Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Form Ba Welath Tax

Caricato da

Anu VenkateshCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Form Ba Welath Tax

Caricato da

Anu VenkateshCopyright:

Formati disponibili

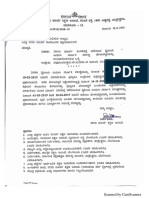

FORM NO.

BA

RETURN OF NET WEALTH

[See rule 3(1)(B)) of Wealth-Tax Rules,1957]

(FOR INDIVIDUALS / HINDU UNDIVIDED FAMILIES / COMPANIES)

ACKNOWLEDGEMENT

For Office use only g

PLEASE FOLLOW ENCLOSED INSTRUCTIONS

g

USE BLOCK LETTERS ONLY

Receipt No.

Date

g PAN MUST BE QUOTED

1 PERMANENT ACCOUNT NUMBER 2 NAME 3 ADDRESS FOR COMMUNICATION ( A. RESIDENCE or B. OFFICE

Seal and Signature of Receiving Official

8 Ward / Circle / Special Range 9 If there is change in jurisdiction, state old Ward / Circle / Special Range 10 Valuation Date 11 Assessment Year 12. Residential Ststus

13.Whether Original

PIN Telephone Fax if any 5 Date of Birth/formation (DD-MM-YYYY) 7 Is there any change in Address? if yes, whether A.

4 Sex (M/F) 6 Status

Yes

or Revised u/s 14 / 15 / 17 14. If revised,Receipt No. date of filing original Return

Yes Yes

Return?

and No No

No or B.Office

15.Is this your first Return?

Residence

16.Are you assessed to Income Tax?

STATEMENT OF NET WEALTH AND TAX STATEMENT OF NET WEALTH 17 Aggregate Value of immovable property (item 28.1e) 18 Aggregate Value of movable property (item 28.2d) 19 Includible net wealth of other persons (item 28.3e) Aggregate value of interest in assets held in a Firm/AOP as 20 partner/member (item 28.4f) 21

NET WEALTH(As Rounded off to nearest multiple of hundred rupees)(17+18+19+20) in Words

112 113 114 115 116

0 0 0 0

STATEMENT OF TAX 22 Tax on Net Wealth 23 Add : interest on late filing of return 24 TOTAL TAX AND INTEREST PAYABLE (22+23) 25 Less prepaid tax and interest (Attach Challans) Date Name of the Bank and Branch I II III Total 26 Balance tax and interest payable (24-25) 27 Amount of refund due, if any 118 119 135 Branch Code Amount (Rs.)

137 149 151

COMPUTATION OF NET WEALTH INCLUDING NET WEALTH OF OTHE PERSON(S) INCLUDIBLE IN ASSESSEE'S NET WEALTH

VALUE OF ASSETS AS DEFINED U/S 2 (ea) OF THE WEALTH TAX ACT

28.1 IMMOVABLE PROPERTY Description (a) Building(s)S.2(ea)(i) Urban Land(s)S.2(ea)(v) Total Address (b) As per Statement As per Statement Value as per Schedule III (c) Debts owned Net Amount in relation to (c)- (d) ] the asset (d) (e) [

0 Source: www.taxguru.in

0 154

0 0

28.2 MOVABLE PROPERTY Description (a) (i) Motor Cars S.2(ea)(ii) (ii) Jewellery etc.S.2(ea)(iii) (iii) Yachts, etc S.2(ea)(iv) (iv) Cash in Hand S.2(ea)(vi) Total Value as per Schedule III (b) Debts owned in relation to the asset (c) Net Amount (b)- (c) ] (d) [

0 155 Debts owned Net Amount in relation to (c)- (d) ] the asset (d) (e)

0 0

28.3 INCLUDIBLE NET WEALTH OF OTHER PERSONS Name of other Person (a) Relationship (b) Aggregate Value of all Assets (c) [

Total

0 156

0 0

28.4 INTEREST HELD IN THE ASSETS OF A FIRM OR ASSOCIATION OF PERSONS (AOP) AS A PARTNER OR MEMBER THEREOF Names and Address of Firm(s) / AOP(s) (a) Name(s) of other Partners / Members (b)

Value of the Assessee' Assessee's interest s Profit in the assets of firm Sharing / AOP as per ratio % Schedule III

Debts owned Net Amount in relation to (d)- (e) ] such interest (e) (f)

(c)

(d)

Total 29 ASSETS CLAIMED EXEMPT Description of Asset Value

0 157

0 0

Debts owned in relation to the asset

Reason for the claim

30 LIST OF DOCUMENTS / STATEMENTS ATTACHED Description In figures

In Words

VERIFICATION I, Son / daughter of declare that , to the best of my knowledge and belief, the information given in this return and the annexures and statements accompanying it is correct and complete, and that the net wealth and other particulars shown therein are truly stated and in accordance with the provisions ot the Wealthtax Act, 1957, in respect of net wealth as on the valuation date chargeable to the Wealth-tax for the assessment year I Further declare that I am making this return in my capicity as and that I am competent to make this return and verify it. Date : 1/7/2014 Place : Pune Signature Source: www.taxguru.in

FORM NO. BA RETURN OF NET WEALTH [See rule 3(1)(B)) of Wealth-Tax Rules,1957] (FOR INDIVIDUALS / HINDU UNDIVIDED FAMILIES / COMPANIES) ACKNOWLEDGEMENT For Office use only g g PLEASE FOLLOW ENCLOSED INSTRUCTIONS PAN MUST BE QUOTED g USE BLOCK LETTERS ONLY AAXPR7562H Seal and Signature of Receiving Official 8 Ward / Circle / Special Range 9 If there is change in jurisdiction, state old B. OFFICE P ) Ward / Circle / Special Range 10 Valuation Date 11 Assessment Year 2011-12 Telephone 4 Sex (M/F) 6 Status 15-04-1952 No or P M Individual 13.Whether Original P or u/s 14 / 15 / 17 14. If revised,Receipt No. date of filing original Return 15.Is this your first Return? Yes 16.Are you assessed to Income Tax? Yes No P and 31st March 2011 12. Residential Ststus RESIDENT Revised Return? Receipt No. Date

1 PERMANENT ACCOUNT NUMBER 2 NAME ( A. RESIDENCE 133 4th Nain Road, Industrial Town BANGALORE PIN 560044 Fax if any 5 Date of Birth/formation (DD-MM-YYYY) 3 ADDRESS FOR COMMUNICATION or

A. RAVINDRANATH

7 Is there any change in Address? Yes if yes, whether A. Residence

B.Office

P No

STATEMENT OF NET WEALTH AND TAX STATEMENT OF NET WEALTH 17 Aggregate Value of immovable property (item 28.1e) 18 Aggregate Value of movable property (item 28.2d) 19 Includible net wealth of other persons (item 28.3e) 20 Aggregate value of interest in assets held in a Firm/AOP as partner/member (item 28.4f) 112 113 114 115 116 29,099,124 920,747 20,825,143 50,845,000

21 NET WEALTH(As Rounded off to nearest multiple of hundred rupees)(17+18+19+20) Five Crores Eight Lakhs Forty Five Thousand Fourteen only in Words STATEMENT OF TAX 22 Tax on Net Wealth 23 Add : interest on late filing of return 24 TOTAL TAX AND INTEREST PAYABLE (22+23) 25 Less prepaid tax and interest (Attach Challans) Date I III Total 26 Balance tax and interest payable (24-25) 27 Amount of refund due, if any 30/03/2012 11/9/2012 II 18/08/2012 Name of the Bank and Branch State Bank of India, Commercial Branch Bangalore State Bank of India, Commercial Branch Bangalore State Bank of India, Commercial Branch Bangalore

118 119 135

478,450 47,840 526,290

Branch Code 4196 4196 4196 137 149 151

Amount (Rs.) 100,000 200,000 226,290 526,290 -

COMPUTATION OF NET WEALTH INCLUDING NET WEALTH OF OTHE PERSON(S) INCLUDIBLE IN ASSESSEE'S NET WEALTH VALUE OF ASSETS AS DEFINED U/S 2 (ea) OF THE WEALTH TAX ACT 28.1 IMMOVABLE PROPERTY Description (a) Building(s)S.2(ea)(i) Urban Land(s)S.2(ea)(v) Total Address (b) As per Statement As per Statement Value as per Schedule III (c) 26870630 2228494 29099124 0 154 28.2 MOVABLE PROPERTY Description (a) (i) Motor Cars S.2(ea)(ii) (ii) Jewellery etc.S.2(ea)(iii) (iii) Yachts, etc S.2(ea)(iv) (iv) Cash in Hand S.2(ea)(vi) Total Value as per Schedule III (b) 0 776000 0 144747 920747 0 155 28.3 INCLUDIBLE NET WEALTH OF OTHER PERSONS Name of other Person (a) Relationship (b) Aggregate Value of all Assets (c) Debts owned in relation to Net Amount the asset (b)- (c) ] (c) 0 0 0 (d) 776,000 144,747 920,747 920,747 [

Debts owned in relation to the asset (d)

Net Amount (c)- (d) ] (e)

26,870,630 2,228,494 29,099,124 29,099,124

Debts owned in relation to the asset (d)

Net Amount (c)- (d) ] (e)

0 Total 0 0 156 28.4 INTEREST HELD IN THE ASSETS OF A FIRM OR ASSOCIATION OF PERSONS (AOP) AS A PARTNER OR MEMBER THEREOF Names and Address of Name(s) of other Firm(s) / AOP(s) Partners / Members (a) (b) A. Ravindranath Rajhans Enterprises A.Balachandra Murthy A.R. Ashwath B. Akash Total Assesse e's (c) 51% 25% 12% 12% 183789333 0 157 29 ASSETS CLAIMED EXEMPT Description of Asset Land & Building No. 133, 4th Main, Rajajinagar Land & Building No. 132, 4th Main, Rajajinagar 20,825,143 20,825,143 Value of the Assessee's (d) 183789333 Debts owned in relation to such (e) Net Amount (d)- (e) ] (f) 20,825,143 [ 0 0

Value 1,986,587 4,293,959

Debts owned in relation to Reason for the claim the asset Used for Business Used for Business

Land & Building No. 136, 4th Main, Rajajinagar Land & Building No. 137, 4th Main, Rajajinagar Building No. 61/63 & 66, 2nd Main, Rajajinagar Land & Building No. 50/11, 2nd Main, Rajajinagar Land 62/63, 4th Main Road Land & Building Davanagere Land & Building No. 101, Jayanagar Land & Building No. 134, 4th Main Road Land & Building No. 27 (SK) 2nd Main, Rajajinagar Land Chaitanya Developers No. 273, V.V. Puram House 30 LIST OF DOCUMENTS / STATEMENTS ATTACHED Description

1,528,904 3,341,967 3,353,813 44,596,462 2,345,710 780,752 11,450,200 2,366,150 769,565 53,000

Used for Business Used for Business Used for Business Used for Business Used for Business Rented Residential-Self Occupied Used for Business Rented Residential-Self Occupied

In figures

In Words

VERIFICATION I , A. BALA CHANDRA MURTHY Son / daughter of ASHWATHRAM SHETTY declare that , to the best of my knowledge and belief, the information given in this return and the annexures and statements accompanying it is correct and complete, and that the net wealth and other particulars shown therein are truly stated and in accordance with the provisions ot the Wealthtax Act, 1957, in respect of net wealth as on the valuation date Wealth-tax for the assessment year I Further declare that I am making this return in my capicity as competent to make this return and verify it. Date : Place : 20/10/2012 BANGALORE Signature and that I am chargeable to the

FORM NO. BA RETURN OF NET WEALTH [See rule 3(1)(B)) of Wealth-Tax Rules,1957] (FOR INDIVIDUALS / HINDU UNDIVIDED FAMILIES / COMPANIES) ACKNOWLEDGEMENT For Office use only g g PLEASE FOLLOW ENCLOSED INSTRUCTIONS PAN MUST BE QUOTED g USE BLOCK LETTERS ONLY ABDPB4068P Seal and Signature of Receiving Official 8 Ward / Circle / Special Range 9 If there is change in jurisdiction, state old B. OFFICE P ) Ward / Circle / Special Range 10 Valuation Date 11 Assessment Year 2011-12 Telephone 4 Sex (M/F) 6 Status 8-Jul-1960 No or P M Individual 13.Whether Original P or u/s 14 / 15 / 17 14. If revised,Receipt No. date of filing original Return 15.Is this your first Return? Yes 16.Are you assessed to Income Tax? Yes No P and 31st March 2011 12. Residential Ststus RESIDENT Revised Return? Receipt No. Date

1 PERMANENT ACCOUNT NUMBER 2 NAME ( A. RESIDENCE 134 4th Nain Road, Industrial Town BANGALORE PIN 560044 Fax if any 5 Date of Birth/formation (DD-MM-YYYY) 3 ADDRESS FOR COMMUNICATION or

A. BALACHANDRA MURTHY

7 Is there any change in Address? Yes if yes, whether A. Residence

B.Office

P No

STATEMENT OF NET WEALTH AND TAX STATEMENT OF NET WEALTH 17 Aggregate Value of immovable property (item 28.1e) 18 Aggregate Value of movable property (item 28.2d) 19 Includible net wealth of other persons (item 28.3e) 20 Aggregate value of interest in assets held in a Firm/AOP as partner/member (item 28.4f) 112 113 114 115 116 35,353,343 7,021,788 1,952,393 44,327,500

21 NET WEALTH(As Rounded off to nearest multiple of hundred rupees)(17+18+19+20) Five Crores Eight Lakhs Forty Five Thousand Fourteen only in Words STATEMENT OF TAX 22 Tax on Net Wealth 23 Add : interest on late filing of return 24 TOTAL TAX AND INTEREST PAYABLE (22+23) 25 Less prepaid tax and interest (Attach Challans) Date I III Total 26 Balance tax and interest payable (24-25) 27 Amount of refund due, if any 30/03/2012 11/9/2012 II 18/08/2012 Name of the Bank and Branch State Bank of India, Commercial Branch Bangalore State Bank of India, Commercial Branch Bangalore State Bank of India, Commercial Branch Bangalore

118 119 135

413,275 41,320 454,595

Branch Code 4196 4196 4196 137 149 151

Amount (Rs.) 100,000 200,000 154,595 454,595 -

COMPUTATION OF NET WEALTH INCLUDING NET WEALTH OF OTHE PERSON(S) INCLUDIBLE IN ASSESSEE'S NET WEALTH VALUE OF ASSETS AS DEFINED U/S 2 (ea) OF THE WEALTH TAX ACT 28.1 IMMOVABLE PROPERTY Description (a) Building(s)S.2(ea)(i) Urban Land(s)S.2(ea)(v) Total Address (b) As per Statement As per Statement Value as per Schedule III (c) 34001290 1352053 35353343 0 154 28.2 MOVABLE PROPERTY Description (a) (i) Motor Cars S.2(ea)(ii) (ii) Jewellery etc.S.2(ea)(iii) (iii) Yachts, etc S.2(ea)(iv) (iv) Cash in Hand S.2(ea)(vi) Total Value as per Schedule III (b) 1382716 5529750 0 109322 7021788 0 155 28.3 INCLUDIBLE NET WEALTH OF OTHER PERSONS Name of other Person (a) Relationship (b) Aggregate Value of all Assets (c) Debts owned in relation to Net Amount the asset (b)- (c) ] (c) 0 0 0 (d) 1,382,716 5,529,750 109,322 7,021,788 7,021,788 [

Debts owned in relation to the asset (d)

Net Amount (c)- (d) ] (e)

34,001,290 1,352,053 35,353,343 35,353,343

Debts owned in relation to the asset (d)

Net Amount (c)- (d) ] (e)

0 Total 0 0 156 28.4 INTEREST HELD IN THE ASSETS OF A FIRM OR ASSOCIATION OF PERSONS (AOP) AS A PARTNER OR MEMBER THEREOF Names and Address of Name(s) of other Firm(s) / AOP(s) Partners / Members (a) (b) A.Balachandra Murthy Rajhans Enterprises A. Ravindranath A.R. Ashwath B. Akash Total Assesse e's (c) 25% 51% 12% 12% 17230570 0 157 29 ASSETS CLAIMED EXEMPT Description of Asset No. 132, 4th Main Road Rajajinagar No. 136, 4th Main Road, Rajajinagar 1,952,393 1,952,393 Value of the Assessee's (d) 17230570 Debts owned in relation to such (e) Net Amount (d)- (e) ] (f) 1,952,393 [ 0 0

Value 5,133,508 1,218,416

Debts owned in relation to Reason for the claim the asset Used for Business Used for Business

No. 137, 4th Main Road, Rajajinagar No. 50/11, 2nd Main Road, Rajajinagar No. 66, 2nd Main Road, Rajajinagar Chaitanya Developers Davanagere Building Gandhi Bazaar Building Land & Building No. 101, Jayanagar Land & Building No. 134, 4th Main Road No. 31, Jayanagar, 4th Block No. 273, V.V. Puram House 30 LIST OF DOCUMENTS / STATEMENTS ATTACHED Description

4,082,489 531,004 3,353,813 44,596,462 2,345,710 780,752 11,450,200 2,366,150 769,565 53,000

Used for Business Used for Business Used for Business Used for Business Used for Business Rented Residential-Self Occupied Used for Business Rented Residential-Self Occupied

In figures

In Words

VERIFICATION I , A. BALACHANDRA MURTHY Son / daughter of ASHWATHRAM SHETTY declare that , to the best of my knowledge and belief, the information given in this return and the annexures and statements accompanying it is correct and complete, and that the net wealth and other particulars shown therein are truly stated and in accordance with the provisions ot the Wealthtax Act, 1957, in respect of net wealth as on the valuation date Wealth-tax for the assessment year I Further declare that I am making this return in my capicity as competent to make this return and verify it. Date : Place : 20/10/2012 BANGALORE Signature and that I am chargeable to the

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Answers of Verbal and Numerical Reasoning TestsDocumento139 pagineAnswers of Verbal and Numerical Reasoning TestsMuhammad Nour100% (5)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Definitions of CommunityDocumento29 pagineDefinitions of CommunityJiselle Umali100% (3)

- Definition of Economic According To Adam SmithDocumento8 pagineDefinition of Economic According To Adam SmithJp Kafle100% (2)

- Black Box WorkbookDocumento381 pagineBlack Box Workbookznhtogex33% (3)

- Curriculum Vitae: Anu. GDocumento5 pagineCurriculum Vitae: Anu. GAnu VenkateshNessuna valutazione finora

- Exam Time TableDocumento3 pagineExam Time TableAnu VenkateshNessuna valutazione finora

- Numbers To WordsDocumento3 pagineNumbers To WordsAnu VenkateshNessuna valutazione finora

- Numbers To WordsDocumento3 pagineNumbers To WordsAnu VenkateshNessuna valutazione finora

- Contract Labour Regulation Abolition Act Tamil NaduDocumento5 pagineContract Labour Regulation Abolition Act Tamil NaduAnu VenkateshNessuna valutazione finora

- Contract Labour Regulation Abolition Act Tamil NaduDocumento5 pagineContract Labour Regulation Abolition Act Tamil NaduAnu VenkateshNessuna valutazione finora

- PGD in Financial Manage C-1Documento2 paginePGD in Financial Manage C-1Anu VenkateshNessuna valutazione finora

- E-TDS RPU Setup ReadmeDocumento3 pagineE-TDS RPU Setup ReadmeNitinAggarwalNessuna valutazione finora

- 6 Kvat Commodity CodeDocumento11 pagine6 Kvat Commodity CodeAnu VenkateshNessuna valutazione finora

- Form No. 1: Application For Permission To Construct, Extend or To Take Into Use Any Building As A FactoryDocumento2 pagineForm No. 1: Application For Permission To Construct, Extend or To Take Into Use Any Building As A FactoryAnu VenkateshNessuna valutazione finora

- 21 - How To Export & Import Data in TallyDocumento3 pagine21 - How To Export & Import Data in TallyAnu VenkateshNessuna valutazione finora

- 1 Salary Wages Sheet With Esi Epf Calculation or Advance Labour Welfare FundDocumento3 pagine1 Salary Wages Sheet With Esi Epf Calculation or Advance Labour Welfare FundAnu VenkateshNessuna valutazione finora

- Ratio AnalysisDocumento5 pagineRatio AnalysisAnu VenkateshNessuna valutazione finora

- Using Excel As Audit Tool - 1Documento2 pagineUsing Excel As Audit Tool - 1joseph davidNessuna valutazione finora

- 1 Salary Wages Sheet With Esi Epf Calculation or Advance Labour Welfare FundDocumento4 pagine1 Salary Wages Sheet With Esi Epf Calculation or Advance Labour Welfare FundAnu VenkateshNessuna valutazione finora

- Part 1 PivotDocumento71 paginePart 1 PivotLyka LagunsinNessuna valutazione finora

- How Markets Work PDFDocumento185 pagineHow Markets Work PDFaamna_shaikh01Nessuna valutazione finora

- BS Accountancy Qualifying Exam: Management Advisory ServicesDocumento7 pagineBS Accountancy Qualifying Exam: Management Advisory ServicesMae Ann RaquinNessuna valutazione finora

- Managerial Economics 3rd Edition Froeb McCann Ward Shor Solution ManualDocumento5 pagineManagerial Economics 3rd Edition Froeb McCann Ward Shor Solution Manualcharles100% (26)

- Omestic Saving Mobilisation AND Small Business Creation THE Case OF AmeroonDocumento16 pagineOmestic Saving Mobilisation AND Small Business Creation THE Case OF AmeroonGiles DomkamNessuna valutazione finora

- McKinsey 2020 Asia Asset Management Survey - Brochure - 2020!10!15Documento22 pagineMcKinsey 2020 Asia Asset Management Survey - Brochure - 2020!10!15New DiensNessuna valutazione finora

- Alan Brinkley US History Chapter 17 SummaryDocumento3 pagineAlan Brinkley US History Chapter 17 SummaryUmmi CiptasariNessuna valutazione finora

- Copy1 Paystub 1Documento1 paginaCopy1 Paystub 1raheemtimo1Nessuna valutazione finora

- 8.2 Assignment - Regular Income Tax For IndividualsDocumento8 pagine8.2 Assignment - Regular Income Tax For Individualssam imperialNessuna valutazione finora

- What Is Generational Wealth and How Do You Build It PDFDocumento4 pagineWhat Is Generational Wealth and How Do You Build It PDFJunior Mebude SimbaNessuna valutazione finora

- The Padma Multipurpose Bridge Project Will Change The Economic Landscape of Southwestern Bangladesh If Its Opening Is Matched With Improvements To Energy Security and Other Infrastructure - OdtDocumento18 pagineThe Padma Multipurpose Bridge Project Will Change The Economic Landscape of Southwestern Bangladesh If Its Opening Is Matched With Improvements To Energy Security and Other Infrastructure - Odtsayda tahmidaNessuna valutazione finora

- Rindermann, H. 2018. "Causes of National and Historical Differences in Cognitive Ability - and Reciprocal Effects"Documento146 pagineRindermann, H. 2018. "Causes of National and Historical Differences in Cognitive Ability - and Reciprocal Effects"YmeNessuna valutazione finora

- If You Can Be The Next President of The PhilippinesDocumento3 pagineIf You Can Be The Next President of The PhilippinesI'm YouNessuna valutazione finora

- Islamic Economic System, Capitalism and SocialismDocumento24 pagineIslamic Economic System, Capitalism and Socialismshab-i-tab86% (36)

- A Survey of Zakah, Issues, Theories and AdministrationDocumento70 pagineA Survey of Zakah, Issues, Theories and AdministrationFa Omar SanyangNessuna valutazione finora

- Monthly Budget Worksheet: HousingDocumento3 pagineMonthly Budget Worksheet: HousingrizviNessuna valutazione finora

- Itr 21-22Documento1 paginaItr 21-22Jatin KaushalNessuna valutazione finora

- Liberalism PDFDocumento12 pagineLiberalism PDFhujjatunaNessuna valutazione finora

- Din 211 Risk Management and Insurance 2019 NotesDocumento99 pagineDin 211 Risk Management and Insurance 2019 NotesNancyNessuna valutazione finora

- FilipinoSariSariStore Draft HMalapitDocumento25 pagineFilipinoSariSariStore Draft HMalapitRomy Wacas100% (2)

- Financial ManagementDocumento201 pagineFinancial Managementprashanth kNessuna valutazione finora

- Di Boscio - Mining Enterprises and Regional Economic DevelopmentDocumento316 pagineDi Boscio - Mining Enterprises and Regional Economic DevelopmentstriiderNessuna valutazione finora

- Ge 3: Understanding The Self: First Semester, SY 2020 - 2021Documento12 pagineGe 3: Understanding The Self: First Semester, SY 2020 - 2021Rachel repaldaNessuna valutazione finora

- Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDocumento100 paginePrepared by Coby Harmon University of California, Santa Barbara Westmont Collegelydia christina0% (1)

- Chap 03 - Islamic EconomicsDocumento35 pagineChap 03 - Islamic EconomicspakipakiNessuna valutazione finora

- Topic 1 Introduction To Financial ManagementDocumento15 pagineTopic 1 Introduction To Financial ManagementMardi UmarNessuna valutazione finora