Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Accounting Changes

Caricato da

Shielle AzonCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Accounting Changes

Caricato da

Shielle AzonCopyright:

Formati disponibili

ACCOUNTING CHANGES MULTIPLE-CHOICE QUESTIONS (1-17) 1.

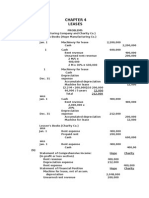

On January 1, 2008, Bray Company purchased for 240,000 a machine with a useful life of ten years and no salvage value. The machine was depreciated by the double declining balance method and the carrying amount of the machine was 153,600 on December 31, 2009. Bray changed retroactively to the straight-line method on January 1, 2010. Bray can justify the change. What should be the depreciation expense on this machine for the year ended December 31, 2010? a.15,360 b.19,200 c.24,000 d.30,720 Items 2 and 3 are based on the following: On January 1, 2008, Warren Co. purchased a 600,000 machine, with a five-year useful life and no salvage value. The machine was depreciated by an accelerated method for book and tax purposes. The machines carrying amount was 240,000 on December 31, 2009. On January 1, 2010, Warren changed retroactively to the straight-line method for financial statement purposes. Warren can justify the change. Warrens income tax rate is 30%. 2. In its 2010 income statement, what amount should Warren report as the cumulative effect of this change? a.120,000 b.84,000 c.36,000 d.0 3. On January 1, 2010, what amount should Warren report as deferred income tax liability as a result of the change? a. 120,000 b. 72,000 c. 36,000 d.0

4. On January 2, 2010, to better reflect the variable use of its only machine, Holly, Inc. elected to change its method of depreciation from the straight-line method to the units of production method. The original cost of the machine on January 2, 2008, was 50,000, and its estimated life was ten years. Holly estimates that the machines total life is 50,000 machine hours. Machine hours usage was 8,500 during 2008 and 3,500 during 2009.Hollys income tax rate is 30%. Holly should report the accounting change in its 2010 financial statements as a(n) a. Cumulative effect of a change in accounting principle of 2,000 in its income statement. b. Adjustment to beginning retained earnings of 2,000. c. Cumulative effect of a change in accounting principle of 1,400 in its income statement. d. Adjustment to beginning retained earnings of 1,400. 5. The cumulative effect of a change in accounting principle should be recorded separately as a component of income after continuing operations, when the change is from the a. Cash basis of accounting for vacation pay to the accrual basis. b. Straight-line method of depreciation for previously recorded assets to the double declining balance method. c. Presentation of statements of individual companies to their inclusion in consolidated statements. d. Completed-contract method of accounting for long-term construction-type contracts to the percentage-of-completion method. 6. When a company changes from the straight-line method of depreciation for previously recorded assets to the double declining balance method, which of the following should be reported? Cumulative effects of change in accounting principle, Pro forma effects of retroactive application a. No No b. No Yes c. Yes Yes d. Yes No Items 7 and 8 are based on the following: During 2010, Orca Corp. decided to change from the FIFO method of inventory valuation to the weighted-average method. Inventory balances under each method were as follows: FIFO Weighted-average January 1, 2010 71,000 77,000 December 31, 2010 79,000 83,000 Orcas income tax rate is 30%.

7. In its 2010 financial statements, what amount should Orca report as the cumulative effect of this accounting change? a.2,800 b.4,000 c.4,200 d.6,000 8. Orca should report the cumulative effect of this accounting change as a(n) a. Prior period adjustment. b. Component of income from continuing operations. c. Extraordinary item. d. Component of income after extraordinary items. 9. On January 1, 2010, Roem Corp. changed its inventory method to FIFO from LIFO for both financial and income tax reporting purposes. The change resulted in a 500,000 increase in the January 1, 2010 inventory. Assume that the income tax rate for all years is 30%. The cumulative effect of the accounting change should be reported by Roem in its 2010 a. Retained earnings statement as a 350,000 addition to the beginning balance. b. Income statement as a 350,000 cumulative effect of accounting change. c. Retained earnings statement as a 500,000 addition to the beginning balance. d. Income statement as a 500,000 cumulative effect of accounting change. 10. Is the cumulative effect of an inventory pricing change on prior years earnings reported separately between extraordinary items and net income for a change from LIFO to FIFO to weighted-average weighted-average a. Yes Yes b. Yes No c. No No d. No Yes 11. On August 31, 2010, Harvey Co. decided to change from the FIFO periodic inventory system to the weightedaverage periodic inventory system. Harvey is on a calendar year basis. The cumulative effect of the change is determined a. As of January 1, 2010. b. As of August 31, 2010.

c. During the eight months ending August 31, 2010, by a weighted-average of the purchases. d. During 2010 by a weighted-average of the purchases. 12. In 2010, Brighton Co. changed from the individual item approach to the aggregate approach in applying the lower of FIFO cost or market to inventories. The cumulative effect of this change should be reported in Brightons financial statements as a a. Prior period adjustment, with separate disclosure. b. Component of income from continuing operations, with separate disclosure. c. Component of income from continuing operations, without separate disclosure. d. Component of income after continuing operations, with separate disclosure. 13. On January 1, 2010, Poe Construction, Inc. changed to the percentage-of-completion method of income recognition for financial statement reporting but not for income tax reporting. Poe can justify this change in accounting principle. As of December 31, 2009, Poe compiled data showing that income under the completed-contract method aggregated 700,000. If the percentage-of-completion method had been used, the accumulated income through December 31, 2009, would have been 880,000. Assuming an income tax rate of 40% for all years, the cumulative effect of this accounting change should be reported by Poe in the 2010 a. Retained earnings statement as a 180,000 credit adjustment to the beginning balance. b. Income statement as a 180,000 credit. c. Retained earnings statement as a 108,000 credit adjustment to the beginning balance. d. Income statement as a 108,000 credit. 14. On January 1, 2007, Taft Co. purchased a patent for 714,000. The patent is being amortized over its remaining legal life of fifteen years expiring on January 1, 2022. During 2010, Taft determined that the economic benefits of the patent would not last longer than ten years from the date of acquisition. What amount should be reported in the balance sheet for the patent, net of accumulated amortization, at December 31, 2010? a.428,400 b.489,600 c.504,000 d.523,600 15. On January 1, 2007, Flax Co. purchased a machine for 528,000 and depreciated it by the straight-line method using an estimated useful life of eight years with no salvage value. On January 1, 2010, Flax determined that the machine had a useful life of six years

from the date of acquisition and will have a salvage value of 48,000. An accounting change was made in 2010 to reflect these additional data. The accumulated depreciation for this machine should have a balance at December 31, 2010 of a.292,000 b.308,000 c.320,000 d.352,000 16. Oak Co. offers a three-year warranty on its products. Oak previously estimated warranty costs to be 2% of sales. Due to a technological advance in production at the beginning of 2010, Oak now believes 1% of sales to be a better estimate of warranty costs. Warranty costs of 80,000 and 96,000 were reported in 2008 and 2009, respectively. Sales for 2010 were 5,000,000. What amount should be disclosed in Oaks 2010 financial statements as warranty expense? a. 50,000 b. 88,000 c. 100,000 d. 138,000

17. At December 31, 2010, Off-Line Co. changed its method of accounting for demo costs from writing off the costs over two years to expensing the costs immediately. Off-Line made the change in recognition of an increasing number of demos placed with customers that did not result in sales. Off-Line had deferred demo costs of 500,000 at December 31, 2009, 300,000 of which were to be written off in 2010 and the remainder in 2011. Off-Lines income tax rate is 30%. In its 2010 income statement, what amount should Off-Line report as cumulative effect of change in accounting principle? a. 140,000 b. 200,000 c. 350,000 d.500,000

Potrebbero piacerti anche

- Intermediate Accounting I IntroductionDocumento6 pagineIntermediate Accounting I IntroductionJoovs JoovhoNessuna valutazione finora

- Investment Centers and Transfer Pricing Ch 13Documento41 pagineInvestment Centers and Transfer Pricing Ch 13Karen hapukNessuna valutazione finora

- All in CupDocumento11 pagineAll in CupRosemarie Qui0% (1)

- Financial Management - FSADocumento6 pagineFinancial Management - FSAAbby EsculturaNessuna valutazione finora

- Prelimx No AnswersDocumento7 paginePrelimx No Answerscarl fuerzasNessuna valutazione finora

- Quiz InvestmentsDocumento2 pagineQuiz InvestmentsstillwinmsNessuna valutazione finora

- Fa2prob3 1Documento3 pagineFa2prob3 1jayNessuna valutazione finora

- 10 Responsibility Accounting Live DiscussionDocumento4 pagine10 Responsibility Accounting Live DiscussionLee SuarezNessuna valutazione finora

- Aud Prob Part 2Documento52 pagineAud Prob Part 2Ma. Hazel Donita DiazNessuna valutazione finora

- Father's Retirement Savings GoalDocumento2 pagineFather's Retirement Savings GoalEngr Fizza AkbarNessuna valutazione finora

- Budgeting Activity - DayagDocumento5 pagineBudgeting Activity - DayagAlexis Kaye DayagNessuna valutazione finora

- Try This - Cost ConceptsDocumento6 pagineTry This - Cost ConceptsStefan John SomeraNessuna valutazione finora

- CSI Inc's Investment Account AuditDocumento4 pagineCSI Inc's Investment Account Auditandrei jude matullanoNessuna valutazione finora

- Accounting for Property, Plant and EquipmentDocumento4 pagineAccounting for Property, Plant and EquipmentSheenaNessuna valutazione finora

- Studet Practical Accounting Ch17 PPE AcquisitionDocumento16 pagineStudet Practical Accounting Ch17 PPE Acquisitionsabina del monteNessuna valutazione finora

- Pressures For Global IntegrationDocumento16 paginePressures For Global IntegrationMahpuja JulangNessuna valutazione finora

- Auditing Theory and Problems (Qualifying Round) : Answer: DDocumento15 pagineAuditing Theory and Problems (Qualifying Round) : Answer: DJohn Paulo SamonteNessuna valutazione finora

- Manage Direct Labor CostsDocumento26 pagineManage Direct Labor Costshae1234Nessuna valutazione finora

- Cost Accounting Solution Manual by GuerreroDocumento5 pagineCost Accounting Solution Manual by GuerreroArlene Magalang NatividadNessuna valutazione finora

- Investment in Associate Problems AnswersDocumento9 pagineInvestment in Associate Problems AnswersMytha Isabel SalesNessuna valutazione finora

- English Iii: University of Guayaquil Facultad Piloto de OdontologíaDocumento4 pagineEnglish Iii: University of Guayaquil Facultad Piloto de OdontologíaDianitaVelezPincayNessuna valutazione finora

- Far Eastern University - Makati: Discussion ProblemsDocumento2 pagineFar Eastern University - Makati: Discussion ProblemsMarielle SidayonNessuna valutazione finora

- FIN 500 Extra Problems Fall 20-21Documento4 pagineFIN 500 Extra Problems Fall 20-21saraNessuna valutazione finora

- 1Documento1 pagina1Magsaysay SouthNessuna valutazione finora

- Final Exam SBAC 2B 1 Cost CCTG ControlDocumento5 pagineFinal Exam SBAC 2B 1 Cost CCTG ControlMaria Erica TorresNessuna valutazione finora

- Intangible Assets CourseworkDocumento3 pagineIntangible Assets CourseworkNezer VergaraNessuna valutazione finora

- Financial Management - Part 1 For PrintingDocumento13 pagineFinancial Management - Part 1 For PrintingKimberly Pilapil MaragañasNessuna valutazione finora

- CA 04 - Job Order CostingDocumento17 pagineCA 04 - Job Order CostingJoshua UmaliNessuna valutazione finora

- CoMa Quiz 2Documento21 pagineCoMa Quiz 2Antriksh JohriNessuna valutazione finora

- Examination About Investment 1Documento3 pagineExamination About Investment 1BLACKPINKLisaRoseJisooJennieNessuna valutazione finora

- Amortization of Intangible AssetsDocumento2 pagineAmortization of Intangible Assetsemman neriNessuna valutazione finora

- This Study Resource Was: Process Costing - AverageDocumento7 pagineThis Study Resource Was: Process Costing - AverageIllion IllionNessuna valutazione finora

- Tom Schriber A Director of Personnel at Management Resources Inc Is in The Process of Designing A Program That Its Customers Can Use in TheDocumento1 paginaTom Schriber A Director of Personnel at Management Resources Inc Is in The Process of Designing A Program That Its Customers Can Use in TheDoreenNessuna valutazione finora

- P1 - ReviewDocumento14 pagineP1 - ReviewEvitaAyneMaliñanaTapit0% (2)

- CHAPTER 9 Without AnswerDocumento6 pagineCHAPTER 9 Without AnswerlenakaNessuna valutazione finora

- Partnership Liquidation and Capital Account CalculationsDocumento18 paginePartnership Liquidation and Capital Account CalculationsAngelica DuarteNessuna valutazione finora

- Chapter 6Documento8 pagineChapter 6Ro-Anne LozadaNessuna valutazione finora

- Chap 013Documento667 pagineChap 013Rhaine ArimaNessuna valutazione finora

- Philippine Interpretations Committee (Pic) Questions and Answers (Q&As)Documento7 paginePhilippine Interpretations Committee (Pic) Questions and Answers (Q&As)rain06021992Nessuna valutazione finora

- 01 Task Performance 1 (Answer)Documento2 pagine01 Task Performance 1 (Answer)Arrah mae SantiagoNessuna valutazione finora

- Advanced Financial Accounting and Reporting: G.P. CostaDocumento27 pagineAdvanced Financial Accounting and Reporting: G.P. CostaryanNessuna valutazione finora

- Borrowing Costs - Assignment - For PostingDocumento1 paginaBorrowing Costs - Assignment - For Postingemman neriNessuna valutazione finora

- Management Science FinalDocumento8 pagineManagement Science FinalAAUMCLNessuna valutazione finora

- Quiz#1 MaDocumento5 pagineQuiz#1 Marayjoshua12Nessuna valutazione finora

- EXERCISE 9-3 Direct Materials BudgetDocumento2 pagineEXERCISE 9-3 Direct Materials BudgetNABILAH KHANSA 1911000089100% (1)

- P2 Process CostingDocumento9 pagineP2 Process CostingGanessa RolandNessuna valutazione finora

- Prelim Exam Discussion: Priority of OrderDocumento3 paginePrelim Exam Discussion: Priority of OrderMarianne Portia Sumabat100% (1)

- Lease Accounting ProblemsDocumento27 pagineLease Accounting ProblemsElijah Lou ViloriaNessuna valutazione finora

- Non-Routine DecisionsDocumento5 pagineNon-Routine DecisionsVincent Lazaro0% (1)

- MAS 2023 Module 5 Standard Costing and Variance AnalysisDocumento20 pagineMAS 2023 Module 5 Standard Costing and Variance AnalysisDzulija Talipan100% (1)

- 2 Statement of Financial PositionDocumento7 pagine2 Statement of Financial Positionreagan blaireNessuna valutazione finora

- Quiz - Module 9Documento12 pagineQuiz - Module 9Alyanna AlcantaraNessuna valutazione finora

- Prequalifying Exam Level 2 3 Set B FSUU AccountingDocumento9 paginePrequalifying Exam Level 2 3 Set B FSUU AccountingRobert CastilloNessuna valutazione finora

- Advanced Accounting ExamDocumento10 pagineAdvanced Accounting ExamMendoza Ron NixonNessuna valutazione finora

- Activity No. 1Documento1 paginaActivity No. 1anna mae orcioNessuna valutazione finora

- MAS 7 Exercises For UploadDocumento9 pagineMAS 7 Exercises For UploadChristine Joy Duterte RemorozaNessuna valutazione finora

- Acctng Error 2Documento5 pagineAcctng Error 2Kim FloresNessuna valutazione finora

- AccountingDocumento8 pagineAccountingGuiamae GuaroNessuna valutazione finora

- Prism Region 4a-Pnc Cup Far QuestionsDocumento16 paginePrism Region 4a-Pnc Cup Far QuestionsShin YaeNessuna valutazione finora

- Accounting Changes-QUESTIONNAIRESDocumento7 pagineAccounting Changes-QUESTIONNAIRESJennifer ArcadioNessuna valutazione finora

- 5Cs in My LifeDocumento1 pagina5Cs in My LifeShielle AzonNessuna valutazione finora

- Shiela C. Azon BS Accountancy IVDocumento13 pagineShiela C. Azon BS Accountancy IVShielle AzonNessuna valutazione finora

- Who Am IDocumento3 pagineWho Am IShielle AzonNessuna valutazione finora

- At Professional Responsibilities and Other Topics With AnswersDocumento27 pagineAt Professional Responsibilities and Other Topics With AnswersShielle AzonNessuna valutazione finora

- A Business Other Transfer TaxesDocumento37 pagineA Business Other Transfer TaxesShielle AzonNessuna valutazione finora

- The Taximan's StoryDocumento4 pagineThe Taximan's StoryShielle Azon78% (18)

- Thesis Writing - Customer SatisfactionDocumento27 pagineThesis Writing - Customer SatisfactionShielle AzonNessuna valutazione finora

- Implementing Quality ConceptsDocumento36 pagineImplementing Quality ConceptsShielle AzonNessuna valutazione finora

- Gross EstateDocumento3 pagineGross EstateShielle AzonNessuna valutazione finora

- Emerging Management PracticesDocumento13 pagineEmerging Management PracticesShielle AzonNessuna valutazione finora

- Relationship of Extent of Facebook Use and Level of Intimacy in Actual FriendshipsDocumento35 pagineRelationship of Extent of Facebook Use and Level of Intimacy in Actual FriendshipsShielle AzonNessuna valutazione finora

- Third-Party Auditing For Small BusinessDocumento4 pagineThird-Party Auditing For Small BusinessShielle AzonNessuna valutazione finora

- The Law of Conversation of Electric ChargeDocumento1 paginaThe Law of Conversation of Electric ChargeShielle AzonNessuna valutazione finora

- Auditing Theory - Overview of The Audit Process With AnswersDocumento44 pagineAuditing Theory - Overview of The Audit Process With AnswersShielle Azon90% (30)

- Information System Incident InvestigationDocumento2 pagineInformation System Incident InvestigationShielle AzonNessuna valutazione finora

- Website Development LayoutDocumento24 pagineWebsite Development LayoutShielle AzonNessuna valutazione finora

- Improve AP Efficiency with Best Practices in Microsoft Dynamics GPDocumento4 pagineImprove AP Efficiency with Best Practices in Microsoft Dynamics GPShielle AzonNessuna valutazione finora

- Accounting Change Answer KeyDocumento4 pagineAccounting Change Answer KeyShielle AzonNessuna valutazione finora

- Veneration Without Understanding - R. ConstantinoDocumento9 pagineVeneration Without Understanding - R. ConstantinoShielle AzonNessuna valutazione finora

- Develop Long-Range Plans SWOT Analysis Corporate Functional StrategiesDocumento34 pagineDevelop Long-Range Plans SWOT Analysis Corporate Functional StrategiesShielle Azon50% (4)

- Steps To Peace With GodDocumento3 pagineSteps To Peace With GodShielle AzonNessuna valutazione finora

- Considerations in Deactivating Vendors in Microsoft Dynamics GPDocumento1 paginaConsiderations in Deactivating Vendors in Microsoft Dynamics GPShielle AzonNessuna valutazione finora

- General Topic: ArraysDocumento4 pagineGeneral Topic: ArraysShielle AzonNessuna valutazione finora

- Feasibility StudyDocumento3 pagineFeasibility StudyShielle Azon100% (1)

- ICAEW Principal of Tax Question Bank 2024 Final 1Documento226 pagineICAEW Principal of Tax Question Bank 2024 Final 1k20b.lehoangvuNessuna valutazione finora

- Cocktail ReceptionDocumento2 pagineCocktail ReceptionSunlight FoundationNessuna valutazione finora

- Additional Income and Adjustments To Income: Schedule 1Documento1 paginaAdditional Income and Adjustments To Income: Schedule 1Betty Ann LegerNessuna valutazione finora

- Income Taxation in General Income TaxDocumento5 pagineIncome Taxation in General Income TaxRose Anne PerejaNessuna valutazione finora

- Tan vs. Del RosarioDocumento1 paginaTan vs. Del RosarioFaustina del RosarioNessuna valutazione finora

- W13-Module13 Social, Political, Economic and Cultural Issues in Philippine HistoryDocumento9 pagineW13-Module13 Social, Political, Economic and Cultural Issues in Philippine HistoryDorson AdoraNessuna valutazione finora

- Midterm tax deductions guideDocumento9 pagineMidterm tax deductions guideThe Second OneNessuna valutazione finora

- IDT SaranshDocumento204 pagineIDT Saranshconnectsujata1Nessuna valutazione finora

- Lex in MotionDocumento2 pagineLex in MotionMark Jeff Cleofe0% (1)

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocumento1 pagina1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsmelanie vistalNessuna valutazione finora

- 213Documento1 pagina213yoeliyyNessuna valutazione finora

- Retail Invoice / Bill: Your Total Savings: Rs.197.71Documento2 pagineRetail Invoice / Bill: Your Total Savings: Rs.197.71Karthik TNessuna valutazione finora

- IESCO ONLINE BILLL Atif SalehDocumento1 paginaIESCO ONLINE BILLL Atif SalehUmair SharifNessuna valutazione finora

- The August BallotDocumento4 pagineThe August BallotKyreon LeeNessuna valutazione finora

- Income Tax On IndividualsDocumento25 pagineIncome Tax On IndividualsMohammadNessuna valutazione finora

- Scenario - Taxation 2019 UNISA - Level 1 Test 4Documento7 pagineScenario - Taxation 2019 UNISA - Level 1 Test 4Tyson RuvengoNessuna valutazione finora

- ExempDocumento1 paginaExempFiaz Ahmed LoneNessuna valutazione finora

- ICDS - 7 Government GrantsDocumento17 pagineICDS - 7 Government Grantskavita.m.yadavNessuna valutazione finora

- EA - SAL - SUM of Nitesh Tiwari GKPDocumento5 pagineEA - SAL - SUM of Nitesh Tiwari GKPNitesh TiwariNessuna valutazione finora

- Digest Consolidated Cases G.R. Nos. 187485, 196113 and 197156Documento6 pagineDigest Consolidated Cases G.R. Nos. 187485, 196113 and 197156Rebecca S. Ofalsa100% (2)

- 2019-01 Nieuwsbrief Uzk ENUDocumento2 pagine2019-01 Nieuwsbrief Uzk ENUAdrian OanceaNessuna valutazione finora

- Deposit Confirmation/Renewal AdviceDocumento1 paginaDeposit Confirmation/Renewal AdviceJignesh Jagjivanbhai PatelNessuna valutazione finora

- William Reagan V Commissioner of Internal RevenueDocumento1 paginaWilliam Reagan V Commissioner of Internal RevenueAlexis CatuNessuna valutazione finora

- Instructions For Forms 1099-INT and 1099-OID: (Rev. January 2022)Documento8 pagineInstructions For Forms 1099-INT and 1099-OID: (Rev. January 2022)AbhishekNessuna valutazione finora

- WEWAXX RRLDocumento23 pagineWEWAXX RRLMERCY LEOLIGAONessuna valutazione finora

- Journal Entries for Cleaning Business TransactionsDocumento4 pagineJournal Entries for Cleaning Business TransactionsDonabelle MarimonNessuna valutazione finora

- TAX 467 Topic 4 Capital Allowance - AgricultureDocumento11 pagineTAX 467 Topic 4 Capital Allowance - AgricultureAnis RoslanNessuna valutazione finora

- Income Tax of Corporations Chapter 12Documento12 pagineIncome Tax of Corporations Chapter 12kp_popinjNessuna valutazione finora

- InvoiceDocumento1 paginaInvoiceZohab HassanNessuna valutazione finora

- 23091400096557KKBK ChallanReceiptDocumento2 pagine23091400096557KKBK ChallanReceiptbloodushortfilmNessuna valutazione finora