Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Section 3: Monitor and Control Finances: Report On Budget and Expenditure in Accordance With Organisational Protocols

Caricato da

viviopiaTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Section 3: Monitor and Control Finances: Report On Budget and Expenditure in Accordance With Organisational Protocols

Caricato da

viviopiaCopyright:

Formati disponibili

Section 3: Monitor and control finances

Implement processes to monitor actual expenditure and to control costs across the work team

3.2

Monitor expenditure and costs on an agreed cyclical basis to identify cost variations and expenditure overruns

Implement, monitor and modify contingency plans as required to maintain financial objectives

3.4

Report on budget and expenditure in accordance with organisational protocols

3.1 Implement processes to monitor actual expenditure and to control costs

across the work team

3.2 Monitor expenditure and costs on an agreed cyclical asis to identify cost

!ariations and expenditure o!erruns

3.3 Implement" monitor and modify contingency plans as re#uired to maintain

financial o $ecti!es

3.4 Report on udget and expenditure in accordance with organisational protocols

Monitoring and controlling finances %ontrols Up-to-date and complete record keeping provides a mechanism to maintain and introduce effective internal controls Monitoring and e!aluation !he organisation"s financial records are used to determine to what extent business operations are meeting expectations #perational and marketing strategies, and performance standards should be constantly monitored to determine how well they are impacting on the organisation"s financial objectives $here necessary the financial plan should be adjusted to make allowance for changes in the internal or external environment &hat udgets" records and reports contri ute to the monitoring and e!aluation function' %ash flow udgets %ash flow budgets and reports are vital for all businesses $hen planning business activities the budget is one of the primary tools used !here are various types of budgets &owever, the first step in planning, in most instances, is to construct a sales forecast !his indicates the organisation's projected income over the budgeting period (rom the projected sales figures you can construct a cash flow budget ) a comparison of the inflows and outflows in the organisation -to determine how much cash the organisation will have at specific periods of time during the year, and how much of your incoming monies can be allocated to other budgets * + month cash flow budget minimises uncertainty and predicts future events early enough to tae corrective action if needed !hen again, if you"re applying for a loan, you may need to create a cash flow budget that extends for several years into the future, as part of the application process !he primary use of a cash flow budget is to predict the businesses ability to take in more cash than it pays out indicating the businesses ability to create the resources necessary for expansion It can also predict cash flow gaps , periods when cash outflows exceed cash inflows when combined with cash reserves ) so that steps can be taken to ensure that the gaps are closed, or at least narrowed !hese steps might includelowering inventory investments lowering investments in accounts receivable looking for outside sources of cash, such as a short-term loan, to fill the cash flow gaps

(ow cash flow works %ash flow is the movement of money in and out of a business ) the process through which the business uses cash to generate services or goods for sale to customers, collects the cash from the sales, and then completes this cycle all over again .nalyse the businesses previous year's sales amounts -income (actor in answers to the following questions- &ow much did you sell last year, at what periods during the year/ &ow much will you sell in the upcoming year/ $hat seasonal fluctuations or trends or other variables are likely to affect your sales/ $hat are your expectations for the upcoming year/ !he following figures, for a retail sports business, represent the first + months' figures for last year !hey can be used to predict the next years' sales for that period 0ast 1ear 2anuary (ebruary March *pril May 2une 345,666 345,766 384,766 385,566 399,966 39:,+66

1ou might expect, for instance, sales to be 4 percent higher in the off season and 4 7 percent higher during the peak period; which begins in *pril <rojections 2anuary (ebruary March *pril May 2une 345,456 345,+57 384,:47 396,455 399,+99 39:,5:+

!o project cash inflows you will need to factor in forecast changes ) to the internal workforce =higher staffing capacity, new machinery, training or other factors that might increase productivity>, plus any

costs of goods sold operating expenses debt payments major purchases putting together the projected cash In its basic form, the completed cash flow budget combines the following information on a month-bymonth basisBeginning Cash Balance ? <rojected %ash Inflows -<rojected %ash #utflows = Your Cash Flow Bottom Line (the ending cash balance) #bviously a cash flow budget will include more detail than is listed above &owever, the basic form of the cash flow budget will always remain the same

* positive cash flow bottom line indicates your business has a cash surplus at the end of the month * negative cash flow bottom line indicates that your line indicates that your business has run into a cash flow gap , a period where cash outflow exceeds cash inflow when combined with your beginning cash balance %ash outflows and inflows rarely, if ever, occur at the same time More often than not, cash inflows lag behind cash outflows, leaving the business short of money on occasion !his cash flow gap represents an excessive outflow of cash that might not be covered by an inflow for weeks, months, or even years *ny business, small or large, may experience a cash flow gap from time to time , it does not necessarily mean the business is in financial trouble @egative cash flow gaps are often filled by external financing sources Aevolving lines of credit, bank loans, and trade credit are just a few of the external financing options available * cash surplus is the cash that exceeds the cash required for day-to-day operations &andling cash surplus effectively is just as important as the management of money into and out of the cash flow cycle Identification of excess funds allows management to assess new profit-making opportunities or to invest in additional resources with the aim of expansion *lternately cash surplus can be used to pay down debts )e tors <reparing cash flow statements regularly, as well as creditor and debtor reports, will assist with improving cash flow !he business needs to know when debts fall due and should follow up overdue payments <oor management of debtors will have a greater impact on some businesses under the BC! as the business might be funding BC! payments to the tax office before the tax has been collected *ccounting records can also be used to calculate gross margins on product lines to determine which products contribute the most to the bottom line and which are under performing Bross margin is calculated by taking cost of goods sold from sales %omparing a product line"s gross margin to budgeted and previous figures will inform the business how the product is performing Dudgeted balance sheets display comparative estimates for a budgeted period !he current balance sheet, at the end of a selected period, compared with that of another similar period =usually 48 months> !his report also includes non-cash items, such as estimated provision and depreciation for income tax #nce the actual results are known, a report is evaluated and prepared to identify if significant differences have occurred Management evaluate the budgeted balance sheet to make sure it reflects a sufficiently strong financial position * capital expenditure budget addresses an organisation"s long-term capital requirements, or the purchase strategy for facilities and equipment required for it to meet its long-term objectives Most organisations prepare long-term capital expenditure budgets for periods of 7 or more years !he general ledger displays account balances at the beginning of a period, the total debits and credits, and the balance at the end of the period !he product activity report displays every transaction assigned to a specific product line or product within a specified period * sales analysis reportEbudget report displays cost of sales, sales revenue, gross profit, units sold, average cost and percentage margin within a selected period It compares this year"s sales with the figures for the same period last year !his could also be produced in a spreadsheet format !he sales budget is prepared =as we have already seen> from the sales forecast !he sales budget provides the information required to prepare the cash receipts part of the cash budget Fariance analysis reports compare the current actual profitE cost statement or cash flow with the budgeted profitE cost figures Unless this is done, serious shortfalls or problems may not be identified in sufficient time to take appropriate action (or example, tightening of cash flow, clearing up debtors etc

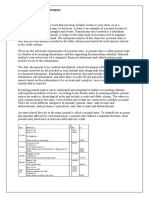

!here are other expenditure and cost reporting procedures that can be useful to an organisation (or instance, it might be useful to report on the cost of items or products made in your organisation, or in your division of the organisation ) particularly if you work in a manufacturing business If your organisation offers only one product or service, you can easily calculate the cost per unit by dividing all =direct and indirect> costs associated with operating the business by the total output Most businesses, however, offer more than one product or service !he unit cost of each is assessed by allocating particular costs or proportions of costs against each product or service (or instance, a company producing photograph albums could allocate unit costs as illustrated*nit costs

!he percentage cost of total indirect cost is calculated based on the total labour cost to produce each album &ow the organisation chooses to allocate the costs depends on the service or product and the nature of the business (rom the unit cost a breakeven analysis can be conducted !he expenditure and revenue reportE budget forecasts sales and expenses over a defined period, such as 48 months Most of the other budgets produced within an organisation will draw on this budget, as it determines the number of people employed, level of raw materials stock, rent, leases, and so on +reparation of a re!enue udget: should examine past sales trends carefully should take account of what is happening in the particular market, is it growing, stable or declining should take account of what is happening in the economy especially if sales are sensitive to economic conditions as they are in industries like building, tourism, housing and entertainment must involve those directly responsible such as sales representatives and sales management Dreakeven analysis works out how many units must be sold to cover indirect and direct cost combined It aids in setting goals or targets, while providing a record of costs and indicator of the point when revenue =unit cost multiplied by the number of units sold> generated from sales equals total costs =indirect costs plus direct costs> to produce the productE service

!o accurately determine the breakeven point and present it as a report, you will need to find the following informationthe direct costs involved with productionE provision of the product the cost to produce each unit =unit cost> the indirect costs incurred to operate the organisation =or proportion disbursed to a particular cost centre> !he breakeven point is the point where the organisation is not losing money and not making money either It is good to know where this point is and how much of every dollar above that amount is profit !hree terms must be defined and calculated 4 (ixed %osts which are the costs that do not change whether sales go up or not -they do not vary in the medium to short term If the level of production varies, fixed costs must be paid, regardless of production levels !hese are, therefore, costs that would still need to be paid even if production was shut down (or example, building rental is a fixed cost =as well as being an indirect cost>, as buildings are rented for a fixed period and the rental must be paid regardless of whether the building is occupied or not Come other examples are; basic utilities, salariesE labour, car payments, memberships, equipment and lease payments, etc 8 Fariable %osts which are the costs that rise and fall depending on your sales Come examples are; the cost of the product sold, packaging, transportation, manufacturing costs, marketing, labour, etc Girect and indirect costs can be either variable or fixed $hen you are looking at direct and indirect costs, you need to consider which of these =or which components of these> are fixed and which are variable, so that you can accurately record them in your financial reports, particularly the %ost of Boods Cold report 9 !he Fariable %ost <ercent per Unit of Cales *dd up all the variable costs involved for each sale Givide the variable cost per sale by the average sales price !he result is the Fariable %ost <ercent per Unit

!he formula is as follows(ixed %ost divided by =4-Fariable %ost <ercent <er Unit> !he result is the number of units you must sell to breakeven !o determine the dollar amount, multiply by the average amount of each sale (or example- (ixed costs are 3:66 per month Fariable costs are 37 per sale !he average sale is 346 !herefore, the Fariable %ost percentage per unit is 37H346 I 76J !he breakeven point is 3:66H=4-76J> I 3:66E76J I 34,K66 1ou will need to have 34,K66 in sales to break even It also tells you that for every dollar in sales over 34,K66, you will make 76J of it in profit +rofit and loss reports <rofit and loss reports show the gross and net profitsE losses for a reporting period in accordance with organisational policy and procedures and accounting requirements (inal general ledger accounts reflect the future viability of any commercial company and must be compiled with the utmost care and attention (or example, if a business buys a part for 3+6 66 then sells it for 3876 66 a profit of 3456 66 has been achieved !his is a correct assumption if a gross profit figure =with no costs calculated> is required &owever, for any business transaction there will be both direct and indirect costs associated Indirect costs will includewages stationery electricity rent vehicle costs telephone etc !he compilation of a <rofit and 0oss report can include these costs but even then might not show a true representation of the profitEloss for the required period, because not all of the expenses apply directly to the accounting period in which they have been accounted (or example, gas rates could be paid and accounted for in the month of 2une, but the actual gas used was for the previous 9 months.

Many organisations identify their operational costs by using electronic spreadsheets or computer accounting systems which are fast, accurate and efficient If the organisation operates a computer accountingE costing system, it can readily access cost figures from the appropriate personEdepartment Defore you can cost products or services effectively, analysis of the following costs is requiredlabour =including all salaries and on-costs> equipmentEproject materialEstock overheads =such as payroll, leasesE vehicles, rent, telephone, etc> Girect costs are those that are directly incurred to deliver a product or service Girect cost, readily identified as belonging to the end product, include most labour, plant and equipment, materials or stock, and travel or freight costs Girect labour costs are all the costs of employing every person directly involved in producing the product or service within your organisation, and includegross salary workers compensation insurance Cuperannuation Buarantee charge leave loading long service leave *dministrative support staff who are not directly involved in the production process or service delivery are identified as indirect costs !he following costs can also come under the heading of overheadsCuperannuation leaveE holidays =annual and public> workers compensation leave loading sick pay Lxpenses, the cost of doing business, include both the costs directly attributed to productE service production and general operating expenses (or accounting purposes, gross sales are the total dollar amount of sales &owever, in the course of normal business, items may be returnedErefunded andEor cash discounts may be offered to customers who pay early etc !hus a net sales figure is returned once all cash discounts, refunds and other allowances are deducted from the gross sales Most businesses calculate a cost =as a percentage> that they can use to calculate the real profits 1our enterprise will have a percentage figure for this calculation; such as 46J !he example that gave our profit of 3446 66 is, therefore decreased by 46JI355 66 !he overhead percentage of 46J is not intended to be a realistic indication of the overhead percentage in any business !he overhead percentage is a variable that must be calculated for each individual concern * <rofit and 0oss report will give a better representation of the business when taken over as long a period as possible @ote- It is not possible to make a profit or a loss on BC!, therefore BC! figures should not be shown on a <rofit and 0oss report

@ot all <rofit and 0oss sheets will have the same format; they might, for instance, show percentages rather than dollar figures 1our enterprise will have guidelines for formatting and printing profit and loss reports Aatio analysis is the analysis of performance through comparisons or ratios, and is important in business decision making Aatio analysis provides a means of comparing performance and examining trends to other firms in the industry %ommonly used ratios include liquidity ratio =cash assetsE cash liabilities>, average debtors =trade debtorsE average daily credit sales> and inventory turnover =cost of goods soldE average inventory> Aatios are not just a device used by accountants, but a useful tool that identifies strengths and weaknesses of a business and leads to questions about performance that should result in action Aatios can also be used to set performance targets (or example, a business seeking to improve its cash flow position may do so by setting targets to reduce average debtors andEor inventory turnover Understanding the relationship between their impact on cash flow and these items, gives greater control over the business and the ability to clearly communicate performance objectives

Potrebbero piacerti anche

- Business Plan Financial ProjectionsDocumento5 pagineBusiness Plan Financial ProjectionsPrem Singh Dhankhar100% (1)

- Understanding Financial Statements (Review and Analysis of Straub's Book)Da EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Valutazione: 5 su 5 stelle5/5 (5)

- ELM-555-RS-Instructional Strategies ChartDocumento3 pagineELM-555-RS-Instructional Strategies ChartChevron McDonald0% (1)

- BSBFIM601 Manage FinancesDocumento7 pagineBSBFIM601 Manage FinancesLiu ElaineNessuna valutazione finora

- The Financial Plan: Serjoe Orven Gutierrez - Mmed ReporterDocumento41 pagineThe Financial Plan: Serjoe Orven Gutierrez - Mmed ReporterSerjoe GutierrezNessuna valutazione finora

- Masan Group CorporationDocumento31 pagineMasan Group Corporationhồ nam longNessuna valutazione finora

- Projected Cash Flow StatementDocumento6 pagineProjected Cash Flow StatementIqtadar AliNessuna valutazione finora

- How To Write A Financial PlanDocumento6 pagineHow To Write A Financial PlanGokul SoodNessuna valutazione finora

- Lecture 2728 Prospective Analysis Process of Projecting Income Statement Balance SheetDocumento36 pagineLecture 2728 Prospective Analysis Process of Projecting Income Statement Balance SheetRahul GautamNessuna valutazione finora

- SHS Business Finance Chapter 3Documento17 pagineSHS Business Finance Chapter 3Ji BaltazarNessuna valutazione finora

- Financial Appraisals 12-1-2012Documento5 pagineFinancial Appraisals 12-1-2012Muhammad ShakirNessuna valutazione finora

- Financial Plan PerbisDocumento9 pagineFinancial Plan PerbisDamas Pandya JanottamaNessuna valutazione finora

- Financial PlanDocumento20 pagineFinancial PlanHarold FilomenoNessuna valutazione finora

- The Full Business Plan: Strategy and StructureDocumento4 pagineThe Full Business Plan: Strategy and StructureIya MendozaNessuna valutazione finora

- Writing The Business PlanDocumento8 pagineWriting The Business PlanIngrid Yaneth SalamancaNessuna valutazione finora

- Matriculation NoDocumento12 pagineMatriculation NokerttanaNessuna valutazione finora

- How To Forecast Financial StatementsDocumento8 pagineHow To Forecast Financial StatementsHsin Wua ChiNessuna valutazione finora

- Matriculation NoDocumento13 pagineMatriculation NoKetz NKNessuna valutazione finora

- Understanding Profitability: Dhof@iastate - EduDocumento56 pagineUnderstanding Profitability: Dhof@iastate - EduLeilanie Felicita GrandeNessuna valutazione finora

- Assign 1 Audit AssuranceDocumento5 pagineAssign 1 Audit AssuranceAyesha HamidNessuna valutazione finora

- BudgetingDocumento9 pagineBudgetingGAMBOA, LIEZEL G.Nessuna valutazione finora

- Cash Flow Statement 1Documento5 pagineCash Flow Statement 1furqanNessuna valutazione finora

- Wa0023Documento10 pagineWa0023Akriti KapoorNessuna valutazione finora

- Financial Planning and ForecastingDocumento12 pagineFinancial Planning and ForecastingMahesh SatapathyNessuna valutazione finora

- Flash Reports DefinitionDocumento8 pagineFlash Reports Definitionca_rudraNessuna valutazione finora

- Financial PlanningDocumento7 pagineFinancial PlanningJabid Al BasherNessuna valutazione finora

- Methods of Financial ForecastingDocumento2 pagineMethods of Financial ForecastingCristine TondoNessuna valutazione finora

- Cash Budget (FM 2024)Documento13 pagineCash Budget (FM 2024)jescataryNessuna valutazione finora

- Cash Budget PDFDocumento13 pagineCash Budget PDFsaran_1650% (2)

- TaxDocumento10 pagineTaxNur Athirah Binti MahdirNessuna valutazione finora

- Financial Accounting & AnalysisDocumento5 pagineFinancial Accounting & AnalysisSourav SaraswatNessuna valutazione finora

- Financial Planning and AnalysisDocumento2 pagineFinancial Planning and AnalysisleslieNessuna valutazione finora

- Chapter-2 Intainship ProjectDocumento8 pagineChapter-2 Intainship ProjectAP GREEN ENERGY CORPORATION LIMITEDNessuna valutazione finora

- Basic of CostingDocumento15 pagineBasic of CostingAmit JaiswatNessuna valutazione finora

- Managing The Finances of The Enterprise What Is Finance? People Seem To Either Love or Hate Finance, But The Fact IsDocumento8 pagineManaging The Finances of The Enterprise What Is Finance? People Seem To Either Love or Hate Finance, But The Fact IsDavy RoseNessuna valutazione finora

- Doing Financial ProjectionsDocumento6 pagineDoing Financial ProjectionsJitendra Nagvekar50% (2)

- Fabm 2Documento170 pagineFabm 2Asti GumacaNessuna valutazione finora

- How To Make A Financial Statement For Small BusinessDocumento6 pagineHow To Make A Financial Statement For Small BusinessAaron MushunjeNessuna valutazione finora

- Financial Forecasting 1Documento44 pagineFinancial Forecasting 1ABOOBAKKERNessuna valutazione finora

- Fiscal Management WF Dr. Emerita R. Alias Edgar Roy M. Curammeng Financial Forecasting, Corporate Planning and BudgetingDocumento10 pagineFiscal Management WF Dr. Emerita R. Alias Edgar Roy M. Curammeng Financial Forecasting, Corporate Planning and BudgetingJeannelyn CondeNessuna valutazione finora

- Assess BSBFIM601 AustraliaDocumento16 pagineAssess BSBFIM601 Australiasfh5pfxv4fNessuna valutazione finora

- Arashpreet Kaur (A00114492) Ramanjeet Kaur (A00114494) Amandeep Singh (A00111934) Simranbir Singh (A00114610) Submitted To - Prof. Kevork TekazaryanDocumento6 pagineArashpreet Kaur (A00114492) Ramanjeet Kaur (A00114494) Amandeep Singh (A00111934) Simranbir Singh (A00114610) Submitted To - Prof. Kevork TekazaryanArashpreet KaurNessuna valutazione finora

- Ch.13 Managing Small Business FinanceDocumento5 pagineCh.13 Managing Small Business FinanceBaesick MoviesNessuna valutazione finora

- Assignment of Management of Working Capital: Topic: Cash BudgetDocumento10 pagineAssignment of Management of Working Capital: Topic: Cash BudgetDavinder Singh BanssNessuna valutazione finora

- Accrual Accounting: Financial Depreciate Assets Intangible Assets Work in ProgressDocumento4 pagineAccrual Accounting: Financial Depreciate Assets Intangible Assets Work in ProgressGesa StephenNessuna valutazione finora

- Business PlanDocumento14 pagineBusiness PlanAlee OvaysNessuna valutazione finora

- The CommonDocumento5 pagineThe CommonDarshan SawantNessuna valutazione finora

- What Is Cost Accounting and DiferencesDocumento6 pagineWhat Is Cost Accounting and Diferenceskasuntop99838Nessuna valutazione finora

- Business Financial Terms and Ratios DefinitionsDocumento18 pagineBusiness Financial Terms and Ratios DefinitionssubburamsharmaNessuna valutazione finora

- Accounting For Manager DDocumento315 pagineAccounting For Manager DPRASANJIT MISHRANessuna valutazione finora

- PREPARING, ANALYZING, AND FORECASTING FINANCIAL STATEMENT - qUANTIFYING THE BUSINESS PLANDocumento24 paginePREPARING, ANALYZING, AND FORECASTING FINANCIAL STATEMENT - qUANTIFYING THE BUSINESS PLANNamy Lyn Gumamera0% (1)

- Assignment 1Documento9 pagineAssignment 1Yashveer SinghNessuna valutazione finora

- Financial Terms and RatiosDocumento76 pagineFinancial Terms and Ratiosbanshidharbehera100% (1)

- CHAPTER 8 Analyzing Financial Statements and Creating ProjectionsDocumento13 pagineCHAPTER 8 Analyzing Financial Statements and Creating Projectionscharrygaborno100% (1)

- CHAPTER 8 Analyzing Financial Statements and Creating ProjectionsDocumento13 pagineCHAPTER 8 Analyzing Financial Statements and Creating ProjectionsDanica PobleteNessuna valutazione finora

- UNIT-3 Financial Planning and ForecastingDocumento33 pagineUNIT-3 Financial Planning and ForecastingAssfaw KebedeNessuna valutazione finora

- Ratio Analysis M&M and Maruti SuzukiDocumento36 pagineRatio Analysis M&M and Maruti SuzukiSamiSherzai50% (2)

- R2R Unit 1Documento16 pagineR2R Unit 1Bhavika ChughNessuna valutazione finora

- Tools to Beat Budget - A Proven Program for Club PerformanceDa EverandTools to Beat Budget - A Proven Program for Club PerformanceNessuna valutazione finora

- 19BSBADM506Bsection2Documento21 pagine19BSBADM506Bsection2viviopiaNessuna valutazione finora

- Bali BibleDocumento10 pagineBali BibleviviopiaNessuna valutazione finora

- Nyny Meal PlansDocumento7 pagineNyny Meal Plansviviopia100% (1)

- Confrontation MeetingDocumento5 pagineConfrontation MeetingviviopiaNessuna valutazione finora

- Occasion SegmentationDocumento4 pagineOccasion SegmentationviviopiaNessuna valutazione finora

- p0043360 - La011220 Assignment 1 - Bsbmkg514a Ed 1Documento4 paginep0043360 - La011220 Assignment 1 - Bsbmkg514a Ed 1viviopiaNessuna valutazione finora

- Training Material For 06th Sem Engineering Students of MCE - Seventh SenseDocumento280 pagineTraining Material For 06th Sem Engineering Students of MCE - Seventh Sensemanu manoharNessuna valutazione finora

- Ratio and Proportion, AgrawalDocumento4 pagineRatio and Proportion, AgrawalShrishailamalikarjunNessuna valutazione finora

- Algebra 6 Principles and Sample ProblemsDocumento14 pagineAlgebra 6 Principles and Sample ProblemsKrisha Jean MacalinoNessuna valutazione finora

- Mixture Allegation Final VersionDocumento6 pagineMixture Allegation Final VersionS.h. RonyNessuna valutazione finora

- Math 6 Q2 Module 2Documento10 pagineMath 6 Q2 Module 2Matt The idkNessuna valutazione finora

- Course Outlines Form 2 Term 1Documento9 pagineCourse Outlines Form 2 Term 1Allana HNessuna valutazione finora

- Quiz No. 1 June 8, 2018 Math VI-1Documento28 pagineQuiz No. 1 June 8, 2018 Math VI-1LetCatalystNessuna valutazione finora

- Lesson 1: An Experience in Relationships As Measuring Rate: Student OutcomesDocumento8 pagineLesson 1: An Experience in Relationships As Measuring Rate: Student OutcomesRubelyn FerrerNessuna valutazione finora

- Load Balancing by Link Bandwidth - HuaweiDocumento3 pagineLoad Balancing by Link Bandwidth - HuaweiEKo SupriyantoNessuna valutazione finora

- Unit 2 PABE11 Material Balance 1Documento37 pagineUnit 2 PABE11 Material Balance 1Germa CandelaNessuna valutazione finora

- SolutionsDocumento92 pagineSolutionsjourneytohopeNessuna valutazione finora

- ABM Business Math CG 2Documento5 pagineABM Business Math CG 2Michelle GoNessuna valutazione finora

- RatiosDocumento5 pagineRatiosOmer AliNessuna valutazione finora

- Advanced Programme Quant - Ratio and ProportionDocumento5 pagineAdvanced Programme Quant - Ratio and ProportionRanga Harsha VardhanNessuna valutazione finora

- Tve Grade 8 Firstquarter Module 2021 PDF NewDocumento37 pagineTve Grade 8 Firstquarter Module 2021 PDF NewSamantha Nicole CarlotoNessuna valutazione finora

- Solutions To Mock Cat TestDocumento12 pagineSolutions To Mock Cat Testapi-3748754Nessuna valutazione finora

- Grade 5 Enrichment Lesson Plans FinalDocumento43 pagineGrade 5 Enrichment Lesson Plans Finalgay.radocNessuna valutazione finora

- Chapter 2-MMWDocumento10 pagineChapter 2-MMWRr NgayaanNessuna valutazione finora

- Executive Summary: Meaning of RatioDocumento3 pagineExecutive Summary: Meaning of RatioVDRATNAKUMARNessuna valutazione finora

- NASA Aeroelasticity Handbook Volume 2 - Design Guides Part 2 PDFDocumento596 pagineNASA Aeroelasticity Handbook Volume 2 - Design Guides Part 2 PDFBrunno VasquesNessuna valutazione finora

- Social Medicine 2.1Documento16 pagineSocial Medicine 2.1Mihai DumbravanNessuna valutazione finora

- wsb-12-07 BasculaDocumento116 paginewsb-12-07 BasculaArturo BetancourtNessuna valutazione finora

- GR 8 - Maths - Trace The ConceptDocumento173 pagineGR 8 - Maths - Trace The Conceptdlobela24Nessuna valutazione finora

- Two-Term and Three-Term Ratios: Focus OnDocumento24 pagineTwo-Term and Three-Term Ratios: Focus OnAbdullah JafarNessuna valutazione finora

- Week4-Worksheets LS3 - Ratio and ProportionDocumento5 pagineWeek4-Worksheets LS3 - Ratio and ProportionRoberto Ragas100% (2)

- 7CCSDocumento6 pagine7CCSvuongkien.workNessuna valutazione finora

- RatioDocumento10 pagineRatiokate winsley ramosNessuna valutazione finora

- 9803 Syllabusofclass3to10Documento59 pagine9803 Syllabusofclass3to10sreeNessuna valutazione finora

- 25 July Himanshu FOADocumento66 pagine25 July Himanshu FOAamanNessuna valutazione finora