Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

The Credit Hedging Agency Model Vs Credit Default Swaps

Caricato da

Jasvinder JosenTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

The Credit Hedging Agency Model Vs Credit Default Swaps

Caricato da

Jasvinder JosenCopyright:

Formati disponibili

Credit Hedging Agency vs.

Credit Default Swaps

This article appeared in The Edge on Nov 25, 2013

By Jasvin Josen Some time back in September 2013, this newspaper published a convincing case of a Credit Hedging Agency model as an alternative to Credit Default Swaps to hedge credit risk in the Malaysian credit market. This initiative would allow investors to hedge the default risk in lower rated corporate bonds and hence promote the credit market segment. In this article, I examine the Credit Hedging Agency model and discuss its suitability as an alternative to the well-established credit default swap product. Credit Hedging Agency: The potential business model The establishment of Danajamin, a Financial Guarantee Insurer was to promote the issuing of lower rated bonds, typically by small & medium enterprises (SME). The insurer guarantees payments to investors in the event of default of the bond issuer. The guarantee enhances the credit rating of the bonds to typically an investment grade type, and attracts investors to subscribe for the bonds. However the above scheme does not tackle the issue of the general lack of appetite in lower rated bonds in the Malaysian credit market. Now with a Credit Hedging Agency in place, investors who otherwise would be wary of the default risk in lower rated bonds could potentially pay a premium to the Agency as a protection against default risk. Should there be a default, the investor delivers the bond to the Agency and receives par value of the bond plus any accrued coupons. From a business model perspective, I anticipate the agencys prime income to be the premium charged for various corporate bonds default risks. The income will weigh against the contingent liability of the losses suffered from any defaulted bonds. So, very likely, a reasonable capital-to-loss ratio will be established to cover this contingent liability. The Credit Hedging Agency is said to be also involved in market marking of the bonds. As the bonds are sold from one party to another, the default risk protection may be transferred to the new party, via the Agency. Or the protection disappears should the new buyer decide not to hedge the credit risk. Credit Hedging Agency: Potential Challenges The Credit Hedging Agency can materialise in many forms. It can emerge as a single entity or it may consist of member banks. Nevertheless, there will be some interesting challenges ahead.

Pricing of the premium, which is essentially the price of the default risk of the bonds, will be a major task. In established markets, the price for a unique risk in an instrument is derived from the supply and demand for the risk in the market. For example, in equity markets, there is a liquid plain-vanilla options market where option prices are generated via supply and demand by investors. The volatility parameter is actually derived from the prices of the plain-vanilla options to price other illiquid instruments. Similarly, in the credit market, with a liquid credit default swap (CDS) market in place; default probabilities are derived from the prices of the CDS. It has been established in research studies that the CDS market gives out the most reliable default probabilities compared to the bonds market, due to its better liquidity. Without a market that trades the default risk in Malaysia, the Agency will have to theoretically derive the credit risk pricing. This measure may well expose the Agency to various open questions like the acceptability of the model used, any judgemental perimeters applied and the robustness of the pricing model. The main issue here is that the risk is priced remotely and it is not very likely to be aligned with the market. Another potential issue is defining the credit event. Would it include failure to pay coupons and restructuring events, or is it purely confined to bankruptcy events? Multiple events of defaults may further complicate the theoretical pricing of the default premium. And Credit Default Swaps (CDS)? Credit default swaps, which are over-the-counter instruments of the 1990s and early 2000s, were indeed unregulated instruments, an outcome of a few regulations in the U.S. such as the Gramm-Leach-Biley Act, 1999 that exempted regulation for certain OTC instruments like the CDS. The lack of transparency on the CDS further propelled the significant amount of leverage taken by major financial institutions that contributed to a web of inter-connectedness, which induced massive systemic risk into the financial system. However after the 2008 crisis, the CDS is being re-invented as an exchange traded product for those with common names and maturities that can be easily standardized. For the more illiquid names and structures, central clearing houses and swap execution facilities are being put in place, albeit with a number of teething issues to be tackled with.

Conclusion The proposed Credit Hedging Agency initiative is a noble move that hopes to attract investors to trade in lower rated bonds. It is not a tradable product like the CDS, but rather a hedging service with a fee. The survivability of the business model will very much depend on its default premium and volume of business. Meanwhile, we should also pay attention to the enormous effort being put in globally to make the CDS a safer and transparent product.

As a final point, perhaps we need to probe deeper to find out what exactly is the cause of such lack of appetite in subscribing and trading for lower rated bonds, in comparison to other countries. Lower rated bonds attract investors with a different risk profile, compared to higher rated bonds. These investors are willing to accept the higher coupon and take higher risk as they have higher mandate to take more risk. They could be hedge funds and even private equities, but to a large extent, this market consists of bond traders who typically buy and sell bonds for profit, like shares. They often form part of an investment bank activity and make proprietary profits for the bank. Do we have enough of these bond traders in Malaysia? In spite of everything, it is always traders that make a market, not long-term investors.

Potrebbero piacerti anche

- Quantitative Credit Portfolio Management: Practical Innovations for Measuring and Controlling Liquidity, Spread, and Issuer Concentration RiskDa EverandQuantitative Credit Portfolio Management: Practical Innovations for Measuring and Controlling Liquidity, Spread, and Issuer Concentration RiskValutazione: 3.5 su 5 stelle3.5/5 (1)

- CDSDocumento21 pagineCDSVishwanathNessuna valutazione finora

- CLO Investing: With an Emphasis on CLO Equity & BB NotesDa EverandCLO Investing: With an Emphasis on CLO Equity & BB NotesNessuna valutazione finora

- Cdo Modeling OverviewDocumento37 pagineCdo Modeling OverviewtwinbedtxNessuna valutazione finora

- Structured ProductsDocumento23 pagineStructured ProductssunnyNessuna valutazione finora

- Loan Workouts and Debt for Equity Swaps: A Framework for Successful Corporate RescuesDa EverandLoan Workouts and Debt for Equity Swaps: A Framework for Successful Corporate RescuesValutazione: 5 su 5 stelle5/5 (1)

- Converting Swap To FuturesDocumento6 pagineConverting Swap To FuturesJasvinder JosenNessuna valutazione finora

- Wikki - Derivatives TypesDocumento10 pagineWikki - Derivatives TypesSanthoshNessuna valutazione finora

- Managing Liquidity in Banks: A Top Down ApproachDa EverandManaging Liquidity in Banks: A Top Down ApproachNessuna valutazione finora

- Banking Glossary 2011Documento27 pagineBanking Glossary 2011Sahil GuptaNessuna valutazione finora

- Alternative Investment Strategies A Complete Guide - 2020 EditionDa EverandAlternative Investment Strategies A Complete Guide - 2020 EditionNessuna valutazione finora

- Interest Rate Swaps: Pre-2008 CrisisDocumento1 paginaInterest Rate Swaps: Pre-2008 CrisisJasvinder JosenNessuna valutazione finora

- SERIES 24 EXAM STUDY GUIDE 2021 + TEST BANKDa EverandSERIES 24 EXAM STUDY GUIDE 2021 + TEST BANKNessuna valutazione finora

- 26 Structured RepoDocumento4 pagine26 Structured RepoJasvinder JosenNessuna valutazione finora

- Private Equity Unchained: Strategy Insights for the Institutional InvestorDa EverandPrivate Equity Unchained: Strategy Insights for the Institutional InvestorNessuna valutazione finora

- Pricing of A CDODocumento2 paginePricing of A CDOJasvinder Josen100% (1)

- Investing in Credit Hedge Funds: An In-Depth Guide to Building Your Portfolio and Profiting from the Credit MarketDa EverandInvesting in Credit Hedge Funds: An In-Depth Guide to Building Your Portfolio and Profiting from the Credit MarketNessuna valutazione finora

- JPM - Abs-Cdo 2009-09-25Documento95 pagineJPM - Abs-Cdo 2009-09-25Ryan JinNessuna valutazione finora

- Credit Derivatives: An Overview: David MengleDocumento24 pagineCredit Derivatives: An Overview: David MengleMonica HoffmanNessuna valutazione finora

- CDO Valuation: Term Structure, Tranche Structure, and Loss DistributionsDocumento26 pagineCDO Valuation: Term Structure, Tranche Structure, and Loss DistributionsSimran AroraNessuna valutazione finora

- Single Name Credit DerivativesDocumento32 pagineSingle Name Credit DerivativesapluNessuna valutazione finora

- Note On Credit Credit Analysis ProcessDocumento26 pagineNote On Credit Credit Analysis Processaankur aaggarwalNessuna valutazione finora

- A Primer On Whole Business SecuritizationDocumento13 pagineA Primer On Whole Business SecuritizationSam TickerNessuna valutazione finora

- Wholesale BankingDocumento3 pagineWholesale BankingAshutosh Saraiya0% (1)

- A.I.G.'s Lawsuit Against Bank of AmericaDocumento193 pagineA.I.G.'s Lawsuit Against Bank of AmericaDealBook100% (2)

- Fabozzi CH 32 CDS HW AnswersDocumento19 pagineFabozzi CH 32 CDS HW AnswersTrish Jumbo100% (1)

- CMBS 101 Slides (All Sessions)Documento41 pagineCMBS 101 Slides (All Sessions)Ken KimNessuna valutazione finora

- Chapter 1 - OverviewDocumento9 pagineChapter 1 - OverviewC12AYNessuna valutazione finora

- Inside Job VocabularyDocumento2 pagineInside Job VocabularyJenny Hong0% (1)

- Bloomberg Credit Default Swap Cheat SheetDocumento1 paginaBloomberg Credit Default Swap Cheat Sheetmodulus97Nessuna valutazione finora

- Chapter 1 - Investments: Background and IssuesDocumento61 pagineChapter 1 - Investments: Background and IssuesMadhan RajNessuna valutazione finora

- SEC v. Goldman Sachs & Co - Summary of ComplaintDocumento2 pagineSEC v. Goldman Sachs & Co - Summary of ComplaintGeorge ConkNessuna valutazione finora

- Lehman ARM IndexDocumento19 pagineLehman ARM IndexzdfgbsfdzcgbvdfcNessuna valutazione finora

- Minibond Series 35Documento58 pagineMinibond Series 35Ben JoneNessuna valutazione finora

- CMB S Borrower GuideDocumento14 pagineCMB S Borrower Guideboobravi85Nessuna valutazione finora

- Collateralized Debt Obligation: Rahul Krishna M Roll No:159 PGDM-FinanceDocumento25 pagineCollateralized Debt Obligation: Rahul Krishna M Roll No:159 PGDM-FinanceRahul KrishnaNessuna valutazione finora

- Types of CDOsDocumento9 pagineTypes of CDOsKeval ShahNessuna valutazione finora

- Bosphorus CLO II Designated Activity CompanyDocumento18 pagineBosphorus CLO II Designated Activity Companyeimg20041333Nessuna valutazione finora

- in The Sequential Tranche Paydown Structure, ForDocumento60 paginein The Sequential Tranche Paydown Structure, ForRimpy SondhNessuna valutazione finora

- CLO Default PricingDocumento96 pagineCLO Default Pricingprimus_interpares01Nessuna valutazione finora

- Hedge Fund Risk Management: September 2009Documento18 pagineHedge Fund Risk Management: September 2009Alan LaubschNessuna valutazione finora

- Collateralized Mortgage Obligations: An Introduction To Sequentials, Pacs, Tacs, and VadmsDocumento5 pagineCollateralized Mortgage Obligations: An Introduction To Sequentials, Pacs, Tacs, and Vadmsddelis77Nessuna valutazione finora

- Lehman Brothers ABS Credit Default Swaps - A Primer - December 9, 2005Documento21 pagineLehman Brothers ABS Credit Default Swaps - A Primer - December 9, 2005AC123123Nessuna valutazione finora

- High Yield Bond MarketDocumento6 pagineHigh Yield Bond MarketYash RajgarhiaNessuna valutazione finora

- Aladdin Synthetic CDO II, Offering MemorandumDocumento216 pagineAladdin Synthetic CDO II, Offering Memorandumthe_akinitiNessuna valutazione finora

- The Aig Backdoor Bailout: But A Bailout of Whom?Documento6 pagineThe Aig Backdoor Bailout: But A Bailout of Whom?arnejkrNessuna valutazione finora

- Securitisation Primer and Analysis of A Financial Technique: Andrea Durante November 2010Documento25 pagineSecuritisation Primer and Analysis of A Financial Technique: Andrea Durante November 2010Emmanuele Orospies SpadaroNessuna valutazione finora

- Greenwich Capital CMBS 2006 & Outlook For 2007Documento43 pagineGreenwich Capital CMBS 2006 & Outlook For 2007bvaheyNessuna valutazione finora

- LemonsAndCDOsWhyDidSoManyLenders PreviewDocumento68 pagineLemonsAndCDOsWhyDidSoManyLenders PreviewkunalwarwickNessuna valutazione finora

- SFA CLO White Paper PrimerDocumento20 pagineSFA CLO White Paper PrimerAditya DeshpandeNessuna valutazione finora

- B Pension Risk TransferDocumento7 pagineB Pension Risk TransferMikhail FrancisNessuna valutazione finora

- Recession Is A Contraction Phase of The Business Cycle, or "A Period of ReducedDocumento21 pagineRecession Is A Contraction Phase of The Business Cycle, or "A Period of Reducedmayank04Nessuna valutazione finora

- Cds BloombergDocumento30 pagineCds BloombergSharad Dutta100% (1)

- Case Write Up Sample 2Documento4 pagineCase Write Up Sample 2veda20Nessuna valutazione finora

- Thesis Credit Default SwapsDocumento7 pagineThesis Credit Default Swapsjessicaoatisneworleans100% (2)

- Credit Default Swaps and GFC-C2D2Documento5 pagineCredit Default Swaps and GFC-C2D2michnhiNessuna valutazione finora

- Dissertation On Credit Default SwapDocumento6 pagineDissertation On Credit Default SwapBuyingPaperCanada100% (1)

- Credit Default SwapsDocumento18 pagineCredit Default SwapsBhawin PatelNessuna valutazione finora

- Pricing Convertible SecuritiesDocumento1 paginaPricing Convertible SecuritiesJasvinder JosenNessuna valutazione finora

- 26 Structured RepoDocumento4 pagine26 Structured RepoJasvinder JosenNessuna valutazione finora

- Delta One: What Does It Do?Documento1 paginaDelta One: What Does It Do?Jasvinder JosenNessuna valutazione finora

- Interest Rate Swaps: Pre-2008 CrisisDocumento1 paginaInterest Rate Swaps: Pre-2008 CrisisJasvinder JosenNessuna valutazione finora

- Auditing Derivatives: Middle Office (Valuation)Documento4 pagineAuditing Derivatives: Middle Office (Valuation)Jasvinder JosenNessuna valutazione finora

- Audit Derivatives: Product Control - Think of What Can Go WrongDocumento3 pagineAudit Derivatives: Product Control - Think of What Can Go WrongJasvinder JosenNessuna valutazione finora

- Sovereign Bonds - The FundamentalsDocumento1 paginaSovereign Bonds - The FundamentalsJasvinder JosenNessuna valutazione finora

- The Crash of 2:45 - An AutopsyDocumento5 pagineThe Crash of 2:45 - An AutopsyJasvinder JosenNessuna valutazione finora

- CBBC or Turbos - Pricing and RiskDocumento5 pagineCBBC or Turbos - Pricing and RiskJasvinder JosenNessuna valutazione finora

- Auditing Derivatives - Think of What Can Go Wrong: Trading FloorDocumento3 pagineAuditing Derivatives - Think of What Can Go Wrong: Trading FloorJasvinder JosenNessuna valutazione finora

- The Rehabilitation of The CDSDocumento3 pagineThe Rehabilitation of The CDSJasvinder JosenNessuna valutazione finora

- Derivatives in Court: "Collared" Interest Rate SwapsDocumento4 pagineDerivatives in Court: "Collared" Interest Rate SwapsJasvinder JosenNessuna valutazione finora

- CBBC or Turbo Warrants - Knowing The ProductDocumento5 pagineCBBC or Turbo Warrants - Knowing The ProductJasvinder JosenNessuna valutazione finora

- Callable Bull and Bear Certificates - An Evolution of Exotic OptionsDocumento3 pagineCallable Bull and Bear Certificates - An Evolution of Exotic OptionsJasvinder JosenNessuna valutazione finora

- D3.12 - SYNER-G Fragility Curves For All Elements at RiskDocumento145 pagineD3.12 - SYNER-G Fragility Curves For All Elements at RiskMohammad AL HaririNessuna valutazione finora

- Quiz 2 - Attempt Review (Keandalan 100)Documento3 pagineQuiz 2 - Attempt Review (Keandalan 100)Yosua Petra HattuNessuna valutazione finora

- 86Documento102 pagine86Brianna LawleyNessuna valutazione finora

- Urban Ecology and Urban Ecosystems, Understanding The Links To Human Health and Well BeingDocumento8 pagineUrban Ecology and Urban Ecosystems, Understanding The Links To Human Health and Well BeingSofía I. Morales NavarroNessuna valutazione finora

- Adverse Selection and Moral Hazard in Micro Health InsuranceDocumento24 pagineAdverse Selection and Moral Hazard in Micro Health InsuranceHarish SihareNessuna valutazione finora

- Construction Report 1Documento15 pagineConstruction Report 1Faroo wazir78% (9)

- Portfolio Management ServicesDocumento83 paginePortfolio Management Servicesragipanidinesh6206Nessuna valutazione finora

- Long-Lasting Effects of Distrust in Government and Science On Mental Health Eight Years After The Fukushima Nuclear Power Plant DisasterDocumento6 pagineLong-Lasting Effects of Distrust in Government and Science On Mental Health Eight Years After The Fukushima Nuclear Power Plant DisasterIkhtiarNessuna valutazione finora

- Article SafewinchDocumento5 pagineArticle SafewinchPietGebruikerNessuna valutazione finora

- 15142800Documento16 pagine15142800Sanjeev PradhanNessuna valutazione finora

- Unit IA - Course Exercise & AssignmentDocumento77 pagineUnit IA - Course Exercise & AssignmentChandra Kumar100% (1)

- PT XXXX Yyyyyy ZZZZZZZZ Form Penilaian Resiko: H&S RepresentativeDocumento1 paginaPT XXXX Yyyyyy ZZZZZZZZ Form Penilaian Resiko: H&S RepresentativeRifqi Thefandika RisandyNessuna valutazione finora

- Project Workbook: Student EditionDocumento54 pagineProject Workbook: Student EditionAdil Er-rami0% (1)

- Melcs 4th Quarter TleDocumento1 paginaMelcs 4th Quarter TleJonRey GaricaNessuna valutazione finora

- Nist Small Business Fundamentals July 2019Documento48 pagineNist Small Business Fundamentals July 2019maria.procopovici.contractorNessuna valutazione finora

- Healthcare Quick Guide To Expiration Date ManagementDocumento11 pagineHealthcare Quick Guide To Expiration Date ManagementMohamed KhaledNessuna valutazione finora

- Dirty Little Secrets - Sharon Drew MorganDocumento272 pagineDirty Little Secrets - Sharon Drew MorganIan Goldsmid100% (4)

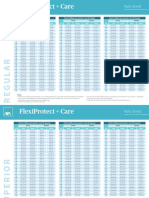

- Flexi+Care Rate SheetDocumento3 pagineFlexi+Care Rate SheetNeil MijaresNessuna valutazione finora

- Deloitte and Chronicle Future of The SOC-Skills Before TiersDocumento11 pagineDeloitte and Chronicle Future of The SOC-Skills Before TiersJ Manuel BuenoNessuna valutazione finora

- IATG01.80-Formulae For Ammunition Management (v.1)Documento23 pagineIATG01.80-Formulae For Ammunition Management (v.1)Ahmed Arafa0% (1)

- Unit-2-Role and Responsibilities of A Software Project ManagerDocumento16 pagineUnit-2-Role and Responsibilities of A Software Project ManagerMallari SudhaNessuna valutazione finora

- IOSH Managing Safely Training SyllabusDocumento1 paginaIOSH Managing Safely Training SyllabusIrfan AhmedNessuna valutazione finora

- India's First Investor Education Initiative: Chapter Five: Equity BasicsDocumento3 pagineIndia's First Investor Education Initiative: Chapter Five: Equity BasicsSagar BodkheNessuna valutazione finora

- Management TeamDocumento39 pagineManagement TeamHatem FaragNessuna valutazione finora

- Building Risk AssessmentDocumento6 pagineBuilding Risk AssessmentSubhradip BhattacharjeeNessuna valutazione finora

- NCPDocumento2 pagineNCPVince John SevillaNessuna valutazione finora

- Practical Solution To Decision MakingDocumento16 paginePractical Solution To Decision MakingChun KedNessuna valutazione finora

- 57R-09 Aace PDFDocumento24 pagine57R-09 Aace PDFmirakulNessuna valutazione finora

- Effects of Divorce On ChildrenDocumento27 pagineEffects of Divorce On ChildrenKate20100% (3)

- APCC PUB - Professional Indemnity Insurance GuidelinesDocumento14 pagineAPCC PUB - Professional Indemnity Insurance GuidelinesSrinivasa MadhusudhanaNessuna valutazione finora

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNDa Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNValutazione: 4.5 su 5 stelle4.5/5 (3)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisDa EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisValutazione: 5 su 5 stelle5/5 (6)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaDa EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaValutazione: 3.5 su 5 stelle3.5/5 (8)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaDa EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaValutazione: 4.5 su 5 stelle4.5/5 (14)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successDa EverandReady, Set, Growth hack:: A beginners guide to growth hacking successValutazione: 4.5 su 5 stelle4.5/5 (93)

- An easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyDa EverandAn easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyValutazione: 3 su 5 stelle3/5 (1)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamDa EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamNessuna valutazione finora

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthDa EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthValutazione: 4 su 5 stelle4/5 (20)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialDa EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNessuna valutazione finora

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingDa EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingValutazione: 4.5 su 5 stelle4.5/5 (17)

- Built, Not Born: A Self-Made Billionaire's No-Nonsense Guide for EntrepreneursDa EverandBuilt, Not Born: A Self-Made Billionaire's No-Nonsense Guide for EntrepreneursValutazione: 5 su 5 stelle5/5 (13)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialDa EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialValutazione: 4.5 su 5 stelle4.5/5 (32)

- Creating Shareholder Value: A Guide For Managers And InvestorsDa EverandCreating Shareholder Value: A Guide For Managers And InvestorsValutazione: 4.5 su 5 stelle4.5/5 (8)

- The Merger & Acquisition Leader's Playbook: A Practical Guide to Integrating Organizations, Executing Strategy, and Driving New Growth after M&A or Private Equity DealsDa EverandThe Merger & Acquisition Leader's Playbook: A Practical Guide to Integrating Organizations, Executing Strategy, and Driving New Growth after M&A or Private Equity DealsNessuna valutazione finora

- Product-Led Growth: How to Build a Product That Sells ItselfDa EverandProduct-Led Growth: How to Build a Product That Sells ItselfValutazione: 5 su 5 stelle5/5 (1)

- Mastering the VC Game: A Venture Capital Insider Reveals How to Get from Start-up to IPO on Your TermsDa EverandMastering the VC Game: A Venture Capital Insider Reveals How to Get from Start-up to IPO on Your TermsValutazione: 4.5 su 5 stelle4.5/5 (21)

- Value: The Four Cornerstones of Corporate FinanceDa EverandValue: The Four Cornerstones of Corporate FinanceValutazione: 4.5 su 5 stelle4.5/5 (18)

- Valley Girls: Lessons From Female Founders in the Silicon Valley and BeyondDa EverandValley Girls: Lessons From Female Founders in the Silicon Valley and BeyondNessuna valutazione finora

- Mind over Money: The Psychology of Money and How to Use It BetterDa EverandMind over Money: The Psychology of Money and How to Use It BetterValutazione: 4 su 5 stelle4/5 (24)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursDa EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursValutazione: 4.5 su 5 stelle4.5/5 (8)

- Finance Secrets of Billion-Dollar Entrepreneurs: Venture Finance Without Venture Capital (Capital Productivity, Business Start Up, Entrepreneurship, Financial Accounting)Da EverandFinance Secrets of Billion-Dollar Entrepreneurs: Venture Finance Without Venture Capital (Capital Productivity, Business Start Up, Entrepreneurship, Financial Accounting)Valutazione: 4 su 5 stelle4/5 (5)

- Buffett's 2-Step Stock Market Strategy: Know When To Buy A Stock, Become A Millionaire, Get The Highest ReturnsDa EverandBuffett's 2-Step Stock Market Strategy: Know When To Buy A Stock, Become A Millionaire, Get The Highest ReturnsValutazione: 5 su 5 stelle5/5 (1)

- The Value of a Whale: On the Illusions of Green CapitalismDa EverandThe Value of a Whale: On the Illusions of Green CapitalismValutazione: 5 su 5 stelle5/5 (2)