'ssued a stimulus package for its auto sector, including a tax cut E4 Set a price floor for air tickets F4 %anded out cash gifts to brighten the mood before the Chinese Jew &ear #4 -tc... +1, ;an&s are f%ooding the econo!" 0ith ne0 %oans Chinese authorities are pushing banks to extend credit and help fight "deflation". To encourage this money supply growth and new lending, the 5/6C 3the 5eople(s /ank 6f China4 has halted sterili1ation operations and has cut the benchmark one)year lending rate by .89 percent and the deposit rate by 8.A" percent. +lso, as part of these efforts, Chinese officials are reversing decades of financial repression and freeing up their banking system. +s China lifts restrictions on lending, banks are flooding the economy with new loans. Credit ceilings under which commercial banks have been operating have now been removed, and credit controls have been relaxed to give banks more leeway in making lending decisions. Chinese lenders will now be able to restructure loans and ad;ust the types and maturities of debt. /anks are being pressured to use this new financial freedom to "promote and consolidate the expansion of consumer credit". 'n addition to stimulating consumption, credit constraints are being relaxed to give loan access to small and medium privately owned businesses, which have until now been mostly shut out of credit by the state)owned financial system. +s part of this effort and in order to help banks overcome their deflation fears, China has said it will tolerate more bad debt. This step is particularly significant, as the heavy penalties imposed for the creation of new non)performing loans has been a big restraint on credit expansion. Hinally, the commitment of Chinese authorities to fight deflation is so great that regulators have stated they will support the sale and securiti1ation of loans. ' repeat, China is moving towards securiti1ation of loans$ The adoption of securiti1ation holds the potential to enormously accelerate money supply growth. China(s efforts to boost lending are working. 'n ?ecember, China(s 7 money and loan growth soared. Iust look at the graph of Chinese money supply growth below.

11

?oes it look like China is headed towards deflation to youL 3this chart will become much scarier once Ianuary(s numbers are added in4 Conc%usion ' view hyperinflation in China as absolutely guaranteed. Mero doubt. China is dismantling all the measures it has put in place over the years to fight inflation. 't is dropping restrictions on purchasing property, eliminating price controls, getting rid of loan 0uotas, lowering interest rates, ceasing its sterili1ation efforts, etcG 't is also pulling out all the stops to boost government spending and new loan creation. 7eanwhile, China(s <! billion dollar trade surplus means that its base money supply looks set to double in !!". There is also the fact that China(s money supply is fro1en due to cash hoarding and will cause inflation to increase when it accelerates. Hinally, the commodity bubble has finished bursting, and China(s economy looks set to shrink. -very economic factor in China suggests an enormous wave of hyperinflation will begin early this year. #hile ' have written about the threats facing the dollar, this will be the event that finally ends the ES(s borrowing binge and destroys our currency. H" erinf%ation in China 0i%% be a !onu!enta% e'ent /ecause China makes most of the world cheap consumer goods, it will export its hyperinflation around the world. This !eans that no fiat< a er currencies

12

0i%% sur'i'e this 0ith its urchasing o0er intact) Some will lose all value 3dollar4 while others will survive while experiencing a loss of purchasing power 3yuan, euro, yen, etc...4. The on%" !one" that 0i%% retain its fu%% 'a%ue in the face of Chinese h" erinf%ation is go%d) China 0i%% sin& the do%%ar to sa'e the "uan 6nce hyperinflation kicks into gear, Chinese authorities will find it impossible to bring it under control without sacrificing the dollar. Since hyperinflation would hurt Chinese exporters as much as losing their ES exports, China will face a clear cut decision. /y dumping the dollar peg and selling its ES? holdings, China will help contain domestic inflation in many ways* 84 China will no longer be printing massive 0uantities of yuan to support the dollar. 4 /y selling dollars in exchange for yuan, China will be able to take those yuan out of circulation, shrinking its monetary base. @4 Since the yuan will strengthen enormously again foreign currencies, Chinese exports will fall and that means there will be a lot more goods available for domestic consumption. <4 Since the yuan will be stronger against foreign currencies like the dollar, Chinese imports will rise. That means cheaper commodity prices across the board. :4 ?ropping the dollar peg will make the yuan a ma;or reserve currency. That means lower interests rates in China as foreign central banks build up yuan reserves. Those e= ecting def%ation are in for a sur rise #estern nations who are lowering interest rate very sharply, without fearing inflation, are mainly concentrating on the domestic dynamics of their economies and the value of their currency. 7y bet is that no one is even considering the possibility that inflation could be imported from China, and, when cheap Chinese imports stop being cheap anymore, it will catch everybody completely by surprise.

)osted by *ric de+arbonnel at ':2% ), -elicio s

Labels: China Currency_Collapse Gold Key_Entries Trade_Deficit Wall_Street_Meltdown

email )rint this post

1$

Potrebbero piacerti anche

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Healing Cancer The Cayce WayDocumento6 pagineHealing Cancer The Cayce WayXavier Guarch100% (2)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Important Cod Liver Oil Update - Dr. Mercola (Atención!)Documento5 pagineImportant Cod Liver Oil Update - Dr. Mercola (Atención!)Xavier GuarchNessuna valutazione finora

- Condition Monitoring of Steam Turbines by Performance AnalysisDocumento25 pagineCondition Monitoring of Steam Turbines by Performance Analysisabuhurairaqazi100% (1)

- RYA-MCA Coastal Skipper-Yachtmaster Offshore Shorebased 2008 AnswersDocumento28 pagineRYA-MCA Coastal Skipper-Yachtmaster Offshore Shorebased 2008 AnswersSerban Sebe100% (4)

- Healing Psoriasis by Dr. PaganoDocumento3 pagineHealing Psoriasis by Dr. PaganoXavier GuarchNessuna valutazione finora

- Healing Foods by Walter LastDocumento29 pagineHealing Foods by Walter LastXavier Guarch100% (6)

- UML Tools For PythonDocumento1 paginaUML Tools For PythonXavier GuarchNessuna valutazione finora

- Dr. Edward Howell - A Man With An Urgent Message (Enzym Rich Diet)Documento3 pagineDr. Edward Howell - A Man With An Urgent Message (Enzym Rich Diet)Xavier GuarchNessuna valutazione finora

- Dr. Edward Howell - A Man With An Urgent Message (Enzym Rich Diet)Documento3 pagineDr. Edward Howell - A Man With An Urgent Message (Enzym Rich Diet)Xavier GuarchNessuna valutazione finora

- Basic Vibration Analysis Training-1Documento193 pagineBasic Vibration Analysis Training-1Sanjeevi Kumar SpNessuna valutazione finora

- HSBC in A Nut ShellDocumento190 pagineHSBC in A Nut Shelllanpham19842003Nessuna valutazione finora

- Viceversa Tarot PDF 5Documento1 paginaViceversa Tarot PDF 5Kimberly Hill100% (1)

- Activated CharcoalDocumento5 pagineActivated CharcoalXavier GuarchNessuna valutazione finora

- Trampas para MoscasDocumento3 pagineTrampas para MoscasXavier GuarchNessuna valutazione finora

- FROM Ruby:2.1.5 EXPOSE 9292 ADD SRC /temp WORKDIR /temp RUN Bundle Install - Without Development Test CMD ("Bundle","exec","rackup","-O","0.0.0.0")Documento1 paginaFROM Ruby:2.1.5 EXPOSE 9292 ADD SRC /temp WORKDIR /temp RUN Bundle Install - Without Development Test CMD ("Bundle","exec","rackup","-O","0.0.0.0")Xavier GuarchNessuna valutazione finora

- Aloe Vera, The Great FoodDocumento3 pagineAloe Vera, The Great FoodXavier GuarchNessuna valutazione finora

- Arctic and Antarctic Sea Ice TrendsDocumento1 paginaArctic and Antarctic Sea Ice TrendsXavier GuarchNessuna valutazione finora

- Led Therapy FaqDocumento3 pagineLed Therapy FaqXavier GuarchNessuna valutazione finora

- How To Prepare For and Conduct A WaterDocumento1 paginaHow To Prepare For and Conduct A WaterXavier GuarchNessuna valutazione finora

- L1 L2 Highway and Railroad EngineeringDocumento7 pagineL1 L2 Highway and Railroad Engineeringeutikol69Nessuna valutazione finora

- Asphalt Plant Technical SpecificationsDocumento5 pagineAsphalt Plant Technical SpecificationsEljoy AgsamosamNessuna valutazione finora

- Employees' Pension Scheme, 1995: Form No. 10 C (E.P.S)Documento4 pagineEmployees' Pension Scheme, 1995: Form No. 10 C (E.P.S)nasir ahmedNessuna valutazione finora

- LOG-2-8-FLEETWAREHOUSE-TEMPLATE-Waybill-Delivery Note-IFRCDocumento1 paginaLOG-2-8-FLEETWAREHOUSE-TEMPLATE-Waybill-Delivery Note-IFRCMNessuna valutazione finora

- M J 1 MergedDocumento269 pagineM J 1 MergedsanyaNessuna valutazione finora

- ICSI-Admit-Card (1) - 230531 - 163936Documento17 pagineICSI-Admit-Card (1) - 230531 - 163936SanjayNessuna valutazione finora

- Appendix - 5 (Under The Bye-Law No. 19 (B) )Documento3 pagineAppendix - 5 (Under The Bye-Law No. 19 (B) )jytj1Nessuna valutazione finora

- Oracle Exadata Database Machine X4-2: Features and FactsDocumento17 pagineOracle Exadata Database Machine X4-2: Features and FactsGanesh JNessuna valutazione finora

- Efs151 Parts ManualDocumento78 pagineEfs151 Parts ManualRafael VanegasNessuna valutazione finora

- Income Statement, Its Elements, Usefulness and LimitationsDocumento5 pagineIncome Statement, Its Elements, Usefulness and LimitationsDipika tasfannum salamNessuna valutazione finora

- HRD DilemmaDocumento4 pagineHRD DilemmaAjay KumarNessuna valutazione finora

- PVAI VPO - Membership FormDocumento8 paginePVAI VPO - Membership FormRajeevSangamNessuna valutazione finora

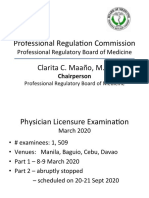

- Professional Regula/on Commission: Clarita C. Maaño, M.DDocumento31 pagineProfessional Regula/on Commission: Clarita C. Maaño, M.Dmiguel triggartNessuna valutazione finora

- Lab 6 PicoblazeDocumento6 pagineLab 6 PicoblazeMadalin NeaguNessuna valutazione finora

- Case Assignment 2Documento5 pagineCase Assignment 2Ashish BhanotNessuna valutazione finora

- Computer First Term Q1 Fill in The Blanks by Choosing The Correct Options (10x1 10)Documento5 pagineComputer First Term Q1 Fill in The Blanks by Choosing The Correct Options (10x1 10)Tanya HemnaniNessuna valutazione finora

- Ingles Avanzado 1 Trabajo FinalDocumento4 pagineIngles Avanzado 1 Trabajo FinalFrancis GarciaNessuna valutazione finora

- Mid Term Exam 1Documento2 pagineMid Term Exam 1Anh0% (1)

- Zelio Control RM35UA13MWDocumento3 pagineZelio Control RM35UA13MWSerban NicolaeNessuna valutazione finora

- Rebar Coupler: Barlock S/CA-Series CouplersDocumento1 paginaRebar Coupler: Barlock S/CA-Series CouplersHamza AldaeefNessuna valutazione finora

- Introduction To Motor DrivesDocumento24 pagineIntroduction To Motor Drivessukhbat sodnomdorjNessuna valutazione finora

- Labstan 1Documento2 pagineLabstan 1Samuel WalshNessuna valutazione finora

- Transparency Documentation EN 2019Documento23 pagineTransparency Documentation EN 2019shani ChahalNessuna valutazione finora

- Ss 7 Unit 2 and 3 French and British in North AmericaDocumento147 pagineSs 7 Unit 2 and 3 French and British in North Americaapi-530453982Nessuna valutazione finora

- CLAT 2014 Previous Year Question Paper Answer KeyDocumento41 pagineCLAT 2014 Previous Year Question Paper Answer Keyakhil SrinadhuNessuna valutazione finora