Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Parliamentary Answers On FATCA

Caricato da

patrickcain0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

51 visualizzazioni20 pagineLiberal MPs Ted Hsu and Scott Brison released 430 pages of documents released to them on January 28 related to the U.S. Foreign Account Tax Compliance Act's implementation in Canada. We've excerpted the 20 pages from both documents that shed light on the issue.

Titolo originale

Parliamentary answers on FATCA

Copyright

© Attribution Non-Commercial (BY-NC)

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoLiberal MPs Ted Hsu and Scott Brison released 430 pages of documents released to them on January 28 related to the U.S. Foreign Account Tax Compliance Act's implementation in Canada. We've excerpted the 20 pages from both documents that shed light on the issue.

Copyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

51 visualizzazioni20 pagineParliamentary Answers On FATCA

Caricato da

patrickcainLiberal MPs Ted Hsu and Scott Brison released 430 pages of documents released to them on January 28 related to the U.S. Foreign Account Tax Compliance Act's implementation in Canada. We've excerpted the 20 pages from both documents that shed light on the issue.

Copyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 20

INQUIRY OF MINISTRY

DEMANDE DE RENSEIGNEMENT AU GOUVERNEMENT

PREPARE IN ENGLISH AND FRENCH MARKING "ORIGINAL TEXT" OR "TRANSLATION"

PRPARER EN ANGLAIS ET EN FRANAIS EN INDJQUANT"TEXTE ORIGINAL" OU "TRADUCTION"

QUESTION NOJN DE LA QUESTION BY 1 DE

DATE

Q-127

2

Mr. Brison (Kings-Hants)

October 28, 2013

REPL Y BY THE MINJSTER OF NATIONAL REVENUE

RPONSE DE LA MINISTRE DU REVENU NATIONAL

Signed by the Honourable Kerry-Lynne D. Findlay

PRINT NAME OF SIGNA TORY

SIGNATURE

QUESTION

INSCRIRE LE NOM DU SIGNATAIRE

Ml TER OR PARLIAMENTARY SECRETARY

MINISTRE OU SECRTAIRE PARLEMENTAIRE

With regard to the United States (U.S.) Foreign Account Tax Compliance Act (FATCA): (a) when

was the govemment first made aware of this legislation and how; (b) what steps has Canada taken

. .

since the legislation's introduction in the U.S., broken dawn by year; (c) during the consideration of

this legislation in the U.S., did Canada make any representations to the U.S. government and if so,

See full text of the question attached.

REPL Y 1 RPONSE ORIGINAL TEXT

TEXTE ORIGINAL

TRANSLATION

TRADUCTION

D

With respect to the above-noted question, what follows is the response from the Canada Revenue

Agency (CRA). The CRA has been asked to reply to Parts (k) to (n), (u), (v), (w)(i), (w)(iv), (x), (y), (z),

(aa), (bb), (cc), (ee), (ft), (hh), (jj), (mm), (qq) to (ss) and (uu).

Parts (k) and (/): The number of financial institutions in Canada that will be impacted by the Foreign

Account Tax Compliance Act (FATCA) will depend on the outcome of negotiations between Canada

and the United States (U.S.). As negotiations between Canada and the U.S.are still ongoing, the

number could not be calculated.

Parts (m) and (n): The number of non-financial entities in Canada that will be impacted by FATCA will

depend on the outcome of negotiations between Canada and the U.S. As negotiations between

Canada and the U.S. are still ongoing, the number could not be calculated.

Part (u): The CRA is responsible for tax administration and is not in a position to comment on Part (r).

Parts (v) and (w) (i): The implications of FATCA in Canada will depend on the outcome of

negotiations between Canada and the U.S.

Part (x): The CRA does not have this information.

Part (y): The CRA does not have this information.

. .. /2

-2-

Part (z): Any legal opinions that may have been sought by the CRA would be protected by solicitor

client privilege.

Part (aa): Any legal opinions that may have been sought by the CRA would be protected by solicitor

client privilege.

Part (bb): None have been addressed to the CRA.

Part (cc): None have been addressed to the CRA.

Part (ee): The CRA is not responsible for such negotiations and assists in an advisory capacity only.

Part (ff): Dep.artment of Finance officiais are responsible for tax policy and the on-going negotiations in

connection with FATCA. Various officiais from the CRA have attended certain negotiation sessions in

an advisory capacity.

Part (hh): The Minister of National Revenue has not personally played a role in the negotiations.

Part (iJ): The CRA is responsible for the administration of taxes and benefits in Canada and is taking

appropriate action to be prepared if it is called upon to administer any outcomes in Canada that

emerge from the on-going negotiations between Canada and the U.S. on an agreement to improve

cross-border tax compliance through enhanced information exchange und er the Canada-United States

Tax Convention.

Part (mm): The CRA is monitoring developments associated with FATCA and ensures that ali

necessary officiais are briefed, as required. Information notes have been prepared as follows: U.S.

Foreign Account Tax Compliance Act (FATCA) (COM 2013-00115); Foreign Account Tax Compliance

Act (United States) (COM 2013-00662) and Foreign Account Tax Compliance Act (United States)

(COM 2013-00953); Foreign Account Tax Compliance Act (United States) (COM2013-011 07); Foreign

Account Tax Compliance Act (FATCA) (COM 2012-00935).

Part (qq): The CRA has consulted with and has been contacted by numerous individuals and groups

to discuss the implications of FATCA and an lnter-Governmental Agreement (IGA) in Canada. The

Government of Canada has been actively engaged with financial institutions. Financial institutions

have made a number of submissions in light of the significant implications of developing new systems

to comply with FA TCA or an IGA.

Part (rr): The CRA makes significant efforts to inform taxpayers and benefit recipients of the ir

obligations and rights in connection with the prograrns it administers. However, the CRA does not

administer FATCA. FATCA is a U.S. law administered by the-Internai Revenue Service (IRS). No

intergovernmental agreement has been signed in connection with FATCA and no Canadian law has

been enacted in connection with FA TCA. As su ch, the CRA can only provide limited guidance to

Canadians such as alerting them to the on-going negotiations being led by Department of Finance

or directing them, should they wish to contact the IR S.

. . ./3

-3-

Part (ss): The CRA makes significant efforts tb inform taxpayers and benefit recipients of their

obligations and rights in connection with the programsit administers: However, the CRA does not

administer FATCA. FATCA is a U.S. law administered by the IRS. No intergovernmental agreement

has been sigried in connection with FATCA and no Canadian law has been enacted in connectioh with

FATCA. As such, the CRAcan only provide limited guidance to Canadians such as alerting

them to the on-gojng negotiations being led by the Department of Finance or directing them, should

they wish to contact the IRS.

Part (Uu): FATCA has global implications and has caused there to be discussions between a wide

range of countries, including Canada. (i) Canada has discussed FATCA and other developmnts in

relation to automatic ex change of information with OECD-memqer countries and other jurisdictions

including Germany, France, Finland, Denmark, Chile, the Netherlands, the United Kingdom and Spain.

(ii) Generally speaking, at the level of subject-matter experts. (iii) Discussions occur on a regular basis

and are expected to continue. (iv) Discussions often occur at OECD-sponsored events. (v) CRA

officiais have participated in international discussions ori FA TCA and other matters related to the

automatic exchange of information.

. .. 14

INQUIRY OF MINISTRY

. DEMANDE DE RENSEIGNEMENT AU GOUVERNEMENT

PREPARE rN ENGLISH AND FRENCH MARK.TNG TEXT" OR "TRANSLATION"

PRPARER EN ANGLAIS ET EN FRANAIS EN INDIQUANT "TEXTE ORIGINAL" OU "TRADUCTION"

QUESTION NOJNO DE LA QUESTION BY 1 DE DATE

Q-127 Mr. Brison (Kings-Hants)

QUESTION

Signed by Mr. Saxton

PRINT NAME OF SIGNA TORY

INSCRIRE LE NOM DU SIGNATAIRE

October 28, 2013

REPL Y BY THE MINISTER OF FINANCE

RPONSE DU MINISTRE DES FINANCES

SIGNATURE

MINISTER OR PARUAMENTARY SECRETARY

MINISTRE OU SECRTAIRE PARLEMENTAIRE

With regard to the United States (U.S.) Foreign Account Tax Compliance Act (FATCA): (a) when was the

government first made aware of this legislation and how; (b) what steps has Canada taken since the legislation's

introduction in the U.S., broken dawn by year; (c) during the consideration of this legislation in the U.S., did Canada

make any representations to the U.S. government and if so, (i) when, (ii) by whom, (iii) to whom, (iv) on what dates,

(v)- See full text of the question attached.

REPL Y 1 RPONSE

Finance Canada

Parts a) to v), w)(ii), x) to gg), kk), mm), oo) to vv), xx) and yy)

ORIGINAL TEXT

TEXTE ORIGINAL

(a) when was the government first made aware of this legislation and how;

TRANSLATION

TRADUCTION

D

FATCA was signed into law by the President of the United States on March 18, 2010 as part of the Hiring lncentives

to Restore Emp/oyment (HIRE) Act. Before the provisions of FATCA were included in the HIRE Act, they were tabled

as a bill in the U.S. Congress in 2009 (H.R. 3933, S. 1934) that was built on a proposai outlined in the U.S. Treasury's

General Expia nation of the Administration's Fiscal Year 201 0 Revenue Proposais ("Green Book") on May 11, 2009.

The Department of Finance monitors major tax developments in key countries.

(b) what steps has Canada taken since the legislation's introduction in the U.S., broken down by year; (c)

du ring the consideration of this legislation in the U.S., did Canada make any representations to the U.S.

government and if so, (i) when, (ii) by whom, (iii) to whom, (iv) on what dates, (v) by what authority (vi) with

what desired effect (vii) and with what outcome;

The Government respects the sovereign right of the U.S. to determine its own tax legislation and its efforts to combat

tax evasion- the underlying objective of FATCA. ln fac;t, the Government of Canada and the Government of the

United States co-operate to prevent tax evasion. However, FATCA has raised a number of concerns in Canada-

among bath dual Canada-U.S. citizens and Canadian financial institutions.

1/6

The Government has consistently raised objections to FATCA and dvanced the principle that, in seeking to meet the

objectives of FATCA, greater reliance can be placed on the procedures that already exist under the Canada-U.S. tax

treaty. The Minister of Finance has raised serious concerns directly with the U.S. about FATCA. For instance, the

Minister wrote an op-ed on the issue for publication in major U.S. newspapers:

http://business. financialpost.com/2011/09/16/read-jim-flahertys-letter-on-americans-in-canada/. The Government is

pleased that the U.S. has accepted the principle of greater reliance on the existing procedures in the Canada-U.S. tax

treaty as the basis for an amended process for achieving FATCA's objective in Canada through the negotiation of an

intergovernmental agreement.

On November 8, 2012, the Government announced that it is in negotiations with the U.S. to sign an intergovernmental

agreement for the implementation of FATCA. As outlined on page 156 of Economie Action Plan 2013

(http://www.budget.gc.ca/2013/doc/plan/budget2013-eng.pdf), the agreement under negotiation is intended to

improve cross-border tax compliance through enhanced information exchange und er the Canada-U.S. tax treaty,

including information exchange in support of the U.S. FATCA provisions. The agreement under negotiation is based

on the reciprocal version of the Model1 IGA released by the U.S. Treasury on July 26, 2012 and updated periodically

sin ce th at ti me (http://www. treasury .gov/resource-center/tax-policy/treaties/Pages/F A TCA.aspx).

The Government is continuing to work with its U.S. counterparts to develop an approach that bath countries will find

agreeable. The Government is close to a proposed agreement with the U.S. and is hopeful th at it will be able to

announce further details in the future. The implications of FATCA in Canada will depend on the outcome of

negotiations between Canada and the U.S.

(d) how many individuals in Canada will be affected; (e) how was the figure in (d) calculated; (f) how many

Canadan citizens residing in Canada are U.S. persans under FATCA; (g) how many Canadian permanent

residents are U.S. persans under FATCA; (h) how many applications for permanent residency is Canada

currently processing from persans who are or will be treated as U.S. persans under FATCA; (1] broken dawn

by province and territory and status, how many personsn Canada are projected to be affected by FATCA; (Jl

how was the figure in (/) calculated;

The implications of FATCA in Canada, including on the number of individuals in Canada that would be affected, will

depend on the outcome of negotiations between and the U.S.

(k) how many Canadian financial institutions will be impacted by FATCA; (/) how was the figure in (k)

calculated; (m) how many non-financial Canadian entities will be impacted by FATCA; (n) how was the figure

in (m) calculated;

FATCA could potentially impact any financial institution that meets the definition of a financial institution as defined in

ttie FATCA legislation. The number of financial institutions and non-financial entities in Canada that will be impacted

by FATCA will depend on the outcome of negotiations between Canada and the U.S.

(o) what consultations has the government undertaken with respect to FATCA's impact on persans resident

in Canada; (p) what consultations has the government undertaken with respect to FATCA's impact on

financial institutions; (q) what consultations has the government undertaken with respect to FATCA's impact

on non-financial entities;

When the Government announced on November 8, 2012 on the Department of Finance website that it had entered

into negotiations with the U.S. to sign an IGA, the posting on the Department of Finance website invited Canadians

wishing to offer comments concerning the negotiations to send their views to the Department.

2/6

(r) what estimates and studies have been undertaken with respect to the consequences of a 30% withholding

of U.S. sourced income to financial institutions; (s) when did the studies in (r) occur and what were their

conclusions;

FATCA has raised a number of concerns in Canada- among bath dual Canada-U.S. citizens and Canadian financial

institutions. These concerns include the possibility of the FA TCA withholding tax being applied against Canadian

financial institutions or their account holders.

The Government has advanced the principle that, in seeking to meet the objectives of FATCA, greater reliance can

be placed on the procedures th at already exist under the Canada-U.S. tax treaty. The Govemment is pleased the

U.S. has accepted this principle as the basis for an amended process for achieving FATCA's objectives in Canada,

and Canada and the U.S. are negotiating an agreement to this effect.

As noted above, the negotiations between Canada and the U.S. on an IGA are based on the Madel 1 JGA released by

the U.S. Treasury. The terms of the Madel 1 IGA include provisions th at wou Id protect financial institutions in Canada

and their clients from FATCA's withholding taxes. The implications of FATCA for Canadians will depend on the

outcome of negotiations between Canada and the U.S.

(t) how much has been spent evaluating FATCA's impact on Canadians; (u) broken down by department, how

was the figure in (r) determined;

The Department of Finance has been assessing the implications of FATCA for Canada since 2009. The Department

of Finance's costs in this regard have been covered by existing resource levels. No federal department to date has

been allocated new funds through the Parliamentary appropriation process for any costs related to FATCA.

(v) what estimates have been undertaken with respect to FATCA's cost to implement for Canada and with

what conclusions;

As noted, FATCA has raised a number of concerns in Canada- among both dual Canada-U.S. citizens and

Canadian financial institutions. These concerns include the question ofwhether the FATCA reporting requirements,

that would campel financial institutions to report information on account holders that are U.S. citizens directly to the

Internai Revenue service (IRS), would be inconsistent with Canadian privacy laws. Unless an agreement is in place,

Canadian financial institutions and dual Canada-U.S. citizens holding financial accounts in Canada would be required

to comply with FATCA starting July 1, 2014. To address these concerns, Canada has engaged in lengthy negotiations

with the U.S.

Under the Madel 1 IGA approach which is the basis for the negotiations, financial institutions in Canada would not

report information directly to the IRS. Rather, information on U.S. clients would be reported to the Canada Revenue

Agency (CRA), which would then exchange it with the IRS through the existing provisions, and protected by the

safeguards under, the Canada-U.S. tax treaty. The Model1 IGA approach would also protect clients of financial

institutions in Canada against FATCA's withholding taxes.

(w) for the five years starting in 2014, how much is FATCA implementation expected to cost (i) Canada

Revenue Agency, (ii) the department of Finance, (iii) the department of Justice, (iv) ether government

departments, agencies, boards, or tribunals; (x) broken dawn by year and cost from 2010-2020, what is the

total financial impact of FATCA implementation expected to be on Canadian taxpayers; (y) how were the

figures in (x) obtained;

1t is anticipated that the Department of Finance's costs will be absorbed within existing resource levels.

3/6

(z) what outside legal opinions has the. government sought with respect to FATCA's compatibility with

Canadian law; (aa) when were the opinions in (z) sought and at what expense;

The Department of Finance is unable to provide information in response to this question because the Department

does not have relevant information or the Department cannat disclose the information because it is subject to

solicitor-client privilege.

(bb} have unsolicited legal opinions been sent to the government regarding FATCA; (cc) how many opinions

in (bb) has the government received (i) on what dates, (ii) with what conclusions, (iii) with what impact on the

Government's actions;

The Department of Finance received an unsolicited legal opinion from Mr. Peter Hogg on December 12, 2012, which

has since been made public through the Access to Information Act, with the consent of Mr. Hogg. As with ali

submissions received from the public, Mr. Hogg's views have been taken into consideration by the Department of

Finance as part of its policy development process. Any conclusion related to consideration by the Government of

Mr. Hogg's legal opinion is subject to solicitor-client privilege.

(del) has the government assessed the possibility of not acceding to FATCA in any way and, if so, with what

conclusion and with what cost to Canada orto Canadians when compared to accession;

If Canada were ta not negotiate an agreement, obligations for Canadian financial institutions to comply with FATCA

would be unilaterally and automatically imposed on them by the U.S. as of July 1, 2014. These obligations would

force Canadian financial institutions to choose between (i) entering into an agreement with the IRS that would require

them to report to the IRS on their U.S. account holders, which would raise concerns about consistency with Canadian

privacy laws, and (ii) being subject to the FATCA withholding taxon certain U.S. source payments, which could have

a significant negative effect on the Canadian economy. ln addition, under FATCA, the obligations on Canadian

financial institutions could result in their clients being subject to FATCA withholding or having their accounts closed in

certain situations.

The Government has consistently raised objections ta FATCA and advanced the principle that, in seeking ta meet the

objectives of FATCA, greater reliance can be placed on the procedures that already exist under the Canada-U.S. tax

treaty. We are pleased the U.S. has accepted this principle as the basis for an amended process for achieving

FATCA's objectives in Canada, and Canada and the U.S. are negotiating an agreement to this effect.

(ee) how much ha.s been spent on negotiations surrounding FATCA, broken down by year and expense;

The Department of Finance's negotiating costs have been absorbed within existing resource levels.

(tf) which i.ndividuals from the government have negotiated on Canada's behalf regarding FA TCA;

The Canadian delegation ta negotiate an IGA with the U.S. is comprised of officiais from the Department of Finance

with assistance from officiais of the CRA.

(gg) what has the Minister of Finance's persona! role been with respect to FATCA negotiations;

The Minister of Finance has provided direction ta the Department of Finance regarding the negotiations and has

stayed abreast of developments throughout the negotiation process.

(kk) what penalties will there be for U.S. failure to meet any of its negotiated obligations;

The implications of FATCA in Canada will depend on the outcome of negotiations between Canada and the U.S.

4/6

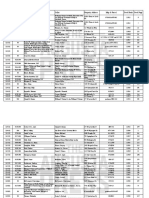

{mm) broken down by department and agency, and with specifie record numbers and titles, what briefing

materials and files have been developed regarding FATCA:

See table be low.

Trac king Date Title ., .. :, .. > .

f Number - : . .. ,. __ -. ,:_.-

. . ... . "'. . ' : .. :

2013FIN396125 13/9/2013

2013FIN391084 29/5/2013

2013FIN388946 16/4/2013

2013FIN384597 8/2/2013

2012FIN378373 24/9/2012

2012FIN376486 15/8/2012

2012FIN37 4854 12/7/2012

2012FIN369017 24/4/2012

2012FIN363958 17/2/2012

2011 FIN361544/ 16/12/2011

2011 FIN361846

2011FIN360134 23/11/2011

2011 FIN355319 9/9/2011

2011FIN354148 30/8/2011

2011 FIN351692 18/8/2011

2011 FIN353037 22/7/2011

2011 FIN350793 29/6/2011

2011 FIN352052 28/6/2011

2011 FIN341782 7/2/2011

201 OFIN334184 13/1/2011

2010FIN331214 6/10/2010

2010FIN327362 26/7/2010

201 OFIN324081 28/6/2010

FATCA IGA Fact Sheet

[title withheld]

Sun Life- Longevity Risk and FATCA

FATCA: Recent Developments and Update on Negotiations with the

U.S.

FATCA [title partially withheld]

FATCA- Release of US Modellntergovernmental

FATCA [title j)_artially_ withhelc!l

FATCA- Release of U.S .. Draft Regulations and Joint Statement; [title

withheld]

FATCA- Letter from lnstitute of International Finance

Updates on U.S. Tax and Account Reporting Requirements for U.S.

citizens residing in Canada and on the Foreign Account Tax

Compliance Act

Update: Foreign Account Tax Compliance Act (FATCA)

Fact Sheet on U.S. Tax Re_portin_g_ lncluding FATCA

Update on the [title partially withheld] and [title partially withheld] efforts

on FATCA

[title partially withheld] the U.S. Foreign Account Tax Compliance Act

(FATCA)

Foreign Account Tax Compliance Act Update- Details of

Implementation Timeline Released by US

Update on outreach [title partially withheld] other countries on FATCA

[title withheld]

Foreign Account Tax Compliance ActlFATCAJ Update

Foreign Account Tax Compliance Act (FATCA) Update

Foreign Account Tax Compliance Act (FATCA) Update

F ATCA Update: [title partially withheld]

Foreign Account Tax Compliance Provisions of the Hiring lncentives ta

Restore Employment Act

ln preparing responses to parliamentary questions, the Government is guided by the ru les and principles contained in

the Privacy Act and the Access to Information Act, and therefore certain information has been withheld consistent with

these rules and principles.

(oo) have any future public consultations with respect to FATCA implementation been planned and, if not,

why not;

When the Government announced on November 8, 2012 on the Department of Finance website that it had entered

into negotiations with the U.S. to sign an IGA, the posting on the Department of Finance website invited Canadians

wishing to offer comments concerning the negotiations to send their views to the Department.

(pp) what is the projected impact of FATCA on the Bank of Canada;

The U.S. FATCA legislation exempts from FATCA's due diligence, reporting, and withholding requirements any

foreign central bank of issue, which would include the Bank of Canada. See paragraph 1471(f)(3) and subparagraph

1472(c)(1)(F) of the Internai Revenue Code.

5/6

(qq) what efforts has the government made with respect to informing financial institutions of their obligations

under FATCA; (rr) what efforts has the government made with respect to informing non-financial entities of

their obligations under FATCA; (ss) what efforts has the government made with respect to informing

individuals residing in Canada of their obligations under FATCA;

The Government does not provide advice with respect to compliance with foreign laws. The Government has

consulted with ind been contacted by individuals, groups and corporations, particularly in the financial sector, to

discuss the implications of FATCA and an IGA in Canada.

The Government announced on November 8, 2012 that it is in negotiations with the U.S. on an agreement to improve

cross-border tax compliance through enhanced information exchange under the Canada- U.S. tax treaty, including

information exchange in support of the U.S. FATCA provisions. The announcement was made on the Oepartment of

Finance's treaty page (http://www.fin.gc.ca/treaties-conventions/notices/unitedstates-etatsunis-eng.asp). Further

information about the negotiations was highlighted on page 156 of Economie Action Plan 2013

(http://www. budget. ge. ca/20 13/doc/plan/budget2013-eng. pdf).

(tt) has Canadian non-compliance with FATCA been assessed as a possibility and, if so, to what extent;

If Canada were to not negtiate an agreement, obligations for Canadian financial institutions to comply with FATCA

would be unilaterally and automatically imposed on them by the U.S. as of July 1, 2014. These obligations would

force Canadian financial institutions to choose between (i) entering into an agreement with the IRS that would require

them to report to the IRS on their U.S. account holders, which would raise concerns about consistency with Canadian

privacy laws, (ii) being subject to the FATCA withholding taxon certain U.S. source payments. Under FATCA, the

obligations on Canadian financial institutions could result in their clients being subject to FATCA withholding or having

their accounts closed in certain situations.

(uu) has FATCA been raised in discussions between Canada and countries other than the U.S. and, if so, (i)

with which countries, (ii) at what level(s) did the discussion occur, (iii) on what dates, (iv) in what forum, (v)

and with which individuals from Canada participating;

Government officiais have held discussions with various countries in which FAT CA has been discussed. Sorne of

these discussions occurred at the OECD while ethers were bilateral discussions. The names of individual countries

cannet be disclosed as this could affect international relations.

(w) have any studies or analysis taken place with respect to FATCA's impact on immigration to Canada by

persons subject to this legislation and, if so, with what conclusion;

The Department of Finance has not undertaken any such studies or analysis, and is not aware of any having been

undertaken.

(xx) has the American Ambassador to Canada raised the issue of FATCA in any discussions and if so, (i)

which discussions, (ii) on what dates, (iii) with what outcome;

The Department of Finance is not aware that the American Ambassador to Canada has raised with the Government

the issue of FATCA.

(yy) has the government considered the correspondence of Peter Hogg regarding F ATCA and if so, (i) with

what impact on policy development, (ii) with what conclusion;

As with ali submissions received from the public, Mr. Hogg's views have been taken into consideration by the

Department of Finance as part of its po licy development process.

Office of the Superintendent of Financial Institutions {OS FI)

This question is not applicable to the Office of the Superintendent of Financial Institutions.

6/6

INQUIRY OF MINISTRY

DEMANDE DE RENSEIGNEMENT AU GOUVERNEMENT

PREPARE IN ENGLISH AND FRENCH MARKING "ORIGINAL TEXT" OR "TRANSLATION"

PRPARER EN ANGLAIS ET EN FRANAIS EN INDIQUANT "TEXTE ORIGINAL" OU "TRADUCTION"

QUESTION NO.IN DE LA QUESTION BY 1 DE DATE

QUESTION

Q-127

2

Mr. Brison (Kings-Hants) October 28, 2013

John Baird, P.C., M.P.

PRINT NAME OF SIGNA TORY

INSCRIRE LE NOM DU SIGNATAIRE

REPL Y BY THE MINISTER OF FOREIGN AFF AIRS

RPONSE DU MINISTRE DES AFFAIRES TRANGRES

SIGNATURE

MINISTER OR PARUAMENTARYSECRETARY

MINISTRE OU SECRTAIRE PARLEMENTAIRE

With regard to the United States (U.S.) Foreign Account Tax Compliance Act(FATCA): (a) when was the

government first made aware ofthis legislation and how; (b) what steps has Canada taken since the legislation's

introduction in the U.S., broken down by year; (c) during the consideration of this legislation in the U.S., did Canada

make any representations to the U.S. government and if so, (i) when, (ii) by whom, (iii) to whom, (iv) on what dates,

(v) by what authority (vi) with what desired effect (vii) and with what outcome; (d) how many individuals in Canada

will be affected; (e) how was the figure in (d) calculated; (j) how many Canadian citizens residing in Canada are

U .S. persons under F ATCA; (g) how many Canadian permanent residents are U.S. persons under F ATCA; See full

text of the question attached.

REPL Y 1 RPONSE

Foreign Affairs, Trade and Development Canada (DFATD)

ORIGINAL TEXT

TEXTE ORIGINAL

TRANSLATION

TRADUCTION

D

For this section, the responses of the Minister of International Trade, the Minister of Foreign Affairs and the

Minister of International Oevelopment are the same.

DFATD is responsible for parts w)(iv), z), aa), bb), cc) and mm) of the question

lt should be noted that in processing parliamentary returns, the Government applies the Privacy Act and the

principles set out in the Access to Information Act, and certain information has been withheld on the

grounds that the information constitutes persona! information .

. (w) for the five years starting in 2014, how much is FATCA implementation expected to cost, (iv)

other government departments, agencies, boards, or tribunals;

DFATD does not expect ta incur any implementation costs.

. . ./2

-2,-

(z) what outside legal opinions has the government sought with respect to FATCA's compatibility

with Canadian law; (aa) when were the opinions in (z) sought and at what expense; (bb) have

unsolicited legal opinions been sent to the government regarding FATCA cc) how many opinions in

(bb) has the government received, (i) on what dates, (ii) with what conclusions, (iii) with what impact

on the Government's actions;

DFATD has not sought outside legal opinion on FATCA and there is no record of any unsolicited opinions

having been submitted.

(ii) what has the Minister of Foreign Affairs' persona! role been with respect to FATCA negotiations;

The Minister of Foreign Affairs has not had a personal rote with respect to FATCA negotiations aside from

requesting that the Minister of Finance review the issue of FATCA.

(mm) broken down by department and a geney, and with specifie record numbers and titles, what

briefing materials and files have been developed regarding FATCA

DFATD developed the following briefing materials and files regarding FATCA:

Briefing materiallfile: Environmental Strategie Evaluation. Title: The lntergovernmental Agreement

Between Canada and the United States to lmplement the U.S. Foreign Account Tax Compliance Act

(FATCA).

Briefing material/file: Briefing Document. Title: Background to be Provided to Missions: U.S. Foreign

Account Tax Compliance Act (FATCA).

Briefing material/file: Memorandum for Information to Deputy Minister of International Trade. Title:

Providing Support to Canadian Companies with the Application of the U.S. Foreign Account Tax

Compliance Act (FATCA) Abroad. Document number: BPTS 00995-2013.

Briefing materiallfile: Meeting Note for Minister of Foreign Affairs Title: Minister of Foreign Affairs

Meeting- Thursday, January 5, 2012. Document number: BPTS 00007-2012.

Briefing materiallfile: Memorandum of Information for the Minister of Foreign Affairs and the Minister

of International Trade. Title: The Impact of U.S. Tax Obligation on Canada-USA Dual Citizens.

Briefing materiallfile: Memorandum of Information for Assistant Deputy Minister Title: Americas U.S.

Foreign Account Tax Compliance Act (FATCA)

.- Briefing materiallfile: GeneraiBrief. Title: Foreign AccountTax Compliance Act (FATCA).

.../3

-3-

(ww) has the Canadian Ambassador to the U.S. raised the issue of FATCA in any discussions and if

so, (i) which discussions, (ii) on what dates, (iii) with what desired goal;

1. (i) Ambassador Doer held a meeting with Senator Chuck Schumer (D-NY) . (ii) The date was April 17,

2012 (iii) The goal was, as noted in the request to the Senator's office, "to discuss TPP, ballast water,

and Beyond the Border." FATCA was discussed on the margins of the meeting.

2. (i) Ambassador Doer raised FATCA at a meeting with congressman Barney Frank, ranking member

of the House Financial Services Committee. (ii) The date was April 23, 2009. (iii) The goal was, as

noted in the request to the Congressman's office, "to discuss issues related to the ongoing financial

crisis and policy response, as weil as issues related to the auto sector." FATCA was discussed on

the margins of the meeting.

3. (i) Ambassador Doer raised FATCA at a meeting with congressman Barney Frank, Chair of the

House Financial Services Committee. (ii) The date was April22, 2010. (iii) The goal was, as noted in

the request to the Congressman's office, "to discuss finance issues in general and financial reform

legislation." FATCA was discussed on the margins of the meeting.

To Note: Ambassador Doer raised FATCA as a general subject matter in telephone calls with

representatives of Congress/Senate wh ile discussing the financial sector. FA TCA was a Iso mentioned in

meetings at the U.S Department of Treasury. However, due to the frequency and multiple subjects

discussed, specifie dates are not available.

(xx) has the American Ambassador to Canada raised the issue of FATCA in any discussions and if

so, (i) which discussions, (ii) on what dates, (iii) with what outcome;

The principles set out in the Access to Information Act have been applied and therefore information

concerning discussions with a representative of another country's government cannet be divulged.

INQUIRY OF MINISTRY

DEMANDE DE RENSEIGNEMENT AU GOUVERNEMENT

,, PREPt\RE IN ENGLLSH AND FRENCH MARK!NG "ORIGINAL TEXT" OR "TRANSLATION"

G PRPARER EN ANGLAIS ET EN FRANAIS EN lNDIQUANT "TEXTE ORIGINAL" ou "TRADUCTION"

\1

QUESTION NO.fNc DE LA QUESTiON

Q-127

BY iDE

Mr. Brison (Kings-Hants)

QUESTION

Paul Calandra

PRINT NAME OF SIGNA TORY

iNSCRIHE LE NOM DU SiGNATAIRE

DATE

October 28,2013

REPL Y BY THE OFFICES OF THE PRIME MINISTER AND THE PRIVY COUNCIL

RPONSE OU CABINET DU PREMIER MINISTRE ET DU BUREAU OU CONSEIL PRIV

. /: __

/ ( . . ---------<''"'/-_->"" __ ,,/'

i ......

.. SIGNATURE

MltJISTER OR PARLIAMENTARY SECRET.4RY

MINiSTRE OU SECRETAIRE PARLEMENT AIRE

With regard to the United States (U,S.) Foreign Account Tax Compliance Act (FATCA): (a) when was the

government first made aware of this legislation and how; (b) wh at steps has Canada taken sin ce the

legislation's introduction in the U.S., broken down by year; (c) during the consideration of this legislation

in the U.S., did Canada make any representations to the U.S. government and if so, (i)- See full text of

the question attached.

REPL Y 1 REPONSE

ORIGINAL TEXT

TEXTE ORIGINAL

TRA.NSLATION D

TR"<DUCTION

With regard to the United States Foreign Account Tax Compliance Act, the Privy Council Office responds

th at the information requested is withheld in accord ance with the princip les of the Access ta Information Act.

INQUIRY OF MII\,IISTRY

DEMANDE DE RENSEIGNEMENT AU GOUVERNEMENT

PREPARE IN ENGLISH AND FRENCH MARKING "ORIGINAL TEXT" OR "TRANSLATION"

PRPARER EN ANGLAIS ET EN FRANAIS EN INDIQUANT "TEXTE ORIGINAL" OU "TRADUCTION"

QUESTION NO./NDE LA QUESTION BY 1 DE DATE

Q-121 Mr. Hsu (Kingston and the Islands)

QUESTION

Signed by Mr. Saxton

PRINT NAME OF SIGNA TORY

INSCRIRE LE NOM DU SIGNATAIRE

October 25, 2013

REPL Y BY THE MINISTER OF FINANCE

RPONSE DU MINISTRE DES FINANCES

SIGNATURE

MINISTER OR PARUAMENTARY SEl.ETARY

MINISTRE OU SECRTAIRE PARLEMENTAIRE

With regard to the implementation of the Foreign Account Tax Compliance Act (FATCA): (a) what steps has

Canada undertaken to complete an lnter-Governmental Agreement (IGA) with the United States; (b) with what type

of legal instrument will the government enact a FATCA implementation agreement; (c) will the government bring an

IGA before Parliament and, if so, in what form; (cf) what steps are in place to ensure parliamentary review of an

IGA; ... See full text of the question attached.

REPL Y 1 RPONSE

Finance Canada

Parts a) to 1}, o) to g), s) to ii), kk) to oo), qg) to ss), ww), and zz) to ccc)

ORIGINAL TEXT

TEXTE ORIGINAL

TRANSLATION

TRADUCTION

D

(a) what steps has Canada undertaken to complete an lnter-Governmental Agreement (IGA) with the United

States;

The Government of Canada has consistently raised objections to FATCA and advanced the principle that, in seeking

to meet.the objectives of FATCA, greater reliance can be placed on the procedures that already exist under the

Canada-U.S. tax treaty. We are pleased the U.S. has accepted this principle as the basis for an amended process for

achieving FATCA's objectives in Canada, and Canada and the U.S. are negotiating an agreement to this effect.

The Government of Canada announced on November 8, 2012 that it is in negotiations with the U.S. on an agreement

to improve cross-border tax compliance through enhanced information exchange under the Canada- U.S. tax treaty,

including information exchange in support of the U.S. FATCA provisions. The announcement was made on the

Department of Finance's treaty page (http://www.fin.gc.ca/treaties-conventions/notices/unitedstates-etatsunis-

eng.asp).

As outlined on page 156 of Economie Action Plan 2013 (http://www.budget.gc.ca/2013/doc/plan/budget2013-eng.pdf),

the agreement under negotiation is intended to improve cross-border tax compliance through enhanced information

exchange under the Canada-U.S. tax treaty, induding information exchange in support of the U.S. FATCA provisions.

1/6

The negotiations are based on the reciprocal version of the Model1 IGA released by the U.S. Treasury on

July 26, 2012 and updated periodically since that time (http://www.treasury.gov/resource-center/tax-

policy/treaties/Pages/FA TCA.aspx).

Under the Mode! 1 IGA approach, financial institutions in Canada would not report information directly to the IRS.

Rather, information on U.S. clients would be reported to the Canada Revenue Agency (CRA), which would then

exchange it with the U.S. Internai Revenue Service (IRS) through the existing provisions, and protected by the

safeguards un der, the Canada-U.S. tax treaty. The Mode! 1 IGA approach would a Iso protect clients of financial

institutions in Canada against FATCA's withholding taxes as weil as the provisions of FATCA that could require that

certain clients of non-U.S. financial institutions be denied access to financial services.

The Government of Canada is continuing to work with the U.S. to develop an approach that both countries will find

agreeable. The Government of Canada is close to a proposed agreement.with the U.S. and is hopeful that it will be

able to announce further details in the future. If an agreement is reached, it would be made public and require

Parliamentary approval for implementation.

(b) with what type of legal instrument will the government enact a FATCA implementation agreement; (c) will

the government bring an IGA before Parliament and, if so, in what form; (d} what steps are in place to ensure

parliamentary review of an IGA;

If an agreement to implement FATCA is reached with the U.S., the agreement would be made public and require

Parliamentary approval for implementation.

(e) what studies have been undertaken asto whether an IGA can be implemented as an interpretation of the

existing double tax treaty;

Article XXVII of the Canada-U.S. tax treaty authorizes the exchange of information for tax purposes, including on an

automatic basis. The due diligence and reporting components of an IGA would require implementing legislation.

(f) in what ways will the government involve Parliament in any process to am end interpretation of the double

taxation treaty;

If an agreement to implement FATCA is reached with the U.S., the agreement would be made public and require

Parliamentary approval for implementation.

Interpretation of the Canada-U.S. tax treaty is an administrative and judicial process. The CRA is the Canadian

authority for administering the tax treaty. Taxpayer disputes regarding interpretation of the tax treaty can rely on the

processes under the treaty or can be taken to the Tax Court of Canada.

(g) who is involved in the process indicated in (a);

The Canadian delegation to negotiate an IGA with the U.S. is comprised of officiais from the Department of Finance

with assistance from offiCiais of the CRA.

(h) by what criteria is the government evaluating any proposed IGA with the US; (1) who established the

criteria in(h), (i) on what date, (ii) under what authority;

FATCA has raised a number of concerns in Canada- among both dual Canada-U.S. citizens and Canadian financial

institutions. These concerns include the question of whether the FATCA reporting requirements, that would compel

financial institutions to report information on account holders that re U.S. citizens directly to the IRS, would be

2/6

inconsistent with Canadian privacy laws, as weil as the possibility that, under FATCA, financial institutions would be

required to deny services to certain clients in certain situations.

Unless an agreement is in place, Canadian financial institutions and dual Canada-U.S. citizens holding financial

accounts in Canada would be required to comply with FATCA starting July 1, 2014. To address these concerns,

Canada has engaged in lengthy negotiations with the U.S.

(/1 is a draft IGA currently being negotiated, and if so, what is the status of said negotiations; (k) when will the

draft IGA be made public;

The Government of Canada announced onNovember 8, 2012 that it is in negotiations with the U.S. on an agreement

to improve cross-border tax compliance through enhanced information exchange under the Canada-U.S. tax treaty,

including information exchange in support of the U.S. FATCA provisions. The announcement was made on the

Department of Finance's treaty page (http://www. fin. ge. ca/treaties-conventions/notices/unitedstates-etatsunis-

eng.asp).

The Government of Canada is continuing to work with the U.S. to develop an approach that bath countries will find

agreeable. The Government of Canada is close to a proposed agreement with the U.S. and is hopeful that it will be

able to announce further details in the future. If an agreement is reached, it would be made public at that time.

(/)will the public be consulted for input on any agreement, and if so, by what means;

When the Government announced on November 8, 2012 on the Department of Finance website that it had entered

into negotiations with the U.S. to sign an IGA, the posting on the website invited Canadians wishing to offer

comments concerning the negotiations ta send their views to the Department.

(o) with which specifie individuals and groups did the Minister of Finance consult regarding FATCA, and on

what dates; (p) with which specifie individuals and groups did the Minister of Finance consult regarding any

IGA, and on what dates;

The Government of Canada has consulted and has been contacted by individuals and groups to discuss the

implications of FATCA and an IGA in Canada.

(q) what studies and analyses has the Department of Finance undertaken with respect to FATCA;

The Department of Finance is reviewing the implications of FATCA on an ongoing basis. FATCA has raised a number

of concerns in Canada- among bath dual Canada-U.S. citizens and Canadian financial institutions.

(s) what analyses and studies have been undertaken asto whether the proposed FATCA regime constitutes

an override of the existing double tax convention; (t) what were the conclusions of the studies in (s);

Article XXVII of the Canada-U.S. tax treaty authorizes the exchange of information for tax purposes, including on an

automatic basis. Under a potential agreement with the U.S., information exchange between Canada and the U.S.

would take place under the existing provisions, and protected by the safeguards under, the Canada-U.S. tax treaty.

(u) what steps is the government taking to ensure that, as a result of FATCA or an IGA, the US will not be

allowed to impose higher taxes on Canadian persons than those agreed under the current convention;

As noted above, the negotiations between Canada and the U.S. on an IGA are based on the Madel 1 IGA released by

the U.S. Treasury. The Model1 IGA is strictly an information-sharing regime. lt would not allow the U.S. to impose

higher taxes on Canadian persans than those agreed under the existing provisions of the Canada-U.S. tax treaty.

3/6

(v) what studies and analyses have been undertaken to determine whether Canadian citizens and residents

are or will be denied financial services in Canada owing toUS tax law in general and FATCA in particular; (w)

' what are the conclusions or recommendations of the studies in (v); (x) what mechanisms are in place to

ensure that Canadian citizens and residents are not and will not be denied financial services in Canada owing

toUS tax law in general and FATCA in particular; (y) what measures will be taken to remedy deniai of

services to Canadians as a result of FATCA;

The negotiations between Canada and the U.S. on an IGA are based on the Model 1 IGA released by the U.S.

Treasury. The terms of the Mode! 1 IGA would protect clients of financial institutions in Canada from the provisions of

FATCA that would require Canadian financial institutions to deny access to financial services to certain clients in

certain situations. This approach would ensure that there would be no conflict with the Access to Basic Banking

Services Regulations under the Bank Act.

(z) what studies and analyses will be undertaken to assess FATCA's impact on the availability ofTFSAs and

RESPs for dual US-Canada citizens; (aa) what are the conclusions of any studies in (z);

The Mode! 1 IGA approach would not impose any U.S. taxes or pe'nalties on account holders at Canadian financial

institutons, nor would it include any provisions that would limit the availability of TFSAs or RESPs for dual U.S.-

Canada citizens.

(bb) what analyses and studies have been undertaken regarding whether the US definition of "resident" for

tax purposes, and its impact on Canadians with dual status, is compatible with Canadian law, including the

Charter of Rights and freedoms; (cc) what analyses and studies have been undertaken regarding whether the

US definition of "resident" for tax purposes, and its impact on Canadians with dual status, as will be

enforced by F ATCA or by an IGA, is compatible with Canadian law and, in particular, the Charter of Rights

and Freedoms;

Canada respects the sovereign right of the U.S. to determine its own tax legislation and its efforts to combat tax

evasion- the underlying objective of FATCA. Regarding the U.S. definition of "resident" for tax purposes, Article IV of

the Canada-U.S. tax treaty contains provisions for applying the concept of residence in the context of Canada-U.S.

tax relations, including acknowledgement that the U.S. taxes individuals who are citizens of that country.

ln respect of any legislation that might be proposed to implement an IGA in Canada, the Minister of Justice is required

under section 4.1 of the Oepartment of Justice Act to examine ali government legislation introduced in or presented to

the House of Gommons by a minister of the Crown for inconsistency with the Charter of Rights and Freedoms and to

report that inconsistency to the House of Gommons.

(dd) what analyses and studies have been conducted with respect to FATCA's consequences upon

Canadians who believed their US Citizenship had been relinquished; (ee) with respect to the studies

referenced in (dd), what particular efforts has the government undertaken to ensure no violation of a

Canadian's charter right would be occasioned by implementingFATCA or an IGA;

The Government of Canada is not able to provide tax advice with respect to individuals who may have tax obligations

in ether jurisdictions.

As noted above, in respect of any legislation that might be proposed to implement an IGA in Canada, the Minister of

Justice is required under section 4.1 of the Department of Justice Act to examine ali government legislation

introduced in or presented to the Hou se of Gommons by a minister of the Crown for inconsistency with the Charter of

Rights and Freedoms and to report that inconsistency to the House of Gommons.

4/6

(ff) what studies and analyses have been undertaken regarding the likely cost of FATCA implementation to (i)

Canadian private institutions, (ii) Canadian individuals, (iii) the government; (gg) how were the figures in (ft)

arrived at, by whom, when, and in consultation with whom; (hh) what studies and analyses have been

undertaken asto whether the likely cost of FATCA implementation to Canadian private institutions, Canadian

individuals, and the government will be offset by the receipt of reciprocal tax information and Canadian tax

law enforcement by the US; (ii) what analyses and studies have been undertaken as to whether the likely

costs and benefits described in (ff) and (hh) are likely to be greater, fesser, or the same as under the current

tax-information-sharing relationship with the US;

As noted, FATCA has raised a number of concerns in Canada- among bath dual Canada-U.S. citizens and

Canadian financial institutions. These concerns include the question of wh ether the FAT CA reporting requirements,

that would campel financial institutions to report information on account holders th at are U.S. citizens directly ta the

IRS, would be inconsistent with Canadian privacy laws. Unless an agreement is in place, Canadian financial

institutions and dual Canada-U.S. citizens holding financial accounts in Canada would be required ta comply with

FATCA starting July 1, 2014. Ta address these concerns, Canada has engaged in lengthy negotiations with the U.S.

Under the Madel t IGA approach which is the basis for the negotiations, financial institutions in Canada would not

report information directly ta the IRS. Rather, information on U.S. clients would be reported ta the CRA, which would

then exchange it with the U.S. Internai Revenue Service (IRS) through the existing provisions, and protected by the

safeguards under, the Canad;i-U.S. tax treaty. The Model1 IGA approach would also protect clients of financial

institutions in Canada against FATCA's withholding taxes.

(j/) what agencies, boards, tribunats, or commissions of the government have studied, interpreted, analyzed,

or commented upon FATCA, (i) to what extent, (ii) on what dates, (iii) with what conclusion(s);

The Oepartment of Finance is not aware of any agencies, boards, tribunals, or commissions of the Government which

have analyzed FATCA other than the CRA and the Office of the Privacy Commissioner.

(kk} what specifie steps has the government taken to assess the privacy implications of FATCA;

The Oepartment of Finance continues ta examine the relationship between FATCA and privacy including

through ongoing consultations with lndustry Canada and the Office of the Privacy Commissioner.

(/1) on what dates and with respect to what topics has the government met with the Privacy Commissioner to

discuss FATCA or the effect of any IGA;

Discussions between the Oepartment of Finance and the Office .of the Privacy Commissioner have been ongoing.

(mm) broken down by province or territory, (i) on which dates and (ii) with what individuals in the provincial

and territorial governments did the government consult on the subject of FATCA; (nn) broken down by

province or territory, (i) on which dates and (ii) with what individuals in the provincial and territorial

governments did the government consult on the subject of any IGA; (oo) does the government have the

support of every province and territory with respect to any proposed implementation of FATCA, and what

evidence does the government have that this support exists;

The Government of Canada has updated the provinces and territories on developments regardin.g FATCA, including

the status of Canada's IGA negotiations with the U.S.

5/6

(qq) how will the government monitor and enforce compliance by Canadian institutions with FATCA

requirements; (rr) how will the government monitor and enforce regulatory oversight of the bank due-

diligence efforts required by FATCA and its implemntation, including (i) by whom (ii) how, (iii) using what

standards such efforts will be evaluated; (ss) what penalties exist and what penalties does the government

intend to establish for failure to adhere to standards indicated in (rr); (ww), what steps have been undertaken

to assess regulatory changes to federal institutions at the provincial and territorial levet that would be

required as a result of FATCA or any IGA;

The CRA is the federal agency responsible for administering tax, benefits, and related programs, and to ensure

compliance on behalf of governments across Canada. As the administrator of Canada's tax laws, the CRA would be

responsible for monitoring and enforcement of any implementing legislation that is enacted to implement the due

diligence and reporting requirements in Canada for Canadian financial institutions under an IGA. The impli.cations of

FATCA in Canada will depend on the outcome of negotiations between Canada and the u:s. If an agreement to

implement FATCA is reached with the U.S, the agreement would be made public and require Parliamentary approval

for implementation .

. (zz) has the government assessed whether FATCA and its implementation would require changes to the ways

in which tax information is currently shared with the US;

With regards to the information exchange components of an IGA, Article XXVII of the Canada-U.S. tax treaty

authorizes the exchange of information for tax purposes, including on an automatic basis.

(aaa) what has the government sought, or does the government plan to seek from the US, in terms of

reciprocal information sharing as a result of the FATCA or IGA negotiations, and what is the current status of

negotiations on this point;

As noted above, Canada's negotiations with the U.S. are based on the reciprocal version of the Model 1 IGA. Under

this approach, the U.S. would agree to provide Canada with enhanced and increased information on certain accounts

of Canadian residents held at U.S. financial institutions. A copy of the reciprocal version of the Model 1 IGA can be

accessed on the U.S. Treasury website at http://www.treasury.gov/resource-center/tax-

policy/treaties/Pages/FATCA. as px.

(bbb) what measures are in place to ensure that no privacy laws or policies are violated in any transfer of

information contemplated in (aaa); and

With regards to the information exchange components of an IGA, Article XXVII of the Canada-U.S. tax treaty

authorizes the exchange of information for tax purposes, including on an automatic basis. lt includes to

protect confidentiality and ensure that information is used solely for the purpose of tax administration.

(ccc) by what process(es) and on what dates will any IGA and its enacting legislation be vetted for

compliance with the (i) Constitution Act, 1867, (ii) Canadian Charter of Rights and Freedoms, (iii) Canadian

Bill of Rights?

ln respect of the Government proposing legislation to implement an IGA in Canada, the Minister of Justice is required

under section 4.1 of the Deparlment of Justice Act to examine ali government legislation introduced in or presented to

the House of Gommons by a minister of the Crown for inconsistency with the Charter of Rights and Freedoms and to

report any inonsistency to the House of Gommons.

Office of the Superintendent of Financial Institutions (OS FI)

This question is not applicable to the Office of the Superintendent of Financial Institutions.

6/6

INQUIRY OF MINISTRY

DEMANDE DE RENSEIGNEMENT AU GOUVERNEMENT

PREPARE IN ENGLISH AND FRENCI 1 M:'\RKING ''ORIGINAL TEXT" OR "TRANSLATION"

PRPARER EN ANGLAIS ET EN FRANAIS EN INDIQUANT "TEXTE ORIGINL" OU "TRADUCTION"

QUESTION NO.iNDE LA QUESTION BY 1 DE DATE

Q-121 Mr. Hsu (Kingston and the Islands)

QUESTION

Paul Calandra

PRINT NAME OF SIGNA TORY

INSCRIRE LE NOM DU SIGNATAIRE

October 25, 2013

. -- --- - . - SIGNATURE

MINISlER OR SECRETARY

MINISTRE OU.,sCRTAIRE P.t1RLEMENTAIRE

With regard to the implementation of the Foreign Account Tax Compliance Act (FATCA): (a) what steps

has Canada undertaken to complete an lnter-Governmental Agreement (IGA) with the United States; (b)

with what type of legal instrument will the government enact a FATCA implementation agreement; (c) will

the government bring an IGA before Parliament and, if so, in what form; (d) what steps are in place ta

ensure parliamentary review of an IGA; (e) what studies have been undertaken asto whether an IGA can

be implemented as an interpretation of the existing double tax treaty; - See full text of the question

attached.

REPL Y i RPONSE

ORIGINAL TEXT

TEXTE ORiGINAL

lRf,NSLATION D

TAADUCTION

With regard to the implementation of the Foreign Account Tax Compliance Act, the Privy Cou neil Office

responds that the information requested is withheld in accorda nee with the principles of the Access to

Information Act.

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Canada 150 Logos - All EntriesDocumento331 pagineCanada 150 Logos - All Entriespatrickcain100% (1)

- Affidavit of Masoud HajivandDocumento12 pagineAffidavit of Masoud HajivandpatrickcainNessuna valutazione finora

- E-Mails Sent by The Government Operations Centre About A Comprehensive Listing of All DemonstrationsDocumento105 pagineE-Mails Sent by The Government Operations Centre About A Comprehensive Listing of All DemonstrationspatrickcainNessuna valutazione finora

- FATCA Lawsuit: The Federal Government's Statement of DefenceDocumento18 pagineFATCA Lawsuit: The Federal Government's Statement of DefencepatrickcainNessuna valutazione finora

- Red Cross Reports On Canada's Immigration Detention SystemDocumento111 pagineRed Cross Reports On Canada's Immigration Detention Systempatrickcain100% (1)

- FATCA Lawsuit: Amended Statement of ClaimDocumento19 pagineFATCA Lawsuit: Amended Statement of ClaimpatrickcainNessuna valutazione finora

- Affidavit of Masoud HajivandDocumento14 pagineAffidavit of Masoud HajivandpatrickcainNessuna valutazione finora

- FATCA SubmissionsDocumento411 pagineFATCA SubmissionspatrickcainNessuna valutazione finora

- FRT Entry For The CZ858Documento3 pagineFRT Entry For The CZ858patrickcainNessuna valutazione finora

- FRT Entry For Swiss Arms FirearmsDocumento2 pagineFRT Entry For Swiss Arms FirearmspatrickcainNessuna valutazione finora

- Scanned From A Xerox Multifunction Device001Documento3 pagineScanned From A Xerox Multifunction Device001patrickcainNessuna valutazione finora

- Order Declaring An Amnesty Period (2014)Documento3 pagineOrder Declaring An Amnesty Period (2014)patrickcainNessuna valutazione finora

- ImmigrationDocumento3 pagineImmigrationpatrickcainNessuna valutazione finora

- Scanned From A Xerox Multifunction Device001Documento3 pagineScanned From A Xerox Multifunction Device001patrickcainNessuna valutazione finora

- Cover LetterDocumento3 pagineCover LetterpatrickcainNessuna valutazione finora

- Private Pardon Companies - What We KnowDocumento4 paginePrivate Pardon Companies - What We KnowpatrickcainNessuna valutazione finora

- Immigration StatisticsDocumento3 pagineImmigration StatisticspatrickcainNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Felipe C. Roque vs. Nicanor Lapuz, G.R. No. L32811, March 31, 1980Documento9 pagineFelipe C. Roque vs. Nicanor Lapuz, G.R. No. L32811, March 31, 1980Fides DamascoNessuna valutazione finora

- David M. Gurewitz/State Bar No. 76641 1Documento10 pagineDavid M. Gurewitz/State Bar No. 76641 1jmiedeckeNessuna valutazione finora

- United States v. Echevarria-Rios, 1st Cir. (2014)Documento7 pagineUnited States v. Echevarria-Rios, 1st Cir. (2014)Scribd Government DocsNessuna valutazione finora

- Heller Et Al v. Menu Foods - Document No. 12Documento2 pagineHeller Et Al v. Menu Foods - Document No. 12Justia.comNessuna valutazione finora

- Prenuptial Agreement For Mutual Respect Entered Into in - On The Date ofDocumento10 paginePrenuptial Agreement For Mutual Respect Entered Into in - On The Date ofKiaOraTorahNessuna valutazione finora

- Social DeviationDocumento10 pagineSocial DeviationAugusta Altobar100% (1)

- CCPT3 10doneDocumento2 pagineCCPT3 10doneaugustapressNessuna valutazione finora

- Restitution of Conjugal RightsDocumento13 pagineRestitution of Conjugal Rightsbijuprasad100% (2)

- Agot V RiveraDocumento3 pagineAgot V RiveraJohn CjNessuna valutazione finora

- MSJ Adelman Brief (Filed)Documento39 pagineMSJ Adelman Brief (Filed)Avi S. AdelmanNessuna valutazione finora

- MSC.1 Circ.1341Documento8 pagineMSC.1 Circ.1341Reuben LanfrancoNessuna valutazione finora

- Service Specialists v. Sherriff of ManilaDocumento3 pagineService Specialists v. Sherriff of ManilaAnjNessuna valutazione finora

- Traffic Control Equipment and Road Furniture: Lecturer Name: Pn. JevaratnamDocumento34 pagineTraffic Control Equipment and Road Furniture: Lecturer Name: Pn. JevaratnamNisa Farzana binti Mohd ZukiNessuna valutazione finora

- FUTSALDocumento4 pagineFUTSALseamajorNessuna valutazione finora

- 01 Intro To Biochem - EditDocumento5 pagine01 Intro To Biochem - EditJoanne AjosNessuna valutazione finora

- Industrial RelationDocumento9 pagineIndustrial RelationVishal KharpudeNessuna valutazione finora

- Unlawful Detainer Complaint 12.23.19Documento33 pagineUnlawful Detainer Complaint 12.23.19GeekWireNessuna valutazione finora

- Claudette Tardif v. Thomas Quinn, 545 F.2d 761, 1st Cir. (1976)Documento4 pagineClaudette Tardif v. Thomas Quinn, 545 F.2d 761, 1st Cir. (1976)Scribd Government DocsNessuna valutazione finora

- Eviction CT Bench BookDocumento53 pagineEviction CT Bench BookChicagoMTONessuna valutazione finora

- IRR Ordinance No. 483, S-2011Documento8 pagineIRR Ordinance No. 483, S-2011Michelle Ricaza-Acosta0% (1)

- Salaries and Allowances of Ministers Manipur Eleventh AmendmentDocumento3 pagineSalaries and Allowances of Ministers Manipur Eleventh AmendmentLatest Laws TeamNessuna valutazione finora

- Tax Rev CaseDocumento3 pagineTax Rev CaseMia UnabiaNessuna valutazione finora

- Federal Decree Law No 36 of 2021Documento12 pagineFederal Decree Law No 36 of 2021aleefaNessuna valutazione finora

- Commonwealth Act No 1Documento20 pagineCommonwealth Act No 1Di Ako Si SalvsNessuna valutazione finora

- College Details PDFDocumento2 pagineCollege Details PDFNanda Kumar Reddy RcNessuna valutazione finora

- Page 1 of 2Documento2 paginePage 1 of 2Cy PanganibanNessuna valutazione finora

- National Grid Corporation Vs BautistaDocumento7 pagineNational Grid Corporation Vs BautistaoabeljeanmoniqueNessuna valutazione finora

- Atty. Claire L. Jamero: Book OneDocumento66 pagineAtty. Claire L. Jamero: Book Oneedmaration 2002Nessuna valutazione finora

- Constitutional Law 2 Cases Full TextDocumento154 pagineConstitutional Law 2 Cases Full TextRascille LaranasNessuna valutazione finora

- Case Study: The Buzz' Staff Charged For Copyright InfringementDocumento4 pagineCase Study: The Buzz' Staff Charged For Copyright InfringementCamille Martinez100% (1)