Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Bond Pending Appeal - Reconsideration of Denial Motion, 10-10-12

Caricato da

RightAWrongCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Bond Pending Appeal - Reconsideration of Denial Motion, 10-10-12

Caricato da

RightAWrongCopyright:

Formati disponibili

Appellate Case: 11-1492

Document: 01018930096

Date Filed: 10/10/2012

Page: 1

UNITED STATES COURT OF APPEALS FOR THE TENTH CIRCUIT _________________________________

UNITED STATES OF AMERICA, Plaintiff - Appellee, v. DAVID a. BANKS, KENDRICK BARNES; DEMETRIUS K. HARPER, a/k/a Ken Harper; CLINTON A. STEWART, a/k/a C. Alfred Stewart; GARY L. WALKER; DAVID A. ZIRPOLO; and DAVID A. BANKS, Defendants - Appellants.

Nos. 11-1487, 11-1488, 11-1489, 11-1490, 11-1491 & 11-1492 (D.C. No. 1:09-CR-00266-CMA)

_________________________________ APPELLANTS JOINT MOTION FOR RECONSIDERATION OF DENIAL FOR RELEASE ON BOND PENDING APPEAL ________________________________ COMES NOW, Appellants Kendrick Barnes, Demetrius K. Harper, Clinton A. Stewart, Gary L. Walker and David A. Zirpolo, by and through their attorneys, Gwendolyn M. Solomon and Joshua Sabert Lowther and Appellant David A. Banks, by and through his attorney, Charles H. Torres joining in, hereby request this Honorable Court reconsider its Order regarding Release of Defendants on Bond Pending Appeal, and, states as follows, Counsel certifies that she has conferred with opposing counsel, Matthew Kirsch, prior to the filing of this motion and he opposes the filing of this motion.

1

Appellate Case: 11-1492

Document: 01018930096

Date Filed: 10/10/2012

Page: 2

1.

The Defendants were convicted of a count of conspiracy to commit wire fraud and

mail fraud and various counts of wire fraud and mail fraud pursuant to 18 U.S.C. 1349, 18 U.S.C. 1341 and 2, 18 U.S.C. 1343 and 2. Sentencing hearings were on July 23, 2012 for Walker and Barnes, July 27, 2012 for Harper and Stewart and July 30, 2012 for Zirpolo, during which the District Court sentenced them, inter alia, to terms of imprisonment of 135 months (Walker), eighty-seven months (Barnes), 121 months (Harper), 121 months (Stewart), 121 months (Zirpolo). On August 24, 2012, the Harper Defendants filed a Joint Motion for Release for Bond Pending Appeal and Defendant Banks joined the motion on August 27, 2012. The government filed its Response on September 10, 2012. The Motions were denied September 24, 2012. The Courts opinion was primarily based upon the district courts assertions that there remain monies several million dollars unaccounted for to the staffing companies. (emphasis added), Joint Appx, Vol. II at 436. The district court issued its reasoning without any factual support and there is no evidence in the record that confirms such statement. Throughout the record and proceedings it has been maintained that the total loss is $5,018,959.66 jointly and severally. No unaccounted funds or assets exist. The Defendants are not a flight risk and do not pose a danger to the community. Defendants request this Court reconsider the release of bond pending appeal. 2. In review of a Motion for Bond Pending Appeal the Court considers the following

factors,

2

Appellate Case: 11-1492

Document: 01018930096

Date Filed: 10/10/2012

Page: 3

The judicial officer shall order that a person who has been found guilty of an offense and sentenced to a term of imprisonment, and who has filed an appeal be detained, unless the judicial officer finds (A) by clear and convincing evidence that the person is not likely to flee or pose a danger to the safety of any other person or the community if released, and, (B) that the appeal is not for the purpose of delay and raises a substantial question of law or fact likely to result in (i) reversal, (ii) an order for a new trial, (iii) a sentence that does not include a term of imprisonment, or (iv) a reduced sentence to a term of imprisonment less than the total of the time already served plus the expected duration of the appeal process. 18 U.S.C. 3143(b)(1)(A); 18 U.S.C. 3143(b)(1)(B). 3. "Under the clearly erroneous standard, the trial court will not be reversed unless its

findings were without factual support in the record, or if after reviewing all the evidence, the appellate court is left with the definite and firm conviction that a mistake has been made." United States v. Mains, 33 F.3d 1222, 1227 (10th Cir. 1994); United States v. Butler, 966 F.2d 559, 562 (10th Cir. 1992); United States v. Beaulieu, 900 F.2d 1537, 1540 (10th Cir.1990). The court stated that the loss exceeded $5 million dollars, according to the court, several million dollars, Joint Appx, Vol. II at 436) (emphasis added). The government does not provide any evidence in the record of accounting to confirm such statement nor mentioned it to the jury. The district courts statement that there were unaccounted for millions of dollars is unsubstantiated with no factual support or evidence in the record and is clearly erroneous. Throughout the record and

3

Appellate Case: 11-1492

Document: 01018930096

Date Filed: 10/10/2012

Page: 4

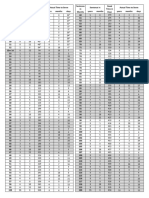

proceedings it has been maintained that the total loss is $5,018,959.66 divisible amongst the six defendants. [Exhibit 1: Docs 782, 797, 798, 799, 800, 801; Exhibit. 903]. Defendants request, in review of the facts and evidence and clear error, that they be granted the relief of release pending appeal. 4. While the Court mentions that the Defendants have not provided any recordation,

the government does not provide any numbers of what they assert was unaccounted for. The government had an auditor, Dana Chamberlin with the U.S. Attorney's Office, Denver, CO. and former financial analyst that testified during the trial and accounted for the monies (loss) owed to the staffing agencies which included the distributions of wages and salaries to the Defendants and the contractors. (Exhibit 2: Doc 612, Transcript (Tr.), October 05, 2011, pp. 1421: 19-20, 25; 1422:1, 6-7). Ms. Chamberlin created a spreadsheet of the timeline with each staffing company and the period that staffing agencies agreed to payroll the contractors. Id. at 1423:19-22, 25; 1424:1-3; see also, Exhibit 900. The monies were not only paid to the Defendants but also the contractors and there were 30% to 40% margins built into the $5 million dollar amounts invoiced to IRP from the staffing companies. Ms. Chamberlins testimony, Q. So, using this methodology that you've described, do you have -- you came up with a total of the difference between the outstanding invoices and the payments that were received for these 42 companies? A. Yes. Q. What was that amount? A. $5,018,959.66. (Exhibit 2: Doc. 612, Tr. October 05, 2011, pp. 1465: 23-25; 1466: 1-4).

4

Appellate Case: 11-1492

Document: 01018930096

Date Filed: 10/10/2012

Page: 5

Quoted by AUSA Mathew Kirsch, a typical arrangement with a temporary, a standard temporary agency or a standard staffing company. The staffing company provides employees to its client company. Those employees work at the client company. The client company approves time cards for those employees and sends them back to the staffing company. The staffing company then pays wages to its employees, and it invoices the client company for those wages, plus the profit that the staffing company is going to make. (Exhibit 2: Doc 608, Tr. September 27, 2011, p. 5: 8-17.) The employees go to work at the client company. The client company, just like in a standard situation, then submits approved time cards back to the staffing company. Based on those time cards, the staffing company does two things; one, it pays wages to the employees. And, number two, it invoices the client company for those wages, plus its mark up.(emphasis added). Id. at p. 6: 6-12. 5. According to the government, the Defendants did not get rich from the income

received. The evidence isn't going to show you in this case that the defendants got fabulously wealthy. Id. at p. 15: 14-15. The Court cited Defendant Harpers sentencing statement in its Order and it seems to have misconstrued. Defendant Harpers statement, One of the things, as well, [government counsel] says, is he doesnt know where the money is. What you are failing to see, again, is the mark-up is included in that 5 million. So there might be 30 to 40 percent as a typical standard in a staffing and payrolling system to do a mark-up. So that $5 million, everyone saying we dont know where it went. A lot of that was profit that they are not accounting for. So, in essence, you take that out, then you start getting to real numbers. Joint Appx, Vol. II at 472-73.

5

Appellate Case: 11-1492

Document: 01018930096

Date Filed: 10/10/2012

Page: 6

The essence of the statement affirms the AUSAs statement above, that the $5 million dollar loss includes a markup of 30% - 40% that is the typical standard in a staffing and payrolling system. The actual salaries received by the Defendants and contractors that remained after deduction of the mark up is provided in the Summary of Minimum Payments to the Defendants. [Exhibit 902]. 6. The Summary of Minimum Payments to Defendants from October 2002 through

February 2005 created by Ms. Chamberlin are as follows, David Banks $172,102.53, Demetrius Harper $183,363.99, Gary Walker $141,407.64, Clint Stewart $67,010.00$, David Zirpolo $66,923.76 and Ken Barnes $243,846.71. Id. The sources of the amounts are from Defendants personal bank records, payroll records provided by the staffing agencies and bank records from IRP, DKH and Leading Team. (Exhibit 2: Doc 612, Tr. October 05, 2011, p. 1457: 5-8); [Exhibits 902, 903, 904, 905, 906 and 907, attached.] The loss is accounted for in the summary chart that provides that amounts paid from the staffing agencies to its employees and the amounts invoiced to IRP. [Exhibit 902]. No other outstanding funds or assets exist. 7. The Court compares Defendants with Madoff and Bailey and there is no such

comparison. In Madoff, The district court found that in light of the defendant's age (70) and the length of a potential sentence (150 years), he has an incentive to flee, and that because he has the means to do so, he presents a risk of flight, and therefore should not be released. (emphasis added). United States v. Madoff, 316 F. 58, 59 (2d Cir. 2009). There is a wide variance in Madoff versus the Defendants, approximately an $18 billion dollar loss, his age, length of potential imprisonment and Madoff had a residence abroad.

6

Appellate Case: 11-1492

Document: 01018930096

Date Filed: 10/10/2012

Page: 7

The Defendants had a $5 million dollar loss, age (younger), terms of imprisonment 10 times less and do not own property or other assets nor have the financial means to flee. In Bailey, Bailey was facing forty years for a drug charge and carrying a firearm in relation to drug trafficking, pled guilty to a lesser sentence of five years. U.S. v. Bailey, 759 F.Supp. 685, 686 (D.Colo. 1991). Later, Bailey appealed the denial of his motion to withdraw his guilty plea. Id. Defendants have maintained their innocence, filed an appeal, there was no involvement of weapons or drug related or violent crime(s). 8. The trial court relied upon Bailey that upon imposition of sentence that there is a

heightened risk of flight. Id. at 687. For the purpose of rebutting detention presumption, "clear and convincing evidence" is defined as more than preponderance of evidence, but less than beyond reasonable doubt. United States v. Strong, 775 F.2d 504, 508 (3rd Cir. 1985); see also United States v. Mustakeem, 759 F.Supp. 1172, 1177-78 n. 7 (W.D. Pa.1991) ("Clear and convincing evidence means something more than a preponderance of the evidence and something less than beyond a reasonable doubt"). Pursuant to 18 U.S.C. 3142(a)(1)(b) and (c), from investigation through the inception and close of trial and sentencing, while on bond, the Defendants have been in complete compliance to the restricted and special conditions of bond. Early on the Defendants surrendered all of their passports. [Exhibit 3: Docs 586, 587, 588, 589, 590, 591]. The Defendants do not have any prior criminal history. The Defendants have strong family support and ties to the community. Defendants were remanded into custody October 20, 2011 for forty-two days and released on or about December 01, 2012. Family, friends and church members posted secured bonds ranging from $40,000.00 to $80,000.00. [Exhibit 4: Docs 593, 595,

7

Appellate Case: 11-1492

Document: 01018930096

Date Filed: 10/10/2012

Page: 8

597, 599, 601, 603]. Upon release, defendants were on the strictest conditions set forth in probation, stipulated to special conditions and complied with them all. [Exhibit 5: Docs 582, 584, 585, 592, 594, 596, 598, 600, 602, 604, 623 and 644]. The Defendants had plenty of opportunity to flee after release from incarceration in December 2011 through August 2012 facing sentencing with the knowledge of the possible length of sentencing of up to 135 months but did not and chose not do so. During re-entry to the community, Defendants did not participate in any unlawful activities and there was no harm, danger or threat to the community. Despite consideration to the Defendants argument for release pending appeal, the recommendations by probation, the district court already had predetermined to remand defendants into custody prior to each sentencing hearing. The Defendants are committed to their family, friends and church and are dedicated to prove their innocence. The Defendants are not a flight risk, have no means or intentions to flee. The Defendants are willing to adhere to all restrictions imposed as deemed necessary while awaiting the appellant decision. The Defendants request release pending appeal. 9. With the evidence accounting for all of the monies received by the defendants and

losses accounted for, Defendants request the Government articulate what assets are accounted for and what assets are not accounted for. Thus, if the Government cannot account for some of the loss then how does it arrive a $5 million dollars? The appellate court cannot perform accurate analysis for flight risk without evaluating this information. WHEREFORE, Defendants pray that this Honorable Court reconsider the denial for request of bond pending appeal taking into consideration the aforementioned statements and evidence and grant release pending appeal.

8

Appellate Case: 11-1492

Document: 01018930096

Date Filed: 10/10/2012

Page: 9

This 10th day of October, 2012. Respectfully submitted, s/ Gwendolyn Maurice Solomon, Esq. Gwendolyn Maurice Solomon, Esq. Post Office Box 62654 Colorado Springs, Colorado 80962 gms@solomonlaw.org www.solomonlaw.org 719.287.4511 s/ Joshua Sabert Lowther, Esq. Joshua Sabert Lowther, Esq. National Federal Defense Group 915 Bay Street, Suite 200 Beaufort, South Carolina 29902 jlowther@nationalfederaldefense.com www.nationalfederaldefense.com 866.380.1782 Attorneys for Appellants, Barnes, Harper, Stewart, Walker and Zirpolo CHARLES H. TORRES, P.C. s/ Charles H. Torres Charles H. Torres, #7986 303 E. 17th Ave, Suite 920 Denver, CO 80203 Telephone: (303) 830-8885 Facsimile: (303) 830-8890 Email: Chas303@aol.com Counsel for David Banks

Appellate Case: 11-1492

Document: 01018930096

Date Filed: 10/10/2012

Page: 10

CERTIFICATE OF SERVICE I hereby certify that on October 10, 2012, I have filed electronically the within and foregoing APPELLANTS JOINT MOTION FOR RECONSIDERATION OF DENIAL FOR RELEASE ON BOND PENDING APPEAL with the Clerk of the United States Court of Appeals for the Tenth Circuit using the CM/ECF Appellate system, which will automatically generate a Notice of Docket Activity N.D.A. D.A. to the following: Mr. Matthew T. Kirsch, Esq. Assistant United States Attorney District of Colorado matthew.kirsch@usdoj.gov Ms. Suneeta Hazra, Esq. Assistant United States Attorney District of Colorado suneeta.hazra@usdoj.gov Mr. James C. Murphy Assistant United States Attorney District of Colorado james.murphy3@usdoj.gov Charles H. Torres Attorney for David A. Banks Chas303@aol.com Mr. Joshua Sabert Lowther, Esq. Attorneys for Appellants, Barnes, Harper, Stewart, Walker and Zirpolo jlowther@nationalfederaldefense.com Respectfully submitted, s/ Gwendolyn Maurice Solomon, Esq. Gwendolyn Maurice Solomon, Esq. Post Office Box 62654 Colorado Springs, Colorado 80962 gms@solomonlaw.org www.solomonlaw.org 719.287.4511 Attorney for Appellants,

10

Appellate Case: 11-1492

Document: 01018930096

Date Filed: 10/10/2012

Page: 11

Barnes, Harper, Stewart, Walker and Zirpolo

11

Potrebbero piacerti anche

- ACLU Letter To Taylor Swift's LawyersDocumento6 pagineACLU Letter To Taylor Swift's LawyersAnonymous GF8PPILW5Nessuna valutazione finora

- Why Supervised Release Must EndDocumento3 pagineWhy Supervised Release Must EndJabari ZakiyaNessuna valutazione finora

- Secret Prosecutions and The Erosion of Justice - Law360Documento29 pagineSecret Prosecutions and The Erosion of Justice - Law360Grant Stern100% (2)

- PAYING FOR INFORMATION A Report of The Ethics Advisory Committee of The Canadian Association of JournalistsDocumento4 paginePAYING FOR INFORMATION A Report of The Ethics Advisory Committee of The Canadian Association of Journalistsjsource2007Nessuna valutazione finora

- Fifth Circuit Opinion in Ellis Ray Hicks v. Department of Public Safety & CorrectionsDocumento11 pagineFifth Circuit Opinion in Ellis Ray Hicks v. Department of Public Safety & CorrectionsWilliam MostNessuna valutazione finora

- Crim Pro Pointers To ReviewDocumento7 pagineCrim Pro Pointers To ReviewErika Vanessa PintanoNessuna valutazione finora

- People v. Marti: Private search and seizure by shipping company does not violate constitutional rightsDocumento166 paginePeople v. Marti: Private search and seizure by shipping company does not violate constitutional rightsKamille SimeonNessuna valutazione finora

- Defendant's Sentencing MemorandumDocumento4 pagineDefendant's Sentencing MemorandumLeslie RubinNessuna valutazione finora

- 23-Judges' Rule 11 Motion For SanctionsDocumento27 pagine23-Judges' Rule 11 Motion For SanctionsCole StuartNessuna valutazione finora

- Unreasonable SearchDocumento33 pagineUnreasonable SearchLeo GuillermoNessuna valutazione finora

- Motion To Stay From Fletcher FamilyDocumento7 pagineMotion To Stay From Fletcher FamilyWAFF 48 NewsNessuna valutazione finora

- MTN For Reconsideration of Detention OrderDocumento50 pagineMTN For Reconsideration of Detention OrderTom KirkendallNessuna valutazione finora

- Violence Against Women in CustodyDocumento8 pagineViolence Against Women in CustodyPatricia DillonNessuna valutazione finora

- Resource Guide for Managing Prisoner Civil Rights LitigationDocumento183 pagineResource Guide for Managing Prisoner Civil Rights LitigationTania Dora Romero AramayoNessuna valutazione finora

- Criminal Jury Trial Judge'S Manual: State of Minnesota VDocumento47 pagineCriminal Jury Trial Judge'S Manual: State of Minnesota VChristian Román OlmedoNessuna valutazione finora

- Good Time Table 2019Documento4 pagineGood Time Table 2019Michael Lowe, Attorney at LawNessuna valutazione finora

- 13 Amjur Pof 2d 609 1Documento99 pagine13 Amjur Pof 2d 609 1legalmattersNessuna valutazione finora

- Post, or Distribute: Punishment and SentencingDocumento32 paginePost, or Distribute: Punishment and Sentencinghimanshi khivsaraNessuna valutazione finora

- United States v. Cecala, 10th Cir. (2000)Documento6 pagineUnited States v. Cecala, 10th Cir. (2000)Scribd Government DocsNessuna valutazione finora

- I C J J: Nterbranch Ommission Uvenile UsticeDocumento23 pagineI C J J: Nterbranch Ommission Uvenile UsticeCalifornia Judicial Branch News Service - Investigative Reporting Source Material & Story IdeasNessuna valutazione finora

- Defendant's Brief in Support of Motion To DismissDocumento17 pagineDefendant's Brief in Support of Motion To DismisschatickssichaticksNessuna valutazione finora

- Exposing Fundamental Conlifcts Between Narco Analysis and The Self Incrimination DoctrineDocumento14 pagineExposing Fundamental Conlifcts Between Narco Analysis and The Self Incrimination DoctrineGautam SwarupNessuna valutazione finora

- Padilla Motion To Revoke Detention OrderDocumento10 paginePadilla Motion To Revoke Detention OrderNewsChannel 9 StaffNessuna valutazione finora

- Jpi Juvenile Justice Reform in CTDocumento56 pagineJpi Juvenile Justice Reform in CTPatricia DillonNessuna valutazione finora

- Malicious ProsecutionDocumento6 pagineMalicious ProsecutionMark BasermanNessuna valutazione finora

- Human Rights in The Age of Artificial IntelligenceDocumento40 pagineHuman Rights in The Age of Artificial IntelligenceVictor Eme100% (1)

- United States v. JonesDocumento34 pagineUnited States v. JonesDoug MataconisNessuna valutazione finora

- DACV019576 - Order of ProtectionDocumento36 pagineDACV019576 - Order of ProtectionthesacnewsNessuna valutazione finora

- Hand Out PacketDocumento26 pagineHand Out PacketEditorNessuna valutazione finora

- Prosecutor-Led Bail Reform: Year One Transparency ReportDocumento24 pagineProsecutor-Led Bail Reform: Year One Transparency ReportPhiladelphia District Attorney's OfficeNessuna valutazione finora

- Gardner Motion To StrikeDocumento15 pagineGardner Motion To StrikeLaw of Self DefenseNessuna valutazione finora

- Color of Juvenile Transfer NASW Social Justice BriefDocumento27 pagineColor of Juvenile Transfer NASW Social Justice BriefKaren ZgodaNessuna valutazione finora

- ABA Ethics Opinion 06-441 Excessive CaseloadsDocumento9 pagineABA Ethics Opinion 06-441 Excessive Caseloadsthomasmoore99Nessuna valutazione finora

- DCEB 13 616 Appellate BriefDocumento19 pagineDCEB 13 616 Appellate BriefMark R.Nessuna valutazione finora

- Kermit Smith, Jr. v. Gary Dixon, Warden, Central Prison, Raleigh, North Carolina, Kermit Smith, Jr. v. Gary Dixon, Warden, Central Prison, Raleigh, North Carolina, 14 F.3d 956, 4th Cir. (1994)Documento56 pagineKermit Smith, Jr. v. Gary Dixon, Warden, Central Prison, Raleigh, North Carolina, Kermit Smith, Jr. v. Gary Dixon, Warden, Central Prison, Raleigh, North Carolina, 14 F.3d 956, 4th Cir. (1994)Scribd Government DocsNessuna valutazione finora

- The Rest of Their Lives - Human Rights Watch - Juvenile Life Without Parole StudyDocumento167 pagineThe Rest of Their Lives - Human Rights Watch - Juvenile Life Without Parole StudyTlecoz Huitzil100% (9)

- TORGENSEN - Motion To UnsealDocumento7 pagineTORGENSEN - Motion To UnsealThe Salt Lake TribuneNessuna valutazione finora

- IdkDocumento48 pagineIdkMike WilliamsNessuna valutazione finora

- Women and LawDocumento38 pagineWomen and LawThoom Srideep RaoNessuna valutazione finora

- Conflicted Identies The Battle Over The Duty of Loyalty in CanadaDocumento26 pagineConflicted Identies The Battle Over The Duty of Loyalty in CanadaBijalBhattNessuna valutazione finora

- Unit 4 Evidence PacketDocumento48 pagineUnit 4 Evidence PacketMargaret VogelNessuna valutazione finora

- HR Cases (Search and Seizure)Documento33 pagineHR Cases (Search and Seizure)Jim Jorjohn SulapasNessuna valutazione finora

- 13 Texas Law Enforcement Officers Amicus Brief For Rodney ReedDocumento26 pagine13 Texas Law Enforcement Officers Amicus Brief For Rodney ReedInjustice Watch100% (1)

- Supreme Court of Guam Opinion: People v. Frankie Garrido Blas (CRA15-011), 2016 Guam 19Documento24 pagineSupreme Court of Guam Opinion: People v. Frankie Garrido Blas (CRA15-011), 2016 Guam 19Judiciary of GuamNessuna valutazione finora

- Reforming Indigent Defense: How Free Market Principles Can Help To Fix A Broken System, Cato Policy Analysis No. 666Documento24 pagineReforming Indigent Defense: How Free Market Principles Can Help To Fix A Broken System, Cato Policy Analysis No. 666Cato InstituteNessuna valutazione finora

- The Tyranny of Usa Civil InjusticeDocumento38 pagineThe Tyranny of Usa Civil InjusticeJoshua J. IsraelNessuna valutazione finora

- Definition: Unauthorized Practice of Law in California - Legal Reference Treatise - California Attorney General - State Bar of California Office of Chief Trial Counsel - Jayne Kim Chief Trial Counsel California State BarDocumento3 pagineDefinition: Unauthorized Practice of Law in California - Legal Reference Treatise - California Attorney General - State Bar of California Office of Chief Trial Counsel - Jayne Kim Chief Trial Counsel California State BarCalifornia Judicial Branch News Service - Investigative Reporting Source Material & Story IdeasNessuna valutazione finora

- THE PEOPLE OF THE PHILIPPINES, Plaintiff-Appellee, MIKAEL MALMSTEDT, Defendant-AppellantDocumento34 pagineTHE PEOPLE OF THE PHILIPPINES, Plaintiff-Appellee, MIKAEL MALMSTEDT, Defendant-AppellantRonielleNessuna valutazione finora

- Greene County Prosecuting Attorney Dan Patterson Press Release On 2017 "Human Trafficking and Prostitution" Raids at Asian Massage ParlorsDocumento3 pagineGreene County Prosecuting Attorney Dan Patterson Press Release On 2017 "Human Trafficking and Prostitution" Raids at Asian Massage ParlorsElizabeth Nolan BrownNessuna valutazione finora

- Competing InterestDocumento379 pagineCompeting InterestErant LuciNessuna valutazione finora

- Bill of Rights: April 18, 2016 Content Team 2 CommentsDocumento8 pagineBill of Rights: April 18, 2016 Content Team 2 CommentsSheila Mae YucotNessuna valutazione finora

- Juvenile RecidivismDocumento10 pagineJuvenile RecidivismAdam TomasiNessuna valutazione finora

- OSB 2017 FuturesTF SummaryDocumento20 pagineOSB 2017 FuturesTF SummaryLaura OrrNessuna valutazione finora

- Petiton For Discretionary Review in Ford v. Texas, Texas Court of Criminal Appeals (October 15, 2014)Documento73 paginePetiton For Discretionary Review in Ford v. Texas, Texas Court of Criminal Appeals (October 15, 2014)David C WellsNessuna valutazione finora

- Sentencing Objectives and Victim ImpactDocumento11 pagineSentencing Objectives and Victim ImpactAwani PatelNessuna valutazione finora

- Court Hearing Transcript, 9/1/20, Baptiste v. Charles Baker, Governor of Massachusetts, Eviction MoratoriumDocumento77 pagineCourt Hearing Transcript, 9/1/20, Baptiste v. Charles Baker, Governor of Massachusetts, Eviction MoratoriumRichard VetsteinNessuna valutazione finora

- An Angel Among Demons III: An Angel Among Demons, #3Da EverandAn Angel Among Demons III: An Angel Among Demons, #3Nessuna valutazione finora

- Reform in the Making: The Implementation of Social Policy in PrisonDa EverandReform in the Making: The Implementation of Social Policy in PrisonValutazione: 2 su 5 stelle2/5 (1)

- Transcripts, Week 3, 10-12-11Documento217 pagineTranscripts, Week 3, 10-12-11RightAWrongNessuna valutazione finora

- Transcripts, Week 3, 10-11-11Documento205 pagineTranscripts, Week 3, 10-11-11RightAWrongNessuna valutazione finora

- 20120320+Motion+to+Dismiss+Indictment+Conviction Speedy+Trial 5thAmendment+ViolationsDocumento35 pagine20120320+Motion+to+Dismiss+Indictment+Conviction Speedy+Trial 5thAmendment+ViolationsRightAWrongNessuna valutazione finora

- Doc853 Jury Related Motion To Restrict by Prosecution KirschDocumento2 pagineDoc853 Jury Related Motion To Restrict by Prosecution KirschRightAWrongNessuna valutazione finora

- FBI Search Warrant, 2-7-05Documento25 pagineFBI Search Warrant, 2-7-05RightAWrongNessuna valutazione finora

- Doc855 Jury Related Motion To Restrict 2Documento3 pagineDoc855 Jury Related Motion To Restrict 2RightAWrongNessuna valutazione finora

- Transcripts - Week 1, 9-28-11Documento272 pagineTranscripts - Week 1, 9-28-11RightAWrongNessuna valutazione finora

- Post Trial Interview Juror SachterDocumento3 paginePost Trial Interview Juror SachterRightAWrongNessuna valutazione finora

- Doc856 Jury Related Judge Keeps Prosecutions Motion RestrictedDocumento2 pagineDoc856 Jury Related Judge Keeps Prosecutions Motion RestrictedRightAWrongNessuna valutazione finora

- Doc854 Jury Related Defense Motion To UnrestrictDocumento3 pagineDoc854 Jury Related Defense Motion To UnrestrictRightAWrongNessuna valutazione finora

- 20110501+Proffer+Support+2002 2005+Staffing+MatrixDocumento12 pagine20110501+Proffer+Support+2002 2005+Staffing+MatrixRightAWrongNessuna valutazione finora

- Too Small To Win, Too Big To Lose - IRP Vs IBM, 2-1-13Documento1 paginaToo Small To Win, Too Big To Lose - IRP Vs IBM, 2-1-13RightAWrongNessuna valutazione finora

- Transcripts - Week 2, 10-6-11Documento126 pagineTranscripts - Week 2, 10-6-11RightAWrongNessuna valutazione finora

- Darlene M. Martinez, RMR, CRR United States District Court For The District of ColoradoDocumento7 pagineDarlene M. Martinez, RMR, CRR United States District Court For The District of ColoradoRightAWrongNessuna valutazione finora

- Indictment, 6-9-09Documento22 pagineIndictment, 6-9-09RightAWrongNessuna valutazione finora

- Transcripts - Week 1, 9-27-11 ClosingDocumento148 pagineTranscripts - Week 1, 9-27-11 ClosingRightAWrongNessuna valutazione finora

- Transcripts - Week 3, 10-20-11Documento20 pagineTranscripts - Week 3, 10-20-11RightAWrongNessuna valutazione finora

- How Can Judge Withhold Over 200 Pages of Court Transcripts, Needed For Appeal in IRP6 Case? - Week 3, 10-17-11Documento236 pagineHow Can Judge Withhold Over 200 Pages of Court Transcripts, Needed For Appeal in IRP6 Case? - Week 3, 10-17-11RightAWrongNessuna valutazione finora

- Transcripts - Week 1, 9-29-11Documento263 pagineTranscripts - Week 1, 9-29-11RightAWrongNessuna valutazione finora

- Transcripts - Week 2, 10-7-11Documento139 pagineTranscripts - Week 2, 10-7-11RightAWrongNessuna valutazione finora

- Transcripts - Week 2, 10-5-11Documento200 pagineTranscripts - Week 2, 10-5-11RightAWrongNessuna valutazione finora

- Transcripts - Week 3, 10-13-11Documento174 pagineTranscripts - Week 3, 10-13-11RightAWrongNessuna valutazione finora

- Transcripts - Week 2, 10-4-11Documento241 pagineTranscripts - Week 2, 10-4-11RightAWrongNessuna valutazione finora

- Transcripts - Week 1, 9-28-11Documento272 pagineTranscripts - Week 1, 9-28-11RightAWrongNessuna valutazione finora

- Transcripts - Week 2, 10-3-11Documento251 pagineTranscripts - Week 2, 10-3-11RightAWrongNessuna valutazione finora

- Transcripts - Week 1, 9-27-11 OpeningDocumento78 pagineTranscripts - Week 1, 9-27-11 OpeningRightAWrongNessuna valutazione finora

- Transcripts - Week 1, 9-30-11Documento93 pagineTranscripts - Week 1, 9-30-11RightAWrongNessuna valutazione finora

- Sentencing Statement - David Zirpolo, 8-1-12Documento16 pagineSentencing Statement - David Zirpolo, 8-1-12RightAWrongNessuna valutazione finora

- Transcripts - Week 1, 9-26-11Documento39 pagineTranscripts - Week 1, 9-26-11RightAWrongNessuna valutazione finora

- Sentencing Statement - Demetrius Harper, 7-31-12Documento11 pagineSentencing Statement - Demetrius Harper, 7-31-12RightAWrongNessuna valutazione finora

- Fast Ethernet Switch at-FS705L (Data Sheet) - EngDocumento2 pagineFast Ethernet Switch at-FS705L (Data Sheet) - EngBaroszNessuna valutazione finora

- Aartv Industrial Training ReportDocumento48 pagineAartv Industrial Training ReportRupal NaharNessuna valutazione finora

- Career As A Pharmacist in South AfricaDocumento2 pagineCareer As A Pharmacist in South AfricaPaul WasikeNessuna valutazione finora

- GT2-71D Amplifier Unit Data SheetDocumento3 pagineGT2-71D Amplifier Unit Data SheetKenan HebibovicNessuna valutazione finora

- Vim 101 - A Beginner's Guide To VimDocumento5 pagineVim 101 - A Beginner's Guide To VimHuy TranNessuna valutazione finora

- Factors for Marketing Success in Housing SectorDocumento56 pagineFactors for Marketing Success in Housing SectorNhyiraba Okodie AdamsNessuna valutazione finora

- Hofa Iq Limiter Manual enDocumento8 pagineHofa Iq Limiter Manual enDrixNessuna valutazione finora

- ELEC 121 - Philippine Popular CultureDocumento10 pagineELEC 121 - Philippine Popular CultureMARITONI MEDALLANessuna valutazione finora

- Masonry Design and DetailingDocumento21 pagineMasonry Design and DetailingKIMBERLY ARGEÑALNessuna valutazione finora

- 71cryptocurrencies Have Become One of The Hottest Topics in The Financial WorldDocumento2 pagine71cryptocurrencies Have Become One of The Hottest Topics in The Financial WorldicantakeyouupNessuna valutazione finora

- Only PandasDocumento8 pagineOnly PandasJyotirmay SahuNessuna valutazione finora

- 12V Laptop ChargerDocumento12 pagine12V Laptop ChargerSharon Babu0% (1)

- Prova ScrumDocumento11 pagineProva ScrumJoanna de Cassia ValadaresNessuna valutazione finora

- House Bill 470Documento9 pagineHouse Bill 470Steven DoyleNessuna valutazione finora

- Logiq 180 UsuarioDocumento414 pagineLogiq 180 UsuariolaboratorioelectroNessuna valutazione finora

- DamaDocumento21 pagineDamaLive Law67% (3)

- Ultrasonic Pulse Velocity or Rebound MeasurementDocumento2 pagineUltrasonic Pulse Velocity or Rebound MeasurementCristina CastilloNessuna valutazione finora

- Case Study ExamplesDocumento18 pagineCase Study ExamplesSujeet Singh BaghelNessuna valutazione finora

- Final ThoughtDocumento6 pagineFinal ThoughtHaroon HussainNessuna valutazione finora

- Introduction To TQMDocumento24 pagineIntroduction To TQMSimantoPreeom100% (1)

- Lecture 3 - Evolution of Labour Laws in IndiaDocumento13 pagineLecture 3 - Evolution of Labour Laws in IndiaGourav SharmaNessuna valutazione finora

- Ds Gigavue FM Fabric ManagerDocumento9 pagineDs Gigavue FM Fabric ManagerMARCELOTRIVELATTONessuna valutazione finora

- m100 Stopswitch ManualDocumento12 paginem100 Stopswitch ManualPatrick TiongsonNessuna valutazione finora

- Ascon PhivDocumento48 pagineAscon PhivSDK341431100% (1)

- Liftoff: Guide To Duo Deployment Best Practices: Version 2.1 Published October 3, 2019Documento14 pagineLiftoff: Guide To Duo Deployment Best Practices: Version 2.1 Published October 3, 2019Johana RNessuna valutazione finora

- Frias Lindsay Iste Stds Self AssessmentDocumento4 pagineFrias Lindsay Iste Stds Self Assessmentapi-572977540Nessuna valutazione finora

- DATEM Capture For AutoCADDocumento195 pagineDATEM Capture For AutoCADmanuelNessuna valutazione finora

- Converting WSFU To GPMDocumento6 pagineConverting WSFU To GPMDjoko SuprabowoNessuna valutazione finora

- 18mba0044 SCM Da2Documento4 pagine18mba0044 SCM Da2Prabhu ShanmugamNessuna valutazione finora

- Relocation Guide Version 5.6 - New BrandingDocumento29 pagineRelocation Guide Version 5.6 - New BrandingEndika AbiaNessuna valutazione finora