Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Application Form For: 7. Name of Proprietor / Partners / Directors of The Company and Their Address

Caricato da

ganapathy2010svTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Application Form For: 7. Name of Proprietor / Partners / Directors of The Company and Their Address

Caricato da

ganapathy2010svCopyright:

Formati disponibili

a

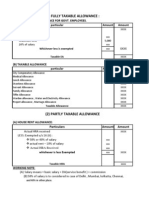

APPLICATION FORM FOR MSEs

Name of the Branch : _____________________________ T o be submitted along with documents as per the checklist ( for Office Use)

1. Name of the Enterprise 2. REGD OFFICE ADDRESS

3. ADDRESS OF FACTORY / SHOP

4.WHETHER BELONGS SC/ST/OBC/MINORITY COMMUNITY Telephone No Mobile No 5.CONSTITUTION 6.Date of Establishment

TO

E-mail address PAN CARD NO Proprietary / Partnership Firm / Pvt Ltd / Ltd Company / Co-op Society

7. Name of Proprietor / Partners / Directors of the Company and their address

NAME

AGE

ACADEMIC QUALIFICATI ON

RESIDENTIAL ADDRESS

PHONE NO (RES)

Experience IN LINE THE OF

ACTIVITY

8. ACTIVITY

EXISTING PROPOSED

9. NAME OF ASSOCIATE CONCERNS AND NATURE OF ASSOCIATION

NAME ADDRESS

PRESENT BANKER

NATURE OF

ASSOCIATION

EXTENT OF INTEREST AS A PROP / PARTNER / DRIECTOR OR JUST INVESTOR IN ASSOCIATE CONCERN

10. Relationship of proprietor / Partner / Director with the officials of the Bank / Director of the Bank 10 (a) CREDIT FACILITIES (EXISTING) Type facility Current A/c Cash Credit Term Loan LC / BG If banking with our bank, CIF and Account Nos 10 (b) It is certified that our unit has not availed any loan from any other Bank / Financial Institution in the past and I am not indebted to any other Bank / Financial Institution other than those mentioned above 11. CREDIT FACILITIES PROPOSED Type facilities of Amount Purpose which required for Security Offered of Limit Balance Present Banker Security Lodged Rate interest ( Rs in lakhs) of Repayment

Primary

Security

(Details

with

Whether security

collateral offered

approx value to be mentioned)

(Please mention yes or no) (if Yes, then

provide detailed below)

Cash Credit

Term Loan LC / BG

In case of Term Loan requirements , the details of machinery may be given as under Type of Purpose Whether for which imported Machine or required indigenous Name of Total cost Contribution Loan of machine being made required supplier the (in case of by promoters imported

machine, breakup basic fright, insurance and customs duty the of cost,

may be given)

12. Details of collateral security offered, If any, 3rd party guarantee *

(* as per RBI guidelines bank are not to take collateral security for loans upto Rs 5 lakhs to MSME units )

13. PAST PERFORMANCE / FUTURE ESTIMATES (Actual performance for two previous years,

estimates for current year and projections for next year to be provided for working capital facilities. However for term loan facilities projections to be provided till the proposed year of repayment of loan)

(Rs. in lacs)

Past Year II Actual

Past Year I actual

Present Year Next Year (Estimates) (Projections)

Net Sales Net Profit Capital

(Networth in

case of companies)

14. Status regarding Statutory Obligations

Statutory Obligation Whether Complied with (Write Yes / No). If not applicable, then write N.A. Remarks (Any Details in connection with the relevant obligation to be given)

1.

Registration

under

shops

and

establishment Act 2. Registration under SSI (Prov/final) 3. Drug Licence 4. Latest Sales tax returns filed 5. Latest Income Tax returns filed 6. Any other statutory dues remaining outstanding

SPACE FOR PHOTO

SPACE FOR PHOTO

SPACE FOR PHOTO

Only one photo of proprietor / each partner / each working director is required to be affixed. Each photo will be certified / attested by the Branch Team with name and signatures on the photograph with Branch stamp. The concerned staff will put his name below the signatures. Date: Place:

I / We certify that all information furnished by me/ us is true; that I / We have no borrowing arrangements for the unit except as indicated in the application; that there are no overdues / statutory dues against me / us / promoters except as indicated in the application; that no legal action has been / is being taken against me/ us / promoters; that I / we shall furnish all other information that may be required by you in connection with my / our application that this may also be exchanged by you with any agency you may deemed fit and you, your representatives, representatives of the Reserve Bank of India or any other agency as authorized by you, at any time, inspect / verify my / our assets, books of accounts etc., in our factory / business premises as given above.

Signature of promoter(s )/ applicant(s) Date:

E:\SMEAUG07\forms\mseform.doc

CHECK LIST (TO BE GIVEN TO THE NEW CUSTOMERS BY BRANCH) OF DATA TO BE KEPT READY BY THE CUSTOMER 1. 2. 3. 4. 5. Proof of Identity Voters ID Card / Passport / driving license / PAN Card / signature identification from present bankers of proprietor , partner or Director (if a company) Proof of residence Recent telephone bills, electricity bill, property tax receipt / passport / voters ID card of proprietor , partner or Director (if a company) Proof of business address Proof of Minority Last three years balance sheets of the units alongwith income tax / sales tax returns etc. (Applicable for all cases from Rs. 2 lacs and above). However, for cases below fund based limits of Rs. 25 lacs, if audited balance sheets are not available, then unaudited balance sheets are also acceptable as per extant instructions of the Bank. For cases of Rs. 25 lacs and above, the audited balance sheets are necessary. Memorandum and article of association of the Company / Partnership deed of partners etc. Assets and liabilities statements of promoters and guarantors alongwith latest income tax returns Rent agreement (if business premises on rent) and clearance from pollution control board, if applicable. SSI registration if applicable

6. 7. 8. 9.

10. Projected balance sheets for the next two years in case of working capital and for the period of the loan in case of term loan (for all cases of Rs. 2 lacs and above) 11. In case of take over of advances, sanction letters of facilities being availed from existing bankers / Financial Institutions alongwith detailed terms and conditions. 12. Profile of the unit (includes names of promoters, other directors of the company, the activity being undertaken, addresses of all offices and plants, share holding pattern etc) APPLICABLE FOR CASES WITH EXPOSURE ABOVE Rs. 25 lacs 13. Last three years balance sheets of the Associate / Group Companies, if any APPLICABLE FOR CASES WITH EXPOSURE ABOVE Rs. 25 lacs 14. Project report (for the proposed project if term funding is required) containing details of the machinery to be acquired, from whom to be acquired, price, names of suppliers, financial details like capacity of machines, capacity utilization assumed, production, sales, projected profit and loss and balance sheets for the next 7 to 8 years till the proposed term loan is to be repaid, the details of labour, staff to be hired, basis of assumption of such financial details etc.) APPLICABLE FOR CASES WITH EXPOSURE ABOVE Rs. 25 lacs 15. Review of account containing monthwise sales (quantity and value both), production (quantity and value), imported raw material (quantity and value), indigenous raw material (quantity and value), value of stocks in process, finished goods (quantity and value), debtors, creditors, banks outstanding for working capital limits, term loan limits, bills discounted. APPLICABLE FOR CASES WITH EXPOSURE ABOVE Rs. 25 lacs 16. Photocopies of lease deeds / title deeds of all the properties being offered as primary and collateral securities. 17. Position of accounts from the existing bankers and confirmation about asset being standard with them (in case of take over) 18. Manufacturing process if applicable, major profile of executives of the Company, any tie ups, details about raw material required and their suppliers, details about buyers, details about major competitors and companys strengths and weaknesses as compared to competitors etc. APPLICABLE FOR CASES WITH EXPOSURE ABOVE Rs. 25 lacs (The check list is only indicative and not exhaustive and depending upon the local requirements at different places, addition could be made as per necessity)

Potrebbero piacerti anche

- Preliminary Due Diligence ChecklistDocumento7 paginePreliminary Due Diligence Checklistekatamadze1972Nessuna valutazione finora

- How To Prepare Project Report For Bank LoanDocumento27 pagineHow To Prepare Project Report For Bank Loanroyuttam4uNessuna valutazione finora

- Common Loan Application Form Under Pradhan Mantri MUDRA YojanaDocumento5 pagineCommon Loan Application Form Under Pradhan Mantri MUDRA YojanaBijay TiwariNessuna valutazione finora

- Principles of Acc. II Lecture NoteDocumento54 paginePrinciples of Acc. II Lecture NoteJemal Musa83% (6)

- MGH GroupDocumento2 pagineMGH GroupEzaz Leo67% (3)

- Application Form For MSEsDocumento5 pagineApplication Form For MSEsSenthil_kumar_palaniNessuna valutazione finora

- Annexure-A Common Loan ApplDocumento7 pagineAnnexure-A Common Loan Applrkp_imsNessuna valutazione finora

- Common Loan Application1Documento9 pagineCommon Loan Application1AnkitNessuna valutazione finora

- SBI SME Checklist Working CapitalDocumento5 pagineSBI SME Checklist Working CapitaleswarscribdNessuna valutazione finora

- Mudra LoanDocumento7 pagineMudra LoanSumit Saha100% (1)

- Common Loan Application Form Under Pradhan Mantri MUDRA YojanaDocumento5 pagineCommon Loan Application Form Under Pradhan Mantri MUDRA YojanaS Ve SuriyaNessuna valutazione finora

- MSE ApplicApplication For MSME Loan Upto Rs. 100 LakhsationDocumento6 pagineMSE ApplicApplication For MSME Loan Upto Rs. 100 Lakhsationprabhu.gampalaNessuna valutazione finora

- Application Form PNB 1166 Upto 1 Crore MsmeDocumento7 pagineApplication Form PNB 1166 Upto 1 Crore MsmeChristopher GarrettNessuna valutazione finora

- Annexure-A Common Loan ApplnDocumento6 pagineAnnexure-A Common Loan ApplnNutrilite AgroNessuna valutazione finora

- MSME Loans Upto Rs.10 Crore - CHECK LISTDocumento1 paginaMSME Loans Upto Rs.10 Crore - CHECK LISTArunkumarNessuna valutazione finora

- SBI-SME-Checklist SME Smart ScoreDocumento2 pagineSBI-SME-Checklist SME Smart ScorebiaravankNessuna valutazione finora

- Check List (To Be Given To The New Customers by Branch) of Data To Be Kept Ready by The CustomerDocumento2 pagineCheck List (To Be Given To The New Customers by Branch) of Data To Be Kept Ready by The CustomerCA Shivang SoniNessuna valutazione finora

- Loan Application Form From SDBIDocumento16 pagineLoan Application Form From SDBIGBKNessuna valutazione finora

- Stree Shakti Package For Women EntrepreneursDocumento3 pagineStree Shakti Package For Women EntrepreneursKavida ThanaramanNessuna valutazione finora

- Application Form CGTMSEDocumento15 pagineApplication Form CGTMSERahul Mittal67% (3)

- Bank of India: Mse I - Loan Application Form For SmesDocumento4 pagineBank of India: Mse I - Loan Application Form For SmesVikashKumarNessuna valutazione finora

- Common Loan Application Form Under Pradhan Mantri MUDRA YojanaDocumento4 pagineCommon Loan Application Form Under Pradhan Mantri MUDRA Yojanaडा. सत्यदेव त्यागी आर्यNessuna valutazione finora

- To Be Submitted Along With Documents As Per The Check ListDocumento4 pagineTo Be Submitted Along With Documents As Per The Check ListArun VijilanNessuna valutazione finora

- Mudra App FormDocumento6 pagineMudra App FormpraveenaNessuna valutazione finora

- Empanelment of ContractorsDocumento8 pagineEmpanelment of ContractorsSumit SinghalNessuna valutazione finora

- 11 Msme Loan Application FormDocumento6 pagine11 Msme Loan Application FormRAKESH BABUNessuna valutazione finora

- Application Registration SupplierDocumento8 pagineApplication Registration SupplierMonalisa ChatterjeeNessuna valutazione finora

- Mudra Check List PDFDocumento2 pagineMudra Check List PDFThabir Sai ChoudhuriNessuna valutazione finora

- Pmmy ApplicationDocumento4 paginePmmy ApplicationSureshNessuna valutazione finora

- Stand Up India Application Form PDFDocumento5 pagineStand Up India Application Form PDFakibNessuna valutazione finora

- Common Loan Application FormDocumento4 pagineCommon Loan Application FormRAM NAIDU CHOPPANessuna valutazione finora

- Above 10 Lakh To 100 Lakh) : Udyog Aadhar Registration No.Documento5 pagineAbove 10 Lakh To 100 Lakh) : Udyog Aadhar Registration No.poonamNessuna valutazione finora

- MUDRA - Loan ApplicationDocumento5 pagineMUDRA - Loan ApplicationuksrajNessuna valutazione finora

- To Be Submitted Along With Documents As Per The Check ListDocumento4 pagineTo Be Submitted Along With Documents As Per The Check ListMonika ShuklaNessuna valutazione finora

- .Checklist For Msme Takeover LoanDocumento2 pagine.Checklist For Msme Takeover LoanRik SenguptaNessuna valutazione finora

- Check List: Shishu: Checklist of Enclosures To Pmmy ApplicationsDocumento1 paginaCheck List: Shishu: Checklist of Enclosures To Pmmy ApplicationsVijay PatilNessuna valutazione finora

- Word - ISS Application For Authorized Persons - BSE - 01-JULY-2015Documento35 pagineWord - ISS Application For Authorized Persons - BSE - 01-JULY-2015meera nNessuna valutazione finora

- PNB Notice - Empanelment of ValuersDocumento15 paginePNB Notice - Empanelment of ValuersMallikarjun MudnurNessuna valutazione finora

- NSIC Form Raw Material AssistanceDocumento6 pagineNSIC Form Raw Material AssistanceVineeth BalakrishnanNessuna valutazione finora

- Indicative Check List of Documents Required For The Credit ProposalDocumento2 pagineIndicative Check List of Documents Required For The Credit ProposalPrakashNessuna valutazione finora

- Sbi Mudra Loan Application Form PDFDocumento4 pagineSbi Mudra Loan Application Form PDFRaviTeja KvsnNessuna valutazione finora

- WorksManual RegFormDocumento3 pagineWorksManual RegFormapi-3779088Nessuna valutazione finora

- VRF-UNITY - NewDocumento6 pagineVRF-UNITY - NewMohamad ChaudhariNessuna valutazione finora

- BCC BR 107 338 Mudra-1-1Documento20 pagineBCC BR 107 338 Mudra-1-1Arun GuptaNessuna valutazione finora

- Appendix 1 and 2 22 20Documento5 pagineAppendix 1 and 2 22 20Rajendra JoshiNessuna valutazione finora

- VAT Procedure in MaharashtraDocumento14 pagineVAT Procedure in MaharashtraDeva DrillTechNessuna valutazione finora

- GOODDDDocumento12 pagineGOODDDPeeyush JainNessuna valutazione finora

- Empanelment NoticeDocumento5 pagineEmpanelment NoticeVikrant BansalNessuna valutazione finora

- (Debit Mandate Form NACH/ ECS/ Direct Debit) : Request ForDocumento2 pagine(Debit Mandate Form NACH/ ECS/ Direct Debit) : Request Forssgentis100% (1)

- One Time Mandate FormDocumento4 pagineOne Time Mandate FormAshishNessuna valutazione finora

- How To Prepare Project Report For Bank LoanDocumento27 pagineHow To Prepare Project Report For Bank LoanDsp VarmaNessuna valutazione finora

- SSA Anand Common Application Form - 11.11.09 - 11.12.09Documento10 pagineSSA Anand Common Application Form - 11.11.09 - 11.12.09Ashish Jain0% (1)

- Common Application Form For Units Above 10 LakhsDocumento55 pagineCommon Application Form For Units Above 10 LakhsBilla NaganathNessuna valutazione finora

- Neral Format: Photo (Affix For Each Applic Ant)Documento6 pagineNeral Format: Photo (Affix For Each Applic Ant)Noorul AmeenNessuna valutazione finora

- Documents Required For Bank Loan/LC: PAN CARD of Promoters & Company. Adhar Cards of PromotersDocumento1 paginaDocuments Required For Bank Loan/LC: PAN CARD of Promoters & Company. Adhar Cards of PromotersKumar HemantNessuna valutazione finora

- Anrlf Loan Package 9-14Documento19 pagineAnrlf Loan Package 9-14api-295308761Nessuna valutazione finora

- Empanelment NoticeDocumento9 pagineEmpanelment NoticeAbhijeetJangidNessuna valutazione finora

- Checklist of Documentary Requirements: (To Be Submitted in 2 Hard Copies and Soft Copy )Documento5 pagineChecklist of Documentary Requirements: (To Be Submitted in 2 Hard Copies and Soft Copy )Dennis Thomas Tudtud0% (1)

- Ubi Process Note of Shourya Virat Trading CompanyDocumento11 pagineUbi Process Note of Shourya Virat Trading CompanyTripurari KumarNessuna valutazione finora

- Bid Doc For Petrol PumpDocumento5 pagineBid Doc For Petrol PumpMianZubairNessuna valutazione finora

- The Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703Da EverandThe Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703Nessuna valutazione finora

- Film Name ListDocumento8 pagineFilm Name Listganapathy2010svNessuna valutazione finora

- Vodafone MSPD3247386338Documento1 paginaVodafone MSPD3247386338shantivanNessuna valutazione finora

- MahiDocumento2 pagineMahiganapathy2010svNessuna valutazione finora

- Surendar ADocumento2 pagineSurendar Aganapathy2010svNessuna valutazione finora

- Ashok ResumeDocumento3 pagineAshok Resumeganapathy2010svNessuna valutazione finora

- Tamil Nadu Public Service Commision - Marks Obtained by The CandidatesDocumento1 paginaTamil Nadu Public Service Commision - Marks Obtained by The Candidatesganapathy2010svNessuna valutazione finora

- Services Marketing ManagementDocumento237 pagineServices Marketing Managementganapathy2010svNessuna valutazione finora

- JeevaDocumento2 pagineJeevaganapathy2010svNessuna valutazione finora

- Dir ListDocumento1 paginaDir Listganapathy2010svNessuna valutazione finora

- Non Teaching Staff ApplicationDocumento4 pagineNon Teaching Staff Applicationganapathy2010svNessuna valutazione finora

- DB Jain College Results Nov 2013 - DB Jain College Exam Results Nov 2013 - Dhanraj Baid Jain College Results 2013Documento1 paginaDB Jain College Results Nov 2013 - DB Jain College Exam Results Nov 2013 - Dhanraj Baid Jain College Results 2013ganapathy2010svNessuna valutazione finora

- Conclave 2011Documento1 paginaConclave 2011ganapathy2010svNessuna valutazione finora

- VJ PresentationDocumento28 pagineVJ PresentationGANAPATHY.SNessuna valutazione finora

- Separate File NaemsDocumento1 paginaSeparate File Naemsganapathy2010svNessuna valutazione finora

- IMC-V G SubramanianDocumento14 pagineIMC-V G SubramanianAnish ShettyNessuna valutazione finora

- CommerceDocumento5 pagineCommerceganapathy2010svNessuna valutazione finora

- Application Form For: 7. Name of Proprietor / Partners / Directors of The Company and Their AddressDocumento5 pagineApplication Form For: 7. Name of Proprietor / Partners / Directors of The Company and Their Addressganapathy2010svNessuna valutazione finora

- Corporate AccountDocumento51 pagineCorporate Accountganapathy2010svNessuna valutazione finora

- TaxDocumento10 pagineTaxganapathy2010svNessuna valutazione finora

- Steps To Enable Javascript in Internet Explorer Versions (6.0,7.0,8.0), Mozilla Firefox3.0, Google Chrome2.0 and Safari4.0Documento1 paginaSteps To Enable Javascript in Internet Explorer Versions (6.0,7.0,8.0), Mozilla Firefox3.0, Google Chrome2.0 and Safari4.0Nirmal RajNessuna valutazione finora

- Technology Trends in The Banking IndustryDocumento44 pagineTechnology Trends in The Banking IndustryNandini JaganNessuna valutazione finora

- Vol2no1 1Documento12 pagineVol2no1 1ganapathy2010svNessuna valutazione finora

- Banking Is at A Very Interesting PhaseDocumento17 pagineBanking Is at A Very Interesting PhaseRahul KadamNessuna valutazione finora

- Technical Education Scholarship Form Binder1Documento12 pagineTechnical Education Scholarship Form Binder1ganapathy2010svNessuna valutazione finora

- TamilDocumento33 pagineTamilganapathy2010sv50% (6)

- Recent Technological Developments in Indian Banking: Vepa Kamesam Deputy Governor Reserve Bank of IndiaDocumento44 pagineRecent Technological Developments in Indian Banking: Vepa Kamesam Deputy Governor Reserve Bank of IndiaRanvijay SinghNessuna valutazione finora

- Technological Innovation in BankingDocumento21 pagineTechnological Innovation in BankingPawan NkNessuna valutazione finora

- 00 FrontDocumento0 pagine00 Frontganapathy2010svNessuna valutazione finora

- Technological Developments in Indian Banking Sector: Research PaperDocumento4 pagineTechnological Developments in Indian Banking Sector: Research Paperganapathy2010svNessuna valutazione finora

- Article PDFDocumento8 pagineArticle PDFganapathy2010svNessuna valutazione finora

- 1 InvoiceDocumento1 pagina1 InvoiceMohit GargNessuna valutazione finora

- CPG SampleDocumento43 pagineCPG SampleRabindra Rajbhandari100% (2)

- Production Planning & ControlDocumento23 pagineProduction Planning & Controlrupa royNessuna valutazione finora

- Guidewire Services Consulting TransformationDocumento4 pagineGuidewire Services Consulting TransformationagNessuna valutazione finora

- Cineplex CRMDocumento7 pagineCineplex CRMSanjeev RamisettyNessuna valutazione finora

- Luqmanul Hakim Bin Johari (2020977427) Individual Assignment Case Study 1Documento7 pagineLuqmanul Hakim Bin Johari (2020977427) Individual Assignment Case Study 1Luqmanulhakim JohariNessuna valutazione finora

- 1992 ColwellDocumento20 pagine1992 ColwellBhagirath BariaNessuna valutazione finora

- Accounting of Clubs & SocietiesDocumento13 pagineAccounting of Clubs & SocietiesImran MulaniNessuna valutazione finora

- Project On RecruitmentDocumento90 pagineProject On RecruitmentOmsi LathaNessuna valutazione finora

- Compensation Survey 2021Documento14 pagineCompensation Survey 2021Oussama NasriNessuna valutazione finora

- BankDocumento7 pagineBankSheeza NoorNessuna valutazione finora

- Investment and Portfolio Management Assignment 1Documento7 pagineInvestment and Portfolio Management Assignment 1tech& GamingNessuna valutazione finora

- Townhall SustDocumento21 pagineTownhall Sustpritom173Nessuna valutazione finora

- Afisco Insurance Corp. v. CIRDocumento6 pagineAfisco Insurance Corp. v. CIRJB GuevarraNessuna valutazione finora

- Constantinides 2006Documento33 pagineConstantinides 2006Cristian ReyesNessuna valutazione finora

- Module 2-APPLIED ECONDocumento5 pagineModule 2-APPLIED ECONMae EnteroNessuna valutazione finora

- Chapter 15 Sales Type LeaseDocumento3 pagineChapter 15 Sales Type LeaseNikki WanoNessuna valutazione finora

- Math ActivityDocumento3 pagineMath ActivityCristena NavarraNessuna valutazione finora

- Unit 6 MANAGEMENT ACCOUNTINGDocumento46 pagineUnit 6 MANAGEMENT ACCOUNTINGSANDFORD MALULUNessuna valutazione finora

- Chipotle 2013 Organizational AnalysisDocumento7 pagineChipotle 2013 Organizational Analysistarawneh92Nessuna valutazione finora

- BarillaDocumento22 pagineBarillaAbhinav LuthraNessuna valutazione finora

- Dealing With Competition: Competitive ForcesDocumento9 pagineDealing With Competition: Competitive Forcesasif tajNessuna valutazione finora

- CRM DimensionsDocumento12 pagineCRM DimensionsetdboubidiNessuna valutazione finora

- HW Microeconomics)Documento3 pagineHW Microeconomics)tutorsbizNessuna valutazione finora

- Project Cooperative BankDocumento33 pagineProject Cooperative BankPradeepPrinceraj100% (1)

- Task 1 Determine The Fair Price of A Future Contract That You Have Chosen and Explain That Affect Its PricingDocumento10 pagineTask 1 Determine The Fair Price of A Future Contract That You Have Chosen and Explain That Affect Its Pricing洁儿Nessuna valutazione finora

- Essay Dev Econ Kalihputro Fachriansyah 30112016 PDFDocumento7 pagineEssay Dev Econ Kalihputro Fachriansyah 30112016 PDFKalihNessuna valutazione finora

- Means of Avoiding or Minimizing The Burdens of TaxationDocumento6 pagineMeans of Avoiding or Minimizing The Burdens of TaxationRoschelle MiguelNessuna valutazione finora